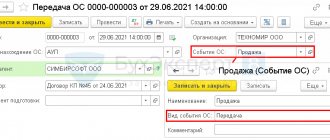

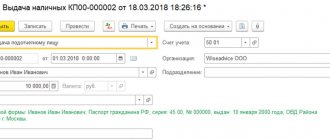

To register a transaction for the sale of a fixed asset, a number of documents are provided in the 1C 8.3 Enterprise Accounting 3.0 software product.

Let's consider step-by-step instructions for two cases in which a transaction for the sale of a fixed asset arises:

- The fixed asset item was accepted for accounting without applying a depreciation bonus.

- The fixed asset was accepted for accounting using bonus depreciation.

Fixed asset or product - when the difference becomes clear

The status of accounting objects and the rules for working with them are determined primarily by the relevant provisions and accounting standards (PBU and FSBU).

According to PBU 6/01 “Accounting for fixed assets”, approved by order of the Ministry of Finance dated March 30, 2001 No. 26n, one of the criteria for classifying an object as a fixed asset (hereinafter referred to as fixed assets) is that the organization does not intend to use it in the future for resale (Clause 4 PBU 6/01). Important! PBU 6/01 is canceled from 01/01/2022. Instead, two new FSBUs are being introduced: 6/2020 “Fixed Assets” and 26/2020 “Capital Investments”. ConsultantPlus experts explained in detail what the new standards will change compared to PBU 6/01 in their Review, which you can view for free after receiving trial access to K+.

Read more about accounting for fixed assets in the material “Fixed assets in accounting (nuances).”

The main characteristic of goods, on the contrary, is their intended purpose for sale (from 01/01/2021 - sub-clause “d” of clause 3 of FSBU 5/2019, until 01/01/2021 - clause 2 of PBU 5/01).

And the main distinguishing feature of a fixed asset is that this object can bring economic benefits to the organization for a long time (more than 12 months).

Thus, if we are talking about a newly acquired object of “long-term use,” then the question of which category it should be classified in comes down only to the presence or absence of the organization’s intention to resell it in the future.

But the intention can change. At the time of acquisition, the organization intended to use the facility for its activities, but then market conditions changed, the owners had other plans for business development, etc.

This means that this property needs to be sold. But the sale process may be delayed, and during the period of searching for buyers, the object will no longer be an asset that brings benefits to the organization. So why should it be considered a fixed asset and subject to property tax all this time?

Let's consider different views on this problem.

We remind you that movable property is not currently subject to tax. Therefore, all further explanations are relevant in relation to immovable fixed assets.

Sales of fixed assets

Vladimir FEDOROVYCH, expert "PBU"

Among the methods of disposal of fixed assets, accounting methodologists mentioned their sale (clause 30 of PBU 6/01 “Accounting for fixed assets”). Moreover, this is one of the most common methods of departure. Sales can be made both to individuals (your employees or other individuals) and to third-party organizations. When performing such a transaction, the organization:

- firstly, it gets rid of property that is obsolete or cannot be used for business activities;

- secondly, he still receives some income (compared to the option of disposing of the object due to its liquidation), and in some cases, profit.

Accounting

When disposing of a fixed asset, paragraph 29 of PBU 6/01 requires writing off its value from accounting. When an object is disposed of as a result of its sale, the proceeds are taken into account in the amount agreed upon by the parties in the contract.