Employers must keep records of payments and other remunerations accrued in favor of their employees, as well as the amounts of insurance premiums calculated from them. To maintain such records in 2021, the Pension Fund of the Russian Federation and the Social Insurance Fund of Russia recommend using an individual card form for recording the amounts of accrued payments and other remunerations and the amounts of accrued insurance contributions. The form of the card is given in the Appendix to the letter of the Pension Fund of the Russian Federation No. AD-30-26/16030, FSS of the Russian Federation No. 17-03-10/08/47380 dated December 9, 2014.

This form is not mandatory, therefore regulatory agencies do not establish any strict requirements for the form and procedure for its maintenance. Accordingly, you can make changes to it - add the necessary columns (rows) and delete unnecessary ones. In addition, it is not prohibited to keep records in another form, which the policyholder will develop independently based on the specifics of the activity, and use the recommended form of an individual card for recording the amounts of accrued payments as a sample. The main goal of this document is to reflect complete and reliable information on accrued payments to employees in kind and cash and calculated insurance premiums, as well as social expenses.

Card for individual accounting of amounts of payments and insurance premiums: what is it?

In 2021, Federal Law No. 212 of July 24, 2009 stated that accounting for insurance and social contributions for an employee is mandatory at the enterprise. From 01/01/2017, payments are regulated on the basis of Ch. 34 Tax Code of the Russian Federation. Article clause 4 art. 431 of the Code almost completely repeats Art. 15, 28 Federal Law No. 212. Accordingly, the employer’s obligation to keep records for each employee has not been canceled.

To simplify accounting, the FSS and the PRF of Russia recommended a card form as an attachment to letters No. AD-30-26/16030, 17-03-10/08–473 dated 12/09/2014 This is not a mandatory form : an enterprise can develop it independently with taking into account the specifics of its activities, for example, hazardous production or the presence of employees who were Chernobyl victims.

After the changes that took place, the new recommended form has not yet been approved. You can use the card form developed in 2014, with minor adjustments. It is necessary to replace outdated references to Federal Law No. 212 with current excerpts from the Tax Code, correct the old names of insurance premiums with new ones, and indicate the current payment limits.

We develop and approve our own form

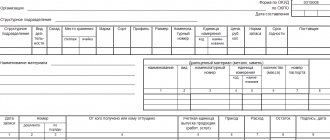

The insurance premium card form used by the organization must be approved in the accounting policy. The register in question must contain the following information:

- organization data: name, tax identification number, checkpoint;

- employee details: full name, tax identification number, SNILS;

- information about the employment contract (number, date);

- information about the presence or absence of disability;

- tariffs used in calculating social contributions;

- amounts of payments to the employee: monthly and cumulatively from the beginning of the year;

- the amount of accrued insurance premiums monthly and cumulatively from the beginning of the year;

- the amount of benefits paid at the expense of the Social Insurance Fund.

Taking as a basis the form approved by the Pension Fund of the Russian Federation and the Social Insurance Fund, removing unnecessary information and adding the necessary information, indicating the necessary links to articles of the Tax Code of the Russian Federation, we received a form.

Social contributions registration card form

Who hands over the Card and in what cases

Payers must keep records of insurance, pension and social contributions for each employee separately from the first day of his work. This is mandatory for all legal entities and individual entrepreneurs who employ at least one person. The full list of payers is given in Art. 419 of the Tax Code of the Russian Federation.

Records are kept in the form of a card, which is issued for each employee on his first paid day. It is filled out once a month based on the results of the previous month with a cumulative total, calculated for the calendar year. If an employee got a job, for example, in March, dashes are added for January–February.

Unlike other forms of insurance reporting (SZV-M, RSV-1), there is no need to specifically submit the card to funds and departments. It is required only for on-site and desk audits by the tax service and various funds, as well as for reconciling payment amounts at the end of the year. Thus, the Pension Fund of Russia requests cards in accordance with the Order of the Pension Fund of Russia No. 34R dated 02/03/2011.

Responsibility for incorrectly filling out the card

Despite the fact that the form of the card is of a recommendatory nature, its maintenance is mandatory. The absence of this register or systematic errors in filling it out may be considered gross violations of the rules for accounting for taxable items, liability for which arises under Art. 120 Tax Code of the Russian Federation.

This responsibility is expressed in fines, which will amount to:

- 10,000 or 30,000 rub. depending on the number of billing periods associated with the error, which did not lead to an underestimation of the base for calculating contributions;

- 20% of unpaid contributions, but not less than 40,000 rubles, if the basis for calculating contributions turned out to be underestimated.

On issues arising when applying Art. 120 of the Tax Code of the Russian Federation, read this article.

Providing a card

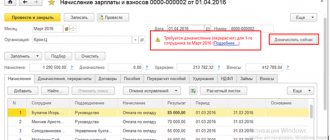

The card is necessary to confirm the fact of keeping records of payments and contributions at the enterprise during audits. The Tax Code of the Russian Federation does not specify the form for maintaining this accounting. Accordingly, you can fill it out electronically (in 1C or Excel) or download a form for an individual accounting card for payments and insurance premiums and fill it out by hand on paper.

If the company’s accounting department works with 1C, the card is printed annually to verify the amount of contributions to funds for each employee or, as necessary, during audits. The form is found in section 1C “Payroll calculation by organizations”, subsections “Taxes and contributions”, “Card”. You should select the employee’s full name, print out the generated form, certify it with the signature of the chief accountant and a blue seal.

It is also recommended to make a paper version of the card at the beginning of the year for the previous period. The document requires the signature of the chief accountant and the seal of the organization. The final and intermediate forms should be kept.

Sample filling

Let's fill out the developed form with information using a conditional example.

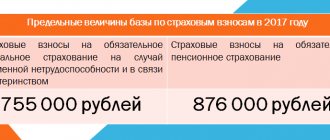

LLC "Company" pays insurance premiums at regular rates to employee Semenov S.S. disability has not been established. The monthly salary is 100,000 rubles. During the year, accrued remuneration reached the maximum bases for calculating insurance premiums. Let us remind you that the maximum payment amounts for calculating social contributions in 2021 are:

- for OPS - RUB 1,021,000.00;

- at VNiM - RUB 815,000.00.

Please note that data on accrued remuneration and social insurance payments must be provided in rubles and kopecks. This is due to the fact that social contributions are calculated with an accuracy of kopecks (clause 5 of Article 431 of the Tax Code of the Russian Federation).

Penalty for late delivery

Failure to provide a card at the request of the inspection authorities will be regarded as failure to keep records of insurance and other payments and contributions. This threatens the employer with tax liability under clause 1 of Art. 126 of the Tax Code of the Russian Federation: a fine of 200 rubles. for each employee. So, an enterprise with a staff of 40 people will pay 200 * 40 = 8000 (rubles).

It must be remembered that the storage period for accounting documents is 5 years (Article 29 of Federal Law No. 402 of December 6, 2011). The requirement to provide cards for an earlier period is illegal.

Results

Payers of contributions are required to keep personalized records of accruals for insurance premiums. As a register for such accounting, a joint letter from the Pension Fund of Russia and the Social Insurance Fund recommended the form of an individual card. The absence of such a register or errors when filling it out are fraught with fines.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Why did we develop a new form?

Its previous form was recommended in the joint letter of the Pension Fund of January 26, 2010 No. AD-30-24/691, FSS of Russia dated January 14, 2010 No. 02-03-08/08-56P. But now it is not relevant, since it contains only one line for the maximum contribution base, and since 2015, the limits for funds are different. In addition, many construction organizations pay contributions at additional rates depending on the classes of working conditions determined during the special assessment, and in the old form they are not provided for.

There are other adjustments that take into account, in particular:

- abolition of the employer's division of pension contributions into insurance and funded parts;

- elimination of the breakdown of contributions for health insurance by fund: to the FFOMS (Federal Compulsory Medical Insurance Fund) and TFOMS (Territorial Compulsory Health Insurance Fund), since contributions are transferred only to the FFOMS;

- the need to indicate the status of a foreign worker (in connection with the obligation to pay contributions from the salaries of foreign workers).

Therefore, instead of one page there are now three (three sections) in the card. The first page must be completed for all employees. The second is only for those who are employed in harmful or dangerous jobs. And the third - for employees receiving benefits from social insurance funds.

How to fill out the form

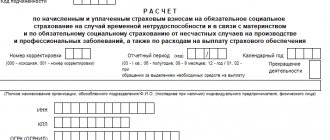

Calculation of contributions based on the general tariff

At the beginning of the form, you must indicate general information about the employee: full name, insurance number, tax identification number, type and number of the concluded contract (labor, civil law, etc.).

The plate on the right shows the tariff code (if general, then 01), as well as the percentage of tariffs by type of contribution: for compulsory pension insurance (MPI) - 22 percent; for compulsory health insurance (CHI) – 5.1 percent; for compulsory social insurance (FSS) - 2.9 percent.

Next, you need to determine the calculation base and the amount of contributions.

In FFOMS.

Since 2015, employers have paid contributions to compulsory health insurance on all payments that are subject to contributions (no limit has been set). Therefore, the card does not provide lines for above-limit payments in terms of compulsory medical insurance. You only need to show the base and the amount of accrued contributions.

In the Pension Fund.

For pension contributions, the base limit is 711 thousand rubles. For all payments above this amount, contributions are paid at a rate of 10 percent. Payments in excess of the limit must be reflected on the card in a special line “Amount of payments exceeding the established…”. They are not included in the database; they are indicated on the card before the line “Base for calculating insurance premiums for compulsory health insurance”.

Therefore, the line where pension contributions are reflected is divided into two parts: for contributions accrued for payments within the base, and for over-limit contributions.

Please note: if a construction company applies a simplification, then payments in excess of the maximum base are not subject to contributions (subclause 8, clause 1, article 58 of law No. 212-FZ, letter of the Ministry of Labor of Russia dated January 30, 2015 No. 17-3 / B-37 ).

In the FSS of Russia.

The limit for contributions to the social insurance fund is 670 thousand rubles, this amount differs from the base limit for pension contributions (Resolution of the Government of the Russian Federation of December 4, 2014 No. 1316). Therefore, on page 1 of the card, different lines appeared for payments exceeding the limit on pension contributions and for payments exceeding the limit on contributions to the social insurance fund.

Please note that there is no limit set for contributions for injuries (they are accrued from all payments).

There is a special line on page 1 for benefits expenses, but at the same time payments need to be deciphered on page 3.

Calculation of additional contributions

For employees who work in harmful or dangerous conditions, you must fill out page 2 of the card.

This sheet reflects the amounts of payments subject to contributions at additional fixed (6 or 9%) or differentiated (from 2 to 8%) tariffs.

You also need to calculate the fees themselves. Moreover, the information must be broken down depending on what class the work belongs to.

During the year, the additional tariff may change if the company conducts a special assessment of working conditions. Until the day the assessment report is approved, contributions must be calculated at rates of 9 and 6 percent (for lists No. 1 and No. 2, respectively). › |

› | Lists No. 1 and No. 2 of production, work, professions, positions and indicators that give the right to preferential pensions were approved by Resolution of the USSR Cabinet of Ministers of January 26, 1991 No. 10.

And from the date of approval of the report - at differentiated tariffs: from 2 to 8 percent (letter of the Ministry of Labor of Russia dated March 13, 2014 No. 17-3/B113). Contributions at different rates are indicated in different subsections of the card.

Reflection of social security expenses

Page 3 of the card is intended for recording the amounts of benefits (sick leave, maternity leave, children's benefits, as well as benefits for insurance against industrial accidents) and other payments at the expense of the Federal Social Insurance Fund of Russia. In addition to the amounts, you must enter the number of payments or sick days.

What it is?

After the amendments to the Federal Law “On Individual Accounting in OPS” came into force in 2003, all residents of Russia were required to issue pension insurance cards. This document is confirmation of registration in the OPS system .

Its official name is insurance certificate of compulsory pension insurance. People often call it an insurance card or SNILS. The document is a small green plastic cardboard containing information about the owner:

- FULL NAME;

- place and date of birth;

- SNILS (personal account number);

- floor;

- date of registration.

The card contains a personal number linked to a personal account in the Pension Fund of the Russian Federation . The number consists of 11 digits and is assigned to each insured person for life.

Why do you need a card and what opportunities does it provide?

- The certificate, or rather its number, contains data on the person’s insurance experience and his pension contributions . This information will be required to assign or recalculate material support.

- Using this document, you can issue benefits, allowances , as well as a number of other documents. It is required in almost all institutions: social security authorities, the passport office, the tax office, etc. Without an insurance certificate, today it is impossible to obtain a foreign passport, open an individual entrepreneur, or even take out a loan from a bank.

- The number of this document may be required for registration on the State Services website , which provides the opportunity to use the services of government agencies online.

- An insurance document is required for women to register maternity capital .

Important! SNILS must be kept by its owner. The information contained in the personal account number is strictly confidential.

Is it mandatory for unemployed citizens and children to receive a card? Everyone will need to register with the OPS , since the development trends of the OPS system in recent years show the need to obtain this document.

- In 2015, legislation expanded the categories of recipients of this document. Now it needs to be issued to all people living in the Russian Federation, including foreigners without Russian citizenship.

- In the future, it is planned to link SNILS to a universal electronic card, which will replace all documents (TIN, medical policy, passport, etc.).

- More and more government services are tied to the number of this certificate, which once again proves the need to obtain it.