Citizens of the country, according to the law, are required to pay taxes on all types of income received, including wages.

The organization independently determines the deductible amount for each full-time employee according to the procedure approved by law and transfers it to the state budget, thus performing the functions of a tax agent.

In order to ensure that the amount of taxes is not erroneous, and that the regulatory authorities have no reason to find fault and fine the company, you need to thoroughly study the formula for calculating them.

What you need to know

The tax agent makes all the necessary calculations and sends the funds to the budget. The procedure for calculating personal income tax is fixed by the provisions of the Tax Code of the Russian Federation. They say that employed citizens contribute to the budget the amount withheld from:

- wages;

- bonus accruals;

- cash gifts;

- sick leave.

To correctly calculate the payment being made, you must strictly follow the procedure for calculating personal income tax :

- Determine the tax base (hereinafter referred to as NB) - sum up all a person’s income received in material or monetary form over the last year. In 2021, the calculation scheme remains the same.

- Check the interest rate. For residents it is equal to 13%, and non-residents deduct 30% of income received on the territory of the Russian Federation. When receiving profits from bank deposits, awarding cash prizes and in other cases, 35% is established.

Tax reporting of organizations and individual entrepreneurs for personal income tax

Employers are required to keep records of each employee to whom they have paid income. Tax agents must also report to the Federal Tax Service on personal income tax calculated and withheld from employed persons.

There are two types of reports:

- 6-NDFL (generalized data is entered on all employees who received income from the employer);

- 2-NDFL (information is provided for each person employed separately).

Each type of reporting has its own deadlines for submission.

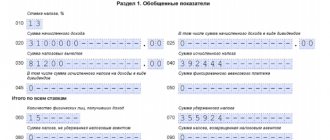

Form 6-NDFL consists of the following sheets:

- title page;

- section 1;

- section 2.

Declaration 6-NDFL contains general data for all persons who received income from the employer

The declaration must be sent to the tax office no later than the last day of the month following the reporting quarter. This form has not been adjusted in 2021, but a number of changes were made last year.

These are changes like this:

- on the title page of form 6-NDFL, the barcode “15201027” was changed to “15202024”;

- The successor organization submits calculations to the Federal Tax Service at its location for the last submission period and updated calculations for the reorganized structure (in the form of accession/merger/division/transformation) indicating on the title page in the line “at the location (accounting) (code)” numbers "215";

- in this case, at the top of the title you need to provide the TIN and KPP of the assignee;

- in the line “tax agent” indicate the name of the reorganized organization or its separate structure.

Table: deadlines for filing 6-NDFL

| Billing period | Deadlines for filing a declaration |

| For the first quarter of 2019 | Until April 30 |

| For the second quarter of 2019 | Until July 31 |

| For the third quarter of 2019 | Until October 31 |

| For the fourth quarter of 2019 | Until April 1, 2020 |

The innovations also affected the 2-NDFL report.

The document can be prepared in two versions:

- the first option has a machine-oriented form and is intended for tax agents;

- the second version of the form is issued by tax agents to individuals upon their applications for presentation at the place of request.

The 2-NDFL declaration records information for each employee separately.

Since 2021, new codes have been introduced into the 2-NDFL certificate:

- 2013 - compensation for unused vacation;

- 2014 - severance pay/average monthly earnings for the period of employment/compensation to the manager, his deputies and the chief accountant in excess of three times the average monthly salary;

- 2301 - fines and penalties to the consumer from the organization based on a court decision;

- 2611 — bad debt written off from the balance sheet;

- 3021 - interest (coupon) on circulating ruble bonds of domestic companies.

Table: deadlines for submitting 2-NDFL

| Situations | Submission deadlines |

| 2-NDFL declarations are sent to the tax office for those employees for whom the employer paid wages in the reporting year, but personal income tax was not levied on this income. | No later than March 1 of the year following the reporting year. |

| Reports are submitted to the tax office regarding absolutely all employees to whom the employer paid wages in the reporting year. | No later than April 1 of the year following the reporting year. |

If the declaration is not submitted on time, the tax agent will face penalties:

- in the amount of 200 rubles. for each overdue 2-personal income tax;

- in the amount of 1 thousand rubles. for failure to submit 6-personal income tax on time.

Calculation of income tax from salary

Before paying for labor, the organization withholds income tax. We will show you how personal income tax is calculated from your salary for the year. The algorithm is like this:

- 1. Determine NB using the formula:

NBbeg.g. = D – Deductions

NBbeg.g. – tax base required for calculation. It is taken from the beginning of the year to the previous, and then the current month.

D – income accrued from the beginning of the year and subject to tax withholding. Summarized for each month.

Deductions are amounts that reduce the amount of the NB. The most common ones are:

- standard – provided to working parents, guardians, and disabled people;

- social – required for paying for education, treatment or making additional contributions to a pension;

- property - given for the sale, purchase or construction of real estate (condition: ownership - more than three years);

- investment – sale of securities or profit from a deposit to the account.

Keep in mind that income tax is not withheld from government benefits, pensions, alimony, remuneration to donors, grants to support scientific activities, etc. The full list contains Art. 217 Tax Code of the Russian Federation.

- 2. NB has been determined, now it’s time to figure out how to calculate personal income tax from your salary. The formula for the year is:

Monpr.month = NBinit.year x 13%

Monpr.month – income tax accrued for the period from the beginning of the year to the previous month.

Montech.month = PNbeg.g. – Monpr.month. – payments for the current month.

Example 1 Sales department economist Osintsev, working at Arctur LLC, is paid a salary of 28,600 rubles. In addition, he was involved in preventing the consequences of the disaster at the Chernobyl nuclear power plant, so he is entitled to a deduction of 3,000 rubles. In addition, he has an adopted son aged 9 years. In June, a bonus was paid - 8,700 rubles. How to calculate personal income tax to be withheld for June?

Solution:

- Income for January-June, taxed at a rate of 13%: 28,600 x 6 months + 8700 = 180,300 rubles.

- The deduction for Osintsev will be: 3000 x 6 months + 1400 x 6 months = 26,400 rubles.

- Income tax paid for January-June: (180,300 – 26,400) x 13% = 20,007 rub.

- Cash held for January-May: 600 x 5 months. – (1400 x 5 months) – (3000 x 5 months)) x 13% = 15,730 rub.

- The required value will be: 20,007 – 15,730 = 4277 rubles.

The accounting department of Arctur LLC must send 4,277 rubles to the treasury for Osintsev for June.

Example of personal income tax calculation

It is necessary to calculate the tax that will be transferred by the enterprise to the state treasury for a resident employee. The employee has a salary of 60,000 rubles, is raising a minor child, for which he has the right to a deduction in the amount of 1,400 rubles monthly. The employee received a one-time bonus for April in the amount of 10,000 rubles. How much will personal income tax be for an employee in April?

We calculate the NB from the beginning of the year:

NB = 60,000 * 4 + 10,000 – 1,400 * 4 = 244,400 rubles.

Tax for January – April will be:

Personal income tax = 244400 * 13% = 31772 rubles.

Tax withheld from an employee's salary for January - March:

Personal income tax = (60000 * 3 – 1400 * 3) * 13% = 22854 rubles.

Personal income tax for April will be:

Personal income tax = 31772 – 22854 = 8918 rubles.

How to calculate income tax from money to be issued

Sometimes employers cooperate with individuals semi-officially. That is, they pay extra salary “in an envelope”. The law does not approve of such actions, because many organizations avoid fulfilling legal obligations. Then two questions arise: how to calculate personal income tax from the amount in hand and the accrued salary?

To calculate, use one of two formulas:

Salary – salary from which income tax is calculated;

ZP – cash transferred in person.

Example 2 Sales manager Vishnevskaya, working in, is paid 21,500 rubles per month by agreement with the employer. How to calculate personal income tax and the amount on which tax is withheld?

Solution:

CJSC Edelweiss pays Vishnevskaya a salary of 24,712 rubles, from which 3,212 rubles. contributes to the budget.

An organization may employ employees who have financial obligations that do not reduce the NB. For example, when deducting alimony, personal income tax is withheld not from the amount handed out, but from the accrued salary. According to Art. 81 of the RF IC, their size is:

- 1/4 of earnings - for one child;

- 1/3 – for two children;

- 1/2 – for three or more children.

Example 3 An employee of Antey LLC Orlov received a salary for June - 35,977 rubles. He is divorced from his wife. By court decision, he is obliged to pay alimony for his minor daughter (25% of income). The tax base, taking into account the deduction for a child, will be:

| Period | Amount, rub. | Personal income tax, r. |

| January-May | 172 885 | 22 475 |

| January June | 207 462 | 26 970 |

How much money should be given to Orlov?

Solution:

The share of alimony will be: 35977 x 25% = 8994.25 rubles.

Calculation of the taxpayer’s personal income tax: 26970 – 22475 = 4,495 rubles.

Cash issued to Orlov: 35,977 – 8994.25-4,495 = 22,487.75 rubles.

Antey LLC must pay Orlov 22,487.75 rubles.

Calculation of personal income tax from the amount in hand

There are organizations that pay part of their employees’ salaries unofficially “in an envelope.” Concealing income is a violation of the law.

Workers undergoing a job interview are often interested in the amount of money that they will receive in their hands “clean”. Knowing the amount issued without taxes, the amount of contributions to the budget can be calculated using the formulas:

Salary “gross” = Amount on hand / 87%, where

Salary "gross" - wages "dirty".

Personal income tax = Amount in hand * 13% / 87%.

Calculation of income tax from a non-resident's salary

Individuals who actually reside in the territory of the Russian Federation for less than 183 calendar days (continuously, throughout the year) are considered non-residents. Deductions for them will amount to 30% of income. They are determined by the formula:

Mon = NB x 30%

Exception: the earnings of highly qualified foreign specialists are taxed at a rate of 13%.

Example 4 B Sidorov works as an ERBS driller. Working hours: 60/30 rotation. Salary – 70,000 rub. The employee is a non-resident of the Russian Federation. Let's determine the amount paid for August. Initial data:

| Period | Amount, rub. | Personal income tax, r. |

| January-July | 343 600 | 103 080 |

| January-August | 411 600 | 123 480 |

Solution:

- Amount of money withheld from an employee in August:

- Payments will be equal to:

123,480 – 103,080 = 20,400 rub.

70,000 – 20,400 = 49,600 rub.

is obliged to hand over 49,600 rubles to Sidorov.

By following the procedure for calculating personal income tax on the amount transferred in hand, the enterprise will prevent the occurrence of many claims from regulatory authorities. Also see “Calculating Income Tax”.

Read also

01.12.2016

Tax agents

Tax agents are persons who are entrusted with the responsibility for calculating, withholding taxes from taxpayers and their further transfer to the state budget.

In Russia, tax agents are recognized as:

- Russian organizations;

- individual entrepreneurs;

- notaries engaged in private practice;

- lawyers who have established law offices;

- separate divisions of foreign companies.

The vast majority of Russian tax agents are individual entrepreneurs and organizations that are employers

.

Employers, acting as tax agents, are required to calculate, withhold and transfer personal income tax to the budget from income paid to their employees .

.

At the same time, employers must withhold income tax (NDFL) in full from both payments to employees working under employment contracts and from payments to individuals under civil contracts.

note

, until the beginning of 2021, payment of personal income tax at the expense of the employer

was not allowed

.

However, from this date, paragraph 9 of Article 226 of the Tax Code of the Russian Federation is stated in a new wording. The bottom line is this: if a tax audit reveals that the agent (employer) unlawfully did not withhold personal income tax (withheld it incompletely), then the arrears can be recovered from his funds

.

Payment of personal income tax when working under civil contracts

Payments under this type of agreement do not relate to wages and are regulated not by the Labor Code of the Russian Federation, but by the Civil Code. In accordance with this, the date of actual receipt of income is considered the day of payment of income under a civil law agreement (including for paid advances). Therefore, personal income tax on advances and payments under such agreements must be withheld and transferred on the day of their actual payment.

- Author: Vladimir

Rate this article:

- 5

- 4

- 3

- 2

- 1

(1 vote, average: 5 out of 5)

Share with your friends!

How to pay personal income tax in 2021

The employer must transfer the personal income tax withheld from the employee to the budget of the tax authority with which he is registered. You can find out the bank details of your tax authority using this service.

For the transfer of personal income tax on payments up to 5 million rubles in 2021, the same procedure has been maintained as before. The tax must be transferred to the same KBK as in 2021: KBK 182 1 01 02010 01 1000 110

.

For those employers who will pay tax at a rate of 15%, a special procedure for its payment has been introduced (letter of the Federal Tax Service dated December 1, 2021 No. BS-4-11 / [email protected] ):

- the amount of tax is paid separately in the part missing up to 650 thousand rubles, relating to the part of the tax base up to 5 million rubles inclusive (KBK 182 1 0100 110);

- the part of the tax amount exceeding 650 thousand rubles, relating to the part of the tax base exceeding 5 million rubles (KBK 182 1 0100 110), is paid separately.

Organizations that have separate divisions must remit income tax withholding to both the location of the main office and the location of each division. However, as of 2021, a new rule has been introduced. If there are several separate divisions on the territory of one municipality

, you can select one inspection.

You must notify the tax authorities of your choice no later than the 1st day of the tax period

. Starting next year, the inspection can be changed.

note

, in 2021, the Federal Tax Service extended the period for notifying tax authorities about the selected inspection. This could be done before January 31, 2020 (letter of the Federal Tax Service dated December 25, 2019 No. BS-4-11/ [email protected] ).

However, this rule no longer applies, that is, in 2021, the tax authorities must be notified before January 11

(taking into account the postponement due to weekends). This information is published on the Federal Tax Service website.

conclusions

Employee payments are subject to income tax, which is transferred to the budget on the basis of a payment order. If an employee is entitled to deductions, then the income received can be reduced by them, and then taxed by multiplying the difference in accrued salary and benefits by the rate percentage.

The employee can independently calculate the amount of tax withheld after receiving the after-tax amount. To do this, it is enough to divide the issued payment amount by 0.87.

Procedure for calculation and deduction

Personal income tax is calculated only from the employee’s income, the source of payment of which is the tax agent. At the same time, the employer does not take into account the employee’s income received from other sources.

An employee may have several tax agents if he combines work for different employers.

The main income of an employee-taxpayer, from payments on which tax is withheld, are wages, including bonuses, disability benefits, vacation pay, etc.

The tax base for personal income tax is calculated taking into account tax deductions to which the employee has the right. Tax legislation provides for the following types of deductions that the tax agent must take into account when determining the tax base:

- standard deductions

- property deductions.

At the same time, an employee can exercise the right to a property deduction only if he provides a notification received by him from the tax authority. Only after receiving such notification from the employee does the accountant have the right to reduce the tax position for personal income tax.

When calculating tax, the following formula for calculating personal income tax is used:

N= (DV)*S

Where N is the amount of tax that the tax agent must withhold,

D - the amount of employee income on which personal income tax is calculated,

V - tax deductions to which the taxpayer is entitled,

S is the tax rate.

The general tax rate provided for by law is 13%. There are several special rates, in particular, on the income of non-resident foreign citizens, if they are on the staff of a tax agent, a tax of 30% is paid.

Example of personal income tax calculation:

- The employee's salary in January 2021 was 40,000 rubles.

- The employee is dependent on two minor children.

- The employee is a citizen of the Russian Federation.

Let's calculate the personal income tax amount:

- The size of the standard tax deduction for the first and second child is 1,400 rubles N= (40,000 rubles - (2*1400) *13% Total: the amount of tax that the tax agent must withhold from the employee’s salary: 4,836 rubles.

Withholding of personal income tax from foreign citizens is carried out taking into account whether such citizens are recognized as residents or not. Residents, in accordance with tax legislation, are individuals who have stayed in the country for at least 183 days over the next twelve consecutive months. The tax rate for non-residents is set at 30%.

Exceptions to this rule appeared in connection with the introduction of amendments to the Tax Code of the Russian Federation in Federal Law No. 368-FZ dated November 24, 2014. The amendments concern citizens of other states working in our country for hire by individuals and persons engaged in private practice. The tax rate for such workers is 13%, but they carry out their activities on the basis of a patent.

In addition to taxes, various deductions are made from employee salaries. It is important to determine the order of such deductions. As follows from the legislation, tax is first withheld from payments due to the employee, and only then mandatory and other deductions are made. For example, alimony is withheld after personal income tax has been deducted.

To withhold personal income tax, a posting is used (Debit account 70, Credit account 68). To pay personal income tax to the budget (Debit account, 68 Credit account 51).

We hand over the “clarification”

You will have to clarify the calculation if you forgot to indicate any information in it or if errors were found (in the amounts of income, deductions, tax or personal data, etc.).

Also, the “clarification” is submitted when recalculating personal income tax for the past year (letter of the Federal Tax Service of the Russian Federation dated September 21, 2016 No. BS-4-11 / [email protected] ).

The Tax Code of the Russian Federation does not determine the deadline for submitting the updated calculation. However, it is better to send it to the inspectorate before the tax authorities find an inaccuracy. Then you don’t have to worry about a fine of 500 rubles.

In the “Adjustment number” line, “001” is indicated if the calculation is corrected for the first time, “002” when submitting the second “clarification,” and so on. In the lines where errors are found, the correct data is indicated, in the remaining lines - the same data as in the primary reporting.

The calculation indicates the checkpoint or OKTMO incorrectly. In this case, you also need to submit a “clarification.” In this case, two calculations are submitted to the inspection (letter of the Federal Tax Service of the Russian Federation dated August 12, 2016 No. GD-4-11/14772):

- in one calculation, the adjustment number “000” is indicated, the correct values of the checkpoint or OKTMO are entered, the remaining lines are transferred from the primary calculation;

- the second calculation is submitted with the correction number “001”, KPP or OKTMO indicate the same as in the erroneous report, zeros are entered in all sections of the calculation.

If the calculation with the correct checkpoint or OKTMO is submitted late, the fine under clause 1.2 of Art. 126 of the Tax Code of the Russian Federation (for violation of the reporting deadline) does not apply.

To reliably formulate the status of settlements with the budget, in the event that the data of the CRSB changes after the submission of updated calculations, you can submit an application to clarify the erroneously filled in details of settlement documents.

Editor's note:

In connection with the transfer of personal income tax administration by interregional (interdistrict) inspectorates for the largest taxpayers to the territorial tax authorities, the Federal Tax Service of the Russian Federation announced the following.

Starting from reporting for 2021, the largest taxpayers with OP need to submit 6-NDFL and 2-NDFL to the territorial tax authorities. Moreover, if “clarifications” on personal income tax for past periods are submitted after 01/01/2017, then they should also be sent to regular inspections (letter of the Federal Tax Service of the Russian Federation dated December 19, 2016 No. BS-4-11 / [email protected] ).