Regardless of whether the agent acts on his own behalf or on behalf of the principal, he performs transactions at the expense of the principal. The agent does not own the ownership of the goods (work, service) being sold. A mandatory condition of any agency agreement is its remuneration, that is, the agent receives remuneration for his services.

Thus, no matter what agency transactions we are talking about, the agent always has income, expenses and objects of taxation only in relation to the amounts of the agent’s remuneration. Depending on whether the agency activity for the agent is permanent or one-time, it is possible to use both account 62 “Settlements with buyers and customers” (the principal for the agent is the customer of services) and account 76 “Settlements with various debtors and creditors." Given the variability, please note that the accounting treatment must be fixed in the accounting policy. If accounting is planned to be carried out using account 76, then the working chart of accounts must provide for appropriate levels of synthetic and analytical accounting.

Sample agency agreement, its difference from a service agreement

Unlike a regular service agreement, remuneration is usually paid as a percentage of the amount of contracts concluded by the agent, and not as a fixed amount. An agency agreement is aimed at representing the interests of the customer when interacting with clients, while a service agreement is aimed at performing certain actions and obtaining results in a variety of areas.

The agency agreement is drawn up in two copies. His sample includes the following:

- number according to the register of agreements of the enterprise, date and place of registration;

- details of the persons drawing up the agreement;

- list of services performed;

- price policy;

- consideration of all possible situations;

- duration and termination of the contract;

- rights and obligations of the parties;

- dispute resolution;

- details, signatures of the parties.

Report prepared by agent

An integral part of the contract is the agent’s report on the fulfillment of the instructions given to him. The Russian Civil Code (Article 1008) makes the provision of this document the responsibility of an agent, but does not impose requirements on its form. The report form is developed by the parties to the contract, taking into account the specifics of their relationship. The law prohibits replacing it with other documents.

Read also: additional agreement for the provision of additional services

The report (usually monthly) shows the cost of services provided. Documents confirming the expenses incurred by the agent are attached to it. If the specifics of the concluded contract do not require other deadlines, the customer is obliged to pay the specified amount within 7 days from the date of receipt of the report.

The agency agreement imposes certain restrictions on both parties. The agent may require the customer not to use the services of other agents in the field of activity entrusted to him and not to take independent actions to achieve the goal set for the agent.

The customer may prohibit the agent from collaborating with competing organizations. However, it would be illegal for the customer to restrict the agent in choosing methods of work or territory of interaction with clients.

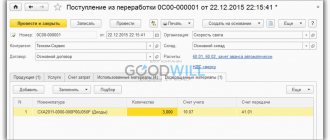

Agent report in 1C 8.3 Accounting

This is influenced by the type of contract chosen.

There is only a posting for the transfer of products to the commission at cost: Debit 45.01 Credit 43.

The next step is to prepare the document “Report of the commission agent (agent) on sales.” This can be done directly from the implementation via the “Create” button. The document form has several tabs, let’s look at each: The “Main” tab reflects the basic information on calculations; the document is filled out automatically according to the basis (implementation) document.

We check the data in the fields: Counterparty Agreement Calculation method Calculations:

- The compensation expense account should be 44.01

- For remuneration 60.01 or 60.02.

- For goods on invoice 62.01 or 62.02.

The cost item is commission services (or agent services).

Question

What documents must the agent provide to the customer (the agent makes purchases)? In whose name should the documents be drawn up if the agent is acting on his own behalf?

Answer

If the intermediary acts on his own behalf. This scheme is always applied under a commission agreement and can be applied under an agency agreement. In this case, the intermediary, on his own behalf, enters into contracts with buyers and sellers. This means that he himself is the seller or buyer under the contract, respectively. Moreover, the principal may not even be mentioned in such agreements. And the intermediary also becomes obligated under the concluded contracts.

Mediator's report

Regardless of on whose behalf the intermediary acts, when carrying out the instructions of his customer, he must report to the principal for the work performed.

For what period (for example, at the end of the month or after the execution of the order) and within what time frame the report is submitted to the principal must be stipulated in the intermediary agreement. If these conditions are not specified in the contract, then reports are submitted by the intermediary as he fulfills the contract or upon termination of the contract.

It is also advisable to set a deadline in the contract for approval of the report by the principal.

The intermediary's report must reflect:

— title of the document (report on the execution of the order);

— the date of its preparation;

— date of its approval;

— names of the intermediary and the principal;

— details of the agreement in pursuance of which it was drawn up (number, date);

- quantity and cost of goods (works, services) sold (purchased) by the intermediary, the date of shipment of the goods and receipt of payment for it. You can attach to the report (if you discuss such a condition in the intermediary agreement) documents confirming these indicators (copies of contracts, invoices, acceptance certificates, etc.);

- the amount of expenses actually incurred that are subject to reimbursement by the principal. And if the principal needs this and you have added this condition to the intermediary agreement, you can indicate a list of documents confirming the intermediary’s expenses and, accordingly, transfer them;

- the amount of intermediary remuneration calculated in accordance with the terms of the agreement, and the amount of additional benefits (if any);

- surnames and initials of managers. They must sign the report.

If the purchase was made from an individual, and he cannot provide the agent with a check or receipt of payment, then other documents confirming payment can be issued. The acquisition of property (fixed assets, goods, other intangibles) from an individual who is not an entrepreneur is formalized by a purchase and sale agreement. If the contract does not say that the property was transferred to the buyer upon conclusion of the contract, then an additional document must be drawn up confirming the acceptance and transfer of the property (for example, an acceptance certificate). Instead of a contract and an acceptance certificate, you can draw up one document - a procurement act.

Types of agreement

One of the types of agency agreement is an agreement for the provision of agency services for finding clients (buyers). It is concluded in accordance with the general model and necessarily contains a list of the main responsibilities of the agent:

- search for clients;

- enter into contracts with them on your own behalf or on behalf of the principal;

- accept payment from them to the principal.

An application form is attached to the document, where data about the new client is entered. If the application is approved by the principal, the agent will sign a contract with the buyer. If the latter has any complaints regarding the quality of the products provided, he resolves this issue with the principal.

An agency agreement for the provision of legal services assumes that the agent looks for lawyers, jurists, and notaries for the customer who care about protecting the customer’s rights. The agent's responsibilities include ensuring the timely receipt, provision and storage of all necessary documentation and reporting to the customer on the work performed by him.

No later than five days after the conclusion of the contract, the agent must be issued the relevant documents and powers of attorney.

An agency agreement for the provision of accounting services is often used by companies providing cellular communications when they enter into agreements with cash register stores.

Online store agent for cash delivery and acceptance

Many online stores, especially those operating in large cities, allow the buyer to receive the ordered goods by courier and pay in cash at the time of delivery. However, for many online stores, this turns into a real nightmare - purchasing, registering, servicing the cash register, meeting the check issuance time, depositing cash at the bank, etc. Read more about the obligation to issue a check.

It's good that this can be shifted onto someone else's shoulders! Most companies offering courier delivery services can take on the responsibility for receiving cash proceeds. As a result, you receive the proceeds directly to your bank account; the courier service is an agent of the online store. How to organize document flow in an online store when working with an agent, how to keep records - we talk about this in the article.

Online store agent for accepting cash

The sale of goods by an online store through an agent can be represented in the form of the following algorithm:

1. The store receives an application from the buyer via the website or by phone. Delivery costs are included in the order price.

2. The ordered goods are transferred by the store (principal) to the agent for delivery.

3. The agent delivers the goods to the buyer and receives cash from him (for the entire amount of the order), punches the cash receipt.

4. The agent transfers the payment from the buyer to the store’s bank account minus his remuneration (usually taken in %). Delivery services are usually paid separately according to the invoice issued by the agent.

From the point of view of civil law, the agent, on behalf of the online store (principal) and at his expense, enters into a retail purchase and sale agreement with the buyer (Article 1005 of the Civil Code). Outwardly, this looks like delivery of goods and receipt of payment. From the point of view of legislation, it is not delivery, but the transfer of goods to the buyer, since when the courier brings the goods to the buyer, the contract has not yet been concluded (Articles 492,493).

Document flow between principal and agent

Regulatory documents do not regulate the forms by which the goods are transferred to the agent from the principal. Therefore, you can create and agree as an annex to the contract such documents that will be convenient for you. As a rule, an agent who has been working in the market for a long time has already developed such forms, and he will offer you to use them.

In practice, document flow depends on the form in which the goods are transferred to the agent from the principal.

1. The agent receives from the principal a ready-made “package” for a specific buyer’s request, i.e. The goods are assembled, packaged, and labeled by the principal. In this case, with the goods, the principal gives the agent a document, which then goes to the buyer. This could be an invoice or a document with a different name - see below, as well as the article about. The transfer of completed orders to the agent can be confirmed by separate documents, for example, an act.

2. The agent receives the consignment of goods in advance and carries out the picking and packaging independently, upon receipt of a confirmed application from the principal. When transferring a consignment of goods, an invoice is drawn up (for example, in the TORG-12 form) or a transfer and acceptance certificate. The agent prepares documents for the buyer for each application.

After the provision of services or at the end of a specified period (for example, a week or a month), the agent draws up and sends to the principal an agent report on the receipt of funds and delivery to the client, which sets out the details of completed orders. You can see an example of a report in the figure.

Document flow between agent and buyer

Now let's talk about what documents the agent should give to the buyer. In doing so, we will keep in mind the following:

1. To conclude a retail purchase and sale agreement, it is sufficient to transfer the cash receipt to the buyer (Article 493 of the Civil Code).

2. The agent needs to have confirmation that the goods have actually been transferred to the buyer (which means that just knocking out a receipt is not enough).

3. The buyer, in accordance with the Rules for the sale of goods remotely (approved by Government Decree No. 612 of September 27, 2007, must provide additional information to the buyer (name, properties, price of the product, terms of purchase, rules of use, return, etc.). This is also necessary do it in writing.

It turns out that handing over just one cash receipt to the buyer is not enough. Moreover, the receipt will include the details of the agent, and not the online store. Therefore, it is necessary for the buyer to understand that the agent acted on behalf of the store, and in case of complaints, contact the store and not the agent.

When selling through an agent, you will not be able to use a sales receipt, because it does not contain the buyer's signature, and besides, the agent again has nothing left in his hands.

Therefore, the principal and agent should agree on the form of the special document. You can call it whatever you want, let it be an invoice. It can contain the following information:

— description of the buyer’s request - what was ordered: product name, quantity, price, total cost, etc.;

— seller details: name, tax identification number, contact information;

— action of an agent on behalf of the store on the basis of an agreement (date and number);

— warranty obligations, procedure for filing claims;

— delivery information: date and signature of the buyer on receipt of the goods.

The document is drawn up in 2 copies, one remains with the buyer, the other with the agent.

Accounting

In the accounting of an online store, when selling goods to a buyer through an agent, the following transactions will occur:

Debit 76 – Credit 41 – goods transferred to agent

Debit 76 – Credit 90-1 – revenue recognized according to the agent’s report

Please note: revenue must be recognized on the dates when the buyer paid the agent for the goods! Revenue (income from sales) is recognized in full - according to the amounts paid by the buyer, without reduction by the retained agency fee.

Debit 90-2 – Credit 76 – the cost of goods transferred and sold is written off according to the agent’s report

Debit 51 – Credit 76 – proceeds from the agent minus the agent’s fee were credited to the current account

Debit 44 – Credit 76 – agent’s remuneration accrued (as of the date of the agent’s report)

Debit 44 – Credit 76 – invoiced by the agent for delivery services

Debit 76 – Credit 51 – paid for delivery services from the current account

If you need advice on accounting and taxation in an online store, write to me on the page. Find out how I can help Internet entrepreneurs, take a look at the page.

Agency services

Subscribers pay for the principal's services through agents. The money goes to the agent’s bank account and is then transferred to the principal’s bank account. It should be taken into account that funds received by the agent’s cash desk are considered as income generated by this activity and are taxed.

For regular or one-time transportation of goods, an agency agreement for transport services is drawn up. The customer provides the agent with all information regarding the cargo (weight/volume, main characteristics, degree of danger to human life and health and the environment, etc.) and the type of transport. As a rule, the agent is entrusted with documenting cargo transportation and accompanying the cargo at all stages of transportation.

Postings under the agency agreement

In accounting, the agent's revenue received for providing services to the principal is classified as income from ordinary activities. It is reflected in account 90, subaccount “Revenue”. Expenses incurred by the agent in connection with intermediary services are indicated on account 26, “General business expenses.” This amount is debited from account 26 to account 90, subaccount “Cost of sales”.

Postings under an agency agreement on the part of the principal include the recognition of revenue (90), the accrual of remuneration to the agent based on his report (26), the write-off of costs for intermediary services (90), the accounting of profits received from buyers (clients) through the agent (51) and the reflection VAT.

Correct execution of an agency agreement for the provision of services protects both parties and contributes to the expansion of business activities.

If you need qualified advice regarding your situation, call the phone number listed at the top of the page, or send a question through the form at the bottom right of the screen. Our specialized lawyer will promptly respond and solve your problem!

Error correction procedure

In practice, errors often occur that need to be corrected. In this case, there are two options for making changes:

- as in any other primary document, the correction is made taking into account the “Regulations on documents and document flow in accounting” (approved by the USSR Ministry of Finance on July 29, 1983 N 105) and clause 7 of Art. Article 9 of Federal Law No. 402-FZ: the inscription “corrected” is made, which is certified by the signatures of the responsible persons, with a transcript, and the date of correction is indicated;

- a protocol of objections is drawn up, on the basis of which a new document is prepared containing correct information.

Organization's report on the simplified tax system

Example when providing services

Peculiarities of document flow under agency agreements

In tax planning, the practice of using intermediary agreements is common. However, the document flow when concluding such transactions has its own characteristics, so violations in it can lead to such consequences for both parties as refusal to deduct VAT, non-recognition of expenses under the contract for profit tax purposes, etc. Let’s consider how to avoid this.

There is a special procedure for issuing and receiving invoices for intermediary agreements. This procedure is established by the Rules for maintaining logs of received and issued invoices, purchase books and sales books for VAT calculations, approved by Decree of the Government of the Russian Federation of December 2, 2000 N 914 (hereinafter referred to as the Rules). The procedure is also clarified by Letter of the Ministry of Taxes of Russia dated May 21, 2001 N VG-6-03/404 “On the use of invoices for VAT calculations” (valid to the extent that does not contradict tax legislation).

When executing agency agreements regarding the issuance of invoices, it is necessary to take into account that the intermediary can act in relations with a third party either on its own behalf or on behalf of the principal. The procedure for issuing invoices depends on the choice of a specific option.

Agency agreement sample (form, sample - 2020)

The features of representing the client’s interests by proxies differ somewhat depending on what document confirms the powers of the proxies and what form the trust relationship has taken, depending on what agreement formalized the cooperation of the parties.

Differences between an agency agreement and a simple power of attorney

In any transactions in which a representative of a certain person, and not this person personally, is involved, the trustee acts for the benefit of his client. That is, transactions are made mainly so that the benefit from them is received by the person on whose behalf the trustee is acting.

- In the case of an agency agreement, the range of powers of the trustee is significantly expanded and may imply, when concluding a transaction, that the trustee (agent) also has such rights and obligations that he can be considered a full-fledged participant in the transaction.

- The principal - this is the principal under the agency agreement - can give the agent the right to perform the necessary actions on his own behalf, and not just represent the interests of the customer.

- In cases where the agency agreement provides for the opportunity for the agent to enter into transactions independently, then he becomes a participant in such a transaction and the actions of the agent, his duties and rights, are enshrined in the text of the document formalizing such a transaction.

Although it is also possible that the principal does not give the agent the right to independently perform legal actions. Then the work of the agent is reduced to the work of a trustee under a regular written power of attorney, everything depends on the amount of authority vested.

Drawing up an agency agreement, its sample

The basic rule of agency agreements will be payment for the work of the agent by the principal. The concept of payment may also include compensation for the cost of current expenses, unforeseen expenses or other expenses.

All these points, as well as payment for the results of the agent’s work, need to be fixed in the text. Now let's consider another important issue of concluding a contract.

The rights of the agent under the contract, the possibility of concluding contracts on his own behalf, the limits of the possibilities of representing the interests of the client and all aspects related to in what areas of life and in what powers the agent will represent the principal.

The clauses in the agreement regarding the powers of the agent are very important. Allowing an agent, although on your behalf, to independently conclude transactions, it is necessary to carefully consider these points.

When drawing up an agreement, it is necessary to clearly indicate the limits of the agent’s powers, exclude the possibility of abuse of trust and provide for all possible consequences and liability of the agent if his actions cause any harm to the principal.

Below is a standard agency agreement, a sample and form of which can be downloaded for free.

Agent's golden rules

When an agent sells goods (works, services) to a principal, the following rules apply when issuing invoices. If the agent sells goods (work, services) under an intermediary agreement on behalf of the principal, then the invoice must be issued to the buyer on behalf of the principal. If the agent sells goods (work, services) of the principal on his own behalf, then the invoice is issued by the intermediary in two copies on his own behalf. In this case, the number in the invoice is assigned by the agent according to the chronology of the invoices issued by him. One copy of this document is handed over to the buyer, and the second is filed in the journal of issued invoices without registering it in the sales book (clause

Agency agreement: accounting by the principal and agent

3 of the Rules). Note that this option, when the agent acts on his own behalf, is the most complex.

After the intermediary has sold the product, he informs the principal of the invoice issued to the buyer. Then the principal issues an invoice with these indicators, as expected, in duplicate. The first copy is registered in the sales book with the principal, the second copy of the invoice is transferred to the agent. Please note that the numbering of invoices must correspond to the chronology of invoices issued by the principal. The intermediary does not register invoices received from the principal in the purchase book (clause 11 of the Rules).

Invoices issued by the agent for the amount of his commission are recorded in the principal's purchase book as the right to tax deductions arises. For the agent, such invoices are subject to reflection in the sales book.

The commission agent and the agent can indicate the amount of intermediary remuneration in one invoice with the cost of goods (work, services) on separate lines indicating the corresponding VAT amounts.

Agent and principal

In tax planning, the practice of using intermediary agreements is common. However, the document flow when concluding such transactions has its own characteristics, so violations in it can lead to such consequences for both parties as refusal to deduct VAT, non-recognition of expenses under the contract for profit tax purposes, etc. Let’s consider how to avoid this.

There is a special procedure for issuing and receiving invoices for intermediary agreements.

This procedure is established by the Rules for maintaining logs of received and issued invoices, purchase books and sales books for VAT calculations, approved by Decree of the Government of the Russian Federation of December 2, 2000 N 914 (hereinafter referred to as the Rules).

The procedure is also clarified by Letter of the Ministry of Taxes of Russia dated May 21, 2001 N VG-6-03/404 “On the use of invoices for VAT calculations” (valid to the extent that does not contradict tax legislation).

When executing agency agreements regarding the issuance of invoices, it is necessary to take into account that the intermediary can act in relations with a third party either on its own behalf or on behalf of the principal. The procedure for issuing invoices depends on the choice of a specific option.

Agent's golden rules

When an agent sells goods (works, services) to a principal, the following rules apply when issuing invoices. If the agent sells goods (work, services) under an intermediary agreement on behalf of the principal, then the invoice must be issued to the buyer on behalf of the principal.

If the agent sells goods (work, services) of the principal on his own behalf, then the invoice is issued by the intermediary in two copies on his own behalf. In this case, the number in the invoice is assigned by the agent according to the chronology of the invoices issued by him.

One copy of this document is handed over to the buyer, and the second is filed in the journal of issued invoices without registering it in the sales book (clause 3 of the Rules).

How to correctly draw up documents under an agency agreement received from the agent

Note that this option, when the agent acts on his own behalf, is the most complex.

After the intermediary has sold the product, he informs the principal of the invoice issued to the buyer. Then the principal issues an invoice with these indicators, as expected, in duplicate.

The first copy is registered in the sales book with the principal, the second copy of the invoice is transferred to the agent. Please note that the numbering of invoices must correspond to the chronology of invoices issued by the principal.

The intermediary does not register invoices received from the principal in the purchase book (clause 11 of the Rules).

Invoices issued by the agent for the amount of his commission are recorded in the principal's purchase book as the right to tax deductions arises. For the agent, such invoices are subject to reflection in the sales book.

The commission agent and the agent can indicate the amount of intermediary remuneration in one invoice with the cost of goods (work, services) on separate lines indicating the corresponding VAT amounts.

Agent report as process completion

The agent's report completes the document flow during the execution of agency contracts. The deadlines within which the report must be transferred to the principal are not established by law, so they should be specified in the agency agreement.

Attention! Specify the deadlines for submitting the report in the agency agreement. This is important for the purpose of timely payment of VAT by the principal, since if the agent is not informed in time, he may be late in paying the tax. Please note that the five-day period for issuing an invoice is counted from the day the agent sold the goods.

How to reduce paperwork?

Some experts believe that it is possible to reduce the flow of documents between the agent and the principal, since in paragraph.

24 of the Rules does not say that for each invoice issued by the commission agent to the buyer, the principal must issue his own invoice to the commission agent.

Consequently, it is enough for the principal (principal) to issue one invoice at the end of the month with the indicators of all invoices of the commission agent (agent).

It is important. Reduced document flow may result in incomplete payment of VAT on some transactions. In this case, liability will arise for late payment of tax.

Please note that this may result in incomplete payment of VAT on some transactions. For example , the shipment occurred in one reporting period, but the invoice was issued in another, and the taxpayer did not charge VAT. In this case, liability will arise for late payment of tax.

Trade without a waybill or invoice

If the agent carries out retail trade, issuing cash and sales receipts to the buyer instead of a delivery note and invoice, as when trading under supply contracts, the document flow procedure will be simpler.

During retail sales, the agent does not issue invoices to buyers; therefore, he cannot transfer to the principal the indicators of the invoice issued to the buyer.

Therefore, the agent is limited to submitting a report with the necessary documents attached (copies of cash receipts, other documents) confirming the fact of sale of goods to customers. Such a report serves as the basis for the principal to issue an invoice, which is recorded in the journal of issued invoices and in the sales book and sent to the agent.

Agency agreements for the purchase of goods, works, services

When an agent carries out instructions from the principal to purchase goods (order work or services), invoices are drawn up as follows.

If goods (work, services) are purchased through an agent, but on behalf of the principal, then the invoice must be issued by the seller (contractor) in the name of the principal.

Only in this case will it be the basis for deducting VAT on goods (work, services) purchased from the principal.

If the purchase of goods (order of work or services) is carried out by an agent on his own behalf, then the invoice is issued by the seller (contractor) in the name of the agent. In this case, the basis for the principal to accept VAT for deduction will be the invoice received from the agent.

In this case, such an invoice is issued by the intermediary to the principal reflecting all the indicators from the invoice issued by the seller to the agent. Note that both invoices (both received and issued) are not recorded by the agent in the purchase book and the sales book.

The agent does not register invoices received from sellers in the purchase book (clause 11 of the Rules).

A. Urvantseva

K. e. n.,

tax consultant

LLC “Kuzminykh and partners”

Document

Decree of the Government of the Russian Federation of November 29, 2014 No. 1279 “On amendments to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137”

Source: https://buh-experts.ru/agent-i-principal/

Agent report as process completion

The agent's report completes the document flow during the execution of agency contracts. The deadlines within which the report must be transferred to the principal are not established by law, so they should be specified in the agency agreement.

Attention! Specify the deadlines for submitting the report in the agency agreement. This is important for the purpose of timely payment of VAT by the principal, since if the agent is not informed in time, he may be late in paying the tax. Please note that the five-day period for issuing an invoice is counted from the day the agent sold the goods.

How to reduce paperwork?

Some experts believe that it is possible to reduce the flow of documents between the agent and the principal, since clause 24 of the Rules does not say that for each invoice issued by the commission agent to the buyer, the principal must issue his own invoice to the commission agent. Consequently, it is enough for the principal (principal) to issue one invoice at the end of the month with the indicators of all invoices of the commission agent (agent).

It is important. Reduced document flow may result in incomplete payment of VAT on some transactions. In this case, liability will arise for late payment of tax.

Please note that this may result in incomplete payment of VAT on some transactions. For example , the shipment occurred in one reporting period, but the invoice was issued in another, and the taxpayer did not charge VAT. In this case, liability will arise for late payment of tax.

Trade without a waybill or invoice

If the agent carries out retail trade, issuing cash and sales receipts to the buyer instead of a delivery note and invoice, as when trading under supply contracts, the document flow procedure will be simpler.

During retail sales, the agent does not issue invoices to buyers; therefore, he cannot transfer to the principal the indicators of the invoice issued to the buyer.

Therefore, the agent is limited to submitting a report with the necessary documents attached (copies of cash receipts, other documents) confirming the fact of sale of goods to customers. Such a report serves as the basis for the principal to issue an invoice, which is recorded in the journal of issued invoices and in the sales book and sent to the agent.

How to manage document flow under a commission agreement

What documents are needed to formalize the transfer of property under a commission agreement?

Document the transfer of property from the commission agent to the principal and vice versa using any primary documents drawn up in accordance with the requirements of Part 2, 4 of Art. 9 of the Accounting Law.

You can use standard forms for recording trading operations in commission trading. These include, for example (clause 1.4 of the Resolution of the State Statistics Committee of Russia dated December 25, 1998 N 132):

- list of goods accepted for commission, according to Form N KOMIS-1;

- a list of vehicles (cars, motorcycles) and numbered units (units) accepted for commission in accordance with Form N KOMIS-1a;

- certificate of sale of goods accepted for commission, in form N KOMIS-4;

- card for recording goods and settlements under commission agreements in form N KOMIS-6;

- log of acceptance for commission and sale of vehicles (cars, motorcycles) and license plates (units) according to Form N KOMIS-8.

How to write a commission agent's report

Draw up the commission agent’s report in any form, taking into account the requirements of Part 2 of Art. 9 of the Accounting Law.

We invite you to familiarize yourself with: Reimbursement of utility expenses by the tenant Acts, samples, forms, agreements Consultant Plus

Set the report form in the appendix to the commission agreement. Include in the report information about the execution of the commission agreement and the costs incurred in connection with the implementation of these actions, which the principal must reimburse. In addition, provide in the report the calculation of the commission agent's remuneration and indicate its amount.

Submit the commission agent's report to the principal after execution of the contract (Article 999 of the Civil Code of the Russian Federation).

How can a committent file objections to a commission agent’s report?

The principal files objections to the commission agent's report within 30 days from the date of its receipt or within another period specified in the commission agreement (Article 999 of the Civil Code of the Russian Federation).

We recommend that the contract stipulate that objections must be sent in writing (Article 160 of the Civil Code of the Russian Federation).

You can establish the form of objections in the annex to the contract.

In what cases and how does a commission agent draw up an act of provision of services?

If the commission agent's report only notifies about the execution of the contract and does not contain details of the work, draw up an act of acceptance of the commission agent's services. In the act, describe in detail your actions under the agreement.

Develop the form of the commission agent’s services acceptance certificate yourself, including all the necessary details of the primary accounting document (Part 2, 4, Article 9 of the Accounting Law).

We recommend that the form of the act be established in the appendix to the commission agreement.

How a commission agent prepares invoices and keeps a log of invoices

If you are purchasing goods for the consignor, reissue an invoice from the seller to him. If the consignor's goods are sold, issue an invoice to the buyer. Register such invoices in the invoice register (clause 3 of article 168 of the Tax Code of the Russian Federation, clause 3, paragraph “a”, clause 7 of the Rules for maintaining the invoice register).

In addition, issue an invoice to the principal for the amount of the commission. It does not need to be registered in the invoice journal (clause 1, article 156, clause 3, article 168 of the Tax Code of the Russian Federation, clause 1(2) of the Rules for maintaining the invoice journal).

We suggest you read: Changing your last name on your employment application form

Agency agreements for the purchase of goods, works, services

When an agent carries out instructions from the principal to purchase goods (order work or services), invoices are drawn up as follows. If goods (work, services) are purchased through an agent, but on behalf of the principal, then the invoice must be issued by the seller (contractor) in the name of the principal. Only in this case will it be the basis for deducting VAT on goods (work, services) purchased from the principal.

If the purchase of goods (order of work or services) is carried out by an agent on his own behalf, then the invoice is issued by the seller (contractor) in the name of the agent. In this case, the basis for the principal to accept VAT for deduction will be the invoice received from the agent. In this case, such an invoice is issued by the intermediary to the principal reflecting all the indicators from the invoice issued by the seller to the agent. Note that both invoices (both received and issued) are not recorded by the agent in the purchase book and the sales book. The agent does not register invoices received from sellers in the purchase book (clause 11 of the Rules).

A. Urvantseva

K. e. n.,

tax consultant

Kuzminykh and Partners LLC

Conversations

15.02.2017 16:54  I practically live at work, but the salary is getting smaller... Apparently they started deducting for accommodation... Read more...

I practically live at work, but the salary is getting smaller... Apparently they started deducting for accommodation... Read more...

02/15/2017 14:14 Fire at the tax office Call to the fire department: - Guys, are you very busy? - No, we’re sitting, playing dominoes... - Well, finish the game and get ready slowly, the tax office is on fire... Read more...

01/19/2012 15:24 Ballad about the average number of employees I threw away frivolity, I got up early today - I handed over the average number to the tax office. Having scratched the hard stubble on my face, I open the discreet door, having smoked on the roof… Read more…

03/05/2011 12:01 “Why empty-handed?” Now she is the chief accountant in a small budget institution, but in the 90s she worked in the tax office. This is an incident from my inspection life. There was a notice on the door of our office that in order to register you must... Read more...

12/28/2010 16:09 Red reversal The boss comes to the chief accountant and sees that he has an almost empty bottle of vodka on his desk. He says: “How can you? Drunk at work! And you’re also drinking white stuff!” What does the chief accountant need... Read more...

All entries

Agency agreement for the provision of services

Features of taxation when working under an agency agreement.

When working under an agency agreement, specific features arise in calculating the tax base for VAT and income tax.

2.1. VAT.

VAT taxpayers, when carrying out business activities in the interests of another person on the basis of agency agreements, determine the tax base as the amount of income received by them in the form of remuneration (or any other similar income) in the performance of agency agreements (Article 156 of part two of the Tax Code of the Russian Federation). The VAT tax base for an agency agreement is determined as the amount of income received by the agent in the form of remuneration (Article 156 of the Tax Code of the Russian Federation). Amounts received from the principal for the execution of a transaction (except for amounts due to them in the form of fees or any other income) are not included in the tax base. The procedure for issuing invoices for intermediary agreements is established by the Rules for maintaining logs of received and issued invoices, purchase books and sales books for value added tax calculations (approved by Decree of the Government of the Russian Federation of December 2, 2000 N 914). In accordance with clause 3 of these Rules, agents performing actions on their own behalf store invoices received from sellers for goods purchased for the principal in the journal of received invoices. The purchase book does not record invoices received by the agent from the principal for goods transferred for sale or from the seller of goods, issued in the name of the agent (clause 11 of the Rules).

2.2. Income tax.

1. Income in the form of property (including cash) received by the agent in connection with the fulfillment of obligations under the agency agreement (subclause 9 of clause 1 of Article 251 of the Tax Code of the Russian Federation) is not considered to be the agent’s income. 2. Income in the form of property (including cash) received by the agent to reimburse expenses incurred by him for the principal is not considered income of the agent, if such expenses are not subject to inclusion in the agent’s expenses in accordance with the terms of the concluded agreements. 3. Expenses in the form of property (including money) transferred by the agent in connection with the fulfillment of obligations under the agency agreement (subclause 9 of Article 270 of Part Two of the Tax Code of the Russian Federation) are not considered expenses of the agent. 4. Expenses made by the agent to pay expenses for the principal are not considered to be the agent’s expenses, if such expenses are not subject to inclusion in the agent’s expenses in accordance with the terms of the concluded agreements.

Consequently, the tax base for calculating income tax for an agent will be only the amount of the commission. Moreover, for tax purposes, such amounts are accepted depending on the method of recognition of income and expenses determined by the agent’s accounting policy in accordance with current tax legislation. If the agent uses the accrual method for these purposes, then the date of receipt of income from the sale of intermediary services is the date of actual provision of these services (Article 271 of the Tax Code of the Russian Federation), which is determined on the basis of the agency agreement: - upon completion of the operation (order); - on the last date of the reporting period under the contract (if the contract is long-term or provides for the performance of several operations during a certain period); - on the date of submission of the report by the agent. If the agent has the right to determine income and expenses using the cash method (subject to the requirements of Article 273 of the Tax Code of the Russian Federation), then the date of receipt of income is the day of receipt of funds from the principal (in the form of remuneration) to bank accounts and (or) to the cash desk, receipts in payment for other property (work, services) and (or) property rights, as well as repayment of debt to it in another way.

The agent must document all expenses incurred by him under the contract. Otherwise, the amount of their compensation will be considered gratuitously received funds and, accordingly, will be subject to inclusion in non-operating income and will be subject to income tax. Copies of all documents confirming the expenses incurred by the agent are, as a general rule, attached to the agent’s report. The amount of remuneration should not be established in the contract taking into account compensation for the agent’s expenses under the contract. This leads to an unreasonable overestimation of the agent's revenue. In addition, the agent cannot include such expenses in the cost price, since according to the Civil Code of the Russian Federation they must be reimbursed by the principal. For the same reason, the agent cannot deduct VAT on them.

What documents must be attached to the father's agent?

For example, the report must indicate:

Next, the report should contain the main part, formatted as a table. This includes:

- serial number;

- date and content of the operation;

- cost of the operation;

- the amount of expenses for the operation.

The table can be supplemented with some other columns (depending on the conditions specified in the agency agreement), for example, information about contractors, expenses incurred by the agent, documents accompanying a particular transaction, etc.

Attention

At the same time, the range of his rights and powers has certain restrictions, violation of which can lead to the termination of contractual relations. If the object of the agency agreement is any inventory items, then they do not become the property of the agent at any stage of the transaction, but are transferred from the seller to the buyer without being included in the agent’s accounts.

Agency agreement: accounting by the principal and agent

Important

The report has a greater semantic load than the common citation of the contract, since the subject of the activity in the contract may be disclosed insignificantly. All details regarding completed transactions and actual actions must be reflected in the report.

Essentially, the content of the report is divided into two parts:

- Result of the agent's activity The description of the result of the activity must correspond to the tasks that were assigned to the agent by the terms of the contract.

It should not be forgotten that the result of the agent’s activity in no case should have a material form; otherwise, the agreement may be reclassified by the court as a work contract; precedents are known. It should also be avoided that the goods handled by the parties become the property of the agent for a period of time.

Agent's report under an agency agreement - sample

The absence of mandatory details (or one or more) in the primary document results in the loss of the legal force of this document.

According to the court of appeal, an analysis of the agent’s reports submitted to the court showed that the contents of the report did not indicate any information about the goods, works or services purchased by the agent for the principal; neither the completed business transactions nor their measures, both in kind and in kind, were indicated. and in monetary terms, but only the total amount presented for payment. Also, the report does not contain information on the quantity of goods, works, services, or the price per unit of goods.

Drawing up an agent's report under an agency agreement

The essence of the agency agreement is the fulfillment by the agent of certain tasks for a fee. Such orders include any legally significant and other actions performed at the expense of the principal.

Depending on the terms of the agreement, the execution of orders can be carried out on behalf of the agent or the principal, however, all expenses when performing actions in any case are carried out at the expense of the principal.

This principle stipulates the agent’s obligation to provide reports on expenses incurred, which may be one-time or systematic.

The agent's report under the agency agreement is the main document indicating the proper execution by the agent of the instructions given to him, as well as the acceptance by the principal of the result of the work.

Sample agent report under an agency agreement

Depending on the volume of work performed or sales made, remuneration under an agency agreement may be:

- fixed;

- "floating".

The agreement may be concluded:

- to carry out a single transaction;

- to provide a range of services;

- for a certain period of time;

- indefinitely.

All clauses of the agency agreement, including the provision of a report on the agent’s activities, must be spelled out carefully and scrupulously, since the way the main document is drawn up may affect the fulfillment of obligations under it.

It is also necessary to remember that if suddenly some friction and conflicts arise between the agent’s principal company and the agent himself, the document may acquire the status of evidence (especially important when resolving disputes in court).

Agent's report

It should always be taken into account that the report will be accepted in the immediate legal sense in the absence of objections from the principal within thirty days or another period provided for by the contract. The period for studying the report and assessing its compliance with the facts is a mandatory element of the agency agreement.

In the absence of an appropriate condition provided for by the parties, the above dispositive norm of the Civil Code of the Russian Federation will be applied.

Agent's report under an agency agreement The report is determined by the terms of the agency agreement and the essence of the subject of the agent's activity.

The agent performs both legal and actual actions, but in any case, these are services, although not in the usual sense of services, namely in the context of mediation and targeted compliance with the interests of the principal.

How to prepare an agent's report under an agency agreement

In addition, the parties must provide for the procedure and period for acceptance (approval) of submitted reports by the principal, as well as the procedure for sending objections to the report. If these facts are not reflected in the contract, the principal will have one month to check and accept the statements, or to file objections regarding the costs incurred for the execution of orders by the agent.

If the principal has not sent objections to the submitted reports to the agent within a month, the report will be considered accepted on the terms set out in it. The one-month period for accepting or rejecting the report can be changed by agreement of the counterparties.

Filling out the form and sample Sample agent report under an agency agreement Civil law classifies an agency agreement as a transaction that must be formalized in simple written form.

Unless otherwise stated in the contract, the agent must attach to his report documents confirming the expenses incurred by him at the expense of the customer (Clause 2 of Article 1008 of the Civil Code of the Russian Federation).

The principal, having studied the agent’s report, within a month (or at any other time specified in the contract) has the right to provide the agent with objections to the work done (clause 3 of Article 1008

Civil Code of the Russian Federation). If the agent is not notified of any objections, the report is considered accepted by the customer. Within a week after this, the principal must pay the agent for his services, unless a different payment period is provided for by the contract or business custom (Art.

1006 of the Civil Code of the Russian Federation). If, instead of a report, the agent provides the customer only with documents confirming expenses, and does not provide the report itself, then the principal will have a reason not to pay for the agent’s services (Resolution of the Federal Antimonopoly Service of the Far Eastern District dated July 24, 2009 No. F03-3022/2009 in case No. A73-10353/2008 ).

This is also important for the agent in the following aspect: the payment period for his services in the contract is most often tied to the report. If there is no provision for this in the contract, the dispositive rules of the Civil Code of the Russian Federation are applied, according to which the period is a week from the date of submission of the report.

If the contract period is long (or not defined at all), there are no deadlines for submitting reports, then the agent who wishes to receive remuneration for any period must submit a report. In this case, the principal, on the basis of Art. 1006, 1008 of the Civil Code of the Russian Federation is obliged to pay remuneration for the corresponding period. The report is sent to the principal, so confirmation of receipt of the document is required.

This could be a receipt from a postal or transport organization, a regular secretary’s receipt on a second copy, or the signature of an authorized person in the special line “Accepted” (the most convenient option in case of territorial accessibility).

An agency agreement is the most common type of agreement in the business practice of organizations. It is concluded when carrying out construction and rental activities, transfers and settlements of monetary obligations to third parties, etc. When using an agency agreement, disputes often arise both between the parties to the agreement and between taxpayers and tax authorities.

What do you need to know to minimize risks? According to clause 1 of Article 1005 of the Civil Code of the Russian Federation, under an agency agreement, one party (agent) undertakes, for a fee, to perform legal and other actions on behalf of the other party (principal) on its own behalf, but at the expense of the principal or on behalf and at the expense of the principal.

An essential condition of the agency agreement is the definition of the actions that the agent undertakes to perform.

Source: https://kodeks-alania.ru/kakie-dokumenty-neobhodimo-prilozhit-k-otcheu-agenta/

Features of accounting under an agency agreement.

All settlements under the agency agreement in the Agent’s accounting are reflected in account 76 Settlements with other debtors and creditor. All expenses related to the agency agreement must be reflected in the Agent's account. 76 Settlements with other debtors and creditors, in order to deduct these expenses, together with the agency agreement, from the debt to the Principal when receiving proceeds from the sale of goods.

If the Principal provides the Agent with an advance for the execution of the order, then the advance should be reflected in the posting: D 51 K 76 funds were transferred to the agent from the principal for the production of goods. The funds that the agent received as compensation for costs under the contract are not considered revenue. Therefore, they are not taken into account in the credit of account 90 “Sales”.

The accounting entries for the agency agreement will look like this:

Debit 60 Credit 51 Contents of the transaction. Paid for work and services of organizations related to the execution of the contract (including VAT). Documentation 1. Bank statement.

Debit 76 Credit 60 Contents of the transaction. The costs of payment for work and services of third-party organizations are reflected, which are reimbursed by the principal under the contract (including VAT). Documenting. 1. Invoices received from performing suppliers (not recorded in the purchase book). 2. Invoices, acceptance certificates received from performing suppliers.

Debit 002 Contents of the transaction. The agent received finished products from performing suppliers. Documenting. 1. Invoice from the supplier. 2. Notification of the agent to the principal about the receipt of finished products.

Credit 002 Contents of the operation. The finished products are transferred to the principal. Documentation 1. Invoice on behalf of the agent, or deed of transfer. 2. Invoice on behalf of the agent for the amount of finished products transferred (not recorded in the agent’s sales book).

Debit 76 Credit 90.1 Contents of the transaction. The agency fee is reflected. Debit 90.3 Credit 76.N.1 or 68.2 Contents of the transaction. VAT is charged on the amount of the agent's remuneration. Documentation 1. Agent's report. 2. Copies of primary documents from performing suppliers. 3. Invoice on behalf of the agent for the amount of the agent's fee (registered in the sales book).

Debit 51 Credit 76 Contents of the transaction. Received from the principal compensation for expenses under the agency agreement (including VAT) and agency remuneration Documentation 1. Bank statement.

Information provided by AS-AUDIT

What documents must the agent provide to the principal for purchased services?

What minimum package of documents (instructions, regulations, regulations, etc.) should be present in the company in terms of personnel documentation and labor protection? (Staff 14 people)

Please clarify what features exist when concluding an agreement with an external part-time worker.

✒ When concluding an employment contract with a part-time worker, the same rules apply as when hiring an employee for the main job….

- Agent invoice to buyer

Good afternoon, please tell me.Our supplier delivered the goods to our buyer by rail.

in the documents issued to us for railway services, it is not our supplier, but the owner of the cars, who is...

- Payment by corporate card - postings

Good afternoon. We are your client. Contract 49825. Two related issues. A corporate card was issued directly to the current account. The employee withdrew cash from an ATM and deposited it into the organization’s cash desk.….

Partner links

Loan for starting a small business from scratch https://www.kpk-sodeystvie.ru/omsk/uslugi/kredity-dlya-biznesa Call toll free number

Businessman?

We will help you obtain a loan for the development of a small business from scratch Assistance Finance Group. Profitable terms!

ipc-zvezda.ru

In this case, the parties have the right to agree in the agency agreement, at their discretion, on the conditions and procedure for paying remuneration to the Agent (clause 2, article 1, clause 4, article 421 of the Civil Code of the Russian Federation).

Supply agreement, the supplier is an agent under an agency agreement and acts on his own behalf, but at the expense of the principal

on its own behalf, but at the expense of the Principal.

In this case, the goods supplied under this agreement belong to the Principal.

What is the documentation of transactions between the organization and the individual entrepreneur when transferring goods to an agent? How should an order be issued to the agent to transfer the goods to the buyer, the agent's report?

Having considered the issue, we came to the following conclusion: The transfer of goods from the principal to the agent is documented with a consignment note.

Accounting for agency agreements in 1C: Accounting 8

Article 1006 of the Civil Code of the Russian Federation establishes that the principal pays the agent remuneration in the amount and in the manner specified in the agency agreement.

In most cases, when purchasing services, income is the actual difference between how much the contract was concluded with the customer and how much the services provided actually cost.