From your employees' salaries, you withhold personal income tax or personal income tax - 13%, transfer it to the state, and give the remaining money to the employee. This is how it happens in life.

You hired an employee and agreed that you would give him 20 thousand rubles a month. The employment contract must indicate a salary of 22,990 rubles. This amount includes 13% personal income tax, which you will transfer to the state. Every month you pay 20 thousand rubles to the employee and 2,990 rubles to the tax office.

Submit reports in three clicks

Elba is suitable for individual entrepreneurs and LLCs with employees. The service will prepare all the necessary reporting, calculate salaries, taxes and contributions, and generate payments.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Who submits 6-NDFL in 2021

All organizations and individual entrepreneurs that are tax agents for personal income tax must submit quarterly calculations to their Federal Tax Service Inspectorate in form 6-NDFL. In 2021, calculations must be submitted on time, no later than the last day of the month following the corresponding reporting period (Clause 2 of Article 230 of the Tax Code of the Russian Federation).

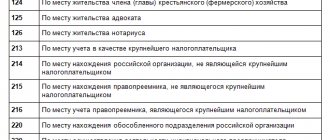

You need to submit 6-NDFL calculations in 2021 to the Federal Tax Service at your place of registration (clause 2 of Article 230 of the Tax Code of the Russian Federation).

For organizations, this is, as a rule, the location, for individual entrepreneurs – the place of residence (clause 1 of Article 83 of the Tax Code of the Russian Federation). If the organization has separate divisions, then the 6-NDFL calculation in relation to income must be submitted to the tax authority at the place of their registration (clause 2 of Article 230 of the Tax Code of the Russian Federation):

- employees of such departments,

- individuals under civil contracts concluded with these separate divisions.

Sanctions for late submission of a report

Tax agents who fail to submit the form on time are fined and their bank account is subsequently frozen. According to clause 1.2 of Art. 126 of the Tax Code, a legal entity or individual entrepreneur pays 1000 rubles. for each calendar month. The delay time is counted from the moment after the deadline for submitting 6-NDFL - the deadline for submitting reports for 2018 must also be observed by the company’s employees. They are subject to a fine of 300-500 rubles.

For the calendar year 2021, reporting papers are submitted 4 times. We recommend downloading the unified form of the new form below to avoid misunderstandings on the part of the tax authorities.

Similar articles

- 6-NDFL for the 4th quarter: due date

- Deadline for submitting 2-NDFL (with sign 2) for 2021

- Submitting 2-NDFL on paper

- Declaration 6-NDFL in 2018

- Accounting calendar for 2021 - reporting

Apply the new form in 2018

From March 25, 2021, for reporting for 2021 and beyond, a new form of calculation, 6-NDFL, is in effect - as amended by Federal Tax Service order No. MMV-7-11/18 dated January 17, 2021. Until this date, you can submit the previous payment form. You can view the changes here:

https://publication.pravo.gov.ru/Document/View/0001201801250013

According to the amendments to the order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450, which approved the form and procedure for filling out the 6-NDFL calculation, the title page of the 6-NDFL form was adjusted, the bar code “15201027” was replaced by the bar code “15202024” ”, the procedure for filling out and presenting the calculation, as well as the delivery format, have been changed.

Changes in document content

Starting from the 2021 calendar year, reporting acts for 2021 are submitted according to a modified format. The exact list of changes to 6-NDFL, deadlines for 2018 can be found on the Federal Tax Service website. The updated version of the form is presented:

- title - a sheet without numbering;

- barcode with the numeric value 15202024;

- changed sequence of filling out reports.

Now tax agents can provide forms in person, send them by e-mail or via TKS through an operator on duty.

Reporting periods in 2021

Paragraph 2 of Article 230 of the Tax Code of the Russian Federation provides that for the purpose of submitting the calculation of 6-NDFL in 2021, the reporting periods are:

- 1 quarter;

- half year;

- 9 months;

- year.

Accordingly, based on the results of these reporting periods, calculations must be submitted to the Federal Tax Service using Form 6-NDFL. Moreover, if the last day for filing 6-NDFL falls on a weekend or a non-working holiday, then the calculation is submitted on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated December 21, 2015 No. BS-4-11/ 22387). Accordingly, some deadlines for submitting 6-NDFL in 2021 may be postponed.

How to meet reporting deadlines?

For 6-NDFL, the deadlines for submission in 2018 do not change. The document is considered sent:

- e-mail – after recording the fact of transfer;

- notification from the TCS operator no later than 24:00 before the expiration of the last day of the period;

- the date the letter was sent by mail is the day the reporting is submitted;

- personal delivery of the document to the tax inspector - the date is entered manually.

If settlement papers are sent to the wrong address, the deadline for submitting the 6-NDFL report (2018) is not adjusted.

Deadlines for submitting 6-NDFL in 2021: table

In 2021, taxpayers (organizations and individual entrepreneurs) need to submit calculations to the Federal Tax Service using Form 6-NDFL within the time limits indicated in the table below:

| Reporting period | Due in 2021 |

| 2017 | April 2, 2021 |

| 1st quarter 2021 | May 3, 2021 |

| 2nd quarter 2021 | July 31, 2021 |

| 3rd quarter 2021 | October 31, 2021 |

| 2018 | April 1, 2021 |

Next, we will explain the deadlines for submitting 6-NDFL for each reporting period in more detail.

6-NDFL for 2021

In 2021, you need to submit the annual calculation of 6-NDFL for 2021. According to the requirements of paragraph 2 of Article 230 of the Tax Code of the Russian Federation, the annual 6-NDFL must be submitted no later than April 1. However, April 1, 2021 is Sunday and tax offices are closed on these days. Therefore, the annual calculation of 6-NDFL for 2021 can be submitted no later than April 2, 2018.

6-NDFL for the 1st quarter of 2021

The deadline for submitting 6-NDFL for the 1st quarter of 2021 is no later than the last day of the month following the reporting period. That is, no later than April 30. But due to weekends and holidays in 2021 (April 30-May 2 are holidays), the deadline for submitting reports is postponed. The postponement of reporting is provided for in paragraph 7 of Art. 6.1 Tax Code of the Russian Federation. The deadline for submitting 6-NDFL for the 1st quarter of 2021 is 05/03/2017. Payments for the 1st quarter of 2021 must be submitted on the first working day after the holidays, that is, May 3.

6-NDFL for the 2nd quarter of 2021

For April-June 2021, you must submit 6-NDFL to the Federal Tax Service no later than the 30th day of the month following the 2nd quarter. The deadline for submitting 6-NDFL for the 2nd quarter (half year) of 2021 is 07/31/2018. There are no holidays in July, and there are no transfers from weekends either, so the deadline is not postponed or extended.

6-NDFL for 9 months of 2021

Report for 9 months - the last calculation of 6-NDFL in 2021. The deadline for submitting 6 personal income taxes for the 3rd quarter (9 months) of 2021 is 10/31/2018. There will be no rescheduling due to weekends or holidays. Therefore, it is better to prepare and submit the calculation in advance. The reporting campaign for 9 months will begin on October 1, 2021. For a delay in settlement of more than 10 working days - until November 9, the inspectorate has the right to block current accounts (clause 3.2 of Article 76 of the Tax Code of the Russian Federation).

In 2021, you do not need to submit a “zero” calculation of 6-NDFL if you did not accrue or pay income on which you need to pay tax (Letter of the Federal Tax Service of Russia dated 01.08.2016 N BS-4-11/13984) We recommend notifying the Federal Tax Service about this that you do not plan to submit a 6-NDFL calculation, and explain the reason. Otherwise, the tax authority may suspend your transactions on accounts (transfers of electronic funds), as well as fine you for failure to submit a payment (clause 3.2 of Article 76, clause 1.2 of Article 126 of the Tax Code of the Russian Federation). If you nevertheless decide to submit a “zero” calculation of 6-NDFL, then the tax authority will accept it (Letter of the Federal Tax Service of Russia dated May 4, 2016 N BS-4-11/7928).

If you violate the deadlines for submitting 6-NDFL in 2021, then penalties may be applied to the organization or individual entrepreneur or the account may be blocked. Read more about this “Fines for late submission of 6-NDFL”.

Read also

25.11.2016

How submitted calculations are corrected

Tax agents, having noticed incomplete inclusion of the necessary information in the submitted calculation or errors that resulted in a distortion of the tax amounts payable, submit updated calculations. The updated calculations include data regarding those taxpayers whose information resulted in distortions. In other words, the updated calculation is based on the difference between the correct value of the indicator and that indicated in the previous calculation.

To correctly fill out the calculation in form 6-NDFL, you need to study the instructions for filling

Submission of updated calculations releases you from tax liability, subject to the following conditions.

- The updated calculation is submitted after the filing deadline, but before the tax payment deadline.

- The updated calculation is submitted after the deadline for submitting the calculation and paying the tax has expired, provided that before its submission the tax agent has paid the missing amount of tax and the corresponding penalties.

- The updated calculation was submitted before the tax agent learned that the tax authority had discovered filling errors that resulted in an underestimation of the amount of tax payable or that an on-site tax audit had been ordered.

Example 5. On April 12, 2021, Sever LLC submitted the 6-NDFL calculation for the first quarter of 2021. On May 20, the company established that it had not included in the calculation payments to A.I. Iksov and the corresponding personal income tax amounts - 2,000 rubles. On May 27, Sever LLC paid 2,000 rubles in personal income tax and penalties (from the day following the payment deadline until May 27 inclusive). On May 28, Sever LLC presented an updated calculation, in which, for the relevant items, it indicated the amounts related to payments made to A.I. Iksov. Since the tax inspectorate had not yet discovered the error in the calculation and had not scheduled an on-site audit, Sever LLC was not held liable for taxation.

Section 1

Sec.

1 of Form 6-NDFL includes general information about income, as well as accrued and withheld tax from January to September 2018. The section is filled out separately for each tax rate, with the exception of lines 060-090. The total indicators for these lines are recorded only on the first page of the section. 1. This section contains:

| Line | Index |

| 010 | Tax rate |

| 020 | Amount of employee income |

| 025 | Amount of calculated dividends |

| 030 | The amount of standard, property and social deductions |

| 040 | Amount of calculated personal income tax |

| 045 | Amount of accrued tax on dividends |

| 050 | Amount of advances paid for a foreign worker |

| 060 | Total number of employees to whom income was accrued |

| 070 | Amount of personal income tax withheld |

| 080 | Amount of unwithheld personal income tax |

| 090 | Return of withheld personal income tax to the taxpayer (for example, if an employee’s salary was recalculated and the amount of withheld tax exceeded the calculated one) |

Let's look at an example of filling out section. 1 form 6-NDFL for 9 months of 2018.

Alliance LLC for 9 months of 2021 accrued income to its employees in the amount of 6,832,350 rubles. The amount of deductions amounted to 210,000 rubles. The amount of calculated personal income tax is RUB 860,906. The amount of unwithheld tax is RUB 102,700.

Algorithm for preparing a report when paying bonuses, vacation pay and sick leave

accrued to 30 employees:

| Month | July | August | September |

| Salary | 750 000 | 710 000 | 780 000 |

| Monthly bonus | 15 000 | 10 000 | |

| Leave compensation upon dismissal | 17 000 | ||

| Vacation pay | 32 000 | ||

| Hospital benefits | 12 000 | ||

| Remuneration under the GPC agreement | 20 000 |

Leave compensation upon dismissal was paid to the employee on September 10, 2018, vacation pay on August 20, 2018, and sick leave benefits on July 16, 2018.

On August 15, remuneration was paid to the individual who carried out the installation of equipment under a civil contract in the amount of 20,000 rubles. (Personal income tax - 2,600 rubles). The advance payment date is the 20th of each month, the salary date is the 5th of the month following the month of income accrual.

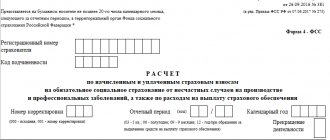

Title page

The title page of form 6-NDFL is filled out by both the tax agent and the tax authority employee in specially designated cells. It contains:

- TIN of the organization's checkpoint (or only TIN for entrepreneurs or self-employed people) in accordance with the tax registration certificate.

- In the line “Adjustment number” indicate the serial number of the clarification. For the primary report, the value 000 is fixed.

- In the “Representation period” field, enter the code designation of the reporting period:

Basic requirements for drawing up a report and methods of submission to the inspection

The law imposes certain requirements for the preparation of this report. These include, in particular:

- Each unfilled cell must have a dash. If the field must contain a quantitative-cumulative value, a zero must be entered in the leftmost cell, while a dash must be entered in the remaining cells;

- All fields must be filled in from left to right;

- It is prohibited to print a tax report on both sides of a sheet;

- If filling is done manually and not on electronic media, it is recommended to use ink of three colors: black, purple and blue;

- If filling out a tax report is done using computer technology, Courier New font size 16-18 should be used.

How to fill out the form correctly - step by step procedure

The rules for filling out the 6-NDFL calculation are presented in this article, and here is a detailed filling out of each line of the report.

Below are only those filling out features that need to be taken into account when submitting reports for 9 months of 2021.

Title page

At the top, enter the TIN and KPP (for individual entrepreneurs, notaries, lawyers, heads of peasant farms) only the TIN.

In the “submission period code” field, you should indicate code “33”; this code can be found in Appendix 1 to the Procedure for filling out the 6-NDFL calculation. It corresponds to 9 months.

In the “tax period” field the year “2018” is entered.

Otherwise, the title page is filled out in the standard way, including:

- Federal Tax Service code

- name of the legal entity or full name of the individual entrepreneur;

- OKTMO;

- contacts;

- information about the person who submits the report - the tax agent himself or a representative.

Section 1

In the first section of the 6-NDFL calculation, the data is reflected in summary form - the total amount of income and tax for the period from the beginning of the year is considered to be a cumulative total.

When filling out a report for 9 months of 2021, it is necessary to provide indicators for the period from the beginning of January to the end of September 2021.

That is, the amounts for the last 3 quarter must be added to the data indicated in the previous half-year report.

Features of filling out the first section of 6-NDFL when preparing reports for 9 months are given below.

Step-by-step completion of section 1:

- 010 – the tax rate is traditionally entered; if individuals have been paid income taxed at different rates since the beginning of the year, then section 1 is filled out separately for each.

- 020 – income accrued from January to September 2021 for all individuals; if there were no payments to employees in the last 3 months, then the indicator will simply repeat the value calculated for the half-year. This includes those amounts that, firstly, are subject to personal income tax, and secondly, the accrual date for which was included in the 9 months of 2021. Look specifically at the date of accrual, and not the payment of funds to individuals.

- 025 – the amount of dividends accrued in the first 9 months of 2018.

- 030 – the total amount of deductions provided for nine months. This indicator decreases the accrued income from line 020 during taxation. The total amount of benefits for all individuals is also entered.

- 040 – personal income tax, which is calculated from accrued income minus deductions. The indicator can be calculated by subtracting line 030 deductions from line 020 income and multiplying by the tax percentage rate from line 010.

- 045 – personal income tax on dividends, calculated as the rate multiplied by the accrued dividends from line 025.

- 050 - the line shows a fixed advance payment - these are the amounts of income tax paid by foreign workers on a patent on their own; the tax agent can reduce the personal income tax payable by the amounts of payments already paid by foreigners. If there were no such payments in the first 9 months of 2018, then 0 is entered in the field.

- 060 – the number of individuals to whom income was accrued in the period from January to September. If an employee is fired and then rehired or reinstated in the same reporting period, then he must be counted as one, since this is the same individual.

- 070 – personal income tax, which was withheld for the period from the beginning of January to the end of September 2021.

- 080 – personal income tax, which the tax agent could not withhold.

- 090 – personal income tax return, which was carried out within a nine-month period.

Line 070

In this section, it is important to correctly fill out line 070 in 6-NDFL, since the tax agent does not withhold personal income tax from all income.

For example, foreigners with a patent pay tax on their own; the employer does not need to withhold personal income tax from their income.

What is the value of line 070? Filling out line 070 in the first section must be done on a cumulative basis from the beginning of the year.

Personal income tax is withheld on the day the income is issued to the employee.

This rule does not apply to advance payments - wages for the first half of the month; in relation to this, personal income tax payments must be withheld from wages for the second half of the month.

The indicators on line 040 (calculated personal income tax) and 070 (withheld personal income tax) may differ. In 040 the tax is shown, which is calculated from the entire amount of accrued income, and in 070 only from those amounts that were paid in the last 9 months.

From the salary for the last month of the 3rd quarter (September 2018), personal income tax will be calculated in the 3rd quarter, and withheld only in October. Therefore, this tax will be included in line 040, but not in line 070.

Section 2

The indicators in this section of form 6-NDFL are given only for the last 3rd quarter. Typically, this section is the most difficult to fill out.

To register, you need to correctly determine three dates:

- actual receipt of income;

- tax withholding;

- tax transfers.

At the same time, this should include those amounts for which the personal income tax payment deadline fell in the last quarter.

Actual date of receipt of income:

- For an advance (salary for the first half of the month) - the last day of the month in which the advance was accrued;

- For wages – similar to advance payment;

- For other payments (sick leave, vacation pay, vacation compensation, dividends, severance pay) - the day of payment.

Tax must be withheld on the date when the money is given to the employee or transferred to his account. Personal income tax must be transferred on the same day or the next.

The first question that arises when filling out form 6-NDFL for 9 months is whether it is necessary to include the advance payment and salary accrued for June.

The date of actual receipt of such income is considered to be 06/30/2018; personal income tax is withheld on the date established as the deadline for paying wages for the second half of the month (from the 1st to the 15th). Personal income tax is transferred either on the day of deduction or the next. That is, the transfer date falls in the last quarter of 2021 (July), which means these amounts must be included in the calculation for 9 months.

This means that the first entry in the second section will be about the salary for June:

- 100 – date of actual receipt of income in the form of salary and advance payment for June – 06/30/2018;

- 110 – the day when income tax is withheld - on the day of payment of salaries for the second half of the month, for example, 07/05/2018;

- 120 – the day when the tax is transferred, if the withholding date is 07/05/2018, then the transfer deadline is 07/05/2018 or 07/06/2018;

- 130 – salary amount for June;

- 140 is the amount of tax withheld from it.

Next, data is entered for the period July-September 2021. Again, only data are shown for which the personal income tax payment deadline fell in the last quarter:

- Sick leave accrued and paid in July-September 2018;

- Salary for July, August.

There is no need to include wages for September, since the day of transfer of personal income tax from it will be in October, which does not belong to the reporting period of 9 months.

Vacation pay

The date of actual receipt of income in the form of vacation pay is the day they are paid to the employee - 3 days before going on annual leave.

The date of deduction of personal income tax from vacation pay is the day of payment.

The transfer period is the day of payment or the next day.

Thus, if an employee goes on vacation in June, vacation pay is paid in June 2021, then there is no need to show them in section 2 of the 6-NDFL calculation for 9 months.

If vacation pay is issued in July or August, then it must be included in the calculation for 9 months.

If vacation pay was paid in the last month of the 3rd quarter - September, then they also need to be included in the calculation for 9 months.

Example:

Vacation pay was issued on September 20.

The date of actual payment of income is 09/20/2018, the retention period is 09/20/201, the transfer deadline is 09/20/2018 or 09/21/2018.

How to fill out 6-NDFL for 9 months (due after the 3rd quarter of 2021):

Sample filling when only wages were paid - excel.

Sample when vacation pay is paid in August - excel.

Example of filling out sick leave - link.

Example of reflecting an advance payment - link.

Section 2

This section is prepared for 3 reporting months, i.e. when preparing calculations for 9 months, information for July, August, and September is transferred here.

In Sect. 2 the following information is recorded:

| Line | Intelligence |

| 100 | Date of receipt of income, the amount of which is reflected on page 130 |

| 110 | Date of personal income tax withholding from the amount recorded on page 130 |

| 120 | Deadline for transferring taxes to the budget |

| 130 | The amount of personal income tax income actually received on the day specified in page 100 |

| 140 | The amount of personal income tax withheld on the date reflected on page 100 |

If for at least one type of income received on the date specified on page 100, the day of tax withholding or transfer is different, a separate block on pages 100-140 is formed for this income.

Next, we will consider the procedure for filling out section. 2, continuing the previous example.