Accounting for funds in an enterprise is one of the main tasks of accounting. Since money can be cash and non-cash, the operations for accounting for them are different, and accounting for cash is a little more difficult. In this article you will find important features and requirements for such accounting.

Cash accounting is usually called cash accounting because all transactions involving cash are not only carried out in a room called the “cash desk”, but are also posted to account 50 “cash desk” in the chart of accounts. True, if an organization sells goods, services or work at retail, cash may be in retail outlets, but it also needs to be put into a cash register - a special control device that issues checks to customers. Who can handle cash, how to keep track of it and what documents are needed?

Chart of accounts

Cash flow accounting is carried out in account 50 “cash” in the chart of accounts. This account is an active synthetic one and sub-accounts are usually opened for it, showing the cash flow in the context of:

- 50-1 “Cash desk of the organization” - to reflect cash transactions directly at the cash desk of the organization (issuance of money for household needs, travel expenses, etc.);

- 50-2 “Operating cash desk” - to reflect cash transactions carried out in separate divisions and areas of the enterprise (in shops, cafes, kiosks, etc.);

- 50-3 “Cash documents” - to reflect transactions with strict reporting forms, as well as other securities (stamps, vouchers, bills, etc.);

- other subaccounts, if necessary.

For each of the subaccounts, it is necessary to conduct analytics in the context of movement in each department.

Goals and objectives of cash accounting

Considering that the money of economic entities, both in cash and non-cash form, is one of the most highly liquid assets, cash accounting must fully provide data on the sources of their receipt and the direction of further use. Operations with financial resources involve performing tasks such as:

- documenting records of the organization's finances;

- compliance with legislation when making payments of various types;

- targeted use of funds;

- settlements with counterparties, budget, employees and other creditors.

The theoretical foundations of accounting for funds and their movement are reflected in PBU 23/2011. As part of the financial statements, to analyze financial information, enterprises use Form 4 “Cash Flow Statement”. The peculiarities of cash accounting also lie in the fact that economic entities that simultaneously apply several taxation regimes are required to maintain separate control over cash and non-cash receipts and expenses.

The tasks of cash accounting also consist of analyzing information about ongoing transactions for tax purposes. Thus, the cash expense register gives an idea of the actual expenses of the entity in the current period.

Accounting documents

Cash accounting is briefly carried out on the basis of primary documents - expenditure and cash receipt orders in accounting registers. Warrants may be issued by an authorized accountant or cashier. The primary document has a number of required details:

- name of the organization and its details;

- number;

- Date of preparation;

- transaction amount;

- purpose of the operation;

- FULL NAME. and the signature of the person authorized to accept and issue money.

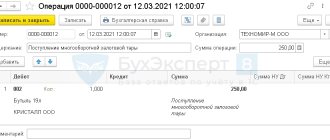

The arrival of cash at the cash desk is documented as a receipt order, and the issue of cash is documented as an expense order. The recipient of the money must write in his own hand how much cash he received and sign. Orders are registered in a special journal, where they are assigned serial numbers.

For mass payments to employees (salaries, bonuses, advances, etc.), payroll is used. It contains a list of the surnames and initials of the recipients and the amounts due to them. A signature is placed next to each amount upon receipt. Based on the statement, a consolidated expenditure order is still drawn up, to which it is attached.

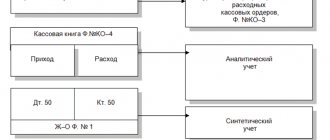

In addition, maintaining a cash book is mandatory. In this register, all cash movements for each day are recorded and the remaining funds are withdrawn the next day. The book is filled out in two copies: one sheet remains in it, the second (tear-off) must be submitted to the accounting department along with the primary documents for the day. No corrections are allowed in the book itself, much less in the primary cash documents.

Accounting for other funds

In addition to cash registers and current accounts, economic entities have the right to store funds using special bank accounts: letters of credit (one of the forms of non-cash payments in which the bank transfers funds by order of the client), deposits, check books. For these purposes, cash accounting is carried out using account 55.

Special bank accounts are used when it is necessary to carry out special transactions. For example, deposits are used to store money in credit institutions at increased interest rates, while check documents contain an order to issue funds to the bearer.

Another account that reflects information about the availability of money is account 57 “Cash in transit.” Used in cases where there are some temporary differences in movement, for example:

- Dt 57 - Kt 50 - money issued from the cash register to replenish a bank account;

- Dt 51 - Kt 57 - receipt to the bank account.

Cash accounting (briefly) is generalized information about the movement, receipt and use of monetary assets in an enterprise.

Cash accounting

The accountant reflects information about the receipt of cash in the organization as a debit to account 50, and expenditures as a credit. Under one agreement, a commercial organization has the right to accept from the counterparty no more than 100,000 rubles. In this case, it is necessary to use cash register equipment (CCT) with an online data transfer function that issues fiscal receipts. Failure to use CCP may result in serious fines.

For synthetic accounting, a journal order for account 50 and a general ledger are used; the accountant maintains analytics for each division separately in special registers. The balance (remainder) must be displayed at least once a month. Accounting data must correspond with other accounts.

Accounting upon receipt and withdrawal

Cash accounting involves making a posting to account 50 in correspondence with another account upon the completion of an incoming or outgoing cash transaction.

A receipt transaction refers to the receipt of cash at the cash desk. Receipt amounts are entered in the debit of account 50.

In this case, depending on the source of funds, the corresponding account can be:

- 51 – when withdrawing cash from a current account;

- 60 – if cash comes from suppliers;

- 62 – from buyers;

- 66, 67 – upon receipt of loan funds from the bank;

- 71 – from accountable persons;

- 73 – repayment of loans by employees, amounts of damage contributed by employees;

- 75 – from the founders:

- 76 – from other contractors.

The posting of cash receipts is reflected on the basis of the primary document - the cash receipt order.

The amounts of cash withdrawn from the cash register are entered into credit account 50. In this case, depending on the direction of issuing money, the corresponding account can be:

- 51 – depositing cash at the bank;

- 58 – financial investments;

- 62 – payment to the supplier, seller;

- 60 – refunds to customers;

- 66, 67 – repayment of loans in cash;

- 68, 69 – payment of taxes, contributions;

- 70 – staff remuneration;

- 71 – issuance of money for reporting;

- 75 – refunds to founders;

- 76 – to other counterparties.

The basis for recording the entry for cash withdrawal from the cash register is the cash receipt order.

Accounting entries for account 50 Cash (table)

The table below shows the most common cash accounting entries.

Table with receipt transactions:

| Operation | Debit | Credit |

| Withdrawing funds from a bank account | 50 | 51 |

| Receiving cash from foreign currency accounts | 50 | 52 |

| Receipts to the cash desk from special accounts (letters of credit, bills of exchange) | 50 | 55 |

| Cash refunds from sellers/suppliers | 50 | 60 |

| Receipt of funds from buyers | 50 | 62 |

| Receipt of short-term/long-term bank loan | 50 | 66 (67) |

| Refunds of unspent accountable money | 50 | 71 |

| Cash receipts from staff | 50 | 73 |

| Founder's contribution in cash | 50 | 75 |

Table with transactions upon disposal:

| Operation | Debit | Credit |

| Transfer of proceeds to the bank | 51 | 50 |

| Delivery of foreign proceeds to the bank | 52 | 50 |

| Transfer of funds to special accounts | 55 | 50 |

| Making payments to suppliers | 60 | 50 |

| Refunds to customers | 62 | 50 |

| Repayment of loans | 66 (67) | 50 |

| Payment of tax amounts, insurance contributions | 68 (69) | 50 |

| Payment of wages | 70 | 50 |

| Issuance of accountable funds | 71 | 50 |

| Issuance of funds to employees for other transactions not related to wages | 73 | 50 |

| Payment of dividends by a company participant | 75 | 50 |

Examples

Example 1:

An enterprise receives goods worth RUB 100,000 from a supplier. Payment for goods is made in cash from the cash register. In this case, the accountant draws up a cash order for the amount of 100,000 rubles, on the basis of which the following entry is reflected: Debit 60 Credit 50 in the amount of 100,000.

Example 2:

The founder makes a contribution to the authorized capital in cash in the amount of 40,000 rubles. The accountant draws up a cash receipt order for the specified amount, on the basis of which he makes the posting: Dt 50 Kt 75 in the amount of 40,000.

Example 3:

The staff is given a salary according to the statement for February 2021 in the total amount of 300,000. An expense cash order in the amount of 300,000 is issued for the statement, on the basis of which the posting of Dt 70 Kt 50 is made.

Example 4:

The company takes out a short-term loan (for a period of less than 1 year) in the amount of 100,000. Loan money is issued at the bank in cash and is received using posting Dt 50 Kt 66 on the basis of PKO.

How does accounting for individual funds differ from accounting for an enterprise?

The conditions for accounting for funds for some individual entrepreneurs are somewhat different from the previously discussed procedure. Entrepreneurs operating under special regimes are allowed not to organize accounting (subclause 1, clause 2, article 6 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ). Such individual entrepreneurs also have the right:

- do not use the cash book (clause 4.6 of the procedure).

- do not prescribe PKO and RKO (clause 4.1 of the procedure).

Exemption from the use of accounting frees such an individual entrepreneur from drawing up Form 4, and all small businesses also have this right.

For details about the nuances of working with a cash register, see the material “Procedure for conducting cash transactions in 2015–2016.”

Kinds

Depending on the area of activity, all funds of the organization are allocated by type of storage and use. The frequency of use of a certain type of asset must correspond to its size in the total mass. As a rule, these indicators are regulated by the company’s statutory and internal documents and the legislation of the Russian Federation. Cash included in current assets can be distributed according to the following types:

- cash;

- non-cash;

- monetary documents (money supply equivalents).

In modern enterprises, all existing forms are used simultaneously, this makes it possible to quickly distribute them and include them in financial, economic or investment activities.

Definition

An enterprise's cash is the most liquid share of its current assets. The source of their formation depends on the legal form of the organization and the type of its activity. With all the variety of placements, funds are reflected only in the asset balance sheet of the enterprise. Relationships with government tax authorities, counterparties (suppliers and buyers), extra-budgetary funds, company employees, its partners, owners and founders are based on monetary payments. The reliability and solvency of an organization depends on the correct redistribution of financial flows and the availability of a certain free volume of its own monetary assets.

Admission

When creating any enterprise, its main (current) line of activity is determined, as a result of which it will receive income (PBU 9/99). Sales of manufactured products, purchased goods, work performed, services provided are the main source of the formation of the money supply. At the same time, the company can make a profit from investment and financial activities. The main channels for increasing the monetary assets of any enterprise are:

- revenue from customers when selling products;

- proceeds from the sale of non-current and current assets;

- gratuitous receipts from owners and third parties;

- special-purpose financing;

- compensation for material damage caused;

- return of accountable amounts;

- received loans, loans, credits;

- sale of securities;

- returns from suppliers (advance payments, penalties);

- interest on loans provided to other organizations;

- issue (release) of securities (for a joint stock company).