Any company or individual entrepreneur uses cash in its activities: in settlements with organizations and individuals, with its employees, etc. In each case, “cash” passes through the cash register, where after all income and expense transactions, at the end of the day there may be some amount of money left. The cash balance limit is the amount of cash that a company or individual entrepreneur defines as the maximum possible balance at the end of each day, and everything that exceeds it must be deposited at the bank. Is a cash limit required for everyone, and how to calculate it, we will tell you further.

Who needs a cash balance limit?

The cash balance limit for 2021 must be calculated by enterprises that, by law, are not classified as small. Individual entrepreneurs (regardless of the tax regime) and legal entities with the status of micro and small enterprises can independently decide whether they need to calculate the minimum amount of cash.

To accurately determine whether an enterprise belongs to the micro or small category, you can use the register created by the Tax Service and located on the Federal Tax Service website, indicating:

- name or full name;

- OGRN (OGRNIP);

- TIN.

Attention! If the information is incorrect, you can submit an application with the correct information. If the enterprise is not in the register, you cannot use any benefits for small businesses.

Requirements for processing cash transactions

An organization can make cash payments in two ways:

- upon receipt of cash proceeds at the cash desk;

- in the absence of cash proceeds.

The list of cash uses is not limited to the payment of wages and settlements with accountable persons; the company determines and regulates it independently. But, in any case, a limit on the cash balance for 2021 must be set. This requirement is specified in clause 2 of the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U. It means that every company must have a cash register, and it defines the maximum balance of money at the end of the operating day. If there is more money left than the established maximum balance, the organization is obliged to hand it over to the bank, because otherwise it may be punished administratively.

The cash balance is displayed on the basis of all transactions completed during the day, issued by incoming and outgoing orders and posted according to the cash book. At the end of the day, the cashier must reconcile all the calculations and withdraw the remaining money, which should be recorded in the cash book.

How to calculate the cash limit in 2018?

Since businesses are required to make the calculations themselves, you need to know how to calculate the cash limit for 2021. You need to be based on the Directive of the Central Bank No. 3210-U.

The cash limit for 2021 is set based on money turnover parameters. Real figures are taken (planned ones for new enterprises), as they are checked by Tax Inspectorate inspectors. There is no need to coordinate the calculations and the results obtained with the bank. Everything is formalized on the basis of the order of the manager.

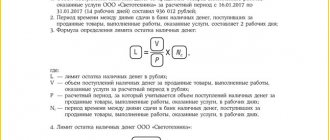

The answer to the question of how to set a cash limit in 2021 depends on whether the company has cash revenue. If there is, then the formula from clause 1 of the Appendix to Directive N 3210-U is used:

Limit = volume of receipts / billing period * number of days between collections

Any 1-92 days can be selected as the billing period. The days between collections are established in the agreement concluded with the bank (up to 7 days if there is a bank in the locality, or up to 14 days if there is no bank).

If money comes only from the current account (there is no cash proceeds), in the formula the volume of receipts is replaced by the volume of cash disbursement.

Sample calculation of the cash limit for 2021 for a trading company

In October, revenue is 300,600 rubles, in November – 350,700 rubles, in December – 500,000 rubles, collection is carried out daily. The minimum amount of money must be:

(300,600+350,700+500,000)/(21+22+21)*1=1,151,300/64=17,989 rub.

An example of a calculation for a company paying in cash for goods and services

For October, 25,000 rubles were issued for reporting, for November - 30,000 rubles, for December - 52,000 rubles, funds are withdrawn from the account every 3 days. Limit calculation:

(25,000+30,000+52,000)/(21+22+21)*3=1,672 rub.

The final stage is an order from the manager approving the calculations.

Results

The figure corresponding to the amount above which the cash balance in the legal entity’s operating cash desk at the end of the working day cannot be exceeded should be determined by the legal entity itself, using a legally established formula.

The formula has 2 outwardly identical options, which differ fundamentally in the characteristics of the volume of cash money involved in the calculation: this is either the volume of sales or the volume of payments for a certain period. Other indicators included in the formula are similar in meaning, but their meanings depend on what specific (sales or payments) volume of cash is taken as the basis for the calculation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Orders to establish and cancel a limit

The order approving the cash balance limit for 2021 is drawn up in free form. The Tex must include the number from which the minimum volume is applied, the frequency of depositing (withdrawing) funds to the bank, and the responsible person. The order can also indicate the validity period. If there is no such indication, the document is valid until the moment when the need arises to revise the minimum volume. The calculation can be included in the text or created as an appendix.

Directive No. 3210-U does not define how long the order is valid without specifying the validity period. For example, if at the beginning of 2021 the minimum volume has not changed compared to the end of 2021, it is better to create a new cash limit order for 2021. There is a possibility that Tax Inspectorate inspectors may recognize the old document as invalid.

If an enterprise has structural divisions (representative offices, branches), they can transfer cash to the parent company or have their own current accounts. In the first option, the order is developed for the company as a whole (in several copies) and distributed among departments. In the second option, each structure develops its own documentation.

Important! If the turnover volume changes, the minimum volume is calculated again.

The cash limit for an LLC in 2021 for a new enterprise looks something like this:

Small businesses (including LLCs and JSCs) can choose whether to set a minimum volume or not. If a company operates with a certain minimum volume of management, after entering it into the register of small enterprises, an order must be issued to cancel it. It should be clear from the content from what date the old order is cancelled.

An order to cancel restrictions on the minimum volume is created in free form. It is necessary to take into account that at the same time changes are being made to local regulations related to the conduct of cash transactions.

The order to abolish the cash register limit for individual entrepreneurs in 2021 looks like this:

Individual entrepreneurs and small businesses

For individual entrepreneurs, the obligation to determine the maximum cash balance at the end of the day is not provided for by the Central Bank's instructions. Cash limits for small businesses are also optional in 2021. Clause 1, 4 of the Federal Tax Service Letter N ED-4-2/13338 dated 07/09/2014 states that legal entities with the status of a small business entity can independently decide whether this is necessary. And if a cash balance limit is not set, you can store any amount of money without depositing it in the bank. If the balance is fixed by order, this cannot be done.

Storing excess amounts

In a standard situation, at the end of the working day, the company should not have cash in excess of the established minimum amount. But the law provides for exceptions. Exceeding is permitted:

- on paydays;

- if funds were received from the bank for settlements on weekends (holidays);

- on days of social payments and scholarships.

Attention! Money is transferred from the bank only when it is really needed on holidays (weekends).

Why do you need a cash limit and how is it set?

Establishing a limit limits the amount of cash that may be in the operating cash desk at the end of the working day (clause 2 of Bank of Russia Directive No. 3210-U). The limit may be exceeded on days when employees are paid salaries, scholarships, social benefits, and on weekends if the legal entity carries out cash transactions there.

Determining the amount of the limit is mandatory for legal entities and separate divisions that independently deposit money to the bank. If separate divisions deposit money at the cash desk of a legal entity, then the total amount of the limit established by the organization also takes into account those limits that are provided for the divisions. Individual entrepreneurs and legal entities classified as small businesses have the right not to set such a limit.

Read about the cases in which a legal entity can be classified as a small business entity here.

The legal entity independently calculates the cash balance limit (for divisions and its total value) and approves its size with an administrative document. One of the copies of this document is sent to the division.

Penalty for exceeding cash limit

Exceeding the balance in the cash register is considered a violation of the law, for which administrative punishment is provided (Article 15.1 of the Administrative Code). A fine of 40-50 thousand rubles may be imposed on the company, and 4-5 thousand rubles on the manager. In practice, the company and its officials are most often punished simultaneously.

If there is too little money in the cash register at the beginning of the working day, it must be returned (withdrawn) frequently. When calculating balances that are too large, there is a possibility of additional costs in the form of a fine. If the excess occurs accidentally, it is better to give them to the accountable person. The amount is not limited by law.

Why is it important to set a cash balance limit?

At enterprises that have not determined the cash register limit, it is automatically recognized at level 0, and they are forced to hand over each amount received to the cash register to the bank.

In such circumstances, there may be no change for the store's cash register, or for any small expenses you will need to go to the bank and get money. Did you know? Since it is not allowed to store cash in a cash register for loose change, there is a way to issue this money to the seller for 3-4 weeks by issuing an order for the issuance of loose change and issuing an expendable cash order - there is no direct prohibition on this in the law.

Is it necessary to set a cash limit for individual entrepreneurs?

For small businesses and individual entrepreneurs, the Directive allows no cash limits to be set; they are allowed to hold any amount, as long as they meet the criteria by which they are classified in this group. Small enterprises are those whose income is no more than 800 million rubles. per year, employees - no more than 100 people, the state has a share of no more than 25%, and other enterprises - no more than 49%. Individual entrepreneurs include entrepreneurs who have not registered as a legal entity. At their own discretion, such enterprises may establish restrictions in the manner described for other companies. In this case, they will be required to deposit excess money into a bank account. Entrepreneurs who want to ensure the safety of storing funds and control cash voluntarily set restrictions.

Important! If in the past period the enterprise did not belong to a small enterprise or an individual entrepreneur set a limit that is no longer required, then an order to cancel it will be needed, otherwise problems will most likely arise during a tax audit.

Who is covered by the procedure for conducting cash transactions?

By order of the Central Bank of the Russian Federation, new rules for conducting cash transactions were introduced. At the same time, the forms for maintaining cash documents have not undergone any changes.

The changes will most affect individual entrepreneurs. And, despite the fact that individual entrepreneurs will have to change their usual mode of operation, for them this will more than pay off by simplifying cash transactions.

In addition to individual entrepreneurs, the changes will affect enterprises and organizations. In particular, innovations will affect accounting.

It is very important that individual entrepreneurs promptly familiarize themselves with the updated rules for conducting cash transactions in order to avoid penalties.

Coordination

The order is an internal document of the organization. There is no need to coordinate it with the bank or tax authorities (although it is advisable, in order, for example, to prevent an unscheduled arrival of collectors).

However, if it is nevertheless developed and exists (even with reference to Regulation No. 343-P of the Bank of Russia dated October 12, 2011 and without an appendix), then for failure to comply with the rules regarding restrictions on cash held in the cash register, the institution or person will face administrative liability in in the form of such a nuisance as a fine.

Accountable amounts

The amounts issued from the cash register for reporting to the employees of the enterprise are not limited by limits. This applies to cases of payment of daily allowances and reimbursement of expenses for advance reports of seconded employees.

If an employee is given money to pay for goods or services under an agreement between an organization and its counterparty (registered enterprise or individual entrepreneur), then the one hundred thousand limit must be observed (taking into account all previous cash payments under a specific agreement).

Calculation features

So, you can calculate the LC in two ways: by the amount of cash receipts or by the amount of disposal. It all depends on which operations predominate in a particular economic entity.

For example, if a company only receives revenue in cash and makes other payments by bank transfer, then the LC should be calculated using the receipts method.

Calculation formula:

The billing period can be absolutely any period of time from one to 92 days. Moreover, the year does not matter; the calculation period can be taken for the current year and for any previous financial periods.

Determine the number of days between the days of depositing money into the bank based on the banking service agreement, breaks between collections (if any) or actual intervals.

Please note that there are limitations to this value. So, if your organization is located in an area where there is no bank branch, then the period cannot exceed 14 working days. In other cases, the period is limited to a maximum of 7 working days. But the greater the number of days in the calculation interval, the greater the LC amount.

Calculation of the cash limit for 2021, sample.

VESNA LLC works seven days a week.

Revenue for February 20, 2019 amounted to RUB 300,000. (largest amount of cash per day); for the period from 08/11/2018 to 09/22/2018 - RUB 1,500,000.

Cash is deposited into a bank account once every three days - this is a constant indicator. But the billing period can significantly affect the size of the personal account.

Option 1. VESNA LLC has defined the billing period as one day - 02/20/2019, the cash balance limit will be 900,000 rubles. (RUB 300,000 / 1 day × 3 days).

Option 2. VESNA LLC has a billing period from 08/11/2018 to 09/22/2018, amounting to 43 days, the cash balance limit will be 104,651.16 rubles. (RUB 1,500,000 / 43 days × 3 days).

Conversely, if the bulk of cash transactions are cash withdrawals, with the exception of salaries, scholarships and other social benefits, then use the disposal method. Provided that the company does not receive revenue in cash.

Calculate using the formula:

Determine the billing period and the interval between collections for calculation in a similar manner. The amount of cash disposal transactions does not include the payment of wages, scholarships, benefits and other social benefits. It is acceptable to use an online calculator to calculate the cash limit.

Limit as part of cash discipline in 2021

Any enterprise can use cash, but to do this, you first need to open a cash register and, by internal order, limit the maximum amount that can remain in it.

Amounts exceeding the cash limit on hand must be deposited at the bank. This is indicated by the Directive of the Central Bank No. 3210-U.

Every working day, before the end of the shift, the cashier reconciles cash documents, writes down the balance of cash in the cash book and certifies it with his signature. It is this balance that cannot exceed the established limit.

Responsibility

Exceeding the permitted amount of cash at an enterprise becomes a reason for bringing the offender to justice:

| Amount of fine (RUB) | Article | |

| For legal entities | 40000-50000 | Article 15 clause 1 of the Code of Administrative Offenses |

| For individuals and individual entrepreneurs | 4000-5000 | Article 15 clause 1 of the Code of Administrative Offenses |

However, this law also has its exceptions. According to the instructions of the Central Bank, it is permissible to exceed the limit with impunity:

- for issuing salaries and other payments to employees;

- on days when the company is open and financial institutions have a day off (for example, these are Saturday and Sunday for most retail stores).

Why is this necessary?

Initially, the cash limit was introduced as a measure to limit the amount of cash in circulation by a business. Money lying in non-cash bank accounts ceases to be a dead weight for the state, they begin to “work”.

For entrepreneurs themselves, limiting cash is primarily a security issue. Emergencies, robberies, fraud - it is impossible to insure against everything, but if you keep only part of your proceeds in cash, many risks can be reduced.

This might also be useful:

- Online cash registers in 2021

- Taxpayer personal account Nalog.ru

- Chart of Accounts 2019

- What an individual entrepreneur needs to know about auditing cash transactions

- Cash discipline for individual entrepreneurs in 2021

- How can an individual entrepreneur keep accounting records?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

How to approve

Let's say the amount of LC has been calculated, but this is not enough for work. It is required to approve an order for the cash limit for 2021, sample:

Please note that there is no standardized form for this type of order. Therefore, draw up the administrative document in any form.

If the organization has already approved its LC. For example, the calculation was carried out in 2021. But this year, 2021, the company has increased its turnover, and the current limit is not enough for uninterrupted and productive work. In this case, an order to cancel the cash limit is required. Note that two orders can be issued: the first order to cancel the outdated standard, and the second order to approve the new LC. Or you can combine two orders in one document. Sample:

Sample orders:

about the absence of a cash limit

on setting a limit

What restrictive measures on payments through the cash register are provided for organizations?

The limit for cash payments between legal entities in 2021 is at the level of 100,000 rubles. It is used for transactions:

- between counterparties-enterprises;

- with the participation of two individual entrepreneurs;

- with a composition of participants from a legal entity and individual entrepreneurs.

The restriction applies to transactions in foreign and national currencies (conversion into ruble equivalent is carried out at the officially established rate valid on the day of payment). The limit is valid for payment within one transaction secured by contractual relations. Businesses can make multiple cash payments with a total overdraw, but under different contracts and subject to the restrictions of individual agreements.

In the case of cash flow between the organization and its branches, the limit does not apply. The list of exceptions includes transactions for the payment of salaries with accountable funds and amounts to an individual entrepreneur for use for personal purposes of a non-commercial nature.

It is allowed to spend from the proceeds posted to the cash desk for the purpose of:

- payments of money to enterprise personnel in the form of salaries and social payments;

- cash expenses in favor of the entrepreneur to cover personal expenses;

- reimbursement of accountable funds;

- refund of previously paid amounts, taking into account the limit introduced by the Central Bank.

In other cases, cash payments are made according to the following algorithm:

- Transfer of available proceeds to the bank.

- Withdrawing money from an account to pay a counterparty.

- Making payments in cash.

The given sequence of actions is relevant for paying rent, issuing (repaying) loans, repaying accrued interest on loans, and issuing dividends.

The disadvantage of the above mechanism is the need to pay interest for the delivery of proceeds to a financial institution and its withdrawal. The purpose of introducing such a rule was to provide an additional measure of state control over the movement of funds between business entities and to suppress money laundering.

Limit per contract

The introduced restrictive limit is linked to the conditions and number of transactions between counterparties. The limit is set for each contract. In the context of one agreement, an enterprise can pay (or accept as payment) a maximum of 100,000 rubles. But it is allowed to make payments with a similar limit for other transactions with the same counterparties.

Cash payments between legal entities in 2021 require compliance with a number of features at the stage of concluding an agreement:

- the subject of the transaction can be any service or product - from payment for goods to processing a loan;

- the amount of cash deposited during the term of the agreement cannot exceed the limit established by the Central Bank;

- the limitation on the amount of cash payments applies to a specific agreement even after the end of its validity period;

- splitting payments into parts, using installments does not allow increasing the limit, the accumulated amount of cash payment under the agreement is taken into account;

- if the transaction amount exceeds the permitted threshold, part of the funds (within the legally established limit) is paid through the cash desk, the remaining funds are transferred by bank transfer.

Basic standards

The rules for conducting cash transactions in Russian legislation are strictly regulated.

Any deviation from current standards is punishable by large fines and serious sanctions. Thus, the key requirements for conducting cash transactions are established in the Instructions of the Central Bank of Russia No. 3210-U dated March 11, 2014 (as amended on June 19, 2017). All economic entities that carry out cash transactions must strictly comply with this standard. In simple words, if an organization works with cash (accepts payments, makes payments, makes payments), then compliance with Instructions No. 3210-U is mandatory.

Let us recall that cash transactions are any facts of economic activity that are directly related to the receipt, disposal or other movement of cash within an economic entity (organization).

Should it be revised?

The review of the cash register limit is voluntary and does not need to be changed for a long time. If it turns out that such money is not enough to cover the current cash needs of the enterprise, it can be revised at least monthly. The main thing: do not forget to give the bank an order to change the limit.

Did you know? If you do not want to periodically issue resolutions approving the limit and monitor the expiration of their validity period, do not enter into the order the period for which the restriction is established - then it will be valid indefinitely.

Form and points of the order

In the upper right corner or at the very top of the document, the full name of the organization or the last name, first name and patronymic of the individual entrepreneur is indicated.

Then follows the heading “ORDER establishing a limit on the organization’s cash balance” with a number and date. In the main part of the paper, the manager specifies which documents he refers to. It is also necessary to mention what date the limit is set.

Usually the accounting department deals with the preparation of this paper and prescribes a certain frequency: once a year, with each reporting cycle.

Note! There are times when restrictions on holding cash need to be reconsidered. In this case, the law allows the order to be reissued on any date of the accounting year.

It is advisable to notify the bank with which the organization interacts about this event, since bank employees can carry out collections by agreement.

The order (in the first paragraph) also talks about the calculations made in the application. The latter depend on the billing period. By law, this time should not exceed 92 days.

The paper reflects the specific amount that constituted revenue during this period (or the fee that was paid to employees, if the calculations are based on this indicator). If the billing period remains the same, then this is stated in the order.

The second paragraph of the order indicates the financially responsible person, who, if the limit is exceeded at the end of the working day, is obliged to take all funds exceeding this figure to the bank and deposit it in the organization’s current account.

Attention! An employee interacting with cash must fulfill the duties of a cashier, be listed in this position or combine it with the position of an accountant.

If the organization is small and operations related to the circulation of cash are carried out by an accountant, then there must be an order assigning cashier duties to the accountant. This requirement is related to the requirements of the constituent documents of banking organizations with which legal entities deal.

An appendix on calculating the cash balance in the cash register for the billing period is attached to the order. The balance is calculated based on the receipt of funds for this period or from the payment of wages to employees, calculated using formulas. An appropriate note about this is required.

Thus, the amount of the limit itself with the time for which it is set is disclosed in the very first paragraph, and the official paper is completed with the signatures of the manager and chief accountant.