Form T-54 is a unified form for personal accounts of employees of enterprises and organizations. It is issued for each employee upon hiring and is most often used in large companies (small companies prefer to use other forms that are more convenient for them).

A personal account in the T-54 form is one of the most important documents at enterprises, since it indicates detailed personal information about the employee, the number of hours worked for each specific month, salary accruals and deductions.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

What is a payroll employee's personal account?

This is a document that is used in accounting to reflect information about monthly accruals, deductions and payments due to a specialist.

IMPORTANT!

The use of standardized forms is optional. The company has the right to independently develop the structure of the document, which fully corresponds to the features and specifics of the organization’s activities, its current remuneration system, conditionally permanent details for calculating wages and other information.

A independently developed form should be approved in the company’s accounting policy, as well as the use of a unified form. When developing a document, do not forget to take into account the mandatory details of the primary documentation (Article 9 of Law No. 402-FZ).

Use free instructions from ConsultantPlus experts to properly organize the calculation, payment and accounting of salaries. In the system you will find step-by-step guides and samples of all the documents that need to be completed.

Build payment type codes

Table 3 – Filling out payment type codes

| Data_Fakt | Vall | Summ_Vall | Cost | Summ_Cost | Summ_S_Vall | Summ_S_Cost | D_Cost |

| 02.06.2001 | |||||||

| 28.11.2002 | |||||||

| 07.01.2003 | |||||||

| 12.08.2009 | |||||||

| 01.02.2009 | |||||||

| 02.02.2009 | |||||||

| 01.02.2009 |

2.4 Describe the list of primary documents and the possibility of changing them in the document “Employee’s Personal Card”

All financial and economic operations of the enterprise, including payroll, must be documented and justified.

The list of primary documents for recording the use of working time and settlements with personnel (wages) and the forms of these documents were approved by Resolution of the State Statistics Committee of Russia dated January 5, 2004 No. 1.

The primary accounting of the number of personnel of the organization is carried out on the basis of the following documents:

— order (instruction) on hiring (Form No. T-1), which is the basis for hiring. The person responsible for accounting for the personnel of the organization’s employees, in accordance with this order, fills out a personal card for each newly hired employee, makes an entry in the work book, and opens a personal account in the accounting department;

— personal card (form No. T-2), which is filled out for each employee. It contains general information about the employee (last name, first name, patronymic, date and place of birth, education, etc.), information about military registration, appointment and transfer, advanced training, retraining, leave and other additional information;

— order (instruction) on transfer to another job (Form No. T-5), which is used when registering the transfer of an employee from one structural unit to another;

— order (instruction) on granting leave (Form No. T-6), which is used to formalize annual and other types of leave provided to employees in accordance with the Labor Code of the Russian Federation, current legislative acts and regulations, collective agreements and schedules vacations;

— order (instruction) on termination (termination) of an employment contract with an employee (dismissal) (Form No. T-8), which is used when registering the dismissal of employees. Based on it, the accounting department makes settlements with the employee;

— other unified forms To record working hours and pay wages to personnel, the following unified forms of primary documentation are used:

— a timesheet for recording working hours and calculating wages (Form No. T-12) and a timesheet for recording working hours (Form No. T-13), which records the use of the working time of all employees in a given organization. The report card in form No. T-13 is used in conditions of automated data processing. Form No. T-12 is filled out manually by an accounting employee. The symbols of worked and unworked time presented on the title page of form No. T-12 are also used when filling out form No. T-13. These timesheets are compiled in one copy and submitted to the accounting department. They allow not only to take into account the time worked by all categories of employees, but also to monitor compliance by workers and employees with the established work schedule. Based on the timesheets, wages are calculated, statistical reporting on labor is compiled. The use of working time is recorded in timesheets either by the method of continuous (daily) registration of appearances and absences for work, or by registering only deviations (no-shows, tardiness, etc.). d.). Notes on the reasons for absence from work or for part-time work, for working overtime and other deviations from the established work schedule must be entered into the timesheet only on the basis of documents (certificates of incapacity for work, certificates, orders for the performance of state or public duties and etc.).

This is interesting: Sample resignation letter 2021

Accounting for time spent on overtime work can also be carried out on the basis of lists of persons who performed this work. The lists are compiled and signed by the head of the structural unit. The overtime manager makes a note of the number of overtime hours actually worked. Based on lists with this mark, the data is entered into the timesheet. Downtime can also be taken into account in the timesheet. The relevant data is entered on the basis of downtime sheets issued by the head of the structural unit. The following forms of statements are used for the calculation and payment of wages.

— payroll statement (Form No. T-49), which is recommended for medium and small organizations. When compiling this form, it is permissible not to fill out other payroll and payroll statements;

— payroll (form No. T-51), which is used to calculate wages for all categories of workers. Recommended for use in large organizations;

— payroll (form No. T-53), which is used to record wage payments;

— personal account (forms No. T-54 and No. T-54a), which is filled out by an accountant for each employee on the basis of primary employment documents and which indicates the necessary information: last name, first name, patronymic; workshop, department of an organization; category of personnel; employee personnel number; number of children (to determine deductions when calculating personal income tax); Enrollment Date.

The personal account is filled out throughout the year, and all types of accruals and deductions made are reflected in it on a monthly basis. The data contained in the personal account is the basis for calculating average earnings when paying for vacations, accruals for sick leave, etc. The following year, a new personal account is opened for each employee.

The most important indicators reflecting labor costs are labor standards, which are established for workers in accordance with the achieved level of equipment, technology, organization of production and labor.

Labor legislation provides for the following types of labor standards:

— production rate — the amount of products that a worker (group of workers) of a certain qualification must produce per unit of working time,

- standard time - the amount of working time (in hours, minutes) that an employee (group of employees) of a certain qualification must spend on the production of a unit of product (work, service);

- service rate - the number of objects (equipment units, production areas, workplaces, etc.) that an employee (group of employees) must service per unit of time (per hour, working day, work shift, working month);

— headcount norm — the number of employees with the appropriate qualifications to perform a certain amount of work (production, management functions). Depending on the nature of production, various primary documents are used to record production output - piece work orders, route sheets, production reports, etc. In conditions of mass production, output is taken into account when accepting finished products. The output of each team member is established on the basis of output reports filled out by the foreman.

In mass production, output is taken into account using route sheets in combination with a report from the foreman or foreman, which records the acceptance of work (their volume) per shift. In individual or small-scale production, output is taken into account, as a rule, using piecework orders work. They are prescribed on the basis of technological maps. Work orders can be issued for one shift or for a longer period (up to one month), depending on the time required to complete the production task. After receiving the products from the workers, the foreman signs the work order and transfers it to the accounting department.

Bibliography

1. Andreeva V.I. Samples of documents in office work/ - M.: CJSC "Business School" Intel-Sintez", 2007.

2. Computer Science: Basic Course/Ed. S.V.Simonovich. - St. Petersburg: Peter, 2002. 400 s.

3. Kozharsky V.V., Sushkevich V.N. Accounting in enterprises and organizations: Proc. manual.- Mn.: PKF “Account”, 2005. p.127

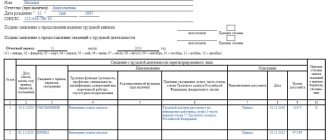

Form T-54

A unified personal account card in the T-54 form is intended to reflect monthly information about accrued wages and other accruals for a particular employee, about all deductions made based on data from primary accounting documentation for production, about work performed, standards of time worked, as well as other orders for different types of payment.

This is what the T-54 form looks like:

The document is created separately for each specialist from the beginning of the calendar year or from the date of official employment. Information is entered monthly for one calendar year. The organization decides independently how to fill out the employee’s personal account form for the salary, enshrining the established procedure in the accounting policy. The nuances depend on the company’s field of activity and the number of employees. In separate departments, the rules may differ.

The accounting procedure is approved by the manager, and all pay slips and personal accounts are filled out exclusively by an accounting employee or another responsible person who is entrusted with accounting responsibilities in the company.

Payslips: registration and issuance - Audit-it.ru

Kurevina L. , magazine expert

Journal “Government Institutions: Accounting and Taxation” No. 2/2019

The Ministry of Labor periodically reminds employers in its letters of one or another of their responsibilities in the field of labor relations. Recently, in a Letter dated 23.10.

2018, No. 14-1/OOG-8459, department officials noted that the employer, in accordance with labor legislation, is obliged to inform the employee about the components of his salary, that is, to issue pay slips, and this obligation cannot be canceled either by an agreement with the employee or by a collective agreement . We will tell you in this article how to prepare and issue pay slips to employees.

In order to protect the employee’s right to timely receipt of wages in full in accordance with Art. 21 of the Labor Code of the Russian Federation The Labor Code provides that the employer issues a written salary calculation to each employee (including part-time employees).

At the same time, the pay slip is still only mentioned in Art. 136 of the Labor Code of the Russian Federation, based on which, when paying wages, the employer is obliged to notify in writing each employee:

- about the components of the salary due to him for the corresponding period (such parts, by virtue of Article 129 of the Labor Code of the Russian Federation, are remuneration for labor, compensation and incentive payments);

- on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee;

- on the amounts and reasons for the deductions made. Such deductions, in particular, include personal income tax, unspent and untimely returned advance payments, amounts collected from the debtor employee under writs of execution, including alimony, the amount for unworked vacation days (Article 137 of the Labor Code of the Russian Federation);

- about the total amount of money to be paid.

As for the form of the pay slip and the procedure for issuing it, then, as before, these issues are regulated directly by the employer. In this case, you should be guided by the letters of the Ministry of Labor and the Ministry of Finance.

Payslip form

So, the form of the pay slip according to Art. 136 of the Labor Code of the Russian Federation is approved by the employer, taking into account the opinion of the representative body of employees in the manner established by Art. 372 of the Labor Code of the Russian Federation for the adoption of local regulations.

The use in an institution of a form for issuing a pay slip that is not approved by the employer is a violation of labor legislation and entails administrative liability under Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Before understanding the contents of the payslip, we note that it can be in two forms:

Despite the fact that about electronic form in Art. 136 of the Labor Code of the Russian Federation does not say anything; the Ministry of Labor indicated the possibility of notifying workers in this form in Letter No. 14-1/OOG-1560 dated 02/21/2017. The procedure for sending a pay slip should be fixed in the employment contract (if such a form of notification is established for some employees), a collective agreement, or a local regulatory act.

As for the form of the pay slip itself, the Letter of the Ministry of Finance of the Russian Federation dated April 14, 2016 No. 02-06-05/21573, in particular, states that pay slips for employees’ wages are formed on the basis of the document forms established by Order No. 52n:

- payroll (f. 0504401) or payroll (f. 0504402);

- certificate card (f. 0504417), which is used to register reference information about the salary of an employee of an institution and which reflects the amount of accrued wages by type of payment, the amount of deductions (by type of deduction), and the amount to be issued.

The payslip reflects

| Personnel Number | days worked (hours) | components of salary | amount of temporary disability benefits | compensation for failure to pay wages and other payments on time | size and basis of deductions made | total amount of money |

There is no need to reflect on the payslip other payments not listed in Art. 136 of the Labor Code of the Russian Federation, for example, travel expenses (Letter of the Ministry of Labor of the Russian Federation dated February 26, 2016 No. 14-2/B-154 “On the inclusion of travel expenses in the pay slip”) and insurance premiums.

At the same time, the pay slip indicates the amount of additional insurance contributions for the funded pension (Clause 8, Article 9 of the Federal Law of April 30.

2008 No. 56-FZ “On additional insurance contributions for funded pensions and state support for the formation of pension savings”).

An approximate form of a pay slip is shown below.

Pay slip

| Establishment | |||||||

| Department/code/personnel number | |||||||

| FULL NAME. | |||||||

| Position/profession | |||||||

| Salary (rub.) | |||||||

| Month year | Work days | Working hours (40 hour work week) | |||||

| Accrued | Period | Days | Watch | Amount (rub.) | Held | Period | Amount (rub.) |

| Salary for hours worked | Personal income tax | ||||||

| Disability benefits | |||||||

| Monthly bonus | |||||||

| Additional payment for work on weekends (holidays) | |||||||

| Payment for continuous work experience | |||||||

| Total accrued | Total withheld | ||||||

| Paid | date | Amount (rub.) | |||||

| Prepaid expense | |||||||

| Salary | |||||||

| Disability benefits | |||||||

| Total paid |

It remains to be noted that the legislation does not provide for the requirement to sign pay slips and certify them with a seal, but the employer can establish it independently.

Procedure for issuing a pay slip

By virtue of Art. 136 of the Labor Code of the Russian Federation, pay slips are issued along with wages. Salaries must be paid at least every half month, therefore, slips must also be issued twice. However, according to the Letter of Rostrud dated 24.12.

2007 No. 5277-6-1, it is sufficient to issue slips only when paying the second part of the salary, when all components of the salary are determined, since when paying the first part these components may still be unknown.

There is no need to show the component parts for each half-month separately on the sheet.

In addition, you need to issue a pay slip when dismissing an employee, so that he knows what amounts are paid to him and for what.

But it is not necessary to issue a slip when paying vacation pay, despite the fact that this payment is considered remuneration for time not worked.

In this regard, Rostrud reported that the payment of vacation pay does not relate to the payment of wages, therefore it is not necessary to issue a pay slip in this case (Letter No. 5277-6-1).

On what day should payslips be issued?

There are no specific instructions regarding the day the certificate is issued, so the employer determines it himself. This can be either the payday itself or the day before it is received.

In any case, the day the slip is issued does not depend on how the salary is issued: at the institution’s cash desk or through a bank card.

The Labor Code talks about the very fact of payment of wages, which entails the obligation to issue a pay slip, and the methods of payment are not specified (Letter of the Ministry of Labor of the Russian Federation dated October 23, 2018 No. 14-1/OOG-8459).

Do I need to take confirmation from the employee of receipt of the pay slip?

The procedure for confirming the issuance of pay slips to employees is also not defined by law, but it would be better to take care of such confirmation in order to avoid problems with regulatory authorities.

A paper payslip can be issued to the employee personally against signature, but to transmit the slip via electronic communication channels, it is necessary to provide the technical ability to confirm receipt of the document by the employee.

When issuing pay slips on paper, you can provide a tear-off part in it, in which employees will sign for receipt, or develop a journal for issuing pay slips, where employees will sign their signatures.

The journal must record on what day the pay slip was issued, to whom (last name, first name, patronymic, position, structural unit), for what period, and the employee’s signature.

Here's an example:

_________________________________________

(name of institution)

Logbook for issuing pay slips for __________/_________.

| No. | Date of issue of payslip | Employee's full name | Employee position | Signature |

payslips ______________ ____________ _______________

position signature transcript of signature

To confirm the issuance of a pay slip, you can also add a separate column to the payroll in which employees will sign for receipt of the pay slip.

Speaking about the procedure for issuing pay slips, you need to remember that the income of an individual relates to the employee’s personal data (Clause 1, Article 3 of the Federal Law of July 27, 2006 No. 152-FZ “On Personal Data”).

By virtue of Art. 7 of Federal Law No. 152-FZ, third parties gaining access to personal data must ensure the confidentiality of such data. Therefore, those responsible for issuing pay slips should be warned (under signature) of the need to maintain secrecy (confidentiality).

Form T-54a

This form is intended to reflect information about accruals and deductions made using automated programs and accounting systems. The form records monthly data for one calendar year on the following:

- accruals (salary, additional payments, material payments, bonuses, compensation);

- deductions (taxes, fees, alimony, penalties under writs of execution);

- payments (advances, settlements, recalculations).

This is what the T-54a card looks like:

In the accounting policy of the organization, they indicate what needs to be transferred to the settlement department of the personal account in order to transfer wages to employees.

Important information

When using the specialized accounting program “1C: Salaries and HR Management,” most accountants face two problems:

- How to print an employee's personal account. Where are the personal accounts of employees in the ZUP and how to print them? To receive a specialist’s personal statement on paper, go to the program menu, select “Reports”, then “Personal account in form No. T-54 (T-54a). In the dialog box that appears, select Full Name. specialist for whom you want to print the medicinal product, select the reporting period (calendar year), determine the printing parameters. The document is ready for printing.

- How to register an employee’s bank account for salary transfers. To enter an employee’s card or bank book number for salary crediting, go to the 1C “ZUP” program menu, select the “Payroll calculation by organization” tab, then go to “Cash and bank”, then “Personal accounts of organization employees”. Then select the “Add” item and register the number of the specialist’s current account, which is opened with a banking organization.

LS No. T-54

Shelf life

In accordance with current legislation, information containing personal information about accruals and deductions for insured persons (citizens) must be stored for 75 years. The company is obliged to independently ensure the safety of primary documentation.

If the company does not have an archivist position on staff, then assign responsibility for storing and maintaining the archive to a specific specialist. Indicate such responsibilities in the job description, and familiarize the assigned employee with the new instructions against his signature.

Procedure for opening personal accounts

First of all, it should be noted that personal accounts are opened in order to keep records of the taxpayer’s fulfillment of tax obligations for basic taxes or other obligatory payments to the budget, the obligation to transfer mandatory contributions to the pension fund and pay social contributions, as well as fines and penalties in special tax authorities. organs

When a personal account is opened, the taxpayer’s registration data serves as the basis for this, and, if available, the client identification number.