From 2021, all employers who hire workers under labor and civil contracts must submit a monthly report to the Pension Fund in the SZV-M form. As for control over the payment of insurance premiums, this function is assigned to tax authorities who accept reports on the payment of pension, medical and social benefits.

Despite such changes, personalized accounting remains under the control of pensioners. The tax service is not interested in this type of reporting and its representatives will not accept it, no matter how much employers would like to make the reporting process more convenient for themselves.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

When preparing SZV-M in 2021, policyholders may encounter a number of difficulties and ambiguous situations. The most common problem that accountants encounter during the preparation of a report is that the employee has not been assigned an INN or SNILS.

Main nuances

On April 1, 2021, Resolution of the Board of the Pension Fund of Russia No. 83p On approval of the form “Information about insured persons” came into force.

The abbreviation SZV stands for “incoming information about the insured.” The letter M indicates that the form must be submitted monthly. In an organization, a dispute often arises about who should prepare this report: accounting or representatives of the human resources department who accept the employee into the organization, and where copies of all his documents are stored. The answer to this is simple: the person responsible for a given segment of work is appointed directly by the manager. One thing is clear - the person in charge must have access to current contracts concluded with employees.

The first report had to be submitted for April 2021, starting from this period, reports must be submitted by each employer on a monthly basis. The document must include information about each employee, even if he worked under a contract for only 1 day.

SZV-M must be submitted even if the organization is temporarily not operating, for example, all employees are on unpaid leave, but they have valid employment agreements. This is due to the fact that the submission of this type of report is not related to any payments and accruals. The only thing that matters is the presence of an employment contract or a GPC contract.

When filling out the form, do not forget about those employees who are on maternity leave. If there are no employees in the organization, and therefore no valid contracts, you do not need to submit this form.

To prepare the report and check it, special programs have been created, which can be found on the website of the Pension Fund of the Russian Federation.

As for the form for submitting the report, it can be prepared and submitted on paper. This is only allowed for employers with no more than 25 employees. However, even in this case, it is better to accompany the report with the corresponding file on a flash drive. If there are more employees, the form is submitted exclusively in electronic format, and it must have an electronic signature.

To send a form with an electronic signature, you must be a subscriber to the electronic document management system with the Pension Fund. For this purpose, an agreement is concluded with this government agency. The next step is to obtain a CEP certificate and purchase reporting software. For example, a similar opportunity is provided by the Kontur.Extern system.

Who should submit the form?

Monthly information in the SZV-M form must be submitted to the Pension Fund of the Russian Federation by all organizations and private entrepreneurs that have concluded employment contracts and civil contracts with individuals who are their employees. Even those who are on paid or unpaid leave or maternity leave are not an exception.

Individual entrepreneurs who work without employees do not need to submit any information to pensioners. It is important to understand that there is no zero information on the SZV-M form. This is due to the fact that the form contains not numerical indicators, but quantitative ones, namely the number of workers who are insured and information about them.

Taking this into account, even if an organization has one director under a contract, the SZV-M form is mandatory to be submitted to the Pension Fund.

SZV-M report form

Is it possible to take SZV-M without a TIN?

The employees who are responsible for submitting the report have a question about whether it is possible to submit the SZV-M without a TIN. According to the amendments that were made to Federal Law No. 136 of 2021, if the organization does not have information about the employee’s TIN, this number need not be indicated in the report form.

The TIN is not a mandatory detail, so there will be no sanctions for failure to enter the number from the Pension Fund. But reflecting a fictitious or someone else's number is illegal. You can even get a fine for this. This inaccuracy will be identified by fund employees during a reconciliation with the tax service.

If a report with incorrect information regarding the TIN of one of the employees has already been submitted, it is better to correct the inaccuracy yourself. To do this, you need to submit a supplementary report form. If you submit an electronic version of the document, the program itself will replace incorrect data with corrected ones.

Today, a TIN is not required when filling out other reporting forms, for example, 2-NDFL. Until the end of 2021, tax authorities required employers to independently find out the identification numbers of their employees. If the number was not assigned, employees had to contact the tax office to obtain one.

If an employee does not know his tax number

If an employee does not know his TIN, but remembers exactly that the number was assigned to him, the organization’s accountant can find it out on his own. To do this, you need to visit the official website of the Federal Tax Service and use the service called Find out TIN.

In the appropriate field, you must enter the employee's full name, date of birth, and passport information. If the person was indeed previously assigned a number, it will appear on the monitor screen. If the employee made a mistake and in fact the code was not assigned to him, the tax authorities’ website system will notify about this fact.

There is no longer any need to force an employee to apply to the Tax Office for a TIN. Form SZV-M without TIN can be sent to the Pension Fund. If you fill out the form in this way, when sending it, you may receive a notification that the TIN field has not been filled in for a certain employee. However, this will not be an obstacle to the report reaching the recipient. If there are no other errors in the document, it must be accepted by the inspector.

ETKS of professions is intended for tariffication of work and assignment of qualification categories to workers.

What impact does the state of receivables and payables have on the financial condition of the organization - read

It follows from this that an employee who is a Russian citizen and has not received a TIN does not pose any problem for the person responsible for filling out the SZV-M form.

However, for the convenience of accounting and to avoid disputes with inspectors in the future, it is better to ask the employee to contact the Tax Inspectorate to obtain a TIN.

Sample of filling out the SZV-M form for February 2019

If an employee has two TINs and other situations

In conclusion, we will consider several issues related to obtaining a TIN, which arise quite often in practice. What to do if tax authorities mistakenly assigned a second personal number to an individual? Is it necessary to change the TIN and obtain a new registration certificate if a person has lost a previously issued certificate, moved to a new place of residence or changed his last name? Not only the employee, but also the accountant needs to know the answers to these questions.

An individual can have only one TIN (unified throughout the entire territory of the Russian Federation for all types of taxes and fees) (clause 7 of Article 84 of the Tax Code of the Russian Federation). Therefore, before registering a person for tax purposes on any basis (for example, at the location of the property), the inspection must make sure that the individual does not have a TIN in order to avoid the situation of re-assigning this number.

However, in practice, individuals sometimes receive two (or more) TINs. For example, this can happen if a person who lives in one region and is registered with the tax authorities at his place of residence purchases real estate in another region. The inspectorate at the location of the property, having received information about the registration of rights to this property, will register the individual.

If the TIN database does not contain up-to-date information about whether an individual has a personal number, the tax authorities will assign him a TIN, which will result in a “duplication” of the number. Due to two TINs, confusion may arise when calculating personal taxes, as well as difficulties in filling out tax reports.

In such a situation, a person should only have one TIN. Tax authorities are required to recognize the remaining numbers as invalid (subclause 3 of clause 20 of the Procedure, approved by order No. ММВ-7-6/ [email protected] ). However, we note that the legislation does not provide for a clear algorithm of actions in this case. In particular, it does not say what exactly needs to be done for the tax authorities to recognize the number as invalid.

Therefore, if an accountant becomes aware that an employee has two TINs, then it makes sense to inform such an employee that one of the numbers is redundant and recommend that they contact the tax office with an application to cancel this number. In our opinion, such an application can be submitted both to the inspectorate at the place of residence and to the inspectorate that issued the second tax registration certificate (with the second TIN).

Most likely, inspectors will leave in place the number that was assigned first (as a rule, this is the number received from the Federal Tax Service at the place of residence). In any case, tax officials must inform the person which number will remain valid. It is this number that will need to be used in the future, including when filling out the 2-NDFL certificate and the SZV-M form.

Also, the accountant will be able to check which number is declared invalid using the “Invalid TIN of Individuals” service on the website of the Federal Tax Service of Russia (you can go to the page of this service through the “Electronic Services” section; then by the number you can find out whether it is listed in the database of invalid TIN one region or another).

If a person has lost his certificate of registration with the tax authority, he can obtain a second certificate from the inspectorate at his place of residence (place of stay) (section 1.2 of the Basic principles of organizing work on registration and registration of legal entities and individuals, approved by order of the Ministry of Taxes of Russia from 22.07.

If a person has moved to a new place of residence, then the certificate of registration with the tax authority does not need to be changed. The TIN remains the same (clauses 29 and 35 of the Procedure, approved by order No. 114n).

The TIN is also retained if the last name, first name, patronymic, gender, date or place of birth have changed. In any of the listed situations, an individual can receive a new tax registration certificate, which will indicate the previously assigned TIN (clause 36 of the Procedure, approved by order No. 114n). However, as reported on the Federal Tax Service website, obtaining a new certificate in such cases is not necessary.

If the employee does not have SNILS

When an employer hires new employees, he requests a certain package of documents from them. The insurance number of an individual personal account (SNILS) must be present among the papers. A person may not have such a document. This is possible if this place of work, for example, is the first. In such a situation, the employer is responsible for preparing the document.

There may be another reason why a person does not have such a document: he simply could have lost it. Whatever the reason, it will take some time to restore or register SNILS, which can reach three weeks. Given this fact, it may happen that at the time when it is necessary to submit the SZV-M report, the employee will not yet have his insurance number on hand.

This field in the report form cannot be left blank; it must be filled out. If you provide incorrect details, an error will be identified when checking the provided data by Pension Fund employees. As a result, the employer will be held accountable in accordance with Article 17 of Federal Law No. 27. The amount of the fine that will have to be paid will be 500 rubles for each SNILS that was indicated incorrectly.

If the report is submitted using a telecommunications channel, the policyholder will be refused to accept the report, since the document will not pass the program’s verification. You must not miss the deadline for submitting the report, since this will also entail penalties: in this case, you will have to pay 500 rubles for each employee for whom information was not submitted in a timely manner.

In this case, the only acceptable option is not to include in the form the data of an employee who does not have SNILS. After the insurance certificate has been issued, you can send a supplementary report, which will include all employees who were not previously included in the reporting.

It is best to submit such a report with a cover letter indicating the reason why the employee was not included in the initial report form. As a basis for such actions, it should be noted that it was not physically possible to submit data on the SNILS of some employees in a timely manner, since at the time of submitting the report such a document had not yet been issued for them.

In such a situation, there is a possibility that no penalties will be applied to the employer. But if possible, it is better to avoid this and ask employees in advance for information about their SNILS.

Zero report on form SZV-M

Even if the organization has suspended its activities, the SZV-M zero report must still be submitted. In such a company there is at least one founder (director) who needs to be reported.

Since March 2021, a new procedure for submitting reports by certain categories of insured persons has been in effect. Starting from the specified period, reports SZV-M and SZV-STAZH are required to be submitted in relation to:

- The head of the organization, who is the sole founder, regardless of whether an employment contract has been concluded with him.

- Chairman of the HOA, GPC, SNT, ONT, DNT (in the absence of a concluded employment or civil law contract)

These changes were made by letter of the Ministry of Labor of Russia dated March 16, 2018 No. 17-4/10/B-1846, brought to the attention of the Pension Fund Branches by letter of the Pension Fund dated March 29, 2018 No. LCH-08-24/5721.

Let us recall that previously the Pension Fund of the Russian Federation allowed not to submit a report for the sole founder and chairmen of cooperatives and partnerships (Letter No. LCH-08-26/9856 dated July 13, 2016).

Changes from 2021

From the beginning of 2021, new rules for submitting the SZV-M form have come into force.

There are five of them:

- The term for filing SZV-M has been changed. If previously the report was submitted by the 10th day of each month following the reporting month (in some cases a fluctuation of one or two days was allowed), then starting in January of this year a new deadline has been established, which is set for the 15th. That is, now the employer is given 5 more days to prepare the report.

- The pension fund will impose a fine if a company with more than 25 employees submits a paper report instead of an electronic form. Last year, such sanctions were not applied to employers.

- Making a mistake in the TIN has become more dangerous than before. Starting from 2019, a tax identification number is a mandatory element when maintaining personalized records. It is not necessary to reflect it in the SZV-M, but in the new calculation of contributions it must be recorded without fail. If last year it was more difficult for pensioners to track the TIN of each employee, then since the new year the fund has additional opportunities for this, and, accordingly, the likelihood of receiving a fine is higher.

- If an error is detected in the SZV-M form, not only the company, but also its manager and the chief accountant will face penalties.

- The Pension Fund has approved the updated electronic format of the SZV-M form.

New electronic form

In 2021, the Pension Fund changed the format of information submitted using the SZV-M form twice. This happened in September and December. According to the changes made, the number of errors and inaccuracies was reduced, the admission of which led to the rejection of the report and its sending for revision. According to the order of the Pension Fund No. 432 of 2019, the number of errors decreased from 30 to 14.

Now pensioners are not punished for an extra dot, dash or space. If an incorrect registration number is entered, this will be regarded as a gross violation and the form will not be accepted.

The new form is more advanced, thanks to which accountants no longer experience difficulties filling out the SZV-M.

Starting in January 2021, the report is submitted in a new electronic format, which was approved in December 2021 by the Resolution of the Pension Fund, which gained force in early January of the new year. Failure to comply with the requirements for the report form will result in the organization receiving a negative report, which will indicate non-acceptance of the report.

The business activity type code is a set of numbers that makes it possible to identify the individual entrepreneur’s method of generating income.

The list of primary documents confirming the import of goods from Belarus to Russia is presented in this article.

In what cases is gross salary assigned - find out

What if at the time of submitting the SZV-M there is no information about SNILS in relation to the new employee?

The organization has hired an employee for whom this is his first job. He does not have an insurance certificate for compulsory pension insurance. In this regard, the employer applied to the Pension Fund of Russia to obtain such a certificate. However, at the time of submitting the SZV-M form for the month in which the employment contract was concluded with the individual, the certificate is not yet ready, i.e. no data on SNILS. How to fill out information on such an employee in the SZV-M form?

No later than the 10th day of each month, the employer must submit to the Pension Fund of Russia information in the SZV-M form (approved by Resolution of the Board of the Pension Fund of the Russian Federation dated 01.02.2016 No. 83p) about the individuals working for him, with whom in the reporting month the agreements are, continue to be valid or employment contracts or civil contracts have been terminated (Clause 2.2 of Article 11 of Federal Law No. 27-FZ dated 01.04.1996, hereinafter referred to as Law No. 27-FZ).

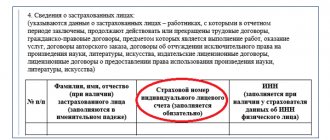

This information includes: Full name, TIN (if the employer has information about the TIN), SNILS.

SNILS is indicated in the certificate of compulsory pension insurance. The employee must submit this document among other mandatory documents listed in Art. 65 of the Labor Code of the Russian Federation for employment.

The exception is the situation when an individual gets a job for the first time. In such a situation, the employer issues an insurance certificate for him (Part 4 of Article 65 of the Labor Code of the Russian Federation).

To do this, a questionnaire is submitted to the fund body for a new employee in the ADV-1 form (clause 9 of the Instructions, approved by order of the Ministry of Health and Social Development of Russia dated December 14, 2009 No. 987n, hereinafter referred to as the Instructions). Within three weeks from the date of receipt of the questionnaire, the Pension Fund of the Russian Federation must prepare and send an insurance certificate to the employer for delivery to the individual (clause 13 of the Instructions).

If such a certificate is not yet ready at the time of filing the SZV-M, the employer cannot reflect SNILS in the reporting in relation to the new employee.

According to Part 4 of Art. 17 of Law No. 27-FZ, failure to submit the SZV-M form within the prescribed period or reflecting incomplete and (or) unreliable information in it entails a fine of 500 rubles in relation to each individual.

However, in the above situation, the indication of incomplete information about the employee (without SNILS) is due to objective reasons. In this regard, it is advisable to attach a cover letter to the SZV-M for the reporting month justifying the reasons for the lack of data on SNILS.

In this case, as soon as the insurance certificate is ready, the employer needs to submit SZV-M reporting for the past month (the month of concluding an employment contract with the employee) with the code “additional” (it is indicated in field 3 “Form type (code)___”). In such a report, you will need to indicate data that was not reflected in the original form with the code “source”.

22915 May 5, 2016

Where and how to submit

Reports should be submitted to the territorial branch of the Russian Pension Fund in which the institution was registered. If an organization has branches or separate divisions, a different procedure for sending reports applies. The department is obliged to independently submit the form to the branch of the Pension Fund of the Russian Federation at its location. Moreover, the report should indicate the TIN of the parent organization, and the checkpoint of the branch (Law No. 27 of 04/01/1996, as amended).

IMPORTANT!

Budgetary organizations report in two ways: electronically or on paper. Moreover, if the average number of employees is 25 or more employees, then the report must be sent electronically through special communication channels. Otherwise, the policyholder faces a fine of 1,000 rubles.

Payers of contributions with a staff of up to 24 people have the right to submit a report on paper or send an electronic version.

You no longer need to indicate the TIN in SZV-M

If the company does not have information about the TIN of employees, it may not be indicated in the SZV-M. Such amendments were introduced by Federal Law No. 136-FZ of May 1, 2016.

If you indicated an incorrect TIN, the fund will detect an error when reconciling with the Federal Tax Service. Therefore, if you have already filed a report, it is safer to correct the inaccuracy. The funds believe that for this it is enough to pass the supplementary SZV-M. The program will replace the previous information with new information.

Last week, the fund answered another controversial question on the new form: Is it necessary to take the SZV-M if the company only has a founding director? On its website on April 29, the Pension Fund of the Russian Federation gave official clarifications: The policyholder monthly no later than the 10th day of the month. following the reporting period, provides the following information about each employee (including persons who have entered into contracts of a civil law nature, for remuneration for which insurance premiums are calculated in accordance with the legislation of the Russian Federation):

1) Insurance number of an individual personal account; 2) Last name, first name, patronymic; 3) Taxpayer identification number.

Simply put, if the company has one founding director, SZV-M must be passed. Companies include in the report “physicists” who worked for a month under employment and civil law contracts. The director does not enter into an employment contract, but an employment relationship arises with him. The Ministry of Finance also agrees with this (letter dated March 15, 2016 No. 03-11-11/14234).

Dear colleague, Glavbukh is cheaper in August!

Hurry up to subscribe to the magazine “Glavbukh” at a favorable price, prices will increase in the fall!

Helpful advice

The fact that the developers of the SZV-M form did not include the TIN in the group of mandatory information does not mean that the column with the TIN can always be left empty.

If you do not know the employee’s TIN, it is better to clarify and check the data once again. Use the Federal Tax Service service for this:

To use this service, you will need the following employee information:

- FULL NAME.;

- Date of Birth;

- series and number, date of issue of the identity document.

You need to fill out the required fields of the request form and send it by clicking on the “Send request” button. If your employee is registered with the tax authorities and has been assigned an INN, the service will instantly respond: “Information about the INN has been found” and will indicate this INN.

We tell you more about the work of the “Find out TIN” service here. Now you have a TIN at your disposal, which can be found in SZV-M. If the service did not find information about the TIN, feel free to leave this field empty in the report.

Whatever result the Federal Tax Service gives you when checking your TIN, take a screenshot of the screen with the result. This will help you subsequently justify your actions for not filling out the employee’s TIN in SZV-M if the Pension Fund has complaints about the incompleteness of the personalized information provided.

Will an accountant be fined for not having SNILS and TIN in SZV-M?

2016 added new worries and worries to accountants. Form 6-NDFL has been introduced for the tax office. The Pension Fund of the Russian Federation did not stand aside either. In addition to quarterly reporting, monthly reporting has been introduced in the form of SZV-M. This form provides for entering data about each employee who has entered into an employment or civil contract with the enterprise. Full name, SNILS and Pension Fund are required details. And all accountants, naturally, are interested in the question, are there already penalties for unsubmitted reports or reports with errors in SNILS or TIN?

SZV-M: responsibility and penalties for errors

First of all, we need to mention the fine for not submitting a report at all. Failure to provide information about one employee will cost the company 500 rubles. The fine for a report with distorted data will be the same. The right to impose fines is granted directly to the Pension Fund branches receiving reports. Accordingly, we can assume that if an enterprise employs 100 people, 10 of them did not submit reports or submitted reports with errors, then the fine amount will be 5,000 rubles.

If the report is not submitted for 50 people, then you can reserve 25,000 rubles in your current account to pay the fine. It should also be taken into account that the report is monthly. Now, more specifically, whether errors in SNILS and/or TIN will be punished.

SZV-M without TIN or SNILS: will there be punishment?

The short answer to this question is yes, it will. The enterprise or organization will be punished in the amount of the same 500 rubles specified in the previous paragraph. The punishment will also apply for each incorrect report, that is, for each incorrectly entered SNILS or TIN. More details about the types of punishment can be found in paragraph 4 of Article 17 of Federal Law-27 as amended by Federal Law-385 dated December 29, 2015. Whether in such a situation the employee who submitted an incorrect report will be punished is up to the enterprise to decide.

What should accountants do in such a situation? Many employees are hired without having a complete package of documents, promising to deliver them later. And then comes the reporting period. Experts recommend the following way out:

— if an employee does not know his TIN and cannot provide a certificate or a copy of it, then the Rules allow the line with the TIN to be left blank. The basis for failure to enter data on the TIN is Federal Law-136 dated January 1, 2016. But if the data is entered into the line, then there should be no errors. An incorrect figure equals a fine of 500 rubles;

— if an employee does not know his SNILS, cannot provide a certificate, and has not received it yet, then the enterprise is obliged to obtain a certificate for him by submitting an appropriate application to the Pension Fund of Russia branch. Basis - Federal Law-27, Art. 9. clause 3). An enterprise is given no more than 2 weeks from the date of signing the employment contract to receive SNILS. The deadlines for receiving SNISL are specified in clause 9 of the Instruction of the Ministry of Health and Social Development of the Russian Federation dated December 14, 2009 No. 987n. If the reporting deadline has arrived and SNILS has not yet been received, then experts suggest submitting the report without including this employee in it. Later you will have to submit an additional report for a specific employee.

If the Pension Fund treats the absence of a TIN leniently, then without SNILS the report will be considered not submitted. You can prepare for a fine of 500 rubles for each sheet.

How to restore an employee’s SNILS

An enterprise is required to submit an application for the issuance of SNILS only if the employee has not previously received it at all. If the certificate is simply lost, the employee will have to restore it himself. State portals do not make it possible to quickly find out the SNILS number of a careless employee. Information can only be provided by the “confused” person himself. But to do this, you need to first register on the State Services website and look at the necessary information in the “Extended notice of the status of an individual personal account” tab.

Why is the TIN column needed?

Many of those filling out the SZV-M report make the same mistake. Almost everyone believes that if the TIN is not a mandatory requirement, then you don’t have to waste time on it. But it's still better to spend it. The TIN for the Pension Fund serves as the same identifier as SNILS. If in the latter case an error is made, the data will be posted using information from the TIN. But, if this column is empty, then a fine is inevitable: the Pension Fund will simply not count this sheet as passed.

A fine is possible even when the TIN is entered, but there is still hope that the inspector will be in a good mood and will not want to waste time issuing a notice of the fine. In this situation, there can be only one advice - spend an extra 5 minutes on each report in order to enter and once again double-check all the data for each employee. In addition, the Taxpayer Identification Number (TIN) for any person can be easily found on the Federal Tax Service website. This information is not classified as secret.

How to enter information about employees in a new report: randomly or alphabetically

The instructions for filling out the SZV-M do not contain any special requirements in this regard. An accountant can enter data in a way that is convenient for him.

Deadline for submitting the SZV-M form in 2021

Thus, this year the preparation of this report is given 5 days more than in 2016.

At the same time, as before, if the deadline for submitting the SZV-M falls on a weekend or holiday, it is postponed to the next working day (see, for example, letter of the Pension Fund of the Russian Federation dated December 28, 2021 N 08-19/ 19045). For example, for March 2021, the SZV-M form can be submitted until April 17, 2021. Liability of the policyholder

The information that the Pension Fund needs so much is not so voluminous: in the SZV-M form only the full name, SNILS and TIN of the insured persons are indicated. That is, there are no complex calculations, analysis, etc. for you here. Apparently, it was precisely because of this “simplicity” that officials decided not to bother themselves with approving the procedure for filling out the SZV-M form - all the necessary information is indicated line by line.

At the same time, in practice it turned out that not everything is so simple. Of course, if you have employees working for a hundred years who do not get married, do not get divorced, do not quit, you do not enter into GPC agreements, etc., then drawing up a report in the SZV-M form is simply a matter of technique. However, alas, few people can boast of this state of affairs.

On the other hand, for failure to provide the relevant information to the Pension Fund or for providing incomplete or unreliable information, financial sanctions in the amount of 500 rubles are applied to the policyholder. in relation to each (!) insured person (Part 3 of Article 17 of the Law of April 1, 1996 N 27-FZ, hereinafter referred to as Law N 27-FZ).

So, if a company has a staff of hundreds, or even thousands, of people, then the size of the fine for failure to submit the SZV-M form may be far from “penny”. Please note! Since January 1, 2017, the policyholder’s liability for failure to comply with the method of submitting the SZV-M form has also been established.

According to the new Instructions

If a company submits information in the SZV-M form late or submits a report to its Pension Fund office on paper, whereas it should submit it electronically, penalties are inevitable. Of interest is the situation when certain inaccuracies were discovered in the timely submitted SZV-M form.

Is it possible to correct them in such a way as to avoid liability? Eat! And it is provided for in the Instructions on the procedure for maintaining individual (personalized) records of information about insured persons, which was approved by Order of the Ministry of Labor of December 21, 2021 N 766n. At the same time, the old Instructions for accounting, approved by the Order of the Ministry of Health and Social Development of December 14, 2009

N 987n, was declared invalid. We note that the new Instructions on personal accounting regulate the following issues: 1) the procedure for registration in the OPS system; 2) the procedure for submitting and deadlines for receiving and recording by the territorial bodies of the Pension Fund of the Russian Federation information about insured persons necessary for maintaining an individual (personalized ) accounting;

"Minus" fine

The procedure for correcting errors in information about insured persons submitted to the Pension Fund is prescribed in Section 3 of the Instructions. Two options for the development of events are considered here. Errors or inconsistencies in the SZV-M form were discovered by “pensioners.” In this case, the policyholder is given a notice to eliminate the detected errors.

This notice can be delivered (clause 37 of the Instructions): a) in person against signature; b) sent by registered mail. The date of delivery of this notice is considered to be the sixth day counting from the date of sending the letter; c) transmitted electronically via TKS. The notice is deemed to have been delivered by the policyholder on the date indicated in the operator’s confirmation of receipt of the message.

It is no coincidence that we drew attention to the date when the notification about the elimination of errors in the information submitted to the Pension Fund is considered received. The fact is that it is from this day that five days are counted, which are allotted to the policyholder to correct these errors. And if you meet this five-day deadline, that is, clarify the detected inaccuracies or discrepancies, then the policyholder will not be fined.

The policyholder independently (before this became known to the Pension Fund of Russia) discovered that the previously submitted SZV-M information contained errors (inaccuracies, etc.). In such situations, the policyholder has the right to submit updated (corrected) information for the reporting period to the Pension Fund of Russia , in which this information is specified.

And then the policyholder will also not be fined under Part 3 of Article 17 of Law No. 27-FZ. For example, the company sent the SZV-M form with the “output” type for March 2021 to the Pension Fund on the deadline of April 17, 2021 and the fund accepted it (the corresponding protocol has been received). However, it was later discovered that the SZV-M form included information about an employee who quit in February 2021.

"Work moment

As such, there is no “clarification” on the SZV-M form. Corrections and “corrections” of information are made to the form in a special manner. For this purpose, the same form is filled out, but the “type of form” must be correctly indicated. There are three options here: - code “iskhd” (“original form”). We indicate this code when submitting the SZV-M form for the first time;

— code “additional” (“complementary form”). We use this code if it is necessary to change information about the insured persons that was reflected in the form with the code “outcome”, or to supplement it; - code “o”. This code must be entered in the SZV-M form if you need to remove it from previously submitted information.

Thus, the policyholder has the right to correct errors in the information in the SZV-M form without a penalty only if its original version (i.e. with the code “output”) is submitted within the specified period and, importantly, is accepted by the Pension Fund of Russia branch In this regard, the question arises: will the policyholder be released from liability if he “forgets” to indicate information about a particular insured individual in the original SZV-M form?

Indeed, according to the new Instructions, financial sanctions are not applied if the policyholder “if an error is identified in the previously submitted individual information regarding the insured person” clarifies (corrects) this information. If it was an employee, then she did not provide information about him at all... It turns out that in such situations a fine cannot be avoided.

25 people or more - the form is submitted electronically (via telecommunications channels).

Less than 25 people - on paper in person at the Pension Fund or by mail with a list of the attachments.

Discussed here.

For late submission of reports or distortion of monthly information about each employee, policyholders face a fine of 500 rubles. for each insured person (Article 17 of Law No. 27-FZ).

Also, the fund has the right to additionally fine officials 300-500 rubles if the report is submitted late or with errors (Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation).

Discussed here.

For untimely submission of SZV-M, fines must be paid to the Pension Fund of the Russian Federation.

The procedure for collecting fines is established by Art. 17 Federal Law dated April 1, 1996 No. 27-FZ. The procedure includes several stages: drawing up an act, which must be delivered to the person who committed the offense within five days from the date of its signing; issuing a requirement to pay a fine for failure to submit a report in the SZV-M form to the Pension Fund of the Russian Federation.

Payment of the fine is made within 10 calendar days from the date of receipt.

In case of non-payment or incomplete payment by the policyholder of financial sanctions upon request, the collection of the amounts of financial sanctions is carried out by the Pension Fund of the Russian Federation in court. Direct debiting of fines for SZV-M from the bank accounts of organizations and individual entrepreneurs is prohibited.

The SZV-M report must be submitted to the Pension Fund on a monthly basis.

The deadline for submission is no later than the 15th of the following month.

| The reporting month | Deadline |

| January | February 15, 2021 |

| February | March 15, 2021 |

| March | April 15, 2021 |

| April | May 15, 2021 |

| May | June 17, 2021 |

| June | July 15, 2021 |

| July | August 15, 2021 |

| August | September 16, 2021 |

| September | October 15, 2021 |

| October | November 15, 2021 |

| November | December 16, 2021 |

| December | January 15, 2021 |

Note: if the due date falls on a weekend or holiday, the deadline for submitting the report is moved to the next business day.

For failure to submit monthly reports to the Pension Fund or submitting a report with incomplete or unreliable information, a fine of 500 rubles is provided for each employee.

In addition, officials of the organization (manager, accountant) may additionally be charged a fine in the amount of 300 to 500 rubles (Article 15.33 of the Code of Administrative Offenses of the Russian Federation).

Is it necessary to take SVZ-M IP without employees?

Individual entrepreneurs or organizations that have at least one employee must report using the SZV-M form. Therefore, individual entrepreneurs without employees do not need to submit a SVZ-M report.

Do NGOs and public organizations without employees need to submit a report?

In accordance with the Letter of the Ministry of Labor of Russia dated March 16, 2018 No. 17-4/10/B-1846, brought to the attention of the Pension Fund Branches by the Pension Fund Letter dated March 29, 2018 No. LCh-08-24/5721, SZV-M must be submitted in relation to the chairman of the HOA , Civil Procedure Code, SNT, ONT, DNT (in the absence of a concluded employment or civil law contract).

Do newly created LLCs without employees, general director and bank account need to submit SZV-M?

In accordance with the Letter of the Ministry of Labor of Russia dated March 16, 2018 No. 17-4/10/B-1846, brought to the attention of the Pension Fund Branches by the Pension Fund Letter dated March 29, 2018 No. LCH-08-24/5721, SZV-M must be submitted in relation to the head of the organization , who is the sole founder, regardless of whether an employment contract has been concluded with him.

Do organizations need to submit a report during the liquidation process?

According to the explanations given by the Pension Fund of the Russian Federation, the fact that an organization is in the stage of bankruptcy does not relieve it of the obligation to submit a report in the SZV-M form. In this case, a zero form is filled out and signed by the bankruptcy trustee.

New reporting form SZV-M: asked - we answer

April 29, 2016

- Information on the employee is presented without a tax identification number due to its absence. Are financial sanctions applied in this case?

Monthly reporting is submitted in the form “Information about insured persons” (form SZV-M), which provides for filling out the taxpayer identification number (TIN) if the policyholder has data on the individual’s TIN. THAT. The absence of the TIN of the insured person in the information provided by the policyholder in the SZV-M form will not be a reason for refusal to accept monthly reports, and financial sanctions are not applied to such policyholder.

- Can the deadline for submitting reports be extended if the policyholder does not have information about the employee’s SNILS number?

All indicators of the SZV-M form, with the exception of the “TIN” indicator, are required to be filled out. In addition, SNILS is a document required to be presented when applying for a job. In this regard, the SZV-M form information about the SNILS number is required to be filled out.

The absence of SNILS data from the policyholder is not a basis for extending the deadline for submitting reports. And violation of the deadline due to the lack of SNILS entails financial sanctions.

- Is the SZV-M form submitted if the quarterly reporting is “zero”?

If someone submits a report, it means that he is an employee of this organization and he has all the authority to provide reports on its behalf. Accordingly, reporting must be submitted for at least one employee. The absence of accrual of insurance premiums cannot serve as a basis for failure to submit monthly reports to SZV-M.

- Is it necessary to submit monthly reports for the founder in the absence of accrual of insurance premiums?

Working citizens are understood as persons (Article 7 No. 167-FZ), which include those working under an employment contract, including heads of organizations who are the only participants (founders) and members of organizations. THAT. they are subject to the compulsory pension insurance regime, and upon payment of insurance premiums they acquire pension rights.

Taking into account the above, persons in the category under consideration are classified as employed and must submit the SZV-M form to the Pension Fund on a monthly basis, even in the absence of accrual of insurance contributions.

Fresh materials

- Clarification on 4 FSS When it is necessary to adjust 4-FSS The calculation presented in the FSS in form 4-FSS does not need adjustments if...

- Social tax 2021 Tax accrualIn accounting, the amounts of advance tax payments are reflected in the credit of account 69 (68)…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Why do they buy gold? Selling gold competently is a process that will require you to spend some free time. It will be necessary to find out...

Filling out the SZV-M report. What information is required to be filled in?

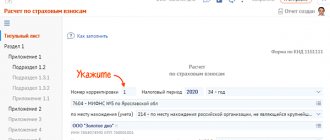

Reporting period

(filled in automatically by task name).01 - January, 02 - February, 03 - March, 04 - April, 05 May, 06 - June, 07 - July, 08 - August, 09 - September, 10 - October, 11 - November , 12 – December.

Form type (code)

. The type must be indicated: initial, supplementary, canceling.

- “out”

is the form that the policyholder submits for the first time during the reporting period; - “additional”

- if the policyholder decided to supplement or correct information that was previously accepted by the Pension Fund of the Russian Federation (for example, if the employer for some reason did not indicate information about one of the employees in the initial report);

It is possible

to send

a supplementary

SZV-M report to the Pension Fund - without selecting employees; -

only the FFU

, the same attribute will remain in the printed form. If you need to select employees, we follow the scheme (KOPF + upload). The “Additional” attribute can be specified in the second step generating a report. - “cancel”

- if the form is submitted to cancel previously submitted information (for example, a canceling form must be submitted if the policyholder in the original form indicated an employee who was fired before the start of the reporting period).

Policyholder details

(filled in automatically according to the Details). All details are mandatory: - registration number of the policyholder in the Pension Fund of the Russian Federation, - short name, - TIN and KPP.

Information about the insured persons

. — Full name (patronymic name is indicated if available); — SNILS (required); — Taxpayer Identification Number (indicated optionally, pulled from the employee’s card if filled out).