An ordinary desk audit of the VAT declaration submitted at the end of the next quarter may turn into an unpleasant “surprise” for a company or individual entrepreneur. The fact is that tax authorities not only verify information about taxes and deductions within the enterprise, but also compare it with the declarations of counterparties, and the verification program used finds discrepancies due to any errors made by both parties. The result may be receiving a request from the Federal Tax Service to clarify the declaration data, submit a package of primary documents, and even refuse a tax refund. Let's try to figure out how an enterprise should act if the VAT reconciliation with the counterparty reveals inconsistencies due to the fact that the counterparty did not pay VAT.

As it was before

Before the introduction of the mentioned norm in the Civil Code of the Russian Federation, VAT, the deduction of which was denied, could not be recovered from the counterparty - the courts did not recognize such a right. The arbitrators indicated: the taxpayer receives a deduction if all conditions specified by law are met and does not have the right to shift responsibility for the refusal to his business partners . The requirement to receive a tax deduction can only be presented to tax authorities who refused to recognize it, and the counterparty has nothing to do with it (resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 23, 2013 No. 285213 in case A56-45502012, resolution 9AAS dated March 19, 2015 No. 09AP-605415) .

At the same time, the arbitrators pointed out that Article 15 of the Civil Code of the Russian Federation, which talks about compensation for losses, cannot be applied to tax relations related to the refund of VAT from the budget. In addition, the fact that the tax authorities refused to accept a deduction due to the actions of the counterparty does not mean that they were illegal.

As a result, additional charges of VAT, other taxes, as well as penalties and fines that the company received due to the dishonest actions of the counterparty were not recognized by the courts as losses subject to compensation by the other party to the transaction.

About coordinated actions with the counterparty

If a company is deprived of the right to deduct VAT, but it:

- did not pursue the goal of tax evasion as a result of actions coordinated with other persons, and in the absence of such a goal, did not know and should not have known about the violations committed by these persons,

- acted within the framework of behavior expected from a reasonable participant in economic transactions.

And this means applying to her a measure of property liability for non-payment of taxes by other persons, which is illegal

.

What changed

After the appearance of Article 431.2 in the Civil Code of the Russian Federation, the situation changed. The concept of a “representation of circumstances” introduced by her allows the party that relied on those representations to claim damages or penalties from the party that made them. And if the assurances were significant, you can demand termination of the contract.

In an example it looks like this:

The company has secured the assurance of its potential counterparty that it pays all taxes on time, maintains accounting records and records, draws up all primary documents and, in general, is an exemplary taxpayer. The counterparty assured that he has the goods, and the documents in accordance with which they were received will be provided upon request. Relying on these assurances, the taxpayer decides to enter into an agreement with this counterparty.

Let's assume the delivery was successful and the deal is closed. However, by deducting VAT from this transaction, the taxpayer receives a refusal. Having checked the counterparty’s transactions with its suppliers, inspectors determined that the transactions were formal in nature with the aim of obtaining unjustified tax benefits.

Previously, the company would not have been able to recover VAT from the seller (for reasons stated above), but now this is possible. Let's look at how exactly - using an example from judicial practice.

The tax base

The basis for calculating VAT is the amount of revenue (income) of the counterparty (taxpayer) from the transactions listed in Article 161 of the Tax Code of the Russian Federation.

Determine the tax base taking into account VAT:

- when purchasing goods (work, services) from foreign organizations that are not tax registered in Russia (clause 1 of Article 161 of the Tax Code of the Russian Federation);

- when leasing state (municipal) property directly from executive authorities and management (paragraph 1, paragraph 3, article 161 of the Tax Code of the Russian Federation);

- when purchasing (receiving) state or municipal property that is not assigned to state (municipal) organizations (paragraph 2, paragraph 3, article 161 of the Tax Code of the Russian Federation).

Determine the tax base excluding VAT (including excise taxes for excisable goods):

- when selling property by court decision (except for property seized from the former owner during bankruptcy proceedings) (clause 4 of article 161 of the Tax Code of the Russian Federation);

- when selling confiscated and ownerless property, treasures, purchased valuables and valuables transferred to the state by inheritance (clause 4 of Article 161 of the Tax Code of the Russian Federation);

- when selling as an intermediary (with participation in settlements) goods (work, services, property rights) of foreign organizations that are not tax registered in Russia (clause 5 of Article 161 of the Tax Code of the Russian Federation).

Facts of the case

The seller assured the buyer of his good faith, namely:

- in paying taxes and submitting reports;

- in accounting and preparation of “primary” documents;

- possession of the object of the transaction by right of ownership.

In addition, he promised the buyer the following:

- include the VAT paid by the buyer in tax reporting;

- provide all the necessary primary documents - invoices, delivery note, acceptance certificate and others.

In confirmation of his serious intentions, the seller promised, and this is enshrined in the contract, to provide documents that would confirm the guarantees given to him within 5 working days after receiving the corresponding request . In addition, he voluntarily accepted the obligation to compensate the buyer for losses that he incurs due to the seller’s violation of tax laws and/or his representations. In accordance with the agreement, the seller agreed to reimburse, among other things, additional VAT, penalties and fines imposed by the tax authorities on the buyer due to the actions of the seller.

When checking the legality of deducting VAT from this transaction from the buyer, the tax authorities examined transactions between the seller and his counterparties. They came to the conclusion that some of them were fictitious, that is, the products were not actually supplied, the transactions were carried out only “on paper” in order to obtain an unjustified tax benefit. As a result, the buyer was denied a VAT deduction for an amount exceeding 12 million rubles .

Having received such a decision from the Federal Tax Service, the buyer went to court. Moreover, he filed the claim not against the tax authorities, but directly against the seller himself. His claims were based on the establishments given by the seller on the basis of Article 431.2 of the Civil Code of the Russian Federation.

Case Study

Tax officials conducted an on-site inspection at JSC SPTB Zvezdochka (a large defense enterprise). They considered that the company did not confirm the reality of transactions with three suppliers, and added additional VAT of 14 million rubles. The tax authority referred to the fact that:

- suppliers did not have the opportunity to supply goods (one person worked, there was no warehouse, etc.),

- invoices were signed not by the director, but by an unidentified person,

- suppliers paid minimal taxes,

- the company failed to exercise due diligence.

Court decisions

The arbitrators found the Federal Tax Service's arguments about the fictitiousness of the transaction between the seller and its counterparty convincing. The seller could not prove that the transactions were real in nature, and also that he himself was responsible for failure to provide a tax deduction to the buyer. Given these circumstances, the courts concluded that the seller had unlawfully given the buyer an assurance of his good faith. In this case, the fact whether the buyer appealed the decision of the tax authority or not does not play any role .

As a result, the courts of all instances recognized that since the seller voluntarily gave assurances about the circumstances and knew that the buyer would rely on them, the latter rightfully demands compensation for losses in the form of VAT, the deduction of which was refused.

Why are there more VAT requirements?

The ASK VAT-2 system operates in automatic mode, that is, at the first stage, reports are checked without the participation of tax inspectors. The program analyzes the VAT return on the fly, checking control ratios, as well as information from purchase and sales books with similar data from counterparties.

The smart system cannot be deceived - not a single violation can hide from its gaze. If it is detected, then the requirement to provide an explanation for VAT is generated automatically. Accountants have therefore seen an increase in the number of these requirements in recent years.

conclusions

So, the case A53-228582016 discussed above and the related Resolution of the Administrative Court of the North Caucasus District dated 06/05/2017 can be called a precedent, since in it the shortfall in VAT amounts was recognized for the first time as losses subject to compensation by the second party to the transaction. To take advantage of this in practice, experts recommend including in the contract provisions for assurance of the circumstances given in terms of taxes and fees . This makes it possible to receive compensation from the counterparty, and in a simplified manner:

- without challenging the decision of the Federal Tax Service in court, unless this is specifically provided for in the contract;

- without the need to establish the fact of the loss and its size (it will be indicated in the decision of the Federal Tax Service - additional assessment of taxes, fines, penalties);

- without the need to prove the guilt of the counterparty (the applicant is based on the assurances given to him that turned out to be unreliable).

When including provisions on assurance of circumstances in the contract, the following must be specified:

- the circumstances for which the assurance is given are significant for the second party to the transaction when concluding and executing the contract;

- the party that gave them understands that the counterparty will rely on them for its financial and economic activities;

In addition, as sanctions for the unreliability of these assurances, it is worthwhile to provide not a penalty, but rather compensation for losses. And then there is a chance to recover the VAT that was not accepted for deduction, along with penalties and a fine, from the other party to the transaction, who gave unfounded assurances.

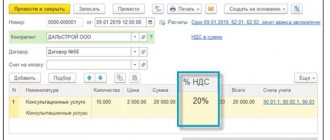

Tax rate

The tax rate depends on the type of goods (work, services) that the tax agent organization buys or sells on the territory of Russia (Article 164 of the Tax Code of the Russian Federation).

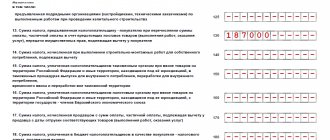

The amount of VAT that must be transferred to the budget is determined at the calculated rate:

- if the tax base includes VAT;

- upon receipt of an advance (partial payment) for upcoming supplies of goods (work, services), for the sale of which the tax base is determined without taking into account VAT.

This follows from the provisions of paragraph 4 of Article 164 of the Tax Code of the Russian Federation.

If the cost of goods (work, services) in the contract is established without VAT, the tax agent must transfer the tax to the budget at his own expense. In this case, determine the tax amount in the following order. First, increase the tax base (the value specified in the agreement) by the amount of VAT at a direct rate - 18 or 10 percent. And then, based on the increased tax base, determine the amount of VAT at the calculated rate: 18/118 or 10/110 (letter of the Ministry of Finance of Russia dated September 8, 2011 No. 03-07-08/276).

If the tax base does not include VAT, the amount of tax that needs to be transferred to the budget is determined at a direct rate - 18 or 10 percent. This rule applies to two categories of tax agents:

- on intermediaries selling goods (work, services) of foreign principals or principals in Russia (clause 5 of Article 161 of the Tax Code of the Russian Federation);

- on organizations (entrepreneurs) that sell confiscated and ownerless property (clause 4 of article 161 of the Tax Code of the Russian Federation).

When selling goods (work, services, property), such tax agents are required to present the calculated VAT amounts to buyers (clause 1 of Article 168 of the Tax Code of the Russian Federation).

An example of VAT calculation for the sale of goods to a foreign organization that is not tax registered in Russia under an intermediary agreement

Alpha LLC (commission agent) sells goods to a foreign organization under a commission agreement. The foreign organization (committent) is not registered in Russia for tax purposes. When selling such goods in Russia, VAT is charged at a rate of 18 percent.

The sale price of goods agreed with the principal is RUB 2,000,000. (excluding VAT). The commission (including VAT) is 10 percent of the sale price of the goods (including VAT) and is retained by the commission agent from funds received from buyers.

The amount of VAT that Alpha imposes on customers is: RUB 2,000,000. × 18% = 360,000 rub.

The selling price of goods including VAT is: RUB 2,000,000. + 360,000 rub. = 2,360,000 rub.

All goods were sold and paid for. The following entries were made in Alpha's accounting records:

Debit 004 – RUB 2,360,000. – goods received on commission are accepted for accounting;

Debit 62 Credit 76 – 2,360,000 rub. – the shipment of the consignor’s goods is reflected;

Debit 76 Credit 68 subaccount “Calculations for VAT” – 360,000 rubles. – VAT has been charged for the foreign principal;

Loan 004 – RUB 2,360,000. – goods sold under a commission agreement are written off;

Debit 76 Credit 90-1 – 236,000 rub. (RUB 2,360,000 × 10%) – reflects the amount of remuneration under the commission agreement;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” – 36,000 rubles. (RUB 236,000 × 18/118) – VAT is charged on commission fees;

Debit 51 Credit 62 – 2,360,000 rub. – payment for goods has been received;

Debit 76 Credit 51 – 1,764,000 rub. (RUB 2,360,000 – RUB 360,000 – RUB 236,000) – funds were transferred to the principal.

Situation: at what rate should a tax agent withhold VAT on amounts received from buyers and charge VAT on his remuneration when selling confiscated goods taxed at a rate of 10 percent on behalf of the Federal Property Management Agency?

The amount of tax that must be withheld and transferred to the budget from the cost of sold confiscated goods is determined at a rate of 10 percent. Present the VAT amount calculated in this way to the buyer in addition to the price of the goods sold (clause 1 of Article 168 of the Tax Code of the Russian Federation).

Calculate VAT on the remuneration amount at a rate of 18 percent (clause 3 of Article 164 of the Tax Code of the Russian Federation). Regardless of what goods are sold on behalf of the Federal Property Management Agency.

An example of calculating VAT and reflecting in accounting transactions for the sale by an organization of confiscated goods, subject to VAT at a rate of 10 percent, on behalf of the Federal Property Management Agency

Alpha LLC, on behalf of the Federal Property Management Agency, but on its own behalf, sells confiscated goods (the agreement was concluded on a competitive basis).

On January 17, Alpha received for sale a consignment of goods confiscated at customs - 1000 packages of Czech-made Libero baby diapers. The sale price of the goods agreed with the Federal Property Management Agency was 500 rubles. per package. This corresponds to the level of market prices. Thus, the total amount of the shipment was 500,000 rubles. (1000 packages × 500 rub./pack).

On January 20, Alpha sold the entire batch of confiscated goods. The buyer was Torgovaya LLC. On the same day, the proceeds from the sale of goods in full were credited to Alpha's bank account.

Sales of baby diapers in Russia are subject to VAT at a rate of 10 percent (subclause 2, clause 2, article 164 of the Tax Code of the Russian Federation).

The amount of VAT that Alpha presented to Hermes in addition to the price of the goods sold was: RUB 500,000. × 10% = 50,000 rub.

The selling price of goods including VAT is equal to: 500,000 rubles. + 50,000 rub. = 550,000 rub.

Alpha presented Hermes with an invoice dated January 20 for the cost of the goods shipped. The Alpha accountant registered this invoice in the sales book on the same day.

According to the agreement, Alpha's remuneration (excluding VAT) for the sale of confiscated goods is 10 percent of the sales value of these goods (including VAT).

The remuneration amount is transferred to Alpha's current account after approval of the report on the sale of confiscated goods. The report on the sale of confiscated goods was approved on January 24. On the same day, the remuneration amount was credited to Alpha's bank account.

The amount of remuneration (excluding VAT) was 55,000 rubles. (RUB 550,000 × 10%). The remuneration amount including VAT is RUB 64,900. (RUB 55,000 + RUB 55,000 × 18%).

Alpha presented the Federal Property Management Agency with an invoice dated January 24 for the amount of its remuneration. The Alpha accountant registered this invoice in the sales book on the same day.

The working Chart of Accounts of Alpha (approved as an annex to the accounting policy) provides that a subaccount “Settlements with the Federal Property Management Agency” is opened to account 76 “Settlements with various debtors and creditors”.

Alpha's accountant made the following entries in the accounting.

January 17:

Debit 002 – 550,000 rub. – goods received for sale are accepted for accounting.

January 20th:

Debit 62 Credit 76 subaccount “Settlements with the Federal Property Management Agency” – 550,000 rubles. – reflects the selling price of goods shipped to the buyer;

Loan 002 – 550,000 rub. – the cost of goods shipped to the buyer is written off;

Debit 76 subaccount “Settlements with the Federal Property Management Agency” Credit 68 subaccount “Settlements for VAT” - 50,000 rubles. – fulfilled the duties of a tax agent to withhold VAT;

Debit 51 Credit 62 – 550,000 rub. – payment for goods sold has been received from the buyer;

Debit 76 subaccount “Settlements with the Federal Property Management Agency” Credit 51 – 500,000 rubles. (550,000 rubles – 50,000 rubles) – funds were transferred to the Federal Property Management Agency for goods sold (minus withheld VAT).

January 24:

Debit 76 subaccount “Settlements with the Federal Property Management Agency” Credit 90-1 – 64,900 rubles. – the amount of remuneration under the contract has been accrued;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 9900 rubles. (RUB 55,000 × 18%) – VAT is charged on remuneration;

Debit 51 Credit 76 subaccount “Settlements with the Federal Property Management Agency” – 64,900 rubles. – the amount of the reward was credited to Alpha’s bank account.

How to write off accounts receivable with an expired statute of limitations

The Ministry of Finance of Russia, in letter dated January 14, 2015 No. 07-01-06/188, provided the necessary list of documents that accompany the procedure for writing off receivables with an expired statute of limitations:

- act on the inventory carried out;

- an order to write off accounts receivable with an expired statute of limitations, signed by the head of the enterprise.

In this case, write-offs must be made separately for each counterparty and each agreement with him.

Writing off a debtor's debt in accounting

Debt write-off in accounting should be carried out not only in the context of a specific debtor, but also within the framework of a specific agreement. So, if there are several consecutively concluded contracts, then the overdue debt should be considered within the framework of each of such contracts, payment for which was not made on time.

For accounting purposes, there are 2 options for writing off bad debt:

- If the organization, in accordance with the current accounting policy, created a reserve for doubtful debts, then the entries from table 2 are made:

table 2

| No. | Wiring | Write-off |

| 1 | Dt 63 Kt 62 (58, 60, 76) | For the amount of bad debt written off within the created reserve |

| 2 | Dt 91 Kt 62 (58, 60, 76) | For the amount of written off bad debt not covered by the reserve |

| 3 | Dt 007 | The entire amount of bad debt is taken into account off the balance sheet |

NOTE! The last entry reflecting the amount of debt written off on off-balance sheet account 007 is required. Accounting for written off bad debt is maintained for the next 5 years from the date of drawing up the inventory report and issuing an order to write it off.

In the event of newly discovered circumstances, if during this period the debtor’s property, previously not discovered, is revealed, which can be recovered to pay off his debts, the debt can be restored again with reverse entries 2 and 3 after its repayment.

- If the organization, in accordance with the current accounting policy, has not formed a reserve for doubtful debts, then entries 2 and 3 from Table 2 are made.