The single tax on temporary income is mandatory for all citizens of the Russian Federation, so failure to pay it carries consequences in the form of material penalties. The amount of the fine for the UTII declaration is regulated by the relevant provisions of the Tax Code. After reading this article, you will find out what measures are being taken in relation to non-payers, what affects the size of the monetary penalty and whether this fee is expected to increase in 2021.

Fine for UTII declaration

shtraf-envd.jpg

Related publications

Firms and individual entrepreneurs registered as UTII payers are required to submit a declaration to the Federal Tax Service Inspectorate by the 20th day of the month following the end of the quarter, and before the 25th day - to pay the imputed tax itself. But life is unpredictable, and anything can happen, including unplanned delays in fulfilling taxpayer obligations. What are the consequences of such delays?

Delay in filing a declaration

If you are late in filing a declaration by at least one day, based on the provisions of Article 119 of the Tax Code, the UTII payer faces, first of all, a fine. But its amount will depend on the period during which the report will be submitted. The penalty for the UTII declaration in 2021 is 5% of the amount of tax payable according to the declaration for each full or partial month from the date of delay. At the same time, the legislation provides for a minimum amount of such a fine - 1000 rubles, which firms or individual entrepreneurs will be required to pay regardless of how low the base for calculating the sanctions turns out to be. The maximum amount of the fine is also limited: it cannot exceed 30% of the tax amount according to the overdue report, regardless of when this report is filed.

The described fine for the UTII declaration is imposed on the individual entrepreneur or the company as a whole. At the same time, the official guilty in this circumstance may also be held liable for delay in filing the declaration. According to Article 15.5 of the Code of Administrative Offenses, he may be given a warning or a fine of 300 to 500 rubles.

Late submission of the report threatens with another unpleasant consequence. If the delay is more than 10 days from the last reporting date, then the Federal Tax Service has the right to block the current account of the company or entrepreneur based on the provisions of paragraph 3 of Article 76 of the Tax Code. In such a situation, the account owner is left with the opportunity only to transfer budget payments. Opening a new account in such circumstances will also not resolve the situation, since the requirement to suspend operations applies to all banks. After the declaration is submitted, the inspectorate withdraws the request to freeze the account, but this takes some time, usually from 10 days to two weeks.

Late payment of UTII

Delay in payment of the imputed tax is also fraught with fines and penalties.

The fine in 2021, based on Article 122 of the Tax Code, may amount to 20% of the amount of arrears, and in addition, its amount may be increased to 40% if the taxpayer’s malicious intent is proven. However, this is possible in most cases only after a trial, so if the debt is repaid without waiting for such an extreme turn of events, then a fine in its maximum amount will definitely be avoided.

The situation with penalties is different; they are accrued regardless of additional circumstances, starting from the first day of delay, based on 1/300 of the current key rate (remember, now it is 10.5%) for each day of late payment.

As a rule, an account is not blocked for late payment of imputed taxes, but such a turn of events cannot be completely ruled out. But here it must be said that, in contrast to the freezing of funds due to late filing of reports, which occurs after 10 days from the target date, in the case under consideration, much more time passes before inspectors resort to such measures.

At the same time, according to Article 46 of the Tax Code, the Federal Tax Service has the right to collect taxes, as well as penalties and fines from the taxpayer’s funds. Simply put, if the declaration is filed, that is, the inspectors know how much tax is due, they can simply withhold this amount from the current account if the taxpayer himself delays paying off the debt voluntarily.

What else

Until January 20, it is required to submit information on the average number of employees. Violation of this deadline will only result in a fine of 200 rubles. For untimely submission of financial statements, the tax office will issue you a fine of 200 rubles, but for each form. There are only five forms, in the end you get 1 thousand rubles.

Important! But responsibility for failure to submit reporting forms to statistical authorities has been significantly tightened since 2021:

- officials face a fine of 10,000–20,000 rubles;

- a fine of 20,000 – 70,000 rubles was introduced for legal entities;

- a repeated violation will entail an increase in these amounts: for officials the fine will be 30,000 - 50,000 rubles, for legal entities - 100,000 - 150,000 rubles.

If you have questions, ask in the comments!

Fines for UTII declaration for individual entrepreneurs

If an entrepreneur is late in filing a declaration, he may be fined. The penalty amount will be 5% of the tax that is not paid on time. A fine will be charged for each month of delay.

Individual entrepreneurs - payers of UTII must submit a declaration in the form approved by order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/353 (clause 2 of the order of the Federal Tax Service of Russia dated December 22, 2020 No. ММВ-7-3/590).

The tax period for UTII is a quarter (Article 346.30 of the Tax Code of the Russian Federation). The declaration must be submitted to the tax authority no later than the 20th day of the month following the previous quarter (clause 3 of Article 346.32 of the Tax Code of the Russian Federation).

If an entrepreneur is late in filing a declaration, he may be fined. The penalty amount will be 5% of the tax that is not paid on time. A fine will be charged for each month of delay, regardless of whether it is full or not. The fine should be no more than 30% of the amount of tax not paid on time, but not less than 1000 rubles (Article 119 of the Tax Code of the Russian Federation).

In addition, the entrepreneur can be held administratively liable - issued a warning or imposed a fine of 300 to 500 rubles (Article 15.5, Part 3 of Article 23.1 of the Code of Administrative Offenses of the Russian Federation).

The entrepreneur must transfer the amount of tax indicated in the declaration to the budget no later than the 25th day of the first month following the expired quarter (clause 1 of Article 346.32 of the Tax Code of the Russian Federation). If an entrepreneur is late with payment, he will be charged a penalty. The amount of the penalty will be calculated as follows:

Penalties for late payment of tax = Amount of tax not paid to the budget x Number of days of delay (calendar) x 1/300 of the current refinancing rate

In addition to penalties, tax authorities can fine the entrepreneur. The fine will be 20% of the amount of unpaid tax (Article 122 of the Tax Code of the Russian Federation). The legality of the fine will have to be challenged in court. According to the judges, only those entrepreneurs who made a mistake with tax calculation can be fined (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 05/08/2007 No. 15162/06).

3 months free use all the features of Kontur.Externa

Example 1. Calculation of the statute of limitations

Let's look at a specific example.

The taxpayer did not pay UTII for the 1st quarter of 2021, that is, until April 25, 2021. In this case, the formation of the reporting period of limitation begins from 07/01/2021. During the period from 04/26/2021 to 07/01/2021, the tax office may hold the payer of an individual entrepreneur or legal entity liable for non-payment.

A bad debt to the budget is an amount that can be recognized by a court or for which the statute of limitations has passed.

Letter of the Ministry of Finance of Russia dated November 15, 2010 No. 03-02-08/80

Is there a fine for late submission of UTII?

Submitting a UTII declaration: it is important to submit it on time

The unified tax on imputed income (hereinafter referred to as UTII) is a type of tax that is paid for certain types of business without fixing profits, based on indirect indicators.

The taxation system, based on UTII and representing a special tax regime, is regulated by Ch. 26.3 of the Tax Code of the Russian Federation (Part 2). Information about the prospects for the existence of UTII can be found in our article Will UTII be abolished and when? Read about the calculation of periods for UTII in the material Which period for UTII is considered reporting or tax?

According to paragraph 3 of Art. 346.32 of the Tax Code of the Russian Federation, UTII declarations are submitted to the tax authorities no later than the 20th day of the month following the tax period, which, according to Art. 346.30 of the Tax Code of the Russian Federation is 1 quarter. The declaration is submitted in accordance with the order of the Federal Tax Service of the Russian Federation “On approval of the tax return form for UTII” dated 07/04/2014 No. ММВ-7-3/ Features of submitting a declaration when deregistering a taxpayer are enshrined in the letter of the Federal Tax Service of the Russian Federation “On reflecting UTII accruals” dated 20.03. 2020 No. GD-4-3/

For officials, a fine for failure to submit UTII on time is levied under Art. 15.5 of the Code of the Russian Federation on Administrative Offenses and amounts to 300–500 rubles. Alternatively, a warning is provided.

To find out whether you need to submit a zero UTII declaration, read our article Zero UTII declaration - the need to submit.

Delay in filing a declaration and liability for late submission of a declaration: judicial practice

A fine for UTII in case of delay in filing a declaration is imposed, in addition to officials, on the organization itself in accordance with clause 1 of Art. 119 of the Tax Code of the Russian Federation. In accordance with this norm, the penalty for late submission of the UTII declaration is 5% of the amount of tax not paid on time based on the declaration, but not less than 1,000 rubles. and no more than 30% of this amount.

In addition to the fine for late submission of the UTII declaration in accordance with clause 3 of Art. 76 of the Tax Code of the Russian Federation, a decision may also be made to suspend transactions on accounts.

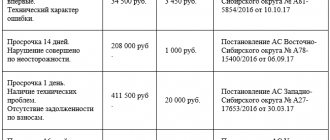

Failure to pay a fine for failing to submit a UTII return on time may become the basis for the tax office to file an administrative claim in court. If the fine does not exceed 20,000 rubles, then the case is considered through summary proceedings (appeal ruling of the Sverdlovsk Regional Court dated July 27, 2016 in case No. 33a-12279/2016).

A difficult financial situation and long-term treatment (if the declarant is an individual entrepreneur) may be grounds for reducing the amount of the fine collected (Resolution of the AS DO of June 28, 2016 No. F03-2698/2016 in case No. A24-3217/2020).

When bringing officials to justice, the period for bringing them to justice is 1 year from the date of the violation. Termination of proceedings based on general terms (3 months for a decision made by a judge, and 2 months in relation to decisions made by other persons) is the basis for canceling the decision to terminate proceedings (resolution of the Khabarovsk Regional Court dated 02.06.2016 No. 4A-357/2016) .

So, the fine for late submission of the UTII declaration is established both for the organization (under Article 119 of the Tax Code of the Russian Federation) and for the officials responsible for filing the declaration (under Article 15.5 of the Code of Administrative Offenses of the Russian Federation). In addition to a fine, a decision may be made against the organization to suspend account transactions. A decision may be made against an official to issue a warning instead of a fine. Also, the difficult financial situation of the complainant may be grounds for reducing the amount of the fine collected.

Important features of declaration

If a single tax payer has ceased his activities, but has not been deregistered, he is not exempt from filing a declaration. For individual entrepreneurs and organizations on UTII registered as special regime taxpayers, it is not permitted to:

- failure to submit a quarterly declaration form to the fiscal authority;

- submitting a document with zero indicators.

An entrepreneur or organization is considered deregistered only after submitting the appropriate application:

- for individual entrepreneurs – UTII form-4;

- for organizations - UTII form-3.

If the company ceased operations in the middle of the tax period, then the tax is calculated taking into account the basic profitability for the full month.

An important feature is that the imputed tax is calculated taking into account possible income from a certain type of activity. Actual income does not play any role, even if the company operates at a loss. Taxpayers are required to pay a fixed amount of UTII and report this to the tax authorities.

Will there be a fine for failure to submit a UTII return on time?

a fine for failure to submit a UTII declaration on time in 2020. How much it is and what other measures can be taken in relation to a negligent UTII payer, read in this material.

What does tax legislation provide for failure to file a return?

The sanctions that the tax office may apply if it does not receive the required report on time are prescribed in Art. 119 of the Tax Code of the Russian Federation. The exact amount of the fine that will be established depends not only on the submission of the declaration (calculation), but also on the actual payment of the amount of tax due under this declaration to the budget:

- 5% of the amount of unpaid tax for each month of delay (full or incomplete). This means that even if there is a delay of several days, there is already one incomplete month.

In addition, penalties will be charged for the tax underpaid to the budget in its own way, according to Art. 75 of the Tax Code of the Russian Federation, regardless of whether any other sanctions were applied to the taxpayer or not.

What sanctions are imposed for failure to submit a report on time under the Code of Administrative Offenses of the Russian Federation?

Violation of tax laws entails not only tax sanctions, but also administrative liability. In case of failure to submit a tax return, the provisions of Art. 15.5 Code of Administrative Offenses of the Russian Federation.

According to Art. 15.5 of the Code of Administrative Offenses of the Russian Federation, officials (responsible for submitting reports and paying taxes) may be given a warning or imposed a fine, which ranges from 300 to 500 rubles for each violation.

NOTE! According to the Code of Administrative Offenses of the Russian Federation, fines must be paid within 60 days from the date of the decision on the offense. Such fines in case of non-payment may be collected through the courts. If the case is about non-payment of a fine under the Art. 15.5 of the Code of Administrative Offenses of the Russian Federation has reached the court, then by decision of the judge another fine may be collected, 2 times the original amount, but not less than 1000 rubles. The following may also be prescribed:

It should be remembered that in certain cases (resulting in a shortfall in tax receipt by the budget in an amount defined as particularly large), in addition to administrative liability, criminal liability may also be applied.

You can find out in detail what and when criminal liability is imposed on negligent taxpayers in our section.

What additional measures may be applied to those who do not submit UTII reports?

For those who do not submit their UTII reports on time, general additional measures may be applied. Among other things, first of all, you should remember about blocking the bank accounts of an unscrupulous taxpayer.

The ability for tax authorities to block bank accounts is provided for in Art. 76 Tax Code of the Russian Federation. If the submission of the declaration is overdue by more than 10 working days after the filing date established by law, the tax office has the right to send to the banks where the taxpayer is serviced a decision to suspend transactions on his accounts.

Transactions are blocked in the expenditure part (that is, money will be credited to the account, but the taxpayer will not be able to use it). When blocking, the following nuances are taken into account:

- 1 - payments under court decisions in compensation for harm to life and health, as well as payments for alimony obligations;

2 - calculations for severance pay and wages paid according to executive documents;

Secondly, it should be mentioned that in the event of failure to receive a declaration from the taxpayer, the Federal Tax Service may initiate tax calculation using its data. Namely, to conduct a desk audit without a declaration. In this case, activity on UTII is a very suitable case for such a check, since the tax is calculated based on the amounts imputed to the calculation, and not on actual income. That is, a UTII payer who has not provided a calculation will be required to pay to the budget the amount that the tax office itself will calculate. Moreover, if the payer does not submit his version of the calculation in the declaration, the result of the desk audit will become mandatory for him to carry out.

For more information about what a cameral without a declaration is, read: “Art. 88 Tax Code of the Russian Federation (2016): questions and answers.”

Results

For failure to submit any declaration on time, including the UTII declaration, a number of measures are provided for the taxpayer:

Therefore, in order to avoid falling under this set of measures, it is recommended to submit UTII declarations in a timely manner.

Find out more about how to prepare and when to submit a UTII declaration and what the nuances of settlements with the budget may be in this special mode from our section.

Results

For failure to submit any declaration on time, including the UTII declaration, a number of measures are provided for the taxpayer:

- tax sanctions;

- administrative sanctions;

- criminal sanctions in certain cases;

- other enforcement measures, for example, blocking bank accounts or presenting for tax payment based on a desk audit without a declaration.

Therefore, in order to avoid falling under this set of measures, it is recommended to submit UTII declarations in a timely manner.

Find out more about how to prepare and when to submit a UTII declaration and what the nuances of settlements with the budget may be in this special mode from our section.

Sources:

- Tax Code of the Russian Federation

- Code of Administrative Offenses

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Under what KBK is the fine paid for late submission of the UTII declaration?

Alevtina K, good afternoon.

You can always look at KBK here Tools - KBK

The UTII tax penalty is paid at KBK 182 1 0500 110.

quote from the website Modern Entrepreneur Taxes and accounting for small businesses

Transfers of taxes and fines in favor of budgets of different levels are made through payment orders. In field 104 in the payment document it is necessary to indicate the code KBK, by which the treasury classifies the transferred funds. This code helps to quickly identify the purpose of the payment and its recipient, which speeds up the process of processing incoming money.

182 1 1600 140 KBK (transcript 2020): what tax?

You can find out the BCC and its affiliation with a certain type of tax from Order of the Ministry of Finance No. 65n, which was issued on July 1, 2013 (as amended on May 3, 2020). All numbers in the 20-digit code have a precise information message, for example:

- the first three characters in the KBK indicate the authority administering the payment - the combination of numbers “182” refers to the Federal Tax Service; — the following numbers “116” are typical for budget revenues from fines, sanctions and damages.

Call 182 1 1600 140 KBK transcript 2021 - what is the tax? This combination of numbers does not indicate a specific tax, but transfers to pay off fines that were presented to a business entity for violations of tax law. A paid fine may result from the following offences:

— the procedure for registering with the Federal Tax Service was violated (Article 116 of the Tax Code of the Russian Federation); — the tax return is submitted to the regulatory authority in paper form, provided that the company had to submit an electronic version of the document (Article 119.1 of the Tax Code of the Russian Federation); — a gross violation of tax accounting was revealed - lack of primary documentation, accounting and tax registers were not maintained, VAT amounts do not have documentary evidence in the form of invoices, etc. (Article 120 of the Tax Code of the Russian Federation); — tax reporting was not submitted on time (Article 126 of the Tax Code of the Russian Federation); — submission of inaccurate reporting by a tax agent, for example, errors in 2-NDFL certificates or 6-NDFL calculations (Article 126.1 of the Tax Code of the Russian Federation); — the enterprise ignored the tax authorities’ request to provide explanations (Article 129.1 of the Tax Code of the Russian Federation); — a notification was not submitted for controlled transactions (Article 129.4 of the Tax Code of the Russian Federation).

This BCC is also indicated when transferring fines provided for in Articles 119.2, 125, 128, 129, 132, 133, 134, 135, 135.1, 135.2 of the Tax Code of the Russian Federation.

FAQ

Question No. 1. Is it difficult to prove that the delay in payment was “without intent?” Answer: yes. It is quite difficult to prove this option to the tax authorities; it is extremely rare. The only options are to present documents - evidence or the presence of an overpayment of taxes.

Question No. 2. What if the tax office did not count the overpayment for previous periods against upcoming payments, identified a delay, and assessed penalties and fines? In such a situation, you must immediately contact the Federal Tax Service office with a personal visit with evidence of the existence of an overpayment; you will have to write a letter about offsetting the overpayments against upcoming payments. In such a situation, penalties and fines will most likely be removed.

Fine for late submission of UTII declaration

The legal fact that serves as the basis for beginning to monitor compliance with the deadlines for submitting tax calculations and tax returns by taxpayers as provided for in tax legislation is the arrival of the legally established deadline for submitting the relevant reports to the tax authority.

It is worth noting that on the part of the tax authorities, inspectors daily reconcile the list of taxpayers who have not submitted one or another tax reporting with the reporting actually submitted for the day.

A tax return (calculation), as well as documents that, in accordance with tax legislation, must be submitted along with a tax return, can be submitted by taxpayers to the tax authorities:

1). On paper:

-personally or an authorized representative (representative);

-by post, with a mandatory description of the attachment.

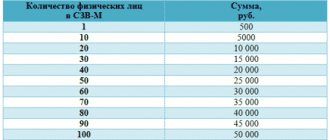

2). If the number of employees is more than 100 people, then taxpayers have an obligation to submit reports to the tax authority via TCS communication channels.

Failure to comply with the procedure for submitting tax reports in electronic form entails a fine (in the amount of 200 rubles) in accordance with Article 119.1 of the Tax Code of the Russian Federation. At the same time, proceedings in the case of tax violation provided for in Article 119.1 of the Tax Code of the Russian Federation are carried out in accordance with Art. 101.4 Tax Code of the Russian Federation.

Is it possible to avoid sanctions?

The question of whether it is possible to avoid punishment in the form of a fine is of interest to absolutely all taxpayers. An expert from the legal aid center answers:

“We all go to the doctor only when the disease has already taken us by surprise, but no one thinks about disease prevention. Very often, the “imputed people” carry out their activities independently, without the involvement of competent personnel responsible for the correct filling out and deadlines for submitting the UTII declaration. This leads to problems with late submission of reporting documentation to the Federal Tax Service. If you have already allowed a similar situation to occur, take care of your business reputation in advance and immediately contact the tax authorities with an appropriate explanation, which should set out the reasons for the current situation. If the Federal Tax Service considers the reasons to be valid, and you have evidence corresponding to this, then penalties can be avoided. However, business should be conducted in such a way that violation of deadlines is excluded from the established tax reporting procedure.”

Svetlana Kotlakova, expert at the center for legal support of entrepreneurs “Business Consult”

In a word, penalties can be avoided if you approach the issue responsibly. The deadline for contacting the tax office with an explanation is 5 days from the date of violation of the deadlines for the UTII declaration.

The procedure for determining the date of submission of tax reports is:

- When sending a tax calculation (declaration) by post, the day of their submission is considered to be the date of dispatch on the post office stamp;

- When transmitting an electronic document (tax return) via communication channels, the date of submission is the date of their sending.

Failure to submit tax reports on time - fines

Failure to comply with deadlines for submitting tax reports to the tax authorities, or failure to submit them at all, is often tolerated by taxpayers. One of the reasons for missing the deadline is a change in the tax reporting template, or a change in the order of its submission.

| Do not forget that if the last day for filing reports falls on a Sunday or a non-working national holiday, then it is shifted to the next working day following this weekend or holiday (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). |

IMPORTANT! In the absence of tax activities that do not involve non-submission of reports in the absence of an object of taxation, a zero tax return must be submitted. Its absence will entail a fine of 1,000 rubles. (letter of the Ministry of Finance dated October 7, 2011 No. 03-02-08/108).

Violation of the deadlines for submitting declarations (calculations) entails the imposition of penalties in the amount of 5% of the unpaid amount of tax subject to payment (additional payment) on the basis of this tax document (declaration), for each full or partial month from the day established for its submission, but no more 30% of the specified amount and not less than 1000 rubles, according to Article 119 of the Tax Code of the Russian Federation.

Violation of the deadline for submitting a UTII declaration

A declaration for the calculation of the single tax on imputed income is submitted to the tax authority at the place of implementation of the type of activity or at the place of registration of a legal entity or individual entrepreneur (for example, for passenger transportation services, cargo transportation, taxi).

| Deadlines for submission: 1st quarter – April 20 2nd quarter -July 20 3rd quarter -October 20 4th quarter – January 20 next year. There cannot be a zero declaration for UTII. Even if the taxpayer temporarily does not conduct business, he must pay tax based on physical indicators (area, number, etc.). |

The deadline for submitting a UTII declaration to the tax authorities is established by law no later than the 20th day of the month following the reporting quarter (clause 3 of Article 346.32 of the Tax Code of the Russian Federation).

| ? Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

The UTII declaration form is filled out

When applying the taxation system, in the form of paying a single tax on imputed income (UTII), income in this case is determined in accordance with Article 346.26 of the Tax Code of the Russian Federation. Declaration form, approved by order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7–3/

In the UTII tax return on line_100 “Tax base” of section 2 “Calculation of the amount of single tax on imputed income for certain types of activities”, this is considered imputed income in accordance with Art. 346.29 Tax Code of the Russian Federation. If the taxpayer uses several types of activities, then a separate sheet of Section 2 is filled out for each type and, accordingly, income is calculated in total and for all 4 quarters of the reporting tax period.

| The tax base for UTII-imputed income is calculated using the following formula: VD = BD X FP amount X K1 X K2, where: VD - imputed income; BD - basic profitability; FP - physical indicator; K1 and K2 are correction factors. |

The amount of single tax is calculated using the following formula:

Single Tax = (N/base * 15% (or a reduced rate according to the regulatory documents of the constituent entity of the Russian Federation) - Insurance premiums.

Violation of the deadlines for submitting a tax return for a single tax entails the imposition of penalties in the amount of 5% of the unpaid amount of tax subject to payment (additional payment) on the basis of this tax document (declaration), for each full or partial month from the day established for its submission, but not more than 30% of the specified amount and not less than 1000 rubles, according to Article 119 of the Tax Code of the Russian Federation.

It is worth noting . that there are no “indulgences” for late submission of reports, i.e. The approach to everyone is the same, to those who were overdue for one day and those who didn’t even think about it, say a month.

For example, if the taxpayer not only delayed the submission of the declaration, but also did not pay the tax, then the amount of penalties will be correspondingly greater.

| Let's look at an example: IP - on UTII. 2021 has ended, the declaration for the 4th quarter was required until January 20, 2021. The declaration is submitted only at the beginning of April - on the 8th. The calculated tax was not paid in full: out of 22 thousand rubles. Only 4 thousand rubles were transferred for payment. Thus, we count the months of delay: the overdue period was 3 full months (from 01/21/18 to 03/20/18) plus one incomplete (from 03/21/18 to 04/08/18). Penalties are calculated for 4 months. The amount of the fine is equal to 5% of the amount of arrears multiplied by the number of months of delay. True, there is an upper limit in the form of 30% of the amount not paid on time. In our example, the tax arrears are 22 – 4 = 18 thousand rubles. The amount of the fine is 18 thousand * 5% * 4 months. = 3.6 thousand rubles. The maximum amount will be 18 thousand * 30% = 5.4 thousand rubles. As a result, the fine to be paid is 3,600 rubles. |

In addition to penalties for violating the deadlines for submission, which are established by the Tax Code, fines are also provided for by the Administrative Code of the Russian Federation, which must be paid by officials responsible for the timely submission of tax reports (declarations) Article 15.5 of the Code of Administrative Offenses of the Russian Federation. Penalties vary from 300 to 500 rubles, or an administrative penalty in the form of a warning may be imposed.

Also, tax authorities can send a notification to the bank about blocking an existing current account for late submission of tax returns (clause 3 of Article 76 of the Tax Code of the Russian Federation). The account is blocked if tax reporting is not submitted within 10 days after the expiration of the deadline for submission. The tax authorities block all accounts opened at the time of the account analysis.

The account is unblocked only after the declaration is submitted. The tax authority sends to the bank a corresponding decision on “resumption” of operations on the account.

See also: Maternity capital. Maternity capital use 2012

Categories Court decisions

Bank account blocking

According to Article 76 of the Tax Code of the Russian Federation, if the “imputed” entrepreneur does not submit a reporting document to the tax office within 10 working days from the date established by law, the Federal Tax Service has the right to contact the bank that services the individual entrepreneur in order to block his bank accounts.

In this case, account blocking only affects expense transactions. Funds may be transferred to the taxpayer’s personal account in the same manner, however, he will not be able to dispose of them. The following points are also taken into account:

- Blocking of a bank account occurs without prior warning to the entrepreneur in accordance with Letter of the Federal Tax Service of Russia dated July 28, 2016 N AS-3-15/

- The blocking applies not only to the amount of funds in a bank account, but also to all forms of deposits, regardless of the amount of the taxpayer’s debt (letter of the Ministry of Finance dated April 15, 2010 No. 03-02-07/1-167)

The Ministry of Finance also defines a number of cash write-offs excluded from the overall picture:

- alimony, compensation and other forms of obligations assigned in court;

- remuneration of hired personnel and calculated insurance premiums;

- payments under other executive documents.

Other payments, including taxes, cannot be made from a blocked bank account.