Transportation and procurement costs (TPC) are associated with the procurement and delivery of material assets: raw materials, goods, raw materials, materials, tools. In this article we will look at the features of accounting for material and equipment in the cost of materials.

You will learn:

- what document in 1C reflects TZR when purchasing materials;

- how to deduct VAT on additional expenses so that it is reflected in the VAT return;

- how to reflect the payment of the cost of materials and delivery to the supplier with one payment document on different accounts.

Step-by-step instruction

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

On January 29, the Organization purchased stationery from Karandash LLC. Materials worth RUB 9,322. (including VAT 18%) are accepted for accounting.

Delivery of materials was carried out by the supplier for an additional fee. The cost of services was 1,416 rubles. (including VAT 18%). The Organization's accounting policy provides that equipment and materials are distributed among purchased materials in proportion to the cost of their acquisition.

On January 29, the Organization paid the cost of materials and their delivery.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Purchasing materials | |||||||

| January 29 | 10.01 | 60.01 | 7 900 | 7 900 | 7 900 | Acceptance of materials for accounting | Receipt (act, invoice) - Goods (invoice) |

| 19.03 | 60.02 | 1 422 | 1 422 | Acceptance for VAT accounting | |||

| Registration of SF supplier | |||||||

| January 29 | — | — | 9 322 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.03 | 1 422 | Acceptance of VAT for deduction | ||||

| — | — | 1 422 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| Reflection in accounting of materials delivery services | |||||||

| January 29 | 10.01 | 60.01 | 1 200 | 1 200 | 1 200 | Accounting for delivery service costs | Receipt of additional expenses |

| 19.03 | 60.01 | 216 | 216 | Acceptance for VAT accounting | |||

| Registration of SF supplier | |||||||

| January 29 | — | — | 1 416 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.03 | 216 | Acceptance of VAT for deduction | ||||

| — | — | 216 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

| Transfer of payment to the supplier | |||||||

| January 29 | 60.01 | 51 | 10 738 | 10 738 | Transfer of payment to the supplier | Debiting from the current account - Payment to the supplier | |

Features of accounting for transportation costs

Transportation costs (otherwise known as transportation and procurement costs) include the following costs:

- Payment of transportation costs for delivery of goods;

- Payment for loading and unloading operations;

- Temporary storage fee.

Payment options for the cost of goods delivery services:

- The company includes the cost of delivery in the price of the goods;

- Refund of the amount spent by the seller in accordance with the concluded agreement with the buyer;

- The buyer pays transport costs separately;

- They pay for services in accordance with the concluded agreement for the delivery of goods with the transport company.

Purchasing materials

Regulatory regulation

Materials for production purposes are accounted for in account 10.01 “Raw materials and supplies” at actual cost or accounting prices (clause 5 of PBU 5/01, chart of accounts 1C).

Actual cost is the actual costs directly related to the acquisition of inventories, including the costs of procurement and delivery to the place of use of inventories, including insurance costs. VAT is not included in the cost of inventories (clause 6 of PBU 5/01).

In tax accounting (TA), the actual cost of inventories is determined in the same way based on their acquisition prices and other acquisition costs, excluding input VAT and excise taxes (clause 2 of Article 254 of the Tax Code of the Russian Federation).

If inventories are used for activities not subject to VAT, then incoming VAT is included in the actual cost (clause 1, clause 2, article 170 of the Tax Code of the Russian Federation).

Accounting in 1C

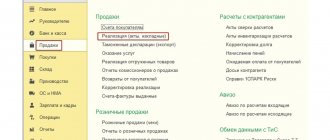

The purchase of materials is reflected in the document Receipt (act, invoice) transaction type Goods (invoice) in the section Purchases – Purchases – Receipt (acts, invoice) – button Receipt – Goods (invoice).

This document can not only be entered manually using the supplier’s paper invoice, but also downloaded from the invoice in Excel format.

More details Downloading nomenclature and prices from TORG-12

And if an organization and its supplier have an EDI connected, then they can exchange electronic documents.

The tabular section indicates the purchased production materials.

Postings according to the document

The document generates transactions:

- Dt 10.01 Kt 60.01 - materials accepted for accounting;

- Dt 19.03 Kt 60.01 - VAT accepted for accounting.

Documenting

The organization must approve the forms of primary documents, including the document on the receipt of materials. In 1C, a Receipt Order in form M-4 is used.

The form can be printed by clicking the Print button - Receipt order (M-4) of the document Receipt (act, invoice) .

PDF

The article Non-production expenses includes the costs of containers and packaging of products in finished product warehouses (services of their auxiliary workshops, the cost of purchased containers, payment to third-party organizations for packaging and packing), costs of transporting products to the departure station and its loading, as well as payment for transport services - forwarding offices) commission fees (deductions to sales organizations in accordance with regulations and contracts), other sales expenses.

[p.248] The cost of production is the sum of the current costs of an enterprise for the production and sale of products. When comparing options, you should use the full cost, including the cost of transporting products to places of consumption. The comparability of the production cost indicator of different options is very important. [p.85] Expenses for transportation of products - a) expenses for delivery of products to the station or pier of departure, loading into cars and onto ships b) payment for the services of specialized transport and forwarding offices. [p.199]

The costs of transporting products include the costs of delivering them to the station or pier of departure, loading them into wagons and ships, supplying and cleaning wagons, and maintaining railway tracks, if this is provided for in product supply contracts. [p.34]

Mining enterprises and consumers of their products are, as a rule, remote from each other. The costs of transporting products to the consumer can be paid by the supplier and included in the price of the products supplied to him or paid by the consumer and taken into account in his production costs [3, 14, 17]. [p.132]

The economic efficiency of combination is determined by a number of factors. This is, first of all, the improvement of equipment and production technology. Further, savings are achieved by eliminating unproductive costs for transporting products, since most of the raw materials and intermediate products, when combined, do not leave the enterprise. Great benefits come from the integrated use of resources. Equipment and general plant facilities are used more efficiently. [p.307]

An important problem associated with reducing production costs is strengthening control over the costs of transporting products. These expenses occupy a significant share in the cost of production (5-6% in mechanical engineering, 10-12% and higher in the food industry), but associations and enterprises do not have information on the amount of transportation and procurement costs. This situation is explained by the fact that the accounting and control methodology does not provide for determining the amount of these expenses. Transportation and procurement costs are included in the cost of materials, which makes it difficult to analyze material consumption [p.78]

NON-PRODUCTION COSTS - costs associated with the sale of products, costs of containers and packaging of products in the finished product warehouse, costs of transporting products, commission fees, other costs associated with the sale of products. [p.21]

Example. Distribution costs 880 thousand rubles, profit 488 thousand rubles, costs of transporting products 410 thousand rubles. Gross output will be equal to 958 thousand. rub. (880 thousand, rub. -J-+ 488 thousand rub. - 410 thousand rub.). [p.132]

Costs for transporting products to the departure station (pier), loading into vehicles. [p.204]

Expenses for transportation of products, loading and unloading and other transport work, as well as for work and services included in the current month's commercial expenses, are written off to the commercial actual cost of products sold in proportion to the indicators recommended by industry regulations). [p.284]

Expenses for transportation of products 3450 18500 7308 12292 1950 [p.105]

The competitor's expenses are formed by the following components: expenses for increasing the product quality index (operator 176), expenses for increasing the variety of products (operator 178), advertising expenses (operator 173), expenses for storing unsold products (operator 175) and expenses for transporting products ( operator 182). All expenses are formed linearly, i.e. directly proportional to changes in forming factors. [p.156]

Non-production costs, costs of transporting products, advertising, service and research. [p.50]

The Planning - Transportation window (Fig. 16) is intended to determine safety stocks in Markets 2 and 3 and the costs of transporting products. [p.65]

Proper planning and accounting of distribution costs and the cost of pumping (transferring) oil, petroleum products and gas is one of the conditions for economic accounting, which assumes that an enterprise, organization, association covers all costs for transportation and storage of oil and gas products from the proceeds from its sale and makes a profit. On the other hand, the consistent implementation of the principles of economic accounting, and therefore the economy regime, ensures a reduction in distribution costs and the cost of transportation and storage of oil, petroleum products and gas. [p.240]

The operation of the parallel supply system is based on the fact that the influence of many internal and external factors on the production volume of factories supplying the same types of products is, as a rule, of a multi-temporal nature. Therefore, the occurrence of failures in the fulfillment of the supply plan by factories usually does not coincide either in duration or in frequency; as a result, some failure at any enterprise is compensated by the work of another supplier during this period. The regulator in the form of a parallel supply system without additional capital investments increases the reliability of supplies and construction production. Deciding on the use of such a regulator includes choosing the optimal combination of costs for transporting products, creating and storing inventories and losses from downtime that occur at construction sites, depending on the reliability of plant supplies. The optimality criterion is taken to be the minimum amount of the above costs. The economic effect of using this regulator, resulting from a reduction in direct costs and overhead costs of a construction organization, as well as from a reduction in construction duration, usually amounts to 0.4-0.6% of the volume of construction and installation work performed. The decision on the use of any of these types of regulators in specific given conditions should be made based on the total minimum of the reduced costs that arise in all areas of construction production. These decisions directly affect the order [p.316]

A relatively successful option for locating enterprises for the material and technical base of construction is selected based on the minimum reduced costs, taking into account the costs of transporting finished products to the consumer and is determined by the formula [p.33]

To obtain the full cost of production, it is necessary to add non-production costs to production costs, which include the costs of containers and packaging of products in finished product warehouses, costs of transporting products (delivering them to the place of departure, loading, payment for the services of specialized freight forwarding offices) , commission fees, other sales expenses. These costs are distributed among products in proportion to their factory costs [p.318]

Transport costs T (t) consist of transport costs for the transportation of materials and raw materials and the costs of transporting finished products, which are determined by the transport tariff ср, average transportation distances b, various cargoes and transportation volumes Vt (materials supplied) and Q/ (finished products) for all types of cargo [p.111]

The average prices of sold agricultural products do not include the costs of transportation, forwarding, loading and unloading, as well as value added tax. The price level depends on the share of individual channels in the total volume of sold agricultural products and is determined by dividing the revenue received from the sale of products on the farm by the number of products sold. [p.549]

Manufacturing organizations reflect the costs of selling products, recorded in account 44 Selling expenses. In this case, the amounts are written off in whole or in part. In case of partial write-off, packaging and transportation costs are subject to distribution (between individual types of shipped products on a monthly basis based on their weight, volume, production cost or other relevant indicators). Trade, supply and distribution and intermediary organizations reflect the amount of distribution costs recorded in account 44 Selling expenses related to goods sold and written off by posting D-account. 90 Set count. 44. The procedure for distributing distribution costs between sold goods and the balance of goods for the reporting period is given in clause 2.18 of the Methodological recommendations for accounting of costs included in distribution and production costs, and financial results at trade and public catering enterprises, approved by Roskomtorg and the Ministry of Finance of the Russian Federation 20.04 .95 No. 550, 32-2. Transportation costs are subject to distribution. [p.120]

When exporting natural gas, the tax base is the cost of products sold minus VAT on sales to CIS member states, customs duties paid and costs of gas transportation outside Russian territory. [p.301]

Inventories are material assets that are used as objects of labor in production and other economic processes. They are entirely consumed in each cycle and fully transfer their value to the cost of products produced, work performed and services provided. Inventories are valued in accounting and on the balance sheet at their actual cost, which is determined on the basis of the costs of their acquisition and production, including payment of interest for the purchase on credit provided by suppliers of these resources, markups (surcharges), commissions paid to supply, foreign economic organizations, the cost of commodity exchange services, customs duties, transportation, storage and delivery costs carried out by third-party organizations. [p.175]

Here is an example of how a careful attitude to competition helped one US company avoid a possible costly mistake. It was planned to modernize an existing plant in the US to produce a new chemical product. The company has calculated that at current prices for raw materials and final products, production can be sustainably profitable. However, further analysis showed that the project was unprofitable. In the project, the raw material was a chemical product supplied mainly from Europe, and most of the final product was exported to Europe. Since the US company did not have any significant cost advantages, it did not make sense to pay the costs of transportation back and forth across the Atlantic Ocean. For a short time, the project could possibly bring high profits, but the likely losses after European manufacturers with low costs entered the market outweighed these profits. [p.267]

Thus, the packaging of finished products by volume should be a multiple of 500 packs (one box), and for transportation using containers - a multiple (by volume) of 45-50 boxes. With this approach, transportation overhead costs can be significantly reduced and will amount to no more than 10-12% of the manufacturer's selling price. [p.221]

Transporting products in foreign trade marketing often requires special planning, since processing marine insurance, government or other documentation is time-consuming, and certain modes of transport may be unavailable or inefficient (inadequate ports, poor roads, poor rail networks). Inventory management must take into account the cost and availability of storage, as well as the costs of transporting small quantities. [p.233]

Costs for transporting products to the departure station (pier) and loading them into cars, wagons, ships. . Expenses for payment of railway and road tariffs or water freight and other fees for shipping products. …… [p.182]

Non-production expenses are taken into account on the collection and distribution account of the same name by cost items: costs for containers and packaging, costs for transporting products, commission fees and other sales expenses. Amounts taken into account [p.302]

Expenses for transporting products Expenses for delivering products to the station (pier) of departure, loading into wagons (on ships) costs for securing products on railway platforms and wagons, payment for services of specialized transport and forwarding enterprises, etc. [p.187]

The business will be located in Indianapolis, a location that is advantageous in terms of the cost of transporting products throughout the country. The manufacturing location in the Midwest is also reliable and cost-effective, and skilled personnel are easy to hire and rents are not very high. Key positions in the administration will be filled by business school graduates from Northwestern University or Harvard, familiar with manufacturing activities, licensing agents and strategy developers. The production will be led by the former head of one of the best companies in the Midwest, [p.22]

The factors that must be analyzed depend on the overall strategy of the firm. Product demand and competitors' strategies are major factors in the direction of international activities related to domestic production and foreign distribution. If factories are located overseas, environmental factors may include worker skill levels, wage levels, government attitudes toward foreign ownership, labor and tax laws, access to raw materials and supplies, and the cost of transporting the finished product to its final market. In some cases, the capabilities of the market itself in a country may not justify locating a business there at the initial stage, but it may still be necessary from the point of view of long-term goals of market penetration to gain a certain share of it and advertise the company's products. In another case, the goal may be to use production location to reduce costs in order to sell products on the domestic market or in third countries. In any case, a multinational approach may involve tailoring products to a variety of market circumstances. A global approach involves moving towards more standardized products and focusing on their marketing. Decisions regarding plant location, sourcing and financing, and market penetration may be driven by countermeasures aimed at counteracting global competitors. Cash income from one part of the world can be used to subsidize entry into other markets, as illustrated in Example 9.6. Joint venture opportunities may be sought to gain access to know-how and new technologies that can later be used in wholly owned businesses. [p.280]

Operation 65. Based on the GATP-2 invoice, reflect on the accounts the costs of transporting products sent for export to the customs point. Identify the offsetting accounts and record them in the business journal. [p.29]

The location of a plant or warehouse affects costs through wages, transportation and energy costs. For example, Armstad manufactures its consumer electronics in the Far East, using local cheap labor. Transport costs can be reduced when the company is located near the supplier of raw materials or the consumer of the final product. [p.180]

The national economic approach assumes the comparability of options for final products. This condition is especially important when comparing hydraulic transport systems with their main competitor - the railway. The costs of the railway and the hydrotransport system, which delivers the supplier’s DT cargo to the consumer, bypassing warehouses and various loading and unloading devices, are compared. Meanwhile, enterprises receiving cargo by rail incur high costs for the construction and operation of access roads, cargo receiving facilities, supplying cargo to production, warehouses, etc. For example, the costs of maintaining all these structures at the Novolipetsk Metallurgical Plant exceed the costs of transportation by rail. Slightly less, but also on a larger scale, the supplier enterprises bear the same costs. [p.17]

In the article Costs of transporting products to the station (pier) of departure and loading into cars, wagons, ships, costs are taken into account only when, in accordance with the price list, [p.182]

The costs of packaging and transportation of products, which are part of non-production expenses, are distributed directly between individual types of products. If it is impossible to attribute these costs to a unit of production directly, they should be distributed among individual products in proportion to the weight, volume or production cost of the latter. [p.249]

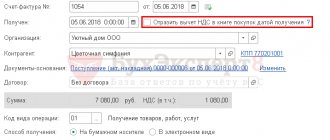

Registration of SF supplier

VAT is accepted for deduction if the conditions are met (clause 2 of Article 171 of the Tax Code of the Russian Federation):

- materials purchased for activities subject to VAT;

- a correctly executed SF (UPD) is available;

- materials were accepted for accounting (clause 1 of article 172 of the Tax Code of the Russian Federation).

To register an incoming invoice, you must indicate its number and date at the bottom of the Receipt document form (act, invoice) and click the Register . PDF

The Invoice document received is automatically filled in with the data from the Receipt document (act, invoice) .

Operation type code : “Receipt of goods, works, services.”

If the document has the Reflect VAT deduction in the purchase book by date of receipt checkbox , then when it is posted, entries will be made to accept VAT for deduction.

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt 19.03 - VAT accepted for deduction.

Purchase Book report can be generated from the Reports - VAT - Purchase Book section. PDF

Reporting

The VAT return reflects the amount of VAT deducted:

In Section 3 page 120 “Amount of VAT to be deducted”: PDF

- the amount of VAT accepted for deduction.

In Section 8 “Information from the purchase book”:

- invoice received, transaction type code "".

Reflection in accounting of materials delivery services

The method of reflecting additional expenses in accounting is established by the organization independently in its accounting policies.

Accounting options may be as follows:

- are included in the cost of inventories by allocating costs for each unit of materials;

- are taken into account in a separate expense account (clause 83 of Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 N 119n). This option cannot be applied in 1C without additional modifications to the program.

In NU, additional costs when purchasing materials are included in the cost of materials and equipment (clause 2 of article 254 of the Tax Code of the Russian Federation).

Find out more about the procedure for accounting for costs for the delivery of materials in the articles Accounting for additional costs when purchasing assets and Options for accounting for additional costs when purchasing inventory items

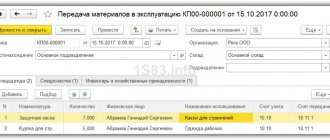

Additional expenses, which are included in the actual cost of materials, are documented in the document Additional Receipt. expenses in the section Purchases – Purchases – Additional receipts. expenses or from the document Receipt (act, invoice) Create based on button .

On the Main it is indicated:

- Content - the name of the service, in our example - Transport services .

- Amount - the amount of delivery costs - 1,200 rubles.

- Distribution method - the method of distributing additional costs between individual purchased materials. Can take on the following values: By amount – i.e. proportional to the cost of inventory items. (in our example);

- By quantity - i.e. proportional to the quantity of goods and materials.

On the Products , the materials for which you want to distribute the amount of additional costs according to the selected method are indicated. This tab can be filled out for several documents Receipt (act, invoice) .

You should install:

- Accounting account (BU) - 10.01, additional accounting account. expenses in accounting.

- Accounting account (NU) - 10.01, additional accounting account. expenses at NU.

- VAT account - 19.03 “VAT on purchased inventories”: in our opinion, it is more correct to indicate the account for input VAT relating to an asset to the cost of which additional expenses are added.

Postings according to the document

The document generates transactions:

- Dt 10.01 Kt 60.01 - additional cost. expenses are included in the cost of inventories;

- Dt 19.03 Kt 60.01 — VAT on additional charges. expenses are taken into account.

Third party transportation costs

If there is no need or possibility of creating your own fleet for transportation, it is allowed to order services from third-party companies on the basis of a concluded contract. Expenses in accounting are reflected using accounts 60 and 20. Account 60 is credited and means that a debt has arisen to the counterparty who delivered the goods. Account 20 is responsible for assigning the cost of the service to the expenses of the main production. Instead of account 20, accounts 25, 26, 15, 16 can be used. The choice of account is influenced by the specifics of the organization’s activities and the provisions of the accounting policy.

In tax accounting, the costs of delivering goods by third parties are considered material costs and are of a production nature. The algorithm for recognizing them in accounting should be prescribed in the accounting policy. In this local act, enterprises set the date of occurrence of expenses according to one of the criteria:

- the day of final payment for the service, which is indicated in the contract signed between the company and the transport organization;

- the date when the customer of the services was presented with documents for settlements;

- the last day of the tax period that is the reporting period.

The set of documentation will consist of an agreement with the counterparty for the transportation of goods and forms confirming the fact of implementation of the service. The norm is regulated by the Transportation Rules, approved by government decree No. 272 of April 15, 2011. A mandatory element will be the execution of a consignment note. The form is filled out by the person acting as the shipper. The document is drawn up in triplicate.

REMEMBER! For goods transported by one vehicle, one consignment note can be prepared. If a consignment of goods is distributed between two or more vehicles, then invoices must be prepared for each vehicle.

The Charter of Motor Transport, approved by Law No. 259-FZ of November 8, 2007, instructs carriers not to accept valuables that need to be transported without a completed and signed waybill (clause 3 of Article 8). Letter No. 03-03-06/1/744 dated November 11, 2011 provides explanations for the set of documentation generated when ordering cargo transportation services from third parties. It is recommended to attach a consignment note to the contract and the waybill. It is compiled in 4 copies. The fourth form is needed so that it is returned to the shipper after delivery has been completed. This document should serve as the basis for accounting for transport services and making payments for them.

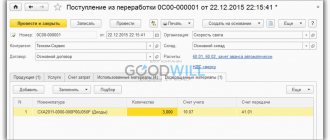

Registration of SF supplier

To register an incoming invoice, you must indicate its number and date at the bottom of the Receipt of additional expenses and click the Register . PDF

The Invoice document received is automatically filled in with the data from the Additional Receipt document. expenses .

Operation type code : “Receipt of goods, works, services.”

If the document has the Reflect VAT deduction in the purchase book by date of receipt checkbox , then when it is posted, entries will be made to accept VAT for deduction.

Postings according to the document

The document generates the posting:

- Dt 68.02 Kt 19.03 - VAT accepted for deduction.

Purchase Book report can be generated from the Reports - VAT - Purchase Book section. PDF

Reporting

The VAT return reflects the amount of VAT deducted:

In Section 3 page 120 “Amount of VAT to be deducted”: PDF

- the amount of VAT accepted for deduction.

In Section 8 “Information from the purchase book”:

- invoice received, transaction type code "".

Transfer of payment to the supplier

The transfer of payment to the supplier is formalized by the document Write-off from the current account, transaction type Payment to the supplier in the Bank and cash desk section – Bank – Bank statements – Write-off button.

To pay under several settlement documents or under several contracts, it is necessary to split the payment.

Postings according to the document

The document generates the posting:

- Dt 60.01 Kt - the debt to the supplier has been repaid.

Test yourself! Take a test on this topic using the link >>

See also:

- Document Receipt additional. expenses

- Purchase of materials with additional delivery costs,

- Purchase of a fixed asset with additional delivery costs

- Additional costs when purchasing goods under the simplified tax system

- Document Receipt additional. expenses

- Purchasing goods from a separate division with delivery costs included in their price

- Transport costs when purchasing goods are taken into account separately

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Invoice issued by a separate division Separate divisions (branches) are not VAT payers and do not have their own TIN...

- Who is the shipper in the UTD and TN if the cargo is sent from the custodian's warehouse? ...

- The forwarder charges for cargo insurance; what supporting documents is he obliged to provide to the transportation customer? ...

- Documents from the forwarder, should he sign the shipper's waybill? ...

Results

Organizations conducting trading activities can independently determine in their accounting possible options for reflecting incurred transportation costs: as part of purchased goods or as independent expenses.

In this case, it is necessary to correctly reflect their write-off depending on the chosen method of accounting for such expenses. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.