The act of writing off fixed assets is a document that serves as the basis for deregistration of a fixed asset item. If a fixed asset is accepted on the basis of an acceptance and transfer certificate, form OS-1 and form OS-1a, then for disposal of the object the Ministry of Finance has developed unified forms of acts: form OS-4 - for one object, form OS-4a - for vehicles, form OS- 4b - for a group of objects.

and write-off acts can be found at the end of the article. How to fill out the form correctly? As an example, we will give the execution of an act, form OS-4.

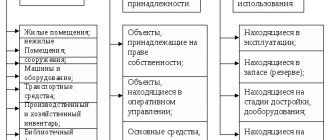

What are fixed assets

Fixed assets include any property of an enterprise used to carry out its activities: these can be materials, machinery, instruments, equipment, etc., in other words, everything that is involved in the labor process.

It should be noted that any inventory items acquired by an organization for work must be listed on its balance sheet. Once materials, equipment or machinery become unusable, they must be written off.

Read more about the article: what are fixed assets?

Procedure

In order to write off fixed assets, it is necessary to first establish their unsuitability for further use. For this purpose, the company creates a special commission, the main task of which is to certify the fact of a defect, wear, etc.

The commission must include at least three people, including the financially responsible person.

Most often, only full-time employees of the enterprise are included in the commission, but in some cases, these may also be third-party experts who have the necessary knowledge and skills to determine irreparable failure, for example, of particularly complex equipment.

After the property is declared completely faulty, the commission draws up a special act, on the basis of which the organization writes an order to write off fixed assets. This order, in turn, serves as the basis for drawing up a write-off act.

Why is the document needed?

The act of writing off fixed assets is the primary documentation confirming the removal of any property from the balance sheet of the organization. Drawing up the act will entail certain actions:

An appropriate mark will be placed on the inventory card for the assets that need to be written off.- The accountant creates transactions:

- for disposal of property

- to display costs associated with write-off of fixed assets

- on registration of components of a written-off object

- on displaying non-operating expenses (income) in tax accounting

What property is considered suitable for write-off?

Drawing up an act for write-off of fixed assets becomes necessary in the following cases:

- if you plan to sell the property of a legal entity

- The OS cannot be used in the future in the production activities of the enterprise due to physical or moral wear and tear

- in connection with the occurrence of an emergency, emergency situation and subsequent liquidation of the organization

- when transferring property to another company as a contribution to the authorized capital

- in case of transfer of the OS to another organization for further operation

- after identifying a property malfunction or its absence

In most cases, the need to write off property arises after it has broken down and there is no way to carry out repairs. To carry out the procedure, the head of the organization appoints a commission.

Commission conclusion

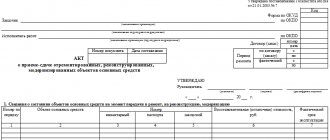

The responsibilities of the commission include inspecting the object to be written off and drawing up an act of form No. OS-4 in 2 copies. At the next stage, the documents are submitted to management for signature; without it, the acts are invalid. Next, one of the forms is sent to the accounting department, the other is transferred to the financially responsible employee.

In a number of situations, spare parts may remain from a decommissioned object, which can later be used in the company’s production activities. To do this, you will need to draw up another act and transfer the remaining parts for storage.

Rules for drawing up an act

When writing the act, you should adhere to certain recommendations:

- the front part of the form indicates the name of the enterprise, its details (TIN, KPP), the branch on the balance sheet of which the OS is listed

- at the next stage, the reason for the write-off should be justified; a link to the director’s order is indicated as supporting documentation

- Below is the full name of the financially responsible employee

- then on the right side of the form the following data is entered: OKPO code from the constituent documentation, date of removal of property from the balance sheet, date and number of the order justifying the write-off of fixed assets, personnel number of the employee who bears financial responsibility

- on the right side of the form there is a space for confirmation of the write-off procedure by the manager

- then in the corresponding line the act is assigned a number, the date of its writing and the reason for writing off are indicated

The next section of the act contains information about the object being written off (Table 1).

| Column number, no. | Description |

| 1 | the name of the OS is indicated |

| 2 and 3 | inventory and serial numbers respectively |

| 4 and 5 | date of production of the object and date of receipt on the balance sheet of the legal entity |

| 6 | You must enter the period during which the property was used |

| 7 | indicates the price of fixed assets on the day of placement on the balance sheet of the enterprise |

| 8 | amount of depreciation charges |

| 9 | the residual value is indicated (column 9 = gr.7 – gr.8) |

There are 2 tables on the back of the form. One describes the features of the operating system (for example, the presence of precious metals in the item being written off). Several lines are highlighted below in the form. They include the commission’s conclusion on the disposal of fixed assets. Then, if necessary, you can indicate a list of documentation attached to the write-off document.

Below, the commission members put signatures in the lines with their positions and full names.

The final table contains the following data:

- expenses incurred by the company to write off fixed assets

- spare parts from the decommissioned OS, remaining for further production activities

- the amount of money received from the sale of property removed from the balance sheet

The document is completed by the signature of the chief accountant of the enterprise.

Sample act for write-off of property

The law does not regulate the mandatory form of the form, so enterprises can develop their own sample. But organizations use the previously created form No. OS-4. A sample act of write-off of property is available on the website:

The document provides all the positions necessary to fill out. The form allows you to write off several objects at once.

Features of drawing up an act for the disposal of budgetary property

Budgetary enterprises in the process of registration and other transfer of fixed assets must be guided by the list of documentation determined by Instruction No. 62n, paragraphs 24, 25.

For example, certain forms are used to deregister food products and inventories (Table 2).

| Form number | Description |

| 0504202 | menu-requirement justifying the issuance of products |

| 0504203 | forage and feed distribution list |

| 0504210 | statement of issue of inventory materials for production needs |

| 0504230 | act on write-off of inventories |

| 0504143 | act on write-off of household and soft equipment |

If there is no standard form to reflect the movement of the OS, then you can use a non-unified document. But when entering information into it, you must be guided by Instruction No. 157n, paragraphs 6, 7.

Video about writing off budget property:

Thus, the fundamental documents for filling out the act are the manager’s order to write off and the primary documentation for registering the asset. If all sections of the act are filled out properly, then it will be easy to track the procedure for writing off property from the organization’s balance sheet.

How to draw up an act correctly

Today, the act of writing off fixed assets can be written in any form, however, most enterprise employees, in the old fashioned way, prefer to use previously generally applicable mandatory forms in their work. Their advantage is obvious: there is no need to rack your brains over the structure and content of the document, since all the necessary positions are indicated in it. Such unified forms also include form OS-4. This act can be filled out both when writing off one object or several at once.

Purpose, definition

Before creating any document, it is worth understanding the terminology. The technical condition report with a conclusion represents a form with a detailed description of the operating condition of the equipment. It indicates possible shortcomings and breakdowns of equipment. The document can be used to justify equipping an enterprise with new equipment and writing off obsolete models.

Inspection of the technical base on a regular basis requires documentation. An inspection report is drawn up.

The form is filled out by members of the commission from competent employees. If we consider the required columns in the form, experts highlight the need to indicate the serial number, year of manufacture and article number of the equipment undergoing diagnostics. Additionally, an authorized member of the commission must note the number of the technical unit received at the time of the inventory.

The document must be accompanied by the results of measurements and examinations that were assigned to assess performance. The section indicates the degree of suitability for use at the time of inspection. If obvious defects are identified, a representative of the commission indicates this with clarification of the possibility of repair and the required time to return to its former performance. Papers will be needed to evaluate non-working devices and determine the extent of defects. Experienced managers also schedule scheduled inspections of enterprise equipment to identify problems at the initial stage of their occurrence, which can significantly reduce the cost of equipment restoration.

This type of act allows you to perform several tasks:

- reflect the actual state of the equipment;

- identify deficiencies that need to be corrected;

- confirm the fact of verification;

- protect interests at court hearings;

- make a claim regarding the quality of services provided;

- resolve controversial issues.

Sample of filling out the OS-4 form

- At the beginning of the document, on its front side, the following is indicated:

- name of company,

- her TIN,

- checkpoint,

- the structural unit to which the written-off fixed asset belongs.

- Next, the basis for the write-off is written - here you need to put a link to some supporting document (usually an order from the manager) and the financially responsible person (only the employee’s full name is written here).

- On the right side of the form enter:

- OKPO code of the company (can be found in the constituent documents),

- date of write-off of fixed assets from accounting,

- number and date of issue of the document that became the basis for write-off,

- personnel number of the financially responsible employee.

- Below is the document number, the date it was compiled, and the reason for the write-off.

- On the right is a place for approval of the act by the director of the enterprise.

The next part is presented in the form of a table and relates directly to the property being written off:

- in the first column,

- in the second and third - inventory and serial numbers, respectively,

- on the fourth or fifth date of release of the product and the date of its acceptance onto the balance sheet of the organization.

- in the sixth column (i.e., the time that the property was actively used in work),

- in the seventh - the cost of the object at the time of its acceptance for accounting,

- in the eighth - the amount of accrued depreciation,

- in the ninth - residual value (the value in the last paragraph is the difference in indicators from the two previous columns).

Regulatory regulation

The required technical condition of various equipment is provided for by the standards. There is a specialized collection of standard formats for various acts - “Album of unified forms of primary documentation.” When drawing up documents of this type, they are guided by it. There are various sections included.

The technical condition report is drawn up according to precisely regulated rules. Deviation from them may be grounds for declaring the document invalid. As you can see, it is required not only to know, but also to follow the correct order. The sample act has the following positions in the order of writing:

- Contact the manager. The text of the appeal should be located in the upper right corner. Be sure to indicate the position, name of the organization and the initials of the manager in the genitive case.

- Title columns. In the center of the page indicate the name of the form (Act), the essence of the problem (technical condition of the equipment). All words are written in one line. The use of abbreviations and additions is prohibited.

Next, indicate the serial number of the document and the date the form was filled out. The date form is day, month and year. The day of the month and year are written only in Arabic numerals, and the name of the month is written in words.

- Reasons for drawing up the document. List all the reasons for passing the inspection, indicating the name and number of the document being drawn up. Next, the composition of the commission and the competent persons who will carry out diagnostics of the equipment are prescribed.

- Justification for the commission's actions. This part briefly describes equipment problems, indicating the article and inventory number of the equipment being tested at the time the paper was compiled.

- Expert opinion. The block must contain the conclusions of the commission based on the results of the inspection. Here it is permissible to express a personal opinion on the problem and indicate recommendations for eliminating the identified shortcomings.

- List of applications. Members of the commission list supporting documents that can confirm the reality of the audit and its results. Only original forms are used. If equipment breaks down, the form is supplemented with a conclusion about the fact that the equipment has been written off.

- Witnessing. The form must be signed by all members of the commission. Positions held are indicated next to each name. The document will be valid only after being affixed with the organization's seal.

This is an approximate procedure for filling out and appearance of the technical report form. During the inspection, those present have the right to express a personal opinion about the causes of malfunctions and how to eliminate them, and also determine the decommissioning of equipment.

The act is drawn up in one copy, but if necessary, it is allowed to use copies.

Sample of filling out the reverse side of the OS-4 form

The reverse side of the act also contains two tables. The first contains individual parameters that serve as part of the characteristics of the object, including information about the content of precious metals.

Below the table there are several lines in which the commission taking part in the write-off of fixed assets makes its conclusion (in this case, on the write-off).

If necessary, a list of additional documents accompanying this act is indicated.

Then the commission puts its signatures next to the indicated positions with their full names.

The last table includes information about:

- expenses incurred for write-off of fixed assets,

- remaining inventory items suitable for further use,

- funds proceeds from the sale of written-off property.

Finally, the act is certified by the signature of the organization’s chief accountant.

Repair, modernization and reconstruction

In order for the OS to be used for a long period, it must be repaired. During repairs, the characteristics of the object are not improved, but only its viability is maintained. Repair costs are considered expenses of the current period in both accounting and tax accounting (clause 1 of Article 260 of the Tax Code of the Russian Federation).

Modernization or reconstruction of equipment is carried out in order to improve its performance, power, increase its useful life or change its purpose. The costs of such work are taken into account as capital investments and increase the cost of the facility being modernized (clause 27 of PBU 6/01, clause 2 of Article 257 of the Tax Code of the Russian Federation).

Depreciation on reconstructed or modernized equipment continues to accrue throughout the entire period of work. But if modernization and reconstruction work continues for more than 12 months, then depreciation should be stopped until the work is completed (clause 2 of Article 322 of the Tax Code of the Russian Federation).

Sample order for modernization of fixed assets

How to correctly draw up an act of write-off of fixed assets in the OS-4 form

The act can be filled out manually or on a computer.

There is only one important condition: it must contain the original signatures of the head of the enterprise, as well as members of the write-off commission.

There is no strict need to certify the form with a seal - as of 2021, legal entities are exempted by law from the obligation to use various types of cliches and stamps in their work.

The act is drawn up in at least two copies :

- one of which is transferred to the accounting department of the enterprise, so that in the future, on its basis, the accountant can reflect the write-off of the property specified in the act,

- the second remains with the financially responsible person, who then gives it to the warehouse in order to either dispose of the fixed asset or sell it.

If necessary, additional copies of the act can be created.