Deductions

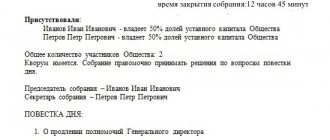

General rules for paying dividends Dividends are paid from the company’s net profit in proportion to the shares of participants (shareholders)

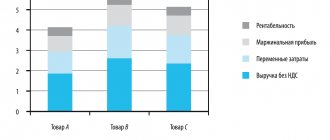

Accounting for the organization's income Accounting for the organization's expenses Formation of financial results for ordinary activities of the organization

If you seriously decide to start trading, then you will have to choose which method of calculating the cost

After the President of the Russian Federation signed the law on the next amendment to the Tax Code, many

State fee for arbitration: amounts State fee is a mandatory fee paid when filing a statement of claim.

One of the groups of expenses that can be taken into account when calculating income tax is

An order to increase wages in connection with an increase in the minimum wage is a document with a special

The audit report must be submitted to Rosstat. In the event that the auditor's report on the annual

We process accountable money correctly. You can issue accountable money to an employee of an organization in three ways: from the cash register

The general meeting of founders can be either regular (with established frequency) or unscheduled (at