Deductions

Step 1. Documents for deduction when purchasing an apartment Step 2. Filling out the 3-NDFL declaration Step

A tax deduction is an opportunity to receive money from the state, or not pay taxes partially

Cash is the most liquid part of operating assets and represents money on hand, and

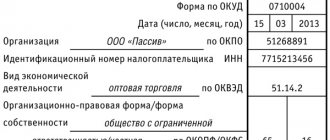

What forms to submit to Rosstat: 1-enterprise and 1-individual entrepreneur - basic data on activities; 1-T

The question is how to return income tax on the purchase of a residential building and

Drawing up a vacation schedule is the responsibility of all employers, regardless of the number of employees in the company. This

Electronic document management with counterparties is commonplace for many companies. The basis of traffic between accounting departments

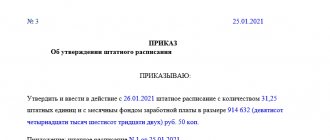

What is a staffing table? This is a document that is used to formalize the company structure, composition and

VAT are three letters that each of us has definitely heard. Even if you don't

Dear Colleagues! We are starting a series of publications on an important topic for every organization - briefings