The birth of a child is always a joyful and responsible event that requires certain efforts and expenses. One of the most important tasks is the assistance and support of young parents by the state. In the article we will tell you about postings for maternity benefits in 2021 and give examples of calculations.

Types of benefits: (click to expand)

| Disposable | One-time |

| For pregnancy and childbirth | Child care up to 1.5 years old |

| When registering early | For a child of a conscripted soldier |

| Upon adoption | |

| Pregnant wife of a conscript | |

| Lump sum benefit at birth |

Amount of payments for children

In 2021, the size of the BiR one-time benefit in accordance with the law for women will be:

- 100% of the average salary of a working woman

- 100% of the amount of monetary allowance - for military personnel under contract

- In the minimum amount based on the minimum wage for everyone else, including the unemployed

For women giving birth who received high wages, for example a million a year, there is a limit on the payment of benefits, for example:

- RUR 266,191.8 - in general; RUB 368,865.78 – during multiple pregnancy; • 296,613.72 rub. - during complicated childbirth.

A sick leave certificate for pregnancy and childbirth is issued to a woman at 30 weeks.

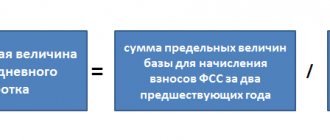

For normal births, a certificate of incapacity for work is given for a period of 140 days, for complicated ones for 156 days, and if the pregnancy is multiple, then 194 days. The payment is calculated based on wages for the previous 2 years before the onset of maternity leave, for example, an employee left in 2021, which means For the calculation we take 2015 and 2021.

Exception to the general rule

An exception to the general rules for paying a lump sum benefit at the birth of a child are insurance companies registered in the constituent entities of the Russian Federation taking part in activities within the framework of the pilot project (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294). Currently, 33 constituent entities of Russia are participating in it, in which employees receive payments by contacting the Social Insurance Fund directly.

In addition, an exception is made for employees of organizations in the Far North and similar areas: the size of the one-time benefit is adjusted by the regional coefficient.

Postings for calculating a lump sum payment

The payment of all benefits is accounted for in account 70 - wages. The accountant will accrue benefits on the credit of account 70, and pay them on the debit. If wages are usually calculated from the organization’s sources, then benefits are paid from the Social Insurance Fund. All settlements with the Social Insurance Fund are carried out on account 69 “Settlements for social insurance”.

Thus, we will make the following entries:

- Debit account 69 – Credit account 70 - accrual of one-time benefit

Maternity payments are not subject to personal income tax. If the payment is from the cash register, then we will make the following entry:

- Debit account 70 – Credit account 50 “Cash”

If you transfer benefits to a bank card, we get:

- Debit account 70 – Credit account 51 “Current accounts”

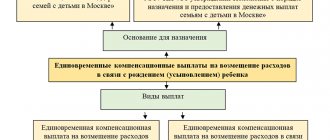

One-time benefit for the birth of a child

To whom?

Only one of the parents - mother or father.

How many?

The benefit amount is 18,004.12 rubles. The regional coefficient is added on top if it applies in your area.

How is it prescribed?

The employee brings:

- application in free form;

- certificate of birth of the child from the registry office;

- a certificate from the other parent’s place of work stating that he was not paid benefits;

- depending on the situation, other documents listed in paragraph 28 of the order may be needed.

When is it paid?

Transfer the benefit to the employee within 10 days from the date of receipt of documents from him. If more than six months have passed since the birth of the child, do not pay benefits.

There is no need to withhold personal income tax and pay insurance premiums from the benefit amount.

Maintenance services up to one and a half years

The benefit until the child is one and a half years old is paid from the Social Insurance Fund. To do this, the accountant will make the following entries:

- Dt 69-1 Kt 70 accrual.

- Dt 70 Kt 50 payment.

Additional payment before actual earnings:

The employment contract may provide for additional payment up to actual earnings at the expense of the organization; this is not a benefit, so the employer will have to pay.

- Debit 20 (23, 25, 26, 44...) Credit 70 – an additional payment has been added to maternity benefits up to the actual average earnings;

- Debit 70 Credit 50 (51) – an additional payment was issued to maternity benefits up to the actual average earnings.

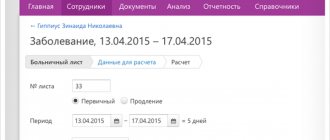

Example of calculating maternity benefits

- The employee went on maternity leave on July 3, 2021, the billing years will be 2015 and 2021, the vacation period is 140 days

- Woman's income in 2015 amounted to one hundred twenty thousand rubles in 2016. one hundred forty-four tons, total two hundred sixty-four tons../ 731, we get 361.15 rubles. average daily earnings.

- 361.15 *140=50561 rub. Total our allowance.

When is an employer obligated to pay benefits?

All benefits must be accrued within 10 calendar days from the date of receipt of the full set of documents. And the transfer of money occurs on the next payment - this can be the day of the advance payment or the day of salary. If today, March 21, and an employee brought documents, then by April 1 you must calculate everything and send the money on your next paycheck.

If payment is delayed, you will need to pay compensation and a fine for violating labor laws. For companies it ranges from 30,000 to 50,000 rubles, and for officials of an organization - from 1,000 to 5,000 rubles. But that is not all. If a manager does not settle accounts with employees due to selfish goals or other personal interests, he may be subject to criminal liability, including imprisonment. Therefore, follow the deadlines and do not forget to pay benefits.

Category “Questions and Answers”

Question No. 1. I am an accountant at an enterprise, I am preparing maternity payments for an employee, what payments are due and how to make entries

First, you need to decide whether your region is participating in the Pilot Project; if so, then no wiring will be required, and if not, then:

- When a woman goes on maternity leave, you are provided with a sick leave certificate, on the basis of which you calculate a lump sum maternity benefit in accordance with her salary for the last two years

- then you need to apply for benefits if she is registered in the early stages of pregnancy

- when she gives birth, she provides the next sick leave for which you accrue benefits for child care up to one and a half years and a lump sum at birth

The postings will be similar for all operations,

- Dt 69 Kt 70

- KT 70 Dt 50(51)

If a woman in labor has a complicated birth, she is entitled to an additional payment to the one-time maternity benefit

Accounting for “children’s” benefits and payments

Tatiana MARKOVICH Auditor

The Constitution of Russia (Article 39) guarantees citizens social security by age, in case of illness, disability, loss of a breadwinner, for raising children and in other cases established by law. The state partially compensates citizens for the costs associated with raising children in the form of benefits.

Federal Law No. 81-FZ of May 19, 1995 “On state benefits for citizens with children” (hereinafter referred to as Law No. 81-FZ) established a unified system of state child benefits. This system provides guaranteed financial support for motherhood, fatherhood and childhood.

Law No. 81-FZ establishes the following types of state benefits:

- maternity benefits;

- a one-time benefit for women registered in medical institutions in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly allowance for the period of parental leave until the child reaches the age of one and a half years;

- monthly child benefit.

Although benefits are intended to meet the needs of children, they are not provided to children, but to their parents or persons in their stead. In some cases, benefits are assigned only to a woman-mother or a woman who adopted a child in the first months of his life. In others, the recipients of benefits may be the mother and father (at their choice), as well as other relatives who actually care for the child. In the absence of parents or in other cases when other citizens are engaged in caring for or raising a child, benefits may be provided to persons replacing parents, including adoptive parents, guardians and trustees.