What is staffing

This is a document that is used to formalize the structure of the company, composition and number of employees.

As follows from the explanations to the unified form No. T-3 (approved by Resolution of the State Statistics Committee dated 01/05/04 No. 1), the staffing table must contain a list of structural units, the names of positions, specialties, professions indicating qualifications, as well as information on the number of staff units. Traditionally, it additionally indicates the amount of wages for each position (letter of Rostrud dated March 22, 2012 No. 428-6-1). Create a staffing table using a ready-made template Try for free

A broader definition can be found in judicial practice. The judges note that the staffing table is an organizational and administrative document that contains the following information:

- structure, staffing and number of employees;

- list of structural divisions (if any);

- names of positions, specialties, professions indicating qualifications, information on the number of staff units and official salaries (see, for example, the decision of the Ussuriysky District Court of Primorsky Krai dated November 20, 2017 in case No. 2-5392/2017).

Submit information about the average number of employees via the Internet for free

What should you think about initially?

In order to draw up a hotel staffing schedule, you must:

- Determine which departments and services should function in the hotel.

- Indicate the order of subordination of these departments and services.

- Delineate the areas of responsibility of each department.

- Know the number of personnel required to service the hotel (in our example, 150 rooms).

- Determine what specific functionality each specific employee will be responsible for.

- Determine the wage system.

- Calculate the total wage fund and the amount of tax deductions.

Who and why should compile

In the Labor Code, the staffing table is mentioned twice - in Part 1 of Article of the Labor Code of the Russian Federation, which contains the definition of labor relations, and in Part 2 of Article of the Labor Code of the Russian Federation, where the concept of the employee’s labor function is given. In addition, paragraph 3.1 of the Instructions for filling out work books (approved by Resolution of the Ministry of Labor dated October 10, 2003 No. 69) states that the name of the position (job), specialty, profession is indicated as it is recorded in the staffing table. Thus, without a “staff” it will not be possible to correctly draw up an employment contract or make an entry in the work book.

Draw up and print an employment contract for free

IMPORTANT. If an organization or individual entrepreneur plans to enter into an employment contract with at least one employee, you must first draw up a staffing table.

Most often, the staffing table is required to be presented during inspections by the Labor Inspectorate. But this does not mean that it can be issued “retroactively” if the employer is included in the “labor” inspection plan. This document may also be requested by controllers from the Social Insurance Fund when determining the correctness of the calculation of contributions (clause 91 of the guidelines; approved by Resolution of the Social Insurance Fund dated 04/07/08 No. 81). Pension Fund specialists have a similar right as part of the verification of individual information (clause 2 of Appendix No. 1 to the methodological recommendations; approved by Resolution of the Pension Fund Board of January 30, 2002 No. 11p). Tax authorities can also request a staffing table if they decide that this document relates to the activities of the taxpayer being inspected (clause 1 of Article 93.1 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated October 9, 2012 No. 03-02-07/1-246).

Receive requests from the Federal Tax Service for free and send the requested documents via the Internet

There is another reason to create a staffing table. It is indispensable in disputes regarding dismissal due to reduction in numbers or staff. It is this document that can confirm that changes have indeed occurred in the structure of the organization, which means that the reduction was real and not fictitious.

Is it possible to introduce a maternity tariff unit?

The long absence from work of an employee who has gone on maternity leave spurs the employer’s desire to remove “extra lines” from the staffing table. This desire is especially acute where even a temporary employee has not been hired to fill a maternity position.

, which requires the woman on maternity leave to retain her place of work and position, can cool down the ardor of management In this situation, the employer can only wait: for the employee to return to work or for her dismissal in accordance with Article 80 of the Labor Code (own desire).

Important. Until the employee is fired, the organization has no legal grounds to make changes to the staffing table. There are also no notes about the “declaration” of the bet in the document.

What are the consequences of lack of staffing?

This violation is subject to administrative liability under Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation. The fine for an organization is from 30,000 to 50,000 rubles, for individual entrepreneurs and officials - from 1,000 to 5,000 rubles. The Labor Inspectorate or the court has the right to impose this punishment.

Other sanctions are possible for the absence or failure to provide the “staffing” at the request of the controllers. For example, tax authorities can issue a fine of 200 rubles. on the basis of Article 126 of the Tax Code of the Russian Federation, if the organization or individual entrepreneur does not present this document. In addition, there will be additional tax charges due to the fact that certain expenses or amounts of insurance premiums turn out to be unconfirmed.

Compose HR documents using ready-made templates for free

Staffing requirements

This document will be legal if it contains the following information: a list of structural divisions, names of positions, specialties, professions indicating qualifications, number of staff units and salary for each position. You must also indicate that the document is called “Staffing Schedule” and provide information about the specific employer. In addition, it is advisable to indicate the document number according to OKUD - 0252251.

The easiest way to comply with these requirements is to use the unified form No. T-3 (approved by Resolution of the State Statistics Committee dated January 5, 2004 No. 1). Employers in the private sector have the right to decide for themselves whether they will use this form or develop their own. This has been repeatedly confirmed by Rostrud (letters dated 01/09/13 No. 2-TZ, dated 01/23/13 No. PG/409-6-1 and dated 02/14/13 No. PG/1487-6-1).

ATTENTION. Form No. T-3 indicates another OKUD document number - 0301017, which corresponds to the unified system of primary accounting documentation for labor accounting and payment. If desired, this code can be supplemented with code 0252251.

Download the staffing form.

Important nuances

When defining professions and positions, you cannot take their names, as they say, “out of thin air.” You should adhere to the names contained in qualification reference books or approved professional standards. Moreover, in some cases this is mandatory: Article 57 of the Labor Code of the Russian Federation stipulates that if any positions, specialties or professions are related to the provision of compensation and benefits or the presence of contraindications, then their names must strictly coincide with the names and requirements from regulatory documents , i.e. professional standards and reference books. Similar requirements apply to specialists who have early retirement benefits. In this case, you should be guided by lists 1 and 2 of industries, works, professions and indicators that give the right to preferential pensions (Resolution of the USSR Cabinet of Ministers of January 26, 1991 No. 10 and Resolution of the USSR Council of Ministers of August 22, 1956 No. 1173). If these requirements are neglected, then an employee whose work record book actually indicates a fictitious profession will have problems when applying for a pension. And entries in the labor record are made only in accordance with the staffing table and the employment order.

Another difficulty arises when the SR form indicates not a profession or position, but a specific type of work. This issue is not regulated by law, but in practice, employers are often forced to indicate the type of work in order to avoid problems when confirming a reduction in staff or number of employees. This is necessary when there are such positions in the organization. In this case, use the Procedure for using unified forms of primary accounting documentation, approved by Decree of the State Statistics Committee of Russia dated March 24, 1999 No. 20. This document states that the management of the organization has the right to issue an order (instruction) and indicate all additional details to be entered in Form T -3. If the organization uses only types of work and the number of employees is small, the ShR is allowed not to be compiled.

Freelance employees

Another difficulty that personnel officers encounter when drawing up a SR based on the T-3 form is associated with freelancers: those who cooperate with the organization on the basis of civil law contracts. By virtue of Article 11 of the Labor Code of the Russian Federation, they are not subject to either labor legislation or other acts containing labor law norms. Consequently, they have nothing to do with ShR, since they perform one-time jobs. In practice, freelancers sometimes include workers employed on the basis of an employment contract and performing a specific type of work. If the employer has not issued an order and has not included such work in the SR, a peculiar situation arises: there is no position, but there is an employee. It is advisable to avoid such situations.

Individual entrepreneurs

Individual entrepreneurs with hired employees have the right to work without HR. But if there is a desire or need to approve this document, there are no special requirements for its preparation; the sample individual entrepreneur staffing table for 2021 does not differ from a similar document approved by a legal entity. It indicates the positions, their number and salary. The individual entrepreneur certifies the document with his personal signature.

How to approve staffing

It is necessary to issue an order or instruction from the employer to approve the staffing table. This order is drawn up in any form. It should have made it clear what kind of staffing schedule is being adopted and from what date it will be put into effect. In this regard, it is advisable to formalize the approved staffing table as an appendix to the order.

The details of the order are indicated in the header of the staffing table. Form No. T-3 provides special columns for this.

There is no need to put a stamp on the staffing table. The document can be applied immediately after it is put into effect by the relevant order.

There is no need to familiarize employees with the staffing table (letter of Rostrud dated May 15, 2014 No. PG/4653-6-1).

Keep timesheets for free in an accounting web service

Additional payments

Additional payments that are adopted by the law of the Russian Federation or introduced at the request of the organization are entered into the schedule in columns No. 6, No. 7 and No. 8 (“Additional allowances”). If there is a different payment system at the enterprise, columns No. 5-No. 9 are filled out in accordance with the units of measurement.

Example: At the trading enterprise Argo LLC, the salary of a salesperson is 8,000 rubles when working one shift. After the employment contract was drawn up, the seller began working two shifts. For this he is entitled to a double bonus. In column No. 5 the seller’s main income is entered (8,000 rubles), and in columns No. 6-No. 8 there will be a figure of 16,000 rubles.

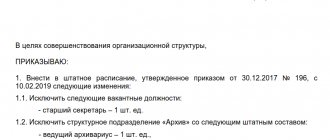

How to make changes to the staffing table

An adjustment is necessary if new positions have appeared in the organization, old ones have been abolished or renamed, or salaries, the number of employees, or the structure of the enterprise have changed. The procedure for making such amendments is not regulated by law.

There are two ways to do this. The first is to draw up a new (changed) staffing table to replace the previous one. The new document is approved by order. The second way is to correct the current “staff”. To do this, an order to make changes is issued.

An employer can combine both methods. For example, with minor amendments (renaming, adding, deleting one of the positions, changing the number of staff units or salary for one of them), you can issue an order for changes. And in case of more global adjustments, approve a new staffing table.

The “summarizing” method is also practiced, which involves summarizing the changes made during the year by individual orders. In this case, from January 1 of the following year, a new staffing table is approved, taking into account all amendments.

Instructions for filling

The unified staffing form looks like a table of 10 columns; it can be supplemented if necessary.

- The first column of the table contains information about the structural unit. The first column “Name” is filled in in free form. For a hotel with 150 rooms, this column may look like this:

- administrative and management service;

- food and beverage service;

- maintenance department;

- Engineering service;

- cleaning and service department.

- The second column of the staffing table contains the codes assigned to each structural unit.

- The third column is filled in with information about the names of the positions of the structural unit. They are usually placed in a hierarchy from management positions to service personnel. The block of administrative and managerial personnel is represented by the following positions:

- director;

Chief Accountant;

- senior administrator;

- administrator;

- accountant;

- lawyer;

- reception worker;

- office and archive worker;

- Marketing and sales department employee;

- security officer.

Food and Beverage Service:

- Chef;

- cook;

- waiter;

- dishwasher

Economic department: purchasing manager.

Engineering service:

- electrician;

- plumber;

- instrumentation specialist.

Cleaning and service department:

- room service;

- cleaning service for office premises and surrounding areas;

- gardener;

- laundry and dry cleaning worker;

- cloakroom attendant;

- porter;

- doorman;

- tour guide;

- nanny.

- employee benefits under the law, such as territorial compensation;

4th. Management independently distributes the amounts of bonuses accrued to each individual employee. The last, tenth column of the table - “Note”, is filled out only in some cases, for example, if there are employees with a piece-rate wage.

The “Total” line refers to columns 4 to 9. This line reflects the total wage fund during the period of validity of the document.

At the top of the staffing table, information about the organization is filled in: name, OKPO code, period of validity of the document and from what date it is entered. In the line “Approved by order” the date and serial number of the corresponding order are indicated. Next, the number of staff units is entered in the line “Staff in quantity”.

The employees who compiled the document sign at the bottom.

Frequency of document preparation and storage periods

Labor legislation does not oblige employers to periodically re-approve the staffing table. Accordingly, this is done only when necessary - when any new inputs appear (positions, numbers, departments, salaries, etc.). If everything is stable in the organization and the structure does not change, then the once approved staffing table can exist indefinitely.

The period during which changes must be made to the staffing table in connection with changes in the company structure has not been established. However, you must remember that on the basis of this document, information is indicated in employment contracts and work books. Therefore, the updated staffing table must be entered in advance, that is, before the dates for drawing up an employment contract or making an entry in the work book.

IMPORTANT. The shelf life of the staffing table is permanent (subparagraph “a” of article 71, section 1.2 of the list, approved by order of the Ministry of Culture dated August 25, 2010 No. 558). This means that it must be kept throughout the existence of the organization, and upon its liquidation, transferred to the state or municipal archive.

Fill out and submit the SZV-TD online for free

Procedure for accepting the ShR

The document is drawn up by any official of the organization to whom such powers are delegated (manager, accountant, human resources specialist). When drawing it up, be sure to rely on labor legislation and internal regulations of the company, for example:

- charter;

- approved structure of the enterprise (if any);

- accounting policy;

- professional standards;

- calculations of monthly official salaries;

- other legal and regulatory technical documents.

Sometimes, before drawing up the HR, another personnel normative act is drawn up - the structure of the organization: a diagram of all divisions, their interrelation and subordination. This form is also not mandatory, but on its basis it is easier to draw up a ShR.

To approve the staffing table, an order is issued, which is signed by the head of the organization or other authorized person. A round seal is not placed on this document, even if the organization uses it. The SR is signed by the one who compiled it, and in the upper column it is necessary to enter the details of the relevant order and confirm them with the signature of the manager.

Sample of filling out the staffing table for 2021

From November 25, 2021, a new staffing table was introduced at Labyrinth-2019 LLC (order dated November 25, 2019 No. 74OK). The structure of the organization includes 7 divisions, including AUP, accounting, human resources department, sales department and household department. The total number of employees is 16.5 units. At the same time, a cleaning lady (with a full-time salary of 12 thousand rubles) is registered at 0.5 times the rate.

Taking into account these data, we will fill out the staffing table according to Form No. T-3.

In conclusion, we note that if the employer, when drawing up the staffing schedule for 2021, adheres to the simple rules discussed above, this will protect him from problems during inspections by regulatory authorities. And timely reflection in the “staff” of changes in the structure of the company will allow you to avoid conflicts, including if it is necessary to dismiss employees “due to layoffs”.