When closing an individual entrepreneur, an entrepreneur must take several mandatory actions.

One of them is filing tax reports. This article examines step by step the procedure for filling out and submitting an entrepreneur’s liquidation declaration to the simplified tax system, discusses in detail the differences between this document and a regular tax return, talks about the timing of its filing, how to correctly calculate the reporting tax period, and also provides information about the consequences awaiting the entrepreneur , if he does not provide documents on time.

Current form

To fill out a declaration under the simplified tax system when closing an individual entrepreneur, use the form approved by Federal Tax Service Order No. MMV-7-3/99 dated February 26, 2016 (hereinafter referred to as Federal Tax Service Order No. MMV-7-3/99, Procedure).

That is, the same form applies as when submitting a regular simplified taxation system declaration for the year when conducting individual entrepreneurial activities.

Also see “Declaration under the simplified tax system in 2021: form for LLCs and individual entrepreneurs.”

According to the law, an example of a simplified taxation system declaration when closing an individual entrepreneur can be drawn up both on paper by hand and on a computer. In general, the entire report takes 3 sheets.

deklaraciya_usn_3.jpg

Losses that arose during the period of application of the simplified “income minus expenses” are not taken into account after the closure of the individual entrepreneur - they cannot be restored even after re-registration.

Paid insurance premiums are included in the individual entrepreneur's expenses for the simplified tax system at 15%. Using the simplified tax system of 6% (income), individual entrepreneurs without hired employees can reduce the tax by the entire amount of insurance premiums paid for themselves, and individual entrepreneurs with employees - by no more than 50% of the contributions transferred in the reporting period for hired personnel. Contributions paid after the closure of an individual entrepreneur cannot be counted toward tax reduction or expenses, so it is advisable to transfer their balance during the period of validity of the entrepreneurial status.

Tax period code

In the vast majority of cases, they fill out a simplified taxation system declaration when closing an individual entrepreneur for less than a full year. Therefore, in her header, in the field with the tax period code, you need to enter the number “50”:

It means the last tax period upon termination of activities as an individual entrepreneur (according to Appendix No. 1 to the order of the Federal Tax Service No. MMV-7-3/99). Let us clarify that in practice, tax authorities ask you to indicate the code “50”, and not “96”.

Closing an individual entrepreneur: when to submit a declaration under the simplified tax system

The answer to one of the most frequently asked questions: “I am closing an individual entrepreneur, when should I submit a declaration under the simplified tax system?” is not as simple as it might seem. In Art. 346.23 of the Tax Code of the Russian Federation lists the deadlines for filing a declaration, but their wording is interpreted differently. So, within what time frame do you need to submit a liquidation declaration when closing an individual entrepreneur on the simplified tax system? Let's explain:

- when terminating activities under the simplified tax system and submitting a special notification about this to the Federal Tax Service (in form No. 26.2-8), you must report no later than the 25th day of the month following the month of termination of the “simplified” activity (clause 2 of Article 346.23 of the Tax Code of the Russian Federation);

- in case of loss of the right to the simplified tax system without cessation of business activity (when, for example, due to exceeding the revenue limit, a transition to OSNO occurs) - no later than the 25th day of the month following the quarter in which the loss of the right to use the simplified tax system was recorded (clause 3 of Art. 346.23 Tax Code of the Russian Federation);

- in all other cases, the deadline for submitting reports for individual entrepreneurs, incl. former, single - until April 30 of the next year (clause 2, clause 1, article 346.23 of the Tax Code of the Russian Federation).

As you can see, there are no separate deadlines for simplified tax reporting for individual entrepreneurs who completely cease their activities. In other words:

- The declaration when closing an individual entrepreneur for 2021 according to the simplified tax system must be submitted before 04/30/2020 (inclusive). If an individual entrepreneur is deregistered in 2021, a declaration for 2021 must be submitted no later than April 30, 2021.

- When an individual entrepreneur lost his right to the simplified tax system before closing, he will have to report by the 25th day of the first month after the quarter in which this happened.

- If, when closing an individual entrepreneur, the taxpayer separately notified the tax authorities about the termination of activities on the simplified tax system, he will have to submit a declaration by the 25th day of the month following the month of termination of work on the simplified tax system. Let us remind you that in case of complete cessation of business and filing an application for exclusion of an individual from the Unified State Register of Individual Entrepreneurs, it is not necessary to send a notification in form No. 26.2-8 (letter of the Ministry of Finance dated July 18, 2014 No. 03-11-09/35436, letter of the Federal Tax Service dated August 4, 2014 No. GD-4-3/ [email protected] ).

To avoid disputes with the Federal Tax Service, it is recommended to submit a declaration soon after the individual entrepreneur is deregistered.

Within the deadlines established for filing a declaration, when closing an individual entrepreneur, an individual will need to transfer a single tax to the budget according to the “simplified tax system”.

Filling out sections

Sections 1.1 (object according to the simplified tax system “Income”) and 1.2 (“Income minus expenses”) of the declaration do not have any fundamental features in filling out when closing an individual entrepreneur. Here's what they usually say:

- OKTMO;

- tax (advance payments thereon);

- by what amount you reduce the tax or have to pay extra to the budget.

But Sections 2.1.1 (object “Revenue”) and 2.2 (“Revenue minus expenses”) - where the tax is calculated - have a common filling feature. When closing an individual entrepreneur, the value of each declaration indicator (income, expenses, amounts of insurance premiums, trade fees, tax amount according to the simplified tax system) for the last reporting period (quarter/half-year/9 months) is repeated in the line for the tax period of the corresponding indicator.

For example, this is how it looks for the “Revenue” object (let’s agree that the income was only in the first quarter of 2021):

What happens if you don't provide the document?

If an entrepreneur does not submit a tax return on time, he is subject to a fine. According to Article 119 of the Tax Code of the Russian Federation, the fine is 5% of the tax amount for each month of delay (including incomplete). The fine is set at no more than 30% of the tax amount stated in the declaration, and not less than 1000 rubles.

According to Article 14 of Law No. 212-FZ, until January 1, 2021, in the absence of a tax return, the Pension Fund of the Russian Federation required pension contributions from the entrepreneur “for himself” in eight times (the maximum) amount. From January 1, 2021, this law lost force; contributions in a fixed amount began to be calculated in accordance with paragraph 1 of Article 430 of the Tax Code of the Russian Federation, where there is no such rule.

We have considered all aspects of filling out and submitting a tax return when closing an individual entrepreneur on the simplified tax system in 2021. We clarified the deadlines for filing the declaration, filled out the sample step by step, found out the differences between tax reporting when closing an individual entrepreneur from the usual one, and also found out what the consequences would be if you do not submit the report. Now you can easily provide the tax authorities with the correct liquidation declaration of the individual entrepreneur.

Filling example

Let’s agree that individual entrepreneur Vladimir Viktorovich Krasnov, being on the simplified tax system “Income,” was expelled from the Unified State Register of Individual Entrepreneurs on April 11 of his own free will due to closure.

Income for the first quarter of 2021 totaled 220,000 rubles. He paid tax in the amount of 13,200 rubles. (RUB 220,000 ×6%).

For the first quarter of 2021, individual entrepreneur Krasnov paid insurance premiums of 17,063 rubles. This amount exceeded the tax payable to the budget, since it consisted of:

- fixed insurance premiums to the Pension Fund for the first quarter. (RUB 7338.50);

- fixed contributions to compulsory medical insurance for the first quarter. (RUB 1,721);

- 1% in the Pension Fund of the Russian Federation on income over 300,000 rubles. for the whole of 2021 (RUB 8,003.32).

Here the link shows a complete EXAMPLE OF COMPLETING THE DECLARATION OF THE STS WHEN CLOSING AN IP, which can also be downloaded for free.

Individual entrepreneurs with the “Income” object can reduce the tax by the amount of insurance premiums paid before the date of termination (!) of the individual entrepreneur’s status.

Insurance premiums paid after the date of termination of business activity cannot be (letter of the Ministry of Finance dated August 27, 2015 No. 03-11-11/49540).

Also see “How to fill out the latest simplified taxation system declaration when closing an individual entrepreneur.”

Read also

23.04.2019

How to fill out the document?

There are two main differences between the declaration upon liquidation of an individual entrepreneur and the usual one:

- A different code is used for the tax period.

- Reporting is submitted not for the calendar year, but for the last tax period (more on this below).

There are 4 tax period codes for individual entrepreneurs using the simplified tax system:

- «34» – for a calendar year;

- «50» – applies if the organization has been reorganized (liquidated) or an individual entrepreneur has been closed;

- «95» – applies if the entrepreneur has changed the tax regime;

- «96» – applies if business activity on the simplified tax system has been terminated.

In the liquidation declaration of an individual entrepreneur, you must use code “50”.

What tax period is it filed?

According to paragraph 3 of Article 55 of the Tax Code of the Russian Federation, when closing an individual entrepreneur, the last tax period is considered to be the time from January 1 to the date of deregistration of the individual entrepreneur.

Example. Petr Sergeevich Ivanov decided to close the individual entrepreneur in April 2021 and submitted an application on form P26001. After this, it is deregistered within 5 working days (clause 1 of Article 8 of the Law of 08.08.2001 N 129-FZ). Ivanov is given a sheet of registration from the Unified State Register of Individual Entrepreneurs in form P60009, which contains the text “an entry was made about the termination by an individual of activities as an individual entrepreneur on April 28, 2021.”

This date will be considered the end of the tax period. Then the tax period for Ivanov’s declaration is from January 1 to April 28, 2021.

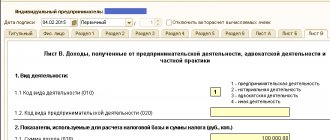

Step by step filling

Let's consider step-by-step filling out the individual entrepreneur declaration on the simplified tax system for Ivanov P.S. Data to fill:

- IP Ivanov Petr Sergeevich.

- TIN 111111111111.

- City of residence Cheboksary.

- Stopped operating as an individual entrepreneur on April 28, 2021.

- Income for the first quarter of 2021 - 50,000 rubles, for the second quarter of 2020 - 10,000 rubles.

- Contributions for compulsory health insurance and compulsory health insurance were paid for the first quarter of 2021 - 10,219 rubles, for the second quarter of 2021 - 3,406 rubles.

- OKVED – 71.20.9.

- OKTMO code – 97701000.

- The object of taxation is “income”.

- Tax rate 6%.

- There are no hired workers.

Title page:

| Count | Filling |

| TIN | 111111111111 |

| Adjustment | 0 |

| Tax period code | 50 |

| Reporting year | 2020 |

| Tax authority code | 2130 (for Cheboksary) |

| Location code | 120 |

| Taxpayer | Ivanov Petr Sergeevich |

| OKVED | 71.20.9 |

| Phone number | 89991119999 |

| On the pages | 3 |

| Confirmation of the accuracy and completeness of information | 1 (taxpayer) |

| Signature and date |

Next section 2.1.1:

| Count | Filling |

| TIN | 111111111111 |

| 102 | 2 |

| 110, 111 | For the first quarter - 50,000 rubles, for the first half of the year - 60,000 rubles. |

| 120, 121, 123 | 6 |

| 130, 131, 133 | For the first quarter - 3,000 rubles. (the number in line 110 is multiplied by the number in line 120, and the result is divided by 100), for half a year - 3,600 rubles. (we multiply the number in line 111 by the number in line 121, and divide the result by 100), for the tax period - 3,600 rubles. (the number in line 113 is multiplied by the number in line 123, and the result is divided by 100) |

| 140, 141, 143 | For the first quarter - 3,000 rubles, for the six months - 3,600 rubles, for the tax period - 3,600 rubles. (indicate the amount of contributions not exceeding advance payments) |

According to the letter of the Ministry of Finance dated August 27, 2015 No. 03-11-11/49540, when reducing the amount of tax, only insurance premiums that were paid before the closure of the individual entrepreneur are taken into account. Insurance premiums, the payment of which was made after the individual entrepreneur was deregistered, do not reduce the tax amount.

Section 1.1:

| Count | Filling |

| TIN | 111111111111 |

| 010 | 97701000 |

| 020 | Section 2.1.2 was not filled out in the example, so we calculate it as follows: from line 130 of section 2.1.1, subtract line 140 of the same section. Calculation: 3,000 – 3,000 = 0. In lines with zeros, put a dash |

| 040 | We calculate: from line 131 of section 2.1.1, subtract line 141 of the same section, and then subtract line 020 from the result. Calculation: 3,600 – 3,600 – 0 = 0 |

| 050 | We count: from line 131 of section 2.1.1, subtract line 141 of the same section, and then subtract the result from line 020. Calculation: 0 – (3,600 – 3,600) = 0 |

| 100 | We count: from line 133 of section 2.1.1, subtract line 143 of the same section, remember the result. Then add line 020 to line 040 and subtract line 050. Subtract the second result from the first. Calculation: (3,600 – 3,600) – (0 + 0 – 0) = 0 |

| 110 | We count: add lines 020 and 040, subtract 050, remember the result. Then from line 133 of section 2.1.1 we subtract line 143 of the same section. Subtract the second from the first result. Calculation: (0 + 0 – 0) – (3,600 – 3,600) = 0 |

| Signature and date |

Features of design in the middle of the year

When filing a liquidation declaration in the middle of the year, you need to display data only for the time worked. In the example, Ivanov P.S. completed Section 2.1.1. only for fields with the names “for the first quarter”, “for the half year” and “for the tax period”, leaving the fields “for nine months” empty, since his individual entrepreneur was deregistered in the second quarter (April 28). Another feature is that the tax period code is different from the usual one: 50 instead of 34.

The amount of fixed insurance premiums for an incomplete calendar year is calculated in proportion to the number of months worked. And for less than a month - in proportion to the days worked.

Fixed contributions in 2021 are: for compulsory health insurance – 32,448 rubles, for compulsory medical insurance – 8,426 rubles.

Declaration methods

When liquidating an individual entrepreneur on UTII, there are no special requirements for submitting a report.

The first method is a paper version, which is submitted in 2 copies. On the second, the tax service must mark receipt.

The second way is through the post office. It is advisable to issue a registered letter. It is recommended to send documents with a notification, which, after receipt by the tax service, should be returned to the sender. Don't forget that there is a shipping deadline that needs to be taken into account. Therefore, the declaration should be sent in advance.

The third way is through the Internet. To use this method, you will have to have your signature notarized. If this has been done previously, there will be no problems with submitting the report.

Penalties for late submission of tax returns

The Tax Code, in Article 119, stipulates that the state imposes a fine on an entrepreneur in case of violation of the deadline for submitting a declaration. The penalty is 5 percent of the unpaid taxes, in addition to the taxes themselves. To calculate this amount, information from declarations is taken as a basis, monthly from the date of filing. The maximum fine is 30 percent of the total tax, the minimum is 1 thousand rubles.

The Code of Administrative Offenses, in turn, collects a fine from the entrepreneur in the amount of 300-500 rubles for violating the filing deadlines.

IP report during the liquidation of an enterprise

When an individual decides to close the management of his individual entrepreneur, he must provide the following documents to the tax service:

- application for state registration of completion by an individual of his individual entrepreneurial activity (form P26001). To submit an application to the authority by an authorized representative, the document must be notarized;

- a receipt confirming that the fee has been paid;

- The entrepreneur also transfers certain documentation about his employees to the Pension Fund of the Russian Federation and the Social Insurance Fund before the individual entrepreneur is closed.

- By contacting the Social Insurance Fund, the entrepreneur must remove himself from the register. The scheme here is not the same as in the Pension Fund, where deregistration occurs automatically after information received from the Federal Tax Service about the termination of the activities of an individual entrepreneur.

When undergoing such a procedure, an individual pays fixed insurance to the Pension Fund for 15 calendar days, starting from the date of state registration of the liquidation of the individual entrepreneur.

Closing can be carried out at any time, at the discretion of the individual, while the declaration is submitted without taking into account the reporting period, it does not play a role.

Consequences for failure to report

When submitting documents, be sure to use examples of how to fill them out - violation of the rules established by the Federal Tax Service is punishable by a fine.

If the documents are not provided on time, the violator faces the following penalties:

- declaration and personal income tax - 1000 rubles per month of delay;

- SZV-M - 500 rubles for each employee;

- RSV-1 and 4-FSS - 5% of contributions for the last 3 months of delay.

If the electronic declaration is filled out with errors, you will have to pay 200 rubles. Violation of the rules for filing SZV-M will cost 1000.

Using the sample, filling out the documents correctly will not be difficult. Timely submission of reports will allow individual entrepreneurs to close their business without problems.

Zero declaration

A zero declaration under the simplified tax system is submitted upon temporary cessation of work. It shows that for some time the business did not bring any income to the individual entrepreneur.

The tax return of this sample is filled out according to accepted rules. But the lines for AP and taxes are partially or completely filled with zeros.

Even if an entrepreneur did not work a single day during the reporting period, he is required to submit a report showing that he did not receive any income. An individual entrepreneur working by deducting expenses from income can include these expenses in the next year’s reporting in order to reduce the amount of payments.

When working under the “Income minus expenses” scheme, the Tax Code obliges the entrepreneur to pay a minimum tax. It is worth noting that if before this the individual entrepreneur used reports of a different type, in the absence of profit he is also obliged to pay tax.

If work was interrupted in the middle of the year, the individual entrepreneur enters the latest available data in his zero declaration of the simplified tax system in the “for the tax period” field. Based on these values, taxes are calculated, which will be significantly less than usual.

In case of temporary cessation of work, personal income tax certificates are not submitted. But it is mandatory to provide data on insurance premiums and SZV.

A zero declaration does not mean the mandatory closure of an individual entrepreneur. But if there is no income for a long time, the Federal Tax Service may close the business and remove it from the Unified State Register of Enterprises due to unprofitability. Or if the audit reveals violations, punish the owner for tax evasion.

When to pay pension contributions

Individual entrepreneurs on the simplified tax system without employees in 2021 must pay at least 36,238 rubles in insurance premiums (from income up to 300 thousand rubles). If he ceased activity, he pays an amount proportional to the time worked. An exact calculation can be made using our calculator. The individual entrepreneur has the right to deduct the entire amount paid from the tax, since there are no employees.

The deadline for paying these contributions is specified in paragraph 5 of Article 432 of the Tax Code of the Russian Federation - no later than 15 days (calendar) from the date of deregistration. From the next day, penalties will be charged. However, there is an important nuance. You can claim a deduction only for the amount of deductions that were paid before the day of deregistration (letter of the Ministry of Finance of Russia dated August 27, 2015 No. 03-11-11/49540).

Therefore, before closing an individual entrepreneur on the simplified tax system without employees, it is wise to pay contributions. Well, or at least that part of them that can be taken into account when calculating the tax. And everything else can be paid within 15 days after deregistration.

Nuances of calculating UTII tax

The usual formula for calculating UTII for a month looks like this:

Physical indicator (FP) x Basic return (BR) * K1 * K2 * Tax rate.

This formula uses the following parameters:

- FP is a physical indicator, different for different activities. For example, for transportation this is the number of vehicles, for veterinary services - the number of employees, for a store - retail space;

- BD – basic profitability per unit of FP;

- K1 – deflator coefficient, which is approved by the Ministry of Economic Development;

- K2 is a coefficient that is set by municipal authorities to support certain industries - it reduces the amount of tax (if absent, it is taken as “1”).

If an entrepreneur closes, then for the last month of work he calculates the tax using a different formula. The calculation given above must be adjusted in proportion to the days worked this month.

The formula will look like:

FP * DB * K1 * K2 * Rate / K days per month * K days worked,

where K is the number of days. How exactly to calculate the tax will be shown below using an example.

Distinctive features

The main feature of the regime is that the amount of income received does not matter when determining the tax base. The calculation is made based on the amount of expected income, which is determined at the state level. Hence the colloquial name “imputation”. In other words, government agencies establish, or more precisely impute, the amount of profit.

The taxation system does not require payment of the following taxes:

- on the income of individuals;

- VAT;

- property tax.

Liquidation

The definition of liquidation of an individual entrepreneur is the termination of registration of an individual as an entrepreneur. As soon as a person goes through the entire procedure and receives written confirmation of removal from the register, he is immediately deprived of all rights and obligations that he had while carrying out his activities. Naturally, there is a limitation. If there are still debts, then an individual, without having the status of an entrepreneur, must pay them off.

In addition to the desire of an individual, liquidation of an individual entrepreneur on UTII can be carried out in the following cases:

- bankruptcy;

- expiration of the validity period of registration documents that allow you to legally stay in the country;

- making an appropriate decision by the court;

- death of an individual.

In principle, all the methods described can be classified as coercive measures, not counting the bankruptcy procedure, which was initiated by the individual himself.

Report submission deadlines

There are no special deadlines for submitting a UTII declaration when closing an individual entrepreneur. In other words, it can be sent within the standard deadline, namely before the 20th day of the first month of the quarter following the reporting one.

✐ Example ▼

For example, let’s take individual entrepreneur Ivan Ivanovich Zaitsev, who provides veterinary services on UTII in the town of Yubileiny near Moscow. At the beginning of 2021, he decided to cease operations. All employees were laid off in the second quarter. In July, the entrepreneur completed all matters and submitted documents for deregistration. The IP was closed on July 15. Therefore, he must submit his last return for the second quarter. The deadline is October 20, 2020.

Prepare a UTII declaration for only 149 rubles