Features of submitting reports for the fourth quarter of 2021

Features of reporting for the fourth quarter of 2021 include the following points:

- Starting from 2021, employers do not submit reports on the average number of employees, because... this information is included in the DAM;

- simultaneously with the SZV-STAZH report, you must submit the EDV-1 report to the Pension Fund;

- When hiring or dismissing an employee, the SZV-TD report from 2021 must be submitted no later than the next working day after the personnel event. For other personnel movements, the SZV-TD is submitted before the 15th day of the month following the month of the personnel event.

We will help you set up filling out SZV forms in 1C:ZUP. Call!

Features of filling out 6-NDFL

According to Art. 230 of the Tax Code of the Russian Federation, tax agents submit to the tax authority at the place of their registration the Calculation of the amounts of tax on personal income calculated and withheld by the tax agent (Form 6-NDFL). This document is provided within a certain time frame:

| Reporting period | Submission deadline |

| For the first quarter | No later than the last day of the month following the relevant period |

| For half a year | |

| In nine months | |

| In a year | No later than April 1 of the year following the expired tax period |

In the Calculation of the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL), the following data is indicated:

· income of individuals;

· tax deductions;

· Personal income tax.

In order to accurately fill out the Calculation of the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL) for the 4th quarter of 2021, you need to pay attention to a number of factors:

| What should you pay attention to? | A comment |

| Form | Form 6-NDFL must be provided, current at that time |

| Tax period code | 34 |

| Transaction codes | Must be consistent with the operations performed |

| Sections of the declaration | Must be filled in with correct information |

| Registration of 6-NDFL | For each separate division - its own 6-NDFL form |

| Delivery method |

|

| Submission deadline | Until 04/01/2021 |

In accordance with Letter of the Ministry of Finance of the Russian Federation dated March 23, 2021 No. BS-4-11/4901 “On filling out and submitting calculations in Form 6-NDFL by a separate division of a Russian organization,” if a separate division of a Russian organization does not pay income to individuals, then There is no obligation to submit a calculation in Form 6-NDFL .

What is the deadline to submit the income tax return for the fourth quarter of 2021?

Legal entities applying the general taxation regime are required to file an income tax return. In addition, this also applies to tax agents who withhold amounts from foreign companies.

The deadline for submitting the declaration is March 29, 2021.

If a taxpayer makes monthly advances based on actual income, he must submit a return for November by December 28, 2021 and for December by March 29, 2021.

If the NPO did not conduct activities, it submits reports after the end of the tax period. And if the activity was carried out, then reporting is submitted as usual - based on the results of each quarter.

Late submission of reports: responsibility

So, the deadlines for submitting reports in 2021 have not changed, and fines for failure to submit them have remained at the same level. According to the general rules, “lateness” in filing a declaration or “Calculation of insurance premiums” may entail a fine of 5% of the amount of tax reflected for payment, but not transferred, for each month of “delay,” incl. incomplete (Article 119 of the Tax Code of the Russian Federation). The maximum fine for failure to comply with reporting deadlines is 30% of the amount of tax unpaid according to the declaration, the minimum is 1000 rubles. (for example, if a zero declaration is not submitted).

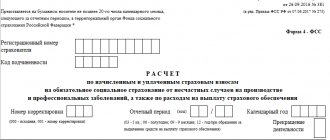

Other forms of reporting provide for various measures of influence. Thus, failure to submit 6-NDFL is punishable by a fine of 1000 rubles. from the employer for each overdue month (clause 1.2 of Article 126 of the Tax Code of the Russian Federation). Impressive sanctions are also provided for late reporting to funds. For example, the fine according to the 4-FSS report will be 5% of the amount of contributions payable for each overdue month, but not more than 30% of contributions and not less than 1000 rubles. (Article 26.30 of the Law of July 24, 1998 No. 125-FZ). Such significant troubles can only be avoided by generating reports without violating the deadlines for their submission.

TOTAL, from July 1, 2021, these changes will affect citizens of the Russian Federation from all regions of Russia: Adygea, Altai, Bashkiria, Buryatia, Dagestan, Ingushetia, Kabardino-Balkaria, Kalmykia, Karachay-Cherkess Republic, Karelia, KOMI, Crimea, Mari El, Mordovia, Sakha (Yakutia) , North Ossetia (Alania), Tatarstan, TUVA, Udmurtia, Khakassia, Chechnya, Chuvashia, Altai Territory, Transbaikal Territory, Kamchatka Territory, Krasnodar Territory, Krasnoyarsk Territory, Perm Territory, Perm Territory, Primorsky Territory, Stavropol Territory, Khabarovsk Territory, Amur region, Astrakhan region, Arkhangelsk region, Belgorod region, Bryansk region, Vladimir region, Volgograd region, Vologda region, Voronezh region, Ivanovo region, Irkutsk region, Kaliningrad region, Kaluga region, Kemerovo region, Kirov region, Kostroma region, Kurgan region, Kursk region, Leningrad region, Lipetsk region, Magadan region, Moscow region, Murmansk region, Nizhny Novgorod region, Novgorod region, Novosibirsk region, Omsk region, Orenburg region, Oryol region, Penza region, Pskov region, Rostov region, Ryazan region, Samara region , Saratov region, Sakhalin region, Sverdlovsk region, Smolensk region, Tambov region, Tver region, Tomsk region, Tula region, Tyumen region, Ulyanovsk region, Chelyabinsk region, Yaroslavl region, federal cities - Moscow, St. Petersburg, Sevastopol, Jewish Autonomous Okrug, Khanty-Mansi Autonomous Okrug, Yamalo-Nenets Autonomous Okrug, Nenets and Chukotka Autonomous Okrug.

Deadlines for submitting other reports

Other types of reporting are submitted within the following deadlines:

| Report | Who should pass | Where should I submit it? | Deadline |

| 4-FSS on paper | Can be rented to employers with up to 25 employees | FSS | 20.01.2021 |

| 4-FSS electronically | All employers | FSS | 25.01.2021 |

| Confirmation of main activity | Legal entity and individual entrepreneur | FSS | 15.04.2021 |

| SZV-M for December | All employers | Pension Fund | 15.01.2021 |

| SZV-TD | All employers | Pension Fund | 01/15/2021 (for personnel changes other than hiring and dismissal) No later than the next working day (upon hiring or dismissal) |

| DSV-Z | Employers paying additional contributions for employees to pension insurance | Pension Fund | 20.01.2021 |

| EDV-1 | All employers | Pension Fund | 01.03.2021 |

| Single simplified declaration | Taxpayers who do not carry out activities and operations on current accounts | Inspectorate of the Federal Tax Service | 20.01.2021 |

| 6-NDFL | Employers paying benefits to individuals | Inspectorate of the Federal Tax Service | 01.03.2021 |

| Water tax declaration | Legal entities and individual entrepreneurs using water bodies in their activities | Inspectorate of the Federal Tax Service | 20.01.2021 |

| Declaration on mineral extraction tax | Mining companies | Inspectorate of the Federal Tax Service | 12/31/2020 (for November) 02/01/2021 (for December) |

| Gambling tax return | Taxpayers carrying out such business | Inspectorate of the Federal Tax Service | 01/20/2021 (for December) |

| 2-NDFL | Companies and individual entrepreneurs paying income to individuals | Inspectorate of the Federal Tax Service | 01.03.2021 |

| Declaration according to the simplified tax system | Legal entity and individual entrepreneur on the simplified tax system | Inspectorate of the Federal Tax Service | 03/31/2021 (legal entity) 04/30/2021 (IP) |

| Declaration on Unified Agricultural Tax | Taxpayers using this special regime | Inspectorate of the Federal Tax Service | 31.03.2021 |

| Property tax declaration | Legal entities having such objects | Inspectorate of the Federal Tax Service | 30.03.2021 |

| Accounting | All companies | Inspectorate of the Federal Tax Service | 31.03.2021 |

Composition and reporting forms for the 4th quarter of 2021

For the 4th quarter of 2021, business entities need to submit the following reporting forms:

Reporting to the Federal Tax Service

- Financial statements. All organizations must report annually, regardless of the tax system and legal form. The BO for 2021 needs to be submitted only to the Federal Tax Service. Submit your reports for 2021 by 03/31/2020.

— UTII. Organizations subject to imputation submit a declaration by 01/20/2020.

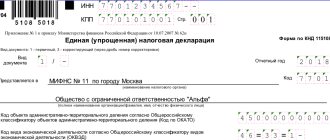

— Unified simplified tax return. To be filled out if your organization has not conducted business and does not have data for declarations on VAT, income tax, simplified tax system and unified agricultural tax. It must be submitted by January 20, 2020.

— VAT. All taxpayers and organizations that issue invoices must submit a VAT return. From the 1st quarter of 2021, the VAT return must be filled out using a new form. Also, starting from 2021, this report form will also be submitted by agricultural producers to the Unified Agricultural Tax. The declaration must be submitted by 01/27/2020.

- Property tax. Companies on OSNO submit a report by March 30, 2020 in electronic form. Those enterprises that have less than one hundred employees can submit a declaration on paper. Due to changes in the taxation of movable property from 2021, use the new declaration form.

— Income tax. Those who apply OSNO must submit the declaration by March 30, 2020.

— 6-NDFL. This report reflects data on calculated and transferred taxes for all employees of the enterprise. You must submit your tax return electronically by March 2, 2020. Only if you have 10 or less than 10 employees, then it is possible in paper form. This innovation is effective from 01/01/2020.

— RSV. Calculations are submitted by employer-insurers by 01/30/2020 for all listed insurance premiums in electronic form (except for contributions for “injuries” and in the case of occupational diseases). If you have 10 or fewer employees on your staff, then it is possible on paper (clause 10 of Article 431 of the Tax Code of the Russian Federation).

Reporting to the Social Insurance Fund

- 4-FSS. This report includes the calculation of contributions for “injuries” and in the case of occupational diseases. It must be submitted to all business entities by January 20 on paper or by January 27 in electronic form. You can report on paper if the number of full-time employees is no more than 25 people. All others submit the report only in electronic form.

Reporting to the Pension Fund

- SZV-M. This report must be submitted to all business entities with hired employees for each month before the 15th of the next month. That is, for the 4th quarter you need to send reports for October, November and December.

— SZV-STAGE. Organizations report every year on the periods of work of their employees, as well as on the insurance premiums accrued from payments. Submit the form by March 2, 2021.

— DSV-3. The report is submitted only by those who make additional insurance contributions for their employee - until January 20, 2020.

Reporting to Rosstat

Organizations need to constantly report to the statistics service. The complete list of all reports to Rosstat is quite large. To find out which reports your organization must submit, you need to go to the official website of the statistics service and indicate one of the following details - TIN, OGRN or OKPO, after which you will see a complete list of reports that you need to submit and the deadlines for their submission.

Responsibility of taxpayers for reporting

Tax legislation defines tax periods and, accordingly, reporting deadlines for newly registered individual entrepreneurs or legal entities:

| Date of registration of individual entrepreneur / legal entity | Taxable period | Normative base |

| At least 10 days before the end of the quarter | The first tax period is the period of time from the date of creation to the end of the quarter in which the organization was created | clause 3.1 art. 55 Tax Code of the Russian Federation |

| Less than 10 days before the end of the quarter | The first tax period is the period of time from the date of creation to the end of the quarter following the quarter in which the organization was created (state registration of an individual as an individual entrepreneur was carried out) | clause 3.1 art. 55 Tax Code of the Russian Federation |

According to paragraph 6 of Art. 6.1 of the Tax Code of the Russian Federation, a period defined in days is calculated in working days, if the period is not established in calendar days. In this case, a working day is considered a day that is not recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday.

Example:

Kuskov K.K. plans to quit his job and register an individual entrepreneur on December 17, 2021, and Matveev M.M. plans to register ABC LLC on December 21, 2021.

In accordance with tax legislation for individual entrepreneur Kuskova K.K. The first tax period is the period from the date of creation to the end of the quarter, i.e. Kuskov K.K. must provide reports for the 4th quarter of 2021.

For ABC LLC, the first tax period is the period from the date of creation to the end of the quarter following the quarter in which the organization was created, i.e. ABC LLC should not provide reports for the 4th quarter of 2021. The period of activity of the organization in 2021 will be included in the tax period of 2021, namely the 1st quarter of 2021.

What taxes must be paid before December 1, 2020?

In the last month of 2021, the budget expects massive payments from individuals for property taxes for 2021 (transport tax, property tax, land tax) as well as personal income tax not withheld by the agent in 2021. An individual will learn the amounts payable from the notification received from the tax authorities organs.

link for a sample tax notice .

Don't be surprised if you've owned the same property in recent years and the taxes you owe have increased compared to previous years. The reason for this is the legislatively established approach to the method of calculating tax. It is calculated on the basis of the cadastral value of the property (previously the inventory value was taken as the basis for the calculation).

The indicated values may differ greatly from each other, which is why property taxes in certain regions have already increased sharply.

The state has provided for the use of special coefficients that reduce the tax burden in the first stages of introducing a new method of tax calculation.

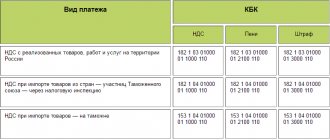

When is VAT payment not related to the 25th?

There are such cases too.

Thus, when paying VAT, you need to focus not on the 25th, but on the 20th, if you import goods from the EAEU member countries (clause 19 of Appendix No. 18 to the Treaty on the EAEU).

If you imported goods in December 2021 and accepted them for accounting in the same month, you must pay the tax no later than January 20, 2021 in full - you cannot split it into 3 parts in such a situation.

If you imported goods from countries other than the EAEU, you do not need to wait until the end of the quarter to pay VAT. The tax is paid at customs simultaneously with other customs payments (Article 82 of the Customs Code of the Customs Union).

Find out which field of the payment order is filled in when paying customs and budget payments from this material.

The 25th does not apply as the deadline for paying VAT even if you, as a tax agent, purchased work (services) from a foreign person who is not registered with the Russian tax authorities. VAT must be paid simultaneously with the transfer of money for work or services (in a separate payment order) - clause 4 of Art. 174 Tax Code of the Russian Federation.

Whom the Tax Code of the Russian Federation classifies as tax agents, see the article.

Questions and answers

- If we submit reports on deadline by mail, but the letter reaches the Federal Tax Service later, will this be a violation?

Answer: In this case, the date of submission of the reports will be taken into account, namely the dated stamp on the postal envelope. The report to the Federal Tax Service is sent by registered mail with notification - the date is indicated in the receipt provided by the post office employee.

2. When counting the days until the end of the quarter when registering an LLC, it turns out exactly 10 days. How to submit reports?

Answer: The first tax period will be the period from the date of creation to the end of the quarter in which the organization was created, because the condition is a period of 10 days before the end of the quarter.

Responsibility of taxpayers for failure to submit reports

For violation of land tax reporting, the legislation of the Russian Federation provides for the imposition of penalties:

| Violation | Collection | Normative act |

| Failure to submit a land tax return | 5% of the unpaid amount of land tax, but not more than 30% and not less than 1000 rubles. | Art. 119 Tax Code of the Russian Federation |

| Failure to submit a land tax return by an organization exempt from paying tax under benefits | Fine 1000 rubles | Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57 “On some issues arising when arbitration courts apply part one of the Tax Code of the Russian Federation” |

| Failure to submit a land tax return | Fine for officials in the amount of 300 to 500 rubles | Art. 15.5 Code of Administrative Offenses of the Russian Federation |

Responsibility for violation of tax payment deadlines is provided:

| Violation | Penalties |

| Conducting business activities without registration | 10% of income (at least 40,000 rubles) |

| Violation of deadlines for filing an application for tax registration | 10,000 rubles |

| Violation of deadlines for submitting tax returns | 5% of taxes (at least 1,000 rubles) |

| Violation of tax payment deadlines | 20% of the tax amount (in case of intentional non-payment of tax 40% of the tax amount) |

Results

The format in which personal income tax reporting should be provided and how to fill it out for the 4th quarter and other periods depends on the type of reporting (which can be presented by a 2-NDFL certificate or a 6-NDFL calculation) and the staff of the company. The deadlines for submitting both types of reporting differ, since the 2-NDFL certificate is submitted once a year, and the 6-NDFL calculation is submitted 4 times during the year.

You can learn more about the responsibilities of a tax agent for personal income tax in the articles:

- “Tax agent for personal income tax: who is, responsibilities and BCC”;

- “What liability is provided for non-payment of personal income tax?”

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service dated October 2, 2018 No. ММВ-7-11/ [email protected]

- Order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.