Employer reporting

Alexey Borisov

Leading expert on labor relations

Current as of February 29, 2020

SZV-M - monthly reporting by employers for employees drawn up under employment and civil law contracts. Let's look at what it is, how to fill it out correctly in 2021, and within what time frame to submit it to the Pension Fund.

Who submits a report on the SZV-M form in 2021

SZV-M is required to be submitted by employers who have full-time employees drawn up under contracts, from whose payments insurance premiums for pension insurance (PII) are paid.

Such agreements include, in particular:

- employment contracts;

- civil contracts, the subject of which is the performance of work or provision of services;

- copyright agreements;

- agreements on the alienation of exclusive rights to works of science, literature, and art;

- publishing licensing agreements;

- licensing agreements granting the right to use works of science, literature, and art.

What is the SZV-STAZH form

The SZV-STAZH form is filled out and submitted by the policyholders to the Pension Fund for all insured persons who are with the policyholder:

- in labor relations (including with whom labor contracts have been concluded)

- or who have entered into civil law agreements with him , the subject of which is the performance of work, the provision of services, under copyright contracts , in favor of the authors of works under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on the grant of rights use of works of science, literature, art, including remunerations accrued by rights management organizations on a collective basis in favor of the authors of works under agreements concluded with users, or with whom employment contracts and (or) civil law contracts have been concluded.

that is, the SZV-STAZH form is submitted by all legal entities and individual entrepreneurs.

Along with the SZV-STAZH form, you must submit the EDV-1 . When submitting reports electronically, forms SZV-STAZH and EDV-1 are generated in one file.

Form SZV-STAZH instead of the RSV-1 report

The SZV-STAZH form was submitted for the first time in 2021 after the cancellation of the RSV-1 calculation, which included, among other things, information about the length of service of employees (subclause 10, clause 2, article 11 of the Federal Law of April 1, 1996 No. 27-FZ). The RSV-1 calculation was canceled after the transfer of the administration of insurance contributions from the pension fund to the tax office.

It turned out that the RSV-1 calculation was divided into two: in the first, the amounts of insurance premiums were removed, the data on the length of service was left - the report was called SZV-STAZH ; secondly, for the amount of insurance premiums, policyholders report to the Federal Tax Service with a DAM - data for the year must be submitted before January 30!

Types of SZV-STAZH

There are three types of SZV-STAZH:

- Original . This is a form that is submitted to insured persons for the first time during the reporting period.

- Complementary . Submitted if the original form data was not taken into account due to errors.

- Assignment of pension . Provided for insured persons who, in order to establish a pension, need to take into account work periods of the calendar year for which the deadline for reporting has not yet arrived.

What types of forms need to be filled out:

- in the original and supplementary - section 1, section 2 and section 3;

- in the form for assigning a pension - sections 1-5.

Who submits the form and when

Employers must report on the SZV-STAZH form for 2020 by March 1, 2021 .

There are cases when it is necessary to submit this form at other times; all cases of reporting are summarized in the table:

| Basis/frequency | Term / per period |

| Annually , for all employees | no later than March 1 of the year following the reporting year |

| Assigning a pension to an employee | within three calendar days from the date the employee contacts the policyholder |

| Dismissal of an employee | on the day of dismissal, it is handed to the employee |

| At the request of the employee | within 5 working days issued to the employee |

| Liquidation of a legal entity | no later than one month from the date of approval of the interim liquidation balance sheet, no later than the day of submission of liquidation documents to the Federal Tax Service, for the period from January 1 of the current year to the date of liquidation |

| Reorganization of a legal entity | no later than one month from the date of approval of the transfer act (separation balance sheet), no later than the day of submission of documents on reorganization to the Federal Tax Service, for the period from January 1 of the current year to the date of reorganization |

| Merger of a legal entity with another legal entity | No later than the day of submission of documents to the tax authority for making an entry in the Unified State Register of Legal Entities on the termination of the activities of the merged legal entity, for the period from January 1 of the current year to the date of merger |

| Bankruptcy of the policyholder | Before the bankruptcy trustee’s report on the results of the bankruptcy proceedings is submitted to the arbitration court |

| Termination of IP activities | no later than one month from the date of the decision to terminate activities as an individual entrepreneur, for the period from January 1 of the current year to the date of termination of activities |

| Termination of the insured-employer's status as a lawyer and the powers of a notary engaged in private practice | simultaneously with the submission of an application for deregistration as an insurer, for the period from January 1 of the current year to the date of termination of powers |

Self-employed persons do not submit the SZV-STAGE form

For individuals officially recognized as unemployed , the SZV-STAZH form is submitted by the employment service.

If an employee resigns during the calendar year and the dismissal is not related to retirement, there is no need to submit the SZV-STAGE form early.

Don't miss the 2021 reporting deadlines .

The procedure for filling out the SZV-STAZH form

When filling out the SZV-STAZH form,

the INN (individual taxpayer number) is indicated in accordance with the certificate of registration with the tax authority of a legal entity or individual entrepreneur. Since a legal entity’s TIN consists of 10 characters, a dash is placed in the last two cells.

The calendar year is indicated in full, with four digits - 2020 .

Type of information - only one of the indicators must be filled in with an X

Information about the periods of work of the insured persons:

The number of insured persons presented in the SZV-STAZH form must match the number of insured persons presented in the SZV-M.

In column 1 of section 3 of the form, the numbering is continuous, in ascending order, without omissions or repetitions .

The number is assigned to the record for a specific insured person. If the data on the period of work of the insured person contains several lines, the number is assigned to the first record for the insured person (in this case, “Last name”, “First name”, “Patronymic name”, “SNILS” are filled in once).

Last name and (or) first name are required. The middle name may be absent, but it is required to indicate if it is present.

If it is necessary to reflect several periods of work for one person, each period is indicated on a separate line.

Operating Period - Dates must be within the reporting period specified in Section 2 of the form.

For forms with the “Pension assignment” type, the “Period of work” column is filled in until the date of expected retirement.

The period of work of the insured person within the framework of a civil contract is filled in with the following codes reflected in column 11:

- “AGREEMENT” - if payment under the agreement was made during the reporting period;

- “NEOPLDOG” or “NEOPLAVT” - if there is no payment for work under the contract.

Territorial conditions (code), Special working conditions (code), Calculation of the insurance period, Conditions for the early assignment of a labor pension - Filled out in accordance with the Classifier of parameters used when filling out information for maintaining individual (personalized) records (appendix to the Resolution of the Pension Fund of the Russian Federation Board dated 11 January 2017 No. 3p ).

Simultaneous indication in columns 9 and 12 in one line of the table of section 3 of the code “VRNETRUD”, “DECREE”, “DLOTPUSK”, “WATCH”, or a combination of codes “27-1” and “27-11” or “27-14” , "27-2" in combination with listing item 23307000-17541 is permitted.

It is not allowed to simultaneously indicate in one line the values in column 8 of the table of section 3 and the values in column 11 “CHILDREN”, “NEOPL”, “QUALIFICATION”, “SOCIETIES”, “SDKROV”, “SUSPENDED”, “SIMPLE”, “ACCOUNTRY LEAVE” , “DLCHILDREN”, “Chernobyl Nuclear Power Plant”, “DOPVIKH”.

The simultaneous combination of the codes “RKS”, “ISS” in column 8 and the codes “NEOPLDOG”, “NEOPLAVT”, “AGREEMENT” in column 11 is allowed.

Information about the dismissal of an insured person is filled out with the symbol “X” only for insured persons whose dismissal date falls on December 31 of the calendar year for which the form is being submitted.

Sections 4 and 5 - to be completed only for SZV-STAZH forms with the information type “ appointment of pension ”.

If during 2021 the policyholder submitted the SZV-STAZH form with the type of information “Pension Assignment” for employees retiring, then for the working person, as well as for a pensioner who has stopped working, he will also need to submit the usual SZV-STAZH form with the “Initial” type. results of 2021.

Section 5 is completed after the adoption of federal legislation on occupational pension systems.

If the type of information is “Pension assignment”, it is mandatory to fill out the first paragraph of Section 4. It is possible to simultaneously fill out the second paragraph of Section 4 and Section 5 of the form

The SZV-STAZH form with the “pension assignment” type cannot be submitted for a period for which data has already been recorded on an individual personal account based on the SZV-STAZH form with the “Initial” or “Supplementary” type.

How to submit the form to the Pension Fund of Russia

SZV-STAZH can be sent via TKS or submitted on paper - in person, by mail or with a representative.

Policyholders who submit information for 25 people or more are required to report only according to the TKS. In this case, not only employees are considered, but also persons who have entered into civil contracts with the insured, payments under which are subject to insurance premiums.

Submission rules according to TKS :

- The document is signed by a strengthened CEP.

- The date of submission of information is considered to be the day when it was sent via TKS to the Pension Fund. This must be confirmed by a document from the EDF operator or the territorial body of the Pension Fund.

If the form is submitted on paper :

- Individual entrepreneurs put only a signature, organizations - a signature and seal (if available).

- Information on magnetic media can be attached to the paper form.

- If the form is sent by mail, then the day of submission is the date indicated on the postmark.

Sanctions for failure to submit

If the policyholder (organization or individual entrepreneur) does not submit the SZV-STAZH form on time, or it contains false information, he will be fined in the amount of 500 rubles for each insured person .

If the form should be sent via TKS, but this order is violated (27-FZ), the fine will be 1000 rubles .

of 300 to 500 rubles is imposed on officials for failure to submit within the prescribed period or for providing incomplete and (or) false information.

If upon dismissal the employee was not given a copy of the SZV-STAZH, then the employer faces liability for failure to comply with labor legislation, provided for in paragraph 1 of Art. 5.27 Code of Administrative Offences. In this case, the following penalties may be applied:

- from 1,000 to 5,000 rubles. against officials and individual entrepreneurs who committed an offense

- from 30,000 to 50,000 rub. to the employer as a legal entity.

Along with the SZV-STAZH form, you must submit the EDV-1 . When submitting reports electronically, the SZV-STAZH and EDV-1 forms are generated in one file.

Correcting SZV-STAZH errors

If it is necessary to correct errors or make adjustments to the reporting, the following forms are submitted:

| Clarification of information in the SZV-STAZH form | Shape/Shape Type |

| In the SZV-STAZH form with the “Initial” type, errors were identified in the information on the insured person and the information was not taken into account on the individual personal account of the insured person (ILS ZL) | Form SZV-STAZH with the “ Additional ” |

| In the SZV-STAZH form, errors were identified in the information on the insured person (for example, in the date of employment) and the information was taken into account on the ILS ZL | Form SZV-KORR with type " KORR " |

| It is necessary to cancel the information on the insured person previously submitted in the SZV-STAZH form | Form SZV-KORR with type “ OTMN ” |

| It is necessary to provide information on the insured person, information about whom was not available in the SZV-STAZH form with the “Initial” type (i.e. the insured person was “forgotten”) | Form SZV-KORR with type “ OSOB ” |

Features of inclusion of workers in SZV-M

- The report includes employees with whom employment contracts were concluded, were valid or terminated during the reporting period (the month for which the report is submitted).

- SZV-M does not need to be drawn up in relation to employees who had payments, but the contract with them was terminated before the start of the reporting period.

- The report must be generated even for those employees who were absent from the workplace, provided that the contract with them continued to be valid.

- A zero SZV-M is not drawn up, and therefore the report is not submitted by individual entrepreneurs (notaries and lawyers) who do not have employees.

- The report is required to be submitted by NPOs, public organizations and legal entities with one founder, even if an employment contract has not been concluded with him.

- SZV-M is subject to submission by an organization that is in the process of liquidation. In this case, the liquidator is included in the report.

Let us further consider which employees should be included in the report and which should not.

For whom is the SZV-M filled out in 2021?

- The employees' employment contract was terminated on March 1. Should it be included in the report for March (reporting period 03)?

Yes, it is necessary, since the employment contract was valid during the reporting period, even if only for one day.

- The contract with the employee was terminated in May, but the last payments were made in June, is it necessary to include this employee in SZV-M for June?

No no need. If the contract was not in effect during the reporting period (even if there were payments), the employee is not included in the report.

- In June, the employee was on unpaid leave, absent from the workplace, and no payments were made to him. Should it be included in SZV-M?

Yes, it is necessary, since the contract with him was not terminated and was valid during the reporting period.

- Is it necessary to draw up an SZV-M if the organization has just opened, the founder and director are the same person and an employment contract has not been concluded with him?

Until March 2021, the Pension Fund allowed organizations with a single founder and no other employees not to take the SZV-M.

But since March 2021, the position of this department has changed radically (Letter of the Ministry of Labor dated March 16, 2018 No. 17-4/10/B-1846): SZV-M must be submitted, including in relation to the head of the organization, who is the sole founder, regardless of whether whether an employment contract has been concluded with him.

The Ministry of Labor explained its position by the fact that labor relations between an employee and an employer arise on the basis of the employee’s actual admission to work with the knowledge or on behalf of his employer in cases where the employment contract is not properly drawn up.

- Is it necessary to submit a report if the organization has several founders, and one of them is entrusted with the functions of the general director, but without concluding an employment contract?

Yes, it is necessary (Letter of the Pension Fund of March 29, 2018 No. LCH-08-24/5721, Letter of the Ministry of Labor dated March 16, 2018 No. 17-4/10/B-1846).

- Is it necessary to take the SZV-M for the chairmen of non-profit organizations: SNT, DNT, etc.?

Yes, it is necessary, but only if the chairman of the NPO receives remuneration for the work he performs.

Starting from May 2021, SZV-M must be submitted to the chairman of a horticultural, gardening or dacha non-profit partnership, the chairman of a garage consumer cooperative or HOA (in the absence of a concluded employment or civil law contract).

The only exception in which the submission of a report to these persons is not provided: when the activities of the chairman are carried out on a voluntary basis (without payment of appropriate remuneration).

At the same time, provisions providing for the activities of the chairman on a voluntary basis must be spelled out in the organization’s Charter. To be exempt from the obligation to submit SZV-M to the Pension Fund, you must provide this constituent document.

- Do public organizations (political parties and trade unions) need to take SZV-M?

Depends on whether contracts have been concluded with employees.

The report must be submitted if employment or civil law contracts are concluded between the public organization and its employees. If they are not there, SZV-M does not give up.

- In what cases should SZV-M be handed over to organizations engaged in charitable activities?

The report is submitted by these organizations only if they reimburse volunteers (volunteers), within the framework of the GAP concluded with them, for food expenses in an amount exceeding the daily allowance.

- Should SZV-M be taken for foreign workers?

Yes, except for highly qualified specialists.

The SZV-M report is submitted for all foreign employees whose payments are subject to insurance contributions for compulsory pension insurance.

Foreigners, including stateless persons, temporarily staying in the territory of the Russian Federation and belonging to the category of highly qualified specialists, are not registered in the compulsory pension insurance system. In their regard, contributions to the OPS are not paid, and SZV-M, accordingly, does not surrender.

- How do separate units (OU) submit reports?

The OP is required to submit a report if he has a separate current (or personal account) and is vested with the authority to pay wages. When filling out the report, the OP indicates the TIN of the parent organization and their checkpoint.

If the OP does not have his own account and does not pay salaries on his own, data on it is included in the report submitted by the “head”.

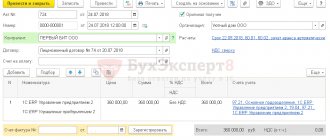

Step-by-step instructions for filling out the SZV-M

Let's take a closer look at how the report is filled out in 2021. As an example, let's take the reporting period - March 2021.

The report consists of 4 main blocks:

- details of the policyholder;

- reporting period;

- form type (code);

- information about the insured persons.

Data must be entered into the report in black or blue ink. The sample is filled in red for clarity.

Sample SZV-M in 2021

Section 1. Details of the policyholder

- Registration number in the Pension Fund of Russia.

You can find out or check this number by requesting an extract on the website of the Federal Tax Service of the Russian Federation. The registration number is indicated in the section “Information on registration as an insurer in the territorial body of the Pension Fund of the Russian Federation.”

- Name (short).

The short or abbreviated name of the legal entity can also be checked in the extract downloaded from the Federal Tax Service website. Individual entrepreneurs indicate the abbreviation “IP” and full name. Individuals who are not individual entrepreneurs (lawyers, notaries) indicate only their full name.

- INN/KPP.

The number is indicated from the certificate issued by the tax authority. Organizations provide TIN and KPP, entrepreneurs and individuals provide only TIN.

Section 2. Reporting period

The reporting period codes are indicated in accordance with the example given in the form itself. For March, the code is 03. The year is indicated in 4-digit format. In the March 2021 report, this section looks like this:

Section 3. Form type (code)

In this section you must indicate the code of the submitted form:

- “outgoing” - if the report is submitted for the first time during the reporting period.

- “additional” - when submitting the SZV-M, supplementing the previously submitted information. A report with this code is submitted, for example, if they forgot to include individual employees in a previously submitted report.

- “cancel” – to cancel a previously submitted report.

Section 4. Information about the insured persons

- No..

The sequence of entering employees into the report can be any: alphabetically, by the date of conclusion of the contract, or generally arbitrary.

- Full name of the insured person.

Filled in the nominative case (who?). The patronymic name is indicated only if it is available.

- Insurance number of an individual personal account.

In this column you must indicate the SNILS number of each employee.

- TIN.

To be completed if the employee has a TIN.

Once the report is completed, it must be signed, dated and stamped (if applicable).

How to submit online through the Pension Fund website

We’ll help you figure out how to submit SZV-M to the Pension Fund for free via the Internet and what you need for this. Some companies offer to install paid programs. But it is advisable to use such programs if you submit a set of reports to various government agencies over the same period. If we are talking only about personalized accounting, then we recommend using the instructions on how to submit SZV-M to the Pension Fund for free via the Internet in the policyholder’s personal account. To register in it, you will need an electronic digital signature or a personal application to the Pension Fund for a registration card.

An easier way offered by the Pension Fund is to download one of the special programs on its website. To provide correct data and avoid penalties, the site provides verification using the CheckPFR program. This program can be easily downloaded to a personal computer without entering into any agreements, and all data can be checked before being sent to the Pension Fund. Very convenient: click “Check”, and if the program does not detect any errors, calmly submit. If, as a result of the check, the message “Error” or “Warnings” appears, review the information again, perhaps you missed something or made a typo somewhere. A missing number or letter, an extra space or brackets, Latin letters - all these are errors due to which the program reports that the report has been filled out incorrectly.

Methods for filling out SZV-M

You can fill out the report:

- By hand or on a computer without using third-party programs. You can download the current form for 2021 on our website or in free legal reference systems.

- Using paid programs and services. The possibility of submitting information about insured persons is provided in most online accounting services, such as “My Business”, “Kontur”, “Sky”.

- Using free software developed by Pension Fund specialists. You can download free software for drawing up the SZV-M report on the Pension Fund website. The following programs are suitable for this: Documents PU 6", "Spu_orb", "PD SPU", "PsvRSV".

After the report has been compiled, it must be checked by one of the programs: CheckPFR and CheckXML. They can also be downloaded from the Pension Fund website.

Delivery methods

If the number of insured persons exceeds 25 people, then the information is submitted only “in the form of an electronic document signed with an enhanced qualified electronic signature in the manner established by the Pension Fund of the Russian Federation” (Clause 2 of Article 8 of the Federal Law of 01.04.1996 No. 27-FZ). But employers have the opportunity to fill out the SZV-M online for free on the Pension Fund website after registering in the system.

If there are less than 25 employees with contracts, the employer submits information in written (on paper) or electronic (through special programs) form.

Deadline for completion of SZV-M in 2021

The deadline for submitting the SZV-M is no later than the 15th day of the month following the reporting month.

| Reporting period 2021 | Deadline |

| January | 17.02.2020 |

| February | 16.03.2020 |

| March | 15.04.2020 |

| April | 15.05.2020 |

| May | 15.06.2020 |

| June | 15.07.2020 |

| July | 17.08.2020 |

| August | 15.09.2020 |

| September | 15.10.2020 |

| October | 16.11.2020 |

| November | 15.12.2020 |

| December | 15.01.2021 |

If the deadline for submitting the report falls on a weekend or holiday, it is postponed to the first working day (Letter of the Pension Fund of the Russian Federation dated December 28, 2016 No. 08-19/19045).

In 2021, the deadline for submitting the report is postponed four times: in February, March, August and November.

Features of delivery of SZV-M to the Pension Fund of Russia

You can submit a report:

- By personal contact with the Pension Fund. Only those organizations and individual entrepreneurs whose average number of employees does not exceed 24 people submit a report on paper.

- By mail: the report must be sent by registered mail with a list of attachments. The date of submission of the SZV-M will be the date the letter was sent.

- In electronic form. If the number of employees is 25 people or more, the report can be sent to the Pension Fund only in electronic form via TCS (telecommunication channels) through EDI (electronic document management) operators. Signed by SZV-M with a qualified electronic digital signature.

SZV-M must be sent in xml format. If it is generated in a different format, the Pension Fund will not accept it.

When submitting a report in electronic form, it is considered accepted after receiving confirmation from the Pension Fund. If confirmation is not received, the report is not considered accepted.

SZV-STAZH and filling example

You can download:

- FORM Information on the insurance experience of insured persons SZV-STAZH (.xls, 50 Kb)

- EXAMPLE of filling out information on the insurance experience of insured persons SZV-STAZH (.xls, 49 Kb)

- EXAMPLE of filling out information on the insurance experience of insured persons SZV-STAZH (.xls, 47 Kb) when assigning a pension

Do not forget that along with the SZV-STAZH form you must submit the EDV-1 . When submitting reports electronically, forms SZV-STAZH and EDV-1 are generated in one file.

Error codes when passing SZV-M

Having received the SZV-M, the Pension Fund must send a verification report. It can be positive (the report is accepted in full or in part) and negative (the report is not accepted in full).

Let's look at the error codes in the SZV-M acceptance protocol:

| Document status | Error code | Decoding | Correction |

| The document was partially accepted | 20 |

| Within 5 days from the date of receipt of the notification, submit a report with the code “additional” with corrected data |

| 30 |

| ||

| Document not accepted | 50 |

| Within 5 days from the date of receipt of the notification, submit a new report with the code “output” |

Penalties for SZV-M

| Violation | Fine |

| Submitting a report on paper with the obligation to submit the document in electronic form* | 1,000 rubles (Article 17 of Law No. 27-FZ of 04/01/1996) |

| 500 rubles for each employee indicated in the report (Article 17 of Law No. 27-FZ of 04/01/1996). An official may additionally be fined in the amount of 300 to 500 rubles (Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation) |

You can avoid a fine:

- If errors are found before they are detected by the Pension Fund. In this case, you need to submit a cancellation form and then a new one with the code “source”. If the new report is submitted before the deadline (before the 15th day of the month following the reporting month), there is no need to pay a fine.

- If the Pension Fund found the errors and sent the corresponding protocol. Then they must be corrected no later than 5 days from the date of receipt of the protocol. If you meet this deadline, there will be no fine.

In other cases, the legality of the fine will have to be challenged in court. Note that in some cases the court sides with the policyholders and cancels the accrued fines:

- Submission of a report with the code “additional” before the Pension Fund of Russia has discovered that the information provided is incomplete cannot serve as a basis for imposing a fine (Resolution of the Administrative Court of the North Caucasus District dated 03.20.2019 in case No. A22-2334/2018, Resolution of the Administrative Court of the Ural District dated 22.03 .2019 in case No. A60-46584/2018).

- If the report is submitted late, but the indexation of pensions is carried out by the Pension Fund even later, there is no cause-and-effect relationship between the information not submitted on time and the fund’s losses (Resolution of the Administrative Court of the North-Western District dated 02/14/2019 in case No. A56-64916/2018).

- The imposition of an administrative fine on individual entrepreneurs on a par with the fine provided for in Art. 17 of Law No. 27-FZ of 04/01/1996, illegal (Resolution of the Constitutional Court of the Russian Federation of 02/04/2019 No. 8-P).

- Incorrect indication of the period for which the report is submitted cannot be the reason for the imposition of a fine (Resolution of the Arbitration Court of the Ural District dated January 31, 2019 in case No. A07-8460/2018).

- The fine may be reduced if the deadline for submitting the report was missed for valid reasons (Resolution of the Autonomous District of the Ural District dated May 24, 2017 No. A76-27244/2016).

- A technical error in the full name cannot be equated to the provision of false information (Determination of the Supreme Court of the Russian Federation dated September 28, 2018 No. 309-KG18-14482 in case No. A34-13366/2017).

- Imposing a fine on a branch instead of the parent organization is unlawful and cannot be the basis for a fine (Resolution of the Administrative Court of the North Caucasus District dated October 23, 2018 in case No. A53-27784/2017).

- In case the PRF delays procedural deadlines ─ for example, on drawing up an inspection report (Determination of the RF Armed Forces dated January 13, 2020 No. 309-ES19-24792).

The Pension Fund of the Russian Federation no longer has the right to fine an individual entrepreneur twice for failure to submit SZV-M (as an insurer under the law on personalized accounting and as an official under the Code of Administrative Offenses) ─ administrative liability under Art. 15.33.2 of the Code of Administrative Offenses of the Russian Federation no longer applies to individual entrepreneurs (Law dated December 16, 2019 No. 444-FZ “On Amendments...”).

Special requirements

The instructions on the procedure for maintaining individual (personalized) records of information about insured persons, approved by Order of the Ministry of Labor dated December 21, 2016 No. 766n, state that policyholders must wait for a receipt notification of the receipt of the report. That is, according to the rules for submitting SZV-M through the Pension Fund website, it is not enough to send the document on time and with correct data; you also need to receive confirmation from the program that the report was accepted.

The instructions also specify the rules for submitting corrected data. In particular, the company will not be punished if it corrects the errors identified by the Pension Fund of the Russian Federation within 5 days. But the program is allowed to enter information only about those listed in the fund’s notification.

If the policyholder himself discovers an inaccuracy, he has the right to submit a clarifying report, but only in relation to those persons whose information was previously accepted by the Pension Fund. Any additional forms indicating previously forgotten workers are considered a violation. For this, a fine of 500 rubles is provided for each person (Article 17 of the Federal Law of April 1, 1996 No. 27-FZ), information about which was not transmitted in a timely manner, is emphasized in the letter of the Pension Fund of the Russian Federation dated March 28, 2018 No. 19-19/5602 .

At the same time, according to the RF Supreme Court, if a company forgot to mention an employee with a contract, then such an independently identified error should not be punished. So the fine issued by the Pension Fund of the Russian Federation for submitting the supplementary SZV-M form can be easily challenged in court.

Read more: Supplementary SZV-M upon expiration of the deadline – will there be a fine?

Let's sum it up

- SZV-M is submitted in relation to all insured workers with whom labor, civil and some other contracts were concluded during the reporting period.

- SZV-M is also rented by organizations with a single founder (even if an employment contract has not been concluded), non-profit organizations in relation to the chairmen of DNT, SNT, HOA, GPC, etc., as well as public and charitable organizations.

- In a number of cases, the court sides with the policyholders and cancels fines for errors when submitting the SZV-M.

- Organizations and individual entrepreneurs with more than 24 people are required to submit a report only in electronic form according to the TKS through electronic document management operators. Policyholders with fewer employees can submit SZV-M both electronically and on paper.

- The deadline for submitting the report is the 15th day of the month following the reporting month. If the deadline falls on a weekend or holiday, it is moved to the next business day.

If you find an error, please select a piece of text and press Ctrl+Enter.

Who, when and where submits information

Let's start with what the SZV-M form is and for whom it is mandatory. Based on clause 2.2 of Art. 11 of Federal Law No. 27-FZ dated April 1, 1996, employers are required to submit monthly reports on all employees, including part-time workers and persons dismissed during the reporting period. For this purpose, a separate form was approved by the resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83p.

In addition to data about those employees who actually work, they also transmit information about persons with whom there are employment contracts, but who are on leave: at their own expense, annual leave, or parental leave. In other words, it is necessary to send information about persons whose employment relationship is confirmed by employment contracts or civil contracts.

The report must also be prepared by organizations with a single employee in the person of the founder, who does not receive payments under any agreement or with whom no agreement has been concluded. And although the instructions for filling out the SZV-M form do not contain any explanations on this matter, officials insist: “non-contractual” managers are also insured persons in the pension system and must be reported on.

The completed report is submitted to the Pension Fund office at the place of registration of the policyholder.