The audit report must be submitted to Rosstat. If you have prepared an auditor's report on the annual financial statements before submitting the balance sheet, it can be presented together with the financial statements.

If for some reason you receive an audit report after submitting your financial statements to the statistics department, then in this case you must provide an audit report within 10 working days from the date of issue of the audit report. In this case, without a penalty, you can provide an audit report no later than December 31 of the year following the reporting year.

Thus, the audit report for 2021 must be submitted to Rosstat no later than December 31, 2021.

You can provide an audit report to Rosstat in person by sending a valuable letter with a list of attachments or sending a scan of the audit report via TCS through a special communications operator.

It is important to note that when sending an audit report electronically, the file must have the extensions - pdf, tif, jpg. The file name must begin with your organization's OKPO code (example 04436855_AZ2016_OOOCVET.pdf

).

If the audit report is submitted to the territorial office of Rosstat at the location of the organization in person, then it makes sense to draw up a cover letter in two copies, on which you will be marked as having received it, which will be confirmation of timely delivery.

Accounting statements together with the audit report for 2021 will be submitted only to the Federal Tax Service at the location of the organization in the form of an electronic document. In 2021, neither financial statements nor audit reports will be submitted to Rosstat!

The audit is carried out not only for statistics and the tax office! An audit is necessary for the owners of the organization in order to understand how much they can trust the accounting statements and make management decisions.

Let's sum it up

If the organization's reporting is subject to mandatory audit:

- The audit report for 2021 must be submitted to the Federal Tax Service along with the annual accounting reports. If it is not ready by this time, then within 10 working days after its signing, but no later than December 31, 2020.

- In case of violation of the deadline for submitting a conclusion, the organization faces a fine of up to 5,000 rubles, and an official - up to 500 rubles.

- If the absence of an audit report is revealed, they may be fined up to 10,000 rubles. (or up to 20,000 rubles for repeated violation).

If you find an error, please select a piece of text and press Ctrl+Enter.

Changes - where to submit reports

In 2021, changes were made to the law on accounting (law dated November 28, 2018 No. 444-FZ).

According to the amendments made to Art. 18 o GIR BO came into force on 01/01/2020. This means that Rosstat transfers its powers to the Federal Tax Service in terms of the formation and maintenance of GIR BO. Thus, Rosstat no longer accepts either financial statements or audit reports. Reference: GIR BO is a set of accounting (financial) statements and audit reports of business entities in cases where the entity has the obligation to submit accounting reports and is subject to mandatory audit (clause 1 of Article 18 of Law No. 402-FZ).

Starting with annual reporting for 2021, organizations are already submitting balance sheets and audit reports to the Federal Tax Service of the Russian Federation. But the Federal Tax Service will not be able to provide access to the financial statements of organizations for past reporting periods. To obtain such access, you must contact Rosstat. Let us remind you that the storage period for financial statements is 5 years after the reporting year.

How to write a letter to Rosstat about the absence of auditor findings?

If you did not carry out business activities and did not receive income during the reporting period, you need to send a letter to Rosstat about the absence of an audit report. The letter can be sent to the department’s email address or by Russian Post.

There are no strict requirements for the form of the letter - it is enough to write it on a form with the details of a legal entity. The header of the application indicates the name of the recipient (this will be the statistical agency), the name of the sender, address, OKVED. In the main part, Rosstat is notified that the organization does not have the conditions established by Art. 5 of the Law “On Auditing Activities”.

In addition to financial statements, an audit report must be submitted to the statistical authorities. Failure to comply with this requirement may result in penalties.

Audit and statutory audit

In accordance with Art. 5 of the Federal Law of December 30, 2008 No. 307-FZ “On Auditing Activities”, a certain category of organizations is required to undergo mandatory independent verification of financial and economic activities (audit). For refusal or failure to comply with deadlines, the legal entity and its management will have to answer before the law.

Responsibility for the lack of a mandatory audit is penalties that apply to organizations listed in the law “On Auditing Activities”. For them, an independent audit of accounting is mandatory. We will discuss further what penalties exist for the absence of an audit report.

From the owner’s point of view, the financial costs of the audit are balanced by confidence in the reliability of the data for analyzing the financial position of the business prepared by the accounting service, the quality of the accounting service as an integral part of the organization is tested, and the risks of financial losses are identified.

Regulatory regulation

BFO is information about the financial position of a business entity as of the reporting date, as well as about the financial result of its activities and cash flows for the reporting period, systematized in accordance with the requirements of the Federal Law of December 6, 2011 N 402-FZ “On Accounting”.

Organizations required to compile the BFO must send one copy of it to the state statistics body to form a state information resource (Clause 1, Article 18 of Federal Law No. 402-FZ).

Answers to frequently asked questions

How to calculate the amount of assets on the balance sheet for a statutory audit?

The amount of assets on the balance sheet for statutory audit is the balance sheet currency (the amount of assets), which is indicated in line 1600 of the balance sheet.

Is it possible to use a collapsed balance of active-liable accounts to avoid a mandatory audit?

No, you can't do that. For example, you cannot subtract accounts payable from accounts receivable even for one counterparty (if you do not have a debt offset act). All indicators in the Debit and Credit balance sheet are reflected in detail. This is directly stated in PBU 4/99 “Accounting statements of organizations”, paragraph 34:

In the financial statements, offsets between items of assets and liabilities, items of profit and loss are not allowed, except in cases where such offset is provided for by the relevant accounting provisions.

For what year should a mandatory audit of a company be carried out if the amount of revenue or assets exceeds the limits?

According to Federal Law No. 307-FZ, the criterion for conducting a mandatory audit is the excess of revenue by 400 million rubles. or balance sheet currency (assets) of 60 million rubles. for the previous year.

Related article: How much money to spend on advertising

For example, at the end of 2021 there was an excess. This means that the organization will need to conduct an audit for 2021, that is, at the beginning of 2021, and receive an audit report for 2020.

When does an audit become mandatory?

Certain types of organizations are subject to mandatory audit, regardless of their legal form. Such organizations include, in particular:

— joint-stock companies (including closed joint-stock companies) ;

— organizations whose securities are admitted to trading at stock exchanges and (or) other organizers of trading on the securities market;

— housing savings cooperatives (Article 54 Federal Law of December 30, 2004 No. 215-FZ “On Housing Savings Cooperatives”);

— developers (Article 18 of the Federal Law of December 30, 2004 No. 214-FZ);

— an organization that is a professional participant in the securities market;

— non-state pension or other fund;

A complete list of organizations that are required to conduct an audit is published on the website of the Ministry of Finance of the Russian Federation.

In addition, in general, an audit is required if the financial performance of the organization has reached the following values:

— revenue exceeds 400 million rubles;

and/or

— the balance sheet currency exceeds 60 million rubles.

Financial indicators are taken for the year preceding the reporting year. That is, the need to conduct an audit for 2021 is determined based on the results of an analysis of financial indicators for 2021.

Responsibility for mandatory inspection in 2017

Which organizations must submit an audit report to Rosstat?

The obligation to submit an audit report to Rosstat is established by Art. 18 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ and in the regulations of Rosstat. Thus, the department’s order No. 220 dated March 31, 2014 states that if a company’s annual financial statements are subject to mandatory verification by auditors, a report must be submitted to the statistical authorities.

In Art. 5 of the Law “On Auditing Activities” dated December 30, 2008 No. 307-FZ specifies the criteria by which managers and officials can determine whether an organization is subject to annual inspection by auditors.

In addition, you can rely on the following regulations:

- Part 4 Art. 18 of the Law “On Participation in Shared Construction...” dated December 30, 2004 No. 214-FZ (developers);

- clause 8 art. 7.2 of the Law “On Non-Profit Organizations” dated January 12, 1996 No. 7-FZ (state companies);

- clause 2 art. 7.1 of the law of January 12, 1996 No. 7-FZ (state corporations);

- Part 4 Art. 12 of the Law “On Self-Regulatory Organizations” dated December 1, 2007 No. 315-FZ (SRO).

The following entities must submit an audit report to Rosstat:

The obligation to provide an audit report does not apply to agricultural cooperatives, state and local authorities, state extra-budgetary funds, unitary enterprises, state and municipal institutions.

The composition of the presented financial statements for 2021 is systematized in the table:

| Who represents | What forms | Reasons |

| Organizations not related to small businesses | Balance sheet | Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n, Order of the Federal Tax Service of the Russian Federation dated March 20, 2017 No. ММВ-7-6/ [email protected] “On approval of recommended formats for presenting accounting (financial) statements in electronic form,” Letter from the Federal Tax Service RF dated April 19, 2017 No. PA-3-6/ [email protected] |

| Income statement | ||

| Statement of changes in equity | ||

| Cash flow statement | ||

| Report on the intended use of funds received | ||

| Small businesses | Balance sheet | Order of the Ministry of Finance of the Russian Federation dated July 2, 2010 No. 66n (Appendix No. 5), Order of the Federal Tax Service of the Russian Federation dated March 20, 2017 No. ММВ-7-6/ [email protected] “Recommended format for presenting simplified accounting (financial) statements in electronic form "(Appendix No. 11). |

| Income statement | ||

| Non-profit organizations | Balance sheet | Order of the Ministry of Finance of the Russian Federation 07/02/2010 No. 66n, Information of the Ministry of Finance of the Russian Federation “On the peculiarities of the formation of financial statements of non-profit organizations” (PZ-1/20015) |

| Income statement | ||

| Report on the intended use of funds |

Accounting statements can be provided both on paper and in electronic form. At the same time, the signature of the chief accountant on the paper form is not required (Order of the Ministry of Finance of the Russian Federation dated April 6, 2015 No. 57n).

To date, the obligation to submit financial statements in electronic form has not been established (letter of the Federal Tax Service of the Russian Federation dated December 7, 2015 No. SD-4-3/21316, letter of the Ministry of Finance of the Russian Federation dated June 11, 2015 No. 03-02-08/34055).

FEATURES OF PREPARATION AND PRESENTATION OF REPORTING OF MICROFINANCE ORGANIZATIONS (MFOs)

FEATURES OF ACCOUNTING AND REPORTING NOU

Is the organization subject to a mandatory accounting audit in 2020?

Mandatory audit is carried out in relation to the organizations specified in Art. 5 of the Federal Law of December 30, 2008 No. 307-FZ “On Auditing Activities”:

1. if the organization has the legal form of a joint stock company;

2. if the organization’s securities are admitted to organized trading;

3. if the organization is:

- credit institution,

- credit history bureau,

- an organization that is a professional participant in the securities market,

- insurance organization,

- clearing organization

- mutual insurance company,

- trade organizer,

- a non-state pension or other fund (except for a fund that has the status of an international fund in accordance with Federal Law No. 290-FZ of August 3, 2018),

- joint stock investment fund,

- management company of a joint-stock investment fund, mutual investment fund or non-state pension fund (with the exception of state off-budget funds).

4. if the volume of revenue from the sale of products, performance of work, provision of services to the organization for the previous reporting year exceeds 400 million rubles or the amount of balance sheet assets as of the end of the previous reporting year exceeds 60 million rubles;

5. if the organization presents and (or) discloses annual summary (consolidated) accounting (financial) statements;

6. in other cases established by federal laws.

Strictly speaking, this list is open. Every year, the Ministry of Finance of the Russian Federation publishes on its website a list of cases of mandatory audit of accounting (financial) statements for the previous year.

List of cases of mandatory audit of accounting (financial) statements for 2021 ()

Let us note that a draft federal law on amendments to Federal Law No. 307-FZ (No. 273179-7) has been prepared for the second reading. Its consideration is scheduled for July 2021.

The government is going to change the requirements for conducting mandatory audits in relation to non-profit organizations.

For example, in paragraph 3 of part 1 of article 5 of the law of December 30, 2008 No. 307-FZ, it is determined that a mandatory audit is carried out if the organization is “another fund”. This means that any non-profit organization created in the legal form of a “foundation” (including a charity) is required to conduct an audit, regardless of the annual turnover of funds and its balance sheet.

The government bill proposes to establish in the law on auditing the requirements for conducting mandatory audits for non-profit organizations (charitable foundations) - owners of endowment capital, specialized endowment management funds.

It is also proposed to provide for a mandatory audit for non-profit organizations - recipients of income from endowment capital, in accordance with the provisions of the laws on non-profit organizations and on the procedure for the formation and use of endowment capital of NPOs.

At the same time, it is proposed to establish a lower limit of financial indicators, if exceeded, a mandatory audit of charitable foundations is carried out, in the amount of 3 million rubles per year. The government is confident that the above amendments will streamline the current legislation regarding the audit of charitable foundations and reduce the organizational and financial burden on their activities.

Features of submitting financial reporting forms

There are several ways to generate a TOGS accounting report:

In the section "Federal Tax Service"

- Fill out the financial statements and send them to NI.

- When a positive protocol (notification of entry) is received for the report, open it. In the message “In accordance with Art. 18 of the Federal Law of the Russian Federation of December 6, 2011 N 402-FZ... Generate financial statements into statistics and proceed to sending them?” click Yes.

- Select the territorial body of state statistics to which you will send the report.

- In the “Rosstat” section a report “Accounting (financial) reporting in TOGS” will be created.

- Check and submit the report to statistics.

In the "Rosstat" section

- In the “Rosstat” section, create a report “Accounting (financial) reporting in TOGS”.

- Accounting statements sent or submitted for signature in the Federal Tax Service section will be added to the report automatically. If you need to send a different report, click the Select or Download button.

- Check and submit it to statistics.

Load from another program

- In the “Rosstat” section, download the report from the file.

- Check it out and send it to the statistics.

Wait for the protocol from TOGS.

Many organizations do not know that from October 1, 2016, the obligation provided for in Part 6 of Article 5 of Federal Law No. 307 “On Auditing Activities” came into force, according to which information about the results of the audit in Fedresurs (on the website https://fedresurs.ru /) are placed by the legal entity in respect of which the audit is being conducted (by the audit client) without fail.

The full name of the register is the Unified Federal Register of Information on the Facts of the Activities of Legal Entities, Individual Entrepreneurs and Other Economic Entities.

Which legal entities are subject to audit?

1) All joint stock companies (PJSC, JSC, OJSC, CJSC);

2) LLC in the following cases:

— if the sales revenue criteria are exceeded (400 million rubles),

— if the criterion for the amount of assets is exceeded (60 million rubles);

3) Credit organizations;

4) Non-state pension or other funds;

5) Insurance organization;

6) If the organization’s securities are admitted to organized trading;

7) Other cases established by law.

Who publishes information about the results of the mandatory audit in the Federal Resources Agency?

This responsibility rests with the legal entity itself (the audit client); therefore, the organization being audited must publish the results.

What is indicated in the message when publishing an audit report in the Unified Federal Register of Information on the Fedresurs website? The data composition consists of:

— the audited entity, data identifying the audited entity (taxpayer identification number, main state registration number for legal entities, insurance number of an individual personal account, if available);

— name (last name, first name, patronymic) of the auditor, identifying the auditor’s data (taxpayer identification number, main state registration number for legal entities, insurance number of an individual personal account, if available);

— list of accounting (financial) statements in respect of which the audit was conducted;

— the period for which the reporting was compiled;

— date of signing of the conclusion;

— the auditor’s opinion on the reliability of the accounting (financial) statements of the entity being audited, indicating the circumstances that have or may have a significant impact on the reliability of such statements.

What are the deadlines for posting information about the mandatory audit in the Federal Resources Agency?

The deadlines for posting information in the Fedresource are established in the general manner for all messages that are entered into the Fedresource, namely: within three working days of the date of occurrence of the corresponding fact. In this case, the report of the audit results is entered into the Federal Resources Agency within three working days from the date of signing the audit report.

What liability is provided for late publication or failure to publish a notification on the Federal Resources Agency?

If an organization does not publish any mandatory message in the Federal Resources Agency, including an audit report, then it faces an administrative fine of up to 50,000 rubles. For a repeated violation, an official may be disqualified for a period of one to three years (Parts 6-8 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation). In addition, in the event of bankruptcy of an organization that has not published mandatory statements in the Federal Resources Agency, the persons controlling it risk being held vicariously liable, since such an organization hid important information about its financial condition from its creditors.

You can place your audit report in the Unified Federal Register of Information on the official website of the Federal resource: https://fedresurs.ru

To publish a mandatory audit in the Federal Resources Agency, you will need to go through the following steps:

— obtaining CEP for Fedresurs

— installation of a crypto provider to ensure the functionality of the electronic signature

— registration in your personal account on the official website

— preparation and formation of the text of the message to be published

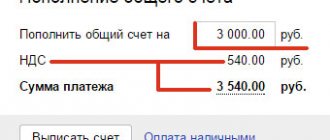

— issuing an invoice in your personal account to pay for the message

— payment for the fact of publication

— publication of an audit message

If you have never posted information on Fedresurs, be prepared for the fact that this will cause great difficulties, even for qualified users, and the period for publishing an audit in this case will be at least 3 business days, which is often unacceptably long, i.e. .To. The maximum period for posting an audit report is 3 days, in accordance with the legislation of the Russian Federation. If you need to post an audit message quickly, without queues, errors and in accordance with the law, then leave a request for publication and post the message within 1 hour, using the publishing service on this site. You can also use similar services for online publication of information about the audit report in Fedresurs.

For example:

fedresurs.com

fedresurs.pro

fedresurs.info

fedresurs.net

Sending from 1C

Sending financial statements together with the audit report

If your organization has connected the 1C-Reporting

, then you can send the financial statements and the audit report to Rosstat directly from the 1C program. The report is prepared and sent through: Reports – 1C-Reporting – Regulated reports.

The auditor's report is attached to the full financial statements ( Accounting statements since 2011

) on the

Additional files

. If you only need to send the financial statements, and the audit report will be sent later, then leave this field blank.

A copy of the report for Rosstat can be created from the report form using the link Submit to Rosstat

.

In the next step, you need to specify the period and click on the Create

.

Please indicate the date of signature

.

In the field Accounting statements

the report from which the copy for Rosstat was created will be indicated by default. It can be changed if necessary.

To save a copy of the report, click on the Save

.

Sending through the 1C-Reporting

– by clicking the

Send

.

Submitting an audit report after financial statements

Sending an audit report separately from the financial financial institution via the 1C-Reporting

possible through informal document flow on the

Letters

.

You need to create a new letter.

In the To

the Rosstat branch

is indicated (must be selected from the list of regulatory authorities).

The file with the audit report is attached using the Add

.

Click the Send

a letter with an attached audit report is sent to Rosstat.

The 2021 mandatory audit is designed to disclose information about economic entities as openly and transparently as possible. At the same time, it allows you to increase the efficiency of the company, reduce pressure on conscientious organizations, identify risks and errors, and eliminate them with minimal losses. Mandatory audit in 2021, as before, is regulated by law and failure to conduct it can lead to unpleasant consequences.

Punishment for violators

Art. 19.7 of the Code of Administrative Offenses of the Russian Federation provides for administrative liability for organizations and managers for untimely submission of audit results by external auditors to the inspection bodies. Cases of violators are considered in court.

The following fines are established:

- for officials - 300–500 rubles;

- for companies - from 3 to 5 thousand rubles.

Important! Paying a fine does not relieve you of the obligation to undergo an audit and submit the corresponding report.

In addition, violators will be punished under Art. 15.11 and 15.19 Code of Administrative Offences.

For the absence of a mandatory audit report, the following penalties are established for responsible persons:

- from 5 thousand to 10 thousand rubles. - in case of a primary violation;

- from 10 thousand to 20 thousand rubles. or disqualification for a period of 1 to 2 years - if repeated.

More significant penalties are provided for non-disclosure of information on financial markets:

- for officials - from 10 thousand to 50 thousand rubles;

- for organizations - from 300 thousand to 1 million rubles.

Joint-stock companies are required to publish annual financial statements on the Internet. Is there liability provided if a JSC publishes annual reports on the website on time and an audit report later? ConsultantPlus experts answer this question in detail. If you don't already have access to the system, get a free trial online.