An order to increase wages in connection with an increase in the minimum wage is a document of particular importance for the employee and no less important for the employer. Since last year, the federal minimum wage has been equal to the subsistence level and amounts to 11,280 rubles. In this regard, many employers are faced with the task of correctly processing wage increases. We will tell you what formalities need to be followed.

The Labor Code of the Russian Federation in Article 130 defines wage growth as one of the state social guarantees, the implementation of which is the responsibility of employers. Salaries should rise as consumer prices rise, that is, indexation should be carried out. This, in particular, is evidenced by Letters of Rostrud dated April 19, 2010 No. 1073-6-1, Ministry of Labor dated December 26, 2017 No. 14-3/B-1135 (this document especially emphasizes the employer’s responsibility for failure to index under Article 5.27 of the Code of Administrative Offenses of the Russian Federation with a fine of up to 50,000 rubles) and Article 134 of the Labor Code of the Russian Federation. At the end of 2021, an Order was issued to increase the minimum wage from January 1, 2021 in Russia (Ministry of Labor of Russia dated August 24, 2018 No. 550n) - in accordance with it, this figure was 11,280 rubles.

Employers must adhere to these rules. At the same time, the legislation does not limit managers from intending to increase wages by amounts exceeding the minimum wage. Since almost all employers sooner or later face the need to increase employee wages, let’s figure out how to properly document this event.

How to create an order

Let us say right away that there is no sample order for a salary increase in connection with an increase in the minimum wage in the law. There is neither a mandatory nor a form recommended by officials for such a form.

This means that each employer will have its own sample order to increase wages in connection with an increase in the minimum wage. It is prepared in accordance with the rules and customs of document flow accepted within the organization.

It makes sense to consolidate the sample order on salary changes due to an increase in the minimum wage from 2021 at the level of internal documents as a mandatory template for the future. So as not to overthink things later and waste time on drawing up another such order.

Is it possible to do without raising wages?

Before answering this question, let’s look at what we mean by a salary increase. So, the reasons for it could be:

- increase in the minimum wage - wages should be increased for employees whose payments for work are below the level provided for by law;

- mandatory indexation of wages - in connection with rising consumer prices (Article 134 of the Labor Code of the Russian Federation);

Ignoring this obligation is a reason for imposing fines on the violator under Art. 5.27 Code of Administrative Offences. Details are in the note “Salary indexation in 2019-2020: how and by how much.”

- voluntary salary increase by decision of the manager. In this case, the employer has the right to increase salaries at his discretion, both for all employees/positions and selectively. As for the size of salaries, the legislation does not set any restrictions on voluntary salary increases.

Is it possible to make changes to the staffing schedule and draw up additional agreements to employment contracts if the organization has increased salaries? The answer to this question is in ConsultantPlus. If you don't have access to the system, get a free trial online.

Contents of the order

Now about how to write an order to increase wages in connection with an increase in the minimum wage. As was said, the law does not impose strict requirements for its details.

Most importantly, do not forget to refer to the regulatory framework (although formally this is not necessary):

- Order of the Ministry of Labor of Russia dated 08/09/2019 N 561n (if you increase only to the federal minimum wage);

- regional agreement on the new minimum wage from January 1, 2020 (if you increase the minimum wage to the regional one);

- Part 11 of Article 133.1 of the Labor Code of the Russian Federation, which, under certain conditions, obliges employers to increase salaries to regional minimum wages (when working on working hours and fulfilling labor standards).

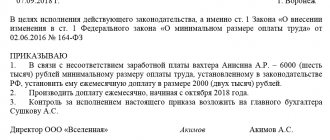

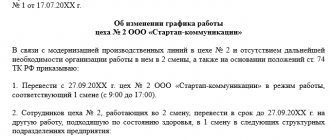

The following shows in the most general form how to draw up an order for a salary increase in connection with an increase in the minimum wage (+ read our recommendations and advice after):

| LIMITED LIABILITY COMPANY "___________________________" (OOO "_____________________") ORDER on a salary increase due to an increase in the minimum wage ___________________ ___.___.____2019 In connection with the increase in the minimum wage from January 1, 2020 on the basis of Part 11 of Article 133.1 of the Labor Code of the Russian Federation I ORDER: 1. Establish from January 01, 2021, in the manner prescribed by the _________________ Regulations on remuneration, approved by order dated ___.___._____ year No. _____, a salary of 12,130 rubles for the following employees:

2. The head of the HR department ____________________ prepare additional agreements for employment contracts with full name, full name. <…˃. CEO ________________ /__________________/ (signature) |

It is very important in the order to increase wages and increase the minimum wage to provide a reference to the general internal regulatory act of the enterprise, which regulates the remuneration of personnel. For example, the Regulations on remuneration.

Also, in the order to increase wages in connection with the increase in the minimum wage, it is necessary:

- list full name employees who were promoted (preferably with positions and personnel numbers);

- so that the date of the salary increase is not later than the date of entry into force of the Federal Law on increasing the all-Russian minimum wage and/or the start date of the regional agreement with the updated “minimum wage”;

- indicate the new final salary amount (for all employees at once or separately if there is a difference in the amounts);

- list with whom to prepare additional agreements for salary increases (the list of persons must match those who received the increase).

At the end, the order is signed by the director of the organization. Visas for a personnel officer, accountant, or lawyer will not be superfluous.

From our website, you can freely order a salary increase in connection with the increase in the minimum wage in 2021 via a direct link .

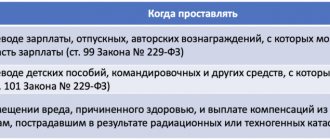

When is a salary increase order prepared?

The Labor Code of the Russian Federation provides all workers with a guarantee in the form of wages at a level not lower than the minimum wage, without taking into account regional allowances and coefficients. This means that employers must monitor the innovations that the authorities approve in this area and raise salaries for their employees if the amounts currently paid are below federal standards.

According to current legislation, the minimum wage is established annually from January 1. It is permissible to increase it or maintain it at the same level, depending on the level of the living wage for the working-age population approved by officials for the 2nd quarter of the previous year. Therefore, an order to increase salaries due to the minimum wage will be needed at least once a year.

The last time the requirement to increase the minimum wage came into force was on 01/01/2020, and from this date, persons who entered into full-time employment contracts and worked a full month must receive at least 12,130 rubles. This is a federal figure, and in some regions it is higher. But it does not include income taxes and labor allowances in certain localities. This means that a person will receive either less (minus personal income tax) or more (plus regional allowances). If your company’s salaries are below 12,130 rubles or the regional indicator, they need to be recalculated, be sure to increase them.

Another case when you will need an order to increase the salary in connection with a change in the minimum wage is the annual indexation provided for in Art. 134 Labor Code of the Russian Federation.

Let us remind you that for refusal to increase wages taking into account the new minimum wage, fines of up to 50,000 rubles are provided. The fine will increase if employees complain about the delay or incomplete payment of amounts due to them - up to 100,000 rubles, in accordance with Art. 5.27 Code of Administrative Offenses of the Russian Federation.

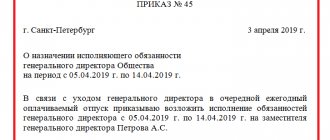

Order for individual entrepreneurs: features

Let us note that for individual entrepreneurs, a sample order for a salary increase in connection with an increase in the minimum wage in 2021 is generally not much different from the standard form. You just need to indicate the name of the individual enterprise in the header, and in the main part list the names of the personnel who need a pay increase.

If a businessman works alone - without staff - then in such an order he simply raises his own wages to the level of the new minimum wage.

Read also

11.11.2019

Algorithm for increasing wages

The wage increase affects several documents. The preparation and modification of them forms the document flow for wage indexation:

- Issuance of an order based on the Regulations on remuneration.

- Familiarization of employees with the order, collection of signatures.

- Making changes to the staffing table.

- Conclusion of additional agreements to the employment contract.

It is worth remembering that information on the procedure for increasing employee wages should be contained in the Regulations on Remuneration. This is a local regulatory act of the enterprise, which provides all the necessary information regarding employee salaries. For example, its size, payment days, bonus system, as well as the frequency of indexation.

Since the law does not regulate the form of this document, employers can develop it independently. The employer is obliged to familiarize the employee with the provision before signing the employment contract. Employees must be aware of any changes to this document, and also confirm their agreement with them by signing.

Methods for adjusting salaries

Let us recall that the components of wages are:

- tariff rate, salary;

- basic salary, basic salary rate.

Salary changes can occur in various ways.

- The first option is to adjust the above elements.

- The second possible option is the appointment or increase of compensation payments.

- The third is the same actions regarding incentive payments (bonuses, incentives).

The amount of labor costs associated with document flow depends on the choice of the method of change, as well as the number of employees to whom it concerns (all or part).

Reduced rewards

This phenomenon is associated with both the legal and extra-legal fields. An employer will be held accountable if he broke the law by reducing the wages of his employees. The reduction will be legal only under the following circumstances:

- Labor standards are not met, as are labor duties, for reasons beyond the control of the parties. But you need to save at least 2/3 of the bet when such circumstances occur.

- The employee is guilty of not fulfilling the duties and standards. Then they pay for the work in accordance with the volume actually completed.

- The appearance of a complete defect, with proven guilt of the employee. In this case, you are allowed to refuse payment altogether.

- Partial defect for which the employee is at fault.

- Downtime due to the fault of the employer.

- Downtime due to reasons beyond the control of the parties.

- Downtime due to the employee's fault.

Recalculation

Sometimes errors .

Accordingly, in order to put accounting documents in order and correct an error, you need to perform certain actions (deductions or additional payments), which are documented .

According to Article 137 of the Labor Code of the Russian Federation, wages will be withheld in the following cases:

- if an arithmetic error was made in the calculations ;

- if the employee did not fulfill his job duties or there was downtime due to his fault (these circumstances must be confirmed by the labor dispute commission or a court decision);

- if the cause of the error was the employee’s unlawful actions (a court decision is also required).

If any part of it was withheld from an employee’s salary for another reason, then we can talk about a violation of the law . This also applies to cases where the error occurred due to the fault of technical means.

An employee can voluntarily reimburse the employer for the “extra” amount, but he cannot be forced . This rule was legalized by the Supreme Court of the Russian Federation in its Determination No. 59-B11-17 of January 20, 2012.

In what cases is the salary of employees changed?

The provision regarding remuneration for the employee under the employment agreement is one of the most important, therefore it must be clearly stated, without the possibility of double interpretation.

An employee is paid either for the time worked or for the amount of work performed. Payment of salary assumes that every month a person who has worked the established monthly quota will receive the same amount. When a financial opportunity arises or due to the entry into force of legislative acts, the company's management may revise the salary amount.

Most often, this happens when workers’ salaries are set at the minimum wage. As soon as this minimum limit is raised, the company's management must immediately revise the employee's remuneration upward.

Otherwise, administrative measures may be applied to her. It is not allowed, for standard work hours, for wages to be less than the minimum wage.

Attention! From 2021, all business entities must implement wage indexation when the consumer price and service index increases. That is, the remuneration of the company's employees should be adjusted upward by the indexation factor.

Its commercial enterprises can independently set in their regulations, and budgetary enterprises can apply the approved inflation rate for the purpose of wage indexation.

On a voluntary basis, business entities can increase salaries if they have the financial opportunity, in order to increase the employee’s interest and productivity.

How to determine frequency?

The Labor Code does not provide precise instructions on the timing and coefficients for salary increases. But regular implementation of this procedure is mandatory for both commercial and budget organizations.

For commercial organizations, this issue is resolved at the commercial level. The honesty of the manager and the available amounts play the most important role. The coefficient helps determine the exact time of the procedure.

It should be taken into account that not every company is ready to enter into collective labor agreements. And if the document is drawn up, then indexation is not always considered the employer’s responsibility. There are several options to change the situation:

- Make changes everywhere, including any types of labor agreements, individual and collective, local acts of other types. A separate chapter is being created for this. Separately, they indicate that management is obliged to periodically increase salaries.

- Drawing up a separate local act, which will be called the Regulations. All employees familiarize themselves with this document against their personal signature.

Who received a minimum wage increase from October 1

Lucky Muscovites. This year, the minimum wage in Moscow changed twice: from July 1 and from October 1 (PP No. 1177-PP dated September 10, 2019):

- from July 1st they raised it by 570 rubles. up to RUB 19,351;

- from October 1, the amount was increased by another 844 rubles. up to 20,195 rub..

The minimum wage in Moscow from October 1, 2021 is 20,195 rubles (approved by Moscow Government Decree No. 1177-PP dated September 10, 2019). In the Moscow region, the figure has not changed - 14,200 rubles (agreement on the minimum wage in the Moscow Region No. 41 of 03/01/2018).

The amount is adjusted depending on the cost of living, which legislators have the right to change quarterly. It is possible that it will soon be counted in the regions.

IMPORTANT!

In 2021, the total amount of money earned by an employee from a particular employer cannot be less than 11,280 rubles.

Duration of document storage

A document that records an increase in salary for one or more employees is a type of personnel order. However, in addition to this, it also regulates the calculation of wages for employees. In this regard, the storage period for such an order is set at least 75 years.

Such an order is filed in a general folder, along with other personnel documents. Copies of it can also be filed along with salary calculation forms, new staffing schedules, in the employee’s personal file, etc.

After the year ends, the file of orders for this period is submitted to the archive, where it should be stored in the future for a specified period of time.

Attention! If this deadline has not yet expired, and the company is forced to cease operations for some reason, then all documents must be transferred to the city archive. If the storage time has expired, then by order of the manager they are subject to destruction.

It is necessary to approach the storage of administrative documents of the company responsibly. If they were destroyed before the end of the period, or the storage conditions were violated, then the responsible persons may be subject to administrative or criminal penalties.

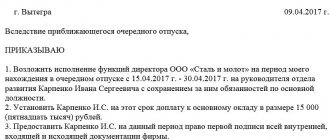

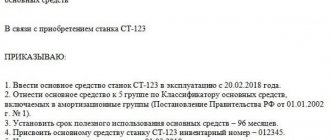

Order to change the staffing table due to an increase in the minimum wage

The legislation does not contain a strictly established form of the document. It can be arbitrary. In this case, the company's letterhead should be used for registration. An order usually consists of three parts.

- A cap. It must contain the date and place of compilation, as well as the serial number of the order.

- Main part. It indicates the reasons for drawing up and references to the relevant regulations.

- Signatures of the persons listed in the document and to whom it applies.

It looks like this:

Can payments be less than the minimum wage?

This is only possible if the employee is assigned part-time work.

In such circumstances, the employment contract must stipulate:

- break times;

- beginning, end of the period of performance of duties;

- opening hours for each day;

- work and rest schedule in general;

- the period for which such a regime is established.

Remuneration depends on the time actually spent on performing the direct duties of a citizen. The amount of work completed also plays a role. However, there are no restrictions on annual paid leave. The same applies to calculating length of service and other rights.

What minimum wage should I use?

If a minimum wage is not established in the region and industry, then the federal minimum should be used.

If there is a regional minimum wage, you need to focus on its value. Joining regional agreements is automatic. But you can refuse it. To do this, a written, reasoned refusal must be sent to the Ministry of Social Development within 30 calendar days after the agreement is published. If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

If there is an industry minimum wage, you need to focus on it. The refusal procedure is similar to that described above. But the document is sent to the Ministry of Labor. If two minimum wages are established by law - regional and sectoral and the company did not have time to abandon them, then the greater value of these two types should be used.