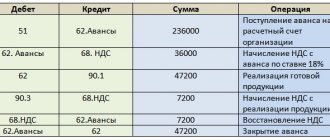

Accounting entries

The receipt of materials into the organization is carried out under supply contracts, by manufacturing materials by the organization, making a contribution to the authorized (share) capital of the organization, receiving the organization free of charge (including a gift agreement). Materials include raw materials, basic and auxiliary materials, purchased semi-finished products and components, fuel, containers, spare parts, construction and other materials.

The following are accounting entries reflecting the receipt of materials into the organization.

- Accounting for receipt of materials under a supply agreement. Accounting entries

- Accounting for receipt of materials based on advance reports. Accounting entries

- Accounting for the receipt of materials under an exchange agreement. Accounting entries

- Accounting for receipt of materials under constituent agreements. Accounting entries

- Accounting for free receipt of materials. Accounting entries

- Accounting for the receipt of materials produced in-house

Business Solutions

- the shops

clothes, shoes, products, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

And the second way: without accompanying documents. Then you will have to identify all the information manually, as well as enter it. Thus, the procedure will be complicated tenfold, and the registration period will be approximately delayed. It is worth doing your best to avoid receiving goods and materials that cannot acquire accompanying papers.

This is not only unprofitable, but also threatens with serious shortcomings. After all, the human factor comes into play. An employee is capable of making mistakes, which will lead to an incorrect assessment. Accordingly, there will be a shortage ahead, which will be revealed during the inventory.

List of accounts involved in accounting entries:

|

|

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Postings reflecting the accounting for the supply of materials with payment to the supplier after receipt of the materials | ||||

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 51 | The fact of repayment of accounts payable to the supplier for previously received materials is reflected. | Purchase price of goods | Bank statementPayment order |

| Postings for accounting for the supply of materials on prepayment | ||||

| 60.02 | 51 | Prepayment to the supplier for materials is reflected | Advance payment amount | Bank statementPayment order |

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 60.02 | The previously transferred prepayment is offset against the debt for the materials received. | Purchase cost of materials | Accounting certificate-calculation |

Problems with accounting and control of inventory items

When working with assets, some difficulties may arise related to the regrouping of costs, re-grading, untimely appearance of papers or the formation of balances. Let's look at these issues in more detail.

“Re-grading” of raw materials and type of measurement during write-off

One of the important difficulties that usually arises due to the inattention of the person in charge or in the case when the form submitted for deletion lists an item that is not among those recorded. This is due to:

- incorrectly inserted card;

- entered different units at the time of entry and deregistration;

- outdated names used by foremen;

- incorrect quantity in stock.

"Redden" residues after they were written off for production

The presence of a negative balance indicates that errors were made during inventory or work. In some cases, the accounting department simply has not yet received the remaining papers in which the missing amount can be delivered to the receipt. To avoid this complexity, accounting can be divided into management and accounting.

Delay in documentation from suppliers

If you do not control the document flow, the accountant will not know when, in what quantity and from whom the materials arrived. Therefore, he will not know what to demand from the procurement department. As a result:

- it will be difficult to write off raw materials that have not yet been delivered to the receipt;

- accounts payable information will be inadequate;

- Compiling reconciliation acts and reporting will be quite problematic.

Accounting for receipt of materials based on advance reports. Accounting entries

Below are accounting entries reflecting the accounting of receipt of materials from accountable persons on the basis of advance reports and the primary documents attached to them (delivery notes, invoices).

The receipt of materials from an accountable person can be reflected in two options:

- In the first option, a standard posting scheme is considered, reflecting the receipt of materials from account 71 “Settlements with accountable persons”. The disadvantage of this option is that the accounting does not reflect the supplier from whom the materials were received and for which VAT was refunded.

- In the second option, the receipt of materials is reflected in correspondence with account 60 “Settlements with suppliers and contractors” and further, the debt to the supplier is closed in correspondence with account 71 “Settlements with accountable persons”. With this reflection option, there is an additional opportunity to analyze supplies by supplier

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| A variant of accounting entries reflecting the receipt of materials from accountable persons according to the standard scheme | ||||

| 71 | 50.01 | The issuance of funds from the organization's cash desk to an accountable person is reflected. | Amount issued for reporting | Account cash warrant. Form No. KO-2 |

| 10 | 71 | The receipt of materials from the accountable person to the organization's warehouse is reflected on the basis of primary documents attached to the advance report. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) Advance report |

| 19.3 | 71 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| A variant of accounting entries reflecting the receipt of materials from accountable persons according to a scheme using a accounts payable account | ||||

| 71 | 50.01 | The issuance of funds from the organization's cash desk to an accountable person is reflected. | Amount issued for reporting | Account cash warrant. Form No. KO-2 |

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected on the basis of primary documents attached to the expense report. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 71 | Reflects payment to the supplier by the accountable person for materials received | Purchase cost of materials | Accounting certificate-calculationAdvance report |

Organization of accounting of material assets in accounting

In this documentation, inventory items are a static indicator. We have already said that it includes everything that is stored as raw materials, and is also currently being produced, and those warehouses in which goods are ready for sale and transportation.

The accountant is obliged to reflect all transactions that occur with these items on the accounts of the enterprise. This is receipt, any movements within the company and write-off due to sale or as a result of damage. Everything must be taken into account and calculated; entries must not be skipped or made approximately, otherwise distortion will begin and questions will arise from the tax office.

Accounting for the receipt of materials under an exchange agreement. Accounting entries

The legal basis that determines the procedure for forming an exchange agreement is defined in Chapter 31 “Barter” of the Civil Code of the Russian Federation. The methodology for reflecting supply transactions under an exchange agreement is discussed in more detail in the article “Accounting for the purchase and sale of goods under an exchange agreement”

The cost of materials to be transferred is established based on the price at which, in comparable circumstances, the organization determines the cost of similar materials.

Below are accounting entries reflecting the accounting for the receipt of materials from suppliers under an exchange agreement with the usual procedure for transferring ownership of materials, in accordance with Article 223 “Moment of the emergence of the acquirer’s right of ownership under the agreement” of the Civil Code of the Russian Federation and Article 224 “Transfer of a thing” of the Civil Code of the Russian Federation.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 60.01 | The receipt of materials from the supplier under an exchange agreement is reflected. Subaccount 10 is determined by the type of materials received | Market value of materials excluding VAT | Invoice (TMF No. M-15) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Invoice (TMF No. M-15) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | InvoicePurchase book |

| 62.01 | 91.1 | The transfer of exchanged materials to the supplier under the exchange agreement is reflected | Market value of transferred materials | Invoice (TMF No. M-15) Invoice |

| 91.2 | 10 | The write-off of transferred materials from the organization’s balance sheet is reflected. Subaccount of account 10 is determined by the type of materials transferred | Cost of materials | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | The amount of VAT accrued on the transferred materials is reflected | VAT amount | Invoice (TMF No. M-15) Invoice Sales book |

| 60.01 | 62.01 | The debt of the second party under the exchange agreement is offset | Cost of materials | Accounting certificate-calculation |

Methods

There are only two methods by which goods and materials can be accepted. But these operations are very difficult for a new employee. After all, the reception is accompanied by a lot of different information. And if you enter it all and check it, then a huge array of factually unnecessary information will accumulate. And the work will take a long time. Therefore, it is customary to record only key information. This includes the name, quantity, price, VAT and other data. But related information is often simply not noted.

Let's return to the methods. The first of them transmits the entire layer of information through documents. Then the work is greatly simplified. You just need to enter the received data. After all, in essence, posting goods to a warehouse in 1C, what is it, is just an automated procedure for filling out tons of forms, entering information in various fields. The employee carries out a reconciliation, notes the necessary actions, and the smart system does everything further on its own.

Accounting for receipt of materials under constituent agreements. Accounting entries

According to the constituent agreement, the founders (participants) contribute various types of property, including materials, to the authorized (share) capital of the organization. According to clause 8 of PBU 5/01 “Accounting for inventories”, the actual cost of inventories (materials) contributed to the contribution to the authorized (share) capital of the organization is determined based on their monetary value, agreed upon by the founders (participants) of the organization .

Based on the above provisions, the receipt of materials under the constituent agreement can be reflected in the accounting below with the following entries.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 75.1 | We reflect the receipt of materials under the constituent agreement. Subaccount 10 is determined by the type of materials received | Estimated cost of materials agreed upon by the founders | Receipt order (TMF No. M-4) Certificate of acceptance of transfer of materials |

| 19 | 83 | If the founder transferring materials to the authorized capital of the organization, in accordance with clause 3 of Article 170 of the Tax Code of the Russian Federation, restores VAT, the receiving party must make this posting | The amount of VAT restored by the founder | InvoiceAct of acceptance of transfer of materials |

conclusions

Now we know what the posting of goods in 1C is. This is a very convenient procedure that simplifies the original, classic version tenfold. In fact, you don’t need to carefully fill it out, because the automatic system will do everything itself using a standard script. And what is more important, she will not make mistakes and will always enter information completely correctly. If necessary, it will identify a shortage, create a request for a refund, or take any other action. The benefits are obvious. All that remains is to select the specific software, or rather, the version, as well as the company that will carry out the integration and supplement this package with auxiliary utilities that allow you to control the entire mechanism from one device. And various boxed offers from Cleverens do an excellent job of fulfilling this role.

Number of impressions: 9820

Accounting for free receipt of materials. Accounting entries

In accounting, according to clause 16 of PBU 9/99 “Income of the organization,” income in the form of gratuitous receipt of property is recognized “as it is generated (identified).”

In tax accounting, according to paragraphs. 1 clause 4 of Article 271 “Procedure for recognizing income under the accrual method” of the Tax Code of the Russian Federation, income in the form of gratuitous receipt of property is recognized on the date the parties sign the property acceptance and transfer act.

According to clause 9 of PBU 5/01 “Accounting for inventories”, “the actual cost of inventories received by an organization under a gift agreement or free of charge ... is determined based on their current market value as of the date of acceptance for accounting.”

Based on the above provisions, the gratuitous receipt of materials can be reflected in the accounting below using the following entries.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 91.1 | We reflect the free receipt of materials. Subaccount 10 is determined by the type of materials received | Market value of materials on the date of acceptance for accounting | Receipt order (TMF No. M-4) Certificate of acceptance of transfer of materials |

Working with imports

A lot of new variables appear that did not exist before. For example, compliance with international standards, which sometimes contradict current Russian legislation. Currency also becomes an important aspect, because valuables were purchased with it, and the full cost is calculated in rubles. That is, you need to convert at the current rate. This means that at a minimum there should be prompt access to it. After all, quotes are constantly changing.

This means that your software must initially be adapted to such conditions and have an import processing function. Otherwise, you will have to keep your own records for each line or product item. Which is long and problematic. In addition, you need to specify the basis for the posting of imported goods. And the taxation system is also capable of undergoing changes.

In principle, when any material value is not produced on the territory of the Russian Federation, it is not subject to the standards that exist in our country. At the same time, others are presented. If they are similar or identical, there will be no problems, but in cases of discrepancy, troubles are quite possible. Storage conditions also raise questions. After all, the path that an object will take is usually very long. And during this period, damage and the appearance of defects are quite possible. And the supplier, who did not discover this in advance, will try not to write off this defect, but to pass it on so that he does not have an unnecessary headache. Therefore, the check must be more thorough.

Accounting for the receipt of materials produced in-house

According to the methodological instructions, materials are accepted for accounting at actual cost. The actual cost of materials when manufactured by the organization is determined based on the actual costs associated with the production of these materials. Accounting and formation of costs for the production of materials are carried out by the organization in the manner established for determining the cost of relevant types of products. Those. The procedure for reflecting materials produced in-house in accounting depends on the methodology for calculating the cost of products used in the organization.

Currently, the following types of assessment of finished products are used:

- At actual production cost. This method of assessing finished products (manufactured materials) is used relatively rarely, as a rule, in single and small-scale production, as well as in the production of mass products of a small range.

- Based on the incomplete (reduced) production cost of products (manufactured materials), calculated based on actual costs without general business expenses. Can be used in the same industries where the first method of product evaluation is used.

- At standard (planned) cost. It is advisable to use in industries with mass and serial production and a large range of products.

- For other types of prices.

Below we will consider two options for recording the receipt of materials produced in-house in accounting.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Accounting for materials at standard (planned) cost. | ||||

| 10 | 40 | The release (manufacturing) of materials is reflected at the planned cost | Planned cost | Receipt order (TMF No. M-4) |

| 40 | 20 | The actual production cost is reflected | Actual cost of manufactured materials | Accounting certificate-calculation |

| 10 | 40 | The write-off of deviations between the cost of materials at actual cost and their cost at standard (planned) cost is reflected. | The amount of deviation is “black” or “red” depending on the balance of the deviation | Accounting certificate-calculation |

| Accounting for materials at actual cost. | ||||

| 10 | 20 | The release (manufacturing) of materials is reflected at actual cost | Actual production cost | Receipt order (TMF No. M-4) |

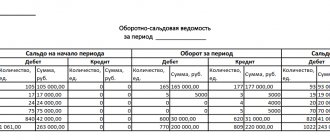

Rules and methods for accounting for inventory items in an organization

They must be accounted for on special balance sheet accounts through a number of primary documents. When drawing up a balance sheet, they are included in the second section, which is called “Current assets”. You can track changes in it, since balances are entered at the beginning and end of each reporting period.

Inscribed in the reporting, they provide information that accounting work was carried out on them. The dynamics of movement and change are revealed, because their purchases and write-offs are indicated in registers and statements.

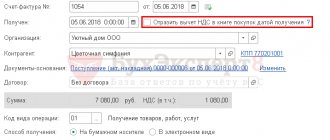

Universal transfer document (UDD)

This document is both a waybill and an invoice. Legislatively introduced in 2013 and not mandatory for use. You can decide for yourself whether you want to draw up two documents or just the UPD. Like an invoice, UTD provides the basis for obtaining a tax deduction.

The use of a universal document simplifies the process of transfer and acceptance of inventory items. Use it to formalize the supply of goods, works or services and the transfer of property rights. The UPD is signed by the authorized person responsible for the preparation of primary documents or purchase and sale transactions.

In the legally established form of the UPD there is a status field. It determines which document you are submitting the UPD instead of:

- Invoice and delivery note;

- Packing list;

- Invoice (for electronic form).

The status of the document changes the order in which it is filled out: for status 2, you do not need to fill out some lines, the UPD number and the required signatures change. To use the UPD in an organization, its form must be approved. The official form is advisory in nature, and the organization may make changes to it. But all mandatory details of the primary documents must comply with the requirements.