Algorithm for calculating the depreciation coefficient of fixed assets

The depreciation ratio of fixed assets (hereinafter referred to as KAOS) shows how much the fixed assets of an enterprise are worn out and how soon they will have to be repaired or updated. This indicator is calculated using the formula

KAOS = A / PSt × 100,

Where:

A - depreciation (account balance 02);

PSt is the initial cost of fixed assets (account balance 01).

You can also use the data from Form 5 from the notes to the balance sheet to calculate this ratio.

For an algorithm for filling out Form 5, see the article “Filling out the Appendix to the Balance Sheet (Form 5).”

An example of a balance sheet can be found in the material “Procedure for compiling a balance sheet (example).”

In this case, KAOS will be equal to:

KAOS = page 5,200 (data on depreciation) / page 5,200 (data on original cost) × 100.

This indicator is calculated for a specific date, most often at the beginning and end of the year.

KAOS is a conditional indicator and depends on the chosen method of calculating depreciation. Let's look at how it will change in 2015 using an example (for clarity, let's agree that the company has only one OS).

Example

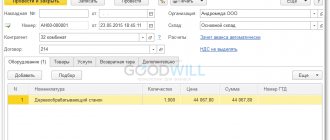

in January 2012 I bought a machine at a price of 578,470 rubles. (including VAT RUB 88,241.18). It was put into operation the same month. The period of use is 8 years. Production capacity - 500,000 units. for the expected service life.

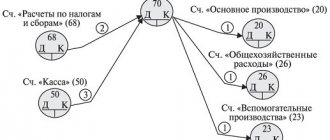

Postings:

Dt 08 Kt 60 — 490,228.82 rub. - OS arrived;

Dt 19 Kt 60 - 88,241.18 rub. — VAT;

Dt 01 Kt 08 — 490,228.82 rub. — OS accepted for accounting.

SALT for account 01 for 2015:

| Beginning balance | Revolutions | Balance | |||

| Dt | CT | Dt | CT | Dt | CT |

| Machine | 490 228,82 | 490 228,82 | |||

Change in the initial cost of the OS

After registering an asset, its initial cost does not change, except in cases where the following is carried out:

- reconstruction, modernization or other completion of an asset or partial liquidation of an asset (clause 14 of PBU 6/01, clause 2 of Article 257 of the Tax Code of the Russian Federation);

- revaluation of fixed assets (clause 14 of PBU 6/01). The cost of fixed assets will change only in accounting records; in NU, the cost of fixed assets will not change during revaluation.

OS revaluation

Revaluation of fixed assets in accounting is carried out annually at the end of the reporting year (December 31). Revaluation is carried out by recalculation (clause 15 of PBU 6/01):

- initial or current (replacement) cost of fixed assets;

- the amount of accrued depreciation for the entire period of use of the OS.

The results of the revaluation are not reflected in tax accounting and do not change the initial or replacement cost of the fixed assets, as well as the amount of accumulated depreciation (paragraph 6, clause 1, article 257 of the Tax Code of the Russian Federation).

If you plan to carry out an annual revaluation of the cost of fixed assets in accounting, then it is necessary to stipulate this in the accounting policy.

Find out more about OS Revaluation.

OS recovery

In BU, the costs of modernization and reconstruction increase the initial cost of the OS if, as a result of the work:

- its initially adopted standard performance indicators (SPI, power, quality of application, etc.) are improved (clauses 14, 27 PBU 6/01).

Costs for repairs in accounting do not increase the cost of fixed assets, but relate to expenses for ordinary activities of the reporting period in which they took place (clauses 5, 7 PBU 10/99, paragraph 67 of the Guidelines for accounting of fixed assets, approved by Order Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n).

In NU, the costs of modernization, reconstruction, and completion of the facility change the initial cost of the OS in the event that such work led to (clause 2 of Article 257 of the Tax Code of the Russian Federation):

- a change in the technological or service purpose of an OS object, the emergence of new qualities, for example, the possibility of increased loads;

- improvement of production capacities and qualities of the OS facility;

- increasing the technical and economic indicators of the OS, modernizing and replacing obsolete and physically worn-out equipment with new, more productive ones.

The costs of repairs in the BU do not increase the cost of the operating system, but are classified as other expenses of the reporting period in which they occurred (Article 260 of the Tax Code of the Russian Federation).

The organization has the right to create a reserve in the NU for the upcoming repair of fixed assets; this right must be secured in the accounting policy for tax accounting (Article 324 of the Tax Code of the Russian Federation).

See also:

- OS upgrade

- OS Inventory

- OS sales

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Accounting policy for accounting of fixed assets This publication provides the existing key points for accounting for fixed assets,…

- Accounting policy for tax accounting of fixed assets This publication provides the existing key points for accounting for fixed assets,…

- Accounting and analytical accounting of fixed assets: legislation and 1C This publication describes the main fixed asset accounting accounts and the system…

- Reflection of fixed assets in the financial statements This article discusses how data on accounting accounts is reflected...

Application of the wear and tear coefficient of fixed assets in financial analysis

OSes play an important role in the life of an enterprise. Financiers use various techniques for a comprehensive analysis of fixed assets and the dynamics of their movement.

You will learn about methods of analyzing the balance sheet from the material “Methodology for analyzing the balance sheet of an enterprise.”

KAOS refers to indicators of the state of the OS. Most often, it is considered along with the OS serviceability coefficient (CGOS), which characterizes the technical condition of the OS and is expressed by the ratio of the residual value of the OS to the primary value. The higher the CGOS, the better the technical condition of the OS.

It is calculated according to the formula

KGOS = Co/Sp,

Where:

Co - residual (final) cost of fixed assets;

Sp - initial cost.

This indicator, like KAOS, depends on the depreciation method used and is conditional. In this regard, it is more advisable to compare the values of these indicators with the data of competitors or with the average value in the industry.

More details about the KGOS can be found in the article “Formula for calculating the serviceability coefficient of fixed assets.”

In addition to the above indicators, do not forget about the moral and physical indicators of the OS condition.

Obsolescence is the depreciation of assets due to technical and technological progress.

Physical wear and tear - material wear and tear under the influence of climatic conditions or during labor. This depreciation is subject to accounting and can be determined in 2 ways:

- by useful life (expected) use (depreciation);

- during a technical inspection of an OS facility.

The analysis must be carried out in dynamics. Based on the results, a conclusion is drawn about the degree of suitability and wear of the OS.

Operations with depreciable property: accounting and tax accounting

Fixed assets and intangible assets in the Tax Code of the Russian Federation constitute a general concept - depreciable property. If the property lasts 12 months or less or costs no more than 10,000 rubles, then it is not considered depreciable, but is immediately included in material expenses when put into operation (subclause 3, clause 1, article 254 of the Tax Code of the Russian Federation). In accounting, fixed assets worth no more than 10,000 rubles. are also written off as production costs as they are put into operation (released into production) in accordance with clause 18 of Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26. In this case, it is possible to establish another limit for classifying objects into the specified category of fixed assets based on technological features (according to Letter of the Ministry of Finance of Russia dated October 18, 2002 No. 16-00-14/403, it can be either more or less than 10,000 rubles). Accounting for depreciable property is perhaps one of the areas where the most significant differences in the rules of accounting and tax accounting are observed. The main differences between accounting and tax accounting of fixed assets are reflected in table. 1.

Table 1. Similarities and differences between accounting and tax accounting of fixed assets

Show entire table

| Name | Accounting | Tax accounting | |

| Determining the initial cost of fixed assets | |||

| + | Acquisition costs (purchase price) | Included in the cost of the fixed asset (clause 8 of PBU 6/01) 1 | Included in the cost of the fixed asset (Clause 1, Article 257 of the Tax Code of the Russian Federation) |

| + | Costs of construction, manufacturing (excluding taxes, except for unified social tax) | Included in the cost of the fixed asset (clause 8, 12 PBU 6/01) | Included in the cost of the fixed asset (Clause 1, Article 257 of the Tax Code of the Russian Federation) |

| + | Costs associated with bringing it to a state suitable for use | Included in the cost of the fixed asset (clauses 8, 12 PBU 6/01) | Included in the cost of the fixed asset (clause 1 of article 257 of the NKRF) |

| Expenses for information and consulting services | Included in the cost of the fixed asset (clauses 8, 12 PBU 6/01) | Included in other (indirect) expenses (subclauses 14 and 15 of clause 1 of article 264 of the Tax Code of the Russian Federation) | |

| Registration Fees and Fees | Included in the cost of the fixed asset (clauses 8, 12 PBU 6/01) | Included in other (indirect) expenses (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation). | |

| Customs duties and fees | Included in the cost of the fixed asset (clause 8, 12 PBU 6/01) | Included in other (indirect) expenses (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation) | |

| Non-refundable taxes | Included in the cost of the fixed asset (clauses 8, 12 PBU 6/01) | Included in other (indirect) expenses (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation) | |

| Intermediary fees | Included in the cost of the fixed asset (clauses 8, 12 PBU 6/01) | Included in other (indirect) expenses (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation) | |

| — | Positive amount differences taken into account before the object was accepted for accounting | Reduce the cost of a fixed asset (clauses 8, 12 PBU 6/01) | Included in non-operating income (clause 11, article 250 of the NKRF) |

| — | Negative amount differences taken into account before the object was accepted for accounting | Increase the cost of a fixed asset (clauses 8, 12 PBU 6/01) | Included in non-operating expenses (clauses 5, 6, article 265 of the Tax Code of the Russian Federation) |

| — | Interest on borrowed funds | Included in the cost of the fixed asset (clauses 8, 12 PBU 6/01) | Included in non-operating expenses (clause 2 of article 265 of the Tax Code of the Russian Federation) |

| Exchange rate and amount differences on interest accrued on borrowed funds associated with the acquisition of fixed assets | Before the object is accepted for accounting, they are included in the initial cost (clauses 11, 23 PBU 15/01) 2 | Not taken into account as part of the initial cost of the fixed asset (subclause 40, clause 1, article 264 of the Tax Code of the Russian Federation) | |

| other expenses | Included in the cost of the fixed asset (clauses 8, 12 PBU 6/01) | Refers to other expenses (Article 264 of the Tax Code of the Russian Federation) and non-operating expenses (Article 265 of the Tax Code of the Russian Federation) | |

| Cost of fixed assets received free of charge | Accepted for accounting at market value (clause 10 of PBU 6/01). It is necessary to confirm it with documents or with the help of an expert assessment (clause 23 of the Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34 n). The cost of property is taken into account as deferred income | Included in non-operating income, except for the cases specified in Art. 251 Tax Code of the Russian Federation. Income assessment is carried out based on market prices determined taking into account the provisions of Art. 40 of the Tax Code of the Russian Federation, but not lower than the residual value. Pricing information must be supported by documentation or independent assessment | |

| Cost (part of the cost) of property acquired using budgetary funds and targeted funding | Accounted for as part of the initial cost (PBU 6/01, PBU 13/2000) 3 | Not taken into account as part of the initial cost of fixed assets (clauses 2, 3 and 7 of Article 256 of the Tax Code of the Russian Federation) | |

| Cost of fixed assets put into operation before January 1, 2002. | Determined according to accounting data | Evaluated at residual value, determined in accordance with the procedure established in paragraph. 5 p. 1 tbsp. 257 Tax Code of the Russian Federation. When determining the replacement cost of a fixed asset, the revaluation carried out as of January 1, 2002 is taken into account. The specified revaluation is accepted for tax purposes in the amount of no more than 30% of the replacement cost of the object reflected in the accounting records as of January 1, 2001. At the same time, the amount of revaluation (discount) as of January 1, 2002 is not recognized as income (expense) for the purposes of | |

| Change in the original cost of fixed assets | |||

| + | Completion, retrofitting, reconstruction, modernization, partial liquidation | Change the initial cost of a fixed asset (clause 14 of PBU 6/01) 4 | Change the initial cost of a fixed asset (clause 2 of article 257 of the NKRF) |

| Revaluation of fixed assets at market value | Affects the amount of the cost of fixed assets and depreciation charges (clause 15 of PBU 6/01). | Not provided for tax accounting purposes. Does not reflect or affect costs | |

| Depreciation of fixed assets | |||

| Methods for calculating depreciation | According to paragraphs. 18-19 PBU 6/01 provides for 4 methods: – linear; – reducing balance; – by the sum of the numbers of years of useful life; – proportional to the volume of products produced | In accordance with Art. 257 of the Tax Code of the Russian Federation, 2 methods are used: – linear (a multiplying factor can be used); – nonlinear (it is possible to use a multiplying factor). At the same time, for fixed assets with a useful life of 20 years and above, only the linear method is used | |

| Differences in the useful lives of fixed assets put into operation before 2002. (the period of actual use in accounting is longer than the period established by the norms of Chapter 25 of the Tax Code of the Russian Federation) | The service life is determined when the object is accepted for accounting (PBU 6/01) | Fixed assets, the actual depreciation period of which is longer than the useful life of fixed assets established in accordance with the requirements of Art. 258 of the Tax Code of the Russian Federation, as of January 1, 2002. are allocated to a separate group of depreciable property when assessed at residual value, which is subject to inclusion in expenses evenly over a period of at least seven years from the date of entry into Chapter. 25 of the Tax Code of the Russian Federation in force (clause 1 of article 322 of the NKRF) | |

| + | Useful life of fixed assets after reconstruction, modernization, technical re-equipment | It is allowed: – to revise the useful life; – do not revise | It is allowed: – to increase the period within the terms established for this depreciation group; - do not extend the period |

| Property acquired using budgetary funds; received within the framework of budget (target) financing; received under the conditions specified in clause. 11 Art. 251 NKRF | Depreciation is charged (clauses 8, 17 and 23 of PBU 6/01) | Depreciation is not charged (clauses 2, 3, article 256 and clause 2, article 322, clauses 251, 256 of the Tax Code of the Russian Federation) | |

| Fixed assets that are the subject of leasing | Depreciation rates are determined based on the useful life of the object (clause 4 of PBU 5/01) 5 | Enterprises are given the right to apply the basic depreciation rate with a coefficient not higher than 3 (Clause 7, Article 259 of the NKRF) | |

| Fixed assets, the rights to which are subject to state registration in accordance with the legislation of the Russian Federation | Depreciation can be accrued from the month following the month of commissioning, regardless of the fact of registration. The balance sheet is reflected in the net valuation (including depreciation) (clause 19 of PBU 10/99) 6 | Included in the depreciation group from the moment of the documented fact of filing documents for registration (Clause 8, Article 258 of the Tax Code of the Russian Federation) | |

| Passenger cars and passenger minibuses with an initial cost of more than 300 thousand. rub . and 400 thousand. rub . respectively | Depreciation rates are determined based on the useful life of the object (clause 4 of PBU 6/01) | The basic depreciation rate is applied with a coefficient of 0.5 | |

| Repair of fixed assets | |||

| Repair of fixed assets over 12 months | The accrual of depreciation is suspended during the period of restoration (repair, reconstruction, modernization) of an object, the duration of which exceeds 12 months (clause 23 of PBU 6/01) | In accordance with Art. 256 of the Tax Code of the Russian Federation, fixed assets transferred to conservation for more than three months are excluded from depreciable property; undergoing reconstruction and modernization for more than 12 months (clause 3 of Article 256, 260 and 324 of the Tax Code of the Russian Federation) | |

| Disposal of depreciable property | |||

| Loss from the sale of depreciable property | Accounted for in full on the financial results account (PBU 9/99) 7 | When selling a fixed asset, the taxpayer has the right to reduce income from such operations by the amount of expenses directly related to such sale (clause 1 of Article 268 of the Tax Code of the Russian Federation) in equal shares over a period defined as the difference between the useful life of this property and the actual life of its operation until the moment of implementation (clauses 1, 3, article 268 of the Tax Code of the Russian Federation). The resulting loss is included in the taxpayer’s other expenses | |

| Free transfer of depreciable property | The cost of the transferred property is recognized as an expense, and the loss from the transfer is reflected in the financial results account (PBU 10/99) | The cost of the transferred property is not recognized as an expense, the loss from the gratuitous transfer of depreciable property is not taken into account (Clause 16, Article 270 of the Tax Code of the Russian Federation) | |

These differences underlie the formation of permanent and temporary differences that are subject to accounting in accordance with the Accounting Regulations “Accounting for Income Tax Calculations” PBU 18/02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n. Let's consider the most common transactions that cause the formation of differences associated with depreciable property.

Determining the initial cost of fixed assets

A large number of permanent and temporary differences are revealed already during the formation of the initial cost of depreciable property. When determining the initial value of property for tax accounting purposes, the following features should be taken into account:

- Not only refundable taxes (VAT), as is customary in accounting, are excluded from the initial cost, but also all other taxes that are subject to deduction or taken into account as expenses in accordance with the Tax Code of the Russian Federation (for example, state and customs duties) (subclause 1 p. 1 article 2 64);

- the cost of fixed assets of own production is determined based on the direct costs of their creation and increases by the amount of excise taxes (clause 1 of Article 257);

- Expenses in the form of interest on debt obligations received for its purchase are not included in the initial cost of a fixed asset; such expenses are classified as non-operating expenses (subclause 2, clause 1, article 265);

- if expenses can be attributed with equal grounds to the cost of a depreciable fixed asset and other groups of expenses, the taxpayer has the right to independently determine which group these expenses belong to (clause 4 of Article 252);

- The legislator has not established how to calculate the initial cost of property received as a contribution to the authorized (share) capital. Based on the definition of depreciable property (clause 1 of Article 256) and the general principles of recognition of expenses (Article 252), we can conclude that property received as a contribution to the authorized capital is classified as depreciable property with zero initial cost (this does not apply to property contributed to the authorized capital before 2002, since its initial cost is taken from the financial statements as of January 1, 2002 in accordance with transitional provisions). It should be noted that in its Guidelines for the application of Ch. 25 of the Tax Code of the Russian Federation, tax authorities allow fixed assets received in the form of a contribution to the authorized capital to be valued at their residual value according to the tax accounting data of the transferring party.

The most common differences that arise when forming the initial cost of fixed assets and accepting them for accounting are presented in table. 2.

Table 2. Differences arising in the formation of the initial cost of fixed assets

Show entire table

| Name | Differences that arise |

| Interest on borrowed funds | On interest within the limits established by Art. 269 of the Tax Code of the Russian Federation, a temporary taxable difference is formed that arises at the time interest is reflected in accounting and decreases with each depreciation charge. For interest in excess of the norms established by Art. 269 of the Tax Code of the Russian Federation, with each depreciation charge in accounting, a permanent difference is formed, leading to the emergence of a permanent tax liability |

| Amount differences taken into account before the object was accepted for accounting | A temporary difference is formed that arises at the moment of reflection of the amount differences in accounting. If the total differences are negative, then a deductible difference arises. If the amount differences are positive, then a taxable difference arises. The differences decrease with each depreciation charge. |

| Exchange rate and amount differences on interest accrued on borrowed funds associated with the acquisition of fixed assets | A temporary difference is formed that arises at the moment of reflection of exchange rate and amount differences in accounting. If exchange rate and amount differences are negative, then a deductible difference arises. If exchange rate and amount differences are positive, then a taxable difference arises. The differences decrease with each depreciation charge. |

| Payments for registration of rights to real estate and land, transactions with these objects, payments for providing information about registered rights, payment for services of authorized bodies and specialized organizations for property assessment | A temporary taxable difference is formed that arises at the time the specified payments are reflected in the accounting records. The difference decreases with each depreciation charge. |

| Cost (part of the cost) of property acquired using budgetary funds and targeted funding | The cost (part of the cost) of depreciable property acquired through budgetary allocations and targeted financing is recognized in accounting as deferred income. When calculating depreciation on such property, the corresponding part of the cost reflected in the credit of account 98 “Deferred income” is written off to the credit of account 91 “Other income and expenses”. Thus, in accounting, the amount of income reflected on depreciable property acquired using budgetary funds and targeted financing is equal to the amount of expenses in the form of depreciation of this property. Tax accounting does not recognize income and expenses associated with depreciable property acquired through budgetary allocations and targeted financing. In this regard, there are no differences |

| Cost of fixed assets received free of charge | A permanent difference is formed, leading to the emergence of a permanent tax liability, in the amount of the excess of the value at which the property is reflected in tax accounting over the value at which it is reflected in accounting. A temporary deductible difference is formed in the amount of the value of property in accounting, which arises at the time of recognition of income in tax accounting. Repaid as income is recognized in accounting |

| Cost of fixed assets put into operation before January 1, 2002. | A permanent difference is created, resulting in a permanent tax liability. The difference is defined as the excess of the amount of depreciation in accounting over the amount of depreciation in tax accounting (provided that the remaining useful life in accounting and tax accounting is the same) and arises each time depreciation is calculated in accounting |

Let's consider the formation of the initial cost of a fixed asset, the price of which is expressed in foreign currency, using example 1.

Example 1. OJSC “S” acquires fixed assets in March 2005. Under the terms of the contract, the price is expressed in conventional units at the exchange rate on the day of shipment. Payment was made on October 1, the US dollar exchange rate was 27.5 rubles. The cost of the fixed asset is $1,000. The shipment was made on March 6, the US dollar exchange rate was 28.0 rubles. For accounting purposes: – as of March 1: RUB 27,500. – an advance payment has been made for the fixed asset ($1,000 x 27.5 rubles); – as of March 6: 28,000 rub. – the actual costs of the purchased fixed asset are reflected on the date of shipment (USD 1,000 x RUB 28.0); – 500 rub. – the amount difference on the purchased fixed asset is reflected (RUB 28,000 – RUB 27,500); – 30,500 rub. – the fixed asset is credited to the organization’s balance sheet.

Consequently, for accounting purposes, taking into account amount differences, the fixed asset will be listed at a cost of 27,500 rubles. For tax accounting purposes, without taking into account amount differences, according to the terms of the contract, the cost on the date of shipment will be equal to 28,000 rubles, non-operating expenses are formed in the amount of 500 rubles. In this case, a taxable temporary difference arises in the amount of 500 rubles, which will decrease with each depreciation charge. Let us further consider the formation of the initial cost of a fixed asset received free of charge using example 2.

Example 2. According to the tax accounting data of the transferring party, the initial cost of a passenger car purchased at the market price is 600 thousand rubles. A useful life of 10 years is established by the taxpayer in accordance with the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1. The linear method of calculating depreciation is used in both accounting and tax accounting. Moreover, in accordance with paragraph 9 of Art. 259 of the Tax Code of the Russian Federation, a reduction factor of 0.5 is used in tax accounting (the initial cost of a passenger car is more than 300 thousand rubles). After 48 months, the taxpayer transfers the car free of charge. Accrued depreciation for this period in accounting is 240 thousand rubles, in tax accounting - 120 thousand rubles. The residual value of the car at the transferring party, according to accounting data, is 360 thousand rubles, tax accounting – 480 thousand rubles. The documented market price of a four-year-old car is 300 thousand rubles. As a result, the taxpayer who received this car will, for accounting purposes, accept the assessment of the gratuitously received property at market value (300 thousand rubles), and for the purposes of Ch. 25 of the Tax Code of the Russian Federation - not lower than the residual value in the amount of 480 thousand rubles. Due to different estimates of the value of property received free of charge in accounting and tax accounting, a constant difference in the amount of 180 thousand rubles arises. The taxpayer will include income in the amount of 480 thousand rubles in non-operating income in tax accounting. on the date of signing the vehicle acceptance certificate. And the accounting records as of this date will reflect the investment in non-current assets in correspondence with the deferred income account in the amount of 300 thousand rubles. Non-operating income in accounting will be reflected during the depreciation period in the amount of accrued depreciation on this property. In January 2005, there was a difference in non-operating income in the amount of 480 thousand rubles, of which 180 thousand rubles. – constant difference, 300 thousand rubles. – a deductible temporary difference that will be repaid as depreciation is calculated on the car until its value is completely written off in tax accounting.

Change in the original cost of fixed assets

Another group of transactions for which differences arise due to differences in the rules of accounting and tax accounting is associated with changes in the initial cost of objects. The Tax Code of the Russian Federation contains the concept of “replacement cost” only in relation to fixed assets put into operation before January 1, 2002. In contrast to the accounting provisions, the Tax Code of the Russian Federation does not provide for changes in the initial value of fixed assets as a result of the revaluation of property at market prices. However, in connection with the changes that were made to PBU 6/01 by Order of the Ministry of Finance of Russia dated June 10, 2002 No. 45n, expenses from the depreciation of fixed assets in accounting are shown in the account of retained earnings (uncovered loss). In this regard, there are no differences in accounting for income (expenses) in accounting and tax accounting. At the same time, as a result of changes in the accounting value of a fixed asset in accounting, the amount of depreciation charges changes. In tax accounting it remains the same. The differences that arise are presented in table. 3.

Table 3. Differences arising from the revaluation of fixed assets

Show entire table

| Name | Differences that arise |

| Results of revaluation of fixed assets (since 2002) | When revaluing fixed assets, a permanent difference arises, leading to the formation of a permanent tax liability. The difference arises with each depreciation charge and is determined as the amount of revaluation multiplied by the monthly depreciation rate. When carrying out a depreciation of fixed assets, a permanent difference arises, leading to the formation of a permanent tax asset. The difference arises with each depreciation charge and is determined as the amount of depreciation multiplied by the monthly depreciation rate |

What does a high depreciation ratio mean?

Analysts identify 2 possible reasons for increased KAOS:

- the funds are really very worn out;

- depreciation is written off using an acceleration factor.

In practice, financiers use KAOS as an indicator of the risk of failures in the production process. Accordingly, if the indicator is too high, the analyst will conclude that there is a high risk of interruption of the production process and the need for repair or modernization of equipment.

But accounting assumes the possibility of using a mechanism for accelerated depreciation of fixed assets. In this case, the accounting depreciation will significantly exceed the actual one. Accordingly, the analysis should reflect relevant comments to report users.

Results

The depreciation rate of fixed assets is used in conjunction with similar indicators to analyze the state of the company's fixed assets. This indicator is conditional and fundamentally depends on the depreciation write-off method chosen by the company. If it is too high, then, according to analysts, there is a high probability of a workflow failure and the OS needs to be upgraded.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Depreciation after modernization of fixed assets

The procedure for calculating depreciation after modernization of a fixed asset is not defined by accounting legislation. There are Methodological Instructions approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, where paragraph 60 provides only an example of calculating depreciation charges using the linear method, and the annual amount of depreciation charges for fixed assets after modernization is determined in the following order.

The annual depreciation rate for fixed assets after modernization is calculated using the formula:

| 1 | : | Useful life of a fixed asset after modernization, years | * 100% |

Then we calculate the annual depreciation amount. To do this we use the formula :

| Annual depreciation rate for fixed assets after modernization using the linear method | * | Residual value of fixed assets taking into account modernization costs |

The amount of depreciation to be calculated monthly is 1/12 of the annual amount.

An organization has the right to use this method of calculation even if, as a result of modernization, the useful life of a fixed asset has not changed. This is explained by the fact that the example from the Guidelines does not contain conditions on the mandatory increase in useful life as a result of modernization. This means that an organization can calculate depreciation based on the residual value of a fixed asset (taking into account its increase by the amount of modernization costs) and its remaining useful life, regardless of whether this period was extended after modernization or not.

If an organization uses other methods of calculating depreciation (the reducing balance method, the method of writing off value by the sum of the numbers of years of useful life, the method of writing off value in proportion to the volume of production), then the annual amount of depreciation charges can be determined in the following order:

- similar to the order given in the example for the linear method;

- independently developed by the organization.