Four types of operations

IMPORTANT! Information on changes in balance currency balances from ConsultantPlus is available at the link

In the process of activity of a legal entity, there is a permanent change in the structure and volume of property/sources of its appearance. These changes are carried out under the influence of various chemical agents.

The latter lead to balance adjustments.

There are four types of business transactions. Chemical agents are divided into types depending on their impact on the balance. Any type of transaction affects both an asset and a liability. HOs change the structure of the balance sheet, but they may not affect the values within the accounting framework. The balance sheet often remains unchanged. That is, the principle of equality is not violated.

Typical balance changes directly depend on what type of transaction is performed. Let's take a closer look at all 4 types.

First type

Schematically, the change can be expressed as follows: A+ A-. That is, one asset is multiplied, the other is reduced. Decrease/increase is performed by the same amount. The changes apply exclusively to assets. The operation in this case will apply only to objects that are on the farm.

Examples of type 1 chemical weapons:

- Exploitation of valuables.

- Manufacturing process.

- Release of finished goods.

- Shipment of goods.

- Covering accounts receivable.

The first type displays adjustments to asset items.

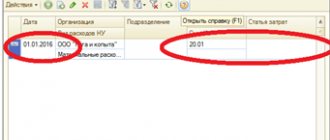

Example No. 1. Let's look at the postings used in type 1 operations:

- DT50 KT51. Transfer of money from the account to the cash desk.

- DT20 KT10. Direction of materials for production needs.

- DT43 KT20. Release of goods into production.

- DT94 KT10. Recording shortages of materials based on inventory results.

- DT58 KT51. Providing a loan that involves accrual of interest.

- DT01 KT10. Release of materials into production.

Example No. 2. The release of materials into production has been completed. They will be used to organize the stage. Materials were supplied in the amount of 20,000 rubles. In this case, the asset “Spending in unfinished production” will be increased by 20,000 rubles.

At the same time, the asset “Raw materials and materials” decreases in the amount of 20,000 rubles. The balance sheet remains the same.

Second type

Schematically, the change can be expressed as P+ P-. One direction of the liability increases, the other decreases. The decrease/increase occurs by the same amount. Adjustments affect only the liability. That is, only the sources of funds change. As a result of operations, the movement of financial sources begins. The second type includes these chemical weapons:

- Transfer of premiums from the consumption fund.

- Deductions from salary.

- Increase in reserve fund.

Example No. 1. At the meeting of the founders, it was decided to direct the profit in the amount of 50,000 rubles. to increase the reserve fund. The basis of the operation is the minutes of the meeting. In this case, the “Reserve Fund” liability will be replenished by 50,000 rubles. The liability “Unused profit” is reduced by the same amount.

Let's look at the postings used in operations of the second type:

- DT84 KT82. Reserve capital increases due to retained earnings.

- DT70 KT68. Tax on personal income.

- DT80 KT84. The authorized capital was reduced to the amount of net assets.

- DT96 KT70. Accrual of vacation pay from the reserve.

- DT91 KT66. Receiving interest on a short-term loan.

The basis for the postings is the minutes of the meeting at which a decision was made to replenish the fund.

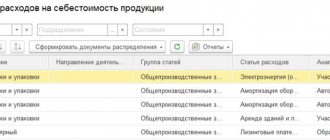

Third type

Schematically, the change can be expressed as follows: A+ P+. Both assets and liabilities are multiplied. The balance currency and its total are also multiplied. Examples of third type operations:

- An increase in the volume of founding contributions made through the accrual of money.

- Depreciation on, intangible assets.

- Payroll accrual.

- Social security payments.

- Lending.

- Advances from customers.

The 3rd type of financial assets involves multiplying assets/liabilities while maintaining the same indicators. The balance currency will be increased.

Example. Raw materials worth RUB 200,000 arrived from the supplier. It was entered into the warehouse. In this case, both the asset “Raw Materials” and the liability “Accounts Payable to Suppliers” increase by a similar amount. The total in both directions (asset/liability) increases by 100,000 rubles.

Example of entries for type 3 transactions:

- DT20 KT70. Calculation of salaries for employees employed in the main production.

- DT51 KT66. Obtaining a short-term loan (money issued by the bank).

- DT76 KT91. Accrual of a fine for violation of the terms of the contract.

- DT08 KT70. Calculation of salaries for employees who are involved in the installation of OS objects.

- DT41 KT60. Shopping.

- DT51 KT67. Obtaining long-term loans.

Primary documents: agreements with banks, counterparties.

ACCOUNTS AND DOUBLE ENTRY

The concept of accounting accounts, their meaning. Construction of accounts. Debit and credit of accounts. Accounts are active and passive. Active-passive accounts. The relationship between accounts and balance. Double entry of transactions on accounts, its essence and control value. Correspondence of accounts as a form of interconnection of accounts when reflecting business transactions on them. Accounting records (postings): simple and complex. Turnovers and account balances. Synthetic and analytical accounting accounts, their meaning and features. The relationship between synthetic and analytical accounts. Chart of accounts, its purpose and principle of construction. Encryption of accounts and its purpose. Generalization and methods of checking current accounting data Chronological and systematic recording of business transactions. Turnover statements for synthetic and analytical accounts.

Control questions:

1. What is meant by an accounting account?

2. Indicate the meaning of such parts of the account as balance and turnover?

3. Why are debits and credits allocated in the account?

4. What accounts are called active?

5. In what part of the active account is the opening balance reflected?

6. In what part of the active account is the increase in the value of property reflected?

7. In what part of the active account is the closing balance reflected?

8. How to calculate the ending balance in an active account?

9. In what part of the active account is the decrease in the value of property reflected?

10. What accounts are called passive?

11. In what part of the liability account is the opening balance reflected?

12. Which part of the passive account reflects the increase in the value of sources of property?

13. In what part of the liability account is the ending balance reflected?

14. How to calculate the ending balance in a liability account?

15. In what part of the liability account is the decrease in the value of property reflected?

16. What is meant by double entry?

17. What is the significance of double entry in accounting?

18. What is meant by accounting entry?

19. What is meant by correspondence of accounts?

20. What are the types of accounting entries?

21. Reveal the essence of synthetic accounts?

22. Reveal the essence of analytical accounts?

23. Reveal the essence of subaccounts?

24. What is the relationship between synthetic and analytical accounts, between active and passive accounts?

25. What is meant by chronological and systematic recording?

26. What stages of processing accounting documents do you know?

27. What principles of placing accounts in the Chart of Accounts do you know?

28. What sections in the Chart of Accounts do you know?

29. What is recorded in off-balance sheet accounts?

30. What types of turnover sheets do you know? What equalities must be observed in them?

ACCOUNTING ACCOUNTS

Accounting objects must be grouped according to homogeneous economic characteristics. Each economically homogeneous group (ie account) is assigned a constant code. For example, materials are assigned code 10, fixed assets 01, etc. The list of codes is given in the Chart of Accounts, explanations of which objects are accounted for in each account, as well as the rules for using accounts are given in the instructions for using the chart of accounts.

All changes that occur with accounting objects represent either their increase or their decrease. In order to separately account for the increase and decrease of accounting objects, the accounting accounts are divided into two parts - debit and credit. The structure of any account is the same - it is a two-sided table. The left side of which is called debit, and the right side is called credit.

Schematically it is depicted like this:

Table 4

| No. ___"Name" | |

| DEBIT | CREDIT |

Most accounts are characterized by the presence of a balance at the beginning and end of the month and debit and credit turnover. Balance - the balance of an account in a monetary measure. Turnover is the amount of increase or decrease in an account in a monetary measure. During the month, amounts for business transactions are recorded on the account, at the end of the month the debit and credit turnovers are calculated and a new balance is displayed.

Classification of accounting accounts in relation to the balance sheet.

In relation to the balance sheet, the accounts are divided into:

1. Balance sheet:

A. active;

b.passive;

c. active-passive.

2. Off-balance sheet

Balance sheet accounts get their name from the names of the sides of the balance sheet and reflect their contents. Thus, active accounts are intended to account for economic assets by composition and location, and passive accounts are intended to account for the sources of economic assets and their intended purpose. It must be remembered that with the same structure of accounts, the purpose of debit and credit in active and passive accounts is different.

1. ACTIVE ACCOUNTS

Table 5

| DEBIT | CREDIT |

| Initial balance (Сн) - availability of property at the beginning of the reporting period | No |

| Turnover by debit (Od) - receipt of property for the reporting period | Loan turnover (Ok) - disposal of property for the reporting period |

| Final balance (Sk) - availability of property at the end of the reporting period Sk = Sn+Od-Ok |

The balance in an active account is always debit. Turnover is recorded as a debit when funds become the property of the enterprise or when the debt of other organizations to the enterprise increases. Loan turnover is recorded on the loan when funds are withdrawn or the debt of other organizations to the enterprise is repaid. The final balance is calculated as the sum of the opening balance and debit turnover minus credit turnover.

2. PASSIVE ACCOUNTS

Table 6

| DEBIT | CREDIT |

| No | Initial balance (Сн) - availability of sources of property at the beginning of the reporting period |

| Turnover by debit (OD) disposal of sources of property for the reporting period | Loan turnover (Ok) - receipt of sources of property for the reporting period |

| Final balance (Sk) - availability of sources of property at the end of the reporting period Sk= Sn+Ok-Od |

The balance in liability accounts must be in credit. Credit turnover shows an increase in the sources of economic funds for the month (including accounts payable), debit turnover shows their decrease. The final balance is calculated as the sum of the opening balance and credit turnover excluding debit turnover.

The impact of account changes on the balance sheet total

Table 7

3. ACTIVE-PASSIVE ACCOUNTS

Designed for accounts that may have both a debit and a credit balance. These accounts include:

Settlement accounts

Matching accounts

Financial performance accounts.

Settlement accounts are designed to record settlements with organizations that act either as debtors or creditors in relation to the enterprise, therefore, at the beginning and end of the period they can have both receivables and payables.

Scheme of entries on active-passive accounts

Table 8

| DEBIT | CREDIT |

| Initial balance (Сн) - the presence of debtors' debt to the enterprise at the beginning of the reporting period | Initial balance (Сн) the presence of the enterprise’s debt to creditors at the beginning of the reporting period |

| Debit turnover (OD) - an increase in accounts receivable or a decrease in accounts payable | Loan turnover (Ok) - increase in accounts payable or decrease in accounts receivable |

| Final balance (Sk d) - the presence of debt at the end of the reporting period | Final balance (Sk k) - availability of sources of property at the end of the reporting period |

To correctly calculate the final balances on settlement accounts, it is necessary to organize additional accounting for each debtor and creditor, using the active accounts formula for calculations for accounts receivable, and the passive accounts formula for accounts payable. In other words, the active-passive account includes two accounts: active and passive. Therefore, in order to calculate the final balances of debit and credit, you need to divide the account into active and passive, and then calculate the final balance using the appropriate formula.

Comparing accounts are designed to reveal financial results (profits and losses). They compare income and expenses from business activities; in particular from the sale of products, goods and other property. These accounts do not have a balance at the reporting date.

Matching account scheme

Table 9

| DEBIT | CREDIT |

| Initial balance (Сн) = 0 | Initial balance (Сн) =0 |

| Expenses: — Cost — VAT — Excise taxes — Export duties | Income: — Revenue |

| Regulating amount: profit (if income is greater than expenses) | Regulating amount: loss (if income is less than expenses) |

| Final balance (Sk) = 0 | Final balance (Sk) = 0 |

By comparing debit and credit turnovers, matching accounts, i.e. expenses and income, you can determine the financial result obtained from the operation: profit or loss. If revenues exceed expenses, then the company makes a profit. Profit is equal to the difference between income and expenses and is recorded in the debit of the matching account as a regulatory amount. If income is less than expenses, then the company receives a loss. The loss is equal to the difference between expenses and income and is credited to the matching account as a control amount.

Financial performance accounts are used to form the final financial result of the organization’s activities in the reporting year. The final financial result is compiled by summing up profits and losses from all business transactions for the reporting year. They have either a debit balance - a loss at the beginning or end of the year, or a credit balance - profit at the beginning or end of the year. Losses, losses, and expenses of the reporting year are recorded in the debit turnover of these accounts. Credit turnover includes profits and income of the reporting year. Comparison of the debit and credit parts of the account allows you to determine the final financial result at the end of the year.

Scheme of financial-revultative account

Table 10

| DEBIT | CREDIT | |

| Opening balance (Сн) = loss at the beginning of the year | or | Initial balance (Сн) = profit at the end of the year |

| Debit turnover: Losses and losses for the year | Loan turnover: Profits and income for the year | |

| Final balance (Sk) = loss at the end of the year | or | Final balance (Sk) = profit at the end of the year |

For active-passive accounts, the rule applies: if the calculations result in a negative balance, then it is transferred to another part with the opposite sign. So, if a profit is made in credit with a “-” sign, therefore, this is the same as a loss in debit with a plus sign. And if receivables with a “-” sign are received, then they are accounts payable.

DOUBLE ENTRY

The movement of property at enterprises is presented in the form of business transactions. Business transactions are reflected in accounting accounts using the double entry method. In the double entry system, any fact of economic activity (business transaction) must be recorded at least twice: as a debit for one and as a credit for the other, so that the debit amount balances the total credit amount.

Let's look at examples of how transactions are reflected in accounting accounts using the double entry method.

Example 1. The cash desk of the enterprise received funds from the current account in the amount of 1000 rubles

During the operation, two accounting objects were affected:

- cash in the cash register - they are assets and have increased by 1000 rubles, the “Cashier” account is set to debit, because an increase in active accounts is recorded in turnover as a debit;

- cash in the current account - they are assets and have decreased by 1000 rubles, the “Current Account” account is recorded as a credit, since in active accounts the decrease is reflected as loan turnover. As a result, the total amount of the company's assets did not change. This is the first type of business transactions for balance sheet changes (A+A -). The following accounting entry can be made for this business transaction:

Debit “Cashier” 1000 rubles,

Credit "Current account" 1000 rubles.

In practice, accounting entries are made using account numbers, whereby the ledger is recorded once, but applies to both the debit and credit of the account.

The previous accounting entry will look like this: Dt 50 Kt 51-1000 rub.

Example 2. Personal income tax in the amount of 30 rubles is withheld from the employee’s salary.

The following accounts were affected during the operation:

· No. 70 “Settlements with personnel for wages” - is passive and reflects the debt to employees for wages.

· No. 68 “Calculations for taxes” - is passive and reflects the debt to the budget for taxes, including personal income tax.

The employee’s salary after tax withholding decreased by 30 rubles, so the liability in the form of the enterprise’s debt to the employee for wages also decreased by 30 rubles. Therefore, account 70 is recorded as a debit, because in passive accounts, the decrease occurs by debit.

Another passive account No. 68, showing the enterprise's tax debt to the budget, increased by 30 rubles, so it is recorded as a loan.

As a result, the accounting entry will take the form: Dt 70 Kt68 - 30 rubles.

This is the second type of business transaction that causes changes in the balance sheet (P-P+).

Example 3. An enterprise received materials worth 1,200 rubles from suppliers. The cost of materials has not yet been paid to suppliers.

As a result of the operation, on one side of the balance sheet, the enterprise’s asset in the form of materials increases in the amount of 1,200 rubles, on the other hand, the liability in the form of debt to suppliers increases by the same amount. This is the third type of change in balance (A+P+).

— active account No. 10 “Materials” is increased and debited;

— passive account No. 60 “Settlements with suppliers and contractors” also increases and

put on credit.

As a result, an entry is made: Dt 10 Kt 60 - 1200 rubles.

Table 7.

Example 4. Debts to suppliers for materials were repaid by transferring funds in the amount of 1,200 rubles from a current account. The operation affects:

- active account 51 “Current account”, which is reduced by 1200 rubles on the loan;

— passive account 60 “Settlements with suppliers and contractors”, which is also reduced by 1,200 rubles due to a decrease in debt and is placed in the debit of the account.

As a result, an accounting entry is made: Dt 60 Kt 51 - 1200 rubles.

Double entry has a great control value, because the total of all debit turnovers for the reporting period is equal to the total of all credit turnovers. Violation of equality indicates non-compliance with the double entry method or a careless error by the accountant when summarizing information.

At the same time, double entry has an important cognitive value, since for each entry it is possible to establish the economic meaning and content of the operation.

The recording of a business transaction in the accounting accounts is called an accounting entry (record). To facilitate recording, each account is assigned a number (cipher, code), i.e. digital designation, therefore, when making transactions, they often use not the name of the account, but its number.

The relationship of accounts in meaning in the process of double entry is called correspondence of accounts; and the accounts themselves are called corresponding accounts.

If the accounts cannot be related to each other in an economic sense, then they are considered non-corresponding.

Wiring can be simple or complex.

Simple entries contain two accounts: one for debit, the other for credit.

For example, wiring Dt 10 Kt 60 - 1000 rub. - it's simple wiring.

Complex transactions contain three or more accounts, where either one account corresponds to several credit accounts, or several debit accounts correspond to one credit account.

For example, complex wiring

Dt 10 - 1000 rub.

Dt 08 — 2000 rub.

Kt 60 - 3000 rub.

means that materials worth 1,000 rubles and non-current assets worth 2,000 rubles were received from the supplier. The total debt of the enterprise to the supplier is 3,000 rubles.

If the accountant incorrectly indicated the amount in the accounting entry, he can make a corrective entry.

Corrective postings are of two types:

- complementary;

- reversing (reducing).

Additional entries are made if the amount initially indicated was less than necessary. In this case, an additional entry is made for the missing amount.

Reversing entries are made if the amount initially specified was larger than necessary. In this case, the posting is made for the excess amount in red. This correction method is called “red reversal”.

Balance currency in asset

It is customary to include all components of the balance sheet in the assets section of the balance sheet currency section, indicating their value at the time of drawing up such a balance sheet. This may include tangible assets (enterprise property), fixed assets and inventories, organization accounts, finished goods and work in progress. Also taken into account are cash and monetary securities that currently belong to the organization and have some value. This also includes receivables to the organization from other organizations. The asset summarizes the so-called “fair” value of the farm.

Foreign currency balance

A legal entity may have financial reserves in the currencies of other countries on its own balance sheet. In particular, these include:

- cash in the form of currency at the cash desk ("Cashier" account, sub-account),

- money placed in foreign currency accounts with authorized credit institutions (account “Currency accounts”),

- foreign currency funds placed on deposit accounts, letters of credit and other financial instruments (account “Special accounts in banks”, sub-account).

In addition, the balance sheet of the enterprise takes into account such foreign currency finances that were collected or deposited into bank accounts for settlements with creditors, but were not posted at the time of the accounting date (the “Transfers in transit” account, sub-account).

Does the balance sheet currency depend on the type of activity of the enterprise?

To understand whether the balance sheet currency depends on the type of activity of the enterprise, and how much it depends, you should look at today's enterprises and compare different areas. For example, the difference is clearly visible between the manufacturing sector and the service sector. In the first case, a large number of non-current assets - real estate, transport, machinery and raw materials - creates a higher balance sheet currency, while in the service sector there are practically no non-current assets. No need to maintain a fleet of machines or purchase large quantities of industrial raw materials significantly reduces the average balance sheet currency.

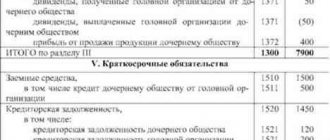

Balance sheet currency in liabilities

The list of positions by balance sheet currency in liabilities includes various sources of income that currently affect the final profit of the farm or enterprise. Typically this includes accounts payable (to partners, customers, suppliers), profits received in the past, authorized capital and borrowed funds. Accounts payable, among other things, include debt to the state in the form of unpaid taxes. In fact, in the list of balance sheet currency in liabilities, the total cost of items is equal to the balance sheet currency in assets; only the method of calculating the total cost of the economy changes.

Impact of business transactions on the balance sheet

The balance sheet is the main form of accounting reporting, which characterizes the financial position of the organization as of the reporting date (clause 18 of PBU 4/99). And different types of business transactions can have different effects on the balance sheet indicators, its structure or balance sheet currency. Moreover, since the balance sheet consists of two sections, assets (A) and liabilities (P), from the point of view of the impact on the balance sheet, business transactions are of 4 types:

- I - A+A-;

- II - P+P-;

- III - A+P+;

- IV - A-P-.

Results

The balance sheet currency is understood as the total total of the assets section and the total total of the liabilities section. The indicator is quite widely used in financial analysis. In addition, the size of the balance sheet currency is one of the criteria that determines whether an enterprise must conduct an audit.

Sources:

- Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n

- Federal Law of December 30, 2008 No. 307-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Own capital: balance sheet currency

In addition, accounting uses the concept of equity. It refers to the section of the enterprise’s balance sheet, which represents the sum of the authorized, reserve, and additional capital. In addition, the legal entity’s equity includes targeted financing and retained earnings.

Changes in equity capital (regardless of whether it is an increase or decrease) in most cases lead to an automatic change in the balance sheet currency of the enterprise.

Changing the balance currency

Any change in the balance sheet currency, whether negative or positive, is always the result of the enterprise’s activities. In case of a positive change, we can talk about expanding the enterprise, obtaining new assets, and revaluing fixed assets. Other reasons include an increase in the period for payment or repayment of debts, inflation. That is, everything that concerns the increase in total assets in the farm is recorded here. The change can also be negative, and then we can talk about a reduction in demand or opportunities for purchasing raw materials. The decrease is often associated with the inclusion of new subsidiaries into the general economy.

Increasing balance currency

It happens that the balance sheet currency may change positively (increase) or negatively (decrease). There are several reasons that cause an increase in the balance sheet currency. In particular, these may be:

- increase in overall production volumes at the enterprise,

- increase in terms of settlements with debtors,

- obtaining a loan from a bank,

- revaluation of fixed assets of the enterprise, etc.

In some cases, an increase in the currency (figure) balance can provoke inflationary mechanisms.

“In addition, the opposite process is possible - a decrease in the balance sheet currency, usually caused by a decrease in business activity and, in fact, being a decrease in the solvency of the company.”

Fixed assets

As a result, under the influence of business transactions of the first type, the total values of the balance sheet asset remain unchanged, since changes concern only the indicators of the lines within the asset;

The second category is characterized by changes within the liabilities side of the balance sheet, when it is not the funds in but their sources that are subject to variations. For example, acting as a tax agent, an enterprise withholds personal income tax from employee earnings of 30 thousand rubles, thereby transforming the values in the amounts of accrued wages (reducing it by the amount of personal income tax) and settlements with the budget (increasing the amount to be transferred to the budget), without touching the final liability results - D/t 70 K/t 68. Changes in liability items affected one line - 1520.

Example

Changes in the balance sheet caused by business transactions classified as the fourth type result in a decrease in both parts of the balance sheet. As a rule, they are caused by operations that remove funds from the company’s turnover. For example, by writing off bad receivables in the amount of 20 thousand rubles, the company reduces the free balance of profit (line 1370 of liabilities) - D/t 91 K/t 62, i.e. the asset decreases by the amount of receivables (line 1230 of the asset) and at the same time the profit of the enterprise decreases by the same amount, i.e. liability.