Before filling out the SZV-STAZH in 1C, we will provide a short reference. SZV-STAZH is a new form of reporting to the Pension Fund, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 N 3p. Information on the insurance experience of insured persons in the form SZV-STAZH, as a general rule, is submitted to the Pension Fund of the Russian Federation no later than March 2, 2021 for 2021. 1. Preparatory stage before drawing up the SZV-STAZH form in the 1C program 2. Filling out information on the SZV-STAZH form in the 1C program 3. Features of filling out information on the SZV-STAZH form in the 1C Accounting 3.0 program

Checking the organization's details to generate the SZV-STAZH report

It is first necessary to find out whether the details of the organization and the Pension Fund in which the enterprise was registered were filled out correctly. To do this, you need to go to the “Settings” section in the 1C 8.3 ZUP program. Next, you need to click on the “Organizations” link. After this, a list of companies will appear in front of the user.

In the window that just opens, you need to double-click on your company. Next, the user will see a detailed company card.

Next, you need to find the “Main” tab and check the name, INN, OGRN.

After this, the user needs to go to the “Funds” tab and check:

- Registration number of the Pension Fund in which the specific organization was registered.

- Name of the Pension Fund.

- The exact code of the territorial body of the Pension Fund.

Setting options before building a report

For the SZV-STAZH report and the forms that correct it, two options are important (menu Settings -> Application Options):

- Posting replacement entries from vacation orders. Check whether all vacations used in the organization are included in the program. If you are missing some type of vacation, contact our technical support team, they will help you adjust the settings. In the new version of the program, we have added two vacations: study vacation and vacation for Chernobyl victims.

- Posting replacement entries from no-show orders. Two types of absences have been added here: suspension from work through no fault of the employee and additional days off for employees who care for disabled children.

One more point: if you have personal settings, they should be reflected on the Global tab. We have changed the settings on the Delivery tab, if you need them, you can copy them so that everything is displayed correctly for you.

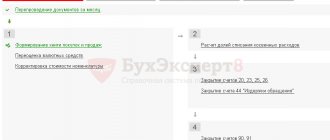

How to construct forms SZV-STAZH and SZV-KORR

The order of construction of these forms is identical, the fundamental difference lies in the type of information submitted. Reports can be found through the menu Current work - Register of reports - Personalized reporting.

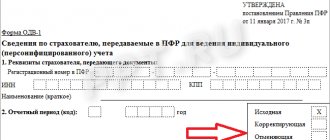

In the window with parameters, the beginning and end of the reporting period are indicated, data for the organization is pulled up automatically. If you need to check information for a department, the program provides this opportunity. Here you define the type of information. By default, the program is set to the “Initial” report form; it is used for the initial submission of information. The “Pension Assignment” option should be selected if you are preparing data for an employee who is about to retire. The “Additional” form is needed if for some reason the Pension Fund of the Russian Federation did not accept your report and sent requests indicating errors.

Pay attention to two options: Always unload vacation more than 28 days and Unload vacation of any duration at the end of the period. The choice of these parameters depends on your Pension Fund branch; in some areas the Pension Fund requires a separate unloading of vacation over 28 days - code DLOTPUSK. The second parameter was previously set by default, because the Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3 put forward the requirement to indicate any leave at the end of the period or before dismissal, and the department’s verification program did not accept reports where it was done differently. And in January this requirement was canceled, so in the new version of Kontur.Personnel this checkbox is unchecked by default.

After filling out all the fields, you can check yourself by generating a printed report form. However, do not forget that organizations with more than 25 employees are required to submit a report electronically.

What mistakes are most often made?

We repeat: if the Pension Fund returned the report to you, pointed out errors in the information of certain employees, and therefore did not post them to personal accounts, then you should provide reliable data using the SZV-STAZH “Additional” form. To correct errors in information from previous periods accepted and taken into account by the Pension Fund of Russia, there is a separate form - SZV-KORR with the type of information “Correcting”. If, over time, it turns out that one of the employees was “forgotten,” select SZV-KORR “Special,” but erroneously submitted information can be canceled using the SZV-KORR “Cancelling” form.

SZV-KORR reports are constructed similarly to the SZV-STAZH report, but only for one person.

How to reflect non-standard cases in the program

Exclusion from the grace period. If an employee with special working conditions that entitle him to preferential pension benefits is transferred to normal conditions for less than a month, then in reporting this period should be taken into account as a month. This requirement was put forward by the Pension Fund, but clarified that the transfer was not carried out at the request of the employee. The basis may be a medical report, an order on production necessity, etc. When the order is approved, the program will offer you to issue a reverse transfer, and in the SZV-STAZH report it will count the transfer period as a month, while maintaining the basis for early retirement.

GPC agreements. Users often ask the question: is it necessary to submit information for those with whom a civil contract rather than an employment contract has been drawn up? The pension fund clearly states that it is necessary. The Kontur.Personnel program implements a certain mechanism for recording such employees. When hiring an employee for a period of less than a month, the code CONTRACT is entered, and this period is marked as paid. If the period lasts more than a month, then the program creates two periods in the Work Book: the first is marked as unpaid (code NEOPLDOG), and the last month as paid (code CONTRACT).

Codes for state and municipal services. In accordance with the requirements of the Pension Fund of Russia, state and municipal institutions must enter special codes to reflect positions. The new version has a Configuration for municipal service. Institutions for which this is relevant can select the appropriate item through the Settings -> Application Options menu, and the program will show you only positions in the state and municipal service.

Bulk editing of details . Most often, the question of mass editing of details arises when, for some reason, special working conditions are not filled in. And this is data that is important for section 5 of the EFA-1 form. In the Organization -> Structure menu, select all staff units for which we need to edit information, in the context menu by right-clicking, select Automatic corrections -> Bulk editing and in the dialog box, mark the details that need to be corrected. The information will automatically be posted to the Working conditions tab in the Staff unit card.

Mass editing may also be required for staff units that were disbanded during the reporting period. In version 1.23, the report “Disbanded staffing units for the period” appeared (menu Current work -> Register of reports -> Staffing table). The procedure is the same: in the context menu, by right-clicking, select Automatic corrections -> Bulk editing, make the appropriate changes.

Check the SNILS of employees to form SZV-STAZH in 1C 8.3

To generate the SZV-STAZH report, it is necessary to indicate SNILS for all individuals for whom information was submitted. To enter or correct SNILS in the 1C 8.3 ZUP program, you need to go to the “Personnel” section and click on “Personnel reports”. Next, a report window will appear in front of the user.

In the window that just appears, you need to click on the link “Personal data of employees.” Next, a window will appear for creating reports to verify the information.

Next, the user needs to select the relevance date, company and press the “Generate” button. After this, a report with personal information will be generated.

If during the check errors were identified in the SNILS information for a particular employee, then you need to double-click on it. This will help open his personal card.

You need to correct the required information in your personal card and click on the “Record and close” button.

Documents upon dismissal. Where to find this in 1C

Regardless of the reason for dismissal, the employer must provide the employee with a package of documents. The list has changed a little in 2021, so let’s look at what exactly needs to be given away and where to find it in 1C.

What documents must be given upon dismissal?

Documents are divided into two categories - mandatory and upon request. If an employer refuses to issue certificates from the mandatory list, he faces a fine of 30,000 to 50,000 rubles. The manager will be responsible for documents upon request. His fine will be from 1,000 to 5,000 rubles (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). The amount may increase if the situation repeats itself during the year (up to 70,000 for the employer and up to 20,000 for the manager). It is better not to delay the issuance of documents and prepare them by the last working day. If the employee is not available on the last day, then you need to send a notice asking to come pick up the documents or send permission to send them by mail. It is better to send a notification to both the registration address and the actual residence address, if they differ.

Now let's look at the type of documents. Mandatory ones include:

- Paper labor form or STD-R form

- Extract from SZV-STAZH

- Extract SZV-M

- Extract 3 ERSV

- Certificate of earnings for two years

- Pay slip

Documents on request:

- Help 2-NDFL

- Information about average earnings

- Information about work (business trips, transfers, bonuses)

Work book or form STD-R

In 2021, the transition to electronic work books began. If an employee has given his consent to maintain an electronic work record, then upon dismissal he is given the STD-R form, which copies the labor information. You can find it along the path: “Salaries and personnel”, “Employees”. Next, click the “Create” button and select STD-R.

If you have already completed the “Dismissal” document before, then all the information will be automatically added to the form. Fill in the remaining fields, complete and click the “Print” button.

Extract from SZV-STAZH

The document reflects the employee’s length of service and professional growth. Its location: “Salaries and personnel”, “Accounting documents”.

After creation, a plate will open where we need to indicate the organization and employee. By double clicking on the last name, you can edit the length of service. After this, the document needs to be processed and printed.

Extract SZV-M

For rent to a pension fund. Go to the menu: “Salaries and personnel”, “Information about insured persons and SZV-M”.

We create a new document where we indicate the required certificate. We select an employee and check the data.

Extract 3 ERSV

Here we need the third section of the calculation of insurance premiums. Select the menu “Reports”, “Regulated reports”. Click the “Create” button and look for the required calculation.

An already generated document will open in front of us. Select the third section and click “fill”. We select the required employee, check the data and print it out.

Certificate of earnings for two years

The certificate contains all the information about the income received during the two-year period of work. Go to the menu “Salaries and Personnel”, “Certificates for calculating benefits (ref)”.

Select the pay period, organization and employee. Then click “Fill in certificate details”.

Pay slip

Of the required documents, we only need to issue a payslip: “Salaries and personnel”, “Salary reports”, “Payslip”.

Indicate the employee, organization, and time period at the top. In the settings, select the items that you want to reflect in the document. Finally, click “Generate”.

If everything in the sheet is correct, then you can print it. It remains to deal with additional information.

Help 2-NDFL

A certificate may be needed to provide to the bank about the employee’s financial situation. It is also necessary when filling out a tax return. The form is located in the “Salaries and Personnel”, “2-NDFL for Employees” menu.

We indicate the basic data again. In the tabular section you can see personal income tax by percentage. If everything is correct, then click “conduct” and then send it to print.

Information about average earnings

The subordinate will need the certificate if he is going to register for unemployment. It can be generated from the dismissal document. “Salaries and personnel”, “Employees”.

Click on the “Print” button and select “Certificate for unemployment benefits”

The employer issues to the subordinate on the last working day documents from the mandatory list and upon request. They contain information about work activity, salary, taxes paid and insurance premiums withheld. Failure to issue will result in a fine, which may increase if the violation is repeated within a year. You can generate the necessary certificates in 1C according to the instructions from the ASTEK company. In our other articles you can learn more about the Social Insurance Fund and insurance payments.

Additional tariff

It happens that a company must transfer contributions to the budget to provide a pension at an additional tariff assigned after a special assessment of working conditions. Such certification allows workers employed in hazardous work to retire earlier.

For these purposes, the developers have introduced a working section on early retirement in the job directory or in the staffing table. You are required to indicate the nature of the work performed and the primary documents. This is extremely necessary so that the machine automatically fills out the fifth section of the SZV-STAZH form, informing about the terms of work for early retirement.

Among other things, it is worth writing down a code for special labor conditions. The machine will thus understand that such conditions need to be automatically entered into the information about their experience. In the job directory, write down the cell for special working conditions in accordance with the PFR parameters classifier.

The position of a subordinate can be added to a special list, which gives a preferential right to retire earlier and for it you indicate the encoding according to the list. In addition, the code of special working conditions, list items and the basis for early assignment of pension benefits should be noted in the working conditions directory, but for this, the machine must be capable of maintaining such working conditions.

A subordinate who has the listed preferential pension preferences goes on a business trip, but its period should not fall into such preferential length of service, then in the working window for business trips you must activate the switch not to add this period to the length of service field for a pensioner.

Composition of SZV-STAZH for 2021

The number of sections of SZV-STAZH to fill out depends on the type of information provided:

Each type of information has its own composition of sections:

- For SZV-STAZH “Initial” or “Supplementary”, sections 1, 2 and 3 are completed.

- For SZV-STAZH “Pension Assignment” all 5 sections are filled out.

For the year-end report, you need to fill out the first 3 sections.

Special periods

There are work periods that require registration differently. Let's look at them in more detail:

- The work of an individual within the framework of a concluded GPC agreement, an author’s agreement, work and accruals for it under other agreements, child care up to the age of three for close relatives or guardians who actually look after the child and this parameter is accrued manually;

- Transfer of a pregnant woman, based on her application and medical evidence, from a job for which she could have retired earlier, but due to her situation, she can no longer work in her previous position. This also includes the time when the issue of her transfer for health reasons was actually decided. For this purpose, go to personnel transfer and in the main window, activate the switch for the period of transfer to maintain preferential Pension Fund of Russia experience, and in the type of Pension Fund of Russia experience field, indicate the transfer of the pregnant woman from work, the right to early retirement, to work;

- Transfer of a subordinate from a job due to early retirement to another that excludes such a preference, but in the same company and no more than a month a year. In the report, this is displayed under the MONTH parameter and in the personnel transfer a corresponding note is made about the transfer according to production needs when this switch is activated. In this case, the machine will understand what actions it needs to carry out.

Features of filling out SZV-STAZH for 2021

- If during 2021 you already submitted SZV-STAZH for employees retiring, then at the end of 2021 these employees must be included again in SZV-STAZH, regardless of whether they retired or not.

- If during 2021 you hired people from prison, information about them should also be included in the SZV-STAZH, since the time worked is counted towards their length of service (Article 1 of the Law dated 04/01/1996 No. 27-FZ, 2.3.17 of the Procedure filling).

- Individual entrepreneurs, notaries, lawyers who do not have employees do not submit SZV-STAZH (Letter of the Pension Fund of the Russian Federation dated July 27, 2016 No. LCH-08-19/10581 - by analogy with SZV-M).

- Companies with a single founder who also works as a director must represent SZV-STAZH, regardless of whether an employment contract has been concluded with him (Letter of the Ministry of Labor of the Russian Federation dated March 16, 2018 No. 17-4/10/B-1846).

Where to find and how to check transferred information

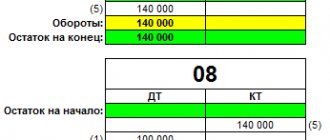

After the download has been completed, Pension Fund Experience Data Transfer (Administration) . It is into these documents that the information for filling out the SZV-STAZH for the period before the transition to ZUP 3 will be loaded.

The data will be uploaded to the information register of Experience Records before the start of operation .

As a result, when filling out SZV-STAZH for the year in which the transfer was made, information will also be filled in for the period before the recommended transfer was performed.

For example, employee Gerankin G.G. I was on vacation in November 2021. This period was highlighted when filling out the SZV-STAZH in ZUP 2.5.

After completing the recommended transfer to December 2021 (in the release before 3.1.5.126), the information for correctly filling out the SZV-STAZH for this employee was not transferred.

However, after additional loading of information using the service Transfer of information about the Pension Fund of Russia experience from previous SZV-STAZH programs for the employee was filled out in the same way as in ZUP 2.5.

SZV-STAGE form for 2021

Since 2021, the form of the report, as well as the procedure for filling it out and the electronic format, have changed. The form of the new SZV-STAZH was approved by Resolution of the Board of the Pension Fund of December 6, 2018 No. 507p and is valid starting with reporting for 2021.

SZV-STAGE form for 2021

There are several ways to pass SZV-STAZH:

- On paper - if the number of employees for whom the report is submitted does not exceed 24 people.

The paper report can be submitted to the fund in person or sent by registered mail with an inventory of the attachments. If you wish, you can submit the report in electronic form: the law does not prohibit this. Please note: for submitting the SZV-STAZH on paper, if you are required to generate it in electronic form, you will be subject to a fine of 1,000 rubles.

- In electronic form - if the report is submitted for 25 or more employees.

SZV-STAZH, submitted in electronic form, must be signed with an electronic signature and sent to the Pension Fund of Russia via telecommunication channels through electronic document management operators.

The procedure for filling out the SZV-STAZH for 2021

Completing the report begins with Section 1:

Section 1

It reflects basic information about the policyholder:

- Registration number in the Pension Fund of Russia.

It consists of 12 characters and is assigned to an organization or individual entrepreneur upon registration with the Pension Fund. You can check it on the Federal Tax Service website by ordering an extract from the state register.

- INN/KPP.

Assigned to a company or entrepreneur upon registration with the Federal Tax Service. TIN of organizations consists of 10 characters, individual entrepreneur - of 12. Entrepreneurs do not have a checkpoint.

- Short title.

Individual entrepreneurs indicate their full names in the report. Organizations enter a short name specified in the charter, and in its absence - a full name.

Section 2

The smallest section of the report consists of only 1 line: “Calendar year”. When reporting for 2021, you must enter “2019” in this line.

Section 3

The most voluminous section in terms of content is SZV-STAZH, which includes 14 columns:

You do not need to fill out all of these columns. For each insured person, you must indicate your full name, SNILS and periods of work in 2021. That is, you need to fill out columns 2, 3, 5, 6 and 7. The remaining columns are filled in as needed.

Information about length of service is entered on the basis of personnel documents: orders for hiring and dismissal, time sheets, contract agreements, work books, etc.

When filling out Section 3, you must be guided by the following rules:

- The employee's full name is indicated in the nominative case: Sergeyev Sergey Stepanovich.

- A separate line is filled in for each employee.

- If contracts of a different nature (labor, civil law) were concluded with the same employee in 2021, information on each contract must be reflected in separate lines indicating a special code in column 11. In this case, the employee’s full name and SNILS do not need to be filled in again.

- If an employee was on staff during the year, but did not work (was on vacation, on sick leave or on maternity leave), such periods must be reflected in columns 6 and 7 in separate lines and special codes in column 11.

- Column 14 is filled out only for employees dismissed on December 31, 2019: enter this date in the column instead of the “x” symbol.

Changes to the document “Contract (work, services)” regarding data recording for SZV-STAZH

In the form of the Agreement (work, services) , information is now displayed about the month from which the data of this agreement were registered for the purpose of accounting for the Pension Fund of Russia’s length of service. Let's look at an example of why this is required.

The recommended transfer was carried out to December 2021. There is an employee with whom a GPC agreement has been concluded for the period from 11/01/2017 to 12/31/2017.

It turns out that the November period of service of this employee was taken into account in ZUP 2.5 and loaded into the Data Transfer .

Therefore, the document Contract (work, services) takes into account the period only from December 2021. This is specified on the document form.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge