The inability to conduct financial transactions leads to the paralysis of many business processes. Settlements with suppliers and customers, payment of rent and other payments are slowed down. If an organization has several current or foreign currency accounts, all will be blocked.

What should an entrepreneur do, how to lift the ban on debit transactions and resume using a current account - read the article.

From this article you will learn:

- What are the consequences of blocking a current account?

- How does the tax office decide to block a current account?

- On what basis can the tax office block a current account?

- How to unblock a current account

- In what cases is a current account blocked illegally?

- How to challenge a tax service decision

- How to reduce the risk of blocking your current account: 5 tips

When and why can an account be frozen?

A bank account is opened for financial transactions in non-cash form. A person stores money on it, receives a salary, pension or other income, and makes payments. For payments a bank card is issued:

- debit - that is, the client credited his money to it;

- credit - that is, it is the bank’s money, and the client takes out loans by paying with a card.

The card is always linked to a specific account.

Seizure of property is one of the interim measures in enforcement proceedings. Since money is considered property, bank accounts and deposits can also be seized. This measure will allow:

- write off the entire amount at once, or a certain percentage (for example, when crediting salaries, the withholding does not exceed 50%, for alimony up to 70%);

- block transactions so that the defaulter cannot spend money, transfer it to other persons or withdraw it;

- collect money as it is credited.

When an arrest is imposed without bailiffs:

- The court issued a ruling to secure the claim - only the amount of the debt is frozen. The debtor will not be able to spend or withdraw the money until the trial is completed.

- The bank will seize the account if the writ of execution comes from the creditor. Yes, if you know which bank the debtor has the money in, it is not necessary to involve bailiffs - you can submit an application and execute it. sheet directly to the bank.

A citizen may have many accounts opened in different banks. Anyone can be arrested for debt. After the opening of proceedings, the bailiff requests data from the Federal Tax Service through the banking monitoring system. The FSSP will see which credit institutions have accounts and will send orders on arrest and write-off to all banks.

What are the consequences of arrest?

If the seizure of funds is imposed by the court as a measure to secure a claim, they will not be written off, but blocked. If the plaintiff wins, the seized money will be retained. If the defendant wins the case, the blocking of funds is lifted, after which they can be disposed of without restrictions.

When a bailiff seizes a bank account, the following consequences occur:

- suspension of account transactions, i.e. the debtor will not be able to withdraw, spend or transfer funds to others;

- writing off the debt amount immediately in full or in parts. As received;

- The credit institution notifies the bailiff and the debtor of each write-off.

Seizure of the debtor's accounts is not the only power of the bailiff. At the same time, it is allowed to send documents to the employer to deduct wages, seize real estate and transport, and movable property. Also, the FSSP, according to Law No. 229-FZ, can prohibit the debtor from traveling abroad and take away his driver’s license.

How not to pay bailiffs by court decisionRelated article

If money is debited from your salary, the bailiff determines the withholding percentage. For example, if a salary is credited to a card, 50 or 70% will be withheld from it (depending on the subject of the requirements). The remaining funds will be available for withdrawal, transfers, and other operations.

How are arrest and write-off related?

If there is money in the account, it will be written off to pay off the debt:

- if there was enough money to close the debt, the bank returns the documents with a note of full execution;

- if the money is written off, but the entire debt is not closed, the bank reports partial fulfillment and retains the arrest for subsequent write-offs;

- if the account is empty, the credit institution will make a note of arrest and write off funds as they are credited.

The debtor may close the seized account. To do this, just submit an application to the bank. After closure, the arrest is automatically lifted, which the credit institution will report to the FSSP.

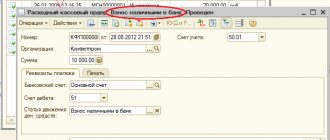

How does the tax office decide to block a current account?

Most often, the sequestration of funds in bank accounts is carried out by the desk department of the Federal Tax Service Inspectorate (hereinafter referred to as the Federal Tax Service Inspectorate). Its employees check all incoming declarations and other reporting from payers. They are the ones who monitor the timeliness of submission and correct completion of tax reporting, and exchange electronic documents via telecommunication channels (hereinafter referred to as TCS).

Having discovered a violation, a specialist from the office department draws up a document - a decision to bring the violator to justice, endorses it from the head of the inspection and seizes the payer’s bank account.

The tax office sends the decision to suspend transactions on accounts to the bank and the organization itself no later than the next day after its adoption. The decision is sent to the bank by email, and to the taxpayer by registered mail. Often, an entrepreneur receives a letter when the account is already blocked.

Having received a tax decision, the bank is obliged to immediately execute it and notify the Federal Tax Service of the amount of funds in the payer’s current account. Some banks inform their clients about the seizure of the current account and the suspension of operations - this is a personal initiative of the banks; by law they are not obliged to do this.

You might be interested in

Every business is unique in its own way. RKO for a specific type of business. Current account + a set of useful banking services on preferential terms.

find out more details

To stay informed about the status of your current account, use remote banking systems - it’s faster than receiving registered letters from the tax office.

How a bank account is seized

The bailiff does not go to banks to manually enter a lien. In 2021, everything is done remotely, through electronic services. Banks operating in Russia are required to post information about their clients in the monitoring system of the Central Bank of the Russian Federation and report client accounts to the Federal Tax Service.

Therefore, it will not be possible to hide accounts in Russian banks; it is a myth that there are banks that do not cooperate with bailiffs. There are simply bailiffs who did not look at the extract properly.

Initiation of proceedings

The claimant submits documents and an application to the FSSP unit at the place of registration of the defendant. The claimant has the right to indicate the institutions where the debtor stores or receives money. The bailiff is obliged to check this data plus send his requests to the monitoring system.

Assets and money can be seized immediately after opening a case.

But until the 5-day deadline has expired, write-off is prohibited. In practice, this rule is often violated. The period for execution begins from the date on which the debtor received the orders. But many bailiffs transfer documents for retention without waiting for notification from the post office. Such actions can be appealed; this is a violation.

Resolution to the bank

The FSSP specialist cannot himself manage the bank accounts of the defaulter. But he has the right to give such instructions to the bank. For this purpose, an arrest order is issued. It states:

- production details;

- information about the debtor so that the bank identifies the owner of the accounts;

- the nature of the requirements (this is important for the amount of deductions);

- details for transferring funds (usually a FSSP deposit);

- other information that is important for debiting funds and blocking transactions.

From 2021, credit institutions are required to calculate the amount of withholding themselves, taking into account the nature of the requirements and the type of income. If the resolution contains incomplete or inaccurate information, the bank is obliged to request clarification from the FSSP.

How does the bank operate?

If the bailiffs have seized the accounts, the bank is obliged to comply with the order no later than 1 day. The responsibilities of the credit institution include:

- control of all credits in favor of the debtor;

- determining the amount of withholding;

- notification of the account owner about arrest, write-offs;

- informing the FSSP about full or partial write-offs, about the closure of accounts.

If the bank has information that the debtor receives income that is prohibited from foreclosure, it notifies the FSSP about this. The full list is specified in Art. 101 of Law No. 229-FZ. Employers, the Pension Fund of the Russian Federation, social security authorities and other departments are required to indicate the income code in the payment order. Using it, the credit institution will check whether the money can be written off.

Blocking operations

Account collection and seizure

If the account is seized, transactions are blocked until the debt is repaid. However, when crediting salaries, pensions or other income, bailiffs and credit organizations are required to comply with restrictions on the percentage of withholding. For example, for alimony they take up to 70%, for other debts - up to 50%. The remaining funds after deduction can be spent at your discretion.

Write-off of funds

If there is money in the account, the bank will transfer it to the FSSP deposit. The amount of debt decreases when property is sold, deductions at the place of work, and write-offs from other banks. The FSSP employee is obliged to inform the bank to avoid double collection. The debtor can also take the initiative and demand from the FSSP to transfer data on the current status of the debt.

What are the consequences of blocking a current account?

If your account is blocked, you will not be able to make any expense transactions: make payments to the budget, issue salaries to employees, pay for the services of a contractor, or buy goods. The only type of permitted payments in such a situation is through writs of execution. These include alimony, collection of moral damages, severance pay and payment of taxes on orders received by the bank before the date of the decision to block the account.

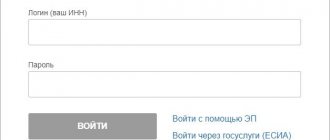

You will not be able to open a new account in another bank to direct your financial flows there. On the website of the Federal Tax Service (hereinafter referred to as the Federal Tax Service) there is a service for checking whether expense transactions have been suspended on the accounts of organizations and individual entrepreneurs. Before opening an account for a potential client, all banks are required to track him through this service. If an organization has frozen accounts, the bank will refuse to open a new account (Clause 12 of Article 76 of the Tax Code of the Russian Federation). It is impossible to close a blocked account.

Before large transactions, check whether your current account is blocked. Use the Federal Tax Service service: just enter the INN and BIC of your bank.

New law - how the bailiff writes off money in 2021

In 2021, all banks apply the following procedure:

- a system of codes has been introduced for different incomes of the debtor: there are separate codes for wages, for different types of pensions, for alimony, for unemployment benefits, etc.;

- the employer or other person (government agency) transferring the income is required to indicate the code on the payment slip;

- when money arrives, the bank looks at the income code;

- if the code allows collection, the bank determines the amount of withholding and transfers the funds to the FSSP;

- no later than 3 days, the credit institution notifies the bailiff and the client about the write-off.

All deposits to which codes are assigned are reflected in the monitoring system of the Central Bank of the Russian Federation. A special algorithm for coloring income has been introduced, where each code is assigned its own color. Upon a complaint from the debtor or on his own initiative, the bailiff can check whether the amount of deductions is calculated correctly.

If an error is made due to the fault of the bank, an administrative case is initiated. If an error is made when processing a payment by an employer or other person, they will also be held accountable.

Administrative liability has been introduced for violations under Art. 17.14 Code of Administrative Offenses of the Russian Federation.

Examples of illegal blocking of a current account

Sometimes inspectors exceed their powers and block the accounts of organizations and entrepreneurs illegally. This happens when employees of the Federal Tax Service do not want to understand a situation that arose due to an ambiguous interpretation of a legal norm, a technical error in a document, or untimely actions of tax officials.

The current account is frozen before the end of the period for voluntary execution of the decision and the entry into force of the decision of the tax inspectorate

For example, an individual entrepreneur has not paid tax according to the simplified tax system. The Federal Tax Service sends a demand for payment, which must be executed within 10 days from the date of receipt. Often, already on the 8th or 9th day, the tax office suspends transactions on your bank account and cuts off your oxygen. Submit or send a tax application and indicate in it that transactions on the current account have been suspended in violation. Then the illegal arrest will be lifted.

Current account blocked for failure to submit reports to the Pension Fund

The pension fund does not have the right to suspend transactions on accounts. It is within his competence only to send a collection order to collect the arrears. If there are sufficient funds in the account, it is executed immediately, and if there is not enough money, it is executed as it arrives. If the Pension Fund of Russia has violated this rule, write an application to the head of the territorial department of the Pension Fund of the Russian Federation to cancel the blocking and file a claim with the arbitration court.

You did not submit a declaration to the Federal Tax Service on time due to the fault of a third party

If you sent the declaration on time, but it was not delivered: it was lost in the mail or a technical failure occurred - it is not your fault. Provide tax confirmation of the fact of sending, and the blocking will be lifted no later than the next business day. If it is not removed, you have the right to go to court.

Loan, deposit and other accounts that are not related to settlement and cash services have been blocked

The Federal Tax Service has the right to block only those accounts that are opened for the purpose of settlement and cash services for the organization. Credit, loan, deposit, and transit accounts are not subject to arrest.

The account is blocked based on the results of an on-site audit if the taxpayer has property or fixed assets

This is one of the preventive measures, its purpose is to collect as many taxes and fines accrued as a result of on-site inspections. To prevent an entrepreneur or organization from evading subsequent payments, the Federal Tax Service decides to block the current account.

The arrest is imposed on the payer’s funds in the amount of the debt to the budget identified during the audit. Tax authorities can apply this measure only if the organization does not have property with which to collect the debt, or if it is insufficient. In all other cases, blocking is illegal.

For example, an LLC owns 3 office premises and 2 vehicles. The total value of the enterprise's property is estimated at 17 million rubles. Based on the results of the on-site audit, the tax authority assessed additional VAT and income tax to the organization. The total amount of the identified arrears is 1.4 million rubles. After the inspection is completed, the servicing bank receives a request from the Federal Tax Service to impose a ban on debit transactions on the LLC’s current account in order to ensure the collection of arrears. This requirement is illegal, and here's why.

The organization's property - 17 million rubles - is quite enough to collect unpaid taxes, penalties and fines - 1.4 million rubles. The decision to suspend operations even in the amount of 1.4 million rubles contradicts the requirements of the law and violates the rights of the organization.

What to do if your bank account is seized

To check the legality of the arrest and write-off of funds, the debtor needs:

- find out whether enforcement proceedings have been initiated, why the arrest was imposed, i.e. check the FSSP resolution;

- check that the bailiff and the credit institution have correctly determined the intended purpose of the moves and funds credited to the account.

Law No. 229-FZ and other regulations do not prohibit the seizure of accounts. Even if you have a MIR payment system card issued for social benefits or pensions: you can use it to receive income from commercial activities, transfers from individuals and legal entities. Therefore, any account opened in the name of the debtor can be seized.

How to find out about arrest and write-off of funds

According to the law, the bailiff sends a resolution to the debtor to initiate a case, to impose arrests and prohibitions. Therefore, the easiest way to find out information is to receive letters on time. BUT the rules are not always followed:

- an FSSP employee may take a formal approach to meeting the deadline for voluntary execution and immediately send the documents to the bank for retention;

- an unscrupulous bailiff may delay sending a copy of the resolution to the debtor or not send him documents at all, or make a mistake in the address;

- letters from the FSSP may not arrive due to the fault of the post office.

What does this mean? A person will suddenly be debited a certain amount. Then everything depends on the speed of reaction - you need to appeal the actions of the bailiff. If the money has already left the FSSP for the claimant, it will be even more difficult to return it.

To avoid problems and find out about the seizure of a bank account in time:

- receive mail, especially registered letters;

- check the online Data Bank on the FSSP portal - you can search for information by last name;

- read SMS, notifications about account status in online banking, in your personal account. In Sberbank, the seized account is marked in red, and the notes contain a link to the bailiff’s document;

- Call the bailiff if a court judgment has been made against you.

Seizure of the debtor's property by bailiffsRelated article

Having lost the trial, get ready to initiate proceedings at the FSSP. Do not keep large sums in the bank so that they are not immediately written off as debts. If you receive your salary on a card, make sure that your accountant is aware of the new codes. You can also submit documents to the FSSP that show the intended purpose of the income.

How to check the legality of a write-off

To check on what basis money was written off, you can:

- request a statement of accounts and deposits in the bank, which indicates the basis for each write-off (for example, the statement will indicate the FSSP production number);

- contact the FSSP and personally receive documents about the initiated proceedings and the amount of debt;

- send a request to the FSSP by mail or through State Services.

You can act personally or through a representative. For example, you can contact a lawyer, describe the situation to him, and issue a power of attorney to represent your interests. When defending in enforcement proceedings, a lawyer can prepare complaints, challenge arrests and write-offs. Sometimes it is more profitable to immediately write off debts through bankruptcy than to pay bailiffs and banks or borrow from microfinance organizations.

Can money be debited from a salary card?

Seizure of a salary account is not a violation of the debtor’s rights. Salary does not qualify as income that cannot be levied.

However, Law No. 229-FZ has rules for deductions from wages:

- no more than 50% is withheld from earnings monthly (for alimony - up to 70%);

- the balance goes to the card, and the debtor can withdraw money or spend it;

- If the balance is not withdrawn, then next month it will be written off - the debtor cannot save money.

In simple words, the restriction applies to each salary transfer. Anything in your account on payday is automatically considered savings. The bank will withhold 50% of the received salary + money on the balance.

Double debiting at the same time at your place of work and at the bank is not allowed - this is a mistake, contact the bailiff immediately. But if other income is received on the card, the withholding will be completely legal.

Seizure of credit card or account

With credit cards, it can be difficult to keep track of debts. It all depends on how the loan is structured:

- if the bank approved the loan and transferred the money to the borrower, it can be written off without restrictions;

- if it is a credit card with a limit, deduction is not allowed, since the money belongs to the bank;

- Seizure of a credit account by bailiffs is allowed, and they will take the money that you make as a regular payment.

If the borrower deposited money as a loan payment, the bank is obliged to write it off and transfer it to the FSSP. To prevent bailiffs from writing off money, deposit it into the bank's cash register or terminal indicating the details of the loan agreement - the funds will go to the bank's account, not yours.

If the payment is credited to a card with an open overdraft credit line, the money becomes the property of the bank and will not be written off by the bailiffs. This is convenient for the borrower and the bank. Tinkoff credit cards provide direct credit to the bank, i.e. You don’t have to worry about unexpected write-offs.

Can pensions, benefits, social benefits and alimony be withheld?

Any account can be seized. What income cannot be written off:

- survivor's pension (although seizure of a pension account is not a violation - other income can be credited to it);

- alimony, child benefits, maternity capital;

- Deductions from compensation for damage to health upon the death of the breadwinner are not allowed.

The full list of income for which debts cannot be withheld is indicated in Art. 101 of Law No. 229-FZ. If the bailiff or bank violates this norm, the withholding can be appealed through the court or the head of the FSSP. We described how to file a complaint against the bailiff here.

On what basis does the tax office have the right to block a current account?

Article 76 of the Tax Code of the Russian Federation gives tax authorities the right to seize ruble and foreign currency current accounts for the following reasons:

Blocked due to non-payment of taxes

With this formulation, only the amount of debt for tax payments, accrued fines and penalties is blocked. All other money remains available for settlement transactions. If an organization has suspended operations on several current accounts, and there are enough funds to pay the arrears on one of them, send an application to the Federal Tax Service Inspectorate indicating the details of the required account and copies of bank statements confirming this fact. The seizure from other accounts must be removed within 2 days from the date of filing the application.

If there is not enough money in the account, the bank will write off all incoming funds from the current account until the debt is repaid in full. To speed up the removal of the arrest, the payer can deposit the missing amount into the account in cash. In any case, the account of an organization or entrepreneur will be unblocked only after all arrears have been received into the budget.

In case of non-payment of taxes, penalties and fines, blocking of current accounts is possible only after a decision is made to collect the debt amount. This usually happens if the taxpayer ignored the preliminary request of the Federal Tax Service for voluntary repayment of the debt or did not receive it.

Tax reporting not submitted

In this case, the account will remain blocked until the Federal Tax Service receives the required declaration or calculation. Art. 88 of the Tax Code of the Russian Federation in paragraph 2 provides a 3-month period for conducting a desk audit. Therefore, the Federal Tax Service will detect missing reports within 2 weeks to 3 months from the end of the reporting period, or less often later. The taxpayer's account will be seized within 10 days from the moment the violation is discovered, while 3 years is the maximum period during which sanctions for such a violation are applicable.

Did not send confirmation receipt of receipt of the Federal Tax Service's request

According to the law, the taxpayer has 5 days to send to the Federal Tax Service a receipt confirming the acceptance of the TKS requirements for a summons to the inspectorate or the provision of documents and explanations. The TCS document flow between the tax office and payers is systematized: if the confirmation receipt is missing from the system for more than 5 days, the system itself will inform the inspector about the need to seize it. In this case, the decision is made within 10 days from the moment the violation is discovered, that is, no later than 16 days from the moment the tax office sends the request.

As a result of the on-site inspection, arrears or a fine were accrued

Sometimes inspectors conduct an on-site inspection of the taxpayer, identify non-payment of taxes, and assess fines and penalties. And then debit transactions on the debtor’s current accounts can be suspended as an interim measure. The head of the Federal Tax Service approves the on-site inspection report, and the decision to block the current account is sent to the bank, and a copy of it is sent to the organization.

The above reasons are the only grounds for suspending operations on the current accounts of an organization or entrepreneur in the Tax Code of the Russian Federation. If the account is blocked for other reasons, you have the right to appeal to the arbitration court to challenge the seizure.

If your account is blocked for illegal reasons, contact the arbitration court.

How to cancel account seizure

How to remove a seizure from an account if your rights have been violated.

When are bailiffs required to lift an arrest?

All restrictions will be lifted as soon as the debtor pays off the debtor. A resolution on this is issued and sent to the bank. Also, the lifting of prohibitions and restrictions occurs in the following cases:

- if a judicial act or executive document is canceled;

- if, based on the debtor’s complaint, the arrest order is cancelled;

- if the bailiff has completed or ceased production.

All prohibitions and restrictions can be lifted if you go through bankruptcy. You can learn more about all the nuances of this procedure from our lawyers.

How to challenge the decision of the Federal Tax Service

The purpose of interim measures on the part of the tax authorities is to guarantee future payments, and not to deprive the taxpayer of the opportunity to conduct his professional activities. Sometimes tax authorities have to remind you of this.

If the deadlines for imposing or removing the arrest from the current account, or its illegal blocking, are violated, the organization suffers losses: penalties and fines for late credit, rental and other payments increase, profitable deals are disrupted or existing contracts are terminated. By filing a claim with the arbitration court at the location of the tax authority, you will receive compensation for losses if you can document their amount.

If you find yourself in a situation where your account is blocked illegally, act!

Prepare objections to the decision to block the account

In your objections, write in detail what exactly the violation of your rights is. For example, blocking an entire current account as an interim measure is disproportionate to the amount of unpaid tax; the organization has property that can act as a guarantee of fulfillment of tax obligations and other reasons. Attach documents proving the legality of the payer's claims (these may be documents confirming the right of ownership of property and others).

An example of objections to a decision to unlawfully block an organization’s current account due to failure to submit a quarterly report in Form 6-NDFL

Send objections to higher authorities of the Federal Tax Service

Submit your objections to the blocking decision to the higher authorities of the Federal Tax Service - usually this is the regional or regional department of the Federal Tax Service of the Russian Federation. If the objections are not satisfied, you should apply for protection of your rights to the arbitration court at the location of the payer.

State duty and deadlines for consideration of the case

For consideration of a case in court, a state fee is charged in the amount of 4% of the value of the claim, but not less than 2,000 rubles. The usual review period is 3 - 4 months. Claims in such cases are justified by Art. 16 Civil Code of the Russian Federation, art. 1069 Civil Code of the Russian Federation, clause 9.2 art. 76 Tax Code of the Russian Federation. Rules for filing applications to the court, payment details and state duty calculators are posted on the websites of arbitration courts.

Tax inspectors also make mistakes and, as civil servants, are required to bear responsibility for breaking the law. Recently, an increasing number of entrepreneurs and organizations have won cases in court and received compensation.

Features of writing off funds

It is important to know the features of arresting and writing off money from different types of accounts. They differ significantly, and this information will be useful when filing complaints and refunds.

Salary

Most employers have long switched to non-cash payment of salaries via cards. It's faster and more convenient than dealing with cash and paying money through a cash register. Seizure of a salary account has the following features:

- no more than 50% can be withheld from wages, and for certain types of debts up to 70% (for example, if the debtor, in addition to the bank debt, also has alimony arrears);

- in the resolution, the bailiff indicates the maximum amount of deductions, but banks are now required to check this information as well;

- 50% is withheld from each salary deposit.

We recommend immediately withdrawing or spending the money remaining after writing off 50% of your salary. The bank has the right to write off the entire balance after the next part of the salary is credited. This rule is specified in Art. 99 of Law No. 229-FZ. Once the next periodic payment is received from the employer, the unwithdrawn money is no longer considered wages, so it is not subject to the 50% withholding limit.

Ekaterina Uryvaeva

Bankruptcy Lawyer for Individuals

Pensions, social benefits

A similar procedure applies when seizing a pension account. Deductions from it can be up to 70%, except for the survivor's pension. When transferring the next pension, the Pension Fund will indicate the payment purpose code. Using it, the bank will calculate the exact amount of deduction and write off the money. If your entire pension has been written off from your card, you can file a complaint and demand a refund.

For children's and social benefits, payment purpose codes are also indicated. If the payment cannot be collected, the bank does not have the right to write off the money. If a social benefit is subject to write-off, the amount of withholding cannot exceed 50 or 70%.

Please note that all social payments are now transferred only to cards of the Russian payment system “MIR”. Therefore, the bank knows in advance about the intended purpose of the money. But this does not mean that all the money coming to the MIR card is pensions or benefits. If violations were committed during write-off, you can file a complaint with the bailiffs or in court.

Accounts with which you repay loans

The most difficult situation is when the accounts through which the debtor repays loans are seized. There are two possible options:

- if the bank debits money to repay the loan from the client’s regular account, they may be foreclosed on according to general rules (therefore, there may not be enough funds on the loan payment date);

- if money is deposited into a special credit account, it immediately becomes the property of the bank, and therefore it is not profitable for the bank to write it off. Especially if you are paying off this loan, and the arrest concerns debts to other financial institutions.

If you are a debtor, we recommend depositing loan money into a special account or through bank branches and terminals. If you put funds for the next payment on a regular card, they may not wait for the loan to be written off and will go to the FSSP deposit. Accordingly, you will automatically default on the loan schedule.

But keep in mind that in many banks, replenishing accounts through the branch’s cash desk has long been a paid service. For withdrawals and deposits of funds to the card account through the cash desk, they charge a commission, for example, VTB and Alfa-Bank.

Who has the right to block an account?

Only three authorities have the right to suspend work and block an account:

- Tax Inspectorate;

- Bailiff Service (FSPP);

- The bank itself.

Each department has its own area of responsibility and its own powers. For the same reason, several authorities cannot seize an account. If the decision was made by the Federal Tax Service, then the reason is solely due to non-compliance with tax legislation. The FSSP oversees its area of execution of court decisions. The bank also has limited powers. Let's look at the reasons for blocking a current account in more detail.

What is an arrest?

Seizure of a bank account means the impossibility of using the funds available on it. The restriction may apply to a certain amount or to all receipts.

The amount is blocked temporarily until the circumstances are clarified (the bank has the right to suspend operations for 5 days until a decision is made by Financial Monitoring).

The funds are blocked in the amount prescribed by the authority’s resolution; the rest of the funds remains at the client’s complete disposal. Another option is that money is periodically debited from the account each time it is received until the debt is repaid.

Or a fixed amount may be left at the account owner’s disposal, the remaining funds are subject to blocking and then debiting.

The nuances of going to court

A complaint to the court is filed at the place of action of the body that made the relevant decision.

Citizens submit it in accordance with the norms of the CAS, entrepreneurs and commercial organizations - in accordance with the norms of the AIC.

The applicant indicates:

- name of the court;

- information about yourself (full name, account number);

- information about the unit of the authority that applied the arrest;

- information about the other side of the case;

- the circumstances are stated (who, for what reasons, applied the arrest, why it was illegal or no longer justified);

- date, signature, full name;

- description from the attached documents.

As a rule, a copy of the resolution or other act on the seizure of the account, and other papers confirming the arguments are attached. For example, a certificate from a bailiff confirming the repayment of a debt.