The word is of Italian origin, its translation sounds approximately like “calculation” or “remainder”. Since the 19th century, the concept began to be applied to accounting balances. Fundamentally, the semantic load of the word has not changed and has acquired an additional meaning - use in a figurative sense, use in the description of foreign economic activity. When asking the question, what is balance in simple words, we expect to hear something unusual. However, the term has not lost its origins and is still associated primarily with accounting.

Choose a business loan

Accounting Methods

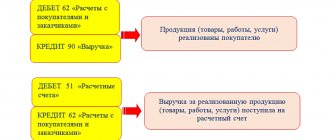

The main concepts used by accountants are “debit” and “credit”. These terms are quite abstract, can be used interchangeably, and both can be interpreted as methods of describing a decrease or increase in funds in an account.

The concepts of debit and credit are opposite. Translated from Latin, debit means “he owes” and credit “I owe.”

In simple words, debit is savings available or funds received into an account. In relation to a company, a debit is the amount in the cash register or in the current account . In addition to cash, property is also debited.

A loan is an expense for a company or individual.

Accounting statements of income and expenses

To assess the activities of an enterprise or income and expenses in the home budget, the concepts of debit and credit are recorded in a table with two columns. The debit is recorded on the left and the credit on the right. Analysis of all incoming and outgoing transactions allows you to see the real picture of the movement of finances.

Ideally, debit and credit should match; even better, if debit exceeds credit, this means that you are in profit.

If the credit amount is greater than the debit amount, this indicates that the organization is unprofitable. There is a budget deficit. A table of income and expenses helps to identify unnecessary expenses and maintain balance.

When does a debit become an income and when does it become an expense?

In the accounting posting system, there is a division of accounts into active and passive:

- Active accounts reflect information about the receipt, debit and current state of the enterprise’s funds. Debit on such accounts shows the receipt of funds, investments and repayment of debt to the company. A loan shows the expenditure of funds and a decrease in the organization’s property.

- Passive accounts reflect the sources of economic funds and changes. Here, debit reflects the expenditure of profits and funds, and credit reflects income (debt repayment, profit growth).

On active accounts, debit is an income, and credit is an expense, but on liabilities, the functions of the methods are opposite. The movement of funds occurs from credit to debit in the case of assets, and from debit to credit in liabilities.

Debit reflects the balances of property in active and passive accounts, and credit reflects sources. To connect the two concepts, the term “ balance ” is used.

If the debit on active accounts increases, this indicates an increase in the organization's ownership. As the debit on the passive account increases, the company's funds decrease.

How to prepare accounting entries for specific business transactions?

Examples of accounting entries for wages

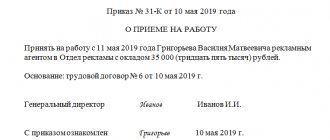

Payroll transactions reflect the following: Debit personal income tax, other deductions and payment of wages, credit - accruals. Accounting entries are made for each employee.

Payroll accounting is carried out on the basis of the following important principles:

- accurate recording of the number of employees and the time they worked;

- correct withholding amounts, including budgetary and extra-budgetary funds;

- monitoring the performance of work by employees;

- correctness when posting labor transactions in accounting.

Table with examples of salary postings:

Payroll posting table.

Renting premises in the accounting department

All actions with the leased property are reflected by both the lessor and the tenant.

To fill out a lease agreement, an agreement form drawn up on the basis of the principles of Chapter 34 of the Civil Code is used. The contract specifies the validity period. If the period is not specified, it is considered that the contract was concluded for an indefinite period. In Russia, when renting for a period of more than a year, state registration is required.

General work log: sample filling and step-by-step guidance for drawing up the document are in the article at the link.

The contract has two parts: main and additional. The additional one includes various payments, such as housing and communal services. In rare cases, housing and communal services fees are included in the general rent. By law, rental expenses are recorded in accounting on a monthly basis.

These expenses are considered as ordinary activities and are taken into account in accounts 20-29 and 44, depending on the activities of the organization.

Table of accounting entries for renting premises with answers:

Table: Accounting for the lessor when recognizing rental income as income from ordinary activities.

Table: Accounting for the lessor when recognizing rental income as other income.

Table: Tenant's accounting.

Examples of accounting entries for wholesale and retail trade

The economic activities of wholesale and retail organizations require the execution of many transactions; they are related to the sale of goods, finished products, as well as services.

Find out the procedure for writing off accounts payable with an expired statute of limitations in this article.

Posting table with trading examples:

Table: Receipt of goods from the supplier.

Table: Sales of goods at the time of payment.

Table: Sales of goods at the time of shipment (OPT).

Table: Sales of goods at the time of shipment (Retail).

Accounting entries for beginners under an assignment agreement

An assignment agreement is a replacement of a creditor under an obligation. There are three parties to the contract. The accounting of the parties is as follows:

- debtor – all debt transactions are reflected in analytical accounting. Costs identified during the validity of the assignment agreement are reflected in other expenses. Changing the lender will not affect financial accounting;

- assignor - the assignment agreement does not generate either income or expenses. But the fact of execution of the operation increases its liquidity;

- assignee - when assigning a debt, records it in debit as a receivable for the amount of the debt, then displays it as a credit in anticipation of the transfer of funds.

The following table with examples for an assignment agreement will help beginners make accounting entries:

Table: Postings under the assignment agreement.

Cash transactions in accounting

Cash transactions involve receiving, issuing and storing cash. Accounting for cash transactions is based on the regulations of the Tax Code of the Russian Federation.

What is depreciation of fixed assets in simple words? The answer is here.

When maintaining a cash register, the following documents are used:

- cash receipt order - to record cash receipts;

- expense cash order - to record cash expenses;

- cash book – takes into account all movements on the cash register.

Table of accounting entries with answers:

Table: Cash transactions in accounting entries.

Provision of services

An organization can either provide services to third parties or use the services of a third party. Accounting for accounting entries in this case will be different.

The main tasks are the following:

- reliable and complete information content of all transactions performed;

- providing information to all participants in the process;

- avoiding a negative outcome for these operations;

- proper documentation;

- competent reflection of expenses in the process of operations;

- receiving monetary profit from the transaction.

Table with answers for business transactions related to the provision of services to third parties:

Table: Provision of services to third parties.

Table: Obtaining services from a third party.

How to prepare accounting entries for fixed assets?

An organization that has fixed assets on its balance sheet is obliged to take them into account in the balance sheet. It is worth noting some features in this process:

- accepting a fixed asset for accounting, its initial cost is determined;

- a fixed asset has a useful life - this is the period during which it generates income;

- it is necessary to depreciate the fixed asset, i.e. write off its partial cost;

- revaluation is not mandatory, the organization has the right to carry it out;

- expenses for capital or current repairs of fixed assets are recorded on debit expense accounts;

- write-off of a fixed asset occurs in the event of non-receipt of profit or its disposal.

Table of accounting entries for fixed assets with examples:

Table: Accounting entries for fixed assets.

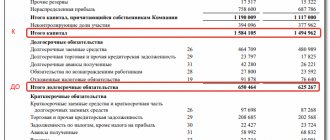

Closing of the year

According to the law, a period is defined for which all economic activities of the organization are carried out; this period lasts from January 1 to December 31. Based on this period, January 1 is the new reporting date, and December 31 is the final one.

You can read how to independently draw up an accounting certificate about correcting an error and writing off a debt here.

Closing the year sums up all the annual financial results of the organization. That is, it resets the balances on accounts 90 and 91, and closes account 99. As a result, the total, profit or loss is taken into account on account 84.

Closing is done on a full year basis. In accounting, the year end is shown as December 31st. After closing, the organization begins a new period with zero financial balances.

Table with examples:

Table: Closing transactions.

Examples of accounting entries for taxes and state duties

Tax expenses and state duties are displayed in the period of actual payment. Based on the purpose of the payment, you need to consider:

- write-off of costs for core activities;

- posting of costs to other expenses if they are not related to the main activity;

- accounting as part of the property.

Payment of taxes and state duties is carried out from the organization's current account. When paying, you must take into account all the payer's details and the correct purpose of the payment.

Examples of postings are clearly shown in the following table:

Table: Postings for taxes and duties.

Loans issued

The organization has the right to issue a loan to a third party organization or individual. Such a transaction must be certified in writing on both sides as a loan agreement. The loan agreement usually specifies the interest level, the period of validity of the agreement, and the payment schedule.

If the interest level is not determined, you can take the current refinancing rate as a basis. The loan agreement can also be interest-free, which must also be stated in the agreement.

The loan can be issued either in cash or in kind; it is worth noting that VAT is not assessed for a cash loan. The amount of interest received is included in sales revenue or other income. This does not affect financial results.

Table: Accounting entries for loans and credits.

Application of debit and credit in practice

Accounting statements are always balanced. Any purchase or transaction entails the simultaneous appearance of a debit and a credit in the accounts. The accounting department usually writes off funds coming into the company. As assets grow, debit accounts increase; when purchasing furniture and inventory, assets also increase.

- The purchase of new equipment for a business increases the debit account (assets), but also increases the credit, showing the amount of funds in the current account.

- A bank loan for the development of an organization is recorded as a debit account, and the amount of debt to the financial institution goes to the credit account. This procedure is called the double counting system.

Thus, accounts decrease and increase when comparing debits and credits. Money constantly moves across accounts, and debits and credits show the redistribution of funds as they are received and spent in the enterprise.

Express check

The final stage of preparatory activities for submitting reports is the launch of the “Express check of accounting” .

With its help we will check:

- compliance with accounting policies;

- conducting cash transactions;

- analysis of the state of accounting.

After performing an express check, the program displays a report on its results, which reflects the number of errors detected.

Next, a report is generated with detailed information about each detected error with correction tips (Fig. 6). If necessary, from the report you can go to the primary documents and correct them.