- fixed assets:

- intangible assets;

- research and development results;

- Intangible search assets;

- tangible prospecting assets;

- fixed assets;

- profitable investments in material assets;

- financial investments;

- Deferred tax assets;

- Other noncurrent assets;

- stocks;

- VAT on purchased assets;

- accounts receivable;

- financial investments (except for cash equivalents);

- cash and cash equivalents;

- Other current assets;

Long-term liabilities in accounting. balance sheet: concept, composition, lines

So, the liability is book. The balance sheet consists of capital, reserves, as well as long-term and short-term liabilities. Long-term (or long-term) liabilities are those obligations that an enterprise must pay off over a period of more than a year. They are reflected in the corresponding lines of the account. balance sheet, which is a key document reflecting the financial condition of the enterprise at the end of a specific period. These include: loans, bank loans, unpaid lease amounts, deferred tax amounts, i.e. different types of debts. On balance sheet lines, long-term liabilities are displayed along with the amount required to repay them. That is, interest, discount, etc. are taken into account and recorded.

Today, enterprises and other organizations (with the exception of credit institutions) use the new accounting system. balance, approved The Ministry of Finance of the Russian Federation, in particular, by Order No. 66n dated July 2, 2010. It is called form No. 1, and according to OKUD 0710001. The composition of long-term liabilities can be fairly accurately traced along the balance sheet lines. Section No. IV is intended for them, which is called “Long-term obligations”. It consists of 5 lines.

| Section IV book. balance sheet “Long-term liabilities” (line by line) | ||||

| Borrowed funds | Deferred tax. obligated | Estimated liabilities | Other obligations | Total according to sec. IV |

| Page 1410 | Page 1420 | Page 1430 | Page 1450 | Page 1400 |

Each of the named lines is supplemented with the following columns: “Explanations” (column No. 1), the indicator “For __ 20_g.” (gr. No. 4), as well as “As of December 31, 20_.” (gr. No. 4 and 5).

When analyzing the financial condition of an enterprise, long-term accounts payable are divided into 2 parts. One of them should be extinguished before the end of the next 12 months. after the reporting date. The second - after a year following the reporting date.

Passive in book. The balance sheet, in addition to Section IV, includes another Section V. It contains information about the obligations that need to be repaid throughout the year, i.e., in a shorter period. It’s called: “Short-term liabilities”.

Composition and valuation of current assets

To determine the composition of current assets, you need to refer to the second section of the balance sheet. Current assets are divided into groups with approximately equal liquidity. Each group is shown in the balance sheet as a separate line:

Inventories consist of:

- Raw materials;

- Finished products;

- Work in progress;

- Products

Inventories are shown on the balance sheet at the lower of 2 possible values – original cost and recoverable cost;

Accounts receivable includes settlements with customers and other settlements. The balance sheet is shown less the provision for doubtful debts.

In the balance sheet, the line for accounts receivable is only in the section with current assets. Some settlements with customers may be long-term; example - sale with installment payment for a period of more than a year. When preparing financial statements, the long-term component must be shown on a separate line of the balance sheet.

Short-term financial investments include:

- Loans issued to other companies;

- Deposits;

- Investments in shares, bonds, bills, and other securities.

Financial investments, depending on the type, are accounted for either at market or at historical cost less a provision for impairment.

Cash is reflected at par value and shows the amount of balances:

- On settlement, currency and special accounts of the organization in banks;

- At the cash desk of the enterprise.

Money is the most liquid component of assets. In practice, there are sometimes restrictions on their use. A typical example is the revocation of a license from a bank that maintains a company’s current account. Cash in such accounts must be transferred to accounts receivable or other current assets and shown on the balance sheet, taking into account the likelihood of their loss.

Line by line filling out Section IV of the book. balance: main nuances

This section should contain information about all obligations the company has that need to be paid off for a period of more than a year. Data from Section IV, together with other economic indicators from other sections, are used in financial analysis. According to the structure of the section, you will need to fill out 5 lines. It should be taken into account that:

- Page 1410: indicate all credits, borrowings (in cash or in kind) of the enterprise, the term of which exceeds a year. When filling out, use data on the account. 67 (calculation of long-term loans, loans).

- Page 1420 is filled out by those organizations that work using PBU 18/02, approved. by order of the Ministry of Finance of the Russian Federation No. 114n dated November 19, 2002 (as amended in 2015). This Regulation defines the general rules for the formation and disclosure of information on profit calculations for payers of this tax. When filling out this line, you should take account data into account. 77 (regarding deferred tax liabilities) and account. 09 (regarding deferred tax assets). It is necessary to have a loan. account balance 77 was more than the flow rate. account balance 09. Only then the line must be filled out.

- Page 1430: indicate reserves formed according to PBU 8/10, approved. By Order of the Ministry of Finance of the Russian Federation No. 167n dated December 13, 2010 (as amended on April 4, 2015). This Regulation regulates the procedure for displaying estimated and contingent liabilities, including contingent assets, in the accounting of legal entities. Account is used. 96 (about reserves for future expenses regarding obligations with a maturity of more than a year). The credit is written down on the line. balance remaining at 31 Dec.

- Page 1450: other long-term liabilities that are not reflected in the previous lines are indicated here. Data you will need: account. 60, 62, 68, 69, 76 (settlements with suppliers, buyers, taxes, social insurance, debtors, creditors), as well as accounts. 86 (targeted financing).

- Page 1400 is the total amount of the enterprise’s long-term borrowed capital (i.e., the total sum of all previous lines of the section: 1410, 1420, 1430, 1450).

Make a book. The balance sheet is best done using specialized software designed specifically for accounting. If it is compiled independently, then based on the results you should compare the balance sheet of assets and liabilities. If the values are the same, then boo. the balance is correct.

It should be noted that no general standard has been established for long-term liabilities. They can be compared with short-term ones in terms of rational use and volumes. It is quite obvious that a positive motivator is an increase in the share of long-term obligations and a decrease in short-term ones. Accordingly, if there is a choice for an enterprise, the best solution will be one that involves an increase in long-term liabilities.

Analysis of current assets

The values of current assets are used to evaluate the enterprise based on financial ratios.

Share of current assets in the overall balance sheet structure

Characterizes the property status of the enterprise and is calculated using the formula:

amount of current assets/balance sheet amount

On the one hand, a high level of current assets reduces the risk of insolvency. On the other hand, it is necessary to maintain a balance between short-term and long-term assets, since the latter increase the sustainability of the enterprise and ensure the production process.

Regulatory values vary by industry. For trading companies, the share of current assets is always significantly higher than for manufacturing enterprises.

Liquidity ratios

All balance sheet indicators in the formulas are taken as the average at the beginning and end of the reporting period.

Reduced values of liquidity ratios indicate the risks of untimely settlement of debts; too high values indicate ineffective management of working capital.

Profitability:

This is (net profit of the enterprise from the income statement/current assets) * 100%

Shows profit per 1 ruble of the value of current assets. A profitability of 18-20% is considered optimal.

Turnover:

Characterizes the company's business activity and is used to assess the effectiveness of management of current assets, especially inventories and receivables.

The turnover period is defined as:

(average amount of current assets for the reporting period/revenue) * number of days of the reporting period

The shorter the turnover period, the faster the current asset turns into cash.

Ranking and use of liabilities to determine the liquidity of an enterprise

When separating liabilities for the purpose of determining liquidity, they rely on financial sources. As you know, on this basis, liabilities are divided into 4 groups, one of which is long-term liabilities (or P3). A visual systematization of liabilities by maturity is as follows:

- P1 (most urgent obligations).

- P2 (short-term liabilities).

- P3 (long-term liabilities).

- P4 (permanent liabilities).

These groups of liabilities are compared with assets, thus determining whether a particular enterprise is liquid. For your information, assets are also ranked into 4 groups: A1 (the most liquid), A2 (quickly liquid), A3 (slowly liquid), A4 (difficult to liquid). In relation to bu. In the balance sheet, this ranking of assets and liabilities will be as follows.

| Index | Row distribution | Ownership of indicators |

| A1 | Page 1250 + 1240 | |

| A2 | Page 1230 | |

| A3 | Page 1210 + 1220 + 1260 + 12605 | Assets |

| A4 | Page 1100 | |

| P1 | Page 1520 | |

| P2 | Page 1510 + 1540 + 1550 | |

| P3 | Page 1400 | Liabilities |

| P4 | Page 1300 + 1530 + 12605 |

Long-term liabilities (P3) are compared with slowly liquid assets (A3). If as a result it turns out that A3>=P3, then the enterprise is considered liquid and is able to pay long-term obligations. This means that the value of slowly liquid assets must be greater than or equal to the value of long-term liabilities.

All indicators necessary for comparisons are taken from the accounting records. balance. The actual value of P3 is the total of Section IV (p. 1400). A comparison of two values (P3 and A3) is used mostly in accounting analysis. balance sheet to determine its liquidity.

Video lesson Calculation of net assets

Net asset analysis is carried out in the following tasks:

- Assessment of the financial condition and solvency of the company (see → “ “).

- Comparison of net assets with authorized capital.

Solvency assessment

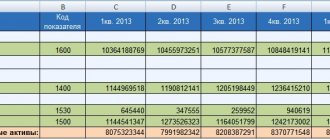

Solvency is the ability of an enterprise to pay for its obligations on time and in full. To assess solvency, firstly, a comparison is made of the amount of net assets with the size of the authorized capital and, secondly, an assessment of the trend of change. The figure below shows the dynamics of changes in net assets by quarter.

Analysis of the dynamics of changes in net assets

Solvency and creditworthiness should be distinguished, since creditworthiness shows the ability of an enterprise to pay off its obligations using the most liquid types of assets (see →). Whereas solvency reflects the ability to repay debts both with the help of the most liquid assets and those that are slowly sold: machines, equipment, buildings, etc. As a result, this may affect the sustainability of the long-term development of the entire enterprise as a whole.

Based on an analysis of the nature of changes in net assets, the level of financial condition is assessed. The table below shows the relationship between the trend in net assets and the level of financial health.

Comparison of net assets with authorized capital

In addition to the dynamic assessment, the amount of net assets for an OJSC is compared with the size of the authorized capital. This allows you to assess the risk of bankruptcy of the enterprise (see →). This comparison criterion is defined in the law of the Civil Code of the Russian Federation ( clause 4, article 99 of the Civil Code of the Russian Federation; clause 4, article 35 of the Law on Joint Stock Companies

). Failure to comply with this ratio will lead to the liquidation of this enterprise through judicial proceedings. The figure below shows the ratio of net assets and authorized capital. The net assets of OJSC Gazprom exceed the authorized capital, which eliminates the risk of bankruptcy of the enterprise in court.

Answers to frequently asked questions

Question No. 1. What does “total capital” mean? What does it include?

The total capital of an enterprise is its own capital + borrowed capital (i.e., the total amount of all capital that exists and is used in the enterprise). This is the name for the entire liability (balance sheet currency).

Question No. 2: Is the presence of long-term liabilities of an enterprise a positive or negative factor? What should you use to correctly characterize this situation?

They are definitely not a negative factor. Quite the contrary, their presence is actually beneficial for the enterprise, especially in light of inflationary processes. Naturally, provided that they are attracted and used rationally, in moderation and competently.

Working capital management

In the process of production and circulation, current assets are transformed from one type to another:

- The company uses the available money to purchase raw materials;

- Finished products are produced from raw materials;

- Finished products are sold to customers;

- Funds from customers are transferred to the company's account.

For a continuous production process, the enterprise must have current assets at each stage in sufficient quantities at any given time. Working capital management is essentially the management of this circulation of current assets.

Let's consider the concept, calculation formula and economic meaning of the company's net assets.