Author: Ivan Ivanov

Accounting is a system of analytical collection, registration and synthesis of information about all business transactions carried out by an enterprise.

The balance sheet (“turnover” in accounting language) is a register that combines and systematizes all accounting information in one document.

How to understand the information that OSV provides, and what information does each line of this form contain?

Basic rules for drawing up a balance sheet

Today, there is no standardized, obligatory sample of this document, so it can be drawn up in free form or using special templates. Sometimes companies develop their own statement forms (based on their own needs) and subsequently print them in a printing house.

At first glance, the balance sheet may seem like a simple set of numbers divided into different columns. However, in fact, it is a clearly structured summary table into which information is entered on various transfers, economic and financial operations of the enterprise, including such as writing off production costs, calculating taxes, calculating depreciation, generating reports, etc. .

The document always indicates

- name of the enterprise or organization,

- whose accounting department generates the document,

- account numbers (sometimes with their decoding),

- specific amounts.

An important condition: if compiled correctly, the final numbers in all columns of the statement must match.

The balance sheet belongs to the category of regular documents and is compiled, as a rule, once a month in a single copy.

It is not necessary to sign the document, but if necessary, it must be certified by the employee who was involved in its preparation or verification (for example, the chief accountant). Likewise, there is no need to put a stamp on the document.

Balance sheets, like any other accounting documents, must be kept for at least five years.

Indicators

“Turnover” allows you to conduct a detailed analysis of the information collected on accounting accounts in the shortest possible time. Before starting to consider SALT, you need to study the structure of the accounting (NU) accounts.

There are three groups of accounts: active, passive and active-passive. The procedure for collecting and systematizing for a particular group is individual. To correctly understand the information from the statement, you need to know the parameters for maintaining accounts, which of them may have a balance, and which must certainly be closed within a certain period. For example, account 20 must be closed monthly, accounts 90 and 91 do not require this procedure in the context of subaccounts, and, meanwhile, the final balance is not formed for them.

Timely verification of the correctness of the reflection of information makes it possible to eliminate errors and create a balance sheet that reflects the real picture of the organization’s financial position.

The main benefit of OSV is to speed up the reporting process, as well as to quickly provide information to external users.

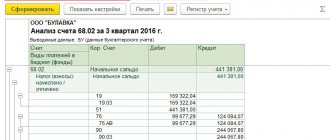

Sample of filling out the balance sheet

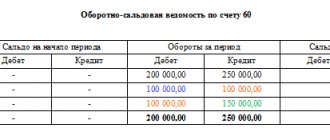

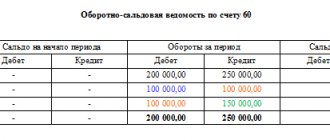

First of all, the statement must indicate the name of the enterprise for which it is being made. Next, enter the name of the document and the specific account for which it is drawn up. In this example, this is an account under code 60, which stands for “Settlements with contractors and suppliers.”

The algorithm for making entries in this sample balance sheet is not very complicated and is made in a certain order, based on the sequence of financial and economic actions performed.

EXAMPLE. Let's assume that the company transferred an advance payment in the amount of 100 thousand rubles to the counterparty. This operation was reflected in the document as an increase in receivable assets in the subaccount (line 60.1). Next, the counterparty provided the company with inventory in the amount of 150 thousand rubles. This operation is entered into the table as an increase in credit liability in subaccount 60.2. Then the enterprise pays the counterparty a partial cost of the goods and this is reflected in the statement as a decrease in liabilities by 100 thousand rubles in subaccounts 60.2 (in debit) and as a decrease in assets in subaccounts 60.1 (in credit). Thus, as a result, the enterprise owes the counterparty 50 thousand rubles during the period of drawing up the document, which is reflected in subaccounts 60.2 (on credit). Line 60 indicates the final total amounts.

Application

It was previously noted that the statement is a register of information about the facts of quantitative and qualitative changes in aspects of the company’s economic activities. Let us note several main functions of OSV:

- identifying inaccuracies and distortions in accounting;

- bringing together information about the state of the enterprise;

- source for assessing profitability;

- factor determining development paths;

- monitoring the correctness of accounting and accounting records;

- assessment of the company's profitability by external users;

- control over the distribution of cost indicators.

The statement can be compiled at any required time (per day, month, quarter, year), for a specific account or for a combination of several.

Restoring standard OSV settings

To set the default settings recommended by 1C, click on the Standard settings in the report settings form.

There are two options for standard OSV settings:

- A simple setting is the balance (balance), indicated as the difference of two components: debit balance and credit balance.

- A setting with an expanded balance is a balance (balance) made up of two components: a debit balance and a credit balance.

default setting is Easy Setup .

Verification of documents

Let's remember what the foundation of financial reporting is based on:

- primary documents on business transactions;

- accounting registers of a business entity.

Thus, before preparing annual reports, it is necessary to check the documents and accounting registers.

At this stage, the absence of documents on the transactions reflected in the program or, conversely, unrecorded transactions on the available primary documents is revealed.

The most common errors are made in the primary accounting documents “fixed assets” and “intangible assets”.

OSV: Compact

Large reports, which include the OSV report, may be inconvenient to work with in a standard form. They do not fit on the pages when printed, or on the screen when viewed: you need to move the mouse from one place in the report to another. As a result, something disappears from the review, and a complete picture does not emerge.

What to do here?

You can move report boundaries manually. To do this, you need to move the cursor to the border of the column, press the right CTRL on the keyboard and, without releasing it, move the mouse to the left if we want to reduce the width of the column, or to the right if to increase it.

By moving the boundaries, we get a more compact report.

However, each time a new report is generated, the boundaries have to be moved again. I would like to make sure that the resulting format is remembered by the program. Can this be done? Can!

Calling the Conditional Appearance settings

Open the Editing conditional design element by clicking the Show settings button - Appearance tab - Add.

Appearance tab

You put:

- Placement - Transfer .

- Minimum width — 9.

- Maximum width — 12.

This setting for all report columns will limit the column width from 9 to 12 characters. If the data does not fit into this format, it will be transferred to another line.

Generating a report

Let's generate a report using the Generate .

Saving the setting

Save the setting in the report options under the name OSV:Compact by clicking the Save settings .

Now, when you select this report, a report with the specified settings will be automatically generated.

Saving OCB settings

The report settings can be saved.

To do this, enter the report settings by clicking the Show settings .

In the settings form that opens, click on the Save settings .

The form for saving report settings consists of two parts:

- Tables with previously saved settings.

- Places to specify the name of the saved setting.

To save the settings you have made, specify the name of the report option in the Name of saved settings and click the Save .

Subtleties of forming turnover on account 01 in 1C

Postings in 1C on the turnover sheet are created on account 01 using the documents:

- Acceptance of fixed assets for accounting;

- OS transfer;

- Decommissioning of the OS.

When an object is registered for accounting, its initial cost is formed, which is accumulated in account 08.

Figure 1: acceptance of fixed assets for accounting

It includes all costs associated with purchase, delivery, installation and other activities at the time of commissioning.

The useful life of the object and the method of depreciation are also indicated. To do this, the document provides tabs: accounting and tax accounting. In NU you can change the way expenses are reflected. They are included in the cost or written off along with depreciation.

Figure 2: depreciation for account 01

When posting a document in the turnover sheet, the following transactions are created:

- Dt 01.01 Kt 08.04 for the amount of the accounting value of the fixed asset;

- Dt 02 Kt 20 for the amount of depreciation monthly.

If the equipment is used only in the office, then depreciation costs are written off to account 26.

In case of premature need to write off equipment, the document transfer of OS to 1C is used. This could be the sale of an object, damage or theft.

Figure 3: transfer of fixed assets for account 01

This document generates standard postings:

- Dt 91.02 Kt 01.09 for the sale amount;

- Dt 91.02 Kt 68.02 for the amount of VAT payable.

Based on the equipment transfer document, an invoice is generated for the buyer. And also in accounting, the amount of depreciation is adjusted and based on the results of turnover in account 91, the residual value of the object is formed.

Transferring the SALT report to an electronic archive

The generated OSV can be saved in an electronic archive, which is located inside the 1C database. This will allow you to return to the statement for previous years in the future without re-creating it in the program.

This is useful if there is a suspicion that someone posted documents from closed periods and the data in the SALT has changed.

Accounting expert8 advises saving the SALT in an electronic archive after the period is closed.

Saving in electronic archive

Generate a report using the Generate . Click the Accounting Register - Save button.

Reading from an electronic archive

To open already saved SALT reports in an electronic archive, click the Accounting Register - Open Archive button.

The program will open a list of saved reports for you to select.

Copying OSV settings by users

If several users work in the database, then you can exchange report settings with each other. This is done through the section Administration - Program Settings - Users and Rights Settings - Personal User Settings - Copying Settings.

The OCB report settings can be copied from the selected user to other users.

Learn more about Copying settings to other users

Accounting policy

The absence of any necessary elements in the accounting policies can lead to violations and incorrect calculations.

Let's consider several common mistakes made when drawing up accounting policies and their consequences:

- The company has chosen one accounting method, but carries out calculations using another. For example, material assets are written off using one method, but another is prescribed in the accounting policy; this will lead to incorrect calculation of costs.

- The methodology for maintaining separate accounting is not reflected (clause 4 of Article 170 of the Tax Code of the Russian Federation). In accordance with Art. 149 of the Tax Code of the Russian Federation, in the presence of taxable and non-taxable transactions, it is necessary to keep separate records (specify which expenses of the organization are taxable and which are non-taxable). For companies engaged in exports, using a 0% rate, it is also necessary to maintain separate accounting, and its methodology must be reflected in the accounting policy (clause 10 of Article 165 of the Tax Code of the Russian Federation). The absence of a methodology in accounting policies will lead to the loss of these expenses and deductions; tax authorities simply will not take them into account.

- The methodology for calculating work in progress is not prescribed. Art. 319 of the Tax Code of the Russian Federation states that if the taxpayer cannot clearly keep records of objects and distribute direct expenses under contracts, then he must establish in his accounting policy a reasonable calculation of work in progress and follow it.

The absence of this clause will lead to the tax authorities establishing their own procedure for calculating the “incomplete”.

The answer to the question “What to check before submitting reports?” neither in the Federal Law dated December 6, 2011 No. 402-FZ “On Accounting”, nor in the Regulations on Accounting and Reporting in the Russian Federation (approved by Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n), nor in the accounting standard - PBU 4 /99 “Accounting statements of an organization” (approved by Order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n) - no.

However, preparatory measures are necessary to avoid the application of another standard - PBU 22/2010 “Correction of errors in accounting and reporting” (approved by Order of the Ministry of Finance of the Russian Federation dated June 28, 2010 No. 63n).

Analyze your accounting policies and, if necessary, make additions to them. Accounting policy is the fundamental document on the basis of which the company’s accounting records are maintained and financial statements are generated.

How to compose

There are three types of document , differing in the type of preparation:

- Compiled according to analytical accounts.

- Statements filled out based on the sum of the values displayed in synthetic accounts.

- Combined type statements compiled according to the two types of statements indicated above.

Completing the first type of document may vary significantly in different organizations. What exactly will a classic SALT document on analytical accounts look like? A regular document drawn up for a passive or active account usually consists of several points :

- The name of the account in question.

- The balance that accounts for credit and debit at the beginning of the month.

- Turnovers carried out on the same credit and debit throughout the entire month.

- Balance at the end of the month.