Repayment of funds provided under a loan agreement, credit agreement or other financial agreements can be ensured by various mechanisms.

If your company has received the bank’s consent to issue a loan, the procedure for signing an agreement on direct debit of funds may precede the issuance of money. What is direct debit and what subtleties of this procedure you should know, we will talk in this article.

Direct write-off

Direct debit - what is it?

In fact, such actions represent a transfer of money from a bank client’s account in favor of the same bank or any other organization, individual, government agencies, and so on. The reason, as mentioned above, most often becomes a right provided in advance in the contract, but sometimes you will also have to seek a court decision. In any case, all this happens without the consent and sometimes without the knowledge of the account owner, which is already fraud if there are no sufficiently serious reasons.

Meaning of the term and its application

Waiting for a loan to be approved can be a very stressful process. Insufficiently savvy bank clients, little familiar with traditional economic and financial terms, are often at a loss when they learn that their loan application has been “accepted.” Is this consent or refusal? The answer is very simple. Accept means “to accept an offer”, “to pre-approve”.

To clarify, we note that this term is directly borrowed from the English language, from the word “accept”, which means “to accept”. Bank employees replace this anglicism with the longer expression “the bank accepts an application to conclude an agreement.” Thus, the concept of “accept” is a convenient replacement for the more cumbersome expression of agreeing to a statement.

This concept is used during the period when the client has submitted an application for a loan (mortgage) and the bank has previously approved it, but the agreement between the parties has not yet been signed. Most often, credit applications submitted remotely , for example, through the Sberbank Online system, receive the “accepted” status.

The concept of “accept” is a convenient replacement for the more cumbersome expression of agreement on a statement.

Causes

The reasons are most often quite banal. These may include overdue debt on bank loans, unpaid alimony, fines, taxes, and so on. Naturally, people are different, some simply do not want or cannot pay such mandatory payments. To be fair, it should be noted that banks, courts and other interested parties first of all try to come to an agreement on good terms. And only then, when it becomes clearly clear that the debtor does not compromise and refuses to negotiate, more stringent measures follow.

Interesting point

It is worth noting an interesting point: when funds are available in several accounts of the debtor, the SPI in the resolution indicates from which account and in what amount such funds should be written off. In fact, bailiffs issue orders for the entire amount of the debt on all known accounts of the debtor, which often leads to the so-called “double execution”. This situation is extremely unfavorable for business, since at one moment it can provoke a crisis of the debtor’s solvency, which, in my opinion, somewhat shifts the balance of interests in favor of the creditor. The courts believe that the debtor, who brought the situation to the point of forced execution, can wait - after all, the excess funds credited to the deposit are still returned to the debtor (Determination of the Supreme Arbitration Court of the Russian Federation dated May 22, 2014 No. VAS-6214/14 in case No. A73 -10215/2013). Thus, the process of collection through the initiation of enforcement proceedings, although lengthy and cumbersome, nevertheless, to a greater extent meets the interests of collectors, since write-off is possible from the debtor’s accounts not in one, but in several banks at once.

Write-off according to the contract

Usually, the agreement for opening a current or card account provides in advance the right to direct debit. What could this mean? The fact that the bank at any time can independently, without additional permission from the account owner, withdraw money and send it in the right direction. Such a system may even be beneficial, because not everyone has the ability to make payments on time, and such a solution will allow a person to allow the bank to perform the necessary actions on his behalf at the right time. However, as a rule, such direct write-off, for which the client wrote an application in advance, is carried out in particularly unpleasant situations described above. It should be noted that usually the bank not only provides for such a right, but also stipulates the situations in which the specified clause of the agreement can come into force. For example, only after the debt increases above the agreed amount. Or after 5 days have passed since the payment was due. And so on. There can be a huge number of options, and they all depend on both the bank and the client, the loan and many other indicators.

The effect of surprise

Considering the situation from the side of the collector, sending a writ of execution to the bank has a certain effect of surprise for the debtor and is a fairly quick way to receive funds due under a judicial act - already on the same day or in the first half of the next day, the bank puts the collection order in the queue. The maximum delay in execution is seven working days and is possible only in a situation where the bank has irremovable doubts about the authenticity of the writ of execution or attached documents. The creditor should not be afraid of the verification procedure, since during the verification the credit institution suspends settlements within the recovered amount on the debtor’s accounts.

Write-off by court decision

This is a more serious decision in which a direct write-off is made. What this is has already been described above, but in short, after the state authorities have determined the punishment, a document comes into force, according to which the bank has the right and even the obligation to write off money from the client’s account and send it according to those specified in the decision details. This happens when alimony is not paid for a long period of time, laws are violated, the punishment for which is expressed in monetary terms, and so on. In fact, in such a situation, the person will be to blame himself, since, having not agreed to voluntarily fulfill certain requirements or obligations, he will be forced to pay for it out of his own pocket. If he agreed, he would still lose money, but it would at least be a balanced and thoughtful decision, the background of which absolutely would not have to be brought to court.

Bailiff

After the initiation of enforcement proceedings, the debtor is obliged to transfer the amount of debt to a special bank account of the bailiff department within five days or to voluntarily fulfill his obligations to the claimant. After this period, the SPI has the right to make a decision to foreclose on the debtor’s funds located in accounts known to the bailiff. It is worth saying that it is necessary to add another two to three weeks to this period, since the bailiffs are in no hurry with forced collection until they receive official information about open accounts from the Federal Tax Service division where the debtor is registered, despite the collector’s indication of the debtor’s known accounts in the application to initiate enforcement proceedings. It follows from this that the process of collection through the FSSP is quite lengthy. In addition, enforcement proceedings are a public process: the debtor is notified of all procedural actions taken in advance, and by the time the resolution reaches the bank, the available balance of the debtor’s accounts is often transferred to a friendly person or a newly opened account in another bank. However, such a transfer of funds during the initiation of enforcement proceedings to a friendly person will only briefly delay the inevitable challenge of the transaction, as well as the possible subsidiary liability of the founders and directors, already in the bankruptcy case of the debtor (which will most likely follow), but there will still be another bank account found.

Other types of write-offs

In principle, the above are two main scenarios in which a banking organization has the opportunity to touch a client’s account without permission. All other options will most often be fraud to one degree or another. If there is no reason to touch the account, but it is still done, then there is a serious violation that threatens criminal liability on a par with theft or robbery. Bank employees need to be very careful when such events occur. It is recommended to check the legitimacy of the actions and the accuracy of the documents several times before starting an undisputed write-off of funds. If you discover the slightest inaccuracies or incomprehensible points, you should immediately notify management and the security service. Otherwise it could be very bad. Some structures specifically conduct such checks to determine how attentive or responsible bank employees are.

Write-off procedure

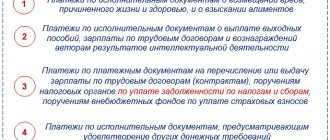

The entire procedure for direct debit can be divided into several main stages.

- The first stage is the emergence of a cause. For example, this could be a debt that has arisen that the client refuses to repay, or a long-term failure to pay alimony, fines, and the like.

- The next stage is legality. There are already possible options, starting from the availability of such an opportunity provided for in the contract, or a separate court decision.

- After this has been sorted out, permission is required from the head of the banking organization in which the debtor opened an account in which there is money. This permission is issued in writing and sent to the head of the relevant structural unit.

- He, in turn, determines the employee who will actually carry out the decision (of management or court). Banking involves just such a system of subordination.

- The bank employee performs all required actions, strictly following what is written in the title document.

In fact, if everything is done correctly, the responsibility will be solely on the debtor. If mistakes are made, then the person who made them will be responsible. For example, the bank's management, if they decided to write off without appropriate reasons, the head of the department, who independently gave instructions, without the consent of superiors, or even an employee, if he carried out the transaction without documents, incorrectly, or even at his own request.

Types of acceptance

Experts distinguish several varieties of this term, some of which we will consider below. The most popular acceptances are:

- agreement or contract;

- accounts;

- bills;

- statements;

- payment or sales document.

Acceptance in other areas

The concept of “acceptance” is very broad. It has several meanings and is used in several areas. Generally speaking, “acceptance” means the party’s agreement to accept the terms of the offer. However, in some industries the explanation may be slightly different.

Right of direct debit

Disputes about whether such actions comply with the constitution still rage. On the one hand, it seems like there are separate agreements or a court decision. On the other hand, all this can, if desired, be classified as fraud and gross violation. This is the main problem that the bank faces when it is necessary to perform direct debit. What could this mean? Everything here is quite simple and clear. If a person from whose account money has disappeared for reasons unknown to him can prove that this was indeed unlawful, the bank will be forced to return these funds. In some cases, you will also have to pay a fine, which is unlikely to make anyone happy. Financial institutions often walk on the edge of legality. Suffice it to recall the services of the same collectors who seem to operate officially, but the methods they use are most often far from legal.

Bottom line

In general, debiting funds from a client’s account without his permission is a very dangerous process that must be carried out strictly in accordance with laws, regulations, agreements, and so on. Any mistakes or violations at this moment are simply unacceptable, as they can have extremely adverse and long-term consequences. In this regard, banking has an extremely negative attitude towards the very need to perform write-offs. If there is another way to solve the problem, the financial institution will prefer it, even if it is less profitable and more time-consuming.