For the convenience of filling out personal income tax returns 3-NDFL and 4-NDFL, the Federal Tax Service has released a special “Declaration” program. These forms are filled out in accordance with the Order of the Federal Tax Service No. ММВ-7-11/822 dated October 25, 2017. Filing personal income tax returns to the Federal Tax Service begins in January 2021 and ends on 05/03/2018.

From January 1, 2021, a new personal income tax return form is in effect.

for 2021, which must be filed in 2021

Convenient alternative

For the reporting period of 2021, individuals who, by virtue of the law and current circumstances, are required to independently declare their income (or want to declare the tax deductions they are entitled to), do so on Form 3-NDFL. It was approved by order of the Russian Tax Service dated December 24, 2014 No. ММВ-7-11/671:

Please note that for the report for 2021, Federal Tax Service Order No. ММВ-7-11/822 dated October 25, 2021 adjusted the form of this declaration, as well as the electronic format and submission procedure, due to changes in the tax legislation of recent years. Therefore, the official developer of the Federal Tax Service software, JSC GNIVTs, has released a new version of the program.

Please note that the current rules allow:

- Fill out the declaration on paper by hand.

- Enter all the data on your computer.

- Apply electronically online in the individual’s personal account on the official website of the Federal Tax Service of Russia www.nalog.ru;

- Or download the free program for 3-NDFL for 2021 on the specified website of the Russian Tax Service.

Many individuals - income tax payers have recently been actively mastering computer technologies. And the Russian tax department understands this, so it invites everyone to download the program for 3-NDFL for 2017 for free in 2021. Of course, in the new version – taking into account all the changes.

Also see “Download the 3-NDFL declaration for 2021 to fill out.”

Possible difficulties

If the product does not install, your computer's hardware and software may not meet the minimum requirements:

- operating systems Windows 7, 8 or 10;

- Windows Vista and XP (SP3) systems are acceptable, but technical support is not provided in this case;

- free 14.5 MB on disk.

If the encoding on the installed program is broken, the developer advises changing the Russian standards in the system settings to any others, and then returning to Russian again.

If you encounter any difficulties with installation, you can contact the manufacturer’s technical support by email at [email protected]

Software from the Federal Tax Service

We advise you to download the “Declaration” program for free in 2021 for 3-NDFL for 2021 exclusively from the official website of the Federal Tax Service of Russia. Here is the exact link (with the index for Moscow):

https://www.nalog.ru/rn77/program//5961249/

Here's what it looks like in 2021 on the website of the Russian Tax Service:

To fill out an income tax return for 2021, absolutely anyone can download the program for 3-NDFL 2021 from the official website of the Russian Tax Service. Here it is freely available: no logins, passwords, or codes need to be entered. It is only enough:

- Go from the main page of the Federal Tax Service website to the “Software” subsection.

- Click “Download” on the “Declaration” program for 3-NDFL for 2017 (it is the bottom element in the picture, this is the installation file InsD2017.msi).

- Specify the path on your PC to save the program file.

Of course, in order to receive a tax deduction, downloading the program for 3-NDFL in 2021 is also a suitable option.

Using the considered option for filling out a declaration - that is, downloading the program for 3-NDFL for 2021 - is relevant for those individuals who have not yet gained access or have not mastered a personal account on the Federal Tax Service website and want to do it personally or through a representative:

- take the completed declaration to your tax office;

- submit to the post office for sending by a valuable letter with a list of enclosed documents;

- send via TKS.

Also see “How to obtain 2-NDFL through the taxpayer’s personal account.”

Instructions for filling out form 3-NDFL in the program for 2021

The Declaration 2021 program allows you to calculate personal income tax and deductions based on the entered data, check the received data and generate a ready-made completed report form for submission to the Federal Tax Service.

The filling process depends on the purpose of preparing the tax return.

Form 3-NDFL is filled out in the following cases:

- Individual entrepreneur for submitting information about income from business activities;

- notaries, lawyers, private practitioners to submit information about income received;

- individuals who wish to independently pay tax on their income;

- individuals who want to receive a deduction for expenses and return part of the previously paid personal income tax.

After starting the program, a window opens with tabs on the left, in which you need to fill in the necessary data depending on the basis for filing 3-NDFL.

Setting conditions

This is the first tab in the program, which must be completed by all persons filing 3-NDFL.

What you need to fill out:

| Declaration type | It should be about, which will mean the preparation of a declaration by a resident of the Russian Federation. |

| general information | Inspection number – click on the button with the ellipsis and select the desired branch of the Federal Tax Service where the report will be submitted (at the taxpayer’s place of residence). You can scroll through the directory in search of your branch, but it’s easier to find it by a four-digit number - just start entering the digits of the Federal Tax Service branch number, and it will be found. After finding the desired branch, click on the “Yes” button, thereby confirming the choice. Adjustment number - leave 0 if the declaration is completed and submitted for the first time in 2021. If a previously submitted form is changed or clarified, then the serial number of the changes is indicated. OKTMO - this code for a taxpayer can be clarified in the classifier. If the Federal Tax Service and OKTMO numbers are not known, then you can find them on the tax website at the link: service.nalog.ru/addrno.do?t=1611198692029. Here you need to indicate your address, after which the Federal Tax Service and OKTMO code will automatically appear. |

| Taxpayer attribute | The appropriate option is selected depending on the reasons for filling out 3-NDFL. For an individual to independently pay tax, for example, on a sold property (apartment, car) or to receive a deduction (for an apartment, treatment, education), indicate “Other individual.” |

| Income available | The type of income received in the reporting year is indicated. Individual entrepreneurs must put o, then the tab on the left “Entrepreneurs” will become available to them. If in 2021 there was income from foreign companies, then you need to, and the “Income outside the Russian Federation” section will become available. If a citizen fills out a declaration who wants to return the tax or pay it themselves, and there were no foreign sources of income, then the first item must be left checked, which is selected by default when loading the program. |

| Statement data | A new function in the Declaration 2021 program that allows you to generate a return application. In this case, you will not need to write it separately and attach it to the completed 3-NDFL form. If you need to make a tax refund or offset, for example, in connection with receiving a deduction, then you should check this box, in which case a corresponding application will be generated automatically. In this case, you do not need to prepare it separately, but you will need to fill out the bottom tab “Tax Credit/Refund”. |

| Reliability is confirmed | When submitting in person Fr. When submitting through a proxy, indicate his full name and details of the power of attorney, which gives the right to file a 3-NDFL declaration on behalf of an individual. |

An example of filling out the “Set conditions” tab for a tax refund when purchasing an apartment:

Information about the declarant

The next tab in the Declaration 2021 program, which all persons must fill out, is “Information about the declarant.” This page displays data about the taxpayer who submits 3-NDFL to the tax authority.

An individual must fill out:

- last name, first name, patronymic - exactly as in the passport;

- TIN - if you don’t know this number, you can check it on the Federal Tax Service website using the link, you need to fill out information about yourself and click “send request”, after which information with the TIN number will appear;

- date of birth;

- place of birth - as in the passport;

- citizenship data - Russian citizenship is already automatically indicated with code 643;

- information about the document - you need to click on the ellipses in the “Type of document” line and select the one you need, usually it’s a passport, its details are written below;

- contact phone number - valid for communication with tax authorities.

An example of filling out the “Declarant Information” tab:

Income received in the Russian Federation

For individuals, income is reflected here, the source of which is Russian companies and citizens.

This tab is filled out by citizens who want to pay the tax themselves or return it due to deductions. Individual entrepreneurs, lawyers, and notaries should reflect income from their activities in the “Entrepreneurs” tab.

The source of income can be the employer, the buyer of the property.

If data on wages for 2021 is provided for the return of personal income tax, then you will need a 2-NDFL certificate, which should be obtained in advance at your place of work. From this certificate you can take the employer’s details, data on accruals, deductions and deductions.

If information about the buyer of property (apartment, car) is provided for the purpose of paying tax, then information about the buyer can be found in the purchase and sale agreement.

Instructions for filling out 3-NDFL when selling an apartment in the Declaration 2021 program.

The procedure for filling out the income tab in the Declaration 2020 program:

- Tax rate - the desired tax rate is selected at the top, most often it is 13 percent, and you need to select the first digit 13 (the last digit 13 is the rate at which dividends are taxed).

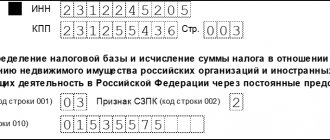

- Adding a source of payments - click on the green plus - indicate the name of the source of payments (name of the organization or full name of the individual), TIN, KPP and OKTMO (for the employer you can find out in paragraph 1 of the 2-NDFL certificate; for individuals to whom the property was sold, indicate this data is not necessary), check the box “Calculate standard deductions using this source” only if the employer did not provide these deductions and you want to receive them through the Federal Tax Service.

- Adding income - click on the green plus in the next field. If the source of payments is the employer, then the income codes and monthly amounts from clause 3 of the 2-NDFL certificate for the entire reporting year are indicated. If the source is the buyer of the property, indicate the income code depending on the type of property and fill in information about the funds received based on the purchase and sale agreement.

- Adding deductions - in the lower field, by clicking on the green plus, all standard, social, property deductions provided by the specified source of payments for the year are added - the deduction code and its amount are taken from clause 4 of the 2-NDFL certificate.

- Total amounts by payment source - based on the entered data, the total income value is generated automatically. These amounts can be checked against clause 5 of the 2-NDFL certificate received from the employer. From clause 5 of 2-NDFL, the total amount of tax withheld is also rewritten.

An example of filling out a tab if the source of payments is the employer organization:

Income outside the Russian Federation

This tab in the Declaration 2021 program is filled out only by those individuals who received funds in foreign currency for the reporting year 2021. In this case, on the first tab “Setting conditions” the corresponding item must be checked.

Here you also need to indicate the name of the source of payments (foreign entity), country code, dates of receipt of income and payment of tax, deductions, as well as information about the currency in which the amount received was expressed.

Entrepreneurs

This tab of the program is filled out only if on the first tab “Setting conditions” the item on receiving income from business activities is checked, that is, it is filled out by individual entrepreneurs, lawyers, notaries, heads of peasant farms and other private practitioners who want to report using a declaration 3- Personal income tax before the Federal Tax Service.

Depending on who fills out the declaration, you need to select the appropriate type of activity and indicate the amount of income.

For example, for an individual entrepreneur, filling out this program tab will look like this:

Deductions

The “Deductions” tab in the Declaration 2021 program is filled out by those individuals who want to return 13 percent of the costs of purchasing real estate (houses, apartments, rooms, land, cottages), paying for education, treatment, and voluntary insurance contributions.

In addition, the tab is completed if the taxpayer wishes to return personal income tax due to incomplete application of standard deductions at the place of work.

At the top, you select what type of deduction the declarant wants to receive, then the necessary data is provided.

Property

Entitled to the buyer of real estate, including when purchasing housing with a mortgage - 13 percent of the costs of paying for real estate and mortgage interest are subject to refund within the limits of property deductions.

The program tab provides information about the purchased object and expenses.

Instructions for filling out 3-NDFL in the Declaration 2021 program when purchasing an apartment.

Registration of 3-NDFL in the program for mortgage deduction.

Social

A deduction is due if an individual in the reporting year had expenses for treatment, medications, training, payment of contributions under voluntary insurance contracts, charity, and qualification assessment.

13 percent is also subject to a refund, taking into account the amount of the required social deduction.

The tab indicates the amount of expenses.

Instructions for filling out 3-NDFL in the Declaration 2021 program for deductions for treatment.

How to fill out 3-NDFL in the program for deduction for education?

Standard

The program tab is completed if the individual has not fully received the required standard deductions from the employer - for children, due to a special status.

Investment

The Declaration 2021 program tab is intended to be filled out by those citizens who claim a tax refund in connection with receiving investment tax deductions.

Tax credit and refund

The last tab of the program is filled out by citizens who wish to return or offset income tax amounts. This innovation in the 2021 Declaration allows you to automatically generate a statement, which eliminates the need for its separate preparation.

The tab indicates what the person wants to do: return or offset the tax. The required amounts and bank details are provided where the Federal Tax Service should transfer the funds.

Technical features of the 2018 version

The official name of the tax program under consideration for 3-personal income tax for 2021 is “Declaration 2017”. Using it allows you to independently generate this report on an up-to-date form, ready for submission to the tax office.

The current 2021 version of the 3-NDFL filling out program for 2017 has the index 1.0.0 and is dated December 28, 2021.

Note that on the Federal Tax Service website in the same section there are several versions of the “Declaration” program for previous years. This is due to constant changes in legislation and the corresponding updating of the form of this report, as well as the opportunity to submit an updated declaration. Therefore, you need to download the program for reporting income for 2021 in the latest and most current version.

Step-by-step instruction

The first stage has been completed. Now you need to install the Declaration program on your computer by running the file InsD2018. msi .

Procedure:

- Once the process has started, a window with the installation wizard should appear.

- Click “Next” and accept the license agreement, having carefully read it first.

- On the next screen, the wizard prompts you to select the folder in which the application will be installed. The user can accept the default directory or select a different one using the Browse button.

- Next, follow the instructions on the screen and confirm the installation.

- The procedure has been completed successfully.

- The next step is to install the printing package. This must be done by following the recommendations on the screen.

- The program is now ready to use and should appear on your computer's desktop.

Program features

The electronic program under consideration for 3-NDFL in 2021, after downloading and installation, allows you to automatically check its correctness during the process of entering the necessary information into the declaration form. And this will reduce the risk of errors.

In addition, the tax program for 3-NDFL 2021 from the website of the Federal Tax Service of Russia will help:

- correctly enter information from other documents;

- will calculate the necessary indicators;

- will check the correctness of calculation of deductions and the amount of personal income tax;

- will generate a completed form for submission to the tax authority.

Thus, for those who have at least some computer skills, it is easier to download the “Declaration” program for 3-NDFL for 2021 than to spend a long time dealing with filling out the paper form of this report.

Also see “Who must submit 3-NDFL for 2021: list.”

Please note that you need to download the “Declaration” program for free not only for 3-NDFL for 2021, but also to fill out the 4-NDFL form. The obligation to submit it is established by paragraphs 7 and 10 of Article 227 of the Tax Code.

Read also

09.01.2018

Comments

Abduaziz 07/30/2019 at 08:55 pm # Reply

What is needed for acquisition documents

Konstantin 02/13/2020 at 09:02 # Reply

Is it possible to open a declaration from the previous year?

In order not to re-enter all the details, is it possible to transfer data from the Declaration 2021 program (saved file) to the Declaration 2019

Tatyana 12/21/2020 at 10:04 am # Reply

Good afternoon Is it possible to apply a social tax deduction for the purchase of medicines if 1) the original receipt is lost, but the pharmacy gave a copy? 2) during the pandemic, were drugs purchased without a prescription because the doctor did not come for several days?