Accounting in examples

Subscribe Free Silver Newsletter

Subscribers 6,731 RSS

| January 2007 | ||||||

| 1 | 3 | 4 | 5 | 6 | 7 | |

| 8 | 10 | 11 | 12 | 13 | 14 | |

| 15 | 17 | 18 | 19 | 20 | 21 | |

| 22 | 24 | 25 | 26 | 27 | 28 | |

| 29 | 31 | |||||

Over the last 60 days, 4 issues (1-2 times a month)

Mailing site: https://kcbux.ru/ Opened: 04/05/2006

Author Marina Ivanovna

Statistics

6,731 subscribers -1 per week

- Issues

- Statistics

All episodes

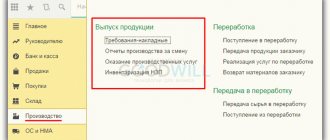

Accounting for the consumption (issue) of materials into production. Accounting entries

The release of materials into production means their release from the organization's warehouse (shops) directly for the manufacture of products (performance of work, provision of services), as well as the consumption of materials for the management needs of the organization.

The release of materials to the warehouses of departments (shops) of the organization and to construction sites is considered as internal movement.

As materials are released from the warehouses of departments (shops) to workplaces, they are written off from the material asset accounts and credited to the corresponding production cost accounts. The cost of materials released for management needs is charged to the appropriate accounts for accounting for these expenses.

The primary accounting documents for the release (consumption) of materials from the organization's warehouses to the organization's divisions (shops) are a limit-fetch card (standard interindustry form N M-8), a demand invoice (standard interindustry form N M-11), an invoice (standard interindustry form form N M-15).

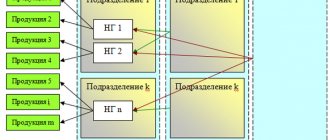

Assessment of work in progress at the cost of raw materials, materials and semi-finished products

This option is very convenient. After all, as a rule, the bulk of raw materials, materials and semi-finished products are released from warehouses to production departments at the very beginning of the production cycle and the amount of raw materials “launched” into the workshop corresponds to the amount of expected product output, and if less comes out, then the corresponding part of the raw materials and materials “ settled" in the WIP.

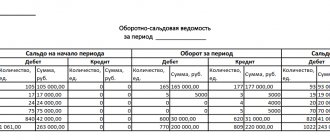

Example 2. Let's return to example 1 and assume that the accounting policy establishes a method for assessing work in progress based on the cost of raw materials, materials and semi-finished products.

The consumption of raw materials, materials and semi-finished products per unit of product (including both finished products and work in progress, that is, based on the “launched” volume) is: 400,000 rubles. / 10,000 units = 40 rub.

Since work in progress is 200 units, its cost will be estimated at: 40 rubles. x 200 units = 8000 rub.

You can calculate it another way:

- the share of unfinished products in the total number of “launched” products: (200 units / 10,000 units) x 100 = 2%;

- share of the cost of raw materials, materials and semi-finished products related to work in progress: 400,000 rubles. x 2% = 8000 rub.

Accordingly, the actual production cost of manufactured products will be: 561,000 - 8,000 = 553,000 rubles.

If the cost of raw materials constitutes a significant part of the cost of the finished product - say, 80% or even 90% (or at least 70 - 75%) - this assessment method can be considered quite accurate and adequate and there is little point in wasting time and effort on then to add to the cost of raw materials, materials and semi-finished products also relatively insignificant and insignificant amounts of wages, insurance premiums, depreciation charges and other production expenses, which in such circumstances are simpler, more convenient and, in general, more logical to attribute entirely to the finished (produced) products.

This situation - the predominance of material costs in the structure of product costs - is especially characteristic of the food industry, and therefore this option may be the most preferable “in all respects”: from the standpoint of simplicity, convenience, clarity, and adequacy.

List of accounts involved in accounting entries:

|

|

Below are accounting entries reflecting the consumption of materials for production and administrative needs.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 20 | 10 | Materials were released into main production. The consumption of materials in the main production is taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 23 | 10 | Materials were released to auxiliary production. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 25 | 10 | Materials were released for general production needs. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 26 | 10 | Materials were released for general business needs. Material consumption taken into account | Cost of materials | Limit-fence card (TMF No. M-8) Demand-invoice (TMF No. M-11) Invoice (TMF No. M-15) |

| 10 | 10 | Materials were released to warehouses (storerooms) of departments (shops) | Cost of materials | Internal movement invoice |

Accounting for other disposals (write-offs, gratuitous transfers) of materials. Accounting entries

Write-off of materials can be carried out in the following cases:

- that have become unusable after expiration of the storage period;

- obsolete;

- when identifying shortages, thefts or damage, including due to accidents, fires, and natural disasters.

The preparation of the necessary information for making a decision on the write-off of materials is carried out by the Commission with the participation of financially responsible persons. Based on the results of the inspection, the Commission draws up an Act on the write-off of materials for each division of the organization, for financially responsible persons.

The write-off of materials transferred under a gift agreement or free of charge is carried out on the basis of primary documents for the release of materials (waybills, applications for the release of materials to third parties, etc.). Article 146 “Object of taxation” of the Tax Code of the Russian Federation states that the transfer of ownership of assets free of charge is recognized as a sale, that is, subject to VAT.

Below are accounting entries reflecting the write-off and gratuitous transfer of materials

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Accounting for shortages (damage) of materials in the presence of culprits | ||||

| 94 | 10 | The write-off of the book value of materials is reflected based on the write-off report drawn up by the commission | Actual cost of written-off materials | Material write-off act |

| 20 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss due to the expenses of the main production | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 23 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss due to the costs of auxiliary production | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 25 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss at the expense of overhead costs | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 26 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss at the expense of general business expenses | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 29 | 94 | The write-off of shortages (losses from spoilage) of materials is reflected within the approved norms of natural loss due to the costs of service industries | Natural loss rate | Accounting certificate-calculation Act of write-off of materials |

| 73.2 | 94 | The write-off of shortages (losses from spoilage) of materials to the perpetrators in excess of the norms of natural loss is reflected | The amount of excess of the norm of natural loss | Accounting certificate-calculation Act of write-off of materials |

| 91.2 | 68.2 | VAT, previously claimed for deduction, was restored for shortages (losses) of materials in excess of the norms of natural loss | VAT amount | Accounting certificate-calculationInvoice |

| 50.01 | 73.2 | Repayment by the guilty person of the debt for cash shortages is reflected | Shortfall amount | Receipt cash order. Form No. KO-1 |

| 70 | 73.2 | Repayment by the guilty person of the debt for shortfalls at the expense of wages is reflected | Shortfall amount | Accounting certificate-calculation |

| Features of accounting for shortages (damage) of materials in the absence of perpetrators. In this situation, the amount exceeding the natural loss rate is written off not to account 73, but to account 91 | ||||

| 91.2 | 94 | Reflects the write-off of shortages (losses from spoilage) of materials in excess of the norms of natural loss in the absence of guilty persons or shortages, the recovery of which was refused by the court | The amount of excess of the norm of natural loss | Accounting certificate-calculation Act of write-off of materials |

| Accounting for material loss due to natural disasters | ||||

| 99 | 10 | Recorded write-off of materials lost as a result of natural disasters | Cost of lost materials | Material write-off act |

| 99 | 68.2 | VAT, previously claimed for deduction, was restored on lost materials | VAT amount | Accounting certificate-calculationInvoice |

| Accounting for free transfer of materials | ||||

| 91.2 | 10 | Disposal of materials reflected | Actual cost of materials | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | VAT is charged to the budget on the cost of materials donated free of charge | VAT amount | Invoice (TMF No. M-15) Invoice Sales book |

Evaluation of work in progress at standard cost

In order to evaluate work in progress at standard cost, the accountant at the end of the month only needs to know the total number of unfinished (unfinished) products.

Well, and, of course, you need to know the value of the standard cost, but it is determined in advance based on plans and established standards, that is, this value does not depend on the actual results of the current month. In principle, it is not even the accounting department that can determine the standard cost, but the planning and economic department of the enterprise, if there is one, and then it is even easier for the accountant.

Typically, the standard cost of work in progress is determined in the same way as the standard cost of finished products - either by direct costs or by all production costs (based on established standards).

Example 4. Let us turn again to the data of example 1, but assume that the accounting policy provides for the assessment of finished products and work in progress at standard cost, which, according to the economic planning department, is 56 rubles. per unit of production.

Since the quantity of work in progress is 200 units, the accountant estimates the “work in progress” in the amount of: 56 rubles. x 200 units = 11,200 rub.

And the actual cost of finished products in this case will be determined as follows: 0 = 549,800 rubles.

At the same time, in accounting, these finished products are already reflected at standard cost in the amount of 56 rubles. x 9800 units = 548,800 rub.

Accounting for the sale of materials. Accounting entries

When an organization sells materials to individuals and legal entities, the sales price is determined by agreement of the parties (seller and buyer). The calculation and payment of taxes is carried out by the organization in the manner prescribed by current legislation.

The sale of materials is formalized by issuing an invoice for the release of materials to the third party, on the basis of contracts or other documents and an invoice. When transporting goods by road, a consignment note is issued.

The following are accounting entries reflecting the sale of materials.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Sale of materials with payment after shipment (transfer) | ||||

| 91.2 | 10 | The disposal of materials is reflected. The posting amount depends on the methodology for estimating the cost of materials upon disposal (at the cost of each unit, at the average cost, using the FIFO method) | Cost of materials | Invoice (TMF No. M-15) |

| 62.01 | 90.1 | Revenue is reflected in the sales cost of materials including VAT. | Sales cost of materials (amount including VAT) | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | The amount of VAT on materials sold is reflected | VAT amount | Invoice (TMF No. M-15) Invoice Sales book |

| 51 | 62.01 | The fact of repayment of the buyer’s debt for previously shipped materials is reflected. | Selling cost of materials | Bank statementPayment order |

| Sale of materials on prepayment | ||||

| 51 | 62.02 | The buyer's prepayment for materials is reflected | Advance payment amount | Bank statementPayment order |

| 76.AB | 68.2 | VAT is charged on advance payment | VAT amount | Payment orderInvoiceSales book |

| 91.2 | 10 | The disposal of materials is reflected. The posting amount depends on the methodology for estimating the cost of materials upon disposal (at the cost of each unit, at the average cost, using the FIFO method) | Cost of materials | Invoice (TMF No. M-15) |

| 62.01 | 91.1 | Revenue is reflected in the sales cost of materials including VAT. | Sales cost of materials. Value with VAT | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | VAT is charged on materials sold | VAT amount | Invoice (TMF No. M-15) Invoice |

| 62.01 | 62.02 | The previously received prepayment is offset against the debt for the transferred materials. | Advance payment amount | Accounting certificate-calculation |

| 68.2 | 76.AB | VAT is credited from the prepaid payment | VAT amount | InvoicePurchase book |