Tax deduction limits are the maximum total amount of actual annual expenses incurred, from which the taxpayer has the right to receive a refund of 13% personal income tax (NDFL). For each type of tax deduction, payment limits are established, while the maximum amount of personal income tax refund depends on the type of tax deduction; there are several groups of them - standard deductions, social tax deductions, property deductions (for example, when buying an apartment or a country house), as well as investment and professional.

In this publication, we will analyze the limits of tax deductions on the main existing grounds established by the Tax Code of the Russian Federation at the current time (for children, for education, for treatment, for the purchase of housing, etc.)

Example 1: Buying an apartment

Conditions for purchasing property: In 2021 Ivanov A.A. I bought an apartment for 2 million rubles.

Income and income tax paid: In 2020, Ivanov A.A. earned 50 thousand rubles a month and paid a total of 78 thousand rubles. Personal income tax for the year.

Calculation of deduction: In this case, the amount of property deduction is 2 million rubles, i.e. You can return 260 thousand rubles (2 million rubles x 13%). But for 2021, Ivanov will be able to return only 78 thousand rubles of the income tax he paid, and he will be able to return the remaining 182 thousand rubles in subsequent years.

Example 2: Receiving a deduction by an individual entrepreneur using the simplified tax system

Conditions for purchasing property: In 2021 Petrov P.P. bought an apartment for 3 million rubles.

Income and income tax paid: Petrov P.P. works as an individual entrepreneur under a simplified taxation system and, accordingly, does not pay personal income tax at a rate of 13%.

Calculation of the deduction: The maximum deduction amount per apartment is 2 million rubles. (i.e. you can return up to 2 million rubles x 13% = 260 thousand rubles). But since Petrov P.P. did not pay income tax in 2020, he will not be able to receive a tax deduction for this year.

If Petrov P.P. in the future, if he gets another job where he will pay personal income tax, he will be able to apply for a tax deduction and get back up to 260 thousand rubles.

Categories of citizens

You can claim a tax deduction under the following conditions:

- first of all, the presence of Russian citizenship;

- income taxed at 13 percent personal income tax;

- there is real estate for housing, purchased with one’s own funds or on credit, except for state budgetary funds, as well as maternity capital;

- a pensioner who has income, for example, from renting out an apartment, paying 13 percent on the income of individuals;

- a citizen of the Russian Federation who purchased housing for a minor child with income subject to a 13 percent tax on personal income.

Worth checking ! A close relative should not participate on the part of the seller (a detailed list is contained in Article 105.1 of the Tax Code of the Russian Federation). If the seller is the parent of one spouse, the other spouse is allowed to take the deduction.

Excerpt from Article 105.1 of the Tax Code of the Russian Federation

Technically, filing a tax return can be done in person or through a legal representative, by mail and, which has become most popular lately, through government electronic services.

Important ! Such services are available through the website of the Federal Tax Service or gosuslugi.ru.

Tax deduction is not provided if:

- there are no documents about official employment and payment of taxes;

- the purchase was made partially or fully at the expense of the employer (payment from the company’s assets);

- when purchasing, programs or subsidies of state origin are involved (an example is maternity capital);

- residential premises were purchased before January 1, 2014 and the deduction has already been made;

- the act of purchase was made between close relatives: mother, father, brothers, sisters, daughter, son;

- the property was purchased after January 1, 2014, but the permissible limit has been exhausted.

In some cases, no tax deduction is provided

Example 3: Buying an apartment with a mortgage

Conditions for purchasing property: In 2021, Ivanov I.I. purchased an apartment for 8 million rubles, of which 6 million rubles were taken out on a mortgage loan. In 2021 Ivanov I.I. paid interest on 100 thousand rubles.

Income and income tax paid: Ivanov I.I. earned 3 million rubles in 2029, from which he paid personal income tax.

Calculation of the deduction: The maximum amount of property deduction when purchasing a home is 2 million rubles. Additionally Ivanov I.I. can receive a tax deduction in the amount of 100 thousand rubles on mortgage interest paid. Total for 2021 Ivanov I.I. will be able to return 2,100,000 rubles. x 13% = 273 thousand rubles. He will be able to return this entire amount at once, because... the personal income tax he paid is more than 273 thousand rubles.

In subsequent years, Ivanov I.I. will only receive a tax deduction on mortgage interest, since he has already received the main deduction for housing. Since the loan agreement was concluded after January 1, 2014, the maximum amount of mortgage interest deduction that he can receive is 3 million rubles. (up to 390 thousand rubles to be returned).

What standard tax deductions are established by Art. 218 of the Tax Code of the Russian Federation for 2021

The procedure for providing standard tax deductions is regulated by Art.

218 Tax Code of the Russian Federation. I would like to immediately note that the main difference between standard tax deductions and other personal income tax deductions is not the presence of specific expenses on the part of the taxpayer, but his direct membership in certain groups of persons. So, what are the standard tax deductions today?

- For certain categories of citizens, standard tax deductions can be 3,000 or 500 rubles.

- All citizens with children can be provided with a so-called child deduction.

Example 4: Purchase of property by spouses in joint ownership (from January 1, 2014)

Conditions for purchasing property: In 2021, the spouses Vasiliev V.V. and Vasilyeva A.A. purchased an apartment worth 5 million rubles for joint ownership.

Income and income tax paid: For 2020 Vasilyev V.V. earned 2.5 million rubles, and Vasilyeva A.A. 3 million rubles.

Calculation of the deduction: In case of joint ownership, the tax deduction can be redistributed in any shares. At the same time, from January 1, 2014, the deduction limit in the amount of 2 million rubles per housing property was lifted. The Vasilyev spouses can distribute the tax deduction in equal shares (50% to the husband and 50% to the wife), and in 2021 each of them will receive a deduction in the amount of 2 million rubles (maximum deduction amount per person) × 13% = 260 thousand rubles. That is, 520 thousand rubles per family.

Who is entitled to a deduction of 500 rubles.

These are persons awarded state awards, participants of the Great Patriotic War, former prisoners of concentration camps, disabled people of the 1st and 2nd groups and others. The full list can be found in sub. 2 p. 1 art. 218 Tax Code of the Russian Federation.

IMPORTANT! In the case where the taxpayer falls into both categories, the deductions are not summed up, but the maximum of them is provided. The taxpayer's income limit for receiving such deductions is not established by law.

If you have access to ConsultantPlus, check whether you have correctly determined the amount of the standard “for yourself” deduction. If you don't have access, get trial of online legal access.

Example 5: Purchase of property by spouses in joint ownership (before January 1, 2014)

Conditions for the acquisition of property: In 2013, the spouses Vasiliev V.V. and Vasilyeva A.A. purchased an apartment worth 5 million rubles. into joint ownership.

Income and income tax paid: Vasilyeva A.A. does not work.

Calculation of the deduction: In case of joint ownership, the tax deduction can be redistributed in any shares, but since the housing was purchased before 2014, the maximum deduction amount for both spouses is 2 million rubles. The Vasiliev spouses can distribute 100% of the tax deduction (2 million rubles) to V.V. Vasiliev. Despite the fact that the apartment was purchased in 2013, in 2021 Vasiliev can submit a declaration only for the last three years: 2020, 2021 and 2021.

Registration regulations

Registration and receipt of a refund can be carried out following different algorithms.

Through the tax office

The right to deduction begins after the end of the year in which the purchase was made.

What needs to be done?

First of all, submit a declaration in form 3-NDFL. Then at work, order form 2-NDFL. The tax office must obtain documents confirming the right to an apartment or house. The taxpayer provides a history of expenses during the home buying process. If you used a loan, attach documentation that shows interest payments under the agreement.

Form 3-NDFL

There are design features if the apartment is jointly owned. Then you need an agreement on dividing the property deduction according to a single model.

You must understand that the state does not pay you money, but returns what you once paid. A tax deduction for the purchase of a residential plot will become legal after the completion of construction and registration of housing in Rosreestr.

Important ! If the housing or its share is located in an apartment building that is still under construction, in order to calculate payments, you must provide a transfer deed (the number and volume of funds involved).

Sometimes a transfer deed is required

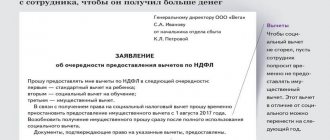

Through the employer

The second method is used if they want to receive a tax deduction in the year when they bought the living space.

Start by collecting and submitting the documents specified above to the tax office. Submit a personal written statement with them. In response, you should receive a notification from the tax service. On average, the waiting time takes a month.

The received notice must be presented to the employer. You will have to write an application again, in any form addressed to the employer. After checking and confirming the accuracy of the documents, the accounting department will not withhold personal income tax deductions from the salary.

You can apply for a tax deduction through your employer

Practice shows that it is very rare that the amount of payments is returned within a year. The remainder is carried over to the next time intervals. If the payment period is extended, a new notice must be issued. The deadline for submission is not specifically specified, but as a standard, the filing date of the declaration is before April 30 of the year that follows the year of receipt of income, and therefore the emergence of the right to deduction.

Tax authorities verify the accuracy of the information provided within four months. The taxpayer then receives a message about the results of the audit.

Important ! If the decision is positive, you must re-apply to the tax service and determine the account details for transferring the amount of the property deduction.

The tax inspectorate conducts an audit for about 4 months

Enrollment takes place within a month.

Example 6: Purchase of property in shared ownership (from January 1, 2014)

Conditions for purchasing property: In 2021 Vasiliev V.V. and Romashkova A.A. purchased an apartment worth 5 million rubles. into common shared ownership (each of them owns ½ of the apartment).

Income and income tax paid: For 2020 Vasilyev V.V. earned 2.5 million rubles, from which he paid income tax. Romashkova A.A. did not work.

Calculation of the deduction: In case of shared ownership, the tax deduction is distributed among the owners in accordance with their shares. At the same time, for housing purchased after January 1, 2014, the limit of 2 million rubles for the entire housing property was lifted .

Based on this and the shares of the owners (50% each), V.V. Vasiliev. and Romashkova A.A can be provided with up to 2 million rubles (maximum deduction amount per person) of property tax deduction.

At the same time, in 2021 Vasiliev will be able to regain 2 million rubles. × 13% = 260 thousand rubles. for 2021, and Romashkova will be able to receive a tax deduction when she gets a job and starts paying personal income tax.

Calculation examples

Example No. 1 . Taxpayer K., 38 years old, purchased an apartment in January 2015 for 2,650,000 rubles. His monthly salary is 65,000 rubles. In January next 2016, he will be able to apply for a refund for the purchase of an apartment from the tax service. The lifetime payment limit under current legislation is 260 thousand rubles. The state will return the amount of 101,400 rubles for 2015. The result is obtained by multiplying thirteen percent of monthly income by 12 months.

Calculation.

65 thousand * 0.13 * 12 = 101,400 rubles.

The refund will continue next year, provided that taxpayer K. continues to work with official tax deductions. The monthly payment amount and the number of working months per year will remain unchanged.

For example, if in 2021 the tax structure received deductions for only five months from the same monthly amount of income, in 2021 the amount of payments will be 42,250 rubles.

Calculation.

65 thousand*0.13*5 = 42,250 rubles.

Until the maximum limit is reached, he will be able to receive 116,350 rubles in subsequent years.

Calculation.

260 thousand – 101,400 – 42,250 = 116,350 rubles.

Tax refunds may continue for several years until the full amount is paid

Example No. 2 . Taxpayer S., 36 years old, bought a two-room apartment for 1,500,000 rubles. Having official income, he submitted documents for a tax deduction. How much can he claim?

In this example, S. can receive 195 thousand rubles in return.

Calculation.

1,500,000*0.13 = 195,000 rubles.

Let's continue with the example. Later, the same person bought another apartment and paid 2 million rubles. This means that from the second purchase S. can return 65,000 rubles.

By right, the maximum amount from which thirteen percent is returned is 2,000,000 rubles.

Calculation.

2,000,000 – 1,500,000 = 500,000 rubles.

500,000*0.13 = 65,000 rubles.

Or you can calculate it this way. We calculate thirteen percent of the maximum limit for the purchase of real estate - 260 thousand rubles. We subtract from it the deduction for the first apartment. As a result, the return for the second object will be 65 thousand rubles.

It is worth remembering that the maximum amount from which a refund can be made is 2 million Russian rubles

Example 7: Purchase of property in shared ownership (before January 1, 2014)

Conditions for the acquisition of property: In 2013, Vasiliev V.V. and Romashkova A.A. purchased an apartment worth 5 million rubles. into common shared ownership (each of them owns ½ of the apartment).

Income and income tax paid: Romashkova A.A. does not work.

Calculation of the deduction: In case of shared ownership, the tax deduction is distributed among the owners in accordance with their shares. At the same time, for housing purchased before January 1, 2014, there is a limit of 2 million rubles for the entire housing property .

Based on this limitation and the shares of the owners (50% each), Vasiliev V.V. and Romashkova A.A can be provided with up to 1 million rubles. property tax deduction. At the same time, in 2021, Vasiliev will be able to file a 3-NDFL declaration and get back 1 million rubles. × 13% = 130 thousand rubles. for 2021, 2021 and 2021.

Romashkova will be able to receive a tax deduction only when she gets a job and starts paying personal income tax. Romashkova does not have the right to refuse a tax deduction in favor of V.V. Vasiliev, as would be possible with joint ownership.

What are the deductions?

A deduction is an amount for certain expenses that reduces an individual's taxable income. Only individuals paying personal income tax can take advantage of the deduction.

The Tax Code of the Russian Federation provides for the following deductions: - standard tax deductions . As a rule, they are provided by the employer at the individual’s place of work. They have a fixed amount, which depends on the taxpayer category, the number of children and the amount of income;

— social tax deductions (expenses for training, treatment and purchase of medicines, expenses for the funded part of the pension and non-state pension provision, voluntary pension insurance, voluntary life insurance, as well as expenses for charity). These deductions in a fixed amount reduce the taxable income of an individual received during the calendar year. The deduction is provided both by the employer, upon written application of the individual, and by the Federal Tax Service - when the taxpayer fills out the 3-NDFL declaration. Deductions for charitable expenses are provided only by the inspectorate;

— investment tax deductions . The deduction is provided to individuals who carry out certain transactions with securities, deposit funds into an investment account, and receive income from transactions related to the investment account. The deduction is provided by the tax agent through whom all of the above operations and actions take place, or by the tax authority;

— property tax deductions . The right to these deductions for an individual arises when selling property and buying housing, constructing housing, purchasing a plot of land for building housing, or purchasing housing from the state. When purchasing housing, land, or building housing, you can take advantage of the deduction by submitting 3-NDFL to the Federal Tax Service or by providing a notification to the employer. When selling property, the deduction is provided only by the tax authority;

— professional tax deductions . The deduction is provided to individual entrepreneurs, notaries and individuals engaged in private practice, lawyers who have established a law office, individuals providing services and performing work under civil contracts, individuals receiving royalties, provided that these categories of taxpayers cannot document their expenses associated with generating income. A deduction is provided in the amount of 20 percent of the amount of income received. You can receive a deduction from the tax authority when filling out 3-NDFL or from your employer by submitting an application;

— tax deductions when carrying forward losses from transactions with securities and transactions with financial instruments of futures transactions . A deduction is provided if expenses from the above operations exceed income, that is, a loss is received. The resulting loss is taken into account for 10 years, starting from the year the loss was received. You can use the deduction only by submitting 3-NDFL to the inspectorate.

These are all types of deductions prescribed in the Tax Code of the Russian Federation. They can be used by individuals who are registered at their place of work in accordance with the labor code and receive an official salary, as well as individual entrepreneurs who apply the general taxation system and pay personal income tax. We will look in more detail at the tax deductions that are used most often. Such deductions include social and property.

Example 8: Buying an apartment using maternity capital

Conditions for purchasing property: In 2021 Vasilyeva E.E. purchased an apartment for 1.7 million rubles, with 400 thousand rubles. She paid for it using maternity capital funds.

Income and income tax paid: In 2020, Vasilyeva earned 1 million rubles, of which she paid 130 thousand rubles in personal income tax.

Calculation of the deduction: A tax deduction is not provided for the amount of maternity capital, so the deduction amount for Vasilyeva will be 1.7 million rubles. – 400 thousand rubles. = 1.3 million rubles (that is, she can return 1.3 million rubles x 13% = 169 thousand rubles). At the same time, in 2021, Ivanova will be able to return only 130 thousand rubles. paid personal income tax. She will return the remaining 39 thousand rubles in subsequent years.

Who is eligible for the professional deduction?

A professional deduction is an opportunity for individual entrepreneurs, private practitioners, executors of GPC agreements or persons receiving royalties when calculating personal income tax to reduce income received by the amount of documented expenses.

Find out what nuances to consider for each category of professional deduction recipients.

Ordinary citizens who are not registered as individual entrepreneurs, are not engaged in private practice, do not perform work under civil contract agreements and do not receive royalties cannot take advantage of the professional deduction.

Example 9: Property acquired before 2008

Conditions for the acquisition of property: In 2007, Sidorov S.S. I bought an apartment for 2 million rubles, but Sidorov decided to receive a tax deduction for this apartment only in 2021.

Amount of income tax paid: In 2018-2020 Sidorov S.S. earned 360 thousand rubles a year and paid 46 thousand rubles a year in personal income tax.

Calculation of the deduction: For property acquired before 2008, the maximum tax deduction amount is 1 million rubles. Accordingly, the maximum amount that Sidorov can return will be equal to 1 million rubles. x 13% = 130 thousand rubles. According to the law, a tax deduction can be issued for no more than the last 3 years (not earlier than 2021 in our case). Therefore, in 2021 Sidorov S.S. will be able to issue a deduction and return 46 thousand rubles. for 2018, 46 thousand rubles. for 2021 and 38 thousand rubles. for 2021. After which the deduction will be completely exhausted.

If you have not yet purchased a home, we recommend our partner’s site-guide, APARTMENT-Bez-AGENTA.ru. This is an educational site for those who want to understand the rules for buying and selling apartments.

Deadlines for submitting documentation

Documentation for a property tax refund when purchasing an apartment is submitted after full payment for the purchased housing occurs. Then the owner prepares documentation for the right to own the purchased property. If the property became yours as a result of a sale or purchase, you must provide a certificate of registration of ownership. As mentioned above, an apartment purchased in a house during construction under an equity participation agreement must be confirmed by a document “deed of transfer of ownership of the apartment.”

Important ! Everything you have paid must be supported by financial documents. According to the standard procedure, the presentation of documentation begins in the second half of January, after the Christmas holidays.

You may qualify for a refund even if you made your purchase several years ago. Let's give a clear example.

You can claim payment even after several years

It so happened that you bought real estate in 2015, but were unable to collect documentation for the tax authorities. Let's look into the near future, into 2021. The fact that you continued to work for all five years and faithfully deduct personal income tax will allow you to submit documents for a refund in 2021. The important thing is that the state will return contributions for three years starting from 2021. Of course, taking into account the nuances that were discussed above (maximum limit, official tax deductions, etc.).

Let's continue to look at examples of various real estate acquisition situations.