The activities of any enterprise are impossible without the presence of official administrative documents. Usually these are orders for the enterprise.

They determine the procedure for fulfilling certain functional obligations and establish legal facts, such as employment, dismissal, promotion of ranks and categories. With the help of orders, regulations, instructions, rules and other organizational measures are approved.

Therefore, it is important to know what types of orders should be in the organization, how and by whom they are drawn up, where and how long they are stored.

What are local regulations, who needs them and why?

The concept of what local regulatory acts of an organization (LNA) are is given in Art. 8 Labor Code of the Russian Federation. These are documents accepted by the employer, containing labor law norms, rules for their implementation and regulation of labor relations within the enterprise. The main requirement for the LDF is not to worsen the situation of workers, as established by law. Signs of a local regulatory act:

- determines the implementation of federal laws in a specific organization;

- acts between the employees and the employer of the company;

- applies to all employees;

- not designed for one-time use - used periodically;

- improves the position of employees and expands the basic level of protection compared to current standards;

- is adopted taking into account the opinion of the representative bodies of workers.

Well-designed local acts help resolve controversial situations.

Recommendations from ConsultantPlus (free access)

Guide to HR issues. The procedure for developing and approving local regulations of the organization

Mandatory documents for personnel records management – 2021

The need for personnel documentation at an enterprise follows from the provisions of labor legislation. In general, we can distinguish documents on personnel that are recommended for maintenance, but are not required, and mandatory documents, without which the personnel service of an enterprise cannot fully operate. Mandatory personnel documents may be required for examination by employees of the State Labor Inspectorate, the Federal Tax Service, the Pension Fund of the Russian Federation and other departments during their inspections.

Mandatory documents include both documents regulating labor relations between the employer and a specific employee (employment contracts, orders for hiring/dismissal, etc.) and those that apply to the workforce as a whole (internal regulations, staffing schedule, etc.) .

Let's consider what mandatory HR documents must be present in an organization, a micro-enterprise and individual entrepreneurs with employees.

What regulatory documents are being developed in LLCs and individual entrepreneurs?

There is no legally approved list of local acts. The Labor Code mentions certain LNAs and considers them mandatory:

- internal labor regulations - Art. 189 – 190 Labor Code of the Russian Federation;

- on wages and bonuses - Art. 135 Labor Code of the Russian Federation;

- vacation schedule - Art. 123 Labor Code of the Russian Federation, letter of Rostrud No. 4414-6;

- establishing the procedure for processing personal data Art. 86, paragraph 8, art. 87 Labor Code of the Russian Federation;

- shift schedules, if they are not an appendix to the collective agreement - Art. 103 Labor Code of the Russian Federation;

- staffing table - Rostrud letter No. PG/4653-6-1.

What other local acts are mentioned in the Labor Code:

- rules and instructions on labor protection - Art. 212 Labor Code of the Russian Federation;

- on labor standardization - Art. 159 Labor Code of the Russian Federation;

- certification procedure - art. 81 Labor Code of the Russian Federation.

IMPORTANT!

Local regulations state when there is a need to resolve a situation that has arisen as a result of the company’s activities. Such LNAs are not mandatory - they are developed at will, if the situation is typical for the specific activities of an LLC or individual entrepreneur.

Micro-enterprise: mandatory personnel documents

The list presented above applies equally to both large companies and small and medium-sized enterprises. As for micro-enterprises, a “simplified” document flow is provided for them in terms of personnel documentation.

According to Article 309.2 of the Labor Code of the Russian Federation, some mandatory personnel documents in an organization classified as a micro-enterprise may not be issued. The employer has the right to refuse (partially or completely) from the adoption of local acts containing labor law norms. For example, a micro-enterprise may not accept the “Internal Labor Regulations”, Regulations on bonuses, wages, shift schedules, etc. But in this case, the employer is obliged to include the conditions regulated by such acts directly in the employment contract with the employee.

For example, if, when hiring employees, the size and procedure for remuneration, conditions for calculating and the amount of bonuses are specified in detail in employee contracts, the employer is not required to have a Regulation on Remuneration and a Regulation on the Procedure for Bonuses.

Let us remind you that the criteria for classification as a microbusiness are: annual income within 120 million rubles. and the average roster of no more than 15 people (Article 4 of Law No. 209-FZ of July 24, 2007, Government Decree No. 265 of April 4, 2016).

Specialized LNA

In addition to the general ones, there is a list of mandatory LNAs applicable to industries. For example, the system of assessment activities in educational institutions. Its mandatory nature is determined by the law on education in the Russian Federation. Each educational institution independently develops its parameters, guided by the list of local acts that regulate VSOKO:

- No. 273-FZ;

- federal program “Development of Education for 2016-2020”;

- Order of the Ministry of Education and Science No. 462 dated June 14, 2013;

- Order of the Ministry of Education and Science of the Russian Federation No. 1324 dated December 10, 2013.

Certain types of local regulatory documentation are used in quality management systems. An approximate list of quality documents is the following documents:

- information about the QMS;

- requirements and specifications;

- methodological developments, recommendations;

- standards, instructions;

- objective data about tests and results.

Order log: why you need it and how to fill it out

All PODs issued to institutions are entered into a special journal - a register in which administrative documents on the main activities are kept. An enterprise can choose the form of maintaining the register independently: either purchase a specialized form (registration book in A-4 format), or develop it depending on needs.

The register also adopts sequential numbering. The specialist must fill out the register very carefully (especially the cells with the date and name), since there should be no errors or omissions in the register. It is worth noting that the full title of the decree can be shortened, but it must be clear and readable.

Thus, after issuing an administrative document, it must be immediately registered in a special registration journal, since, in accordance with legislative regulations, the decree is considered invalid without official registration of the fact of its creation (GOST R 51141-98).

Just like the AML itself, a new register of registration of administrative documentation is created annually and is then maintained throughout the calendar year. If the journal is completed during the reporting period, a new office book is created, which is given the name “Journal of registration of orders for main activities. Part 2". At the end of the year, the register is stitched and archived along with the AML for the given reporting period.

You can download a sample journal recording a list of orders for core activities for free.

How to properly develop, approve, agree

- Who develops it? The specialists responsible for the development of LNA are identified and approved by the manager.

- Development. It is written from scratch or a standard document is taken as a basis, into which the necessary adjustments are made to suit the specifics of a particular organization.

- Coordination. The project is coordinated with specialized departments and lawyers. If required by a collective agreement, with a trade union. Certain documents require mandatory approval from employees - for example, a vacation schedule. During the approval process, changes and adjustments are made to the project.

- Statement. The agreed document is submitted to the manager for signature.

- Familiarization. The approved LNA is handed over to employees for reading. The method of indicating the number and list of employees in local regulations for review and signature is chosen by the developers themselves. If there are few employees, an introductory sheet is attached at the end of the document; if the organization is large, a separate journal is drawn up. All employees are familiarized with documents of a general nature; if the LNA is of a specialized nature, those who are directly related to the activities regulated in the document.

Preparation and registration

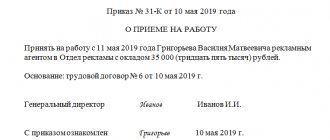

General procedure for placing an order

There are no general rules for drawing up orders for each enterprise today. Therefore, the form and content of administrative documents of this type can be very different. At the same time, there are certain attributes that are required in the process of drawing up all orders, without exception. These include the presence of:

- The ascertaining part. This usually describes the reason that served as the basis for issuing a specific order. In certain types of orders (usually these are personnel orders on appointment to a position), it may be omitted or formalized (for example, with the phrase “on personnel”). If the document concerns the introduction of progressive technologies, various experimental models, revolutionary solutions, it is advisable to describe in detail what preceded this, or for what purpose it is being done.

- Administrative part. It is always written after the word “I command”. If there are several instructions to different performers at the same time, or different tasks are listed, it is necessary to number each item. In order for the administrative part to be understandable to each specific performer, it is imperative to take into account the presence of three main components. Namely: who is ordered to do what needs to be done according to this document, the deadline for fulfilling the order. After all the points, it is advisable to indicate who will monitor the implementation of this order.

Is it necessary to familiarize employees with documents?

Not all LNA require mandatory familiarization. says that it is necessary to familiarize workers with those regulatory documents that are directly related to work activities. For example, a business trip clause is not signed by a person who does not travel anywhere.

Rostrud’s letter No. PG/4653-6-1 states that the staffing table relates to LNA, but is not directly related to activities. Thus, it is not necessary for employees to be familiar with it.

IMPORTANT!

Some features of familiarization with the regulatory documents of the enterprise are established in the collective agreement or other legal regulations.

Mandatory orders

What orders must be in an enterprise?

Each enterprise, regardless of its field of activity, must have several categories of orders. This includes:

- Orders for personnel. This category includes all administrative documents related to the appointment and dismissal of positions, disciplinary action, assignment of ranks and categories to employees, registration of vacations, determination of the operating mode of the enterprise as a whole and a specific unit in particular, and other similar actions. Such documents are maintained by a personnel employee (personnel department).

- Orders on main activities. This category includes all administrative acts that ensure the normal functioning of the company. Usually, to manage them, an office or a housekeeping department is created, which is entrusted with the function of administering economic activities and monitoring the implementation of management orders recorded in orders.

- Orders on administrative (economic) activities. You need to understand that the functioning of any organization is impossible without the normal operation of water supply systems, ventilation, electrical networks, and the normal condition of buildings and structures. Among other things, sometimes it is necessary to streamline the distribution of work rooms and assign property to specific employees. All this requires constant review, periodic replacement and repair. And without administrative documents, it is very problematic to carry out such work.

In order not to be confused about which order belongs where, in the process of compiling them, either special numbering can be entered (for example, the letter “k”, “o”, “a” is added to the serial number of the order through a fraction), or a short name that determines which which group this or that document belongs to.

Remember, orders are administrative documents on the basis of which all the company’s activities are based, certain rules, regulations, procedures for performing work are established, and important legal facts are recorded.

Each enterprise sets the number of directions and types of administrative documents independently. In this case, it is advisable to build on generally accepted practice so that employees quickly understand the purposes for which a particular order is issued.

Responsibility for absence

The responsibility for developing LND lies with both the LLC and the individual entrepreneur. Liability for lack of documentation is regulated by clause 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation - violation of legislation and other regulations that contain labor law norms. If an enterprise does not have a provision on the protection of personal data, liability may arise, including criminal liability.

There is a category of employers exempt from LNA: individuals and owners of micro-enterprises. The latter include the conditions that are prescribed in the LNA in the text of the employment contract. They enter into standard agreements, the form of which is approved by the government.

Types of orders for main activities

Due to the fact that such orders regulate many organizational issues in the process of financial and economic activities of an institution, they are usually divided into groups depending on their functional purpose. The following types of orders are distinguished:

- Structural - regulate structural formations at the enterprise (if any). These include orders to create or terminate the functioning of groups, departments and divisions, and branches.

- Regulatory - these are internal regulations, documents and provisions that normalize the work of the company.

- Organizational - orders that establish basic organizational issues. These include certain goals and objectives that are relevant to the institution at the current time.

- Supervisory - regulate the conduct of scheduled and unscheduled inspections, internal audit and other control activities, inventory, preparation and submission of periodic and annual financial statements, etc.

- Reporting - regulating various reporting and analytical activities in all departments and structural units.

- Financial means financial planning and analytics, strategy development, and key financial management decisions.

- Security documents are internal documentation that is issued for the purpose of supplying the institution with the necessary fixed assets and supplies.

- Informational - orders containing various information about the organization: registration, movement, execution of internal documents.

IMPORTANT!

In 2021, the regulations changed - Order of the Federal Archive No. 44 dated April 11, 2018 came into force. Also, from July 1, 2018, GOST R 7.0.97-2016 came into force, which approved a new procedure for drawing up organizational and administrative documentation.

Who composes?

Working with management decisions has a standard model:

- preparation of a draft order;

- adoption of the final version;

- registration;

- providing copies to necessary persons;

- placement in a personal file;

- transfer for storage.

Typically, a preliminary version is drawn up by a secretary, clerk, or personnel department employee. The prepared act is submitted to the manager for approval, and then for registration.

Information: The order is signed by the director. Then the act is placed in a personal file, and copies are distributed to interested parties.

This material does not cover all types of orders. Read also about the order to conduct an inventory, as well as about orders for business trips and bonuses.

How the presence of primary documents affects taxes and dividends

A few abbreviations just in case. STS is a simplified taxation system. UTII is a single tax on imputed income. OSNO - general taxation system. Those who use it issue invoices with VAT - value added tax.

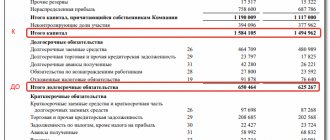

Individual entrepreneur on the simplified tax system “income”, UTII and patent - in this case, the primary documents do not affect the tax. For everyone else, this is very important, because if there are no documents, then taxes will be higher, and dividends will not be paid.

LLC on the simplified tax system “income”: for calculating taxes, primary documents are also not important, but they affect accounting and reporting. For example, if the buyer does not have an invoice, then the supplier is considered to owe money. In this case, the buyer's expenses are not taken into account, and the balance is unreliable. If it is also unprofitable, then it will not be possible to pay dividends. You can also forget about the loan: the bank will not approve it, but an experienced specialist will immediately see such a problematic balance. This is also true for other tax systems.

LLC on UTII: taxes also do not depend on the availability of primary documents, but for the balance it is important - everything is as in the previous paragraph. In addition, UTII is often combined with the simplified tax system or OSNO. For example, a company can sell something retail on UTII and at the same time wholesale on OSNO. This combination is called “separate accounting”, in this case the tax is calculated for each taxation system separately. Also, let’s not forget that such documents will be needed if a warranty case occurs or if a defective product needs to be returned to the supplier - therefore, documents are also needed for UTII.

LLC on the simplified tax system “income minus expenses”: usually, the more expenses are documented, the lower the tax will be. The exception is the situation when expenses are greater than income. In this case, the reporting period closes with a loss, but the tax will still be 1 percent of income. We hasten to warn those who decide not to request part of the closing documents from suppliers so that income and expenses are equal - firstly, let’s not forget about the balance, and secondly, you will still have to pay. The law requires comparing the percentage of the difference between income and expenses and 1 percent of income - and paying the larger amount. But even if expenses are objectively greater than income and the year turns out to be unprofitable, then it is still worth collecting documents - part of the loss can be transferred to the next year. And next year you will pay less taxes.

LLC and individual entrepreneur on OSNO: the more documents, the better. There are no options here, everything must be documented - both in the case of VAT and in the case of income tax. In addition, it is in this case that the tax office most often conducts counter audits, that is, it checks the list of invoices that you and your supplier showed. This happens automatically - we recently wrote about this. The discrepancy is easy to find - and if your supplier did not indicate the invoice that you indicated, then the tax office will request this document from you. But if you don't have one, then that's a problem. You should prepare for unpleasant questions and fines.