In many organizations, funds are transferred or transferred to employees on account, for example, to purchase some materials, or to go on a business trip, etc.

After using the accountable funds, the person is required to provide an advance report indicating the expenses incurred, taking into account the purposes for which the accountable funds were provided.

Below we will consider individual issues relating to the advance report and the return of imputed amounts. Our labor dispute lawyer will help the employee or employer in the process of collecting accountable amounts: professionally, on favorable terms and on time.

What to do if an employee does not report on time?

First of all, you should not rush to classify accountable amounts that are not returned or confirmed by employees within the established time frame as the income of these employees.

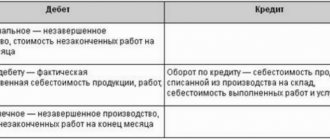

Without an advance report and (or) without depositing unspent accountable money into the cash register (to the current account) of the enterprise, only a debt can be recognized for the employee.

Moreover, this debt arises the next day after the expiration of the period provided for confirming the expenditure of accountable funds. Those. after 3 working days, counting from the moment:

- the end of the period for which accountable money was issued;

- or from the day you start work.

It is at this moment that the debt is recognized, but not the income of the accountable person!

For example, an employee was given funds to purchase office supplies on July 12 until July 18. Thus, he must submit the advance report by July 21 inclusive. And if he does not submit the specified document, then from July 22 this employee is in debt.

The most interesting thing is that even the Directive of the Bank of Russia No. 3210-U directly recognizes accountable amounts not returned by employees on time as only debt. In paragraph 3, clause 6.3, Directive No. 3210-U says that cash can be issued on account only if the employee fully repays his debt (!) for previously received accountable money.

Based on letter No. SA-4-7/23263 of the Federal Tax Service of the Russian Federation dated December 24, 2013, personal income tax is withheld from accountable funds for which the employee did not report on time. But the question is, at what point is personal income tax withheld?

Many companies believe that this moment occurs immediately after the expiration of the period provided for the provision of an advance report. But that's not true! After this period, the employee is recognized only as a debt to his company, for the collection of which all measures must be taken.

In particular, to begin with, it is worth reminding the employee in writing of his obligation to submit an advance report and (or) deposit the balance or the full amount of money issued against the report into the enterprise’s cash desk (to the current account).

In addition, you should sign a reconciliation report with the employee regarding such debt. This correspondence between the company and the employee is evidence that the company has made an attempt to resolve the matter.

And then the employee either reports or writes an application with a request to withhold the debt on accountable amounts from his salary. Or the company sues its employee!

Grounds for issuing money on account

Basically, the employee is allocated certain funds in advance to make expenses in the interests of the company.

In order to receive these funds, you must present one of the documents provided for by local regulations:

- order (instruction) of the head

- a person’s application to receive an accountable amount, written in any form, signed by the manager

This document should reflect:

- purpose of issuing money

- Full name of the employee to whom the funds should be issued

- sum

- the period for which the funds are issued (important for drawing up the employee’s report)

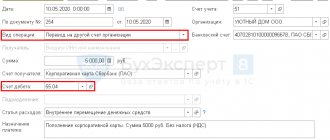

Funds cannot always be issued immediately (if issued in cash through a cash register) due to lack of funds, cash balance limit, but the money will be issued within a certain period. Today, accountable amounts are in most cases transferred to a bank card.

What to do if an employee submits an advance report without supporting documents?

Late submission of an advance report is a minor nuisance for an accountant. But what to do if this report does not contain primary expenses confirming? How to write off accountable amounts without documents?

According to the letter of the Federal Tax Service of the Russian Federation No. SA-4-7/23263 dated December 24, 2013, if an employee, having received money on account, did not provide documentary evidence of the expenditure of the specified amounts, then, on the basis of clause 1 of Article 210 of the Tax Code of the Russian Federation, the specified funds are to the extent that they are not confirmed by documents, are included in the income of the reporting person and in the tax base for personal income tax. But this is only possible if the employee did not solve the specified problem - and did not take care of restoring the original documents.

In a similar manner, many companies decide the fate of those accountable amounts, the expenditure of which was confirmed by documents that cannot be legally recognized as primary.

In accordance with Article 9 of Federal Law No. 402-FZ “On Accounting”, the primary documents used to document all business transactions must contain a closed list of mandatory details. And if at least one of the specified details is missing, then the document cannot be recognized as primary and serve as the basis for recognizing expenses and confirming the funds spent.

This means that an advance report, accompanied by such documents, can be approved by the management of the enterprise for an amount less than what the accountable person spent. Those. within the limits of those amounts that are confirmed by correctly executed documents.

As a result, the employee develops a debt to the company, but until the employee himself makes attempts to eliminate it. For example, require suppliers or contractors to provide correctly executed documents.

However, the issue of incorrect execution of primary documentation accompanying the expense report is quite controversial:

- Documents are attached to the expense report as proof only of the payment made by the employee (!) for goods, work, and services. Such evidence is primarily served by strict reporting forms and cash receipts provided for cash payments. At the same time, these documents must comply not with the requirements of Law No. 402-FZ, but with Law No. 54-FZ of May 22, 2003 “On the use of cash register equipment.” And such compliance will be sufficient to recognize the obligations of the accountable person as fulfilled, even if the invoices and other forms attached to these payment documents were prepared in violation of Article 9 of Law No. 402-FZ;

- In order to accept payments made by an accountable person as expenses, payment documents alone are not enough. This will require other documentation, which clearly shows the relationship between expenses and the business activities of the enterprise. This conclusion was made in letter No. ED-4-3/11515 of the Federal Tax Service of the Russian Federation and in Article 252 of the Tax Code of the Russian Federation. But this conclusion does not apply to confirmation of the fact of payment reflected in the advance report. Even if this report is not accompanied by invoices, but only cash receipts, then the checks alone will be enough for the accountant to accept the expense report. He can request the remaining documents to acknowledge the expenses himself or oblige the accountable person to do so. As a result, taxable personal income tax does not arise if only payment documents are attached to the advance report, and even the debt of the accountable person to the enterprise does not arise. But the primary document (invoices and other documents) drawn up in violation of Law No. 402-FZ only affects the possibility of recognizing expenses as expenses for accounting and tax accounting purposes.

It’s another matter when an employee has no documents at all that would confirm the expenditure of accountable amounts. And even an advance report submitted on time does not matter. In this case, the enterprise must:

- first try to restore the primary account to the expense report;

- if this fails, then the debt owed to the employee must be recognized at the end of the period during which the advance report should have been submitted;

- then make every attempt to collect the debt from the employee;

- if it was not possible to collect funds even through the court, then this debt should be recognized as hopeless and written off as a loss;

- and only after this does the employee have taxable personal income tax income!

Tax consequences for paying insurance premiums

The object of taxation with insurance premiums is payments and other remuneration accrued by payers of insurance premiums in favor of individuals under employment and civil law contracts, the subject of which is the performance of work, provision of services, as well as under contracts of author's order, agreements on the alienation of the exclusive right to works of science , literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art.

Money issued on account and not promptly returned by the employee (and not collected by the employer) is neither a type of remuneration for labor, nor any other payment (including of a social nature) provided for by the employment contract. Consequently, additional assessment of insurance premiums for these amounts is unlawful.

This is confirmed by arbitration practice (Resolution of the Federal Antimonopoly Service of the West Siberian District dated February 18, 2008 N F04-914/2008(515-A67-25)). Despite the fact that the Resolution deals with the unified social tax, the conclusions it contains, in our opinion, can be extended to insurance premiums paid in accordance with Law No. 212-FZ.

Yu.A. Suslova

Auditor

LLC "Audit Consult Law"

How to determine the end of the statute of limitations?

For the purposes of writing off debt and calculating personal income tax, it is very important to understand when the statute of limitations expires:

- First of all, you need to set the date from which this period begins. The countdown begins from the date that follows the last day intended for repayment of the debt (Article 191 of the Civil Code of the Russian Federation), i.e. for submitting an advance report and final settlement of accountable amounts. To do this, it is worth looking at the application of the accountable person, which he filled out to receive the specified funds. 3 working days are added to this number and after the end of this period the claim period begins;

- as soon as the beginning of the limitation period is determined, 3 years should be counted from this date;

- it is necessary to take into account any circumstances that could entail an interruption of the limitation period. For example, an employee acknowledged a debt in writing without paying it off. And from the moment the employee confirms his obligation on the basis of Article 203 of the Civil Code of the Russian Federation, a new statute of limitations begins to run. In this case, the time that has already passed before the break of the term is not counted towards the new term;

- upon expiration of the limitation period, it is necessary to conduct an inventory of debts, confirming its results with an Inventory Act.

The inventory itself must be carried out on the basis of an order from the head of the enterprise (for example, according to the INV-22 form, approved by the State Statistics Committee of the Russian Federation in Resolution No. 88 of August 18, 2009), and the results of the inspection can be documented using the INV-17 Act. Documents confirming the debt should be attached to this Act:

- reconciliation acts signed by both parties to the dispute;

- correspondence with the debtor-employee;

- advance report (if any), and other documents that indicate the existence and amount of debt.

And only then can you write off the recognized bad debt from the company’s balance sheet and charge personal income tax!

But if the accountable person has not confirmed his travel expenses, a completely different procedure for calculating personal income tax applies.

Accountable person – director

It can be issued either according to the unified form No. AO-1 (Order of the State Statistics Committee of Russia No. 55 dated 01.08.2001), or in an arbitrary manner established by the institution, subject to the provisions of clause 2 402-FZ dated 06.12.2011.

It does not matter whether the employee received the advance amount in cash or by transfer to a card; in any case, he must draw up an AO within the allotted three-day period.

The deadline for reporting on accountable amounts for 2021 is 3 business days.

What to do if the employee has not confirmed his travel expenses?

This is the case when the employee did not provide documents - neither payment nor confirming expenses in connection with renting housing during a business trip. How can you write off exactly these accountable amounts without documents?

First of all, for the purposes of calculating taxes on enterprise income, expenses must be documented. This cannot be done without documents. Therefore, in particular, travel expenses, named in paragraph 12 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, can be recognized when calculating the taxable base only if they are documented.

As for personal income tax, the absence of any documents confirming payment for rental housing during a business trip entails inclusion in the employee’s taxable income:

- amounts that exceed 700 rubles for each business trip day, if the business trip was within the country;

- amounts exceeding 2,500 rubles for each day of a business trip outside the Russian Federation.

This is permitted by the Tax Code of the Russian Federation in Article 217 (paragraph 12, paragraph 3).

But the question is, when exactly should this debt be recognized? In this regard, the Ministry of Finance of the Russian Federation at one time defended the opinion that a traveler’s income arises when he is paid a daily allowance in excess of the standard (Letter of the Ministry of Finance of the Russian Federation No. 03-04-06/6-135 dated June 25, 2010).

However, at the time of issuing travel allowances, it is still impossible to say whether the employee will confirm the specified expenses with documents or not. This will become known only after they submit the advance report.

For the purposes of recognizing these excess payments as subject to personal income tax, it should be taken into account that according to Article 223 of the Tax Code of the Russian Federation (clause 6, clause 1), the date of actual receipt of such income is recognized as the last day of the month in which the advance report of the traveler was approved ( namely, approved by the head of the company, and not handed over by an accountable person! ). Thus, the calculation of personal income tax must be carried out on the day of actual receipt of taxable income (in accordance with paragraph 3 of Article 226 of the Tax Code of the Russian Federation). Those. on the last day of the month.

But paragraph 4 of the same tax article 226 states that the withholding of the calculated personal income tax must be carried out at the time of actual payment of income. And in the case of undocumented travel expenses, at what point should tax be withheld if there is no payment of income?

Excess travel amounts are recognized at the time of approval of the advance report of the accountable person, when the amount of his debt to the employer is clearly visible. In fact, in this case no income is paid. This means there is nothing to withhold personal income tax from.

Especially in paragraph 4. Article 226 of the Tax Code of the Russian Federation directly states that personal income tax is withheld directly from the income of the taxpayer (i.e., the accountable person), and paragraph 9 of Article 226 of the Tax Code of the Russian Federation also states that a tax agent does not have the right to pay personal income tax for his employee at his own expense. budget.

Thus, personal income tax on above-limit business trips should be withheld at the earliest date of salary payment (a similar opinion was expressed by the Ministry of Finance of the Russian Federation in letter No. 03-04-06/4-5 dated January 14, 2013).