If you think that assets are just property and haven't thought about why assets are equal to liabilities, it's worth reading!

Hi all! With you is Alexey Ivanov, the knowledge director of the online accounting “My Business” and the author of the telegram channel “Accounting Translator”. Every Friday on our blog on Klerke.ru I talk about accounting. I started with the basics, then I will move on to more complex matters. For those who are just preparing to become an accountant, this will help them get to know the profession better. Seasoned chief accountants should look at familiar categories from a different angle. Today we will understand the concepts of assets and liabilities.

What are non-current and current assets of an organization

By the company's assets, namely by their condition, structure, volume, one can judge the sustainability of the business and the market value of the enterprise; the tax base also depends on them. In addition, it is important to understand that they represent the property of the enterprise, that is, financial, tangible and intangible values. The totality of assets is the property of a company through the use of which it is possible to generate income. Equity is the difference between a firm's funds and its financial liabilities.

Let us make a reservation that if an enterprise operates under a simplified taxation system or pays tax on imputed income, the cost of its funds and the tax base are not related to each other. But even in these cases, it is advisable to take into account the organization’s resources in accounting, since violation of the framework of the mentioned taxation systems (annual income, number of employees, etc.) leads to the transition of the enterprise to OSNO.

All property of the organization includes non-current assets and current assets.

Current assets participate in the production cycle for a year and no more. They completely transfer their value to finished products in a year, usually this includes raw materials, materials, money in the cash register, in the current account, and short-term financial investments.

Non-current funds are those that are used for more than a year. Their cost is transferred to the finished product in parts. It is important to have an understanding of this concept when determining the tax base. This type of company funds is most fully reflected in accounting documents. In practice, this includes all types of property with a useful life of more than a year and a value of more than 15 tax-free minimum incomes of citizens.

Top 3 articles that will be useful to every manager:

- Financial control at the enterprise

- Net profitability of the enterprise

- How to build a company's financial structure

What points should you pay attention to when preparing accounts? balance

Filling out the book form. balance sheet is often accompanied by erroneous entries, omissions, and inaccuracies. Typically, sections I and II are no exception. And this is where accountants make mistakes.

The most common mistake is to display the OS and ON at their original cost. Such an entry will be considered incorrect, since both indicators are the balance sheet must be adjusted by the amount of depreciation charged on each of these assets.

When recording data on financial investments (including section I, p. 1170), it happens that they include interest-free loans. Meanwhile, it is necessary to display them according to “receivables” and taking into account the actual repayment periods.

And one more minor, but very important nuance. All negative indicators (amounts with a minus sign) must be written in parentheses, but without the minus sign. The presence of this very “minus” makes the entry incorrect.

All articles are accounted for. the balance sheet must contain accurate information. It should be understood that if there are errors in it, then the balance for this period most likely will not converge. This means that it will have to be at least double-checked, and the data is not correct. restore accounting.

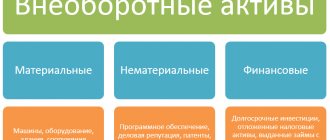

What do non-current assets of an organization include?

They consist of:

- fixed assets;

- intangible resources;

- unfinished capital investments;

- equipment and machinery;

- long-term financial investments;

- other varieties.

The use of non-current assets in operating activities has its disadvantages and advantages.

Advantages:

- Low exposure to inflation.

- Reduced commercial risk of losses during operating activities.

- The ability to consistently generate profits by ensuring the production of goods in accordance with market conditions.

- Reducing losses of inventory items during storage at their expense.

- Possibility of expanding production volumes when market conditions rise using existing reserves.

Flaws:

- They are subject to obsolescence, that is, they lose value even during temporary downtime.

- They are difficult to manage, since they are not subject to structural changes, which means that even with a temporary drop in market conditions, their useful life is reduced. This can only be avoided by the company producing other goods.

- Usually these are resources with low liquidity, in other words, they cannot play the role of a means of payment.

Non-current assets of the organization include:

- Intangible resources.

- Fixed assets.

- Long-term financial investments.

- Construction in progress.

| Intangible assets | Patents, licenses, registered trademarks, software, organizational expenses, etc. |

| Fixed assets | Land plots, environmental management facilities, buildings, structures, machinery, equipment |

| Construction in progress | Company expenses for the purchase/construction of fixed assets that are not yet fixed assets and cannot participate in the business process, that is, they are not subject to depreciation. This amount is included in non-current assets, since it is excluded from circulation |

| Long-term financial investments | Funds invested in financial assets that the firm intends to hold for more than a year. Namely: 1. Costs of equity participation in the authorized capital of other companies. 2. Shares and bonds purchased on a long-term basis. 3. Long-term loans, credits. 4. The cost of property leased under financial leasing rights for a long period of time |

Intangible assets

I want to pay a little attention to this aspect. When they talk about material values, this is understandable (they are listed above). What about intangibles? Anything that is not real. Let's get a look.

- Scientific developments, works of literature and other forms of art.

- Software of any kind.

- Patents for any inventions.

- Trademarks and brands.

- Trade secrets.

- Useful developments and developments.

- Image component (the brand itself is a valuable asset because it attracts customers).

How an organization acquires non-current assets

According to the value transfer method, non-current assets are of three types, and their cost is:

- It is reduced by transferring depreciation charges to the cost of manufactured products (machines, buildings, etc.).

- Decreases due to depletion (minerals, forests, etc.).

- Doesn't go down (ground).

In this case, we can talk about several acquisition methods:

- payment in cash to the seller;

- on credit;

- exchange for shares and other securities;

- construction for which the services of a contractor are used;

- barter exchange;

- self-construction.

Calculation of coefficient

Let’s say the company’s balance sheet contains the data shown in the table:

| Beginning of the reporting period (Q1 2015) | End of the reporting period (Q4 2015) | Calculation of coefficient (OA / VA) | |

| OA | 3250942 | 3750540 | 0,32 |

| VA | 10150784 | 9853816 | 0,38 |

The value of the coefficient at a level less than 1 allows us to assert the predominance of VA in the enterprise. At the same time, a slight increase in OA is observed. However, there is no talk of major changes in the capital structure.

With the help of Co/a it is convenient to control the capital structure of the company, achieving its optimal ratio. Due to the high share of OA, it is possible to expand VA (for example, build a new premises, create a logistics network, etc.). This will contribute to the expansion of production and, as a result, an increase in OA at the enterprise. Understanding the importance of regulating the size of assets allows you to choose the most correct strategy for running a business.

More information about the composition of the organization’s non-current assets

Tangible non-current assets.

These include:

- land;

- buildings (main and non-permanent), structures;

- machines, machine tools, equipment, complex office equipment, instrumentation, vehicles;

- furniture, office equipment, tools with a service life of more than a year;

- unfinished capital construction;

- animals and perennial plants;

- trade equipment (counters, cash registers, showcase refrigerators, etc.);

- equipment along with spare parts that was purchased but not installed;

- property leased/rented;

- library collections;

- other material resources.

A company's assets can be considered non-current if their value can be determined. Also, these resources must comply with the established cost limits - it must exceed 10,000 rubles. Without this, such assets are defined as “low value”, and, even if they last more than a year (for example, a telephone), they are accounted for as current assets in the form of inventories. When recording land plots, their market price at the time of the transaction or cadastral value is used; for buildings and structures, the purchase/construction price is used.

Unfinished capital structures, as well as uninstalled equipment, are accounted for at the market price and the costs of delivery, construction, and project preparation. Furniture, tools, and trade inventory are taken into account at the purchase price. The cost of animals and perennial plantings is somewhat more difficult to estimate, so it is discussed in detail in specialized sources such as cxychet.ru, consultant.ru.

The cost of the organization's fixed assets and non-current assets is gradually transferred to products and reduced annually by the amount of depreciation. The depreciation period, and therefore the amount that is included in the cost price and by which the value of the objects is reduced, is established by law.

Residual value is the difference between the original cost of an object and depreciation over the period of operation. Depreciation is not charged for unfinished construction and uninstalled equipment. Other non-current assets include costs for land reclamation and major repairs that change the value of objects.

There are such ways to obtain these resources: purchase, receipt as a gift, exchange, or formation at the expense of own/borrowed funds or authorized capital. Sometimes fixed assets are a contribution to the authorized capital of a new joint-stock company, then they are necessarily recorded in the constituent documents.

Management of non-current assets of the organization

Operating non-current assets need to go through three stages to complete the value circuit:

- Fixed and intangible assets during use and wear transfer part of the cost to finished products. This process continues over a number of operating cycles until certain types of resources are completely worn out.

- When selling products, depreciation accumulates in the form of the company's depreciation fund.

- The funds of the depreciation fund are part of the organization's own capital. Non-current assets are restored at the expense of this reserve: current and major repairs, acquisition of similar new assets, etc.

The time it takes for the entire cycle for specific types of operating non-current assets indicates their service life. To calculate the latter, use the following formula:

where POva is the time of full turnover (service life) of specific types of operating non-current assets, measured in years;

Na is the annual depreciation rate as a percentage.

The features of the cost cycle of operating non-current assets are taken into account when building the management of these long-term assets of the organization. Although operational non-current resources are divided into a large number of separate types and groups, the goal of financial management in this area is quite simple - to ensure their timely renewal and the most effective use.

Valuation of an organization's non-current assets

The assessment can be made based on:

- Actual cost, in other words, the amount paid in cash or cash equivalents - this includes the costs of purchasing, delivering and installing non-current resources.

- Salvage value, that is, the net value remaining after the end of its useful life (less disposal costs).

- Book value, or at the value indicated on the balance sheet.

It is important to understand that these resources wear out during use. It is customary to distinguish the following wear options:

- Physical. Occurs due to the mechanical load on the equipment during operation.

- Moral. It is the result of scientific and technological progress and can arise due to an increase in labor productivity in industries producing equipment, or due to an increase in the productivity of the equipment itself.

- Social. The use of some non-current assets leads to an increase in the harmfulness of work, the level of industrial injuries, and occupational diseases.

- Ecological. Regardless of age, some of these resources cannot be used as they can harm the environment.

All of these changes lead to a decrease in the value of non-current assets. But it cannot completely disappear, because then the organization loses the funds previously invested. This means that the price of non-current assets is transferred to the cost of the produced goods. This principle is hidden under the term “depreciation”.

To register and evaluate non-current assets of a budget organization, methods based on cost and natural values are used. The first includes the initial price, the balance, manipulations to restore the value and the final price.

- When introducing a product to the market, it is valued at the initial price, that is, the total cost of purchasing, manufacturing, delivery, and installation of the product. The initial cost of the product may change if it is further improved and restructured.

- The remainder is the difference between the initial price and depreciation. In accordance with this value, it is customary to indicate the cost of goods in the organization’s balance sheet.

- Price restoration manipulation is the process of determining the initial cost of a product after the valuation procedure. The price of a product on the market implies the amount that the client is willing to pay for it.

- The final price, that is, the price category regulated by a special commission, if it is necessary to determine the possibility of bankruptcy of the company or if it is required by the management of the organization.

To calculate the fixed assets of an enterprise, a value such as an inventory item was adopted.

Before an organization begins to make a profit from a non-current asset, it needs to contribute funds for its acquisition/improvement. Expenses required by the organization's non-current assets are placed in the loan column. These include:

- settlements with suppliers;

- payment for transportation of the object, its improvement;

- the amount paid in accordance with the construction contract, if we are talking about construction;

- payment for consultations necessary to purchase assets;

- customs duties;

- payment for the services of intermediary companies.

REMEMBER! This list only takes into account costs directly related to the purchase/production of assets.

Why count non-current assets? Their accounting pursues several tasks at once:

- calculation of the volume of tax deductions;

- determining the stability of the organization;

- tracking the dynamics of the company's development;

- calculation of own reserves.

IMPORTANT! The manager must analyze these indicators and their dynamics from time to time in order to more competently approach the development plan and see the strengths and weaknesses of the organization. Let's say that a decrease in indicators requires the search for additional sources to create new long-term assets.

How to calculate non-current assets of an organization

The main indicator when calculating non-current assets is profitability. It allows you to understand:

- quality of asset management;

- the effectiveness of their use for the purpose of generating income.

The following conditions allow you to achieve increased profitability:

- company profits are growing;

- the cost of goods and services has increased;

- reduced costs;

- asset turnover increases.

IMPORTANT! To calculate the return on non-current assets, you need to divide net income by average cost. The first is usually understood as revenue minus all expenses. All calculations are carried out in rubles, and the result is a coefficient that allows one to judge the efficiency of using non-current assets.

The organization's accounting policy regarding investments in non-current assets

Non-current assets are used in production, but are not consumed - we are talking about the company's fixed assets, objects and values.

The balance sheet begins with Chapter I “Non-current assets”, which is divided into 8 groups based on the possibility of alienation:

Art. 1110 – NMA.

Intangible, but they carry a certain value for the company. It can be:

- marks of goods or services;

- works of literature, art, scientific works;

- devices, inventions or creation of utility models;

- innovations, know-how, successes in breeding;

- brand, company image, provided that it can act as an object of sale.

Art. 1120.

Achievements achieved during the research and development process - taking into account the investments that led to the result.

This takes into account:

- the amount of assets spent on the purchase of material resources;

- payment of salaries to employees and service departments;

- social contributions (contributions, etc.);

- wear and tear of used equipment;

- the price of equipment, instruments, accessories required for the work;

- other costs.

Art. 1130 – OS.

Material assets that the company has used for production and management purposes for more than 12 months.

This includes:

- building;

- other buildings;

- Computer Engineering;

- equipment for various types of measurements;

- vehicles;

- instrumental basis;

- perennial plants;

- animals owned by the company.

Art. 1140 – Profitable investments in material assets.

They include funds provided by the enterprise to others to obtain benefits.

Art. 1150 – Cash investments of the company.

The organization's non-current assets placed in the "Company's Cash Investments" section are long-term investments whose duration exceeds 1 year. Their size is displayed at the end of the year, taking into account adjustment data. This is about:

- papers of material value;

- injection of funds into subsidiaries or authorized capital of other companies;

- loans to other organizations, deposits and receivables acquired as a result of the assignment of debt.

Art. 1160 – Deferred tax assets.

This is part of the income tax that has been deferred and allows you to reduce the amount of duty for the next period.

Art. 1170 – Other.

Here we record property that does not fit into any of the above groups, but is used for more than one year:

- investments in other non-current property;

- expenses calculated for a future period, such as a lump sum payment intended to pay a franchise;

- the total volume of advance payments intended for the construction of facilities included in the organization’s property and non-current assets.

Art. 1100 – Final indicators for section I.

This section involves calculating the amount of funds for this chapter. The information is provided for three periods on the last day of the calendar year - the reporting year, last year and the year before.

Results

The ratio of current and non-current assets shows which resources predominate in an economic entity.

Using the ratio in practice, an enterprise will be able to analyze which asset is most in demand for it, as well as identify unfavorable dynamics of resource flow. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.