The filling procedure is prescribed in Order of the Federal Tax Service of the Russian Federation dated October 15, 2020 No. ED-7-11/753. From the 1st quarter of 2021, the 6-NDFL calculation will include the 2-NDFL certificate as an appendix; you will no longer need to submit it separately. The 2-NDFL certificate is filled out separately once a year for each individual to whom income was paid, and the 6-NDFL certificate is submitted quarterly for the entire organization.

Quarterly reporting reflects the total income paid to all individuals. The data in section 1 of form 6-NDFL is shown for the last three months of the reporting period, in section 2 - on a cumulative basis from the beginning of the year. Certificates of income and tax amounts are filled out once a year; they do not need to be submitted with quarterly reports.

Reporting must be submitted at the place of registration of the organization or individual entrepreneur. For each separate division, a separate 6-NDFL calculation is submitted at the place of its registration (letter of the Ministry of Finance of the Russian Federation dated November 19, 2015 No. 03-04-06/66970, letter of the Federal Tax Service of the Russian Federation dated December 28, 2015 No. BS-4-11 / [email protected] ) .

Submit electronic reports via the Internet. The Kontur.Extern service gives you 3 months free of charge!

Try it

Small firms with up to 10 employees are allowed to submit 6-NDFL reports on paper.

If the number exceeds 10 people, you will have to report electronically. This norm applies from 01/01/2020 in accordance with the amendments made to the Tax Code by Federal Law dated 09/29/2019 No. 325-FZ.

The Kontur.Extern system will help you easily and quickly send reports via telecommunication channels.

Submit electronic reports via the Internet. The Kontur.Extern service gives you 3 months free of charge!

Try it

Where to submit the payment

Our organization is the largest taxpayer with an extensive branch network. Where should we submit the invoices for branch employees?

Tax agents must submit quarterly calculations in Form 6-NDFL to the tax authorities at the place of their registration (Order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11 / [email protected] ). At the same time, as in the case of form 2-NDFL, for some categories of tax agents, separate rules have been introduced for determining the tax office to which the calculation must be submitted. However, par. 3 p. 2 art. 230 of the Tax Code of the Russian Federation, which is dedicated to the largest taxpayers, is formulated extremely ambiguously. It is not clear from it to which tax authority representatives of this category should report on Form 6-NDFL.

Specialists of the Federal Tax Service of Russia indicated in letters dated 02/25/2016 No. BS-4-11/ [email protected] and dated 03/02/2016 No. BS-4-11/ [email protected] that the largest taxpayers can submit all calculations to the local tax authority registration as the largest. Or they can act like ordinary tax agents - submit calculations in relation to branch employees to the inspectorate at the place of registration of these divisions.

I am an entrepreneur, I simultaneously work for the simplified tax system and UTII. Where should I submit payments for hired employees?

Like the largest taxpayers, entrepreneurs who combine UTII or the patent system with other taxation regimes have become hostages to the interpretation of the Tax Code of the Russian Federation. So, according to para. 5 p. 2 art. 230 of the Tax Code of the Russian Federation, tax agents - individual entrepreneurs who are registered with the tax authority at the place of activity in connection with the application of UTII and (or) the patent taxation system, submit calculations for their employees to the tax authority at the place of their registration in connection with the implementation of such activities. What kind of calculations we are talking about - only for activities transferred to UTII (PSN), or for all income - is not specified.

If we interpret the Tax Code of the Russian Federation literally, it turns out that the entrepreneur must submit 6-NDFL in relation to all employees (employed both in activities taxable under the OSNO or simplified tax system, and in activities taxed under UTII/patent) to the tax authority according to place of registration as a payer of UTII (PSN). However, the Ministry of Finance interprets this norm differently: at the place of registration of the “imputed” person, only calculations are submitted in relation to payments to employees hired for the purpose of carrying out such activities. And in relation to payments to employees hired for the purpose of carrying out activities taxed under other taxation regimes or engaged in several types of activities at the same time, general rules apply, and the calculation is submitted at the place of residence of the entrepreneur (letter of the Ministry of Finance dated 04/08/2016 No. 03-04- 05/20162).

However, from the wording of paragraph 2 of Art. 230 of the Tax Code of the Russian Federation such a conclusion does not follow, and clause 7 of Art. The Code requires that contradictions and ambiguities in the Code be interpreted in favor of the taxpayer. So, in our opinion, it is impossible to punish an entrepreneur who submitted 6-NDFL for payments to all employees to the Federal Tax Service at the place of registration of the “imputed” (patent) activity.

Report form 6-NDFL

The report form, the procedure for filling out 6-NDFL and its submission for 2020 was approved by Order of the Federal Tax Service No. ММВ-7-11 / [email protected] dated 10/14/2015.

IMPORTANT!

For the 1st quarter of 2021, it is necessary to report to the new calculation form approved by Federal Tax Service Order No. ED-7-11 / [email protected] dated 10/15/2020.

A report that shows the calculation of personal income tax amounts is submitted quarterly in electronic format, if during the reporting quarter the organization made payments in favor of 10 people or more. If an organization reports for less than 10 people, then the form will be allowed to be submitted on paper. The personal income tax amount is indicated in rubles, and the income amount is indicated in rubles and kopecks.

Income in kind

On November 15, a retired employee was given a valuable gift for his anniversary. Personal income tax has not been and will not be withheld. How to reflect this in the calculation?

The date of actual receipt of income in kind is the day the income is transferred. Tax agents calculate personal income tax as usual - on the date of actual receipt of income. The agent must withhold the calculated tax from any income that he pays to the individual in cash. Since no other income was paid to the individual during the tax period, it is impossible to withhold tax.

In annual calculations, Section 1 should show:

- cost of the gift on line 020;

- deduction in the amount of the non-taxable value of the gift (4,000 rubles) on line 030;

- the amount of calculated personal income tax - on line 040

- and her same on line 080, since the tax is not withheld until the end of the year.

There is a nuance in filling out section 2. If personal income tax cannot be withheld when non-monetary income is issued to individuals who are not employees, then the tax agent cannot fill out lines 110, 120, 140. Therefore, when the taxpayer receives income in kind and there is no withholding date and deadline for transferring personal income tax, when filling out lines 110 and 120 of Section 2 of the 6-NDFL calculation, it is allowed to enter zeros - “00.00.0000” (Letter of the Federal Tax Service dated 08/09/2016 No. GD-3-11/ [email protected] ).

The valuable gift block in section 2 can be filled out as follows:

- on line 100 - November 15, 2016;

- on line 110 - 00.00.0000;

- on line 120 - 00.00.0000;

- on line 130 - the cost of the gift;

- on line 140 - 0 rub.

Do not forget that if during the tax period it is impossible to withhold the calculated amount of tax from the taxpayer, the tax agent is obliged no later than March 1 of the following year in writing to inform the taxpayer and the tax authority at the place of his registration about the impossibility of withholding tax, about the amounts of income from which he has not withheld tax, and the amount of unwithheld tax (clause 5 of Article 226 of the Tax Code). This is a 2-NDFL certificate with feature 2.

Deadlines for submitting form 6-NDFL

Form 6-NDFL is sent to the tax office no later than the last day of the month following the reporting quarter. For annual calculations, an extended period applies - no later than March 1 of the following year.

IMPORTANT!

Report for 2021 no later than 03/01/2021, as this is a working Monday.

The table will help you not to miss the deadline for submitting 6-NDFL in 2021:

| Billing period | Deadline for submission |

| For 2021 | Until 01.03.2021 |

| For the 1st quarter of 2021 | Until April 30 |

| For the 2nd quarter of 2021 (calculation on an accrual basis for six months in section 1) | Until August 2 (31.07 - Saturday) |

| For the 3rd quarter of 2021 (calculation on an accrual basis for 9 months in section 1) | Until November 1 (30.10 - Sunday) |

| For 2021 (calculation on an accrual basis for the year in section 1) | Until 03/01/2022 |

Payments in the next reporting period

Salaries for June will be paid on July 5th. How to fill out the calculation correctly? Can these payments be fully reflected in the half-year calculation?

If the salary for March 2021 is paid in April, then this operation is reflected in section 1 of the calculation in form 6-NDFL for the first quarter of 2021 (letter of the Federal Tax Service of Russia dated March 18, 2016 No. BS-4-11 / [email protected] ). A similar approach applies to salaries for June, which are paid in July. The operation is reflected in section 1 of the half-year calculation as follows:

- on line 020 - the amount of accrued wages;

- on line 040 - the amount of calculated tax on wages, while it is not indicated on line 070, since the tax agent is obliged to withhold tax upon the actual issuance (transfer) of money to the taxpayer (according to paragraph 4 of Article 226 of the Tax Code of the Russian Federation).

If you reflect the amount of calculated personal income tax on wages for June in line 070 of the half-year calculation, the data will be incorrect, and this may result in a fine under Art. 126.1 Tax Code of the Russian Federation. If wages are paid on July 5, then the obligation to withhold tax on wages for June will arise only on July 5. This will need to be reflected in section 1 of the calculation of 6-NDFL for 9 months on line 070.

This personal income tax, withheld in July for June, also does not fall into line 080 of the calculation for the half-year. This contradicts clause 3.3 of the Procedure for filling out the calculation.

The situation with filling out section 2 is similar. In accordance with clause 4.2 of the Procedure for filling out the calculation, line 110 indicates the date of tax withholding from the amount of income actually received reflected in line 130. It turns out that in June it is impossible to fill out this line correctly, since the tax was not withheld. The operation will need to be reflected in section 2 of the calculation for 9 months, that is, with direct payment of wages:

- on line 100 - 06/30/2016 (since the date of actual receipt of salary income is determined by clause 2 of Article 223 of the Tax Code of the Russian Federation);

- on line 110 - 07/05/2016 (clause 4 of article 226 of the Tax Code of the Russian Federation);

- on line 120 - 07/06/2016 (clause 6 of article 226 of the Tax Code of the Russian Federation);

- line 130 - salary amount for June;

- line 140 - the amount of personal income tax withheld from it.

Report for employees through Kontur.Extern. Loading data into RSV from SZV-M. Importing data from 2-NDFL 5.06. Zero RSV in no time. Free for 3 months.

Register

Fines for reporting

There is a fine for failure to comply with the deadlines for submitting the report. Each month of delay will cost 1000 rubles according to the norms of clause 1.2 of Article 126 of the Tax Code of the Russian Federation. The official responsible for failure to submit personal income tax reports on time will be fined in the amount of 300 to 500 rubles (Part 1 of Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

If the information in the calculation is found to be unreliable, the organization will be fined 500 rubles (Clause 1 of Article 126.1 of the Tax Code of the Russian Federation). Therefore, the chief accountant of each organization needs to take care not only of how to fill out 6-NDFL without errors, but also how to submit the report without missing deadlines.

Unlawful submission of the 6-NDFL report on paper carries a fine of 200 rubles (Article 119.1 of the Tax Code of the Russian Federation).

In ConsultantPlus you will find not only a detailed guide to 6-NDFL with a form and samples, but also a video seminar that will answer any questions. Get free access using the link below to use them.

Personal income tax on advance payment when paid on the last day of the month

The organization has established the following salary payment days: on the 30th, an advance is paid, and on the 15th, wages are paid. How to fill out the calculation and is it necessary to withhold personal income tax when paying an advance on the last day of the month?

Tax agents are required to transfer the amounts of calculated and withheld tax no later than the day following the day of payment of income to the taxpayer (clause 6 of Article 226 of the Tax Code of the Russian Federation). This provision applies subject to the rules of Art. 223 of the Tax Code of the Russian Federation, it establishes the dates of actual receipt for certain types of income. In relation to wages, this date is recognized as the last day of the month for which income was accrued. It is this norm that makes it possible not to withhold personal income tax when paying money for the first half of the month (the so-called advance).

However, if the “advance” is accrued and paid on the last day of the current month, then the dates of the actual receipt of income (clause 2 of Article 223 of the Tax Code of the Russian Federation) and the actual payment of income (clause 4 of Article 226 of the Tax Code of the Russian Federation) will coincide. This means that the organization will have the obligation to calculate the amount of personal income tax for the past month (that is, in the case under consideration, for payments on the 15th and 30th, if the 30th is the last day of the month). And if payment is made on the same day, then the calculated tax is subject to withholding from the amount paid (decision of the Supreme Court of the Russian Federation dated May 11, 2016 No. 309-KG16-1804). It must be transferred to the budget on the next business day. It turns out that in the situation under consideration, the answer to the question depends on the number of days in the month. And, for example, in April and June, payment of an advance on the 30th will lead to the obligation to calculate and withhold personal income tax, but in May, July or August - not.

The calculation will be filled out accordingly. In April, 04/30/2016 will be both the date of receipt of income and the date of its actual payment. Therefore, it is entered in lines 100 and 110 of section 2 of form 6-NDFL:

- on line 100 - 04/30/2016;

- on line 110 - 04/30/2016;

- on line 120 - 05/04/2016 (the deadline for transferring tax to the budget is the next business day after 04/30/2016).

And in May, on the 30th, only an advance will be paid, and the obligation to calculate and withhold tax will arise only upon final payment on June 15. Therefore, the calculation will be filled out differently:

- on line 100 - 05/31/2016;

- on line 110 - 06/15/2016;

- on line 120 - 06/16/2016.

Zero 6-NDFL

The obligation to submit a calculation in Form 6-NDFL to the tax authority at the place of registration arises if the taxpayer is recognized as a tax agent, that is, makes payments in favor of individuals. If employee income is not accrued or paid during the year, there is no need to submit a report. The Federal Tax Service informed about this in letter No. BS-4-11/4901 dated March 23, 2016.

If during 2021 there was at least one payment in favor of an individual in the nature of wages, sick leave, financial assistance, remuneration for services rendered (work performed) as part of the execution of a civil contract, then a report is drawn up. Since the form is filled out on a cumulative basis, in the future, indicators from the first, second and third quarters will be saved in a cumulative manner. Therefore, in principle, zero 6-personal income tax does not exist; the report will still contain information about at least one payment.

If last year the organization was a tax agent, and this year for some reason stopped paying income to employees, there is no need to submit a report to the tax authority. Although the company is not obliged to explain to the tax authorities what the loss of tax agent status is associated with, it is recommended to send a letter of failure to submit 6-NDFL, drawn up in any form, to the Federal Tax Service.

Salary and compensation for leave upon dismissal

The employee resigns on April 22, 2016. In connection with his dismissal, he was accrued a salary for April 2021 and compensation for unused vacation. Both amounts were paid on the last day of work - April 22. How to fill out the calculation correctly?

In this case, you need to pay attention to the fact that we are talking about two payments: salary and compensation. If the employment relationship is terminated before the end of the calendar month, the date of actual receipt by the taxpayer of income in the form of wages is considered to be the last day of work for which he was accrued income (paragraph 2, clause 2, article 223 of the Tax Code of the Russian Federation). With regard to compensation for unused vacation, the general rules for determining the date of occurrence of income - the day of their payment - apply.

Since both payments are made simultaneously, the date of occurrence of income will be the same - April 22. The tax withholding date is the same for all types of cash payments - the moment of payment (clause 4 of Article 226 of the Tax Code of the Russian Federation). Then in section 2 of the 6-NDFL calculation we reflect (for both accruals):

- on line 100 - 04/22/2016 (date of income);

- on line 110 - also 04/22/2016 (tax withholding date).

Regarding tax transfers, special rules are established only for income in the form of temporary disability benefits, including benefits for caring for a sick child, and in the form of vacation pay (paragraph 2, clause 6, article 226 of the Tax Code of the Russian Federation). In the case under consideration, it is not vacation pay (the last part of Article 136 of the Labor Code of the Russian Federation), but compensation in the manner prescribed by Art. 127 Labor Code of the Russian Federation. This means that the general rules for transferring personal income tax to the budget apply - no later than the next working day (clause 6 of Article 226 of the Tax Code of the Russian Federation). Based on the above, we indicate:

- on line 120 - 04/25/2016 (date of tax transfer).

As you can see, all dates for both payments coincide, which means that on lines 130 and 140 they will be summed up (last paragraph of clause 4.2 of the Procedure for filling out the calculation).

Results

For all cases of reporting income and income tax in 6-NDFL, the instructions are the same - it was approved by order of the Federal Tax Service. And unusual and complex issues of registration of 6-NDFL are explained by tax specialists and officials in separate letters.

Our materials will tell you about how various payments are reflected in 6-NDFL:

- “How to correctly reflect vacation pay in form 6-NDFL?”;

- “Form 6-NDFL - compensation for unused vacation”;

- “How is material benefit reflected in Form 6-NDFL?” and etc.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Recalculation of vacation pay after payment of the annual bonus

According to the “Regulations on Remuneration”, bonuses based on the results of work for the past year are paid in May of the current year. Accordingly, after its payment, the vacation pay of those employees who were on vacation from January to May is recalculated, since the “13th salary” was not taken into account in the calculation of their vacation pay. This year, the missing amounts were paid to employees on May 15. Should they be reflected in the calculations?

The date of actual receipt of income in the form of vacation pay is the day of payment or transfer of this amount to the taxpayer or third parties on his behalf (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation). And the amounts of calculated and withheld tax on such income must be transferred to the budget no later than the last day of the month in which these payments were made (clause 6 of Article 226 of the Tax Code of the Russian Federation). Accordingly, the amounts of vacation pay that were actually paid (additionally paid) to the employee in May will be the income of this month and should be included in the calculation of 6-NDFL for the first half of 2021. Section 2 in this case will be filled out as follows:

- on line 100 - 05.15.2016 (date of actual payment of this income);

- on line 110 - 05.15.2016 (date of personal income tax withholding);

- on line 120 - 05/31/2016 (the last day of the month in which income was paid, even if personal income tax was actually transferred earlier, see paragraph 6 of Article 226 of the Tax Code of the Russian Federation).

Changes in 6-NDFL that need to be taken into account in 2021

For legal successors of reorganized companies, there is an obligation to submit Form 6-NDFL, if the organization itself has not done so before the end of the reorganization. In particular, the successor organization should:

- indicate the TIN and KPP at the top of the title page;

- use code 215 (for the largest taxpayers - 216) in the details “At location (accounting) (code)”;

- in the “Tax Agent” detail, indicate the name of the reorganized entity or its separate division;

- in the new detail “Form of reorganization (liquidation) (code)” indicate one of the values: 1 - transformation, 2 - merger, 3 - division, 5 - accession, 6 - division with simultaneous accession, 0 - liquidation;

- indicate “TIN/KPP of the reorganized company.”

In addition, there have been other changes in the procedure for filling out 6-NDFL.

The largest taxpayers provide checkpoints according to the certificate of registration with the tax office at the location of the legal entity, and not at the place of registration as the largest taxpayer.

Tax agent organizations that are not major taxpayers must indicate the value 214 instead of 212 in the attribute “At location (accounting) (code)”.

On the title page of form 6-NDFL the full details of the document confirming the authority of the representative are indicated. The current 6-NDFL form is used for the last time to generate the 6-NDFL calculation for the 4th quarter of 2021, the new 6-NDFL form is valid from the 1st quarter of 2021, it was combined with the 2-NDFL certificate.

IMPORTANT!

In 2021, companies with separate divisions have the right to choose a tax office to submit reports if the parent organization and separate divisions are located in different municipalities. They need to notify all the Federal Tax Service with which they are registered about their choice by sending a notification no later than the 1st day of the tax period in the form approved by the Federal Tax Service order No. ММВ-7-11/ [email protected] dated 12/06/2019.

Zero salary payments

In May, when paying salaries, it turned out that the amount to be paid to the employee was zero. He still had a small amount of debt left because he had recently returned from vacation, and he also had court-ordered deductions. What to include in 6-NDFL?

The date of actual receipt of salary income for May will be the 31st. On this date, the tax agent is obliged to calculate personal income tax based on the amount of accrued income. And then withhold the calculated amount upon the first actual payment of income (clause 4 of Article 226 of the Tax Code of the Russian Federation) and transfer it to the budget on the next working day (clause 6 of Article 226, clause 7 of Article 6.1 of the Tax Code of the Russian Federation). Accordingly, when filling out the 6-NDFL calculation, the following dates will fall into section 2:

- on line 100 - 05/31/2016;

- on line 110 - the date of the first actual payment of any income in cash after May, including salary advances;

- on line 120 - the first working day after the date indicated in line 110;

- on line 130 - the amount of accrued wages for May (before all deductions);

- on line 140 - the amount of personal income tax withheld from wages for May.

The calculation is filled out in a similar way in a situation where, for some reason, the advance payment turns out to be greater than or equal to the salary, which means that at the end of the month no payments are made to the employee. In this case, line 130 indicates the advance amount, which is the basis for calculating tax for this month.

The external student will help you fill out the declaration without errors, and after sending it, will automatically generate a payment order.

Connect to Extern with a 50% discount (not valid in all regions). Catch a discount

Block 1. Data for each bet

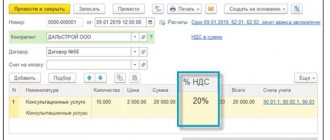

Step 1. Line 010. Tax rate

Column 010 in 6-NDFL contains the interest rate. The example considers the standard personal income tax rate of 13%. In the case of tax calculation at different rates, for each rate the data that relates only to the specified personal income tax rate will be generated. The total values of lines 060 to 090 are indicated once on the first page; on subsequent sheets, zeros are placed in these fields.

Step 2. Line 020. Accrued income

Line 020 (“Amount of accrued income”) indicates all taxable income of employees, calculated on an accrual basis from the beginning of the year - those that were actually received during the year. Line 020 does not include income that is completely exempt from personal income tax and income transferred to employees that is less than the taxable limit, such as financial assistance up to 4,000 rubles (on a general basis) or up to 50,000 rubles (for the birth of a child). The payment of dividends is reflected, among other things, in line 025.

IMPORTANT!

In certain cases, material assistance is not completely subject to personal income tax (clause 8, clause 8.3 and clause 8.4 of Article 217 of the Tax Code of the Russian Federation); for some types of material assistance, personal income tax is partially withheld. In letter No. BS-4-11/ [email protected] dated August 1, 2016, the Federal Tax Service clarified that line 020 should not contain information about income not subject to personal income tax and specified in Art. 217 Tax Code of the Russian Federation. Thus, completely non-taxable financial assistance is not indicated on the form.

Step 3. Line 030. Tax deductions

If taxpayers were provided with tax deductions, their amount is reflected in field 030. Deductions are non-taxable amounts that reduce the base for calculating personal income tax. The Tax Code provides for the following tax deductions:

- standard (Article 218 of the Tax Code of the Russian Federation);

- social (Article 219 of the Tax Code of the Russian Federation);

- property (Article 220 of the Tax Code of the Russian Federation), etc.

Line 030 is filled in in total for all deduction codes (Federal Tax Order No. ММВ-7-11 / [email protected] dated September 10, 2015) for which they were provided.

Step 4. Line 040. Calculated personal income tax

Line 040 (“Amount of calculated tax”) is calculated as the product of line 010 (“Tax rate”) and the corresponding tax base of income (personal income tax base).

The tax base of income (at each rate) is determined as the difference between column 020 (“Amount of accrued income”) and column 030 (“Amount of tax deductions”).

Example:

Tax base of income (rate 13%) = 2,217,431.00 – 34,400.00 = 2,183,031.00 (personal income tax base 13%).

Line 040 (“Amount of calculated tax”) = 2,183,031 × 13% = 283,793 (personal income tax at a rate of 13%).

Tax on dividends is indicated in column 045 and is calculated in the same way.

Step 5. Line 050. Amount of advance payments

This field is filled in if the organization employs foreigners on a patent basis. In this case, line 050 (“Amount of fixed advance payment”) reflects the amount of advances paid to foreigners. If, as the 6-NDFL sample shows, there is no data to fill out line 050, enter zero.

Early payment of wages

Monetary documents for payment of salaries in our organization are signed only by the director. He was supposed to go on a business trip from May 27 to June 15. Therefore, it was decided to pay salaries for May ahead of schedule - on May 26. So, in May, employees received both an advance (05/20) and a salary (05/26). How to reflect this operation in the calculation and is it necessary to withhold personal income tax in May?

As a general rule, the calculation is filled out as follows (letter of the Federal Tax Service of Russia dated March 18, 2016 No. BS-4-11 / [email protected] ):

- line 100 of section 2 “Date of actual receipt of income” of the 6-NDFL calculation (clause 2 of article 223 of the Tax Code of the Russian Federation);

- line 110 of section 2 “Tax withholding date” (clause 4 of article 226 and clause 7 of article 226.1 of the Tax Code of the Russian Federation);

- line 120 of section 2 “Tax payment deadline” (clause 6 of article 226 and clause 9 of article 226.1 of the Tax Code of the Russian Federation).

According to this approach, May 31 must be indicated in line 100. After all, the date of receipt of salary income is always recognized as the last day of the month for which it was accrued (Labor Code of the Russian Federation, clause 2 of Article 223 of the Tax Code of the Russian Federation). This does not depend on the actual date of payment and whether this day is a weekend or a holiday (letter of the Federal Tax Service of Russia dated May 16, 2016 No. BS-3-11 / [email protected] ). As for filling out lines 110 and 120, there are two options:

1. Since all actual payments are made before the date of occurrence of the corresponding income, the tax agent has the right not to withhold personal income tax when paying wages on May 26. And if he uses this right, then the tax calculated as of the last day of May will have to be withheld upon the first payment of any income, including advance payment, in June or subsequent months (Clause 4 of Article 226 of the Tax Code of the Russian Federation). Let's assume this happens on the day the advance payment for June is issued - the 20th. Then the calculation will be filled out like this:

- line 100 - 05/31/2016;

- line 110 - 06/20/2016 (personal income tax was actually withheld on this day);

- line 120 - 06/21/2016.

2. At the same time, the Tax Code of the Russian Federation does not prohibit tax agent from withholding personal income tax when issuing wages before the end of the month for which it was accrued. The tax will also need to be transferred no later than the day following the day the income is paid. And its “early” retention is no exception (clause 6 of Article 226 of the Tax Code of the Russian Federation). Therefore, if the employer withholds personal income tax when paying wages on May 26, the situation will change. The organization will be obliged to transfer it to the budget no later than May 27. And the calculation will be filled out like this:

- 100 — 31.05.2016;

- line 110 - 05/26/2016;

- line 120 - 05/27/2016.

Filling example

Let's look at the procedure for filling out Form 6-NDFL for the year using the example of Romashka LLC. For the fourth quarter of 2021, the following information is available:

- number of employees - 6;

- the total income of employees for the year amounted to 1,440,000 rubles (120,000 rubles per month);

- All employees are entitled to a standard deduction for a child in the amount of 1,400 rubles. The total amount of the deduction was: 1,400 x 6 x 12 = 100,800 rubles;

- amount of calculated personal income tax on income: (1,440,000 rubles - 100,800) * 13% = 174,096 rubles (14,508 rubles per month);

- the amount of personal income tax withheld for the year was 8 = 159,588 rubles, since the tax on the December salary is subject to withholding in January.

Section 1 is filled out like this:

Section 1

The following table lists the fourth quarter transactions that will be needed to be reported in Section 2.

Table 3. Operations of Romashka LLC in the fourth quarter of 2021 for payment of income and withholding personal income tax

| date | Operation and amount |

| 05.10 | Payment of salary for September |

| 08.10 | Personal income tax for September transferred |

| 30.10 | Salary accrued for October - 120,000 rubles, personal income tax calculated - 14,508 rubles |

| 05.11 | Salary paid for October |

| 06.11 | Personal income tax transferred for October |

| 30.11 | November salary accrued - 120,000 rubles, personal income tax calculated - 14,508 rubles |

| 05.12 | Salary paid for November |

| 06.12 | Personal income tax for November transferred |

| 31.12 | December salary accrued - 120,000 rubles, personal income tax calculated - 14,508 rubles |

Note! Wages for December, paid in January, will not appear in the calculation, since the deadline for paying personal income tax on it expires in another reporting period.

Section 2 of the 6-NDFL calculation, completed using these data, will look like

Section 2

Wages and vacation pay arrears

Due to a lack of funds, on May 20, 2021, the organization partially paid salaries accrued for November 2015 and February 2021. How to reflect these payments in the calculation?

In this case, when filling out the calculation, you need to take into account two more letters from the tax service:

- The letter dated 02/25/2016 No. BS-4-11/ [email protected] states that section 2 of the calculation in Form 6-NDFL reflects those transactions that were carried out over the last three months of this reporting period.

- In the letter dated 10/07/2013 No. BS-4-11/ [email protected] - that the rule of clause 2 of Art. 223 of the Tax Code of the Russian Federation on the date of actual receipt by the employee of income in the form of wages does not apply in a situation where it is paid in violation of the deadlines established by Art. 136 Labor Code of the Russian Federation. In this case (in relation to debt), income in the form of wages must be reported in those months of the tax period in which it was actually paid.

In the situation under consideration, wages for November 2015 and February 2021, paid in May 2021, will be income in May 2021. Therefore, the date of its actual payment should be included in line 100 of the calculation:

- on line 100 - 05/20/2016;

- on line 110 - 05/20/2016 (date of personal income tax withholding for these payments, which must coincide with the day of payment, clause 4 of article 226 of the Tax Code of the Russian Federation);

- on line 120 - 05/23/2016 (the next working day after the day of personal income tax withholding indicated on line 110, clause 6 of article 226 of the Tax Code of the Russian Federation);

- on line 130 - the total amount of wage arrears paid in May (without reduction for deductions);

- on line 140 - the total amount of personal income tax withheld (including applied deductions for January - May 2021, if they were not previously applied when paying other income). Unfortunately, the employer will no longer be able to apply deductions for 2015 in this situation, since deductions reduce the base of the current year (clause 3 of Article 210 of the Tax Code of the Russian Federation).

Due to a lack of money, vacation pay for employees who went on vacation in April was paid only in May upon their return to work. How to fill out 6-NDFL?

For vacation pay in st. 223 of the Tax Code of the Russian Federation does not establish any separate rule for determining the date of receipt of income. This means that we use the general rule: the date of receipt of income will be the day of their actual payment - May 2021. On the same date, the organization has an obligation to calculate and withhold the corresponding amount of tax (clause 4 of Article 226 of the Tax Code of the Russian Federation, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 02/07/2012 No. 11709/11, letter of the Ministry of Finance of Russia dated 04/10/2015 No. 03-04- 06/20406).

But tax must be withheld only upon actual payment of income (Clause 4, Article 226 of the Tax Code of the Russian Federation). And clause 6 of Art. 226 of the Tax Code of the Russian Federation says that this tax must be transferred to the budget no later than the last day of the month in which vacation payment was made. Accordingly, the organization will withhold tax upon actual payment in May and transfer it to the budget no later than May 31. The specified dates must be entered in section 2 of the 6-NDFL calculation:

- on line 100 - the date of actual payment of vacation pay (Article 223 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated November 13, 2015 No. BS-4-11/19829);

- on line 110 - the date of tax withholding, which coincides with the date of payment of vacation pay;

- on line 120 - 05/31/2016.

Block 2. Summary of Section 1

Step 6. Line 060. Number of people who have received income since the beginning of the year

The field indicates the total number of individuals to whom the organization made payments of taxable income in the reporting period.

Step 7. Line 070. Total amount of tax withheld at all rates

Line 040 is the calculated tax, i.e. the value of this line shows the amount of tax that must be transferred for the period (1st quarter, 1st half of the year, 9 months, year).

The amount of withheld tax in 6-NDFL (line 070) displays data on the transferred tax amounts only for the current period. This line should not include information about past or future payments.

IMPORTANT!

You can check the data on line 040 using payment orders for personal income tax by comparing fields 106 (“TP” - payments of the current year) and 107 (“MS indicates the serial number of the month”) with the value of line 040.

Example:

For 2021, as in other periods, the value of line 040 must correspond to the amounts calculated (calculated) and transferred to the budget for this period. Please note that not in this period, but for it. Page 070 is checked in the same way as page 040, taking into account the fact that all transfers (tax payment) must be made in the quarter (other period) for which we are reporting. That is, the information is compared according to the reporting period of personal income tax paid in the reporting period. You can check the correctness of the values of lines 040 and 070 by determining the amount of payments for the last reporting month made in the month following the reporting month.

The value of line 070 (“withheld”) does not always match the data in line 040 (“calculated”). This happens when some tax amounts were accrued earlier and withheld from employees later.

Step 8. Line 080. Unwithheld tax

Column 080 includes personal income tax amounts that could not be withheld for any reason.

Step 9. Line 090. Tax refunded

Line 090 reflects the amount of personal income tax that was withheld erroneously and returned to the employee. If there were no such cases, put a zero.

Rent to an individual once a quarter

The organization rents premises from an individual who is not an individual entrepreneur. Rent is accrued every month and paid once a quarter: for January - March - April 20, for April - June - July 20, etc. How to fill out the calculation?

The date of actual receipt of income in the form of rent is the day of issuance (transfer) of funds (clause 1 of Article 223 of the Tax Code of the Russian Federation). This means that this accrual should fall into section 1 of the calculation in the period when the money is actually paid. In this case, this is April and July 2021.

Accordingly, accruals for January-March will be reflected in section 1 of the calculation for the half-year, and for April-June - for 9 months. In section 2, these accruals will also be reflected in the case of direct payment of income to an individual. In this case, this operation will fall into section 2 of the calculation for half a year and nine months:

- on lines 100 and 110 - 04/20/2016 and 07/20/2016 (date of actual payment of rent);

- on line 120 - 04/21/2016 and 07/21/2016 (the working day following the payment date);

- on line 130 - the amount of rent for three months;

- on line 140 - the amount of personal income tax on rent for three months.

Step-by-step instructions on how to correctly fill out 6-NDFL

Although the report has been in effect for several years, the preparation of 6-NDFL still raises questions among employers and accountants. In addition, a number of changes have been made to it that must be taken into account when filling out. Young accountants are entering the profession and require rules for filling out 6-NDFL for dummies. Especially for them, we will analyze the actions step by step.

The document consists of the following sections:

- Title page.

- Section 1 (information is formed on an accrual basis).

- Section 2 (information is reflected only for the specified quarter, without taking into account previous periods).

Below are instructions for filling out form 6-NDFL for 9 months of 2021.

Title page

Step 1. TIN and checkpoint

The TIN and KPP of the organization submitting the report are indicated in the appropriate fields. If the report is submitted by a branch, then the branch checkpoint is indicated.

Step 2. Correction number

If form 6-NDFL is submitted for the first time during the reporting period, then zeros are reflected in the “Adjustment number” field.

An adjustment implies a change in the information submitted to the Federal Tax Service. Clarification of the calculation for the corresponding reporting period is indicated by the adjustment number, for example 001, 002, 003, and so on.

Step 3. Reporting by quarter (period number)

The 6-NDFL submission period is the quarter for which the employer reports:

- 1st quarter - code 21;

- half-year - code 31;

- 9 months - code 33;

- year - code 34.

Codes for organizations transferring information at the stage of reorganization (liquidation) are indicated in Appendix 1 of the order.

We include additional payment for vacation in the calculation

The date of receipt of income in the form of a one-time supplement to annual leave is the day of its actual payment. The Federal Tax Service of the Russian Federation suggests filling out section 2 of 6-NDFL as follows:

- the dates indicated in lines 100 and 110 are the same - the day the additional payment was actually received;

- line 120 indicates the day following the day of actual payment of income.

Form 2-NDFL certificate approved by Order of the Federal Tax Service of the Russian Federation dated October 30, 2015 No. MMV-7-11/ [email protected] Income of individuals is reflected in the form in accordance with the codes that are given in the list approved by Order of the Federal Tax Service of the Russian Federation dated September 10, 2015 No. MMV- 7-11/ [email protected] If any income is not named in the list, then it is included in 2-NDFL under code 4800 “Other income”.

So, if a company pays an employee a one-time additional payment for annual leave, then in form 2-NDFL this amount is reflected with code 4800.

LETTER of the Federal Tax Service of the Russian Federation dated August 16, 2017 No. ZN-4-11/ [email protected]

Why is CPPR necessary?

The 6-NDFL submission period code is an identifier used to automate information processing. Therefore, you should not only indicate the data as accurately as possible, but also use the correct form of their reflection:

- All 6-NDFL period codes consist of two digits; in the corresponding columns of the form, a certain number of places are allocated for this identifier. When preparing reports, it is forbidden to leave empty cells. If data is missing, a dash is added.

- If the report is completed by hand, only blue, purple, or black ink may be used on paper. The entered data must be reflected in rich color without distortion.

- It is not allowed to cross out or erase information, or use proofreaders. If any code is entered incorrectly, the entire report should be reissued with the correct information.

In most cases, special software is used when filling out the form; many operations are performed automatically, which eliminates the possibility of errors.

Reflecting overpaid tax

According to line 090 f. 6-NDFL indicates the total amount of tax that the tax agent returns to taxpayers. The amount is shown as a cumulative total from the beginning of the year.

If in 2021 a company returns to an individual personal income tax that was excessively withheld from last year’s income, then this amount will be reflected on page 090 of section 1 of the calculation for the corresponding period of the current year.

This operation is not included in section 2 of the form. There is no need to submit an updated calculation of 6-NDFL for the previous year.

In this case, the company must submit corrected information to the inspectorate in Form 2-NDFL.

The personal income tax payable must be reduced by the amount of the refund made. If the tax agent transferred the tax without taking this amount into account, then an overpaid amount of tax arises, which must be returned from the budget.

LETTER from the Federal Tax Service of the Russian Federation for Moscow dated June 30, 2017 No. 20-15/ [email protected]

Editor's note:

a tax refund situation arises, in particular, if the company provided the employee with a property deduction (letter of the Federal Tax Service of the Russian Federation for Moscow dated June 30, 2017 No. 20-15/ [email protected] ).

If the employee was provided with a property deduction in October 2021: the tax withheld from the beginning of the year was returned. At the same time, the calculation of 6-NDFL for 9 months has already been submitted to the inspectorate. In this situation, there is no need to clarify the submitted form. The personal income tax refund operation will be reflected in the following statements - for 2021 on lines 030 and 090 of the calculation.

The line 070 indicator does not need to be reduced by the amount of tax to be refunded on the basis of a notification confirming the right to a property tax deduction.

Adjustment

If an error is detected in the submitted form or when recalculating personal income tax for the previous year, an updated calculation . The Tax Code does not provide specific deadlines for this. But if you find an error yourself, correct it immediately and provide a “clarification.”

If you make a correction before the tax authorities find the mistake, you can avoid a fine of 500 rubles.

The features of the updated form 6-NDFL are as follows:

- the correction number is indicated - “001” for the first, “002” for the second, and so on;

- in the fields in which inaccuracies and errors are found, you must indicate the correct data;

- the remaining fields are filled in the same way as in the primary calculation.

We will separately mention how to correct the form if you indicated an incorrect checkpoint code or OKTMO . In this case, you need to submit 2 calculations:

- In the first , you need to indicate the correct gearbox and OKTMO codes and enter the correction number “000”. All other data must be transferred from the previous form.

- In the second calculation, the adjustment number “001” is indicated, as well as the checkpoint and OKTMO, which were indicated in an erroneous form. All sections must contain zero data.