Federal taxes and fees in the Russian Federation Taxes existed in Rus'.

Gradually, taxation underwent changes, as a result of which federal and regional taxes, as well as local ones, were allocated to a separate group. Regional and local payments to Russian citizens are known to a greater extent than federal ones, which will be discussed further.

What are federal taxes and what is their role in Russia

Federal taxes are a separate part of the entire tax system, which operates throughout Russia. Federal taxes include all payments that are prescribed in the codes of Russia, and are also regulated by legislative acts and norms of adopted orders and resolutions. Federal taxes and fees include the following payments:

- value added tax (VAT);

- excise taxes;

- personal income tax (NDFL);

- corporate income tax;

- mineral extraction tax;

- water tax;

- fees for the use of objects of the animal world and for the use of objects of aquatic biological resources;

- National tax.

The presented types have their own fixed rates and form the basis of the country’s entire budget. When considering the list of federal taxes, it is necessary to clarify the definition and approved rates for Russia.

Taxation system in Russia. Types of taxes

Payment nuances

The deadline for paying federal tax depends on its type, but in most cases payment is made no later than the 20th day of each calendar month . The exception is cases of payment of excise taxes and state duties. Some types of payments are paid quarterly.

In addition, those subjects of taxation whose total revenue for 3 months does not exceed 2 million rubles are required to pay taxes quarterly. In the latter case, tax authorities usually require the completion of a separate declaration of a special form.

All types of federal taxes are paid in equal installments. The payment goes to the budget at the place of registration as a taxpayer. If it is paid by a tax agent, it can be accepted at the place of its actual location.

Personal income tax

Among the types of federal taxes, the presented variety ranks first in importance and financial component. It is personal income tax that takes up more than half of the received tax deductions in the country.

Answering the question: personal income tax - what tax (federal or regional) - we can safely say that the presented type of collection is universal in nature, and therefore federal. The fee represents a percentage of all income received by Russian citizens - basic wages, part-time jobs, income received from the sale of property (with certain payment terms), as well as winnings and other receipts into accounts.

Personal income tax is a federal tax that should not be confused with a local or regional tax. The interest rate is set at:

- 9% - on dividends received until 2015 in relation to individuals, as well as on income from mortgage coverage until 2007;

- 13% – the rate applies to income received from various types of work;

- 15% – on dividends received until 2015, taxpayers are Russian resident organizations;

- 30% – the rate applies to all income for non-residents of Russia;

- 35% – on certain types of winnings and prizes.

In the presented situation, the calendar year is established as the reporting period. The declaration of income received must be submitted by April 30 following the reporting period.

The federal personal income tax has certain differences for citizens and organizations, which is presented in the table.

| For individuals | For individual entrepreneurs | Legal entities | |

| Payers | Residents of Russia and non-residents | Individuals who have registered their activities as an individual entrepreneur | – Russian organizations; - Individual entrepreneurs; – Notaries engaged in private practice; – Lawyers who have established law offices; – Separate divisions of foreign organizations in the Russian Federation |

| The tax base | – Rewards received not from tax agents; – Amounts from the sale of property, if an individual has been in possession for less than 3 years; – Amounts received from sources located abroad; winnings and prizes; – Amounts from sales of manuscripts, paintings and other items received by an individual upon inheritance; – Amounts received on the basis of a gift agreement. | – All income received from business activities. – Income = revenue – expenses supported by documents. | All income from activities received by the taxpayer |

| Calculation procedure | Tax rate * tax base (amount of income) | – With confirmation of expenses: income * 13%. – Without confirmation of expenses: Revenue * 20%. | Taxable base = income received – tax deductions. Tax = tax base * tax rate |

| Tax rates | Above rates apply | – 13% – used when calculating the profit received; – 20% – used if it is not possible to document expenses | – 20% on profit tax in certain structures; – 13% – on income with documentary evidence of expenses |

| Paying tax | Submitting a declaration - until April 30, paying taxes - until July 15 | Submission of the declaration by April 30 of the year following the reporting period. Advance payments are made: – No later than July 15 for the period from January to June of the current year; – No later than October 15 for the period July-September; – No later than January 15 for the period October-December. | Tax returns must be filed by April 1 |

It has already been said above what applies to federal taxes and fees, as well as the features of calculating payments taking into account tax deductions. It is necessary to understand what is included in the list of tax deductions for federal taxes of the Russian Federation. Here they highlight:

- standard tax deductions - these amounts are prescribed in Article 218 of the Tax Code of the Russian Federation of federal taxes, identifying the deduction for the child and for the taxpayer;

- social – Article 2021 of the Tax Code of the Russian Federation – expenses for charity, training and other areas;

- investment - Article 219.1 of the Tax Code of the Russian Federation - when carrying out investment activities by the taxpayer;

- property – Article 220 of the Tax Code of the Russian Federation – the opportunity to return 13% of the amount of purchased real estate if taxes were paid earlier;

- professional – Article 221 of the Tax Code of the Russian Federation – royalties and other income from professional activities;

- deductions when carrying forward losses from transactions with securities – Article 220.1 of the Tax Code of the Russian Federation.

All federal taxes are specified in the Tax Code of the Russian Federation - the document undergoes regular changes, which should be remembered when filing a declaration.

How to pay tax: TOP 6 best ways!

Payers of personal income tax from wages, faced with the need to pay taxes on their own, often experience difficulties. We bring to your attention 6 convenient ways to pay taxes.

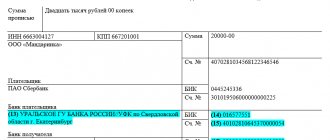

Method 1. Bank cash desk.

It’s convenient because a professional will do all the work for you. You just need to provide payment details and a passport. The payer receives a payment order marked by the bank and can be completely calm. The disadvantages are that sometimes you have to wait in a long line. It is convenient to generate details through your personal account.

Method 2. Payment terminal.

With it, of course, you can only pay some taxes. For example, transport. But quickly, without queues, in any convenient place. The only significant drawback is the relatively high commission. Some terminals simply charge extortionate fees for payments.

Method 3. Taxpayer’s personal account.

Using your personal account, you can not only find out all the necessary information, but also pay taxes. The only drawback is that payments are supported using cards opened in FTS partner banks, and their number is not large (about 13). It is worth noting that the tax office cooperates with almost all major banks.

Method 4. Internet banking.

You can pay through Internet banking of any bank in the Russian Federation. The main thing is that there is money in the card account. Fill out the payment order and then pay. That is, you independently perform the function of a cashier. By the way, for some types of taxes, payment orders are generated automatically.

Method 5. Intermediary sites.

Quite a lot of intermediary sites have appeared that offer to act as a payment operator. Most often this applies to transport tax; on the same sites you can easily check the debt according to the TIN. If you have a notice from the tax office, then enter the UIN number in the appropriate field. In just a couple of seconds, your debt and fields for entering card details will be displayed on the screen. The disadvantage of this method is the need to enter secret data on a dubious site.

Method 6. Electronic wallets.

Electronic payment systems such as Qiwi, YaD, WebMoney and others allow you to pay any tax without any problems. At the same time, in the wallet you will find the function described in the previous paragraph, that is, searching for debt by UIN number from the notification. This eliminates the need to enter details manually. But if you do not have a notification, but only details, then you can still pay through an electronic wallet using “payment to free details”. This function is currently available in all electronic payment systems.

How to pay tax is up to you! The main thing is to be careful when specifying the recipient's details and entering sensitive payment card data. And here is another interesting article on this topic: “Paying taxes for individuals: how to do it quickly?”

Corporate income tax

The general characteristics of federal taxes and fees cannot fail to highlight separately the aspects of calculating corporate income tax. Answering the question whether income tax is federal or regional, in accordance with the law it is established that this is a federal tax. This is explained by a unified calculation of sizes, payment throughout the entire territory of the Russian Federation, as well as an approved rate. On this issue, it is necessary to highlight the following data:

- Income tax is the amount of tax that is calculated taking into account preliminary calculations.

- Payers are all Russian and foreign legal entities operating in the country, as well as foreign companies that are residents of Russia.

- The tax base is the difference between the profits received and expenses.

- The basic tax rate is 20%, which is applied to the previously received tax base.

- Income tax requires filing a return every quarter of the current year. Monthly payment of taxes is possible.

For organizations there is a simplified tax system (STS). STS – is it a federal or regional tax? Not every entrepreneur knows this. But in matters of which simplified tax system is federal or regional, everything is not so simple regarding the legislation. Thus, Articles 13-15 of the Tax Code of the Russian Federation prescribe a complete list of tax fees, which do not have a simplified system. But Article 12 of the Tax Code of the Russian Federation specifies that special tax regimes can be established within the framework of the main list. Therefore, the simplified system is a federal tax.

What it is?

Federal taxes and fees occupy a decisive position in the formation of the budget and therefore are established exclusively at the federal level, being mandatory for collection in all corners of the Russian Federation .

Their number and size are determined by the Tax Code of the Russian Federation. The exception is the establishment of a special regime for calculating taxes in a particular territory. In this case, the size and number of contributions to the federal budget will be determined in accordance with the existing regulations.

When any changes are made to this rule, the specified code is also subject to revision. Only the Government of the Russian Federation has the right to change, amend or repeal the Federal Law.

Giving a payment federal status does not allow us to talk about its exclusive focus. It is likely that only part of the collected amount will go to the corresponding budget, while the rest will be a significant help in filling local and regional budgets.

Value added tax (VAT)

VAT – federal tax or regional? This is a federal indirect tax that is paid by sellers when goods are sold. Payers are organizations and entrepreneurs. The tax base in federal taxes of the presented nature is established in two directions. The first method of determination is that the calculation is carried out on the day of full or partial payment for upcoming deliveries of goods or services. The second is on the day of shipment of goods and services.

It is important to know: What taxes are considered direct in the Russian Federation: types, differences from indirect taxes, table.

Buyers or users of services do not think much about determining which VAT tax - federal or regional. Most simply pay attention to the cost of goods or services, and it is formed taking into account the presented taxation.

Excise taxes

Excise taxes deserve special consideration - what kind of tax is it: federal or regional? Excise tax is an indirect tax that is levied on the price of goods or services provided. The presented fee applies to certain types of products - alcohol, tobacco, fuel and other goods. These fees are paid by organizations, individual entrepreneurs, as well as sellers who deliver goods across customs borders.

Tax rates are set as follows:

- at a fixed rate;

- at an ad valorem rate - the estimated value of the goods at customs is taken into account;

- at a combined rate.

Reference: Ad valorem rate is a rate set as a percentage of the value of the taxable object.

Excise tax rates for each type of product are fully listed in Article 193 of the Tax Code of the Russian Federation.

Mineral extraction tax

Taxpayers in this case are organizations and individual entrepreneurs who are engaged in the extraction of mineral resources. The objects of taxation are:

- minerals that are extracted from the depths of Russia;

- minerals recovered from waste and subject to separate licensing;

- minerals that are mined outside of Russia.

Tax rates are presented in Article 342 of the Tax Code of the Russian Federation. The tax period is every month. Payment of the fee occurs no later than the 25th day of the month following the tax period. (In the Tax Code of the Russian Federation, this tax is regulated in Chapter 26. Mineral extraction tax (Articles 334 - 346)).

General taxation system

The general taxation system (OSNO, OSN, traditional, basic) is a tax regime that is automatically assigned to all individual entrepreneurs and organizations after their creation (except for cases where an application for transition to one of the special regimes was submitted along with registration documents).

OSN is the most difficult tax regime in terms of tax payment and reporting. As a rule, the general regime is used by those entrepreneurs and organizations that for some reason cannot be subject to other taxation systems (for example, due to a large number of employees or income exceeding the available limits).

Read more about the general taxation system.

Water tax

Article 13 of the Tax Code of the Russian Federation indicates whether the water tax is federal or regional. This is a federal tax, which is separately prescribed in Chapter 25.2 of the Tax Code of the Russian Federation. The following data is presented here:

- taxpayers are organizations and individuals who use water resources as a result of conducting a certain type of activity;

- objects of taxation are the water used and the use of individual water bodies;

- the tax base is the volume of water, the area of the provided water space, etc., depending on the type of activity of the taxpayer;

- tax period – quarter;

- the tax rate is prescribed in Article 333.12 of the Tax Code of the Russian Federation;

- The tax is paid no later than the 20th day of the month following the tax period.

Federal taxes and fees have undergone changes in 2021, which you should find out about in advance - before filing a return, if it is filled out independently by taxpayers.

It is also necessary to consider the forest tax - this is a federal or regional fee. Forest tax is a federal payment that is paid similarly to water tax (in accordance with the forest resources used by taxpayers).

Difference from local and regional

Unlike local and regional taxes, federal taxes are established by the Tax Code, as mentioned above.

Local fees are determined by regulations issued by the representative bodies of municipalities on the territory of which they are payable. In addition, the authorities that established these payments determine tax rates, the procedure and deadline for making payments, and the conditions of application.

Regional taxes are established by the laws of the constituent entities of the Russian Federation in whose territory they operate. Tax rates, benefits, terms and amount of payment are determined by regional authorities.

Mechanism for calculating federal taxes

Examples of calculating federal taxes were shown in the table above. There is nothing complicated in this case - the tax base should be multiplied by the rate approved at the time of filing the declaration and paying the fee. Particular attention is paid to the calculation of the tax base, which occurs in accordance with the existing activities of the taxpayer.

Payment procedure

To pay federal taxes, you must first file a return with the Internal Revenue Service. This can be done by Russian post (send by letter with notification), on the Federal Tax Service website, or apply in person. Once the return is filed, staff will issue a receipt for the taxpayer to pay the fee. Payment is made on time.

What items are not subject to federal tax?

Although federal tax is mandatory, there are a number of goods and services that are not subject to tax.

The list includes:

- bakery products;

- children's clothing and shoes;

- medicines and orthopedic products;

- housing and communal services;

- vouchers to sanatoriums and health institutions issued to disabled people;

- educational and scientific book products, etc.

A complete list of goods and services is presented in Article 350 of Chapter 27 of the Tax Code of the Russian Federation.

Do you have to pay federal taxes?

Failure to timely pay federal or local taxes results in criminal penalties. In this case, they are guided by Article 198 of the Criminal Code of the Russian Federation.

The questions of what taxes relate to federal payments and what are the features of their payment were examined in detail. The information presented is important for Russian citizens, as are the following interesting facts:

- Residents of Russia are people who stay in the country for more than 183 days a year. Otherwise, taxpayers are recognized as non-residents, which means they pay federal taxes of the Russian Federation at increased rates.

- In income tax, there are special BCCs (budget classification codes), where the federal budget is allocated in particular. The system is used to better track the payment of all taxes that a taxpayer is required to pay.

- Transport tax – regional or federal? Definitely regional. Each region has the right to set its own rate for payment of fees.

What happens if you don’t pay personal income tax?

Not paying taxes is unwise, if only for the reason that the state can severely punish you for it. Defaulters will have to pay several times more fines and penalties than if they honestly paid the full amount.

If a citizen does not want to pay personal income tax and runs away from the tax office, then if his activities are disclosed, he will face the following consequences

:

- An administrative fine of 2,000 rubles.

- Payment of personal income tax for three years in the amount of 13% of all income during this time.

- Penalty for late payment of tax in the amount of 1/300 of the rate of the Central Bank of the Russian Federation for each day.

- Fine for non-payment of tax in the amount of 40% of the amount.

- A fine for failure to submit returns is up to 30% of the tax amount for each year.

- Criminal liability in some cases under Art. 198 of the Criminal Code of the Russian Federation.

If a significant debt has accumulated and a person does not pay taxes to the budget, the Federal Tax Service may well go to court

for forced collection of debts. An appeal to the court is allowed if a citizen has accumulated tax debts of at least 3,000 rubles.

The court, of course, decides to pay the debt and issues a writ of execution. According to the writ of execution, the bailiffs can create many problems for the defaulter: seize accounts, prevent travel abroad, confiscate property to pay off the debt, and so on.

However, the statute of limitations is three years.

, so many “dark deeds” may go unpunished.