How and why to use it

This process must be reflected in the accounting journal.

Customer-supplied materials and raw materials will be accounted for as fixed assets. Upon transfer, a report is drawn up that includes the main data on the materials. The serial code of raw materials, grade and brand is indicated. It is necessary to indicate which part is suitable for further work. You can use the M-15 waybill form, which is only recommended. To get a good filling result, you can use books and articles on accounting. It is recommended to familiarize yourself with the sample. Appendix No. __ to the Contract Agreement dated “__” ________ 20__ No. _______

REPORT on the use of materials

_____________ "__" ________ 20__ Limited Liability Company "______________________" represented by __________________________________, acting___ on the basis of ____________________, hereinafter referred to as the "Contractor", compiled this report on the use of materials (hereinafter referred to as the Report) transferred by the Limited Liability Company " _____________________" (hereinafter referred to as the Customer) to perform work under the contract dated "__" ________ ____, No. ________ (hereinafter referred to as the Agreement), that:

1. In pursuance of clause ___ of the Contract, the Customer transferred, and the Contractor accepted, materials to perform the work. 2. In the period from “__”________ 20__ to “__”________ 20__, the materials transferred by the Customer were used by the Contractor when performing the work, namely:

| No. | Name of type of work | Name of materials used | Material unit | Price per unit of measurement, rub. | Materials transferred by the customer | Materials actually used by the contractor | ||

| Quantity (volume) | Amount, rub. | Quantity (volume) | Amount, rub. | |||||

The total cost of materials used was ___________ (_________________) rubles. 3. We hereby confirm that there are no unspent materials, no returnable waste, and no fact of excess consumption of materials during the performance of work has been established. 4. This Report is drawn up in 2 (two) copies, one each for the Contractor and the Customer. 5. Attachments to the Report: — ___________________________________ (copies of documents confirming the actual use of materials).

| On behalf of the Contractor | On behalf of the Customer | ||

| (signature) | (FULL NAME.) | (signature) | (FULL NAME.) |

Primary documents drawn up by the parties to the agreement

As you know, an organization can use unified forms of primary documents or independently develop these forms.

The customer (vendor) draws up an invoice for the transfer of raw materials and supplies (standard form No. M-15 can be taken as a basis).

The contractor (processor), having received the materials to be supplied, draws up a receipt order (you can use form No. M-4), where it should be indicated that the materials were received on toll terms.

After execution of the contract, the processor draws up a report on the use of the received raw materials or materials, which must reflect:

- name and quantity of materials received and used;

- name and quantity of finished products;

- name and quantity of residual materials and waste from their use.

After completing the processing work, the parties draw up and sign an acceptance certificate for the work performed, which indicates the monetary value of the work.

The customer, upon receiving finished products, issues a receipt order No. M-4 or an invoice for finished products according to f. No. MX-18 (approved by Rosstat Resolution No. 66 dated 08/09/1999).

Is a report on toll materials required?

When it comes to customer-supplied materials, it is understood that a contract has been concluded between the parties (Article 702 of the Civil Code of the Russian Federation). Accordingly, the party who received the materials supplied for the work is called the contractor.

Civil law requires that the contractor use the materials provided by the customer economically and prudently, and after completing the work, submit a report on the materials used. The remainder of the supplied raw materials must be returned to the customer. By agreement of the parties, the cost of the contractor’s work may be reduced by the cost of materials remaining with the contractor (clause 1 of Article 713 of the Civil Code of the Russian Federation).

Obviously, a report on toll materials is one of the most important documents that are drawn up when executing a contract with toll raw materials. The report will ensure reliable accounting and control of raw materials supplied by the contractor and the customer, and determine the cost of work under the contract. In addition, the amount of materials consumed by the contractor from the customer will be included in the cost of work performed or manufactured products, and therefore, without drawing up reports, it will not be possible to correctly determine, for example, the cost of construction.

At the same time, there is no single form for reporting on the use of customer-supplied materials (sample). How to draw up such a report is up to the parties to decide for themselves. In this case, the form of the report on tolling materials (sample) is fixed in the contract.

The report should clearly indicate how much and what kind of material was consumed during the reporting period and how much was left.

Below is an example of a report on the use of supplied materials in construction.

Prev. / Next

What to pay attention to besides filling out

In order to avoid problems with interaction with regulatory organizations, in particular with the tax authorities, you must strictly adhere to the following principles:

- In the processor's accounting, customer-supplied materials should not be listed on the processor's balance sheet. The accountant must create separate, off-balance sheet accounts for them.

- If the product was manufactured by the seller, then selling identical product names to him is prohibited.

- Ownership of the home and business waste must be assigned to one of the parties in the contract so that there are no questions about the possible gratuitous transfer of materials.

Methodological manual for PC "GRAND-Smeta" version 7

- 1. Working with the regulatory framework 1.1 How to open a regulatory framework?

- 1.2 How to choose the right regulatory framework?

- 1.3 How to open a collection of prices?

- 1.4 How can I view pricing information in the collection?

- 1.5 How to open the technical part of the collection of regulatory framework?

- 1.6 How to find a price in the regulatory framework?

- 1.7 How to add a new regulatory framework to the GRAND-Smeta PC?

- 2.1 Formation of a database of estimates as part of the program 2.1.1 How to create a new local estimate?

- 2.2.1 How to add a price from the regulatory framework to the estimate?

- 2.3.1 How to choose a coefficient for the price from the technical part?

- 2.4.1 How to see the general list of resources according to the estimate?

- 2.5.1 How to calculate the amount of work in an estimate item using a formula?

- 2.6.1 How can I see how estimate items are linked to types of work?

- 2.7.1 How to add an allowance for tightness to the estimate?

- 2.8.1 How to apply individual indexes to individual budget items?

- 2.9.1 How can you enter the value of limited costs not as a percentage, but as a coefficient, or as a monetary amount?

- 2.10.1 How to manually select an arbitrary group of estimate items (including using flags, bookmarks, color filling)?

- 2.11.1 How to understand the reason why budget items are highlighted in red?

- 2.12.1 How to recalculate estimates from one TEP database to the TEP base of another region?

- 2.13.1 Why do you need a custom collection?

- 3.1 How to enter or change current resource prices in the estimate?

- 4.1 How to create a new act?

- 5.3 How to generate several output documents at once?

- 6.1 How to create a new object estimate (summary estimate calculation)?

- 7.1 Initial settings for local estimates

- 8.1 Settings for ranking

- 9.1 Regulatory framework for design and survey work 9.1.1 Selection of regulatory framework

- 9.2.1 Document appearance

- 9.3.1 Adding coefficients from the technical part

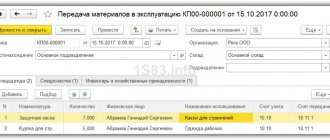

Return of unused goods

On the “Returned materials” tab, click on the “Fill in” button and there are only two items:

- “By residues” - for all residues being processed;

- “According to specification” - balances according to this specification.

It turned out like this:

Let's review the document and see the movements. 1C will generate the following transactions for the production of products from customer-supplied raw materials:

Everything worked out. In the first line we see that on account 43 in the “Main” warehouse we have 5 ready-made lamps, the remaining materials of 5 pieces (as indicated in the specification) were written off to account 20.01, in the last line we get back our 3 LEDs on 41 check.

Accounting for customer-supplied materials in 1C Enterprise 8.2 (8.2.19.83)

AnitaAnn, look. All documents in the “production” block of the BP 3.0 configuration (the entire list) are designed for both the supplier and the processor. Your situation is that you are a mediator. You can record accounting entries in several different ways. Let me draw your attention to the fact that the previously mentioned document “Transfer of goods” with the type of operation “transfer of raw materials for processing” is more correct to reflect the entries in the accounting of the supplier. You can, of course, consider yourself a giver when transferring the MPZ to the processor. However..., it is better to use this document to reflect your materials in the seller’s records. You have someone else’s materials from the customer (supplier). And you are a processor in relation to the seller (your customer).

Quote (AnitaAnn): Based on your answer, I would like to know what document should I then use to report on the use of customer-supplied materials received from the subcontractor? I assume that this is the document “Receipt from Processing”, accounting account K 003.02 (Materials transferred to production). Am I not including the expense account? Are there other options for reflecting this operation? Thank you. The document “Receipts from Processing” can and conveniently reflect the operations of receipt by the supplier in his accounting of what the processor (you, the subcontractor) did for him. And copy your materials to them. Again in relation to documents and their printed forms. It's all about how much emphasis you are going to put on the documents. If it is important for you to reflect the “Report on Consumed Materials,” then there is only one document that is convenient to reflect the write-off of customer materials in the processor’s accounting and receive a printed form of the report on consumed materials you need. This is the implementation of processing services. And, by the way, it is more convenient for them to write off customer-supplied materials (Kt 003.02). In general, if we take as a basis the reflection of business operations specifically in the processor’s accounting, then the set of documents may look like this. 1. Receipt of materials for processing - from the customer, Dt 003.01 2. Request-invoice - transfer of customer materials to production, D003.02 K003.01, there is a special tab in the document. 3. If the processor needs to collect its costs, then a number of independent documents are entered (salaries, write-off of its own other materials, receipt of subcontractor services, etc.). I note that the receipt of services can be reflected even with a simple “Receipt (only services and input VAT). In short, the processor’s accounting accumulates costs on account 20.01. 4. The output of products, works or services is reflected by the processor in the document “Production Report for the Shift”. If you do not previously reflect the transfer of your materials in the Request-invoice, then they can also be written off here (automatically if the specification is filled out). On the first tab they reflect “products”, but not necessarily with accounting account 43. Here it is proposed to indicate in the processor’s accounting in the “accounting account” field - account 20.02 - Production of products from customer-supplied raw materials. Well, other bookmarks need to be filled out. When carried out, one of the postings will be D20.02 K20.01 - at the planned cost of production.

Such costs will be written off later when services are sold, D90.02.1 K20.02. 5. Now we move on to the document that completes the transfer of completed work, services, and products in the processor’s accounting. This is the one mentioned - “Sales of processing services”. We sell them the work, service, and products issued by the shift report. There is also a “customer materials” tab. After filling out and posting, we will receive approximate postings. D 62.01 K90.01.1 D90.03. K68.02. D90.02.1 K20.02

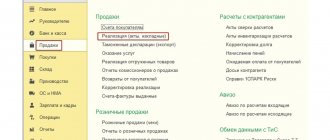

The use of customer-supplied raw materials in processing requires the organization of its accounting, both on the part of the recipient of the raw material and on the giving side. To carry out the relevant operations, all necessary documents can be taken from the “Production” section.

The toll processing scheme provides for a whole list of sequential actions, observance of the order of which is a prerequisite for the correct reflection of the results of work in the 1C program. The list of required documents can be presented in tabular form.

Waste control

This point also plays an important role. If waste is transferred to a recycler, this is reflected in the documentation as a gratuitous transfer. According to current legislation, such manipulation is equivalent to implementation. This means that VAT is charged on such transfer. If the donor organization retains the right to continue to use the waste, the processing costs must be adjusted.

Control transfer of raw materials and receipt of final results may involve their modification and production of the finished product. The first point is that the supplier transfers the material to another company for revision. That is, it must provide raw materials in a state that allows them to be used for the further production of certain goods. In fact, the processor is not engaged in the manufacture of goods, but merely brings them to a certain state.

Provided raw materials in 1C from the processor

| №№ | Operation | Document | Document transaction type | Postings |

| 11 | Capitalization of customer-supplied materials | “Receipt (Acts, invoices)” (in the old version “Receipt of goods, | Dt 003.01 Kt - | |

| 22 | Transfer of customer-supplied raw materials to production | "Demand-invoice" | Dt 003.02 Kt003.01 | |

| 33 | Transfer of customer-supplied raw materials to production | "Production report for the shift" | Dt 20.02 Kt 20.01 | |

| 44 | Transfer of products to the customer | "Transfer of goods" | Transfer of products to the customer | No postings |

| 55 | Sales of processing services, write-off of customer-supplied materials. | “Sales of processing services” | Dt 62.01 Kt90.01 Dt 90.02 Kt20.02 Dt 90.03 Kt68.02 Dt - Kt 003.02 | |

| 66 | Return of remaining customer-supplied raw materials | "Return of goods to supplier" | From recycling | Dt - Kt 003.01 |

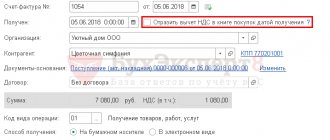

The service implementation document achieves the solution of several problems simultaneously. Below are presented both the features of its structure and those formed by the wiring system. As for determining the cost of customer-supplied materials, in essence the procedure does not differ from a similar operation when working with your own materials.

It is necessary to take into account that the posting of customer-supplied materials involves the selection of contracts that have the “With the buyer” type.

Creating a document “Sales of processing services” involves entering in the “Price” column the cost of services established by the materials processing company. The column “Planned price” reflects data on the planned cost of the processing service in question.

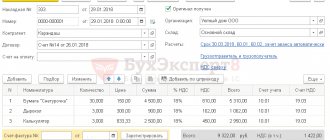

The completed document “Sales of processing services” has the following appearance:

After posting the document, the system will create the following set of transactions:

Processing agreement

There are two main parties here - the supplier of raw materials and the processor. The first retains the role of owner. The contractor undertakes an obligation to complete certain work and timely delivery to the customer. In exchange for his help, he receives a certain amount.

Toll raw materials are materials transferred for processing to another enterprise in order to impart certain properties to it. Once it has been properly processed, the organization that submitted the material for processing receives a corresponding report.

This document indicates the amount of materials that were consumed, data on the products produced and waste generated during the activities of the processor.

It is also mandatory to hand over the acceptance certificate for completed work. Here you can find information about the list of manipulations performed and the final cost of the work. When receiving finished products, a special invoice is issued. The cost of such products is formed on the basis of the price of materials and the cost of work. It also includes payment costs:

- intermediary;

- transportation of material;

- business trips;

- general and general production expenses.

The procedure for forming the cost price must be indicated in the relevant documentation.

Accounting for raw materials supplied by the customer in 1C

| №№ | Operation | Document | Document transaction type | Postings |

| 11 | Transfer of materials for recycling | "Transfer of goods" | "Transfer of raw materials for processing" | Dt 10.07 Kt 10.01 |

| 22 | Return of materials and products from processing: 2.1- write-off of materials; 2.2 — receipt of finished products; 2.3 — return of remaining materials; 2.4 - accounting for processing services; 2.5 - VAT accounting; 2.6 - invoice; | "Receipt from processing" | Dt 20.01 Kt10.07 Dt 43 Kt 20.01 Dt 10.01 Kt10.07 Dt 20.01 Kt60.01 Dt 19.04 Kt60.01 Dt 68.02 Kt19.04 |

It should be noted that in the process of transferring customer-supplied raw materials to production, its write-off is carried out on the basis of the average cost of this material. In this case, when drawing up a document, the option of the contract “With the supplier” is selected.

The document received from processing is characterized by the following structural features:

- Products made from obtained raw materials;

- Recycling service;

- Materials used in processing;

- Returnable materials, that is, returned to owners in their original form;

- Returnable packaging;

- Cost account.

The completed document has the following appearance:

After it is completed, the program will independently create the necessary set of transactions

It must be noted that the 1C program provides all the possibilities for correct accounting of transactions with customer-supplied raw materials. The only condition is the correct sequence of actions performed.

Receipt from processing

We will issue a document in 1C 8.3 for the return of materials from recycling. This document is similar, at first glance, to the goods receipt document, but it performs several more functions:

- firstly, we must write off the materials from which the contractor made our products;

- secondly, we may incur additional costs associated with, for example, the delivery of materials. These costs should be reflected in the cost of finished products;

- thirdly, there may be leftover materials that the contractor returns to us, and we must capitalize them;

- Well, in the end, as a result of all these operations, we should have finished products in the warehouse.

Let's start drawing up the document. Similar to the first one, we will fill in the organization, warehouse and counterparty with the contract.

The tabular part in this document is more varied, so let’s look at it in more detail, by tab. I will provide you with an already completed document as an example, and then we will carefully consider it:

First tab: Products. Here we select the product that ultimately came to us.

Let me remind you that finished products are accounted for in account 43. Another feature on this tab is the “Planned Amount” column. Since at this stage we often cannot accurately indicate the cost of production, we indicate it here manually as planned. In this document, we will be able to accurately calculate only direct material costs - these are the materials that make up our product. Plus some services, again, related to the direct production of this batch.

We will be able to finally calculate the cost only at the end of the month, taking into account the rental of equipment (for example, a car that transported materials), workers’ salaries for the month, electricity, heating, and so on.

We will indicate its specification in each line with the finished product. Thanks to this, we do not have to fill out the “Used Materials” tab manually.

We will not consider the “Services” tab; everything on it is the same as in the “Receipt of goods and services” document, except that, again, you need to indicate the cost account.

So we moved smoothly to the expense account. Let's go to the "Cost Account" tab. This is where he dug in. For me it defaulted to 20.01. If the field is empty, please indicate the one you need. Fill in the details “Cost division” and “And item group”. This is necessary for analytical accounting.

“Used materials” tab. Here we click the “Fill” button and select “According to specification”. Hurray, everything was filled out correctly for me:

Oddly enough, that's all on this tab. Let's move on to "Returned Materials".

General information

The report on product processing is a unified form SP-28. The document was put into circulation by Decree of the State Statistics Committee of September 29, 1997 No. 68.

Since the beginning of 2013, the document has ceased to be binding, like all unified forms. From this moment on, companies received the right to create their own forms. It became possible to include all the necessary information in the document. However, key details must always be present, such as, for example, the name of the document, date of preparation, signatures of responsible persons, essence and name of the business transaction, etc.

For your information! The choice of forms - unified or independently developed - must be indicated in the company’s accounting policy by an appropriate order.