Tax control measures include conducting tax audits, requesting explanations and documents, inspecting premises, and so on. They are mentioned in Article 82 of the Tax Code of the Russian Federation. One of the special forms of tax control is additional measures , which can be assigned at the discretion of the management of the tax authority. Their goal is to confirm and consolidate the conclusions of the Federal Tax Service employees who conducted the inspection. As part of such activities, inspectors seek to collect facts that will confirm the commission of an offense.

We invite you to get acquainted with the answers of Tax Service specialists to 4 important questions related to additional control measures. They are given in the letter of the Federal Tax Service dated October 19, 2021 No. ED-4-2 / [email protected]

Conditions for additional measures

In order for the tax authority to have the opportunity to carry out additional measures, its head must establish:

- Has the taxpayer under audit committed (or failed to commit) a violation of the law;

- Violations identified during the inspection constitute an offense or not.

All tax control activities should be aimed only at collecting additional evidence regarding identified violations, but not at identifying new ones. That is, if tax authorities require evidence that is not related to the violations reflected in the audit report, this is a violation of the interests of the organization - the taxpayer.

Responsibility

The legislation does not contain separate rules of liability for non-compliance with requirements in a situation where additional tax control measures are carried out. The Tax Code of the Russian Federation is applied here in the same manner as in the case of prosecution during an audit or other violations of tax legislation (for example, paragraph 4 of Article 193, Articles 126, 128 of the Tax Code of the Russian Federation).

But judicial practice shows that such control actions do, in many situations, allow tax authorities to identify additional circumstances regarding violations that were established during desk or on-site audits and which make it possible to hold the taxpayer accountable. This is especially true in the case of on-site inspections, when the possibility of questioning witnesses provides a significant part of the evidence base.

Registration of the results of additional measures

There is no specific procedure by which tax authorities should send materials on additional measures. The Tax Code also does not provide for a procedure for documenting the results of such events, that is, drawing up any act or certificate.

However, Article 101 of the Tax Code of the Russian Federation provides for the taxpayer’s right to familiarize himself with the materials of both the audit itself and additional measures related to it. In other words, the tax office must ensure the implementation of such a right and do this within two days from the moment the taxpayer submits the relevant application. The familiarization process occurs through visual examination of extracts, copies and other materials on the territory of the tax authorities.

After reviewing the inspection materials, a protocol is drawn up in the form specified in the appendix to Letter No. CA-4-9/ [email protected]

Forms of additional control

Additional tax control activities are carried out in the form of certain actions, a closed list of which is enshrined in the Tax Code of the Russian Federation (clause 6 of Article 101 of the Tax Code of the Russian Federation):

- Request for documents;

- Interrogation of witnesses;

- Expertise.

The choice of action depends on the specific circumstances of the case, including within the framework of one additional inspection, several similar activities can be carried out, for example, several interrogations or examinations, as well as a combination of different actions.

Read also: How to certify copies of documents for the tax authorities

It should be taken into account that if the taxpayer refuses to provide documents, including by evading such actions, the tax authorities have the right to seize the requested documents. This is possible provided that the materials provided are not sufficient to identify all the circumstances of the violation, or there is reason to believe that the original documents may be destroyed or reduced to a condition that does not allow establishing important circumstances. To carry out a seizure, a separate decision is made with a mandatory indication of the reasons for such an action. In all other situations, the inspector does not have the right to change the list of measures indicated in the decision to conduct additional control.

Objection to tax authorities

After additional measures have been taken within ten days, the taxpayer has the right to submit an objection to the tax authorities based on their results. Such an objection is sent in writing and contains comments on all or some of the results. Copies of documents that substantiate the taxpayer’s arguments are attached to the objection.

Such objections are considered by tax authorities before making the main decision on the on-site audit. If the objection contains objective reasons, the tax authorities may postpone consideration of the audit materials (

Additional tax control measures: reasons

The basis for the legal regulation of all relationships between tax authorities and taxpayers is the Tax Code of the Russian Federation. This document regulates the procedure for conducting inspections, as well as additional actions based on their results (Chapter 14 of the Tax Code of the Russian Federation). From the point of view of the Tax Code of the Russian Federation, additional tax control measures are actions aimed at obtaining additional information (evidence) on violations already identified during an on-site or desk audit.

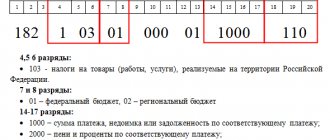

The head of the tax authority makes a special decision on the need to carry out such measures, which indicates:

- Circumstance requiring additional verification;

- Dates;

- Control measure form.

The law clearly defines that such actions should be aimed solely at obtaining new information on an identified violation classified as a tax offense. During this control, it is not allowed to identify new violations, with the exception of those related to the violation that became the reason for additional control measures. Additional tax control measures are carried out only if there are signs of a tax offense and cannot serve as a means of identifying them outside the framework of audit actions.

Tax audit decision

Tax authorities review the tax audit report, other materials based on which violations and written objections from the payer were identified during the audit. After this, the tax authorities make a decision either:

- Bring to justice for committing a tax offense;

- Refuse to bring to justice for committing a tax offense.

The tax authorities make a decision within 10 days from the expiration of the deadline for filing objections from the person being inspected. The period for reviewing inspection materials can be extended both before and after pre-events. The time frame for making a decision by tax authorities depends on the fact of their extension and is:

- 10 days is the usual period;

- 1 month – if the tax authorities decided to extend the period for consideration of audit materials and additional measures, based on the results of which the main decision is made;

- 1 month (2 months for a consolidated group) – if the tax authorities decide to carry out additional measures.

The new period for the desk audit is two months.

According to the general rule, the period for conducting a desk audit of any tax return is three months from the date of its submission (Article 88 of the Tax Code of the Russian Federation); also - within six months from the date of submission by a foreign organization registered with the tax authority in accordance with clause 4.6 of Art. 83 of the Tax Code of the Russian Federation, VAT returns.

Now a desk tax audit based on the VAT return, documents submitted to the tax authority, as well as other documents on the activities of the taxpayer available to the tax authority, is carried out within two months from the date of submission of such a tax return (clause 2 of Article 88 of the Tax Code of the Russian Federation ).

At the same time, for foreign organizations registered with the tax authority in accordance with clause 4.6 of Art. 83 of the Tax Code of the Russian Federation, the deadline for a desk audit of a VAT return remains the same – six months.

But in this “barrel of honey” there is also a “fly in the ointment”. If, before the end of the desk tax audit of the VAT return, the tax authority has identified signs indicating a possible violation of the legislation on taxes and fees, the head (deputy head) of the tax authority has the right to decide to extend the period for conducting the desk tax audit. The period for a desk tax audit may be extended to three months from the date of submission of the VAT return (with the exception of a desk tax audit of a VAT declaration submitted by a foreign organization registered with the tax authority in accordance with clause 4.6 of Article 83 of the Tax Code of the Russian Federation).

Note:

New provisions of paragraph 2 of Art. 88 of the Tax Code of the Russian Federation apply to desk tax audits conducted on the basis of VAT returns submitted to the tax authorities after the day Federal Law No. 302-FZ entered into force, that is, after 09/03/2018.

Of course, shortening the period for conducting a desk tax audit of a VAT return will allow conscientious taxpayers to quickly use funds reimbursed from the budget in their business, which will have a positive impact on the development of individual companies and the country’s economy as a whole. It can be assumed that the next step in this direction will be to reduce the time frame for desk audits and other tax returns to two months.

At the same time, the rule on extending the desk audit of a VAT return to three months if tax officials identify signs indicating a possible violation of the legislation on taxes and fees raises questions. That is, we are not talking about violations that were identified during a desk audit, but about “signs indicating possible violations.” The legislator does not define the concept of these characteristics; accordingly, tax authorities will interpret it in their own way. Apparently, if the tax authorities only “imagining” something, the audit period will be extended.

By the way, there is no mechanism for extending the period to three months: how will the taxpayer find out about this? Will he be notified of the reasons for the extension? It has only been established that the decision to extend the period of a desk audit is made by the head of the tax authority or his deputy. However, nothing is said about the fact that this decision will be sent to the taxpayer.

Expected changes in legislation

The only grounds for canceling a decision by a tax official can be violations of the conditions for reviewing tax audit materials, which include:

- failure to provide the taxpayer with the opportunity to take part in the consideration of the case materials, both personally and through his representative;

- failure to provide the taxpayer with the opportunity to provide explanations.

Currently, the State Duma is considering bill No. 249505-7, according to which tax authorities will have to draw up an act based on the results of additional measures. In this case, the taxpayer will have the opportunity to freely familiarize himself with the act and submit his written objections. It is also believed that such a bill will allow tax authorities to make a more objective decision on the results of an audit.

Such an act will have to contain the start date and end date of additional measures and show the essence of the offense. Such a certificate must be handed over to the taxpayer within 5 days from the date of completion of additional measures. Tax authorities will not attach all documents that were submitted by the taxpayer himself to the report. The act must be transferred to the taxpayer against receipt, or in another way, but on the condition that the payer confirms its receipt.

If the taxpayer evades receiving such a report, tax authorities can send it by registered mail to the individual.

In addition to the above, this bill should reduce the time frame for conducting desk audits. Let us remind you that today the term of the “camera chamber” is 3 months. It is proposed to reduce it to one month.

Thus, having come under an on-site inspection by the tax authorities, the taxpayer organization, it is important to control the timing of this procedure. When prescribing additional measures, the person being inspected must provide the required documents and not resist other measures. Due to the fact that the tax office is currently not obliged to provide the audited person with a report on additional measures, the taxpayer must independently express a desire to familiarize himself with the results of additional measures. If the auditee is not satisfied with some aspects of the result of the measures, he can file a tax objection. The main thing is that relevant evidence be attached to this objection.

Updated declaration: new subject of verification.

According to paragraphs. 2 clause 10 art. 89 of the Tax Code of the Russian Federation, before the changes under consideration, a repeated on-site tax audit of a taxpayer could be carried out, including by the tax authority that previously conducted the audit, on the basis of a decision of its head (deputy head) - if the taxpayer submitted an updated tax return, which indicated the amount of tax in an amount less than previously stated. As part of this repeated on-site tax audit, the period for which the updated tax return was submitted was checked.

The legislator changed the subject of the re-inspection: now the subject of such a re-on-site tax audit is the correctness of tax calculation based on the changed indicators of the updated tax return, which resulted in a decrease in the previously calculated tax amount (increase in loss).

Thus, as before, if an updated declaration with a reduced tax amount is submitted, a repeat on-site tax audit may be carried out. But if previously the audited period was limited - it was the period for which the “clarification” was provided, now the subject of the audit has been established - the data that influenced the reduction of the tax amount or the increase in the loss, which is logical. Accordingly, tax authorities will now be able to check only the validity of the tax reduction based on the information changed in the updated declaration.

This approach was followed by the courts, with which the tax authorities subsequently agreed (Letter of the Federal Tax Service of Russia dated September 26, 2016 No. ED-4-2/17979): in accordance with the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 16, 2010 No. 8163/09, the subject of a repeat on-site tax audit , assigned due to the submission by the taxpayer after a tax audit of an updated declaration in which the amount of previously calculated tax is reduced, only those information of the updated declaration, the change of which resulted in a decrease in the amount of previously calculated tax, are considered. Moreover, during the inspection carried out on the basis of paragraph. 6 clause 10 art. 89 of the Tax Code of the Russian Federation, data that has not been changed by the taxpayer or is not related to the specified adjustment cannot be re-checked. This approach is now enshrined in law.

Position of arbitration courts

The courts supported the taxpayer and motivated their position with the following arguments.

The Tax Code of the Russian Federation regulates the procedure for reviewing tax audit materials. The procedure for considering materials received during tax control activities is enshrined in paragraph 14 of Article 101 of the Tax Code of the Russian Federation and includes ensuring the right of the taxpayer to be present during the consideration of materials and to present their objections and explanations.

PROCEDURE FOR REVIEWING TAX INSPECTION MATERIALS Essential requirements of paragraph 14 of Article 101 of the Tax Code of the Russian Federation:

ensuring the opportunity for the person subject to the audit to participate in the process of reviewing the tax audit materials personally and (or) through his representative;

ensuring the taxpayer has the opportunity to provide explanations (including at the stage of consideration of tax audit materials). Tax audit materials include, among other things, materials obtained as a result of additional tax control measures

Tax audit materials also include the results of additional tax control measures. According to paragraph 1 of Article 101 of the Tax Code of the Russian Federation, tax audit materials include the report and other materials, including those obtained as a result of additional tax control measures. In turn, the person in respect of whom the inspection was carried out has rights established by law, including the right to give explanations at the stage of consideration of materials.

RIGHTS OF THE TAXPAYER In accordance with sub. 7 and 15 paragraph 1 art. 21, paragraph 6 of Art. 100, paragraph 4 of Art. 101 of the Tax Code of the Russian Federation, a person in respect of whom a tax audit is being carried out has the right:

submit written objections to the tax audit report;

participate in the process of reviewing tax audit materials;

give explanations at the stage of consideration of tax audit materials.

Thus, the duty of the tax authorities to ensure the exercise of the taxpayer’s right to familiarize themselves with the audit materials extends not only to the materials received as part of the main audit, but also to additional materials that also relate to the tax audit materials.

The legally established procedure for carrying out additional tax control measures guarantees the taxpayer’s right to become familiar with its results, as well as to submit objections and explanations to the arguments of the tax authority. The head of the tax authority has the right to make a decision on carrying out additional tax control measures within a period not exceeding one month. The decision to appoint additional measures sets out the circumstances that led to the need to carry out such measures, and indicates the timing and specific form of their implementation.

As follows from the literal interpretation of Article 101 of the Tax Code of the Russian Federation, additional measures are prescribed to clarify the circumstances related to detected offenses and to obtain additional evidence of the presence (or absence) of an offense.

The motive for appointing additional tax control measures may be the need to verify the validity of the taxpayer’s objections filed in response to the tax audit report footnote 4. If the arguments raised by the taxpayer in objections to the audit report cast doubt on the conclusions of the tax authority officials who conducted the audit, then the head of the tax authority is obliged appoint additional measures to verify the documents and information provided by the taxpayer. Otherwise, the decision of the tax authority will not be considered legal and justified.

The decision to carry out additional measures also indicates that, having considered the audit materials taking into account the taxpayer’s objections, the tax authority did not consider them sufficient to make a decision on the audit, including on bringing to tax liability.

Additional measures include: requesting documents (Articles 91 and 93.1 of the Tax Code of the Russian Federation), questioning witnesses (Article 90 of the Tax Code of the Russian Federation) and conducting an examination (Article 95 of the Tax Code of the Russian Federation).

Despite the fact that Articles 100 and 101 of the Tax Code of the Russian Federation do not establish the obligation of the tax authority to draw up an act as a special procedural document based on the results of additional measures, the obligation to ensure that the taxpayer can protect his rights and legitimate interests is not excluded footnote 5.

In accordance with paragraph 2 of Article 101 of the Tax Code of the Russian Federation, the tax authority is obliged to notify the taxpayer in advance of the time and place of consideration of the tax audit materials. The Tax Code of the Russian Federation does not contain any exceptions for the consideration of audit materials obtained during additional activities.

The Supreme Arbitration Court of the Russian Federation, in Resolution of the Presidium No. 12566/07 dated February 12, 2008, indicated that violation of these requirements in any case is recognized as grounds for declaring the decision of the tax authority illegal.

The taxpayer’s right to participate in the consideration of tax audit materials is fundamental, and failure to ensure this right serves as the basis for the cancellation of a non-normative act of the tax authority.

The tax authority must inform the taxpayer about the results of additional tax control measures, regardless of their content. According to the legal position of the Supreme Arbitration Court of the Russian Federation, set out in Resolution No. 12566/07 of February 12, 2008, the legislator, regulating tax control measures, proceeded from the need to maintain guarantees for the protection of the rights of taxpayers and other persons in respect of whom tax control measures are carried out. It follows from the Resolution that failure of the taxpayer to familiarize himself with the results of tax control measures, regardless of their scope, will in any case be a violation of the requirements of paragraph 2 of Article 101 of the Tax Code of the Russian Federation and a basis for declaring the decision of the tax authority illegal. Therefore, the tax authority’s arguments that additional measures were carried out only in relation to part of the episodes according to the audit report and did not establish any new circumstances are untenable. Since, as stated, the purpose of carrying out additional tax control measures is to obtain additional evidence of the fact (or lack thereof) of a tax offense, the tax authority in any case must inform the taxpayer about the results of additional tax control measures.

In Determination No. 267-O of July 12, 2006, the Constitutional Court of the Russian Federation indicated that in relation to tax liability, one of the guarantees for the protection of rights and freedoms is the right provided for in Part 2 of Article 24 of the Constitution of the Russian Federation, according to which state authorities, local governments and their officials are obliged to provide everyone with the opportunity to familiarize themselves with documents and materials that directly affect their rights and freedoms, unless otherwise provided by law.

When determining the procedural rights of a taxpayer in a tax offense case, the legislator is obliged to provide him with the right to know about the claims that have arisen from the tax authority and to file objections to them, as well as to present evidence of the illegality or groundlessness of the decision taken. Otherwise, it does not correspond to the above provisions of the Constitution of the Russian Federation, violates the rights of taxpayers and makes paragraph 2 of Article 101 of the Tax Code of the Russian Federation an ineffective norm or acting at the discretion of the tax authorities, which is unacceptable in the sphere of public legal relations.

Thus, the obligation of the tax authority to provide the taxpayer with the right to find out the position of the tax authority based on the results of additional tax control measures corresponds to the right of the taxpayer to raise objections.

The legislator does not clearly define the moment of making a decision on additional tax audit measures. The courts found that after considering the audit materials and the taxpayer’s objections, the tax authority did not make any decision; this was evidenced by the protocol for considering the objections (it recorded only the fact of considering the objections, but not the result).

Article 101 of the Tax Code of the Russian Federation does not provide for a procedure for making a reasoned decision based on the results of consideration of inspection materials and does not establish procedural deadlines for this. However, an analysis of the provisions of Article 101 of the Tax Code of the Russian Federation on making a decision “based on the results of consideration of the tax audit materials” indicates precisely the day of consideration of the audit materials, since the Tax Code of the Russian Federation does not specifically specify any deadlines for preparing the “final form” of the decision or for “making a reasoned decision”. stipulated. Consequently, the subsequent adoption of a decision on the appointment of additional tax control measures (after consideration of objections to the audit report) and the adoption of a decision based on their results without proper notification of the taxpayer violates his right to participate in the consideration of audit materials.

A similar conclusion follows from the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 12, 2008 No. 12566/07, in which the Court used the provisions of the Arbitration Procedural Code of the Russian Federation, guaranteeing that the court provides a person with the opportunity to participate personally and (or) through his representative in the court hearing.

The practice of the Supreme Arbitration Court of the Russian Federation and various federal arbitration districts, which is developing in favor of taxpayers, confirms the legitimacy of the Court’s position in the case under consideration.

PRACTICE OF THE COURTS FAS NWO, in Resolution No. A56-53359/2007 dated October 6, 2008, indicated that failure to notify the taxpayer of the time and place of consideration of the audit materials, taking into account the results of additional measures, is a significant violation of the procedure for considering the audit materials and entails the unconditional cancellation of the tax authority’s decision. The tax authority applied to the Supreme Arbitration Court of the Russian Federation with an application for its review in the supervisory order, but the Presidium of the Supreme Arbitration Court of the Russian Federation left it in force (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 16, 2009 No. 391/09).

FAS VSO in resolutions dated October 14, 2008 No. A19-1755/08-44-F02-2718/08 and dated September 30, 2008 No. A78-604/08-F02-4724/08 also came to the conclusion that consideration of materials of additional tax measures control must be carried out according to the rules of Art. 101 Tax Code of the Russian Federation. A similar practice is developing in other federal arbitration districts (resolutions of the FAS VSO dated November 26, 2008 No. A19-5211/08-43-F02-5441/08 in case No. A19-5211/08-43, dated November 26, 2008 No. A19-3202 /08-44-F02-5856/08;

FAS VVO dated June 10, 2008 No. A11-3589/2007-K2-21/156; FAS DO dated June 24, 2008 No. F03-A59/08-2/2214; FAS ZSO dated June 17, 2008 No. F04-3709/2008(6834-A81-29); FAS MO dated March 16, 2005 No. KA-A41/1740-05; FAS PO dated 05.08.2008 No. A12-18785/07; FAS NWO dated July 17, 2008 No. A42-5637/2007; FAS North Caucasus Region dated September 30, 2008 No. A53-5406/2008-C5-47; FAS UO dated 04.02.2008 No. Ф09-111/08-С3; FAS Central Election Commission dated August 14, 2008 No. A48-274/08-6).

Request for documents: notification of previously submitted documents.

The previously existing procedure for submitting the requested documents assumed that tax authorities did not have the right to request from the inspected person documents previously submitted to the tax authorities during desk or field tax audits of this inspected person, as well as documents presented in the form of certified copies during tax monitoring. The exception to this rule was situations in which documents submitted in original form were returned to the taxpayer, as well as cases in which documents submitted to the tax authority were lost due to force majeure.

Now this rule ceases to apply. The taxpayer, as before, is not obliged to re-submit documents, but he must notify the tax authorities that the requested documents (information) were submitted earlier (clause 5 of Article 93 of the Tax Code of the Russian Federation). The notification must indicate the details of the document with which (as an appendix to which) they were submitted, and the name of the tax authority to which the documents were submitted. The deadline for submitting this notice is ten working days. The exception to this rule remains the same as it was.

Changes have also been made to clause 5 of Art. 93.1 of the Tax Code of the Russian Federation, namely in terms of establishing deadlines for submitting documents on the taxpayer’s counterparties.

Now the person who has received the requirement to submit documents (information) in accordance with clauses 1 and 1.1 of Art. 93.1 of the Tax Code of the Russian Federation - within the framework of the tax audit procedure, it fulfills it within five days from the date of receipt or within the same period notifies that it does not have the requested documents (information).

A person who has received a request to submit documents (information) in accordance with paragraph 2 of Art. 93.1 of the Tax Code of the Russian Federation - outside the framework of tax audits - fulfills it within ten days from the date of receipt or within the same period notifies that it does not have the requested documents (information).

Until now, there was a single deadline for submitting the requested documents - five working days from the date of receipt of the request.

As before, if the requested documents (information) cannot be submitted within the specified time frame, the tax authority, upon receiving from the person from whom the documents are requested, notices about the impossibility of submitting documents within the established time frame and about the time period (if necessary) during which these documents may be submitted, has the right to extend the deadline for submitting said documents. The specified notification is submitted in the manner provided for in paragraph 3 of Art. 93 Tax Code of the Russian Federation.