Some accounting transactions cannot be documented with primary documents. But according to the rules, an accountant cannot carry out anything without a documented basis. What should I do? Draw up such a document yourself. In this article you will find a sample of writing an accounting statement and learn about its features.

Every accountant should be able to do at least three things:

- draw up a balance sheet;

- find the error;

- draw up an accounting statement.

It is the last point that will be discussed in this material. First, let’s find out what kind of paper this is. And where can I find a sample accounting certificate?

The role of an accounting certificate: what is it for?

Any enterprise has the right to independently develop “primary” forms, approving them in its accounting policies. But sometimes it is difficult to justify certain business transactions due to the lack of an established document form for them. For example, calculating daily allowance or expenses. An accounting certificate will help resolve this problem . It can be used in other cases (see table).

| Some cases of using accounting certificates | |

| Situation | Explanation |

| The company is obliged to apply separate accounting for VAT | Reveals the methodology for separate VAT accounting |

| Correction of data for the reporting period and previous years | To solve this problem, use an accounting certificate confirming the correction of an error. |

| As evidence in court | Duplicates information that is already reflected in accounting |

| To process postings | Explains the meaning of the operation or the inaccuracy of the initial posting |

Basically boo. a certificate is a primary document to which the law imposes its requirements. It can be compiled in any form, but certain details must be present. If executed correctly, it will become reliable evidence in conflicts with regulatory authorities.

Ideally, a competent specialist should be involved in the preparation of accounting statements . For example: an economist, accountant or other person who is responsible for the transaction being performed. But in order to successfully cope with the task, you need to know some nuances.

Also see “How to Maintain Accounting for an LLC.”

Explanatory certificate for reflecting business transactions

With the help of such business paper, you can clarify some business transactions or create a basis for reflecting any process in accounting. To do this, you must specify:

- base

- content

- accounting method

It is advisable to provide links to other documents.

Thus, the accounting certificate contains basic details and additional information, which it is advisable to describe in as much detail as possible.

Top

Write your question in the form below

What you need to know when using different forms and samples of accounting statements

You should remember the following subtleties:

- Does not replace the document that must be drawn up by the transaction partners together. Therefore, it makes sense to record some operations in the certificate only for internal purposes.

- The certificate usually only confirms the information already provided in the internal accounting system. Therefore, a specialist must distinguish how to prepare a sample accounting certificate :

Such cases include drawing up an act of acceptance of goods received without documents. The tax office will consider that the submitted sample accounting certificate does not have a legal basis. As a result, expenses may not be recognized. It is impossible to take them into account when calculating tax. And challenging such a decision can be difficult.

- as a “primary”;

- for completely different purposes (informational, etc.). For example, to record a business transaction in a document that can become evidence in legal proceedings.

- In difficult situations, the accountant runs the risk of getting confused in the corrections. To prevent this from happening, we recommend including as much information as possible in the text of the certificate and attaching copies of settlement documents, as well as incorrectly completed documents.

What to do if a certificate was not issued upon dismissal?

Sometimes employees are simply not given the necessary certificate - they forget, or something else happens. What to do in this case? Go to the HR department of your previous organization as soon as possible to correct this oversight. You will need to submit an application requesting a certificate for sick leave. This will take approximately three days, although for the most part everything depends on the personnel department.

You need to apply for such a certificate

Sometimes people themselves forget to pick up their certificate from the personnel department. In this case, they usually receive a call from their previous place of work and are reminded that the finished document is waiting for them in the HR department. You will need to go pick it up, and you can also ask to send the paper by mail to your residential address.

In general, it doesn’t matter why you didn’t receive this document in due time - the main thing is to correct your mistake and pick it up. After all, if you do not show the certificate to the new employer, problems will arise with sick leave compensation. You may lose significant sums of money if you do not take a certificate from your previous place of work.

If such a certificate is not available, sick leave will be calculated based on the minimum wage

Structure: how to write a sample accounting statement

Regardless of its purpose, the document must be executed correctly, since it plays the role of a primary one. Then there will be no unnecessary questions from the tax inspectorate. We recommend using an in-house template, since the legislation of the Russian Federation does not provide for a mandatory accounting certificate form .

The procedure for preparing this document consists of 3 stages:

- Creating a “header” and specifying the following data:

- information about what has changed;

- previous performance;

- correct method of calculation.

The following is an example of an accounting statement with the corresponding text:

| “Economist of LLC “Guru” N.V. Kurnosova made a technical error when calculating depreciation on fixed assets. For 2021, the amount was 21,000 rubles, while it was erroneously indicated as 22,500 rubles. Detailed calculation: ……. On February 1, 2021, N.V. Kurnosova corrected the error by posting Dt 44 Kt 02 - 21,000 rubles. Corrections were made by recording Dt 44 Kt 02 – 1500 rubles. (reverse)" |

- identification of persons;

- confirmation of the need to perform a business transaction.

Also see “Details of accounting documents: basic and mandatory”.

As was said, the company’s management has the right to independently develop and approve by order a sample certificate in order to use it to solve its business problems. At the same time, it is included in the accounting policy of the enterprise.

You can take as a basis accounting certificate 0504833 , which was developed by the Ministry of Finance for public sector institutions (order No. 52n of 2015).

Typically, this document is drawn up in electronic form, taking into account standard design requirements: no typos, filling out all details, exact names of organizations, etc. It is important not to make mistakes when entering dates.

On our website for accounting information you can use the following link.

Such certificates may contain so-called red reversals - postings with a negative number. They serve, for example, for:

- bug fixes;

- write-off of trade margins;

- adjustments to indicators of material and production costs.

Below is a sample of filling out accounting certificate 0504833 .

Certificate for payment of sick leave: form 182n

A certificate for calculating sick leave must be issued immediately after dismissal, along with the work book. You will need it when applying for a new job. This document states the amount of all funds received over the last two years of performance of work duties. And if you did not manage to work for the company for a full two years, the certificate is provided for the working period that you actually spent at the company.

The funds accrued on a certificate of incapacity for work are calculated based on the average monthly income over the past two years, so you need to take active steps to obtain a certificate for accruing sick leave from your previous position.

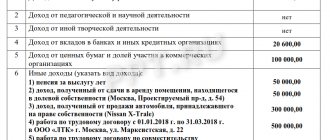

Certificate form 182n

Otherwise, the amount of money for sick leave will be small.

In order for you to be compensated for the time spent on sick leave, maternity leave, or leave to care for a child under one and a half years old, you must obtain an appropriate certificate from the medical institution where you are being observed.

Note! To calculate the amount of money provided for sick leave, you need to submit a certificate for two years for sick leave to the accounting department.

It’s great when you work in one company for a long time - you don’t have to take many difficult steps. However, if you decide to leave your current position, you must also receive certificate 182n along with all the papers. This document is the basis for providing you with benefits.

If an employee decides to change his place of work, he will need a certificate 182n, which indicates the amount of wages for the two previous years

Using the certificate for calculating the certificate of incapacity for work, accountants will be able to find out what your average income per day was and will provide information about the compensation you are entitled to for being on sick leave.

If your work experience does not reach a year, when you are on sick leave, you will be given money in the amount of the average daily wage, not your salary. The reason is that your insurance experience is not yet long enough.

The form of a certificate for providing sick leave from a previous position, issued to a citizen upon dismissal, must include the following:

- the month and year of admission and the month and year of leaving the workplace;

- the amount of money earned over two years, including bonuses and various incentives;

- the number of days on sick leave, maternity leave, child care leave, the number of days of absence from work while maintaining wages (due to cleaning, repairs of the premises, etc.);

- the amount of money credited to the Pension Fund and Social Insurance Fund.

The certificate must indicate salary, bonuses, number of days spent on sick leave, etc.

Varieties

There are several types of accounting statements designed for different business situations:

- settlement;

- about correcting errors;

- for the public sector;

- samples of books certificates on separate VAT accounting;

- about debt write-off;

- intended for court.

Each of them has its own compositional features that allow one to competently confirm the legitimacy of a particular fact.

Requirements for filling

A sick leave certificate from a previous workplace must contain the actual amounts of your income for the time period of performing work duties in this company. Let's take a look at the mandatory filling requirements:

- use of technical means: computer or typewriter;

- the form designated for this purpose must be used;

- if the certificate is filled out by hand, only blue or black ink is allowed;

- there should be no blots or amendments in the document;

- the seal should not overlap the signatures of the boss and chief accountant. It should be located in the lower left corner of the document.

The certificate must be completed only on a special form

Accounting statement: sample filling

This type of certificate is of a primary nature. It is distinguished by the presence of indicators that are already reflected in accounting. The accountant draws it up in the following cases:

- correction of inaccuracies in accounting or tax accounting;

- an explanation of the business transaction ( an accounting statement may be useful when writing off accounts receivable or payable);

- performing additional calculations that explain the specifics of the transaction (especially important when separately accounting for VAT or recognizing expenses).

standard form of accounting statement established by law . But it must have the following details:

- Company name;

- the essence of the operation and the calculation for it;

- date of compilation;

- FULL NAME. responsible persons.

If you are in doubt about how to correctly draw up a sample accounting certificate , follow Article 9 of the Law Certificate of Confirmation of Corrections

Let’s assume that the accountant of Guru LLC N.V. Solovyova found an error in depreciation charges for March 2021: 53,800 rubles were reflected, but according to correct calculations - 41,200 rubles. The surplus is reversed using the posting: Dt 44 Kt 02 – 12 600. A sample accounting certificate about error correction looks like this:

Please note: you must specify:

- the reason for the error;

- all options for the amount that affects accounting;

- date of correction.

At the end of N.V. Solovyova, as the compiler of the certificate, puts her signature. Adjacent to it is the autograph of the chief accountant. After this, the accounting certificate confirming the correction of the error serves as the basis for an accounting correction.

Also see Double Entry Accounting: Meaning and Examples.

When, who and why is such a certificate required?

Any citizen, even with the most excellent health, has probably been on sick leave at least once. For women, this issue is even more relevant, since they bear and give birth to children, for these periods they are issued a certificate of incapacity for work, after which they are awarded child care benefits for children up to one and a half years old.

To find out how much you are entitled to for sick leave or to understand the amount of benefits, you need to understand how much money you receive on average per day. Let's look at the specifics of the calculations.

The total amount of income for the last two years must be divided by 24. We divide the resulting figure by the average number of calendar days in a month. The final number is your income for the day. Using this information, the accounting department can calculate the benefits you are entitled to.

When calculating sick leave, the average daily income is taken into account

Note! If you have been at the same workplace for two or more years, no special manipulations on your part are required - any information can be found in the accounting department of the company. However, if you left one company and moved to another, and then went on sick leave, then you will have to provide a certificate of form 182g. Otherwise, any funds for a certificate of incapacity for work will be given to you based on the minimum wage.

Certificate of write-off of the “creditor”

Overdue accounts payable, for which the time for filing a claim has passed, the enterprise is obliged to include in non-operating income. This is how clause 18 of Art. 250 Tax Code of the Russian Federation. Usually this is done during an inventory and is accompanied by the preparation of an accounting certificate for writing off accounts payable . It should include:

- full information about the debt (contract number, links to the “primary”, etc.);

- calculation of the limitation period.

EXAMPLE At Guru LLC, on March 30, 2021, an inventory of settlements with counterparties was carried out, as a result of which an accounts payable to Septima LLC was identified in the amount of RUB 143,000. The statute of limitations on it expired on March 13, 2017.

Here is an example of how to write an accounting statement for this situation:

| LLC "Guru" ACCOUNTING REPORT No. 24 DATED 03/30/2017 ON THE WRITTEN OF ACCOUNTS PAYABLE As a result of the inventory of settlements with counterparties on March 30, 2021, accounts payable to the limited liability company "Septima" were identified (TIN 7722123456, KPP 772201001, address : Moscow , Shosseynaya St., 7, building 9), for which the statute of limitations has expired (Act of Inventory of Settlements with Buyers, Suppliers, Other Debtors and Creditors dated March 30, 2017 No. 2-inv). This debt arose under the contract for the supply of goods dated April 25, 2014 No. 63-p. Clause 3.8 of the said agreement establishes the payment deadline - until March 15, 2014 (inclusive). The amount of debt for goods supplied is 145,000 rubles, including VAT - 26,100 rubles. The statute of limitations expires on March 13, 2017. Thus, accounts payable in the amount of 145,000 rubles are subject to inclusion in non-operating income for income tax for the first quarter of 2021 on the basis of paragraph 18 of Article 250 of the Tax Code of the Russian Federation and write-off in accounting. Chief accountant_____________Shirokova____________/E.A. Shirokova/ |

Remember: the accountant must correctly determine the statute of limitations, as this affects the result of calculating income tax. To avoid mistakes, refer to Articles 196, 200 and 203 of the Civil Code.

Results

An accounting certificate is a primary accounting document that acquires special significance in situations where it is necessary to correct accounting errors. For most taxpayers, there is no strictly established form of such a certificate, but nevertheless, when issuing it, compliance with certain rules is required.

Sources:

- Tax Code of the Russian Federation

- Law “On Accounting” dated December 6, 2011 N 402-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting certificate of debt for the court: sample

This document can be drawn up in a very general form with references to background data that the form wants to prove in court. It is not at all necessary to refer in the certificate to the fact that it is issued specifically for judicial purposes.

The following is a sample of writing an accounting statement about a “receivable”, which often has to be “knocked out” from the counterparty through the court.

| LIMITED LIABILITY COMPANY "GURU" Address: 105318, Moscow, st. Gogolya, 8, office 15. TIN 7722123456, KPP 772201001 Moscow February 06, 2021 Accounting statement No. 3-s As a result of the inventory of settlements with counterparties on February 06, 2021, receivables from Buben LLC were identified (TIN 7719456789, KPP 771901001, address: Moscow, Kvasovaya St., 9, building 6), for which the statute of limitations has not expired (inventory act dated 02/06/2017 No. 22-inv). This debt arose under the goods supply agreement No. 12/7 dated October 22, 2016. The amount of debt is 500,000 (five hundred thousand) rubles 00 kopecks. The payment deadline under the agreement is December 31, 2016 (inclusive). General Director ______________ /V.V. Krasnov/ Chief Accountant ______________ /E.A. Shirokova/ |

Read also

03.02.2017

What does the document look like?

The form used for the certificate required for calculating sick leave can be taken from the official website of the company by the employee dealing with this documentation. Most often, responsibility for these activities lies with the accountant or HR employee.

The certificate form for 2 working years, required for calculating sick leave, includes three sheets. The title page contains:

- name of the paper (certificate), description of the document;

- date of issue and serial number;

- information about the policyholder: company name, full name of the manager, INN, ORGN, passport details, physical address, telephone number;

- information about you: full name, address, SNILS.

This certificate consists of three sheets

The next sheet contains information about the specifics of your work in this enterprise. The date you started working and the date you left. The funds you received for each year separately deserve special attention.

The third sheet contains the dates of your stay on sick leave, maternity leave, forced leave with your salary retained.

The certificate must be signed by the director, accountant

Then the signatures of the management and the chief accountant and a seal must be affixed.

If an employee presents a certificate after receiving benefits

When a citizen, after receiving benefits, nevertheless brings a certificate from his previous place of work, the monetary amounts must be adjusted. Compensation received for three years preceding the date of submission of the document may be subject to new calculations.

If the employee presented a certificate after he was assigned sick leave benefits, the amount paid will be adjusted

How long does it take to record income?

The basis for calculating average earnings per day is the total income from which contributions to the Social Insurance Fund were withheld; it is also necessary to take into account the number of working days over the last 2 years.

It is during this time period that the accountant writes a certificate in form 182n.

Question: is it permissible to select any two years of my work in the company for the certificate required for calculating sick leave in Form 182H?

Answer: You cannot choose the two years that suit you. If you need to accrue sick leave or maternity leave for the 16th year, the certificate must be dated 15th and 14th years, in cases where you were not on maternity or child care leave at that time.

The certificate must contain salary data for the previous two years.

Note! You must have certificate 182n, which is required for calculating sick leave if you are going to change your workplace. After all, if you do not have this document, it will not be possible to give you enough money as compensation. This is very important for women who are planning to have a child.

Filling Features

Any certificates from the workplace for calculating sick leave must be filled out in the same way. The requirements for them are almost identical.

| Paragraph | Description |

| Clause about the policyholder | The most complete information should be used in the clause about the policyholder. The following must be written down: the full name of the company, last name, first name and patronymic of the boss, his registration number, Taxpayer Identification Number, address of the company, telephone number. |

| Item “Data about the insured person” | This paragraph contains information about the citizen for whom the certificate we are considering is issued. It must be filled in with all the required information. |

| Working hours | An extract is made for the last two years worked for this company, writing down the dates in full: day, month and year. |

| Time periods | All time periods when the employee was on sick leave or those when he could not perform his job duties due to objective reasons should be indicated here. All these intervals are called “temporary disability”, “maternity leave” and so on. |

It is important that all fields are filled out correctly to avoid problems

Note! The mandatory criterion applied to filling out the third and fourth points of the certificate for calculating sick leave is to indicate the numbers of orders dedicated to this event: hiring, maternity leave, receiving bonuses, and so on. Amounts of money are written down as numbers and then decrypted. The certificate must be secured with a round wet seal. It should be placed in such a way as not to obscure the names of the people who signed this paper.

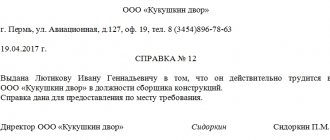

What is a certificate of employment and when is it issued?

The issuance of a certificate of employment is regulated by Art. 62 Labor Code of the Russian Federation. It refers to documents related to work and is issued for presentation at the place of request. The document is in the nature of confirmation or clarification of the requested information. Such certificates are often required by social security authorities, banking, credit institutions and others. The certificate is issued free of charge upon the employee’s oral or written request within three days from the date of application.

| You will learn the latest requirements of legislation, judicial and inspection practice for building personnel records by taking our distance learning course. |

What do you need to obtain a certificate from your place of work?

The request for a certificate can be either written or oral. This depends on the document flow adopted in the organization. Sometimes the employer requires a written request indicating the purpose for obtaining the document and a description of the information that needs confirmation. In accordance with Art. 62, the employer is obliged to issue a document related to work within 3 days after submitting the corresponding written application.