An employment contract is the main legal document regulating the labor relationship between employer and employee.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

One of the important and mandatory points of the document must be a correctly executed payment for labor with a list of all conditions - the absence of this section indicates the invalidity of the contract.

Salary amount in the employment contract

Salary is a prerequisite for the validity of an employment contract. Many employers make the following mistakes when drawing up a standard contract with an employee:

- do not indicate the specific salary amount in the “body” of the contract. For example, they write it like this: “salary according to the staffing table.” This is not true! An agreement containing such conditions can be declared invalid in court. You need to indicate a specific numerical value - 25,000 rubles (twenty-five thousand rubles). Be sure to use numbers first and then words;

- incorrect indication of the payment of bonuses, bonuses, allowances, etc.;

- omission of the fact of payment of the advance. According to the Labor Code of the Russian Federation, wages must be paid twice a month, every half month. Specific dates for payment of advance payments and salaries can be specified either in the employment contract or in local regulations. Payments cannot be made once a month, even if the employee himself requests this in writing;

- Incorrect wage designation. It also happens that the employer pays part of the salary in some kind of product, but “forgets” to mention this in the contract. This is a big mistake! The Labor Code of the Russian Federation states that payments in food products cannot exceed 20% of the employee’s monthly salary. Payments in kind can only be made with the written consent of the worker. Also, you cannot indicate your salary in foreign currency. Regardless of the currency of which country the employer makes payments to its counterparties, it must pay wages exclusively in rubles;

- Many employers, wanting to save on their employees and their salaries, introduce penalties for any, even the smallest violations and stipulate them in the employment contract. If the management decided to include sanctions for violations in the contract, then their list must comply with Art. 137 Labor Code of the Russian Federation. Other types of wage deductions are considered illegal. In addition, if the employer has not violated the list from Art. 137 of the Labor Code of the Russian Federation, he must remember that the amount of all write-offs cannot exceed 20% of the salary of a particular employee. In some cases, this percentage can rise to 50%, and in exceptional cases – up to 70%.

Payroll

Payment of wages under the Labor Code is made in strict accordance with the content of the articles. Every employee, whether he is a main employee or a part-time worker at the enterprise, must know his rights and defend them in case of violation.

Legislative regulation

The main document that regulates employment issues for Russian citizens is the Labor Code. The revised version adopted in April 2021 is currently in effect. Remuneration according to the Labor Code of the Russian Federation occurs in accordance with the following legislative norms:

- Article 129 of the Labor Code of the Russian Federation stipulates the provision regarding mandatory wages for an employee’s work. Among other things, by decision of the employer, employee salaries can be increased by compensation and incentive payments.

- Article 133 of the Labor Code of the Russian Federation establishes the fact of the existence of a minimum wage (minimum wage), which is formed in accordance with the economic situation in the region of Russia.

- Article 132 of the Labor Code of the Russian Federation - there is no maximum and strictly limited salary. In Russia, every person can earn according to their capabilities.

- Article 131 of the Labor Code of the Russian Federation - contains mandatory standards regarding wages. According to the act, the employer does not have the right to replace money with coupons, receipts, things and other items for employees. It is also approved that each worker should receive 20% of the required payments in cash equivalent.

Attention! The legislation does not regulate wages only in Art. 129 Labor Code of the Russian Federation. Depending on the circumstances, Government Decrees and the Civil Code of the Russian Federation are also affected.

Basic Concepts

Wages under the Labor Code include the basic concepts that are contained in the text of regulations. It is difficult for a beginner to understand the features of calculating payments, so it is recommended to study some definitions in advance:

- Salary. Mandatory remuneration for payment to the employee, depending on numerous labor factors and the complexity of production. Accrual occurs in accordance with the volume completed or time worked (based on the number of work shifts).

- Tariff rate. In the Labor Code of the Russian Federation it is synonymous with the definition of “salary”. Employee remuneration at any enterprise is formed in accordance with the value specified in the contract. There may also be a cash accrual amount for hours worked in a shift (sometimes the organization sets a percentage rate on the volume of production produced). Remuneration is specified in the employment contract.

- Forms of remuneration. At the moment there are hourly and piecework. First, the payment is calculated according to the employee’s hours worked. The second one requires counting the products produced, payment is made according to the number of finished units of goods. It often operates in small enterprises where each employee produces the entire product (for example, dumpling shops or bakeries, where the employer counts the products produced in kilograms or loaves of bread, respectively).

- Minimum wage. Minimum wage. The indicator strictly “fixes” the minimum in monetary terms that an employer must pay to employees per hour, shift, day, week, month or year. The value is calculated individually for each region of Russia, since the calculation takes into account the established amount of the subsistence minimum.

The minimum wage in 2021 is 11,280 rubles. Each region must comply with the basic rule prescribed in Article 133 of the Labor Code of the Russian Federation. The indicator cannot be less than the established value at the state level.

Description of payment of bonuses and premiums

If an employer pays its employees additional bonuses and premiums, then it can stipulate their availability in the employment contract. But you need to be very careful. It is not enough to indicate the presence of additional payments and indicate their size; you also need to specify the conditions for receiving them.

If you do not reflect the conditions for receiving additional bonuses and allowances, and also do not provide references to local regulations, it will turn out that the employer will have to pay them all. That is, he will have to pay all those bonuses, bonuses, allowances and other incentive payments regularly along with wages.

If the employer decides to make a reference to a normative act, then he must accurately reflect all the details of this document. Without these details, this link will also not be valid. Any audit from the tax office or labor inspectorate will identify this deficiency, and then penalties will be applied to the employer.

Execution

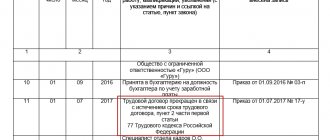

The agreement is drawn up by a personnel officer or other specialist appointed by order to be responsible for the company’s personnel. The document is endorsed by the director and sealed.

The employee must sign the agreement with his own hand, and he is given a copy upon signature.

The signed agreement is registered in the journal and included in the file according to the nomenclature. A copy of the agreement is included in your personal file. Like an employment contract, the agreement must be kept on file for at least 75 years.

Hiring pensioners has its own characteristics! Business trips made on weekends are paid according to a special scheme. You can read more about this in our article. What is more profitable for working pensioners to work or retire in 2016? Our material will help answer this question.

What does the salary depend on?

An official salary is a fixed amount of money that an employee receives for performing his immediate job responsibilities. It does not include any type of payment - neither incentive, nor social, nor compensation.

The salary of any employee depends on many factors, including:

- workload;

- education according to the profile of the work performed;

- qualifications;

- experience in this position.

The amount of remuneration for working personnel is established based on the salary scheme that is used in a single enterprise or in an entire industry.

If an enterprise is financed from the budget of one of the levels, then it must adhere to the industry salary scheme. If the enterprise operates exclusively at its own expense, then it is obliged to approve the staffing table, in which the nomenclature of official salaries must be specified.

The salary is as accurate as a clock

Recording of working hours is mandatory, no matter how the payment of remuneration for labor is organized. But in some systems it is precisely this that is the determining factor that affects the amount of money earned and the features of their accrual.

Hourly pay is the relationship between the remuneration due to the employee and the time that he actually worked, calculated in hours.

In practice, it is not difficult to introduce it, since the employer is already obliged to take into account the working time of its employees (Part 4 of Article 91 of the Labor Code of the Russian Federation).

IMPORTANT! With a salary or tariff system, time tracking is also important, but there the calculation period is a month. In an hourly system, tariffs (salaries) are set for each hour of work.

Additional agreement upon salary changes

Salary is one of the essential terms of an employment contract. If there is a change in salary, this must be reflected in the documents.

This does not mean that you need to immediately rewrite the new employment contract. The Labor Code of the Russian Federation has provided for the possibility of changing the terms of an employment contract by drawing up and signing an additional agreement. This rule also applies to changes in the salary of a specific employee.

If an employee’s salary or other terms of the employment contract change, the employer must take the following steps:

- prepare a model of an additional agreement;

- discuss its provisions with the employee;

- after reaching an agreement, the parties sign this agreement;

- it comes into force from the moment of its signing.

The employer does not have the right to independently change the terms of the employment contract. In addition, he must notify his employee in writing that there is a change in salary. This must be done at least 2 months in advance. The written notice must be given directly to the employee. The employee must be familiar with it by signature. If the employee does not agree to the new terms of the contract, including a change in his salary, then the employment contract terminates. And the employee is subject to dismissal.

If the parties reach an agreement, then they sign an additional agreement in 2 copies - one for each party to the labor relationship. When drawing up an agreement, it is necessary to indicate the details of the employment contract to which this agreement relates.

Who draws up the document

The text of the additional agreement can be prepared by any person at the enterprise who has the necessary knowledge and competencies for this. This is usually a lawyer or HR specialist. Such powers can also be assigned to the accountant who is responsible for issuing wages at the enterprise.

This document must be signed by the manager. Without this, the document will not receive legal force.

The employer's stamp is also affixed to the document. But its presence is not necessary under the new rules, so its absence will not make the additional agreement invalid.

Specifying the terms of salary payment in the contract

The salary is paid to the employee for the performance of his direct labor duties. The salary amount must be specified in the employment contract. It must be written first in numbers, and then in words, indicating kopecks. It cannot be stated that payment occurs “according to the staffing schedule.”

If the employer has a system of additional payments to the basic salary, then this also needs to be prescribed. In this case, you need to provide a link to a specific local act related to the wage system. If the enterprise does not have such an act, then it is necessary to specify in the contract all additional, compensation, incentive and other payments, as well as indicate the conditions under which these payments are made.

If the company is located and operates in the Far North or in areas that have a similar status, then do not forget about northern allowances and regional coefficients. An employee must be very careful when signing an employment contract.

There are unscrupulous employers who “lower” the regional coefficient. For example, during an interview with applicant P., the employer announced his salary of 25,000 rubles, and P. agreed. In fact, in the “body” of the employment contract, the employer indicated a salary of 22,000 rubles and 3,000 rubles - this is the regional coefficient. It turns out that the employee will receive only 22,000 rubles, since personal income tax will be calculated in the amount of 13%.

In fact, it should be written like this:

- salary of 25,000 rubles;

- regional coefficient, according to the one established for a given region by the Government of the Russian Federation.

Calculation of personal income tax occurs only after all allowances and coefficients.

What does the concept include?

Remuneration includes not only the classic salary, but also other monetary values. There are several parameters and criteria that an employee wants to see in the document:

- fixed salary amount (i.e. remuneration for work during a calendar month without taking into account auxiliary payments);

- the tariff rate in effect at the time of determining the conditions of labor payment. What is the tariff schedule by category and how is it formed - read the link;

- all kinds of additional payments for honest, selfless work;

- monetary incentives;

- supplements to the main part of the salary. Here you will find out who is entitled to the regional coefficient and the northern supplement.

The document must indicate both the salary and other payments due to the employee in accordance with the current regulations of the law.

You can watch how to properly organize wages in an enterprise in this video:

Frequency of payments

According to the Labor Code of the Russian Federation, wages must be paid 2 times a month - every half month. Specific payment dates must be indicated in one of these documents:

- employment contract;

- collective agreement;

- labor regulations.

It is imperative to record specific payment days. This could be 2 days a month or several. For example, the advance payment is on the 25th, and the salary is on the 5th. Or you can write it as follows - the advance is paid from the 23rd to the 25th of each month, and the salary is paid from the 5th to the 7th of each month. This is convenient for large enterprises with several thousand employees.

The employer may establish another frequency of payments, but not less than twice a month. The law does not prohibit paying employees the money they earn, for example, 4 times a month. But it is imperative to indicate this in the employment contract or in another local regulatory act, to which a link will be given in the employment contract, the details of this LNA.

FAQ

Employers are interested in the most common questions:

How to correctly indicate hourly wages?

The employment contract must indicate the tariff rate for the employee - dividing the minimum wage by the number of working hours for the billing period (no more than 40 per week). Taking into account additional payments for experience, qualifications, etc. the cost of 1 hour may be more than the tariff rate, but not less.

It is important to indicate in the contract that as the employee improves his qualifications or performs more complex work, the hourly rate naturally increases.

If the employer cares not only about the hours worked, but also about the quality of work encouraged by bonuses, then the contract must specify the tariff rate, the amount of bonus payments and the conditions for their accrual.

Should I indicate the frequency of payments?

According to 6 parts of Art. 136 of the Labor Code of the Russian Federation, the employer is obliged to indicate in the employment contract, labor regulations or collective agreement the terms for the payment of wages. In this case, specific days of the month of payments are recorded.

The employer can set not one, but several days for issue. The first day is specified as the desired date.

The employment contract must indicate that wages are paid two or more times a month, that is, frequency, and specific dates are fixed either in the contract itself or in the LNA to which the contract refers.

In what cases can a gratuitous employment contract be concluded? How to register it?

An agreement on gratuitous labor may be concluded in cases where free services are provided in a high-quality manner, in an appropriate manner, in order to specifically outline the responsibilities of the parties (carrying out work, transferring valuables).

This type of contract is drawn up in the same way as typical paid employment contracts.

The only difference will be an additional paragraph, which will indicate that the services are provided by the employee without wages.

Hourly wage

An employee’s work can also be paid by the hour, that is, for actual stay at the workplace. But such working conditions must be specified in the employment contract.

Each hour of work must “cost” a certain amount of money. To calculate it, you need to divide the minimum wage for a given position by the number of hours that the employee will have to stay at the workplace. You will get a certain tariff rate.

It’s worth starting from this value. Supplements are “inflated” on him for:

- length of service;

- performing a certain amount of work;

- plan overfulfilment;

- work experience;

- employee qualifications;

- other factors that may increase the amount of the tariff rate.

After all the “markups”, the resulting amount exceeds the established tariff rate. The newly obtained value cannot be less.

If the employer decides to set a bonus for the amount of work performed, then the amount of the bonus, which will increase the tariff rate, must be specified in the employment contract. For example, it is important for an employer not only how many hours a particular employee worked, but also how well he performed his work. Then he stipulates in the contract a bonus for the quality of work.

For example, at a standard tariff rate of 100 rubles per hour of work and with an 8-hour working day, employee N. must make 20 parts. The permissible quantity of defects is 2 parts. If there is only 1 marriage, then N. will receive an additional 100 rubles, if there is no marriage at all, then 200 rubles. These provisions must be spelled out in the employment contract.