Any enterprise faces accounts payable or receivable. In the first case, we are talking about the enterprise’s debt to various companies, in the second case, some organizations are financially obligated towards it.

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call.

It's fast and free! Debt may arise if payment deadlines are not met after receipt of the product. The debt is immediately taken into account in settlements between the two companies. The debt must be recorded, this is explained by the need to maintain the order of mutual settlements.

Maintaining tax accounting for accounts receivable

The company's accounts receivable are reflected in the balance sheet as part of current assets. Its total indicators indicate the presence of debts of internal and external counterparties. According to the law, such debt is subject to mandatory reflection in tax accounting. In other words, to group balance sheet items, all debts must be confirmed by primary documents and reflected in analytical accounting by counterparties and types of debt.

Depending on the source of origin, accounts receivable may have different taxation:

- The debt of buyers and customers, in fact, is unpaid sales, therefore such amounts are not included in the tax base. If, according to the agreement with the counterparty, the payment deadline has passed, then such amounts of debt are written off as other expenses. Simultaneously with the debt, VAT is reversed in tax accounting. If we consider this situation from the debtor’s side, then in his accounting such written-off debt will be considered income, which is subject to income tax on a general basis.

- Debt formed from advances issued to suppliers has a statute of limitations of three years. If during this period the supplier has not fulfilled its obligation to supply goods or provide services, then the debt is written off to the non-operating expenses section. The debtor company, in turn, classifies these amounts as non-operating income and subjects them to income tax.

- Amounts received by employees of an enterprise against an advance report, without timely documentary confirmation, also form accounts receivable. Until the reporting person accounts for the money received, such amounts may be identified by tax authorities as income of an individual, which is subject to income tax.

- Loans issued to employees of an enterprise that are not repaid on time also fall under the definition of receivables. In this case, documentary evidence for the tax authorities is a loan agreement, as well as a cash receipt order or an extract from a current account. For an individual, a loan becomes income on which personal income tax must be paid.

For timely and correct tax accounting, accounts receivable must be constantly analyzed, otherwise the company may be subject to penalties for late payment of budget payments.

Legal regulation of accounting for settlements with debtors and creditors

The legal basis for regulating the accounting of settlements with debtors and creditors, in addition to the Civil Code of the Russian Federation, consists of other legislative acts and Regulations.

So, according to Art. 7, clause 1 of the Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ “accounting and storage of accounting documents are organized by the head of an economic entity,” and the organization of accounting primarily involves the construction of an accounting policy that represents is a set of ways for an economic entity to maintain accounting records.” According to Art. 8 Federal Law “On Accounting” dated December 6, 2011 No. 402-FZ and PBU 1/2008 “Accounting Policy of an Organization”, approved by Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n, “an economic entity independently forms its accounting policy, guided by the legislation of the Russian Federation on accounting, federal and industry standards.”

At the enterprise, the reliable and timely reflection of receivables and payables is considered to be the main mechanism for ensuring control over the accounting of mutual settlements with suppliers and contractors. As a rule, to simplify the formation of the necessary information, disclosure of financial statements, and management of assets and liabilities, an enterprise creates appropriate synthetic and analytical accounting of receivables and payables.

The use of analytical accounting at an enterprise allows you to analyze the turnover of accounts receivable and the repayment of accounts payable in the context of each counterparty and homogeneous business transactions.

According to the Chart of Accounts, “to summarize information on all types of settlements of an organization with various legal entities and individuals, as well as intra-business settlements, the accounts of section. VI Calculations".

Section VI “Calculations” includes “the following accounts:

In what cases can you write off accounts receivable?

To ensure that accounts receivable does not distort accounting data, it must be written off periodically, since overdue bad debts do not bring any profit to the enterprise.

Only overdue and bad debts can be written off from the balance sheet, however, for the debt to be recognized as such, the limitation period must pass, which is three years. During this time, the company must take measures to collect debt from the counterparty.

When writing off a debt, it is very important to correctly establish the beginning of the calculation of the statute of limitations. If it is impossible to establish a date, then the calculation of the three-year period will begin from the moment a documentary demand is presented to the debtor.

It should be noted that the statute of limitations can be interrupted for various reasons, for example, the debtor pays off part of the debt or signs a reconciliation act. In this case, the calculation of the new statute of limitations will begin the day after the event occurred. As a result, the deadline may be interrupted more than once, but the law sets a limitation period of 10 years. After this period, receivables are written off in any case.

The write-off of receivables must occur in the reporting period when the statute of limitations expired. In order to determine which debt is subject to removal, it is necessary to conduct an inventory of debts, as a result of which a reconciliation will be carried out with all debtors. If doubtful debt is identified at this stage, a decision is made to create a reserve to cover such debt.

The inventory of receivables is documented in an act. This document can be standard or free-form, but the form must contain all the required details. In the inventory act, the accountant must reflect all debts, including overdue ones.

The need to analyze remote data

Currently, accounts receivable are monetary settlements between firms, or a firm and a supplier, in which there is a period of time between payment and receipt of all ownership rights to a product or service. Under such conditions, money is withdrawn from the company’s turnover and used by another company. This significantly undermines the company's ability to pay, as its financial resources are reduced.

The company needs to clearly understand the dynamics of accounts receivable, its increase or decrease, and under what conditions this occurs. All this is carried out in order to understand the turnover of the company’s capital, in order to make its financial condition stable.

The need to analyze remote control is to control the economical expenditure of money, its rational and profitable investment. All this can significantly improve the solvency of the company and increase its capital.

Under what circumstances does a debt become bad?

Bad debts deserve special attention for several reasons:

- Debt that cannot be repaid overstates the balance sheet currency indicators, and therefore makes the reporting irrelevant, which is contrary to the accounting regulations.

- Bad debts serve as a reason for creating a reserve fund, which is formed through deductions from profits. In accounting, such an obligation is prescribed in the accounting policy. The reserve fund is designed to cover possible losses of the company, therefore, if bad debt is not written off in a timely manner, excess funds may be attracted to the fund.

There can be many reasons why a debt may be considered bad:

- expired statute of limitations

- liquidation or bankruptcy of a counterparty

- impossibility of debt collection due to the unknown location of the debtor

- recognition of debt as bad through court

- seizure of counterparty bank accounts

- insufficient assets of the debtor to collect the debt

- force majeure and force majeure events

- incapacity or death of the debtor

Confirmation of any event must be documentary. Only in this case can the accountant recognize the debt as bad and write it off the balance sheet.

How to improve quality and liquidity

In general, accounts receivable management should lead to achieving its optimal size and optimal liquidity, but a situation usually occurs when they strive to increase liquidity while maintaining volume.

You can act on several fronts:

- Prevent risks (detailed elaboration of contracts, terms of cooperation).

- Monitor mutual settlements, payments, and enforce late payments.

- Analyze the results.

- Adjust credit policy.

Signs of overdue receivables

Overdue receivables may include various types of property rights. Typically, the period within which the debt must be repaid is specified in a written agreement. By mutual agreement, if the relationship between the parties is mutually beneficial, the creditor may agree to extend the term of the financial obligation, but this cannot last forever.

There is practically no generally accepted period at the end of which receivables can be classified as overdue. Each debt has an individual statute of limitations.

Overdue debt can be divided into two types:

- Doubtful is a debt arising as a result of a goods transaction or the provision of services without making timely payment. Such a business transaction does not have a guarantee, pledge or surety.

- Bad debt is part of doubtful debts that meet certain conditions. Namely: the expiration of the statute of limitations, the impossibility of the debtor fulfilling his obligations, recognition of the debt as uncollectible by a court decision.

Debtors bear some responsibility for failure to fulfill contractual obligations, so many counterparties try to at least partially repay the debt. In turn, the responsibility of the creditor is to promptly notify the debtor about the debt that has arisen. Only if such a procedure is followed can a debt be recognized as uncollectible.

Reflection of accounts receivable in tax and accounting

Overdue and uncollectible accounts receivable in accounting must be written off. This requirement is specified in the accounting regulations. If this procedure is not carried out on time, the accounting data will be distorted.

Based on the inventory list, a certificate is drawn up for each obligation, indicating the following information:

- debtor's name

- reason for debt formation

- date the debt arose

- amount of debt

- data from primary documents confirming the occurrence of an obligation

Based on the accounting certificate, the head of the enterprise issues an order to write off the overdue debt. However, this does not mean that the debt will be completely canceled. For five years, doubtful accounts receivable will be reflected in off-balance sheet account 007.

There are different ways to reflect write-offs in accounting. The number of entries depends on whether reserves for doubtful debts were formed in the accounting records.

Write-off receivables are always charged to account 91-2 “Non-operating expenses”. The following entries are made in accounting:

- Dt 91-2 Kt 62(76) – the amount is reflected including VAT or

- Dt 63 Kt 62(76) – debt write-off from the reserve fund

- Dt 007 – transferring the amount to an off-balance sheet account

If for any reason the written-off debt is subsequently paid by the counterparty, then the correspondence of the accounts will be as follows: Dt 50 (51.52) Kt 91-2. At the same time, the off-balance sheet account is credited. If the written-off amounts of bad debts exceed the amount of the created reserve, then the excess amount is charged to non-operating expenses.

At the end of the reporting year, the unused reserve for doubtful debts is also written off to non-operating income, which increases the profit of the current year. At the beginning of a new period, the fund is formed anew, but its size must correspond to the remaining amount of receivables.

In tax accounting, reserves for doubtful debts can be formed only for those obligations that are associated with the sale of work and services. The amount of the reserve is reflected in accounting as part of other expenses, and in tax accounting as non-operating expenses.

A fairly common way to reduce receivables is to assign them under an assignment agreement to another person. When transferring the right of claim, obtaining the consent of the debtor is not required. Documents confirming the fact of debt and the amount of debt are attached to the assignment agreement. The following entries are made in accounting:

- Dt 91-2 Kt 62 – debt write-off for expenses

- Dt 51 Kt 91-2 – receipt of funds under a debt assignment agreement

- Dt 99 Kt 91-9 – reflection of loss from a completed transaction

The negative difference arising between the income from the sale of debt and its real value is recognized as a loss of the company, which is written off as non-operating expenses according to the following scheme:

- half of the proceeds are written off on the date of the transaction

- the rest is expensed after 45 days

Writing off unclaimed receivables worsens the company's financial performance, since the company's responsibilities include paying tax obligations to the budget. Therefore, it is very important to prove the fact that the debt has acquired the status of bad debt. Only in this case will the accountant be able to attribute such expenses to non-operating expenses and thereby reduce the taxable base for profit.

Tax authorities closely monitor this expense item, since accounts receivable resulting from non-receipt of funds for shipped goods reduces the amount of budget payments.

Sample breakdown of accounts receivable for tax authorities

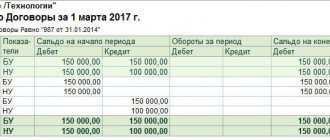

When deciphering accounts receivable, data on debtors is detailed. Such reference information is provided to the tax office in an explanatory note to the annual balance sheet. Debt decryption is carried out in dynamics and, for greater clarity, is distributed in tables:

- Form 5.1 reflects the amount of total debt and the dynamics of its change. This table deciphers balance sheet line 1230. The columns contain data on accounts receivable at the beginning and end of the reporting period. The table also reflects positive and negative changes in the balance. Long-term debt is analyzed separately from short-term debt

- Form 5.2 contains data on overdue debts. Both new debt and those that arose two years ago are entered into this register.

All information on receivables provided to the tax authorities must comply with the contractual terms. All debts must be included in the decryption, regardless of the presence of collateral.

Information about the status of the debt at the beginning of the period is filled in by the accountant based on the debit balances of current accounts (60, 62, 76). It is on the basis of these data that the reserve for doubtful debts is formed in accounting.

The dynamics of changes in accounts receivable for the reporting year are characterized by debit turnover. When filling out table 5.1 in the column “Changes during the period,” interest and penalties accrued in accordance with the terms of the agreement are indicated separately from the principal amount of the debt. The disposal column is filled in based on the credit turnover of account 63 “Provision for doubtful debts.”

The transition of accounts receivable from short-term to long-term is determined by the internal turnover of current accounts. In the table, such information is recorded in separate columns. Data for the line “Long-term debt” is entered in parentheses.