Sales costs are one of the main indicators that an enterprise must take into account to determine the price of a product. These expenses are recorded on accounting account 44 (sales expenses). In the article we will look at what is included in sales expenses, and also look at typical entries in tables and examples for account 44.

Composition of sales expenses

Selling expenses are the costs of an organization to purchase a product, as well as additional costs for its sale. The main items of selling expenses include costs for:

- maintenance and servicing of fixed assets that take part in the sales process (commercial equipment, retail premises, etc.);

- wages for employees who directly support the sales process;

- other representation and management expenses.

To record and analyze generalized information about the amounts of sales expenses, account 44 is used. Expenses are accumulated according to Dt 44, a decrease in the amount of costs is reflected according to Kt 44.

Account correspondence 44

Active account 44: entries are made with an increase in debit and a decrease in credit, subject to closure at the end of the reporting period through a routine operation by allocating costs to the base indicator. Before we figure out how to close account 44, let’s list the main subaccounts:

- Account 44.01 - is intended to formulate the value of distribution costs in trading companies.

- Account 44.02 - is used to collect data on commercial expenses for sales in manufacturing/industrial enterprises.

By debit account 44 reflects the organization's expenses for the reporting period in correspondence with accounts - 02, 04, 05, 10, 23, 29, 16, 19, , 68.71, 69, 70, 76, , 97, 96, etc. For the loan account. 44, full or partial closure of account 44 is carried out with postings to the income accounts of the enterprise - , 99.

Accounting for sales expenses on account 44

The costs of maintaining and servicing fixed assets (store premises, retail equipment) involved in the process of selling goods are one of the main components of sales costs. Let's look at typical transactions for accounting for these expenses:

| Dt | CT | Description | Document |

| 44 | 02 | Calculation of depreciation on fixed assets (buildings, premises, commercial equipment, vehicles, etc.) that are used by the organization in the sale of goods and products | Depreciation statement |

| 44 | 04 | Calculation of depreciation on intangible assets that are used by the organization in the sale of goods and products | Depreciation statement |

| 44 | 10, 60 | Reflection of the tenant's costs for renovation of the premises (shop, retail outlet, etc.) | Certificate of completion |

| 44 | 97 | Reflection of expenses for repairs of fixed assets used in the implementation process | Certificate of completion |

As a rule, the full functioning of the sales process is ensured by employees of the organization, whose job responsibilities are in one way or another related to the sale of goods (services). We are talking about salespeople at retail outlets, loaders, and delivery drivers, whose wages are included in sales expenses.

| Dt | CT | Description | Document |

| 44 | Reflection of the amount of accrued wages of employees who provide the procedure for selling goods | Payroll sheet | |

| 44 | Reflection of the amount of sales expenses incurred by the accountable person | Advance report | |

| 44 | 69.1 | Calculation of the amount of insurance contributions for compulsory social insurance | Payroll sheet |

| 44 | 69.2 | Calculation of the amount of insurance contributions to the Pension Fund of the Russian Federation on the salaries of employees who ensure the implementation process | Payroll sheet |

| 44 | 69.3 | Calculation of the amount of insurance contributions on the salaries of employees who provide the implementation process (compulsory health insurance) | Payroll sheet |

If the production of goods is carried out in-house, then selling expenses can be reflected in the following entries:

| Dt | CT | Description | Document |

| 44 | Attribution of the amount of production costs to the costs of selling goods | Production cost sheet | |

| 44 | Inclusion of the cost of products (works, services) of service industries into sales expenses | Production cost sheet |

The use of additional goods and materials in the sales process is recorded using the following entries:

| Dt | CT | Description | Document |

| 44 | 10 | Reflection of the cost of materials that were used in the process of selling goods | Packing list |

| 44 | 41 | Reflection of the cost of goods used in the process of selling goods | Packing list |

| 44 | Reflection of the cost of finished products that were used in the sale of goods | Packing list |

Typical postings and subaccounts

44 count included in the fourth section of the PS - “Finished products and goods”. The accountant creates two sub-accounts in the accounting system:

- 44.1 “Business expenses” - to account for expenses directly related to the sale of goods and services;

- 44.2 “Distribution costs” - to reflect the costs of public catering enterprises and trade organizations.

They also allocate account 44.01 for trade institutions and 44.02 for manufacturing enterprises.

We present typical transactions for main operations in the table:

| accounting entry | the name of the operation |

| Dt 44 Kt 02 | Depreciation calculation for fixed assets used in the production process |

| Dt 44 Kt 10 | Purchase of materials involved in the sale of products |

| Dt 44 Kt 41 | Costs include the cost of industrial and technical supplies spent on the institution’s own needs |

| Dt 44 Kt 43 | Use of finished products for sales of industrial and technical materials |

| Dt 44 Kt 60, 76 | Representation or advertising expenses provided by other companies |

| Dt 44 Kt 70 | Costs of wages for employees associated with the sale of industrial and industrial materials |

| Dt 44 Kt 94 | Shortages (losses) are taken into account as part of commercial costs |

Industrial and manufacturing companies

For such enterprises, accounting account 44 is an article that summarizes information about the costs of:

- Packaging and stocking of goods in finished goods warehouses.

- Delivery of products to the point (pier, station) of departure, loading them into wagons, cars, ships, and other vehicles.

- Maintenance of premises intended for storing products in places of sale.

- Remuneration of sellers of enterprises engaged in agricultural production.

- Advertising.

- Representation.

- Commissions (fees) paid to sales and other intermediary enterprises.

- Other similar events.

1C Accounting - accounting of business transactions in detail!

subscribe to blog updates via e-mail

Hello, dear readers of the blog-buh blog. In the last two articles (this one and this one), I began to look at the features of setting up the closure of cost accounts (20, 23, 25, 26) in the 1C Enterprise Accounting program, edition 3.0. In today’s article I will talk about another cost account - 44.01 “Costs of distribution in organizations engaged in trading activities” , and of course not only about the account itself, but also about the routine operation of closing the month “Closing account 44 “Costs of distribution”” .

As part of the article, I will touch a little on the question: in what cases should account 44 be used in accounting, and we will also talk about the accounts on which the cost is reflected: 90.02 “Cost of sales” and 90.07 “Sales expenses”. Well, as per tradition, let’s consider a clear example on this topic.

Let me remind you that the site already has a number of articles that are devoted to the issue of closing a month in the 1C BUKH 3.0 program:

- Part 2: “Closing accounts 20, 23, 25, 26” transactions: detailed analysis of “Closing the month” in 1C ACCOUNTING 3.0

- Part 1: “Closing accounts 20, 23, 25, 26” transactions: detailed analysis of “Closing the month” in 1C ACCOUNTING 3.0;

- “Adjustment of item cost”;

- “Revaluation of foreign currency funds”;

- “Calculation of trade margin”;

- “Recognition of expenses for the acquisition of OS for the simplified tax system”;

- “Write-off of additional expenses for the simplified tax system”;

- “Calculation of shares of write-off of indirect expenses”;

- “Calculation of transport tax”;

- “Calculation of land tax”;

- “Calculation of property tax”;

- “Write-off of deferred expenses”;

- “Repayment of the cost of workwear and special equipment”;

- Accounting for depreciation of fixed assets;

- Exclusion of work in progress from the composition of material costs for the simplified tax system;

- Methods of depreciation of fixed assets in 1C Accounting.

A little theory

First, let's talk a little about account 44.01 “Distribution costs” . Sometimes difficulty arises (mainly among novice accountants) in determining in which account to reflect the organization’s expenses on 44 or 20 accounts. In principle, if you open the chart of accounts in the 1C program and look at the full name of account 44, it will become clear in what cases account 44.01 is applied - “Costs of distribution in organizations engaged in trading activities .”

There is also an official document “Order of the Ministry of Finance No. 94n” , which describes in some detail the purposes for which this account is intended. I will give a short excerpt:

“Account 44 “Sales Expenses” is intended to summarize information on expenses associated with the sale of products, goods, works and services . In organizations engaged in trading activities, account 44 “Sales expenses” may reflect, in particular, the following expenses (distribution costs):

- for the transportation of goods;

- for wages;

- for rent;

- for the maintenance of buildings, structures, premises and equipment;

- for storage and processing of goods;

- for advertising;

- for entertainment expenses;

- other expenses similar in purpose.”

From this we can conclude that organizations that are engaged in trading activities should reflect their expenses on account 44.01, and not on account 20. By the way, in the same order you can familiarize yourself with the purpose of the 20th accounts and many others. Let me briefly note the fact that accounts 20, 23, 25 and 26 are used to reflect costs in production organizations , i.e. where there is production.

Reflection of expenses on account 44.01

Now let's look at a small example in which a trading organization (Do It Yourself LLC) buys a large batch of goods from a supplier (Supplier LLC) and sells part of this product to its client-buyer (IP Plotnik V.M.).

So, on March 15, 300 units were purchased from the supplier . goods for a total amount of 300,000 rubles .

The supplier delivered this product and delivery costs (RUB 20,000) were reflected in a separate document “Receipt of goods and services” on account 44.01 “Distribution costs in organizations engaged in trading activities.” This expenditure also took place in the month of March.

| Next, part of the goods is sold. There is a sale of goods in the amount of 50,000 rubles. also in March. This fact is reflected in the document “Sales of goods and services. Please note that the cost of goods sold is reflected in account 90.02 “Cost of sales...” . This will be reflected in the cost of sales on the income statement. But additional expenses incurred, in this example these are delivery costs, will be debited from account 44 to account 90.07 “Sales expenses...” . |

These costs will be reported as business expenses on the income statement. We will see the postings on account 90.07 a little lower when we consider the issue of closing the month.

Regular operation of closing the month “Closing account 44 “Costs of circulation”

Let’s assume that during March there were no more expenses or receipts for this product and let’s move on to Closing the month. When closing the month of March, among other operations, the routine operation “Closing account 44 “Costs of circulation” . Let's look at the movements this document made in the accounting ledger.

A posting has been generated where we see the account 90.07, which I talked about just above. However, now I want to draw your attention to the amount of this transaction. Not the entire amount of delivery costs is debited from account 44.01 (let me remind you that delivery cost 20,000 rubles), but only part of this amount, namely 2,500 rubles. This is the amount of transportation and procurement costs (TPC) that are attributable to goods sold in March. I think it’s worth explaining the formula used to calculate this amount. The formula is as follows:

Amount of goods sold in March * (Amount of goods sold at the beginning of March + goods purchased in March) / (Amount of goods remaining at the beginning of March + Goods purchased in March)

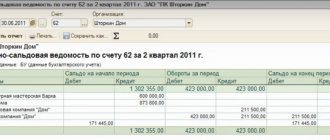

In order to find out the indicators needed for the formula, we just need to create a balance sheet (SAS) for account 44.01 and 41.01 for March:

After we substitute all the values into the formula, it will take the following form:

| 50,000 * (0 + 20,000) / (100,000 + 300,000) = 50,000 * 0.05 = 2,500 Additionally, it is worth saying that based on the regulatory operation “ Closing account 44 “Costs of circulation”, you can generate an explanatory Certificate of calculation Transport expenses". To do this, just left-click on the “Closing account 44 …” item in the Monthly Closing service and select the appropriate line in the list that opens. |

That's all for today.

If you liked this article, you can use the social media buttons to save it to yourself! Also, don’t forget to leave your questions and comments in the comments !

Let me remind you once again that this was material from the “Closing of the Month” section, all articles of which are located here. To learn about new publications in time, you can subscribe to blog updates via e-mail.

Specifics of reflecting costs

To begin with, it should be noted that this category refers to funds allocated to establish communication between the manufacturer and the consumer. This item of costs in its content is classified as current costs. The allocation of these resources takes place annually, and their advances also occur annually.

If the head of the organization manages to increase the efficiency of these costs, then this will give him the opportunity to receive greater profits and direct it to improve the material and technical base, which will lead to an increase in the quality of goods sold and, accordingly, an increase in profits in the future.

If you try to classify the designated category of costs, you can do it as follows:

By economic content:

- material costs;

- funds allocated for remuneration of personnel;

- accrual of depreciation of fixed assets and intangible assets;

- other costs.

By industry sector:

- costs of selling retail products;

- funds allocated to ensure sales of wholesale products;

- costs of selling agricultural products.

Taking into account such a criterion as the quality of trading service, it is necessary to highlight:

- related to improving the quality of trade service;

- unrelated to him.

Fare

Transportation services provided by the intermediary are included in subaccount item 44.2. At the end of the reporting period, account 44 is closed in accounting. Transportation costs in case of incomplete sales of goods are partially written off. To identify the amount to be written off for sales (in the debit of account 90), it is necessary to determine the amount of transportation costs for residual products. Actions are carried out in the following sequence:

- The amount of transportation costs attributable to the balance of products at the beginning and end of the reporting period is calculated (Rtr.n + Rtr.tek).

- The amount of goods sold and remaining goods in the reporting month is determined.

- The result of the ratio of the number obtained in the first point to the number of the second point is calculated. The result is called the average percentage of transportation costs to the total cost of goods.

- The amount of product balance at the end of the month is multiplied by the average percentage of transportation costs (the number from point 3).

- The amount of costs to be written off is determined.

The calculation points can be described by the formula:

— Rtr.k = Sktov × ((Rtr.n + Rtr.tek) / Obkp + Sktov), where:

- Sktov – final balance of account 41 (cost of unsold goods).

- Rtr.n – the amount of costs for transport services attributable to the balance of goods at the beginning of the reporting month.

- Rtr.tek – current expenses for transport services of the reporting period.

- Obkp – turnover on the credit of the “Sales” account (the amount of goods sold).

The remaining expenses are written off to the debit of account 90: Dt 90 Kt 44. Expenses for transport services of intermediaries attributable to unsold goods remain on account 44 and are transferred to the next period.

Chart of accounts

So, with what accounts does account 44 correspond according to the plan? If we talk about debit, then this is:

| 02 | Depreciation of fixed assets |

| 04 | Intangible assets |

| 05 | Amortization of intangible assets |

| 10 | Materials |

| 16 | Deviation in the cost of material assets |

| 19 | Value added tax on purchased assets |

| 23 | Auxiliary production |

| 29 | Service industries and farms |

| 41 | Goods |

| 42 | Trade margin |

| 43 | Finished products |

| 60 | Settlements with suppliers and contractors |

| 68 | Calculations for taxes and fees |

| 69 | Calculations for social insurance and security |

| 70 | Payments to personnel regarding wages |

| 71 | Calculations with accountable persons |

| 76 | Settlements with various debtors and creditors |

| 79 | On-farm settlements |

| 94 | Shortages and losses from damage to valuables |

| 96 | Reserves for future expenses |

| 97 | Future expenses |

When it comes to credit, the following accounts are used:

| 10 | Materials |

| 11 | Animals being raised and fattened |

| 15 | Procurement and acquisition of material assets |

| 45 | Goods shipped |

| 76 | Settlements with various debtors and creditors |

| 79 | On-farm settlements |

| 90 | Sales |

| 94 | Shortages and losses from damage to valuables |

| 99 | Profit and loss |

How to close account 44 - postings

Monthly closure of 44 accounts (entries can be generated manually or through a routine operation) differs depending on the type of activity of the organization. In this case, the zeroing of cost costs occurs for all types of expenses, with the exception of some, distributed as follows:

- In trade and intermediary firms, transport costs are distributed among inventory balances according to the total sales volume and warehouse balances at the end of the period.

- In production and industry, transport costs and packaging costs are subject to distribution between individual product types of sold products, taking into account weight, volume, cost and other factors.

- Agricultural producers use accounts 15 and/or 11 to distribute procurement costs.

General information

First of all, you should find out whether accounting account 44 is active or passive? For specialists who have some experience in preparing balance sheets and reporting, this question does not arise. Any competent accountant knows that account 44 is active. It reflects various costs depending on the specifics of the enterprise's activities. Additional items that accounting account 44 may contain are subaccounts for distribution costs:

- Not subject to UTII (44.1.1).

- Subject to distribution (44.1.3).

- Subject to UTII (44.1.2).

In addition, subaccounts are often opened. 44.2 – selling expenses and 44.3 – selling costs.

The role of 44 accounts in accounting

Position 44 in the Chart of Accounts is active and is designed to reflect information about the costs incurred by the organization in the sale of goods or services.

Thus, existing expenses are accumulated on the debit side of the account, and their disposal is accumulated on the credit side.

In enterprises engaged in commercial activities, this account records expenses such as:

- expenses for transporting goods;

- for payment;

- rental payments;

- funds allocated for the maintenance of retail premises and equipment;

- for an advertising company;

- entertainment expenses.

This account may well be actively used by non-trading organizations. In this case, the following cost items are reflected in it:

- funds allocated for loading and delivery of products;

- resources allocated for maintaining goods in warehouses;

- costs associated with product packaging;

- for an advertising company;

- commission fees and deductions.

Analytics for this account is carried out for each type and item of expenses.