One of the groups of expenses that can be taken into account when calculating income tax is the cost of paying company personnel. Such expenses include not only payments to employees directly in the form of official salaries, tariff rates, piece rates and incentive and incentive payments, but also other payments to the organization’s personnel.

One of the groups of expenses that can be taken into account when calculating income tax is the cost of paying company personnel. Such expenses include not only payments to employees directly in the form of official salaries, tariff rates, piece rates and incentive and incentive payments, but also other payments to the organization’s personnel, in particular:

- compensation payments related to working conditions;

- the cost of food, accommodation, work clothes and safety shoes;

- the amount of reimbursement of interest costs on loans for the purchase of housing;

- other payments to the organization’s personnel.

A complete list of labor costs is contained in Article 255 of the Tax Code of the Russian Federation.

It is necessary to take into account that expenses can include payments not only in cash, but also in kind.

Of course, these expenses can be included in the calculation of the tax base for income tax if they are specified in labor or collective agreements and provided for by the norms of the current legislation (Article 255 of the Tax Code of the Russian Federation). Thus, remunerations that are paid outside the framework of labor and collective agreements cannot be taken into account when calculating tax (clause 21, article 270 of the Tax Code of the Russian Federation).

In addition, these costs must be economically justified and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation).

Certain types of expenses related to labor costs can be taken into account when calculating income tax within the limits of the norms. These include, for example:

- expenses for voluntary personal insurance;

- expenses for non-state pension provision;

- expenses for reimbursement of interest paid by employees on loans for the purchase of housing (clause 16, article 255, clause 24.1 of the Tax Code of the Russian Federation).

Thus, the total amount of contributions to the funded part of the labor pension, contributions under long-term life insurance contracts, voluntary pension insurance and non-state pension provision cannot exceed 12% of the amount of labor costs (paragraph 7, clause 16, article 255 of the Tax Code of the Russian Federation).

Take advantage of all the features of Kontur.Externa

Send a request

To which reporting period should “carrying over” vacation pay be attributed (clause 7 of Article 255 of the Tax Code of the Russian Federation)?

Let's look at an example.

Manager Ivankov S.S., who works at , is going on vacation from 06/29/2020 to 07/26/2020. As it should be according to the norms of the Labor Code of the Russian Federation, vacation pay was paid until the employee went on vacation on June 25, 2020 in the amount of 25,000 rubles. The frequency of filing profit declarations at Clarisa LLC is quarterly. This means that 2 days of vacation pay fall in the 2nd quarter of 2021, and 26 days in the 3rd quarter. That turns out to be 26 days of “rolling over” vacation pay. To what period for profit taxation should they be classified?

In accordance with paragraph 7 of Art. 255 of the Tax Code of the Russian Federation, labor costs taken into account in the tax base include vacation pay payments in the form of average earnings. This means that vacation pay in the amount of 25,000 rubles. Ivankova S.S. should be provided for when calculating the base as part of expenses. But in what period to take them into account, the letter of the Federal Tax Service dated 03/06/15 No. 7-3-04/ [email protected]

According to these explanations, expenses in the amount of 25,000 rubles. must be taken into account during the period of their formation and payment, i.e. in the profit tax return for the 2nd quarter of 2021. According to the fiscal authority, there is no need to divide vacation pay, although the Ministry of Finance of the Russian Federation has a different opinion.

We recommend that you read the material “On the eve of summer, the Ministry of Finance spoke about how to take into account “rolling” vacations for profit .

Are annual remunerations under Article 255 of the Tax Code of the Russian Federation included in taxable expenses?

Consider the following situation.

Gloria LLC plans to provide annual rewards. What should be the company's action algorithm?

1. In accordance with paragraph 1 of Art. 324.1 of the Tax Code of the Russian Federation, Gloria LLC must establish in a document such as an accounting policy an equal method of reserving for the payment of annual remuneration, set a limit on such a reserve and the subsequent percentage of monthly deductions. To do this, an estimate is drawn up, in which the size of the annual reserve is determined, based on the ratio of the annual payroll and the percentage deduction from it to the reserve for the annual remuneration. Next, the annual reserve is broken down monthly (in the monthly amounts it is also necessary to take into account payments for insurance premiums in the amount of the annual remuneration).

Let's say that Gloria LLC has planned that labor costs in 2021 will be 7,000,000 rubles, and the percentage of reservation for annual remuneration will be 10% of them. At the same time, the amount of insurance premiums (including contributions for “injuries”) is 30.2%. This means that the estimated annual reserve limit for annual remuneration will be: 7,000,000 × 1,302 × 10% = RUB 911,400.

ATTENTION! From April 1, 2020, the organization has the right to apply reduced insurance premium rates. See here for details.

2. At the second stage, a reserve is directly formed in a monthly format for the annual remuneration. To do this, the amount of labor costs and accrued insurance premiums should be multiplied by the established monthly percentage of contributions to the reserve. The received reserve amounts should be taken into account in expenses for income tax in accordance with clause 24 of Art. 255 Tax Code of the Russian Federation.

IMPORTANT! The amount of the reserve accumulated during the year using the calculation method should not exceed the limit that was specified in the accounting policy.

Please note: compliance with the reserve limit for annual remuneration should be monitored by year. Let’s say that from January to December 2021, Gloria LLC’s labor costs amounted to 6,890,000 rubles. This means that during this period a reserve was formed: 6,890,000 × 1,302 × 10% = 897,078 rubles. That is, in December the reserve will be formed in the amount of: 911,400 – 897,078 = 14,322 rubles, so as not to exceed the limit.

3. An inventory of the annual remuneration reserve should be made at 31 December 2021. This means that you need to compare the amount of the formed reserve for the year with the amount of remuneration accrued to employees, taking into account insurance premiums, and identify any shortfalls or overruns.

Free food for employees under clause 1 of Art. 255 of the Tax Code of the Russian Federation - are these taxable expenses?

Next example.

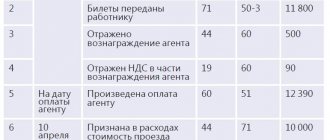

Lira LLC organized free meals for its employees. The organization does not have a specialized canteen, but all the necessary conditions have been created in the room for meals, and food is also purchased, from which lunches are prepared by a specially hired employee. Can such expenses be included in the item “Payment”?

In order to include such expenses in the “Payment” item, you need to reflect the conditions for providing free food in employment contracts with employees. After all, in accordance with Art. 131 of the Labor Code of the Russian Federation, you have every right to partially pay wages in kind. Free meals for employees in this case will be qualified as payment of wages in kind.

In this case, the salary will consist of the accrued salary (piece rate) and the cost of organized free meals. The basis for attributing the costs of free food to wages in such a situation will be clause 1 of Art. 255 of the Tax Code of the Russian Federation, according to which such costs can include amounts accepted from the employer in accordance with various types of settlements with employees. However, according to the Ministry of Finance of the Russian Federation, it is possible to take into account the cost of free food in labor costs only on the condition that the organization keeps records of the income received by each employee, and personal income tax is withheld from the employee from the cost of food (letter of the Ministry of Finance of Russia dated January 09, 2017 No. 03 -03-06/1/80065, dated 02/11/2014 No. 03-04-05/5487).

“Vacation” expenses for income tax purposes

According to paragraph 7 of Art. 255 of the Tax Code of the Russian Federation, for the purpose of calculating income tax, expenses for wages retained by employees during the period of vacation provided for by the legislation of the Russian Federation are taken into account. In addition, clause 8 of this article provides for the inclusion in expenses for tax purposes of monetary compensation for unused vacation in accordance with the labor legislation of the Russian Federation.

In practice, a lot of questions arise in connection with the application of these norms. You will find answers to some of them in this article.

Additional leave provided for by law

In what cases are expenses for additional vacations taken into account for income tax purposes?

Based on Art. 114 of the Labor Code of the Russian Federation, employees are granted annual leave while maintaining their place of work (position) and average earnings. The duration of the annual main paid leave is 28 calendar days ( Article 115 of the Labor Code of the Russian Federation ), and for workers under the age of 18 years - 31 calendar days (extended main leave) ( Article 267 of the Labor Code of the Russian Federation ). In addition, the Labor Code of the Russian Federation provides for the provision of additional paid leave to certain categories of workers ( Article 116 of the Labor Code of the Russian Federation ).