Hello! In this article we will talk about temporary workers and formalizing legal relations with them.

The letter combination “NEOPL” is a symbol for one of the codes that must be included in the reporting

Northern allowances and the regional coefficient serve to cover the increased material and physiological costs of citizens

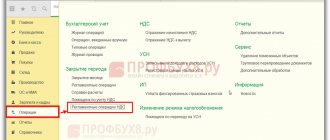

Program 1C: Accounting provides for the possibility of VAT recovery, and you can use two schemes presented

Types of declarations: VAT tax return; tax return: income tax; personal income tax; transport tax;

KND form 1110021 is a standard unified form of document that is submitted to the territorial tax service

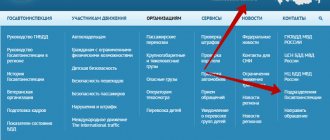

Ways to pay off fines for traffic violations Before paying an administrative fine for non-compliance

Before filling out the SZV-STAZH in 1C, we will provide a short reference. SZV-STAZH is a new form

Accounting in examples Subscribe Free “Silver” newsletter Subscribers 6,731 RSS January 2007 1

Employer reporting Alexey Borisov Leading expert on labor relations Current as of February 29, 2020