If an organization works with cash, a certain percentage of errors is almost inevitable. Cash discrepancies are especially frequent in companies where the cash flow is very extensive and the persons responsible for it often change, for example, in supermarkets with a large number of cash registers, large shopping centers, etc.

Let's consider what the right thing to do in such cases is for the management of the organization, which threatens the cashier who does not keep track of part of the money, and we will also reveal the features of accounting for the shortage through accounting.

Who can identify the shortage?

A shortfall is an identified negative discrepancy between financial accounting indicators and the actual amount of cash in the operating cash register.

NOTE! If there are more funds than would be due according to the documents (positive discrepancy), we are talking about surpluses going to the organization’s profit.

Who and during what procedures can detect such a discrepancy? The most common shortages are:

- the cashier-operator himself;

- an employee performing cashier functions;

- the cashier's immediate superiors;

- inventory commission;

- auditor checking the cash register;

- founders or shareholders of the company;

- senior management;

- auditors during an external audit.

All these persons have the right to reconcile accounting data and count cash in the cash desk at the required time on the basis of paragraphs 37 and 38 of the Procedure for conducting cash transactions in the Russian Federation, approved by decision of the Board of Directors of the Bank of Russia dated September 22, 1993 No. 40.

Posting surplus

Unlike a shortage, where suspicions of theft or embezzlement immediately arise, a case of a surplus can have two interpretations. If there is unaccounted money in the cash register, then perhaps some product was sold at an incorrectly indicated price or there was an underweight. In principle, with modern systems of fixation and operations, such cases should not occur by chance.

It often happens that cashiers in small stores, in the absence of a sufficient number of necessary change notes, report them to the cash register from their wallet. Later, due to forgetfulness or busyness, you may not remove the change notes in time, which will lead to the appearance of surpluses and subsequent problems when they are detected.

The actual market value of identified surpluses requires confirmation. This is done in one of the following two ways:

- An independent appraiser determines the price of non-income assets. This is a simpler and more transparent method.

- The trade organization conducts a comparative analysis of market prices for similar property and draws up a certificate. The following information documents are taken into account:

- advertisements with prices for similar properties in the media;

- invoices from suppliers;

- certificates from statistical agencies, etc.

Surplus valuables found during inventory are correlated with their market value and posted to other income: debit 10 (or 01, 41, 50), credit 91-1.

It's always the cashier's fault

The cashier is entrusted with storage of material assets (in this case, cash proceeds) on the basis of an employment contract concluded with him.

Art. 242 of the Labor Code of the Russian Federation states that in such situations the employee bears full financial responsibility for compensation for lost funds. A Art. 244 stipulates the legality of concluding such an agreement with employees holding the position of cashier if they have reached the age of majority. In addition to cashiers, full financial responsibility falls on some other categories of workers provided for by Resolution of the Ministry of Labor of Russia No. 85 of December 31, 2002.

BY THE WAY! In the event of damage to the company, the cashier may be guilty not only of unlawful actions, but also of inaction, as well as negligence and dishonesty in relation to his own labor duties.

Types of liability for shortages

- Full financial responsibility. This implies reimbursement of the entire missing amount at the expense of the cashier. If the amount that needs to be reimbursed is no more than the average monthly salary of the culprit, then he must reimburse it by order of management, issued no later than a month from the date of discovery of the shortage. Large sums can only be recovered through judicial proceedings. The employer has a year to go to court on this matter.

- Administrative penalty. The cashier, through his action, inaction or negligence, violated the procedure for handling cash, which means he may be subject to administrative liability. Officials can pay 4–5 thousand rubles, and legal entities – 40–50 thousand rubles. - this is in addition to compensation for the amount of the shortfall itself.

- Disciplinary action. May also be imposed by the employer, in addition to damages. A careless cashier can be reprimanded, reprimanded, and in some cases fired without mercy.

- Criminal liability. Threatens those officials in respect of whom the intent of their actions has been proven. Such guilty actions are recognized as:

- theft - secret appropriation of someone else's property;

- fraud - the acquisition of rights to someone else's funds due to abuse of trust or deception;

- embezzlement – theft of entrusted property or funds and subsequent sale, use, transfer to third parties;

- misappropriation – unlawful retention of entrusted assets for one’s use.

ATTENTION! You will have to file a claim in court if the cashier does not agree to voluntarily pay the funds, as well as after the expiration of the established month.

These actions are punished, depending on the severity, the possibility of relapse and the category of the guilty employee, either by a fine, or by compulsory or correctional labor, or by restriction of freedom, arrest or prison. The specific time limits depend on the type of criminal act.

Criminal liability for lack of money in the cash register

| № | Type of offense | Sanction | Term, amount |

| 1. | Theft | Fine | Up to 80,000 rub. or in the amount of salary or income for six months |

| Mandatory work | Up to 180 hours | ||

| Correctional work | From six months to a year | ||

| Restriction of freedom | Up to 2 years | ||

| Arrest | From 2 to 4 months | ||

| Deprivation of liberty | Up to 2 years | ||

| 2. | Fraud | Fine | Up to 120,000 rub. or in the amount of an annual salary or other income |

| Mandatory work | Up to 180 hours | ||

| Correctional work | From 6 months to a year | ||

| Restriction of freedom | Up to 2 years | ||

| Arrest | From 2 to 4 months | ||

| Deprivation of liberty | Up to 2 years | ||

| 3 | Embezzlement, misappropriation | Fine | Up to 120,000 rub. or in the amount of annual income |

| Mandatory work | Up to 120 hours | ||

| Correctional work | Up to six months | ||

| Restriction of freedom | Up to 2 years | ||

| Deprivation of liberty | Up to 2 years |

IMPORTANT INFORMATION! For any act that provides for criminal liability, the perpetrator can be dismissed at the initiative of the employer.

Theft by an employee

A gross violation of the current legislation, which entails criminal punishment. The main condition for establishing this fact is the presence of guilt. That is, theft is, in fact, theft committed at the workplace.

Important! If the amount of stolen money (or the monetary equivalent) does not exceed 2,500 rubles, then only administrative liability arises. If the amount is larger, then criminal prosecution is possible.

Management may impose the following types of liability for theft:

- collection of the amount;

- a reprimand entered into a personal file;

- dismissal.

The employer has the right to dismiss for such a violation with reference to paragraphs. "d" clause 6 of Art. 81 Labor Code of the Russian Federation. At the same time, the manager retains the right to demand compensation for damage caused. The boss can deduct the amount from the severance pay or go to court to recover the shortfall from the employee.

It should be taken into account that any employee can be held accountable, even if he is not a financially responsible person and stole something at the workplace, then such a violation still cannot be ignored. But the person who is documented to be responsible for the valuables will be responsible for the inventory results.

If, nevertheless, we are talking about theft by any other employee, then the employer retains the right to immediately contact law enforcement agencies after identifying the fact of the loss. Then a protocol is drawn up and liability arises in accordance with the Criminal Code, as in the case of theft in any other place (not at work).

Upon the fact of theft, a protocol must be drawn up that confirms the fact of the loss, and also documents the value clearly expressed in monetary terms. If we are talking about a monetary amount, then there are no problems with calculations. But if valuables are missing, then their book value is taken into account. In the event of loss of equipment or any long-term items, depreciation is additionally taken into account and only the final cost at the moment is indicated.

The procedure for collecting shortages

- Detection of monetary discrepancies in the cash register and in papers.

- Request an explanation from the cashier. In case of failure to provide or direct refusal to draw it up, a special act must be written with the signature of two witnesses.

- Issuance by management of an Order (instruction) to compensate for the shortage.

- For a cashier who agrees to voluntary compensation, the amount of the shortfall will be written off from the next salary, or he will deposit the money into the cash register himself. You can agree on an installment plan.

- If the cashier refuses a refund or if the amount is large, management goes to court.

NOTE! The employer may, after considering the circumstances and the cashier's explanation, completely waive the requirement for compensation at any stage, partially or in full.

When the cashier is not to blame

The law stipulates certain circumstances that remove guilt and financial responsibility from the cashier. These include:

- a natural disaster as a result of which the cash register was damaged and funds were lost;

- another act of force majeure independent of the cashier (robbery, theft of funds during transportation or transfer to/from the bank).

In this case, the act of shortage is recorded, in addition to the usual emergency inventory procedure, also by an act of law enforcement agencies.

How to handle accounting shortages

If the cashier is at fault, the amount of the shortfall is not taken into account for income tax purposes, since even with compensation no additional income arises. And if you had to demand the amount in court, management bears the costs of legal fees and fees: these can be legally included in non-operating expenses.

The following entries exist in accounting for these transactions.

- When the employee reimburses the entire amount shortfalls are carried out under “Other income” in the reporting period in which they were recognized by the debtor or the court:

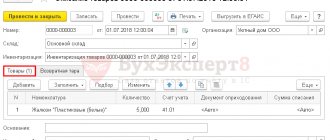

- debit 94, credit 50 – the Nth amount of shortfall in the cash register has been identified;

- debit 73-2 “Calculations for compensation for material damage”, credit 94 - attributing the specified amount of damage to the guilty party;

- debit 70, credit 73-2 “Calculations for compensation of material damage” - the amount is withheld from the cashier’s salary or deposited into the cash register.

- The organization allowed the cashier not to reimburse the shortage. The amount that has already become irreparable damage relates to “Other expenses”:

- debit 94, credit 50 – the Nth amount of shortfall in the cash register has been identified;

- debit 73-2 “Calculations for compensation for material damage”, credit 94 - attributing the specified amount of damage to the guilty party;

- debit 91-2, credit 94 - the amount of the shortfall that is not reimbursed by the cashier is recognized as part of other expenses.

- It's not the cashier's fault. If the funds are lost as a result of force majeure, and the cashier had nothing to do with it, then the losses are attributed to non-operating expenses recognized in taxation and written off to the financial results of the company:

- debit 94, credit 50 – the Nth amount of shortfall in the cash register has been identified;

- debit 91-2, credit 74 - the shortage was written off with an unknown culprit.

Documentation

The documentary aspect plays a key role here. Any identified result must initially be documented. Often, if the volumes of valuables are not too large, a special reconciliation act is created, which indicates a complete list of things on the balance sheet. Further, they note what actually exists.

If the volumes are too large, then the discrepancies simply need to be entered into the act. After this, orders will be issued on how to punish the perpetrators. In this case, it is necessary to prepare documents confirming compliance with all preventive measures. For example, if a storekeeper proves that the warehouse is not provided with adequate protection from thieves, then it will be difficult to accuse him of anything.

If the amount of natural loss allowed for write-off is not exceeded, then an additional act of writing off the shortage is drawn up.