On July 10, the employee was awarded a bonus and paid in advance on July 20.

On July 16, it became known that the employee had died.On July 19, the relatives of the deceased contacted the organization for payment of amounts due to the employee.

It is necessary to arrange a payment to the relatives of the deceased employee.

Starting from the release of ZUP 3.1.13.120 , amounts due upon dismissal (salary and compensation) paid to the relatives of a deceased employee are automatically not subject to personal income tax and contributions.

For more details, see - DISMISSAL DUE TO DEATH - ACCOUNTING FOR PAYMENTS TO RELATIVES OF A DECEASED EMPLOYEE (ZUP 3.1.13.120)

Therefore, the actions described below are not necessary, except for actions related to amounts accrued prior to the date of the employee's death.

Who has the right to receive payments for the deceased?

The general rule is that for an employee who has died, relatives and dependents can receive his payments (Labor Code of the Russian Federation, Article 141). However, in practice, determining who should receive the money is not so simple.

Example: the deceased’s wife and granddaughter applied to the accounting department for payment. At the same time, the marriage with his wife was dissolved, and his granddaughter is an adopted child. It is not possible to determine the whereabouts of blood children. What should the company management do?

Let's turn to the legislation. Family Code (RF IC) in Art. 2 family members include:

- spouse of the deceased - legal husband or wife;

- children of the deceased;

- his parents.

When determining the recipient of payments, you should first of all be guided by these provisions. At the same time, in Chap. 15 of the same document states that other relatives can also be recognized as family members: brothers, sisters, grandparents, grandchildren, non-natural parents and children. The employer decides what to do. He has the right to make a payment to the first of the applicants named in the Investigative Committee.

Question: Should an employer pay the wages of a deceased employee to his only relative (his aunt) and on the basis of what documents? View answer

If several people apply for money at once, considering themselves members of the deceased’s family or his dependents, the issue, as a rule, is resolved by agreement between relatives or by the latter’s appeal to the courts.

If the employer has doubts about who and how legally he will make the payment, it is advisable to transfer this money to the bank account of the deceased employee, notifying the bank of his death.

Thus, the money will become part of the inheritance mass, it will be received by the heirs according to the law, no matter who they are to the deceased. The organization will not be responsible for payment. But a transfer to a bank account with inclusion in the inheritance can be made only 4 months after the death of a citizen (Civil Code of the Russian Federation, Art. 1183). You can leave the money in the organization by depositing it until the moment when the already identified heirs apply for payments.

If you decide to give money to one of your relatives, you should remember that according to the Civil Code of the Russian Federation, only those of them who lived together with the employee or were dependents have this right, regardless of place of residence (Civil Code of the Russian Federation, the same article).

In the example we gave, none of the applicants has the right to receive the salary of the deceased.

On a note! The organization is not obliged to search for relatives and dependents of a deceased employee for the purpose of delivering uncollected amounts of wages and equivalents.

Features of drawing up applications for the issuance of money to relatives

For such documents it is allowed to use a free form, since they do not have a unified one. Both a handwritten version and executed using a personal computer are allowed.

Any such document must include the following information:

- Date of writing the application itself, personal signature of the originator.

- Date of death and name of the authority that issued the certificate.

- Information about the deceased.

- Personal information of the person making the request.

- Full name of the head of the company, indication of the exact position.

If the decision to declare the person dead was made by the court, then write the name of the institution that made the corresponding decision. The addressee for the application is always only the head of the company. The document must contain card details if the money is planned to be transferred there.

Documentation

IMPORTANT! A sample application for payment of wages not received by an employee, funeral benefits and financial assistance in connection with the death of an employee from ConsultantPlus is available at the link

To receive a “dismissal” from a deceased employee, persons who have such a right by law are required to present:

- application requesting payment;

- death document;

- a document proving their identity;

- document confirming relationship with the deceased employee.

The recipient in the application, in addition to the request for the issuance of his payments in connection with the death of the employee, indicates the degree of relationship and the method of receiving payments. If the method of receipt is chosen not from the company’s cash desk, but non-cash, bank details are indicated. The application also indicates a list of attached documents.

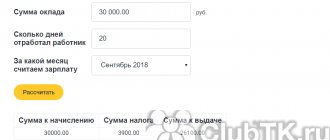

How to calculate salary not received by the date of death?

Let's consider the main payments that a relative of a deceased employee will receive.

- Salary balances.

Calculated using the formula:

Balances = (Salary + bonuses + other allowances) x (Number of days worked until death / Number of days in a month).

Supplements and additional payments for special working conditions (work at night or on weekends, northern coefficient, etc.) are also added to the salary.

- Compensation for unused vacation.

For each month worked, the employee is accrued 2.33 days of paid leave. If he did not have time to use them before his death, this compensation will be added to his salary. A total of 28 vacation days accrue over 12 months.

First of all, it is necessary to calculate how many vacation days the employee has accumulated:

Unused vacation = Number of years worked x 28 + 28 / 12 x Number of months worked in total - The total number of vacation days that the employee spent during the entire period of work.

If an employee has worked for more than half a month, it is counted as a whole period and is included in the accounting. The resulting number is also rounded to the nearest whole in favor of the employee, regardless of the arithmetic rules.

If the employee has worked for less than 1 year, the following formula is used:

28 / 12 x Number of months worked – Number of vacation days used.

The amount of compensation is calculated taking into account the established days:

Compensation = Unused vacation days x Average daily salary.

In turn, the average daily earnings are calculated:

ZPsr. = Salary amount for 12 months / 12 / 29.3.

Let's look at the calculation of the full payment using an example.

Berezkina I.M. submitted an application to the organization where her husband worked until his death for payment of his wages and funeral benefits, attaching all the necessary documents to the application.

Berezkin K.N. did not go to work on the day of his death, April 28, 2019. His salary was 34,561 rubles per month, the average daily salary was 1,179 rubles 55 kopecks. He has accumulated 28 days of vacation (since the last time he took a vacation was in April 2021).

The application was submitted in May 2021. At that time, the funeral benefit was 5,701 rubles 31 kopecks. In addition, the organization’s collective agreement established financial assistance to the families of deceased employees in the amount of 4,000 rubles.

Thus, Berezkina’s widow will receive:

- salary balance – 34,561 x 28/30 = 32,265 rubles 93 kopecks;

- compensation for unused vacation – 28 x 1,179.55 = 33,027 rubles 40 kopecks;

- funeral allowance – 5,701 rubles 31 kopecks;

- financial assistance from the organization - 4,000 rubles.

A total of 74,994 rubles and 64 kopecks will be transferred to her.

Taxes and fees

There is no income tax on amounts due to a deceased employee. According to Art. 44 of the Labor Code of the Russian Federation, the death of an employee means the termination of his obligation to pay the specified tax, therefore, the tax is also not collected from relatives receiving payments from the deceased. Corresponding explanations have been given more than once in letters from the Federal Tax Service and the Ministry of Finance (letter No. 03-04-05/33652 dated June 10, 2015 from the Ministry of Finance and a number of others).

On a note! If wage payments are received by relatives through the inheritance procedure, the amounts will also not be subject to personal income tax. Exception: remunerations paid to the heirs (legal successors) of the copyrights of the deceased (Tax Code of the Russian Federation, Art. 217-18).

Payments for wages and equivalent payments are subject to insurance contributions. The latest clarifications on this matter are given by the Ministry of Finance in letter No. 03-15-07/53912 dated 08/22/17. Officials argue their opinion by the fact that at the time of calculating wages, the employee was alive and was an insured person, and contributions are calculated from the amounts accruals. Let us note that previously the Ministry of Labor and the Social Insurance Fund expressed a completely opposite opinion (attachment to the Fund’s letter No. 4 dated 04/14/15 No. 02-09-11/06-5250, letter of the Ministry of Labor dated 02/20/2013 No. 17-3/292) .

For income tax, the amounts of payments due to a deceased employee are taken into account when determining the tax base (Tax Code of the Russian Federation, 272-4; 255-2-1.8).

Accounting

The accrual of the deceased’s “settlement” is made using standard entries Dt 20,23,44,25, etc. Kt 70. If the organization creates a reserve of expenses for upcoming vacations, then compensation for unused vacation is reflected in the posting Dt 96 Kt 70. For settlements with relatives of the dismissed person on occasion upon the death of an employee, account 76 “Settlements with various debtors and creditors” is used, since they were not and are not employees of the company: Dt 70 Kt 76. Payment and closing of settlements to relatives is reflected by posting Dt 76 Kt 50, 51.

When forming a vacation reserve (estimated liability) and paying compensation from this reserve for non-use of vacation time by the deceased, a temporary difference arises between the accounting and NU. After all, the amount of this liability was attributed according to the accounting system to expenses for ordinary activities at the time of formation. In this case, the actual amounts of costs incurred are reflected in the NU.

Deferred tax assets (repayment) arising in connection with this temporary difference should be reflected in accounting: Dt 68 Kt 09 - for the amount of income tax calculated based on the amount of compensation for unused vacation.

Results

- Wages not received by the deceased, compensation for unused vacation after the registration of the procedure for his dismissal upon death are given to his relatives or dependents. First of all, this is the spouse, parents, children, according to the RF IC.

- According to the Civil Code of the Russian Federation, only those relatives who lived with him or were financially dependent on him have the right to receive the funds of the deceased.

- Property disputes between relatives are resolved by them independently, without involving the organization where the employee worked.

- The law also does not oblige representatives of the organization where the employee worked to search for relatives of the deceased. If no one has applied for the money within 4 months or management has reasoned doubts about the recipient of the funds, the money is transferred to the bank to the account of the former employee or deposited. In the future, they are automatically included in the estate of the deceased and handed over to his legal heirs.

- Personal income tax is not taken from posthumous payments to relatives, but payments to funds are calculated. Settlements with recipients of funds are carried out through account 76 BU.

Features of calculating unpaid wages

Wages are a sum of money that is considered as a means of subsistence for citizens, payable during their lifetime, but not received by them for various reasons at the time of their death. Therefore, in the event of the death of an employee, the employer is obliged to make a final calculation of his wages and all payments that are equivalent to it.

Unpaid wages include the employee's tariff rate or salary for the time actually worked, bonuses and additional payments, bonuses and rewards (if required by working conditions). If the employee was ill before his death, then it is necessary to calculate sick leave payments.

The final payment is subject to all wages accrued to the deceased employee, as well as compensation for unused vacation (if any), minus the appropriate taxes, when provided for by tax legislation.

Article 137 of the Labor Code of the Russian Federation defines deductions that are not made by the employer from the wages of a deceased employee. reimbursement , deductions for the payment of alimony are also stopped, and so on.