KND form 1110021 is a standard unified form of document that is submitted to the territorial tax service for any transactions performed with cash register equipment. For example, this form is required if:

- the initial registration of the cash register with the tax authority is carried out;

- KKM is re-registered with the tax office;

- the ECLZ unit was replaced;

- The cash register is deregistered with the tax service.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Front page

Here the filling is standard. First, enter the TIN and checkpoint. Entrepreneurs do not write checkpoints, because he doesn't have them. Then enter the code of the tax authority where this document will be submitted. Next, you need to use a digital code to indicate the type of document that reflects the operation performed with cash register equipment - just below in the form, in a note, the meaning of the digital code is explained in detail.

After this, you need to write down the full name of the organization with the obligatory indication of the organizational and legal status (IP, LLC, CJSC, OJSC), as well as the code of the type of economic activity according to OKVED.

Then you need to put the required number in the box about who provided this application and at the end enter the contact phone number (landline or mobile - it doesn’t matter) in the appropriate cells.

The final stage of this section: enter 003 in the “application completed on “—” pages.”

In the cells for providing copies, enter 000 - when filling out the form as standard, copies are usually not required, since, as a rule, they are presented only after a request from a tax specialist to confirm any information entered.

Next, only the left part of the page is filled out, since the right and bottom are completed by the tax inspector. First, it is indicated by a number who is submitting the application - the head of the organization himself or his representative, and then his full name (without abbreviations). The last thing that is written on the title page is the applicant’s signature and the date the form was filled out.

Application for deregistration of cash registers with the tax office (form knd 1110021)

Source/official document: Order of the Ministry of Finance of the Russian Federation dated June 29, 2012 No. 94n Where to submit: Federal Penalty for late submission: Failure to use cash registers entails a fine of up to 30 thousand rubles per organization, 10 thousand per manager

Document name: Application for registration of cash register Format: .xls Size: 108 kb

Print Preview Bookmark

Save to yourself:

The procedure for deregistering a cash register is important and responsible. The application is submitted to the Federal Tax Service at the place of registration. Tax specialists will check your fiscal memory. It records all operations: breaking a check, returning money for goods and other data.

To deregister a cash register, you will need to provide the following documents to the Federal Tax Service:

- Application for deregistration of cash registers in the form of the Federal Tax Service, order dated April 9, 2008 N MM-3-2/152.

- CCP document.

- Agreement with the service center for servicing the cash register.

- Registration card.

Reasons for refusal to deregister may be:

- Incorrectly completed application or inaccurate data specified in it.

- Finding a cash register is wanted.

- Damage to seals.

- Expiration of depreciation period.

The inspection of cash register equipment is carried out by a representative of the tax authority in the presence of the applicant. The specialist draws up an act, makes a mark in the passport and registration card, KKS registration card and puts a stamp of the Federal Tax Service.

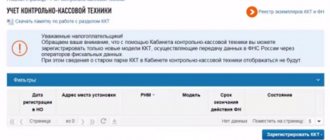

On July 1, 2021, changes to Federal Law dated July 3, 2016 No. 290-FZ regulating the use of cash registers and their deregistration came into force. Fiscal data from the cash register is transferred to an operator licensed to provide these services, he processes it and transmits it to the tax service on a daily basis.

The regulations for deregistration of cash registers are discussed in detail in the order of the Ministry of Finance of the Russian Federation dated June 29, 2012 No. 94n. CCPs must be deregistered within five working days after the tax office accepts the application.

An application for deregistration of a cash register is submitted to the Federal Tax Service in the following cases:

- Change of owner of cash register.

- Expiration of the depreciation period (several days before its expiration).

- Damage to the CCP as a result of fire or natural disaster.

- Termination of activities.

- If the cash register does not comply with the requirements of the legislation of the Russian Federation.

Penalties are provided in the following cases:

- Failure to use CCT entails a fine of up to 30 thousand rubles per organization, 10 thousand per manager.

- Repeated non-use of CCT will result in suspension of the organization’s activities for 90 days, and the manager will be disqualified for 1 to 2 years.

Detailed explanations about the modernization of cash register systems are given on the official website of the Federal Tax Service of Russia.

One form is used for registration and deregistration. When deregistering, Section 2 is completed. On our website you can see:

- Sample form for deregistration of a cash register.

Preview

Full screen preview

Page 2

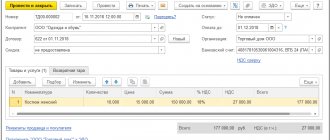

To fill out the second page of the KND form 1110021, you need to take a contract for the maintenance of the cash register - all the necessary information is on the last page.

Before moving on to the main section, we first enter the TIN and KPP - exactly the same as on the title page. Then, in order:

- “KKM model name” - 010. Can be found either on the nameplate (on the back of the cash register), or in the cash register maintenance agreement, or in the KKM passport.

- “KKM serial number” is 020. This information must be entered in full (with zeros), for example: “001234”. Again, you can see this number on the nameplate, in the cash register passport or in the maintenance agreement.

- “Year of manufacture of KKM” - 030. Information is taken from the same above-mentioned sources - passport, maintenance agreement, nameplate.

- “KKM version number” is 040. This number is indicated in the passport, or you can look at it in the maintenance agreement. Typically, the version is indicated in one of two options: “01” or “02”.

- “Series and account number of the KKM identification mark” – 050. This information can also be found either on the cash register body or in the passport. It looks something like this - “AB 12345” (you must also write it in the application, separated by a space).

- “KKM passport number” – 060. Taken from the title page of the cash register passport.

- “EKLZ serial number” is 070. To fill out this line, you need to look at the EKLZ passport or the KKM maintenance agreement. Indicated without the first digit.

- “EKLZ registration number” – 080. This number is registered in the EKLZ passport or in the maintenance agreement. It is assigned to the EKLZ after its activation (either indicated by the manufacturer, or entered after the first maintenance).

- “Cash register equipment is part of the payment terminal” - 090.. As a rule, the number “2” is put here, since “1” is entered only when the cash register is part of the payment terminal.

Items numbered 100, 110, 120 do not need to be filled in, because in paragraph 090 the number “2” was added.

- “Person providing technical support” – 130. This indicates the company with which the contract for maintenance of the cash register was concluded.

- “TIN of the person providing technical support” - 140. TIN of the organization servicing the cash register.

- “Number, start and end date of the maintenance agreement” – 150. This information is taken from the cash register maintenance agreement. It should be said that the expiration date of the maintenance contract is the date until which this service was paid for.

- “Registration and individual number of the seal brand” - 160. Seals are installed on the cash register case on several sides, and their numbers are also entered in the logbook for calling technical specialists and in the cash register passport. The individual number is the one indicated at the top, next to the region, and the registration number is at the bottom, next to the year. First, enter the registration number, separated by a fraction, the individual number.

- “Number and year of production of visual control means” – 170, 180. These are round or square holograms indicated on the POS printer body. Typically, holograms have two versions of the inscription: SVK SO (service) or SVK GR (state register). Since 2013, they stopped installing SVK GR, so if the cash register was released after the beginning of 2013, you do not need to write anything. SVK SO is indicated according to the last year.

Again, all of the above information must be signed and the date of completion indicated.

Application for registration of cash registers (cash register equipment). Example of filling. KND 1110021.

- TIN of an organization 10 digits, or individual entrepreneur 12 digits

- Checkpoint - only for organizations. Individual entrepreneurs do not fill out. The checkpoint of the parent organization is indicated, not a separate unit.

- Code and number of the interdistrict tax inspectorate (MIFTS) to which you are submitting documents. The code and number can be taken from the table:

- Saint Petersburg

- Moscow

- Republic of Crimea

| Name of MIFTS | tax office code | tax office number |

| Pushkinsky district | 7820 | 2 |

| Petrodvortsovy district | 7819 | 3 |

| Admiralteysky district , municipalities No. 2, No. 3, No. 4 | 7838 | 7 |

| Admiralteysky district , municipalities No. 1, No. 5, No. 6 | 7838 | 8 |

| Central district , municipalities No. 78, No. 82 | 7839 | 9 |

| Central district , municipalities No. 77, No. 79 | 7840, 7841 | 10 |

| Central district , municipalities No. 80, No. 81 | 7842 | 11 |

| Resort and Kronstadt districts | 7843 | 12 |

| Vasileostrovsky district | 7801 | 16 |

| Vyborg district | 7802 | 17 |

| Kalininsky district | 7804 | 18 |

| Kirovsky district | 7805 | 19 |

| Kolpinsky district | 7817 | 20 |

| Krasnogvardeisky district | 7806 | 21 |

| Krasnoselsky district | 7807 | 22 |

| Moscow district - legal entities | 7810 | 23 |

| Nevsky district | 7811 | 24 |

| Petrogradsky district | 7813 | 25 |

| Primorsky district | 7814 | 26 |

| Frunzensky district | 7816 | 27 |

| Moscow district - individual entrepreneurs, individuals | 7810 | 28 |

| Tax office number | Tax office code |

| 7701 | |

| 7702 | |

| 7703 | |

| 7704 | |

| 7705 | |

| 7706 | |

| 7707 | |

| 7708 | |

| 7709 | |

| 7710 | |

| 7713 | |

| 7714 | |

| 7715 | |

| 7716 | |

| 7717 | |

| 7718 | |

| 7719 | |

| 7720 | |

| 7721 | |

| 7722 | |

| 7723 | |

| 7724 | |

| 7725 | |

| 7726 | |

| 7727 | |

| 7728 | |

| 7729 | |

| 7730 | |

| 7731 | |

| 7733 | |

| 7734 | |

| 7735 | |

| 7736 | |

| 7743 | |

| 7745 | |

| 7746 | |

| 7747 | |

| 7748 | |

| 7749 | |

| 7750 | |

| 7751 |

| Name of tax office | Tax office code |

| in Simferopol | 7707 |

| in Alushta | 9101 |

| in Yalta | 9103 |

| in Bakhchisaray district | 9104 |

| MIFNS No. 1 (Dzhankoy, Nizhegorsk, Krasnogvardeisky districts) | 9105 |

| MIFNS No. 2 for (Krasnoperekopsky, Pervomaisky, Razdolnensky districts, Armenian city council) | 9106 |

| MIFTS No. 3 (Saki district, Saki city council) | 9107 |

| MIFNS No. 4 for (Feodosia, Sovetsky, Kirvo, Sudak districts) | 9108 |

| MIFTS Russia No. 5 (Simferopol, Belogorsky districts) | 9109 |

| MIFTS Russia No. 6 (Evpatoria, Black Sea regions) | 9110 |

| MIFTS Russia No. 7 (Kerch, Leninsky districts) | 9111 |

| Inspectorate of the Federal Tax Service of Russia for the Gagarinsky district of Sevastopol | 9201 |

| Inspectorate of the Federal Tax Service of Russia for the Balaklava district of Sevastopol | 9202 |

| Inspectorate of the Federal Tax Service of Russia for the Nakhimovsky district of Sevastopol | 9203 |

| Inspectorate of the Federal Tax Service of Russia for the Leninsky district of Sevastopol | 9204 |

- organization (LLC, OJSC, CJSC, etc.) - put one

.

Number and year of issue of the hologram of the state register (SVK GR). Look at the hologram glued to the KKM body. The picture shows holograms of the new and old samples, respectively.

The hologram of the state register has been canceled since 2013, that is, on cash registers manufactured after 2013, the hologram of the state register does not need to be entered.

- online store: www.example.ru

If you are not sure what to write in a particular column, ask the tax inspectors, they are generally adequate people and will definitely help you. Moreover, different tax authorities have different attitudes towards how to fill out this or that column in the application.

Page 3

INN, checkpoint - similar to the previous pages. All other lines concern the real address of the cash register installation.

The only thing that should be commented on is “Name of the location where the cash register equipment will be installed.” Here you need to specify one of several options: “kiosk”, “office”, “warehouse”, “shop”, online store (link), etc.

Then (if necessary) you should enter information about the landlord - not all tax authorities ask for this information, but sometimes it is still needed. If you own the premises, then you do not need to fill anything here. Well, the final chord is the signature and date of filling out the application.